Introduction:

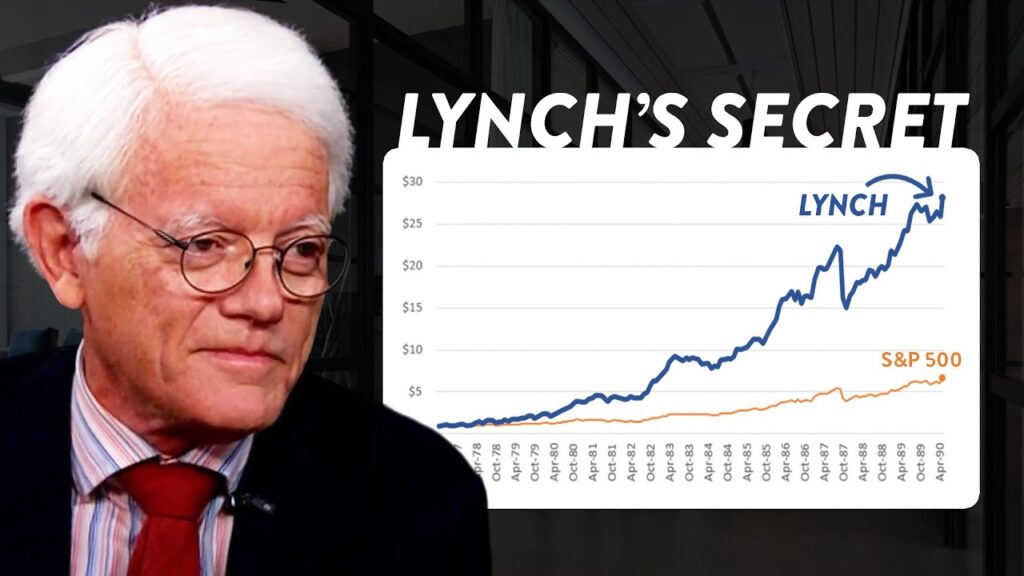

Peter Lynch, the legendary fund manager of Fidelity’s Magellan Fund, delivered an astonishing 29.2% annual return from 1977 to 1990. That’s a 2,800% return in just 13 years, turning a 1 lakh investment into 28 lakh. What is Peter Lynch’s Stock Picking Strategy? Simple, common-sense investing that anyone can apply.

In this guide, we break down Peter Lynch’s Stock Picking Strategy and show you how to apply them to find multibagger stocks in 2025, especially in the Indian stock market.

Rule 1: Invest in What You Know

Lynch believed that retail investors have an edge over Wall Street analysts because they see emerging trends in everyday life before institutions catch on.

The L’eggs Pantyhose Phenomenon

- In the 1970s, Lynch noticed his wife buying L’eggs pantyhose from supermarkets instead of department stores.

- He researched the parent company, Hanes, and found 25% annual sales growth and increasing brand loyalty.

- Result? The stock became a 10-bagger (10X growth) in a few years.

“Go for a business that any idiot can run—because sooner or later, one will.”

How to Apply This in India Today

- Observe fast-growing brands in daily life:

- More people using Zomato Pro for food delivery?

- Increasing demand for Tata Consumer Products?

- Rising adoption of Mamaearth skincare products?

- Ask yourself:

- Is the product/service gaining popularity?

- Are customers loyal to the brand?

- Is the company expanding into new markets?

Rule 2: Focus on the Business, Not the Stock Price

Lynch ignored macroeconomic predictions and focused on understanding individual businesses deeply.

Ford Motors’ Rebound (1982)

- Stock fell 80% due to recession.

- Lynch saw strong fundamentals:

- The launch of the Taurus model (a game-changer in design).

- Cost-cutting measures improving efficiency.

- Improved quality ratings.

- Stock rebounded from $2 to $38.

“The stock market is filled with people who know the price of everything and the value of nothing.”

How to Apply This in India Today

- Ignore short-term stock price movements and focus on business fundamentals:

- Tata Motors: Expanding EV segment (Nexon EV, Punch EV).

- Delhivery: Gaining market share in logistics, despite recent losses.

Rule 3: The Search for 10-Baggers

Lynch’s biggest wins were stocks that grew 10X or more. He found these by identifying small companies with massive growth potential.

Dunkin’ Donuts

- He observed long queues every morning.

- Noticed strong customer loyalty (daily coffee drinkers).

- Franchise model made rapid expansion easy.

- Result: Stock grew 20X in a decade.

Lynch’s Wisdom:

“The key to making money in stocks is not to get scared out of them.”

How to Apply This in India Today

- Look for small/mid-cap companies with exponential growth potential:

- Tata Elxsi (EV design & AI solutions)

- Suzlon Energy (wind power revival)

- Campus Activewear (rising athleisure trend)

Rule 4: Use the PEG Ratio

The Price/Earnings-to-Growth (PEG) ratio compares a stock’s valuation to its earnings growth rate.

Formula: PEG Ratio = (P/E Ratio) ÷ (Annual Earnings Growth %)

- PEG < 1: Undervalued (best opportunity)

- PEG > 1: Overvalued (risky investment)

PEG Ratios of Stocks

| Stock | P/E Ratio | Earnings Growth | PEG Ratio |

|---|---|---|---|

| ABC Motors | 15 | 18% | 0.83 |

| XYZ Paints | 70 | 15% | 4.67 |

| PQR Tech | 55 | 30% | 1.83 |

👉 Focus on PEG < 1 for the best investment opportunities!

Rule 5: Be Flexible

Lynch adapted to changing market trends instead of sticking rigidly to old rules.

Tech Boom & Bust

- Initially skeptical of tech stocks, but later invested in semiconductors and automation.

- Avoided the dot-com bubble crash by focusing on fundamentals.

How to Apply This in India Today

- Identify high-growth sectors:

- AI & Cloud (LTIMindtree, Persistent Systems)

- Renewable Energy (Suzlon, Inox Wind)

- Defense (HAL, BEL)

- Know when to sell:

- If fundamentals weaken.

- If valuation becomes extreme (PEG > 2).

Build Your Multibagger Portfolio

| Rule | Action Item | Example Stocks |

|---|---|---|

| Buy What You Know | Invest in brands you use daily | Zomato, Asian Paints |

| Bottom-Up Approach | Focus on company fundamentals | HDFC Bank, Infosys |

| Hunt 10-Baggers | Target small caps in fast-growing sectors | Tata Elxsi, KPIT Tech |

| Use PEG Ratio | Prioritize growth-adjusted valuation | Reliance, Bajaj Finance |

| Stay Flexible | Adapt and cut losses ruthlessly | Sector rotation |

Conclusion:

Peter Lynch proved that common-sense investing can beat Wall Street. His approach is still relevant in 2025, especially in India’s fast-growing stock market.

✅ Key Takeaways:

- Observe everyday trends to find hidden stock gems.

- Ignore short-term noise and focus on business fundamentals.

- Look for small/mid-cap stocks with explosive growth potential.

- Use PEG ratio to identify undervalued opportunities.

- Stay flexible and adapt to market shifts.

📌 Next Steps:

- Create an “observation list” of rising brands.

- Research their financials & growth potential.

- Start small, invest wisely, and hold patiently.

Ready to begin? Open your demat account on Angel One and start small today!

“The best stock to buy is the one you already own.” – Peter Lynch

Disclaimer: This is not investment advice. Past performance doesn’t guarantee future results.