Introduction

The Om Freight IPO is one of the most anticipated listings in the logistics and freight forwarding space. Backed by over four decades of industry expertise, Om Freight Forwarders Limited has established itself as a leading global logistics provider with operations spanning five continents and more than 700 locations worldwide. The Om Freight Forwarders IPO offers investors a chance to participate in India’s rapidly growing logistics sector, which has become the backbone of global trade and supply chains. With a strong network, technology-driven operations, and a diversified service portfolio, the Om Freight IPO stands out as a noteworthy opportunity for both retail and institutional investors.

This IPO combines a fresh issue of shares aimed at funding future expansion with an offer for sale, allowing existing promoters to partially dilute their holdings. As the logistics industry continues to benefit from India’s booming trade and e-commerce ecosystem, the Om Freight Forwarders IPO could potentially ride the wave of rising demand for integrated supply chain solutions.

IPO Overview

Om Freight Forwarders IPO Details

| Particulars | Details |

|---|---|

| IPO Date | September 29, 2025 to October 3, 2025 |

| Listing Date | October 8, 2025 (Tentative) |

| Face Value | ₹10 per share |

| Issue Price Band | ₹128 – ₹135 per share |

| Lot Size | 111 Shares |

| Sale Type | Fresh Issue + Offer for Sale |

| Total Issue Size | 90,60,074 shares (₹122.31 Cr) |

| Fresh Issue | 18,10,074 shares (₹24.44 Cr) |

| Offer for Sale | 72,50,000 shares (₹97.88 Cr) |

| Issue Type | Book Building IPO |

| Listing At | BSE, NSE |

| Pre-Issue Shareholding | 3,18,65,400 shares |

| Post-Issue Shareholding | 3,36,75,474 shares |

| IPO Document | RHP File |

The Om Freight IPO consists of both fresh capital issuance and an offer for sale. The fresh issue of ₹24.44 crores will support business expansion and acquisition of new equipment, while the ₹97.88 crores from the offer for sale will enable existing promoters to monetize part of their stake.

Important Dates of Om Freight IPO

| Event | Date |

|---|---|

| IPO Open Date | Monday, September 29, 2025 |

| IPO Close Date | Friday, October 3, 2025 |

| Allotment Finalization | Monday, October 6, 2025 |

| Refund Initiation | Tuesday, October 7, 2025 |

| Shares Credited to Demat | Tuesday, October 7, 2025 |

| Listing Date | Wednesday, October 8, 2025 |

| UPI Mandate Confirmation | 5 PM, Friday, October 3, 2025 |

The timeline of the Om Freight Forwarders IPO ensures a quick transition from bidding to listing, with allotment and refunds being processed within three days of closing.

Objects of the Issue

The company plans to use the net proceeds from the fresh issue as follows:

- Funding Capital Expenditure: ₹17.15 crores will be utilized to acquire commercial vehicles and heavy equipment, strengthening operational capacity.

- General Corporate Purposes: A portion will be reserved for working capital, strategic initiatives, and overall business needs.

By deploying fresh capital into equipment and vehicles, the Om Freight IPO aims to scale up its service delivery capabilities while ensuring long-term sustainability in operations.

Company Background – Om Freight Forwarders Ltd.

Om Freight Forwarders Limited is a story of scale, innovation, and trust in the logistics sector. Founded in 1995 and headquartered in Mumbai, the company is part of a third-generation business with a legacy of over 40 years in global logistics and freight forwarding. Over the years, the company has expanded across five continents, 700+ destinations, and 28 Indian branches, making it a formidable player in end-to-end supply chain solutions.

Certified by ISO and backed by memberships in IATA, FIATA, WCA, GLPN, FFI, and MTO, Om Freight has built a strong reputation for credibility in global markets. At the same time, the company has been quick to adopt modern technology, offering digital documentation, GPS-enabled shipment tracking, and real-time monitoring, ensuring complete transparency for its clients.

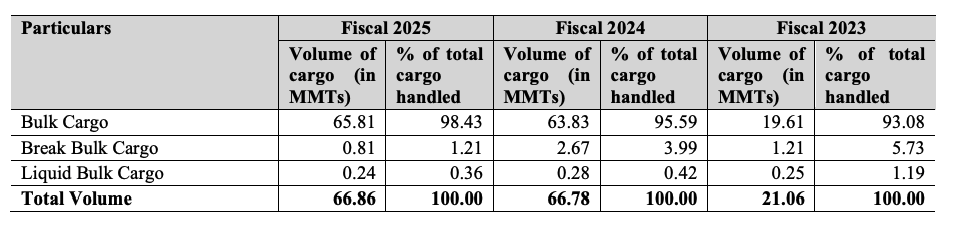

Its business model is well-diversified, covering freight forwarding, customs clearance, vessel agency, transportation, warehousing, and distribution. In FY 2025 alone, Om Freight managed 66.86 million metric tons (MMTs) of cargo, reflecting the scale of its operations.

Cargo Handled Over the Years

The following table highlights Om Freight’s cargo volumes across fiscal years:

Insight: Bulk cargo consistently contributes over 95% of the total handled volume, showing Om Freight’s dominance in large-scale shipments, while break bulk and liquid cargo add flexibility to its service portfolio.

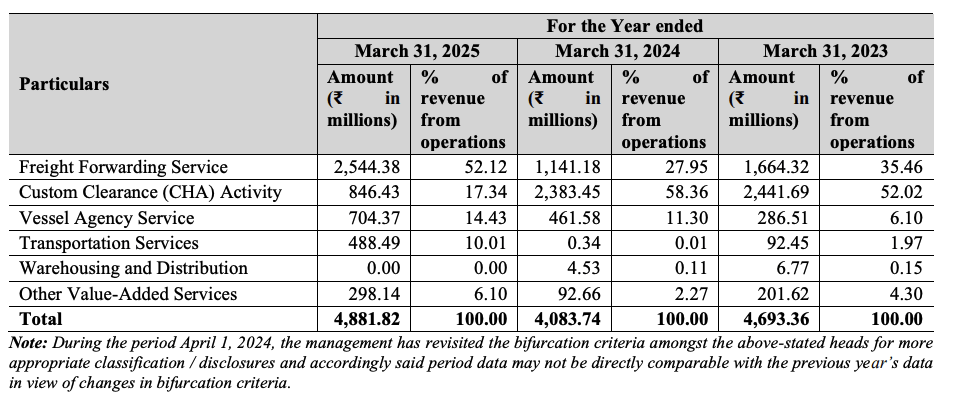

Revenue Split

The company’s strength lies not only in the volume of cargo but also in its diversified revenue streams.

Insight:

- In FY 2025, freight forwarding surged to 52.12% of revenue, showing strong global demand for its services.

- Interestingly, customs clearance, which dominated in FY 2024 at 58.36%, dropped significantly, reflecting a shift in focus towards freight forwarding and transportation.

- Vessel agency and transportation services have been steadily gaining traction, adding resilience to the company’s revenue model.

In essence, the Om Freight Forwarders IPO is built on a company that has shown resilience, adaptability, and scale. Its cargo handling dominance in bulk shipments, combined with its steadily diversifying revenue streams, positions it as a strong player in India’s evolving logistics sector.

Om Freight IPO – Financials & KPIs, Valuation & Peer Comparison

Financial Performance of Om Freight Forwarders Ltd.

| Particulars | FY 2025 | FY 2024 | FY 2023 |

|---|---|---|---|

| Assets | 312.02 | 268.84 | 305.18 |

| Total Income | 494.05 | 421.32 | 493.35 |

| EBITDA | 37.71 | 11.96 | 33.33 |

| Profit After Tax | 21.99 | 10.35 | 27.16 |

| Net Worth | 173.47 | 151.58 | 139.24 |

| Borrowings | 26.95 | 24.47 | 7.53 |

Analysis of Financials

The financial journey of Om Freight Forwarders IPO shows a strong turnaround. Revenue grew 17% YoY in FY25, while PAT surged 113%, indicating operational efficiency. EBITDA jumped from ₹11.96 Cr in FY24 to ₹37.71 Cr in FY25, reflecting better cost management. Borrowings remain low at just ₹26.95 Cr, showing a healthy balance sheet.

Key Performance Indicators (KPIs) of Om Freight Forwarders IPO

| KPI | FY 2025 | FY 2024 | FY 2023 |

|---|---|---|---|

| EBITDA Margin (%) | 7.69% | 2.91% | 7.07% |

| PAT Margin (%) | 4.49% | 2.52% | 5.76% |

| Return on Equity (ROE) (%) | 13.53% | 7.11% | 21.63% |

| Return on Capital Employed (ROCE) (%) | 15.80% | 9.72% | 35.46% |

| Debt/Equity Ratio | 0.17 | 0.17 | 0.07 |

| Debt Service Coverage Ratio (DSCR) | 8.13 | 2.22 | (21.35) |

| Current Ratio | 1.57 | 1.70 | 1.56 |

| Clients Served | 1,715 | 1,662 | 1,664 |

| Cargo Volume (MMTs) | 66.86 | 66.78 | 21.06 |

| TEUs Handled | 1,09,914 | 91,519 | 81,473 |

Analysis of KPIs

The KPIs present a mixed but improving trend. The EBITDA margin expanded sharply to 7.69% in FY25, almost tripling from FY24, showing efficiency gains. PAT margin nearly doubled to 4.49%, a sign of stronger profitability. Cargo volume stayed consistent around 66 MMTs, while container handling grew to over 1 lakh TEUs, highlighting operational scale. ROE and ROCE improved, proving that the company is generating solid returns on capital employed.

Om Freight IPO –Valuation & Peer Comparison

Valuation of Om Freight IPO

| Metric | Pre-IPO | Post-IPO |

|---|---|---|

| EPS (₹) | 6.90 | 6.53 |

| P/E (x) | 19.56 | 20.67 |

| Price to Book Value (P/BV) | 2.48 | – |

Valuation Insights

At a post-IPO P/E of 20.67x, Om Freight Forwarders IPO is priced at a premium compared to some peers. However, considering its asset-light model, diversified logistics services, and margin expansion, the valuation appears justifiable. The P/BV at 2.48 indicates moderate pricing, offering a balance between growth and risk.

Peer Comparison of Om Freight Forwarders IPO

| Company | EPS (₹) | NAV (₹) | P/E (x) | RoNW (%) |

|---|---|---|---|---|

| Om Freight Forwarders Ltd. | 6.90 | 54.44 | 20.67 | 12.68 |

| Tiger Logistics (India) Ltd. | 2.56 | 13.08 | 19.72 | 19.53 |

| Total Transport Systems Ltd. | 5.54 | 51.76 | 13.32 | 10.56 |

| AVG Logistics Ltd. | 15.01 | 163.76 | 16.15 | 8.65 |

| Patel Integrated Logistics Ltd. | 1.13 | 17.48 | 13.33 | 6.25 |

Peer Comparison Analysis

When compared with peers, Om Freight Forwarders IPO stands out for its balanced margins and strong revenue base. While Tiger Logistics has better RoNW at 19.53%, Om offers higher EPS. Total Transport and Patel Logistics trade at lower P/E multiples, making Om appear slightly expensive. AVG Logistics delivers high EPS but at lower return ratios. Investors need to consider whether Om’s premium valuation is supported by its consistent cargo volume and growing container handling scale.

Strengths and Risks of Om Freight Forwarders IPO

| Strengths (Pros) | Risks (Cons) |

|---|---|

| Diversified Services: Offers end-to-end logistics solutions including freight forwarding, customs clearance, warehousing, vessel agency, and transportation. | Low PAT Margin: Despite revenue growth, net profit margins remain modest (4.49% in FY25), limiting earnings leverage. |

| Strong Cargo Handling: Managed 66.86 MMT cargo in FY25, showing operational scale and reliability. | Dependence on Trade Cycles: Global trade slowdown or geopolitical disruptions can directly impact volumes and revenue. |

| Growing Profitability: PAT surged 113% YoY in FY25, showing efficiency gains and margin recovery. | High Competition: Faces competition from established logistics firms like TCI, Tiger Logistics, and global players. |

| Own Fleet Advantage: Owns 135 commercial vehicles and equipment, reducing dependency on third-party vendors. | Debt and Capital Requirements: Though debt is moderate (Debt/Equity 0.17), logistics business remains capital-intensive. |

| Wide Network: Presence across 28 branches in India and partnerships in 800+ international destinations. | Volatile Segment Performance: Revenue mix shows fluctuations (e.g., customs clearance fell from 58% in FY24 to 17% in FY25). |

| Experienced Management: Third-generation promoters with decades of industry expertise and strong client relationships. | Regulatory & Policy Risks: International trade regulations, tariffs, and environmental norms can impact operations. |

| Technology Adoption: GPS tracking, real-time monitoring, and paperless documentation improving efficiency. | Thin ROE Compared to Peers: FY25 RoE at 13.53% is below FY23 (21.63%) and lags some competitors. |

Key Takeaway

The Om Freight Forwarders IPO offers investors exposure to India’s growing logistics and supply chain sector with strong cargo volumes, wide service offerings, and a rising profit trajectory. However, risks like thin margins, sectoral volatility, and competition need to be considered. For long-term investors, the IPO may be an interesting play on India’s international trade and logistics growth story.

Om Freight IPO GMP (Grey Market Premium)

| GMP Date | IPO Price | GMP | Sub2 Sauda Rate | Estimated Listing Price | Estimated Profit* | Last Updated |

|---|---|---|---|---|---|---|

| 26-09-2025 | ₹135.00 | ₹11 (No Change) | 900/12,600 | ₹146 (8.15%) | ₹1,221 | – |

GMP Analysis

The grey market premium (GMP) for Om Freight Forwarders IPO is currently around ₹11, indicating a modest premium of 8.15% over the upper price band of ₹135. This translates into an expected listing price of ₹146 per share. For a retail investor applying with the minimum lot size of 111 shares, the potential listing gain is estimated at ₹1,221.

It’s important to note that GMP is unofficial and purely speculative, often driven by market sentiment, liquidity, and subscription demand. While it provides an early sentiment indicator, investors should not base their decisions solely on GMP. The fundamentals of Om Freight Forwarders IPO, such as strong cargo volumes, expanding service portfolio, and improving profit margins, remain more reliable indicators for long-term investment.

Conclusion: Should You Invest in Om Freight Forwarders IPO?

The Om Freight IPO presents an interesting investment opportunity in India’s booming logistics and supply chain sector. With cargo volumes touching 66.86 MMT in FY25, a diversified service portfolio, and presence across 800+ global destinations, the company has built a strong operational base.

On the financial side, revenue grew 17% YoY in FY25, while PAT more than doubled (113% growth) — a clear sign of improving efficiency and profitability. The IPO is priced at a P/E of 20.67x (post-issue), which is slightly above peers like Total Transport Systems (13.32x) but comparable to Tiger Logistics (19.72x). This suggests the valuation is not cheap but justified considering growth momentum and business scale.

Adding to the excitement, the Om Freight IPO GMP (26 Sept 2025) stands at ₹11, indicating a possible listing gain of around 8.15%. While not a massive premium, it signals decent demand from the grey market.

Final Verdict

- Short-term View: With a positive GMP trend and improving fundamentals, investors may consider applying for potential listing gains.

- Long-term View: The company’s wide global network, technology adoption, and diversified service offerings position it well to capture India’s logistics growth story. However, investors should be mindful of thin margins, competition, and trade-related risks.

Overall, the Om Freight Forwarders IPO looks like a balanced bet — moderate listing gains potential + long-term sectoral growth story. Investors with moderate risk appetite may consider subscribing.

Om Freight IPO FAQs

Q1. What is Om Freight Forwarders IPO?

A logistics and freight forwarding company’s mainboard IPO on NSE & BSE.

Q2. What are the IPO open and close dates?

Opens Sep 29, 2025, closes Oct 3, 2025.

Q3. What is the IPO price band?

Fixed at ₹129 – ₹135 per share.

Q4. What is the lot size?

1 lot = 108 shares. Minimum investment ~₹14,580.

Q5. How much is the issue size?

Fresh issue + OFS totaling ₹163.91 crore.

Q6. When is allotment and listing?

Allotment on Oct 6, 2025; Listing on Oct 8, 2025.

Q7. What is the GMP (Grey Market Premium)?

Around ₹11 today — stable, no change.

Q8. Who are the lead managers?

Beeline Capital Advisors Pvt Ltd.

Q9. What is Om Freight IPO market cap?

Approx. ₹454.62 crore (post-issue).

Q10. Should you apply?

Strong growth, improving margins, low debt — but valuation is slightly on the higher side.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?