The Story That Changed My View of Money

Power of Compound Interest: I wasn’t expecting a life lesson in wealth-building when I stepped out for a cup of tea in a sleepy town in Assam. It was supposed to be a short halt during a solo backpacking trip. But what I stumbled into was a financial masterclass—delivered by a man in a checked lungi, pouring chai.

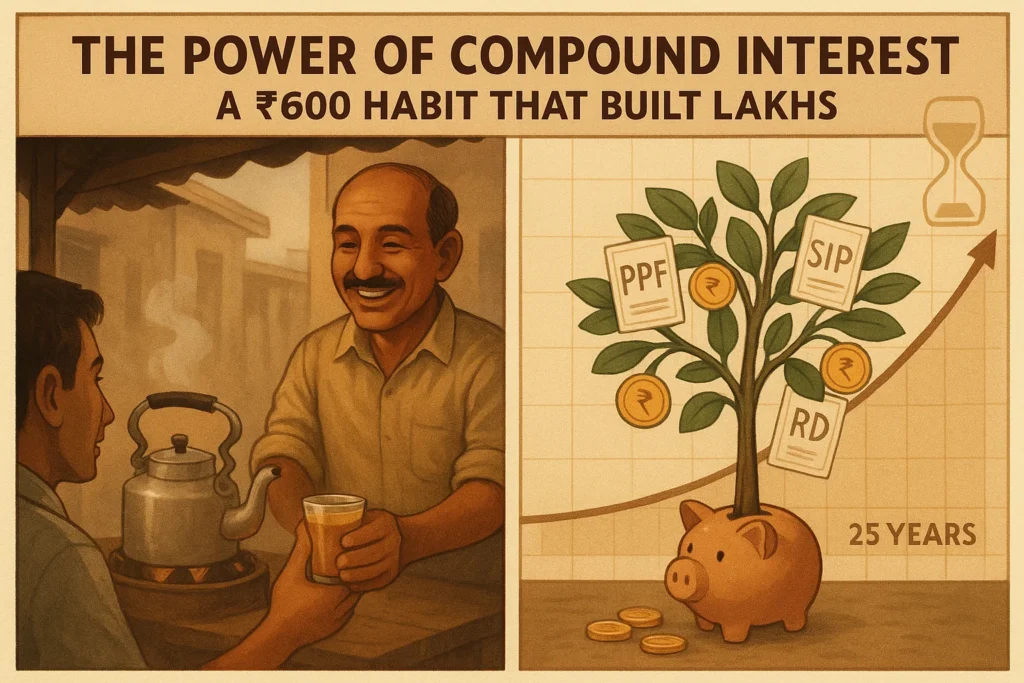

His name was Anupam, and he had run a tea stall at the local bus stop for nearly three decades. His customers included rickshaw pullers, students, office-goers, and the occasional wanderer like me. But Anupam wasn’t your average vendor. He was, as I later discovered, a living example of how the power of compound interest can work for anyone—even those with humble earnings.

He had amassed over ₹45 lakh through nothing more than consistent saving, a bit of patience, and a lot of belief in time.

“Main jyada kamaata nahi tha, bas usi paisa ko waqt ke saath chhod diya.”

(“I never earned a lot, I just let that small money sit with time.”)

That line hit me harder than most of the investing advice I’d heard in finance webinars or YouTube videos.

Understanding the Power of Compound Interest

So what exactly is this “compound interest” that turned a modest tea-seller into a quiet crorepati?

Let’s first get rid of the complex formulas.

🔁 What is Compound Interest?

In simple terms, compound interest is earning interest not just on your original investment (principal), but also on the interest it generates over time. It’s growth on top of growth. Imagine stacking bricks, and every year, the stack grows taller because it’s building on last year’s stack.

Here’s what it looks like in a real scenario:

- Anupam started with ₹600/month in a recurring deposit in the early 1990s.

- When interest rates dropped, he moved to PPF (Public Provident Fund).

- Eventually, he began investing ₹1,000/month in a SIP recommended by his local bank.

He never stopped. No withdrawals. No emergencies dipped into it. He treated it as invisible money.

Assuming an average return of 10–12% over 25 years, his ₹1,000/month grew into ₹45–50 lakh, all without market timing or financial jargon.

💡 Why Time Matters More Than Amount

A common misconception is that you need a lot of money to invest. You don’t. You need a lot of time.

Let’s compare two people:

- Ravi starts investing ₹3,000/month at age 25 and stops at 35.

- Karan starts investing ₹6,000/month at age 35 and continues till 60.

Guess who ends up with more?

Ravi, who invested only for 10 years but started early, beats Karan’s 25-year effort.

Why? Because Ravi gave his money time to compound. Every rupee he invested kept multiplying even after he stopped.

That’s the power of compound interest: the earlier you start, the less you have to invest to reach the same goal.

Lessons from Anupam (and How You Can Start)

Now let’s talk about what you can learn from Anupam.

Anupam didn’t go to school. He didn’t read finance books. He didn’t understand the stock market. But he understood:

- That time is more powerful than effort

- That consistency beats intelligence

- And that good money habits matter more than income level

📌 Lesson 1: Start with Whatever You Have

If you can afford a coffee or a Netflix subscription, you can start investing. Even ₹500/month is enough if you give it 20–30 years.

Platforms like Zerodha, Groww, Paytm Money, and even post offices allow SIPs or recurring deposits. Choose one. Start today.

📌 Lesson 2: Automate and Forget

Anupam said it best:

“Jo paisa aankhon ke saamne hota hai, voh kharch ho jaata hai.”

(“The money you see is the money you spend.”)

The trick is to automate your investments—just like a bill. Set it and forget it.

Apps now let you auto-debit every month into mutual funds, PPF, or ETFs. When it’s invisible, you won’t miss it.

📌 Lesson 3: Reinvest Everything

Don’t withdraw gains. Don’t pause SIPs when the market is down. Let it ride.

Compounding works best when it’s uninterrupted. Let every rupee stay invested. It’s building a snowball. Every time you touch it, you slow it down.

📌 Lesson 4: Don’t Get Greedy

Anupam never chased high returns. He wasn’t looking for “10x stocks” or “crypto moonshots.” He stayed steady with low-risk, consistent options.

This saved him from panic-selling and poor decisions. Stick to simple things that you understand—PPF, index funds, ELSS, or fixed-income instruments if you’re conservative.

Money Brew Like Chai: Power of Compound Interest

Before I left that town, I told Anupam I would write about him someday. He just laughed and said:

“Paisa, Chai jaise hai. Jaldi banega toh feeka lagega. Samay lagega toh swaad aayega.”

(“Money is like tea. If you rush it, it tastes bland. If you let it brew, it’s perfect.”)

The power of compound interest is real. It doesn’t require genius. Just time, patience, and the discipline to not interrupt the process.

So here’s your takeaway:

- Start small. Start now. Let it brew.

- Don’t wait for a raise. Don’t wait for a lump sum. Don’t wait for perfect knowledge.

- Let compounding do what it has always done—build wealth for the patient.

Just like Anupam, you don’t need to be rich to start.

You just need to start to get rich.

FAQs: Power of Compound Interest

What is compound interest?

Compound interest is interest earned on both your original investment and the interest it has already generated.

Why is compound interest powerful?

Because it accelerates your money’s growth over time—especially when reinvested consistently.

How often is compound interest calculated?

It depends on the product—monthly, quarterly, or annually. The more frequent, the better.

Is it better to start early or invest more later?

Starting early gives you more time for compounding—often beating late but larger investments.

Can SIPs benefit from compound interest?

Yes, SIPs in mutual funds compound over time if left invested for the long term.

Which is better—compound or simple interest?

Compound interest is far superior for long-term wealth creation.

What’s the minimum amount I need to start?

You can start with as little as ₹500/month through SIPs or recurring deposits.

Does compound interest work in the stock market?

Yes, especially when you reinvest dividends and stay invested for years.

What kills the power of compounding?

Frequent withdrawals, inconsistent investing, and short-term thinking.

How long should I invest to see real results?

Ideally, 10 years or more. The longer you stay, the more exponential the growth.

Related Articles:

The 15-15-15 Rule: Why the ₹1 Crore SIP Dream Needs a Reality Check

More Articles

Insider Buying in Indian Stocks: Hidden Signals You Shouldn’t Ignore

India’s $40 Billion Spending Wave: What’s Powering the Next Consumption Boom?

Electric Plane Take Off: How Beta’s ₹700 Flight Could Disrupt Aviation Stocks