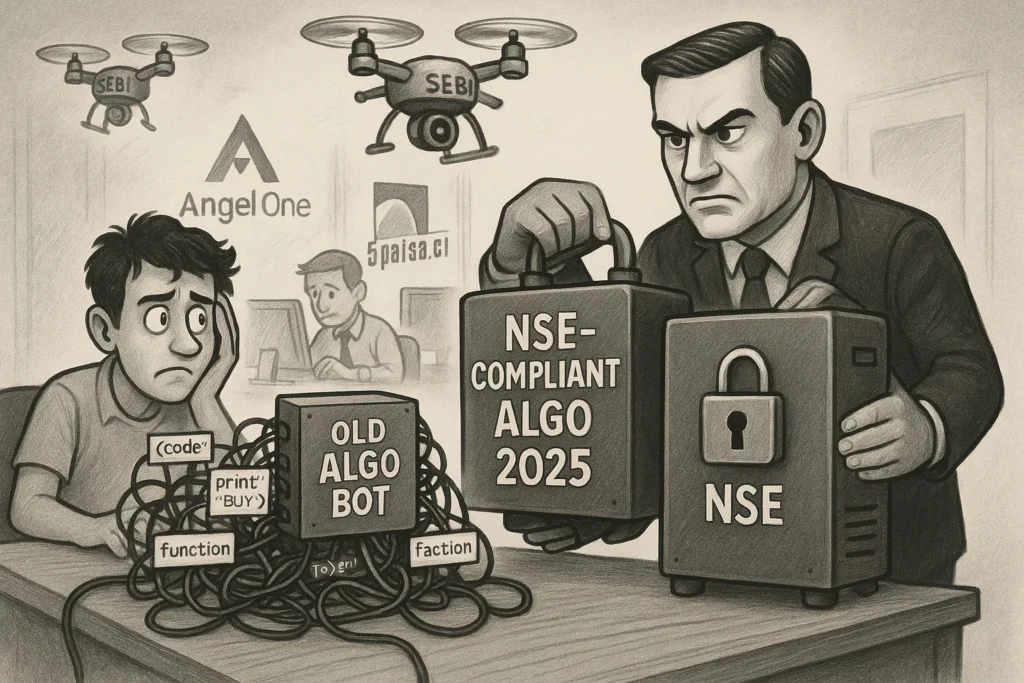

In a country where retail trading has become as mainstream as cricket and chai, one quiet but powerful force has reshaped how everyday investors operate: algorithmic trading. More specifically, NSE retail algo trading—where individual traders automate strategies via broker APIs—has been booming.

Now, the National Stock Exchange (NSE) has stepped in with sweeping new regulations. These aren’t just tweaks to how traders code or place orders. They fundamentally rewire how brokers, traders, and algo developers interact in India’s markets.

Let’s explore what the new rules mean, why NSE introduced them, and how they impact major brokerage firms and individual investors.

The Rise and Risk of NSE Retail Algo Trading

For the past few years, retail algo trading in India has grown at a rapid pace. The appeal is clear: rather than sitting in front of screens, retail investors can build automated strategies that place orders based on pre-defined logic. That logic could be as simple as buying when the 20-day moving average crosses above the 50-day average or as complex as AI-driven sentiment analysis.

Platforms like Zerodha, Angel One, and 5paisa made it easier than ever for tech-savvy investors to tap into this space using APIs. Many of these APIs were open-ended, giving users freedom to build and run their own bots.

But that freedom came at a cost. The unregulated environment created several issues—from erratic order floods to poorly tested strategies destabilizing price discovery. Brokers, exchanges, and regulators increasingly found themselves in the dark about who was running what, and from where.

The Problem That Prompted Change

The surge in DIY algo trading led to several structural concerns:

- Lack of transparency: No tracking of which strategies were live or how they behaved in volatile markets.

- Minimal accountability: If an algo misbehaved, it wasn’t clear who was responsible—the client or the broker.

- Open APIs: These allowed virtually anyone to plug in trading bots, often from overseas servers.

- Risk to market stability: Flash crashes, mispricing, and latency games became more common.

These challenges pushed the NSE and SEBI to rethink the ecosystem entirely. Their answer? A detailed framework designed to regulate, monitor, and legitimize NSE retail algo trading.

What’s Changing in the NSE Retail Algo Trading Framework

The new NSE framework introduces a host of reforms designed to improve accountability and safety across the board. Brokers are now expected to act as the gatekeepers—not just providers—of algo infrastructure.

At the heart of the change is a principle shift: API-based retail trading can no longer be treated casually.

Key Changes in the NSE Guidelines

Here’s what’s new, and what brokers and algo traders will need to comply with:

- Brokers held liable: They are now fully responsible for all API-based orders executed by their clients.

- Secured access only: Open APIs are banned. Instead, only authenticated APIs using static IPs and two-factor authentication are permitted.

- Algo registration mandatory: Every strategy must be registered with NSE and receive a unique Algo ID. Each order must carry this ID.

- Monthly mock sessions: Retail algo traders must participate in simulations or dry runs every month to ensure strategy stability.

- Audit requirements: Brokers must regularly audit API access, monitor usage, and maintain logs for every algo interaction.

- Empanelment of providers: Algo developers must be empanelled with the exchange. Black-box algo providers must be SEBI-registered research analysts.

- India-based servers required: All API orders must originate from Indian servers, eliminating latency arbitrage and regulatory loopholes.

Together, these rules create a tightly monitored system—designed to keep innovation alive while reducing the risk of systemic issues.

How Broker Stocks Are Reacting

As expected, the new norms sent ripples through stock markets, particularly among brokerages and fintech platforms that built their user base by offering retail algo access. Some will feel short-term pain as they overhaul infrastructure and workflows. Others may benefit from improved regulatory standing and investor confidence.

Let’s look at the main players being impacted.

Angel One: A Leadership Test

Angel One has been a pioneer in retail tech enablement, aggressively pushing its API platform in recent years. With thousands of users running automated systems through their interface, it now faces a compliance burden that will require quick pivots.

Why Angel One Is in Focus:

- It has a large base of retail algo users.

- Its API infra will require rapid tightening to comply.

- It may need to temporarily restrict or re-onboard existing algo clients.

- Investors may react negatively in the short term due to compliance costs.

However, Angel One also has a reputation for fast tech upgrades. If it manages the transition smoothly, it may become the benchmark for compliant algo offerings in India.

5paisa: A Model in Flux

5paisa has long positioned itself as a broker for coders and developers, thanks to its easy-access APIs and minimalist cost structure. The new framework hits its open-architecture model hard.

Challenges 5paisa Faces:

- Its developer-first ecosystem could become harder to maintain under stricter NSE controls.

- Retrofitting compliance systems may increase operational costs.

- Some retail clients might leave if flexibility is reduced.

That said, if 5paisa evolves by building NSE-compliant white-box algos or forming partnerships with certified developers, it could retain its niche while becoming more defensible in the eyes of regulators.

IIFL Securities: Quietly Well-Positioned

While not as vocal in the algo API space, IIFL has a robust infrastructure and offers institutional-grade services. It’s better positioned than most to adapt quickly.

Why It May Benefit:

- Its back-end systems already support compliance-heavy structures.

- A smaller algo client base means fewer transitions.

- It can act as an early partner to certified algo developers.

For investors, IIFL could become a dark horse winner as the NSE retail algo trading framework matures.

Winners and Losers: Who Gains From This Overhaul?

This regulation isn’t just a compliance issue—it’s a business realignment. Firms that can retool their infrastructure quickly and deliver compliant offerings stand to gain more users and more credibility.

Likely Winners

- Brokers with closed-loop, secure infrastructure.

- Algo developers already registered with SEBI.

- Retail traders who value consistency and reliability.

- White-box algorithm providers offering tested strategies like VWAP, TWAP, etc.

Likely Losers

- Brokers relying on open APIs with no KYC enforcement.

- Traders using unregistered third-party algo tools.

- Startups without two years of market history, which now cannot be empanelled.

- Users relying on offshore server farms or latency-focused strategies.

The framework creates high entry barriers—but for serious market participants, it also offers a cleaner, more credible field of play.

What Does This Mean for the Retail Trader?

If you’re a retail trader using automation, this framework will affect how you operate—but not necessarily in a bad way.

Yes, you’ll now need to register your strategy, potentially work with approved algo developers, and participate in mock sessions. But in return, you gain a system that tests strategies better, traces orders clearly, and holds brokers accountable.

How Traders Will Need to Adapt

- Get strategies registered: No more ad-hoc bots—you’ll need an NSE-approved strategy ID.

- Use approved providers: If building from scratch, you may need to partner with an empanelled algo developer.

- Participate in simulations: NSE will require monthly test runs for most users.

- Ensure local infrastructure: Your trades must be routed from India-based servers—cloud-based foreign setups won’t work.

In the long run, this creates a more trustworthy ecosystem that offers retail algo traders the same legitimacy as institutional players.

Final Thoughts: Regulation That Elevates, Not Restricts

The NSE’s move to formalize retail algo trading could easily have been overly restrictive. But instead, the framework strikes a surprisingly balanced tone. It preserves the innovation and automation that have made this space exciting—while installing the safety nets that long-term investors, brokers, and regulators needed.

The result? A smarter, safer, and more mature ecosystem for automated retail investing.

For brokers like Angel One and 5paisa, this is a test of resilience and readiness. For retail traders, it’s a wake-up call that the game is changing. And for investors, it’s a fresh lens through which to evaluate fintech and broking stocks in the months ahead.

The age of unregulated automation is over. The future of NSE retail algo trading will reward those who move smart, not just fast.

FAQs: NSE retail algo trading:

What is NSE retail algo trading?

It allows retail investors to place automated orders through APIs provided by brokers on the NSE.

Why did NSE introduce new algo trading rules?

NSE introduced the rules to improve transparency, security, and accountability in API-based trading.

Who is responsible for retail algo trades now?

Brokers now hold full responsibility for all API-based retail algo trades.

Can traders still use open APIs?

No, NSE bans open APIs and allows only secure, authenticated APIs with 2FA and static IPs.

Do traders need to register their algorithms?

Yes, traders must register every strategy with NSE and obtain a unique Algo ID.

What happens if an algo changes?

The trader must re-register the modified strategy with the exchange.

Do traders need to attend mock sessions?

Yes, all retail algo users must participate in monthly simulation exercises.

Can algo orders come from foreign servers?

No, NSE mandates that all API orders originate from servers located in India.

What qualifications must algo providers have?

They must have two years of market experience and SEBI registration for black-box strategies.

How does this affect brokers like Angel One and 5paisa?

These brokers must upgrade infrastructure and enforce strict compliance to continue offering API-based trading.

Related Articles:

New Algo Trading Rules– What Retail Traders Must Know

Algo Trading: A Beginner’s Guide to the Future of Investing

Intraday Trading Strategies: Tips for Beginners and Experts

More Articles

How to Transfer Shares from Groww to Zerodha – Full Guide (2025)

Dark Pool Trading: The Hidden World of Institutional Investing

SEBI vs Jane Street: Inside India’s ₹36,500 Cr Derivatives Manipulation Scandal