Saatvik Green Energy IPO – Intro

The Saatvik Green Energy IPO marks a significant opportunity in India’s rapidly expanding solar energy sector. Valued at ₹900 crores, the IPO is structured as a combination of a fresh issue of ₹700 crores and an offer for sale of ₹200 crores. Investors looking to gain exposure to the renewable energy space can participate in this book-built offering, which reflects the company’s robust growth in solar module manufacturing and EPC solutions.

Scheduled to open on September 19, 2025 and close on September 23, 2025, the Saatvik Green IPO will list on both BSE and NSE with a tentative listing date set for September 26, 2025. The issue price band is fixed between ₹442 to ₹465 per share, with a minimum retail investment of ₹14,880 for 32 shares at the upper price.

With a strong track record in solar module manufacturing and a rapidly growing order book, Saatvik Green Energy Limited aims to leverage this IPO to fund expansion projects, repay borrowings, and further strengthen its position in the renewable energy market.

Saatvik Green Energy IPO Details

The Saatvik Green Energy IPO is a ₹900 crore book-built issue, combining a fresh issue and an offer-for-sale. This section provides a quick snapshot, important dates, and the objectives of the issue for potential investors.

Saatvik Green Energy IPO Snapshot

| Particulars | Details |

|---|---|

| IPO Size | ₹900.00 Cr |

| Fresh Issue | 1,50,53,763 shares (₹700.00 Cr) |

| Offer for Sale | 43,01,075 shares (₹200.00 Cr) |

| Issue Price Band | ₹442 – ₹465 per share |

| Face Value | ₹2 per share |

| Lot Size | 32 shares |

| Minimum Retail Investment | ₹14,880 |

| Employee Discount | ₹44 per share |

| Issue Type | Bookbuilding IPO |

| Listing | BSE, NSE |

| IPO Document | RHP File |

| Registrar | Kfin Technologies Ltd. |

| Shareholding Pre-Issue | 11,20,47,000 shares |

| Shareholding Post-Issue | 12,71,00,763 shares |

Saatvik Green IPO Important Dates (Tentative)

| Event | Date |

|---|---|

| IPO Open | Fri, Sep 19, 2025 |

| IPO Close | Tue, Sep 23, 2025 |

| Tentative Allotment | Wed, Sep 24, 2025 |

| Refunds Initiation | Thu, Sep 25, 2025 |

| Credit of Shares to Demat | Thu, Sep 25, 2025 |

| Tentative Listing Date | Fri, Sep 26, 2025 |

| Cut-off for UPI Mandate | 5 PM, Tue, Sep 23, 2025 |

Objects of the Issue

- Prepayment or scheduled repayment of certain outstanding borrowings: ₹10.82 Cr

- Investment in wholly owned subsidiary, Saatvik Solar Industries Pvt. Ltd., for repayment/prepayment of borrowings: ₹166.44 Cr

- Investment in subsidiary to set up a 4 GW solar PV module manufacturing facility in Odisha: ₹477.23 Cr

- General corporate purposes

Saatvik Green Energy Ltd. – Company Overview & Business Model

Saatvik Green Energy Ltd., a leading solar module manufacturer and EPC service provider in India, has established itself as a key player in the solar energy sector. Since its incorporation in 2015, the company has grown rapidly and currently operates an installed module manufacturing capacity of 3.80 GW as of March 31, 2025, positioning it among the top module manufacturers in India.

The company offers a comprehensive portfolio of solar products, including:

- Mono PERC modules – monocrystalline passive emitter and rear cell modules

- N-TopCon solar modules – available in mono-facial and bifacial options, suitable for residential, commercial, and utility-scale projects

Saatvik Green Energy Ltd. also provides engineering, procurement, and construction (EPC) services, including ground-mounted and rooftop solar projects, along with operations & maintenance (O&M) services for its EPC installations. The company’s EPC portfolio includes marquee projects like:

- 61.42 MW floating solar project in Ramagundam, Telangana (Fiscal 2023)

- 72.15 MW Raghanseda Solar Park, Gujarat (Fiscal 2023)

- 12 MW rooftop project for Jindal Steel and Power Limited (Fiscal 2024)

- 16 MW ground-mounted project for Dalmia Bharat Green Vision Ltd., Tamil Nadu (Fiscal 2024)

The company’s manufacturing facilities are located in Ambala, Haryana, spanning 724,225 sq. ft., making it one of the largest single-location module production units in India. These facilities use fully automated machinery and advanced M10, G12, M10R, and G12R technologies, maintaining high product quality and efficiency. The company plans to expand its installed capacity to 4.80 GW in the coming years.

Key Highlights of Saatvik Green Energy Ltd.:

- Operational EPC base of 69.12 MW as of March 31, 2025

- Supplied over 2.50 GW of high-efficiency solar modules domestically and internationally

- Diverse customer base including utility-scale developers, IPPs, commercial & industrial clients, EPC contractors, and PSUs

- Substantial order book – 4.01 GW domestic orders as of June 30, 2025

- Multiple sales channels – direct sales to large projects, distributors, resellers, and channel partners (53 partners across India)

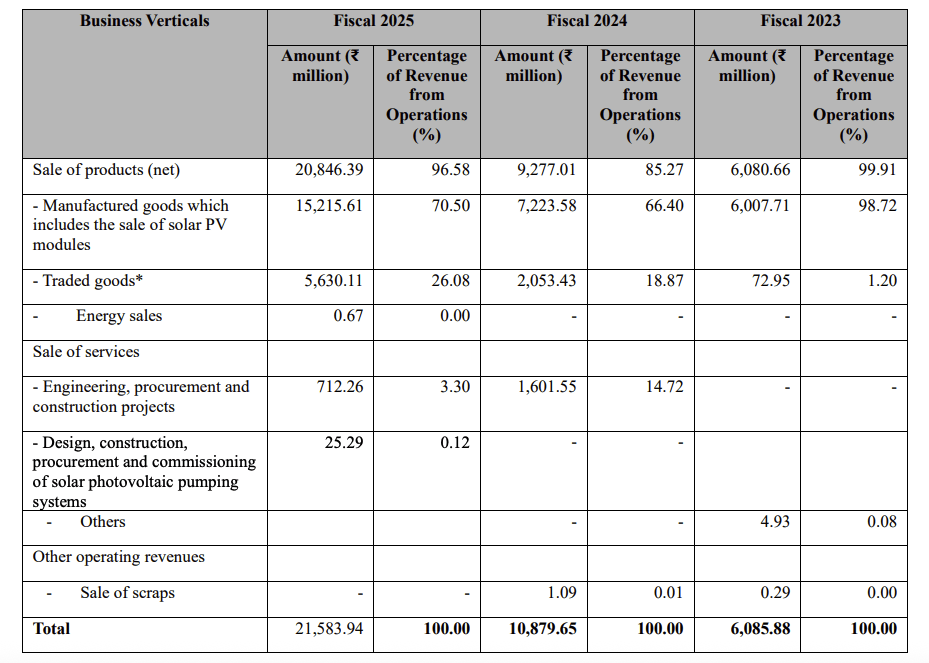

Revenue Breakdown by Business Verticals

Summary: With advanced manufacturing capabilities, a diversified client base, a strong EPC and O&M portfolio, and strategic expansion plans, Saatvik Green Energy IPO offers investors a chance to participate in a fast-growing solar energy company with strong domestic and international presence.

Financial Performance- Saatvik Green Energy IPO

Saatvik Green Energy Ltd. has exhibited robust growth in both operational scale and financial performance over the last three fiscal years. The company’s revenue has more than doubled between FY24 and FY25, with profit after tax (PAT) increasing by over 113%, driven by strong domestic and export module sales, efficient EPC execution, and high utilization of its solar module manufacturing facilities.

Financial Summary (in ₹ Crore)

| Particulars | FY25 | FY24 | FY23 |

|---|---|---|---|

| Assets | 1,635.74 | 688.04 | 263.00 |

| Total Income | 2,192.47 | 1,097.18 | 617.63 |

| Profit After Tax (PAT) | 213.93 | 100.47 | 4.75 |

| EBITDA | 353.93 | 156.84 | 23.87 |

| EBITDA Margin | 16.40% | 14.42% | 3.92% |

| PAT Margin | 9.76% | 9.16% | 0.77% |

| Net Worth | 337.66 | 120.67 | 20.27 |

| Reserves & Surplus | 315.25 | 117.36 | 16.89 |

| Total Borrowing | 458.10 | 263.42 | 144.49 |

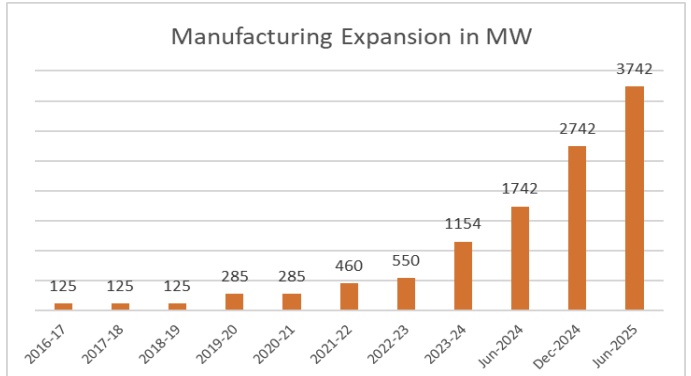

| Installed Capacity (MW) | 3,742 | 1,154 | 550 |

| Effective Installed Capacity (MW) | 1,743.66 | 566 | 510 |

| Actual Module Production (MW) | 1,459.39 | 501 | 248.61 |

| Capacity Utilization (%) | 83.70% | 88.52% | 48.75% |

| Total Order Book (₹ Cr) | 5,076.85 | 559.97 | 686.19 |

| Total Order Book (MW) | 3,522.05 | 300.13 | 223.36 |

| Total Sales (MW) | 1,388.40 | 458.76 | 242.50 |

Key Ratios (FY25)

| Ratio | FY25 |

|---|---|

| ROE | 63.41% |

| ROCE | 60.45% |

| Debt/Equity | 1.36 |

| Asset Turnover | 1.86 |

| PAT Margin | 9.76% |

| EBITDA Margin | 16.40% |

| Current Ratio | 1.14 |

| Net Working Capital (Days) | 26.97 |

| Gross Debt (₹ Cr) | 458.10 |

| Net Worth (₹ Cr) | 337.66 |

Analysis:

- Exceptional Growth: Revenue grew at a CAGR of ~88% from FY23 to FY25, while PAT surged by 113% in FY25, reflecting strong operational execution and high demand for solar modules.

- High Profitability: EBITDA margin of 16.4% and PAT margin of 9.76% demonstrate efficient cost management and sustainable profitability in a competitive industry.

- Strong Returns: ROE of 63.41% and ROCE of 60.45% indicate high returns on equity and capital employed, positioning the company as a highly profitable solar PV manufacturer.

- Healthy Leverage: Debt-to-equity ratio of 1.36 shows balanced leverage, supporting aggressive capacity expansion while managing financial risk.

- Operational Efficiency: Capacity utilization of 83.7% and actual production of 1,459 MW underline effective use of the 3.8 GW installed manufacturing capacity.

- Robust Order Book: Total order book of ₹5,076.85 Cr (~3,522 MW) ensures strong near-term revenue visibility and business stability.

Valuation & Peer Comparison

Saatvik Green Energy IPO is positioned at a premium relative to its book value and earnings, reflecting the company’s strong operational performance, robust order book, and leading position in India’s solar module manufacturing industry.

Saatvik Green Energy IPO Valuation

| Metric | Pre-IPO | Post-IPO |

|---|---|---|

| EPS (₹) | 19.09 | 16.83 |

| P/E (x) | 24.35 | 27.63 |

| Price to Book Value | 43.18 | – |

Analysis:

- The P/E ratio post-IPO at 27.63x indicates a moderately high valuation compared to industry peers, justified by strong revenue growth, high EBITDA margins (16.4%), and an expanding order book.

- The Price-to-Book Value of 43.18x signals market expectations of continued growth and strong return on equity (ROE 63.41%).

Peer Comparison of Saatvik Green IPO

| Company Name | EPS (Basic) | NAV per Share (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

|---|---|---|---|---|---|

| Saatvik Green Energy Ltd. | 19.09 | 30.14 | 27.63 | 63.41 | 43.18 |

| Waaree Energies Ltd. | 68.24 | 158.13 | 19.48 | 55.02 | 23.66 |

| R S Premier Energies Ltd. | 21.35 | 15.33 | 49.96 | 33.14 | 71.07 |

Key Insights:

- Saatvik Green Energy demonstrates superior ROE (63.41%) compared to peers, indicating efficient capital utilization.

- The company’s P/BV is higher than Waaree Energies (23.66x) but lower than R S Premier Energies (71.07x), reflecting market recognition of its growth potential.

- EPS of Saatvik Green Energy is lower than Waaree Energies but higher than R S Premier, positioning it as a mid-sized yet fast-growing player in India’s solar sector.

- Overall, Saatvik Green Energy IPO offers investors exposure to a high-growth, high-margin solar manufacturing company, with strong operational metrics relative to listed peers.

Strengths vs Risks of Saatvik Green IPO

| Strengths | Risks |

|---|---|

| Leading module manufacturer in India with 3.8 GW installed capacity (FY25). | High valuation: P/E 27.63x, P/BV 43.18x may limit short-term upside. |

| Strong revenue growth: Revenue ₹21,583.94 Cr in FY25 (100% YoY) and PAT ₹2,139.30 Cr (113% YoY). | Dependence on solar policies and government incentives. |

| Diverse product portfolio: Mono PERC & N-TopCon modules for multiple applications. | Execution risk in EPC projects – delays or cost overruns can affect margins. |

| Integrated EPC & O&M capabilities for end-to-end solar solutions. | Debt-to-equity ratio of 1.36x exposes financial leverage risk. |

| Large, diversified customer base across India and international markets. | Technology risk – need to invest in R&D to stay competitive. |

| High ROE (63.41%) and ROCE (60.45%) indicate efficient capital use. | Raw material price fluctuations may impact profitability. |

| Strategic expansion plans: Ambala capacity to 4.8 GW, new Odisha & MP facilities. | Competition from Waaree Energies, R S Premier Energies, and new entrants. |

| Robust domestic order book: 4.01 GW as of June 30, 2025. | Export exposure: Currency fluctuations & trade policies risk. |

| Efficient operations: High capacity utilization (83.7%), ISO-certified facilities. | Operational concentration: Majority manufacturing in Ambala; disruptions can affect supply. |

| Strong industry tailwinds due to India’s renewable energy push. | Environmental & regulatory compliance risk. |

Saatvik Green Energy IPO GMP (Grey Market Premium)

Saatvik Green Energy IPO GMP indicates the market sentiment and possible listing gains for investors. The table below shows the latest GMP data:

| GMP Date | IPO Price (₹) | GMP (₹) | Sub2 Sauda Rate | Estimated Listing Price (₹) | Estimated Profit (₹) |

|---|---|---|---|---|---|

| 17-09-2025 | 465.00 | 73 ↑ | 1800/25200 | 538 | 2,336 |

Key Insight: The GMP of ₹73 suggests an estimated listing gain of around 15.70% based on current market trends.

Conclusion – View on Saatvik Green Energy IPO

Saatvik Green Energy IPO presents a compelling opportunity in India’s fast-growing solar energy sector. With a strong manufacturing base of 3.8 GW, a diversified client portfolio, and integrated EPC and O&M services, the company is well-positioned to benefit from the government’s renewable energy push and rising solar adoption. The robust financial performance with 100% revenue growth and 113% PAT growth between FY24 and FY25, coupled with high ROE (63.41%) and EBITDA margin (16.40%), highlights operational efficiency and scalability. While the valuation appears premium compared to some peers, the market tailwinds and expansion plans, including Odisha and Madhya Pradesh facilities, offer long-term growth potential.

Short-Term Strategy

- Monitor the GMP trend and listing day demand to capitalize on potential listing gains.

- Retail investors may consider applying at cut-off within their investment limit for a possible short-term upside of 10–15%.

- Focus on allocation across multiple lots to increase the probability of allotment.

Long-Term Strategy

- Investors with a 2–3 year horizon can leverage the company’s growth story in solar module manufacturing, EPC, and O&M services.

- Consider the strong order book (4.01 GW as of June 2025) and expansion into new capacities as indicators of sustained revenue growth.

- The strategic presence in high solar incidence regions (North India) ensures continued demand and operational advantage.

Allotment Strategy

- Apply for a minimum of 1–2 retail lots to maximize chances of allotment while staying within investment limits.

- Consider small-to-medium HNI applications (sNII) for better probability without overexposing funds.

- Diversify applications across IPOs to optimize portfolio risk versus allocation probability.

“Saatvik Green Energy IPO lights up the path for renewable growth—bright prospects for patient investors.”

Saatvik Green Energy IPO FAQs:

What is the price band of Saatvik Green Energy IPO?

The Saatvik Green Energy IPO price band is set at ₹442 to ₹465 per share.

When does the Saatvik Green Energy IPO open for subscription?

The IPO opens on September 19, 2025.

When does the Saatvik Green Energy IPO close for subscription?

The IPO closes on September 23, 2025.

What is the lot size for retail investors in Saatvik Green IPO?

The lot size is 32 shares per application.

What is the minimum investment amount for retail investors?

The minimum investment required for retail investors is ₹14,880, based on the upper price band.

On which stock exchanges will Saatvik Green Energy IPO be listed?

The IPO will be listed on BSE and NSE.

Who are the promoters of Saatvik Green Energy Ltd.?

The promoters are Neelesh Garg, Manik Garg, Manavika Garg, and SPG Trust.

What is the total size of Saatvik Green Energy IPO?

The IPO is ₹900 Cr, comprising a fresh issue of ₹700 Cr and an Offer for Sale of ₹200 Cr.

What is the tentative listing date for Saatvik Green IPO?

The tentative listing date is September 26, 2025.

Who is the registrar for Saatvik Green Energy IPO?

The registrar of the IPO is KFin Technologies Ltd.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?