Introduction – PhysicsWallah IPO

India’s homegrown edtech unicorn, PhysicsWallah, is gearing up for one of the most awaited IPOs of 2025. Known for revolutionizing affordable online education and hybrid learning, the brand that began with YouTube lectures is now making its way to Dalal Street. The PhysicsWallah IPO is not just a financial event — it’s a moment that symbolizes the rise of Indian edtech from startup screens to stock screens.

With a total issue size of ₹3,480 crore, the IPO combines a fresh issue worth ₹3,100 crore and an offer for sale (OFS) of ₹380 crore. The funds raised aim to fuel offline expansion, invest in technology, and strengthen the company’s rapidly growing learning ecosystem.

For investors, this IPO offers a chance to participate in India’s expanding edtech and upskilling market. But the question remains — does PhysicsWallah’s brand power and growth translate into sustainable financial strength? Let’s decode it in this detailed PhysicsWallah IPO review.

PhysicsWallah IPO Overview

The PhysicsWallah IPO is a book-built issue of ₹3,480 crore, consisting of both fresh equity shares and an offer for sale. The issue opens on November 11, 2025, and closes on November 13, 2025, with the tentative listing date set for November 18, 2025, on both BSE and NSE.

The IPO is managed by Kotak Mahindra Capital Co. Ltd., with MUFG Intime India Pvt. Ltd. as the registrar. Investors can bid within the price band of ₹103–₹109 per share. The minimum application lot size is 137 shares, translating to a retail investment of ₹14,933 at the upper band.

PhysicsWallah IPO Details

| Particulars | Details |

|---|---|

| IPO Date | November 11, 2025 to November 13, 2025 |

| Listing Date | November 18, 2025 (Tentative) |

| Face Value | ₹1 per share |

| Price Band | ₹103 to ₹109 per share |

| Lot Size | 137 Shares |

| Issue Size | ₹3,480 crore |

| Fresh Issue | ₹3,100 crore (28.44 crore shares) |

| Offer for Sale (OFS) | ₹380 crore (3.49 crore shares) |

| Issue Type | Book-built Issue |

| Listing At | BSE, NSE |

| Employee Discount | ₹10 per share |

| Lead Manager | Kotak Mahindra Capital Co. Ltd. |

| Registrar | MUFG Intime India Pvt. Ltd. |

PhysicsWallah IPO Timeline (Tentative Schedule)

| Event | Date |

|---|---|

| IPO Open Date | Tuesday, November 11, 2025 |

| IPO Close Date | Thursday, November 13, 2025 |

| Allotment Date | Friday, November 14, 2025 |

| Refund Initiation | Monday, November 17, 2025 |

| Credit of Shares to Demat | Monday, November 17, 2025 |

| Listing Date (Tentative) | Tuesday, November 18, 2025 |

| Cut-off Time for UPI Confirmation | 5 PM, November 13, 2025 |

Use of IPO Proceeds – PhysicsWallah IPO

The PhysicsWallah IPO aims to raise ₹3,480 crore, out of which ₹3,100 crore will come from the fresh issue and ₹380 crore through an offer for sale (OFS) by existing shareholders.

According to the company’s Red Herring Prospectus (RHP), the net proceeds from the fresh issue will be utilized to fund expansion, digital infrastructure, acquisitions, and other strategic purposes to strengthen PhysicsWallah’s growing edtech ecosystem.

Below is the detailed breakdown of the Objects of the Issue and the expected allocation of funds:

| Objects of the Issue | Expected Amount (₹ in Crores) |

|---|---|

| Capital expenditure for fit-outs of new offline and hybrid centers of the Company | 460.55 |

| Expenditure towards lease payments of existing identified offline and hybrid centers operated by the Company | 548.31 |

| Capital expenditure for fit-outs of new offline centers of subsidiary Xylem | 31.65 |

| Lease payments for Xylem’s existing identified offline centers and hostels | 15.52 |

| Investment in subsidiary Utkarsh Classes & Edutech Pvt. Ltd. for lease payments of its identified offline centers | 33.70 |

| Expenditure towards server and cloud-related infrastructure costs | 200.11 |

| Expenditure towards marketing initiatives | 710.00 |

| Acquisition of additional shareholding in Utkarsh Classes & Edutech Pvt. Ltd. | 26.50 |

| Funding inorganic growth through unidentified acquisitions and general corporate purposes | Balance Amount |

Total Fresh Issue Size: ₹3,100.00 crore

These investments highlight PhysicsWallah’s strategy to:

- Expand offline and hybrid learning presence across India,

- Strengthen its digital infrastructure, ensuring scalability and security,

- Boost brand awareness through aggressive marketing, and

- Pursue acquisitions to diversify and integrate educational verticals.

This multi-pronged approach positions PhysicsWallah as a scalable, hybrid-first education platform capable of serving both urban and regional learners effectively.

Company Overview – PhysicsWallah Ltd.

Founded by Alakh Pandey and Prateek Boob, PhysicsWallah Ltd. has transformed from a humble YouTube channel into one of India’s top five education companies by revenue. What started in 2014 with free online physics lessons has grown into a full-fledged edtech ecosystem that offers affordable courses across JEE, NEET, UPSC, and more.

What Does PhysicsWallah Do?

PhysicsWallah (PW) provides test preparation, professional upskilling, and academic courses through three key delivery modes:

- Online: via its app, website, and 200+ YouTube channels,

- Offline: through PW Vidyapeeth and PW Pathshala centers,

- Hybrid: a two-teacher model that blends live online classes with in-person support.

This flexibility allows students to choose their preferred mode of learning while maintaining access to India’s most affordable courses. For instance, PW’s NEET and JEE batches cost between ₹2,199 and ₹4,800 — a fraction of what competitors charge (₹60,000+).

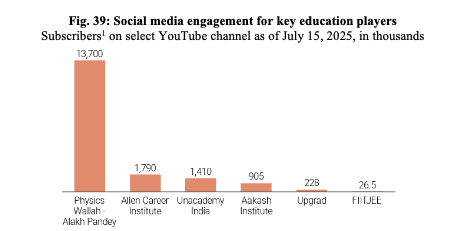

Massive Reach and Community

As of June 30, 2025, the company’s main YouTube channel, Physics Wallah – Alakh Pandey, had 13.7 million subscribers, while its combined YouTube network boasted over 98.8 million subscribers, growing at a 41.8% CAGR over the last two years.

PW has built one of India’s largest student communities, with over 2.1 million unique online users and 0.33 million offline enrollments in just the first quarter of FY26.

Expanding Offline and Tech Ecosystem

PW currently operates 303 offline centers, up from just 28 in FY23 — a phenomenal 165% CAGR.

Its faculty strength has grown to 6,267 members, supported by a proprietary AI-driven learning platform featuring tools like:

- AI Guru: instant doubt-solving,

- AI Grader: automated answer evaluation,

- AI Sahayak and PW Drona: for student progress tracking.

PW’s goal is simple — make high-quality education accessible, affordable, and tech-enabled for every Indian learner.

Financial Performance – PhysicsWallah IPO

PhysicsWallah’s financial trajectory reflects rapid scale-up and strong brand-led growth within India’s competitive edtech landscape.

Revenue and Profit Trends

Between FY24 and FY25, total income surged by 51% — from ₹2,015 crore to ₹3,039 crore — while profit after tax (PAT) grew 78%, signaling improved efficiency and monetization.

However, the company reported a net loss of ₹243 crore in FY25, largely due to increased expansion costs from new offline centers, faculty hiring, and tech investments. Despite short-term losses, operating profit (EBITDA) turned positive at ₹193 crore, compared to a loss of ₹829 crore in FY24 — a clear sign of improving fundamentals.

| Key Financials (₹ in Crore) | FY23 | FY24 | FY25 | Q1 FY26 |

|---|---|---|---|---|

| Total Income | 772.54 | 2,015.35 | 3,039.09 | 905.41 |

| EBITDA | 13.86 | -829.35 | 193.20 | -21.22 |

| PAT | -84.08 | -1,131.13 | -243.26 | -127.01 |

| Net Worth | 62.29 | -861.79 | 1,945.37 | 1,867.92 |

| Total Assets | 2,082.18 | 2,480.74 | 4,156.38 | 5,075.67 |

Key Ratios and Valuation Metrics

- RoNW: -12.5%

- PAT Margin: -8.43%

- EBITDA Margin: 6.69%

- Price-to-Book Value: 14.10x

- Estimated Market Capitalization: ₹31,526.73 crore

Despite recent losses, PW’s valuation reflects strong investor confidence in its future growth, community-driven model, and offline expansion.

Operational KPIs Snapshot

| KPI | FY23 | FY24 | FY25 | Q1 FY26 |

|---|---|---|---|---|

| Total Employees | 7,253 | 12,956 | 15,775 | 18,028 |

| Faculty Members | 2,436 | 3,654 | 5,096 | 6,267 |

| Paid Users (mn) | 1.76 | 3.63 | 4.46 | 2.43 |

| Offline Enrollments (mn) | 0.08 | 0.23 | 0.33 | 0.33 |

| Offline Centers | 28 | 126 | 198 | 303 |

In Summary

PhysicsWallah’s strength lies in its student-first philosophy, affordable pricing, and AI-powered delivery model. Its ongoing expansion into offline centers and hybrid learning gives it a rare advantage in the Indian education sector, making the PhysicsWallah IPO one of the most anticipated listings in the edtech space.

Valuation & Peer Comparison – PhysicsWallah IPO

When evaluating an IPO, valuation is where numbers meet expectations. For PhysicsWallah Ltd., the market is clearly betting on its future growth story rather than current profitability. Let’s unpack what that means for investors.

PhysicsWallah IPO Valuation

The PhysicsWallah IPO is valued at a market capitalization of approximately ₹31,526.73 crore. That’s significant for a company that started as a YouTube channel just a decade ago.

Despite this rapid rise, its earnings per share (EPS) remain negative, reflecting ongoing investments in offline centers, content, and technology. Still, investors appear willing to pay a premium for its brand, scale, and growth potential.

| Metric | Value |

|---|---|

| Market Capitalization | ₹31,526.73 Cr |

| Price-to-Book (P/B) | 14.10 |

| EPS (Pre-IPO) | -0.93 |

| EPS (Post-IPO, annualized) | -1.76 |

| P/E (Pre-IPO) | -116.86 |

| P/E (Post-IPO) | -62.06 |

A P/B of 14.1x shows the stock is priced well above its book value — typical for fast-growing digital companies, but also a reminder that expectations are sky-high.

Since EPS and P/E remain negative, traditional valuation metrics don’t tell the full story. Instead, investors are looking at revenue growth, operating margins, paid user expansion, and brand scale to gauge fair value.

In short:

PhysicsWallah’s IPO valuation reflects future potential, not past profit. For long-term investors who believe in the edtech sector and PhysicsWallah’s execution, this could be a promising bet. But for short-term traders, the high valuation and lack of profitability pose clear risks.

PhysicsWallah IPO Peer Comparison

Finding direct peers for PhysicsWallah is difficult. There’s no listed company in India with the same hybrid structure — blending free community-driven reach with offline center scale and affordable paid programs. Most comparable edtech firms, like Unacademy or Upgrad, are unlisted, while offline giants like Aakash and Allen follow different business models.

Hence, rather than pure P/E comparison, marketing efficiency offers a more meaningful benchmark. It shows how efficiently each company converts marketing spend into revenue.

| Company | Marketing Spend (₹ million) | Marketing Spend as % of Revenue |

|---|---|---|

| PhysicsWallah | 1,956.5 | 10.1% |

| Eruditus Education | 5,610.3 | 27.8% |

| Allen Career Institute | 41,178.7 | 3.6% |

| Aakash Educational Services | 3,41,584.9 | 6.6% |

| Unacademy | 2,443.0 | 29.1% |

| Upgrad Education | 3,400.8 | 22.9% |

| FIITJEE | 31,027.3 | 19.0% |

| Veranda Learning | 486.7 | 13.5% |

💡 What This Means

- PhysicsWallah spends about 10% of its revenue on marketing, much lower than Unacademy (29%) or Upgrad (22.9%).

- This reflects community-led organic growth, driven by founder credibility, strong content, and massive YouTube reach.

- Lower marketing intensity means more efficient customer acquisition — a big edge when scaling in a price-sensitive market.

Investor takeaway:

PhysicsWallah’s business model appears more sustainable and efficient compared to peers that rely heavily on paid marketing. But it still faces the challenge of converting its large free user base into paying customers while maintaining quality and affordability.

Strengths & Risks – PhysicsWallah IPO

Every IPO comes with a blend of opportunity and uncertainty. Below is a side-by-side look at what works in PhysicsWallah’s favor — and what investors need to watch closely.

| Strengths | Risks |

|---|---|

| Massive Student Community & Brand Value — Over 98.8 million YouTube subscribers across 200+ channels and 13.7M on the main channel create an unmatched organic funnel for paid conversions. | Negative Earnings — PhysicsWallah remains loss-making with negative EPS and P/E, reflecting early-stage profitability challenges. |

| High User Growth — Paid user base rose to 4.46 million in FY25, a sharp increase from earlier years. | Premium Valuation — P/B ratio of 14.1x leaves little room for error if growth slows. |

| Omnichannel Model — Strong presence across online, offline, and hybrid formats with 303 centers as of June 2025. | Execution Risks — Rapid offline expansion demands operational efficiency and capital discipline. |

| Affordable Pricing Strategy — Flagship JEE/NEET batches priced between ₹2,199–₹4,800, making education more inclusive. | Competitive Pressure — Deep-pocketed rivals may escalate marketing spends or discounting. |

| Tech & AI Integration — Proprietary tools like AI Guru, AI Grader, and AI Sahayak enhance scalability and learning outcomes. | Regulatory Overhang — Education and edtech sectors are exposed to potential policy and accreditation risks. |

| Strong Academic Ecosystem — 6,267 faculty members, 4,382 published books, and 8.66M question banks power a robust learning engine. | Founder-Driven Identity — Brand perception heavily tied to Alakh Pandey; dependency risk if leadership changes. |

| Revenue Momentum — FY25 revenue up 51% YoY, highlighting strong operational leverage. | Low ARPU Challenges — Affordable pricing caps per-user margins; profitability depends on scaling volume efficiently. |

Bottom Line

PhysicsWallah’s IPO story is more than numbers — it’s about brand trust, accessibility, and technology-led growth. While valuations look stretched compared to financial performance, the scale of its student community and hybrid learning network gives it a first-mover advantage in India’s affordable edtech space.

For long-term investors, this IPO represents a bet on India’s education digitization story. For short-term traders, caution is warranted given the high expectations baked into current valuations.

Grey Market Premium (GMP) & Listing Sentiment – PhysicsWallah IPO

The Grey Market Premium (GMP) acts as an early indicator of investor sentiment before listing. For PhysicsWallah, the initial buzz in the market has been strong, but traders are watching closely to see if that excitement sustains.

PhysicsWallah IPO GMP Update

As of November 10, 2025, the PhysicsWallah IPO GMP is reported at ₹4, showing no change from previous sessions. This suggests a stable but cautious sentiment among grey market participants. The IPO’s issue price is ₹109 per share, and based on current trends, the estimated listing price stands around ₹113, indicating a potential 3.67% listing gain.

| GMP Date | IPO Price | GMP | Sub2 Sauda Rate | Estimated Listing Price | Estimated Profit* | Last Updated |

|---|---|---|---|---|---|---|

| 10-11-2025 | ₹109.00 | ₹4 (No Change) | 400/5600 | ₹113 (3.67%) | ₹548 | 10-Nov-2025 |

GMP data are indicative and change frequently based on market sentiment and subscription levels.

The flat GMP movement indicates that while demand remains steady, investors are weighing the company’s high valuation against its strong brand story.

Key takeaway: The IPO is not showing speculative overpricing — a sign that investors are taking a balanced, fundamentals-driven approach.

Listing Day Expectations

On listing day, moderate listing gains of 2–5% appear likely if broader market sentiment stays stable. PhysicsWallah’s strong retail brand and emotional connection with students could attract healthy participation, especially from retail and HNI investors.

However, since financial performance remains subdued and valuations are rich, analysts expect the stock to perform steadily rather than show a major listing-day rally.

If the company delivers consistent post-listing quarterly results and maintains revenue momentum from its offline centers, it could sustain its valuation levels and gradually attract institutional attention.

For the most accurate and official IPO details, visit:

🔗 PhysicsWallah RHP (SEBI Filing)

🔗 Official Website – PhysicsWallah

🔗 Allotment Status Link (MUFGL)

Conclusion – Final Verdict on the PhysicsWallah IPO

The PhysicsWallah IPO represents a landmark moment for India’s edtech industry — a homegrown brand that grew from a single YouTube channel to a nationwide learning platform.

At its core, this IPO is a story of trust, affordability, and transformation. The brand’s loyal following and efficient cost model give it a competitive edge in a market flooded with deep-pocketed players.

That said, valuation remains the key concern. With negative EPS and a P/B ratio above 14x, investors are clearly paying for future growth, not current profitability.

Our Verdict

For long-term investors, PhysicsWallah could be a strategic buy — provided you believe in India’s digital education journey and the brand’s capacity to monetize sustainably.

For short-term traders, listing gains may be modest, and caution is advised until the company proves consistent profitability.

Final Thought: PhysicsWallah is not just an IPO — it’s a test of how far brand equity and trust can carry an Indian startup in the public markets.

Read more in our detailed IPO reviews here:

🔗 Our IPO Review Section

Frequently Asked Questions (FAQs) – PhysicsWallah IPO

1. What is the PhysicsWallah IPO?

PhysicsWallah IPO is a book-built issue worth ₹3,480 crore, comprising a fresh issue of ₹3,100 crore and an offer for sale (OFS) of ₹380 crore. The IPO aims to fund expansion of offline centers, technology infrastructure, marketing initiatives, and general corporate purposes.

2. What are the PhysicsWallah IPO dates?

The IPO opens on November 11, 2025, and closes on November 13, 2025. The allotment date is November 14, 2025, and the tentative listing date on NSE and BSE is November 18, 2025.

3. What is the price band and lot size of PhysicsWallah IPO?

The price band is set between ₹103 – ₹109 per share.

The minimum lot size is 137 shares, requiring an investment of ₹14,933 for retail investors.

sNII investors can apply for a minimum of 14 lots (₹2,09,062), and bNII investors for 67 lots (₹10,00,511).

4. What is the total issue size of PhysicsWallah IPO?

The total issue size is ₹3,480 crore, comprising 31.92 crore shares (Fresh Issue: 28.44 crore shares and OFS: 3.48 crore shares).

5. What will PhysicsWallah use the IPO proceeds for?

According to the RHP, the net proceeds will be utilized for:

- ₹460.55 crore – Capital expenditure for new offline and hybrid centers

- ₹548.31 crore – Lease payments for existing centers

- ₹31.65 crore – Fit-outs for new Xylem centers

- ₹15.52 crore – Lease payments for Xylem’s centers

- ₹33.70 crore – Lease payments for Utkarsh Classes

- ₹200.11 crore – Server and cloud infrastructure

- ₹710.00 crore – Marketing initiatives

- ₹26.50 crore – Additional shareholding in Utkarsh Classes

- Balance for acquisitions and general corporate purposes

6. Who are the promoters and lead managers of PhysicsWallah IPO?

The company is promoted by Alakh Pandey and Prateek Boob.

Kotak Mahindra Capital Co. Ltd. is the lead manager, and MUFG Intime India Pvt. Ltd. is the registrar to the issue.

7. What are the financial highlights of PhysicsWallah Ltd.?

- Revenue: ₹3,039.09 crore (FY2025)

- PAT: ₹-243.26 crore (FY2025)

- EBITDA: ₹193.20 crore (FY2025)

- Assets: ₹4,156.38 crore (FY2025)

While the company has seen strong revenue growth (51% YoY), profitability remains under pressure due to expansion and marketing costs.

8. What is the valuation of PhysicsWallah IPO?

At the upper price band of ₹109, PhysicsWallah commands a market capitalization of ₹31,526.73 crore.

The P/B ratio is 14.10, and post-issue P/E is -62.06, indicating current losses and a long-term growth valuation.

9. Who are PhysicsWallah’s peers?

There are no listed peers in India. However, major unlisted competitors include Unacademy, Eruditus, UpGrad, FIITJEE, Aakash, Allen, and Veranda Learning.

10. What is the Grey Market Premium (GMP) of PhysicsWallah IPO?

As of November 10, 2025, the PhysicsWallah IPO GMP stands at ₹4, suggesting a possible listing price around ₹113 per share, implying a 3.67% premium over the issue price.

11. What is the shareholding pattern before and after the IPO?

- Pre-issue shareholding: 2,60,79,56,938 shares

- Post-issue shareholding: 2,89,23,60,607 shares

- Promoter holding (Pre-issue): 81.64%

- Promoter holding (Post-issue): To be updated post final allocation

12. When will PhysicsWallah IPO shares be listed?

The shares are likely to be listed on NSE and BSE on November 18, 2025, after final allotment and refund processing.

13. How can investors check PhysicsWallah IPO allotment status?

Investors can check allotment status directly at the registrar’s link:

https://in.mpms.mufg.com/Initial_Offer/public-issues.html

14. Is PhysicsWallah IPO a good investment?

PhysicsWallah IPO offers exposure to India’s fast-growing edtech and hybrid education segment with a strong brand and large user base. However, valuation is expensive, and the company remains loss-making, so investors with a long-term horizon should consider cautiously.

15. Where can I read more about IPO reviews like this?

You can explore detailed IPO analyses and updates on our IPO section:

👉 https://onedemat.com/category/ipo/