Volatility ahead — that’s the message from Friday’s market action. The day started strong, flirted with a breakout mid-session, but closed with a whimper. The Nifty 50 barely held a +0.05% gain, while the Sensex rose 0.32%. Even Bank Nifty ended flat at +0.05%, after showing early strength.

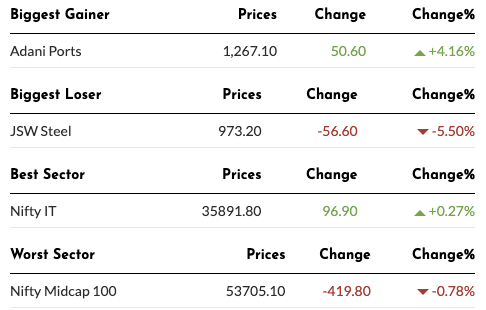

Underneath the surface, things were shakier. The Nifty Midcap 100 dropped 0.78%, and JSW Steel nosedived 5.5%, dragging sentiment lower. The highlight? Adani Ports surged 4.16%, but there weren’t many celebrating.

With markets now closed for the weekend, traders are left staring at charts — and uncertainty. The setup? A stalled rally, narrowing leadership, and mixed global cues.

What’s next? In this edition, we decode the global triggers, chart patterns, stock setups, and sectors that could lead or lag — so you’re not caught off guard when volatility strikes.

Global Market Recap: Strong Tailwind or Trap?

Global markets ended the week on a bullish note — almost too bullish.

- Nasdaq surged +1.52%

- S&P 500 rose +0.63%, and

- Dow added +0.21% — driven by strong Big Tech earnings and hopes of a soft landing in the US economy.

In Europe, the rally was even sharper:

- DAX jumped +1.62%,

- CAC 40 gained +1.50%, and

- FTSE 100 added +0.74% — shrugging off macro concerns for now.

In Asia, sentiment mirrored the optimism:

- Nikkei rallied +1.04%,

- Hang Seng soared +1.74%

- But Shanghai Composite slipped -0.23%, showing China still isn’t dancing to the same tune.

What It Means for India:

- These global gains may set the tone for a gap-up open on Monday, especially with FIIs still active.

- But with Nifty stalling at resistance and midcaps already under pressure, any excitement could fade fast — volatility ahead remains the real theme.

Traders should prepare for Monday as a “reaction day” — a chance to catch either a breakout confirmation or the start of a fade. Don’t chase the open — plan the follow-through.

Nifty Outlook: Breakout Blocked, But Uptrend Holds

Volatility ahead — that’s the clearest signal Nifty gave us on Friday. The index closed at 24,346.70, up just 0.05%, after testing key resistance near 24,580 and getting firmly rejected. This was the same zone where earlier rallies failed — and once again, it’s proving tough to crack..

🔍 What We’re Seeing:

- Resistance Zone: 24,580–24,789 remains a ceiling. Price touched it, stalled, and formed a small-bodied candle — classic indecision at supply.

- Support Zone: The 9 EMA and horizontal support near 23,990 is holding firm. It’s the bulls’ last reliable floor before momentum sours.

- Volume Check: Above-average volume shows institutions were active — but the candle’s size shows no real control. This means either a buildup… or a setup for a trap.

- Gap Magnet Below: The 23,000–23,200 gap still lies unfilled. It’s far — but gaps tend to pull price when things unravel.

What to Expect on Monday:

| Scenario | Watch For | What It Means |

|---|---|---|

| Bullish | Breakout above 24,580 | Rally toward 24,789+ possible |

| Range-Bound | Choppy moves between 24,000–24,580 | Consolidation with volatility |

| Bearish | Breakdown below 23,990 | Retest of 23,800 – sentiment weakens |

Strategy Forward:

Be cautious — volatility ahead means both breakout and breakdown are possible.

No need to jump the gun. Let the price confirm.

Go long only above 24,580 on strength, or on dips toward 23,990 with tight stop-loss.

Stocks in News & Their Impact

DIIs Beat Foreigners in Market Share for the First Time!

For the first time since 2009, domestic institutional investors (DIIs) like mutual funds, LIC, and insurance companies now own more NSE-listed stocks than FPIs (foreign investors). As of March 2025:

- DIIs held 17.62%, slightly higher than FPIs at 17.22%.

- This is thanks to rising SIPs and retail flows, while FPIs have reduced exposure over the years.

Impacted Stocks:

- HDFC AMC, Nippon India AMC, UTI AMC – AMCs benefit directly from retail money flow.

- CAMS – Gains from rising mutual fund activity.

- Positive for domestic-focused sectors (PSU banks, consumer, infra) as they are DIIs’ favorites.

Warren Buffett’s ‘Buy’ Indicator Signals Opportunity

The famous Buffett Indicator (Market Cap to GDP ratio) for US stocks is at its lowest since Sept 2024, hinting that US stocks may be undervalued now. This improves global risk appetite.

Impacted Stocks:

- Infosys, TCS, LTIMindtree – Indian IT firms with large US exposure may benefit from positive sentiment abroad.

- Could support FII inflows into India, especially in tech and large-cap stocks.

BYD Hits Record Sales – EV Demand Isn’t Slowing

China’s BYD sold 380,089 electric/hybrid cars in April 2025, its best-ever month. For the first time in a year, pure EV sales (195,740) outpaced hybrids.

Impacted Stocks:

- Tata Motors, M&M – Already strong EV players in India.

- Olectra Greentech, Sona BLW – Ancillaries that benefit from global EV acceleration.

Vedanta May List Zambia Copper Arm in the US

Vedanta is exploring a $1 billion IPO of its Zambia-based Konkola Copper Mines (KCM) to fund expansion. This follows regaining control of the mines after 5 years.

Impacted Stock:

- Vedanta Ltd – Positive if fundraising reduces debt.

- Could trigger optimism across metal stocks (e.g., Hindustan Zinc, Hindustan Copper).

Paras Defence Posts Strong Q4, Big Order Pipeline

Paras Defence reported a Q4 net profit of ₹19.7 Cr (up 98%), revenue growth of 36%, and is now eyeing an order book of ₹1,500 Cr. Also announced ₹0.50 dividend and a 1:2 stock split.

Impacted Stock:

- Paras Defence – Positive momentum likely to continue.

- Sentiment booster for Data Patterns, BEL, and other defence stocks.

India’s Manufacturing PMI Hits 10-Month High

India’s April Manufacturing PMI rose to 58.2, indicating strong output and export orders — the fastest export growth in 14 years. Selling price inflation also hit a decade-high.

Impacted Stocks:

- L&T, Siemens, ABB India – Capital goods and automation stocks likely to benefit.

- Bharat Forge, Cummins India – Export-oriented industrials in focus.

SEBI vs Pranav Adani – Insider Trading Allegation

SEBI has accused Pranav Adani of leaking deal info about Adani Green’s 2021 SB Energy acquisition to his brother-in-law, who allegedly traded based on that.

Impacted Stocks:

- Adani Green, Adani Enterprises – Might see short-term volatility.

- Traders should stay alert for regulatory updates.

Priority Jewels Files for IPO – All Fresh Issue

Mumbai-based Priority Jewels filed DRHP for an IPO of 54 lakh fresh shares. ₹75 Cr will be used for debt repayment, and the rest for expansion.

Impacted Stocks:

- Kalyan Jewellers, Titan – May gain attention as jewellery demand and valuations rise.

- Watch sentiment in listed peers during IPO buzz.

V-Mart Announces 3:1 Bonus, Skips Dividend

V-Mart will issue 3 bonus shares for every 1 held, its first-ever bonus. But it won’t pay any dividend for FY25.

Impacted Stock:

- V-Mart Retail – May rally in short term on bonus cheer.

- Long-term growth outlook still key for re-rating.

Coal India Output Inches Up, But Supply Falls

April 2025 production: 62.1 MT (up 0.5%)

Offtake/supply: 63.4 MT (down 1.2%)

Impacted Stock:

- Coal India – Neutral to slightly negative; may see range-bound action unless thermal demand surges.

Long-Term Stock Pick: Is Tatva Chintan Ready for a Comeback?

While midcaps are heating up again, one quiet name from the specialty chemical space might be prepping for its next cycle—Tatva Chintan Pharma Chem Ltd.

Business Snapshot

Tatva Chintan is no rookie. It manufactures advanced specialty chemicals used in:

- Supercapacitors

- Agrochemical and pharma intermediates

- Structure directing agents (SDA)

- Catalysts and performance chemicals

Its products find use across industries: automotive, coatings, pharma, petrochemicals, and even fragrances.

What Went Wrong

- Revenue Decline: 5.6% annual drop over 5 years.

- Profit Crash: PAT fell 77% YoY (9MFY24).

- Weak Returns: ROCE down to just 3.4%.

- Valuation Risk: P/E of 118x—way higher than the sector median.

In simple terms: great chemistry, bad math lately.

But Here’s the Catch

Tatva operates in a cyclical segment—global specialty chemicals—where demand, input costs, and exports often swing performance.

And right now:

- Crude prices are stable (good for margins).

- India is focusing on import substitution.

- Global interest in green chemistry and battery-grade chemicals is rising.

If demand recovers and margins normalize, Tatva’s sharp fall may offer a contrarian entry point.

Final Take

Tatva Chintan is not a momentum bet, but a cyclical turnaround story. If you believe chemical exports and clean-tech demand will rebound in 2025–26, this midcap deserves a spot on your watchlist.

💼 Want to track smart entries on such niche opportunities?

Set alerts, track fundamentals, and explore swing-to-investor picks—right from your Angel One account. You don’t need a lab to analyze stocks—just the right tools.

What To Do Now: Monday Gameplan

1. Flat Close After Volatile Friday = Expect Gaps

The market opened strong (+0.5%) but fizzled out to close almost flat at +0.05%. This kind of action signals one thing loud and clear — volatility ahead. Stay light on positions and wait for Monday’s open to confirm direction.

2. Watch 24,580 – Break or Bounce?

This is now the key resistance. A close above this level could trigger a short-term breakout toward 24,789.

No breakout = possible retest of the 23,990–24,000 support zone.

3. Global Sentiment is Strong — But India is Lagging

Nasdaq jumped +1.52% and DAX +1.6% on Friday. If the global party continues, Nifty could open higher. But don’t jump in blindly — India’s flat close hints at exhaustion near highs.

4. Stock Specific is Key

- Bajaj Finance split/bonus trade might stay active.

- Tatva Chintan is our long-term watch, but avoid chasing unless valuation improves.

- Auto & IT showed relative strength, but Metals & Midcaps showed weakness.

5. F&O Strategy

IVs are still low. For options traders, use defined risk strategies like debit spreads. Avoid naked calls or puts — this is a market with traps, not trends.

Final Thought: Stay Light, Stay Sharp

Friday’s action was a warning — rallies can get rejected fast. With signs of volatility ahead, your edge is reacting to confirmation, not predicting headlines. Watch the zones. Play the levels.

💼 Ready to navigate volatility like a pro?

Angel One’s smart alerts, FII data tools, and technical screeners make it easier to cut through noise and act with precision.

📱Open your Angel One app — where your next trade meets logic, not guesswork.