Smallcaps Surge as Nifty Stays Flat – What’s Next for the Market?

The stock market outlook today highlights a shifting trend: while benchmark indices like Nifty 50 and Sensex remain rangebound near all-time highs, smallcaps surge ahead, signaling renewed interest in broader market opportunities. This divergence suggests potential sector rotation and increased appetite for high-beta plays.

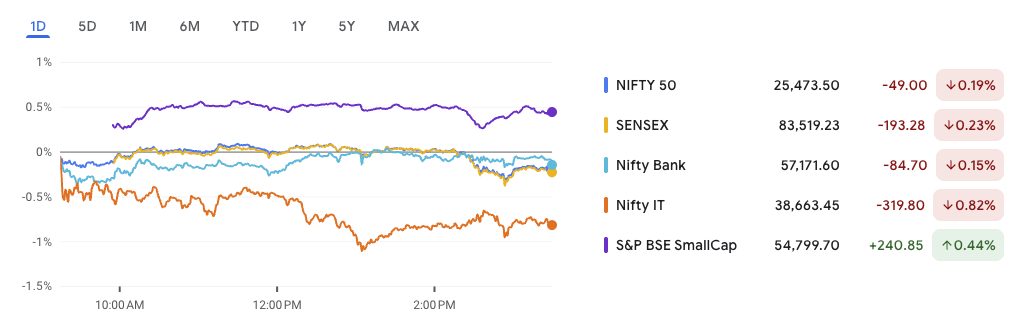

Nifty 50 closed marginally lower at 25,473.50, and Sensex dipped by 193 points. In contrast, the BSE SmallCap Index rose 0.44%, extending its outperformance for the third consecutive session. Is this a short-term catch-up or the beginning of a broader move?

In this newsletter:

Nifty 50 short-term trend, Schaeffler India breakout setup, Smallcap spotlight on BLS International, and latest IPO GMP action.

Nifty Outlook: Can the Bulls Break Free as Smallcaps Surge?

While smallcaps surge and continue to outperform, the Nifty 50 remains caught in a tight consolidation zone — stuck just below its recent highs. On July 9, 2025, the index closed at 25,476, down 0.18%, but still above crucial support levels, suggesting the uptrend remains intact unless key thresholds break.

Technical Snapshot (Daily Chart)

- Current Price: 25,476

- 9-day EMA: 25,352.99

- Pattern Forming: Ascending Triangle

- Trend Bias: Mildly Bullish

Support & Resistance Levels

| Zone | Level | Significance |

|---|---|---|

| Support 1 | 25,352 (9 EMA) | Respected in every dip since early June – trend stays bullish above it. |

| Support 2 | 25,206 – 25,206.50 | Old resistance turned support — clean breakout-retest behavior. |

| Support 3 | 24,452 – 24,462 | Strong base zone with gap-up area — a deeper correction zone. |

| Resistance 1 | 25,670 – 25,674 | Multiple failed breakout attempts — current ceiling. |

| Resistance 2 | 26,266 – 26,500 | Previous all-time high zone — long-term target if breakout succeeds. |

Chart Pattern Watch: Ascending Triangle

- Structure: Higher lows + flat resistance at 25,670.

- Implication: Suggests accumulation; a breakout above 25,674 could unlock a 1,000-point move.

- Target Projection: ~26,500 based on triangle height.

Volume Outlook

Volume has been declining slightly during this range formation — a common sign of a coiling market. A volume spike on breakout will confirm strength. Lack of volume will likely delay the move.

Expected Move: What to Watch

Bullish Bias:

A close above 25,674 with volume could set off a rally toward 26,250–26,500, confirming the triangle breakout and broader uptrend.

Bearish Risk:

A break below 25,206 (structure support) may invalidate the pattern, dragging Nifty toward 24,462 — still a healthy level from a longer-term view.

As smallcaps surge, smart traders may focus on rotational plays — watching for Nifty’s breakout as confirmation of broader bullish continuation.

News and Impacted Stocks: Why SmallCaps Surge Amid Mixed Market Cues

As Nifty 50 remains flat and rangebound near all-time highs, the broader market shows a different story. The smallcaps surge theme continues, driven by sector-specific developments, corporate actions, and investor focus on under-owned segments. Below is a deep dive into the key corporate news and their market impact:

1. Maharashtra Hospitality Sector Under Stress: AHAR Raises Alarm

What Happened:

The Indian Hotel and Restaurant Association (AHAR) has issued a warning regarding escalating taxes in Maharashtra. These include:

- VAT on liquor doubled from 5% to 10%

- 15% hike in license fees

- 60% surge in excise duty

Impact:

AHAR claims this tax burden could collapse the state’s hospitality industry, which supports over 4 lakh jobs directly and around 18 lakh dependents indirectly. With Maharashtra accounting for over 19,000 licensed bars and permit rooms, this is not a niche concern.

Stock Market Angle:

Watch for potential negative sentiment in hospitality-related small caps operating in Maharashtra (e.g., Speciality Restaurants, Westlife Foodworld). Consumer spending in urban entertainment and hospitality could soften if pricing is passed on.

2. Granules India: Drug Recall in the US

What Happened:

Granules India has recalled 33,024 bottles of Metoprolol Succinate ER tablets in the U.S. due to dissolution failure at the six-month stability mark.

Impact:

- The recall is classified as Class II by the USFDA, indicating the product may cause reversible health issues.

- This could affect export revenue temporarily and invite regulatory scrutiny.

Stock Market Angle:

Short-term pressure is likely on Granules India’s stock. However, if the Gagillapur facility resumes full operations by Q3 as planned, recovery is probable. Monitor Q2 results and updates on compliance.

3. Reliance Jio Platforms: IPO Delayed Again

What Happened:

The long-awaited IPO of Reliance Jio has been postponed beyond 2025. Key reasons:

- Company aims for stronger revenue metrics and user base

- Focus on building non-telecom verticals (e.g., AI, devices, enterprise apps)

Impact:

- Jio is valued at over $100–136 billion, and IPO delay affects near-term listing excitement.

- No bankers have been appointed, confirming the pause.

- Tariff hikes affected subscriber churn but growth is now back.

Stock Market Angle:

Reliance Industries may face subdued re-rating in the near term, but long-term investors see consolidation as a strategic play. Also impacts large-cap IPO calendar and sentiment in telecom and digital infra space.

4. Vedanta vs. Viceroy: Short-Seller Clash

What Happened:

US-based Viceroy Research accused Vedanta Resources of an unsustainable financial structure. Vedanta Group has dismissed the report as “baseless” and “malicious.”

Market Reaction:

Vedanta shares fell by 6.2% intraday post-report release.

Impact:

While Vedanta’s fundamentals remain under the lens, volatility may persist till the Annual General Meeting (AGM). Short-term traders must be cautious. Long-term investors should watch for debt restructuring cues and group-level disclosures.

5. Lupin-Zentiva Global Biosimilar Deal

What Happened:

Lupin signed a global license and supply agreement with Zentiva for the commercialization of biosimilar Certolizumab Pegol.

Deal Terms:

- Lupin to develop and manufacture

- Zentiva to market in Europe & CIS

- Lupin receives $10M upfront + up to $50M in milestones

Stock Market Angle:

Positive strategic move for Lupin. With biosimilars gaining traction globally, this deal strengthens revenue visibility and pipeline strength. Watch for sentiment boost in midcap pharma.

6. Sarda Energy Commissions 24.9 MW Hydro Project

What Happened:

Sarda Energy started commercial operations of its Rehar-1 Small Hydro Project in Chhattisgarh through its subsidiary.

Project Specs:

- Capacity: 24.9 MW

- Units: 3 × 8.3 MW

- Power Purchase Agreement with CSPDCL secured

Stock Impact:

Shares rose 2.15% to ₹433. This marks a clear expansion into renewables. Investors are optimistic due to long-term cash flow visibility and regulatory backing.

7. Suzlon Energy Allots 30.33 Lakh Shares Under ESOP

What Happened:

Suzlon completed equity allotment under its ESOP 2022 plan, raising ₹4.72 Cr. These were granted across three tranches in 2023 and 2024.

Stock Market Angle:

Neutral-to-positive. While dilution is marginal, ESOP issuance shows employee alignment. Investors will watch for Suzlon’s execution in clean energy projects, where the long-term growth story remains intact.

8. Bharti Airtel–Ericsson FWA Partnership

What Happened:

Airtel signed a strategic agreement with Ericsson to power its Fixed Wireless Access (FWA) services using Ericsson’s local packet gateway.

Significance:

- Boosts 5G monetization roadmap

- Reduces cost and improves reliability

- Targets broadband penetration in underserved regions

Stock Insight:

Traded flat at ₹2021.70. Long-term implication is significant, as Airtel positions itself for rural broadband growth. Investors should monitor FWA subscriber data in upcoming earnings.

9. Valiant Laboratories Announces ₹81.4 Cr Rights Issue

What Happened:

Valiant Laboratories will raise up to ₹81.46 Cr via a rights issue and has constituted a committee to finalize terms.

Stock Reaction:

Shares rose 1.68% to ₹116.20. The move supports balance sheet expansion and R&D or capex needs.

Investor Takeaway:

Rights issues in small caps can sometimes indicate liquidity needs, but also signal growth plans. Evaluate based on Q1 earnings and issue price when announced.

Bottom Line:

Despite Nifty’s sideways movement, stock-specific developments are driving alpha in smallcap and midcap segments. The smallcaps surge is supported not just by technical breakouts but also by tangible business events, sectoral rotation, and strong institutional interest in second-tier stocks. Stay nimble and informed.

Stocks on Technical Radar: Sterling & Wilson in Focus as Smallcaps Surge

As large-cap indices trade flat, technical traders are increasingly scanning for high-potential breakout setups among small and midcap names. Riding the wave of the smallcaps surge, Sterling & Wilson Renewable Energy Ltd (SWSOLAR) is flashing a bullish pattern that’s gaining attention.

Sterling & Wilson Renewable Energy Ltd (SWSOLAR)

CMP: ₹331.45 | Change: +₹26.10 (+8.55%) | Volume: 15.4 million (strong surge)

EMA (9-day): ₹308.33

1. Primary Support and Resistance Zones

Support 1: ₹308 – ₹312 (EMA + Trendline)

- The 9-day EMA at ₹308 acts as dynamic support.

- A rising trendline from mid-April intersects near ₹312, providing additional support.

- This confluence has held well during recent pullbacks, confirming active buyers at these levels.

Support 2: ₹214 – ₹220 (Swing Low)

- This zone marked a significant bottom in April.

- A breakdown below ₹308 could open room for correction toward this major base.

Resistance 1: ₹333 – ₹335 (Breakout Zone)

- Price has repeatedly tested this level over the past few months.

- It marks the upper boundary of an ascending triangle pattern—traditionally a bullish formation.

Resistance 2: ₹380 – ₹400 (Swing Target)

- If ₹335 is taken out with volume, historical resistance from late 2024 suggests this zone as the next key target.

2. Pattern Watch – Ascending Triangle

- Rising Lows: Buyers have consistently stepped in at higher levels since April.

- Flat Top Resistance: ₹335 has acted as a ceiling for over two months.

- Volume Buildup: Today’s spike in volume is a classic pre-breakout signal.

Implication:

An ascending triangle signals accumulation. If the stock closes above ₹335 with confirmation, it could ignite a sharp rally.

3. Volume & Momentum Insight

- The 15.4M volume surge is significantly above its 10-day average.

- Strong bullish candle above EMA indicates trend strength.

- Sustained participation near breakout level is critical for further momentum.

4. Summary Table

| Component | Levels | Significance |

|---|---|---|

| Support 1 | ₹308 – ₹312 | EMA + trendline confluence zone |

| Support 2 | ₹214 – ₹220 | Major swing low and invalidation level |

| Resistance 1 | ₹333 – ₹335 | Ascending triangle ceiling; multiple failed attempts |

| Resistance 2 | ₹380 – ₹400 | Historical resistance zone; breakout target |

| Pattern | Ascending Triangle | Bullish continuation; rising buying pressure |

| Breakout Target | ₹380 – ₹400 | Measured move from triangle height (~₹65–70 range) |

5. Trading Strategy

Bullish Swing Setup:

- Entry: Buy on close above ₹335 with strong volume.

- Target: ₹380 – ₹400 (short-term swing).

- Stop-Loss: Below ₹308 (breakdown of support confluence).

Retest Strategy:

- Wait for price to break out and return to ₹335 zone.

- Enter on bounce with volume confirmation.

Bearish Breakdown Risk:

- Close below ₹308 with volume invalidates the bullish pattern.

- Could lead to correction toward ₹214.

Conclusion

Sterling & Wilson Renewable Energy is at a technical inflection point. The confluence of strong volume, bullish price structure, and an ascending triangle aligns with the broader smallcaps surge underway in Indian markets. If ₹335 is broken with conviction, traders can expect swift upside toward ₹380–400. Risk management remains key as volatility may spike post-breakout.

IPO update- Key Listing Today

Mainboard IPO GMP Update

With the Smallcaps Surge continuing to attract retail investors, IPO sentiment in both the mainboard and SME space remains buoyant. Here’s a snapshot of the latest GMP updates and potential listing gains:

Mainboard IPOs

| IPO Name | Price Band (₹) | Issue Dates | Listing Date | GMP (₹) | Expected Listing (₹) | Estimated Gain (%) |

|---|---|---|---|---|---|---|

| Anthem Biosciences | 570 | 14 Jul – 16 Jul | 21 Jul | 69 | 639 | +12.11% |

| Smartworks Coworking | 407 | 10 Jul – 14 Jul | 17 Jul | 28.5 | 435.5 | +7.00% |

SME IPO GMP Update

Retail interest in SME IPOs remains strong as the Smallcaps Surge fuels aggressive bids in smaller names. Here’s the latest:

SME IPOs

| IPO Name | Price (₹) | Issue Dates | Listing Date | GMP (₹) | Expected Listing (₹) | Estimated Gain (%) |

|---|---|---|---|---|---|---|

| Asston Pharmaceuticals | 123 | 9 Jul – 11 Jul | 16 Jul | 15 | 138 | +12.20% |

| GLEN Industries | 97 | 8 Jul – 10 Jul | 15 Jul | 30 | 127 | +30.93% |

| Meta Infotech | 161 | 4 Jul – 8 Jul | 11 Jul | 45 | 206 | +27.95% |

| Cryogenic OGS | 47 | 3 Jul – 7 Jul | 10 Jul | 32 | 79 | +68.09% |

Conclusion:

The IPO market continues to ride the wave of Smallcaps Surge, with SME listings showing particularly explosive GMP gains. Keep an eye on upcoming listings—opportunities are heating up in both spaces.

Smallcap of the Day – Alkyl Amines Chemicals Ltd | Riding the Smallcaps Surge

Stock Price: ₹2,325 Market Cap: ₹11,903 Cr.

Sector: Specialty Chemicals Exchange: NSE: ALKYLAMINE | BSE: 506767

Despite a marginal dip in price, Alkyl Amines Chemicals Ltd remains a structurally strong candidate amid the ongoing Smallcaps Surge, supported by its industry leadership and robust fundamentals.

About the Company

Incorporated in 1979 by Mr. Yogesh Kothari, Alkyl Amines is one of India’s top producers of aliphatic amines and their derivatives. These chemicals have wide applications in pharmaceuticals, agrochemicals, rubber chemicals, and water treatment.

The company offers a diversified portfolio of 100+ products, including synthetic acetonitrile, triethylamine, and DMAHCL, with a global market presence. It is also the sole global producer of many niche amines.

Key Financial Highlights

| Metric | Value |

|---|---|

| Revenue (FY24) | ₹1,572 Cr |

| Profit After Tax | ₹186 Cr |

| Operating Profit | ₹291 Cr |

| Net Profit Margin | 10.4% |

| Return on Equity (ROE) | 14.0% |

| Return on Capital Employed | 18.7% |

| Debt to Equity Ratio | 0.00 (Debt-free) |

| Inventory Turnover Ratio | 5.78 |

| EPS Growth (3-Year) | -6.06% |

| Price to Book Value | 8.48 |

| Cash & Equivalents | ₹204 Cr |

Valuation Snapshot

With a P/E of 63.9 and EV/EBITDA of 36.4, the stock trades at premium valuations compared to the industry P/E of 35.7, reflecting investor confidence in its long-term growth story despite short-term margin pressures.

Why It Matters

While many large-cap stocks appear overheated, the Smallcaps Surge is shining light on fundamentally strong mid-sized companies like Alkyl Amines. Its debt-free balance sheet, high export potential, and diversified global clientele make it a key watchlist candidate for investors exploring quality smallcap picks.

Conclusion

The stock market outlook today reflects a tale of two trends—benchmark indices like Nifty 50 staying rangebound, while smallcaps surge on renewed investor interest. With technical indicators hinting at a potential breakout for Nifty and sectoral rotation underway, the broader market looks primed for select stock-specific action. Key breakouts like Sterling & Wilson, robust fundamentals in smallcaps like Alkyl Amines, and strong GMPs in the IPO space all point toward growing risk appetite among investors.

As always, stay stock-specific, watch volume trends, and track macro cues closely—opportunities are brewing beneath the index surface.

Related Articles

How a Tea Seller Used the Power of Compound Interest to Build ₹45 Lakh

China’s Fertilizer Export Halt to India: Stocks Set to Gain from the Supply Shock

The 15-15-15 Rule: Why the ₹1 Crore SIP Dream Needs a Reality Check