Introduction: Why Sector Rotation Matters in Investing

The stock market isn’t a monolith; it’s a collection of sectors that perform differently depending on the phase of the economic cycle. Aligning your portfolio with the right sectors at the right time is a strategy known as sector rotation. By understanding how various sectors react to economic shifts, investors can maximize returns and reduce risk.

In this blog, we’ll dive deep into sector rotation strategies, examine how India’s economic cycles influence sector performance, and provide actionable insights to realign your portfolio effectively.

What is Sector Rotation?

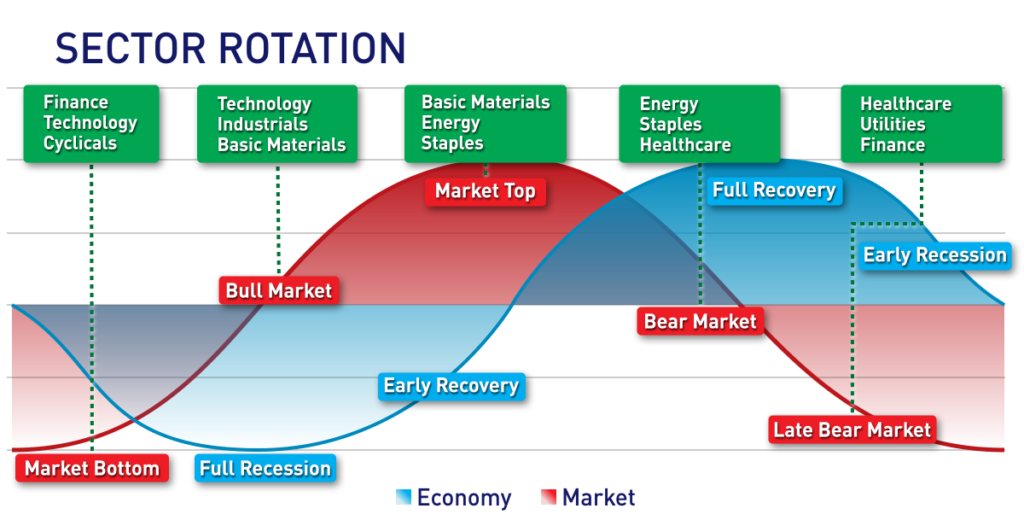

Sector rotation is an investment strategy that involves shifting your portfolio allocation from one sector to another based on the prevailing or anticipated phase of the economic cycle. Different sectors outperform during specific phases of the cycle, such as expansion, peak, contraction, or recovery.

Understanding India’s Economic Cycles

The Indian economy, like others, moves through distinct phases of the business cycle. Here’s how each phase impacts different sectors:

| Economic Phase | Characteristics | Sectors Likely to Outperform |

|---|---|---|

| Expansion | Rising GDP, increased consumer spending, and higher corporate profits. | Banking, real estate, capital goods, automobiles. |

| Peak | Slower growth as inflation rises, interest rates peak, and demand begins to cool. | FMCG, utilities, healthcare. |

| Contraction | Falling GDP, reduced consumer spending, and higher unemployment. | Pharmaceuticals, IT, gold (safe-haven assets). |

| Recovery | GDP starts rising, corporate earnings improve, and confidence returns to the market. | Infrastructure, energy, discretionary consumer goods. |

Sector Rotation Strategies for Indian Investors

1. Follow the Economic Indicators

Key economic indicators such as GDP growth, inflation, interest rates, and corporate earnings can help predict the next phase of the cycle.

Actionable Tip:

If inflation is high and interest rates are rising, consider shifting to defensive sectors like FMCG and healthcare. During falling interest rates, pivot to growth sectors such as banking and real estate.

2. Leverage Historical Trends

Analyze how sectors have historically performed during similar economic conditions. For example, during past periods of economic recovery in India, the infrastructure and energy sectors saw significant growth.

Case Study:

Post-2008 financial crisis, India’s recovery phase (2009-2011) saw strong performances in infrastructure and banking stocks.

3. Diversify Across Cyclical and Defensive Sectors

Cyclical sectors like automobiles and real estate tend to outperform during expansion, while defensive sectors such as FMCG and pharmaceuticals provide stability during contractions.

Actionable Tip:

Maintain a mix of both cyclical and defensive sectors to hedge against unexpected economic shifts.

4. Monitor Government Policies and Budget Announcements

Government initiatives, such as infrastructure spending or tax reforms, can boost specific sectors. For instance, increased allocations to renewable energy can make the energy sector more attractive.

Example:

The Indian government’s focus on affordable housing under the PMAY scheme has consistently benefited real estate and related sectors.

5. Incorporate Global Trends

Global economic trends often influence Indian markets. For example, a global tech rally could drive IT sector growth in India, even during a domestic slowdown.

Real-Life Application of Sector Rotation

- 2020 (Contraction): Pharma (Cipla, Divi’s Lab) surged due to COVID demand.

- 2021 (Recovery): IT (Infosys, Wipro) boomed with digital transformation.

- 2022 (Peak): Energy (ONGC, Coal India) rallied during the oil crisis.

- 2023 (Expansion): Infrastructure (L&T, Ultratech Cement) gains momentum.

Common Pitfalls to Avoid in Sector Rotation

1. Overreacting to Short-Term Trends

Chasing hot sectors based on short-term performance can lead to overvaluation risks. Focus on long-term fundamentals instead.

2. Ignoring Diversification

Over-concentrating in a single sector increases portfolio risk. Always diversify to balance risk and reward.

3. Timing the Market

Perfectly timing sector rotation is challenging. Instead, adopt a gradual approach to reallocating your investments.

Conclusion: Aligning with the Economic Rhythm

Sector rotation is a powerful strategy to enhance portfolio performance by aligning investments with economic cycles. By staying informed about economic indicators, government policies, and historical trends, you can make better decisions about when to pivot between sectors.

In a dynamic market like India’s, where sectors react differently to global and domestic events, mastering sector rotation can give you an edge. Start analyzing your portfolio today and ensure it’s aligned with the current economic cycle for optimized returns.

FAQs

1. Can retail investors use sector rotation strategies?

Yes, retail investors can implement sector rotation by using mutual funds or ETFs focused on specific sectors.

2. How often should I rebalance my portfolio?

Rebalancing depends on market conditions, but a review every 6-12 months is generally recommended.

3. Are there tools to track sector performance?

Yes, platforms like NSE and BSE provide sector indices, and financial websites offer sectoral heatmaps.

4. Can sector rotation guarantee profits?

While sector rotation can improve returns, it’s not risk-free. A disciplined and well-researched approach is essential.

5. Should I consult a financial advisor for sector rotation?

Yes, especially if you’re unfamiliar with market trends or economic indicators.

Helpful Links: