NSDL IPO: India’s Premier Depository Hits the Market With ₹4,011.60 Cr Offer

India’s leading securities depository, National Securities Depository Limited (NSDL), is all set to open its ₹4,011.60 crore IPO for public subscription. Slated to launch on July 30, 2025, the NSDL IPO is entirely an Offer for Sale (OFS) of 5.01 crore equity shares, with no fresh issue component.

As a critical infrastructure institution in India’s capital markets ecosystem, NSDL commands a significant presence in dematerialization, trade settlement, and electronic securities management. The IPO provides investors a chance to own a stake in the backbone of India’s digital securities infrastructure—backed by solid financials, technology leadership, and a stable revenue model.

Let’s dive deeper into the IPO details, lot sizes, financials, and whether this is a must-apply opportunity for retail and HNI investors.

NSDL IPO Details

The NSDL IPO is a book-built issue with a total size of ₹4,011.60 crore, consisting solely of an Offer for Sale (OFS) of 5.01 crore equity shares. No fresh shares are being issued, meaning all proceeds will go to the selling shareholders.

| IPO Details | Information |

|---|---|

| IPO Opening Date | July 30, 2025 |

| IPO Closing Date | August 1, 2025 |

| Listing Date (Tentative) | August 6, 2025 |

| Issue Type | Book Building |

| Face Value | ₹2 per share |

| Price Band | ₹760 to ₹800 per share |

| Lot Size | 18 shares |

| Total Issue Size | 5,01,45,001 shares (₹4,011.60 Cr) |

| Offer for Sale | 100% OFS – 5.01 crore shares |

| Employee Discount | ₹76 per share |

| Listing At | BSE |

| Registrar | Link Intime India Pvt Ltd |

| Lead Manager | ICICI Securities Ltd |

Important Note: There’s no dilution of equity here, as the IPO is purely an exit route for existing shareholders.

NSDL IPO – Important Dates (Tentative)

Stay on top of the NSDL IPO schedule with the key dates below:

| Event | Date |

|---|---|

| IPO Opens | July 30, 2025 (Wednesday) |

| IPO Closes | August 1, 2025 (Friday) |

| Cut-off time for UPI mandate | August 1, 2025, 5:00 PM |

| Allotment Finalisation | August 4, 2025 (Monday) |

| Initiation of Refunds | August 5, 2025 (Tuesday) |

| Shares Credited to Demat Account | August 5, 2025 (Tuesday) |

| Listing Date (Tentative) | August 6, 2025 (Wednesday) |

NSDL IPO Objectives

Since this IPO is entirely an Offer for Sale, there are no fresh proceeds for the company. The objectives of the IPO are as follows:

- Offer for Sale (OFS):

- Up to 5,01,45,001 equity shares of face value ₹2 each will be sold by the existing shareholders.

- The proceeds from the issue will go directly to the selling shareholders.

- Listing Benefits:

- To achieve the advantages of being a publicly listed company on the BSE, including better brand visibility, improved liquidity, and access to future capital markets.

Business Overview: NSDL IPO

The NSDL IPO is set to draw significant investor interest, thanks to the company’s robust business model, strong market leadership, and deep integration with India’s capital markets. National Securities Depository Limited (NSDL) is not just India’s first and largest depository — it is the backbone of the country’s dematerialized securities ecosystem.

At its core, NSDL performs critical depository functions that ensure the smooth operation of the Indian securities market. Its primary services include:

1. Electronic Securities Record-Keeping

NSDL facilitates the electronic holding and transfer of securities. By maintaining allotment and ownership records digitally, NSDL ensures higher accuracy, faster processing, and better transparency for investors, issuers, and intermediaries.

2. Asset Servicing

With a focus on risk mitigation and operational efficiency, NSDL plays a key role in safeguarding dematerialised assets. The company uses advanced technologies to manage and service assets across various asset classes.

3. Transaction Services

NSDL provides a full suite of depository services such as:

- Dematerialisation of securities

- Trade settlements

- Off-market transfers

- Pledging/re-pledging of securities (including margin pledges)

- Corporate actions support

- Unpaid securities pledge accounts (CUSPA) for brokers

These services streamline the operations of brokers, custodians, and registrars, offering seamless post-trade settlement mechanisms.

4. Value-Added Offerings

Beyond core depository operations, NSDL also offers:

- E-voting platforms for shareholder democracy

- Consolidated Account Statements (CAS)

- Blockchain-based monitoring platforms for debentures and NDUs (Non-Disposal Undertakings)

5. Expanding Footprint Through Subsidiaries

NSDL has two key subsidiaries:

- NDML (NSDL Database Management Limited): Offers KYC, e-governance (including Special Economic Zones projects), regulatory platforms, insurance repositories, and digital signature certificate services.

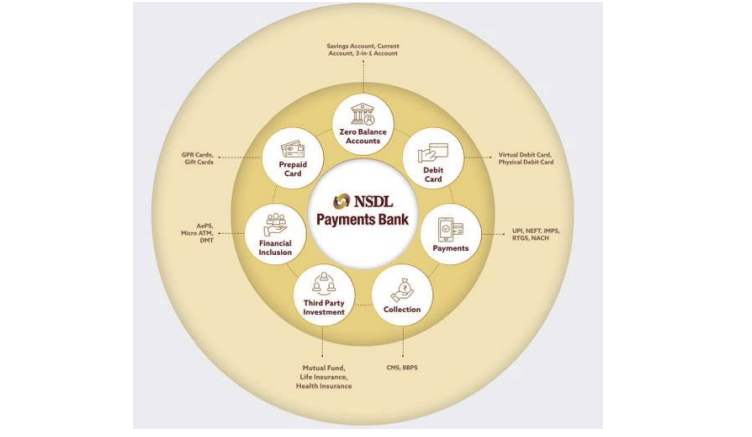

- NPBL (NSDL Payments Bank Limited): Aims at driving financial inclusion through its B2B2C digital banking model. Services include Aadhaar-based payments, micro ATMs, UPI payments, prepaid cards, and distribution of third-party insurance/mutual fund products.

Key Business Metrics (as of FY25):

- Demat Accounts: Over 39.45 million accounts serviced through 294 registered depository participants

- Issuers Registered: 79,773 total issuers (6,287 listed, 73,486 unlisted)

- Securities Held in Demat Form: 4,758.69 billion units

- Value of Assets in Custody: ₹464.16 lakh crore

- Market Share (Debt Custody): 96.98%

- PAT (FY25): ₹3431.24 crore

- Revenue (FY25): ₹14,201.46 crore

- ROE: 17.11%

- Earnings Per Share: ₹17.16

Backed by a seasoned leadership team led by MD & CEO Vijay Chandok, NSDL has grown its revenue, profit, and market presence consistently over the years. From FY23 to FY25, its operating revenue rose from ₹10,219.88 million to ₹14,201.46 million, and profit after tax increased from ₹2,348.10 million to ₹3,431.24 million.

With this IPO, NSDL aims to further strengthen its position as a digital-first, compliance-driven, and innovation-oriented infrastructure institution in India’s rapidly growing financial markets.

Financial Performance: NSDL IPO

NSDL has maintained a strong financial trajectory over the last three fiscal years, showcasing consistent growth in revenue, profitability, and returns. This solid financial base strengthens the credibility of the NSDL IPO, giving investors confidence in its fundamentals.

The table below highlights NSDL’s key financial metrics from FY23 to FY25:

NSDL IPO Financial Highlights (₹ in million)

| Particulars | FY23 | FY24 | FY25 | CAGR (%) FY23–25 |

|---|---|---|---|---|

| Revenue from Operations | 10,219.88 | 12,106.45 | 14,201.46 | 18.23% |

| Profit After Tax (PAT) | 2,348.10 | 2,948.78 | 3,431.24 | 21.07% |

| EBITDA | 3,286.04 | 4,112.20 | 4,929.43 | 22.42% |

| PAT Margin (%) | 21.35% | 22.18% | 22.35% | – |

| Operating Profit Margin (%) | 22.89% | 23.62% | 23.95% | – |

| Return on Equity (RoE) | 16.43% | 16.78% | 17.11% | – |

| Earnings Per Share (EPS) | ₹11.74 | ₹14.29 | ₹17.16 | – |

| Net Worth | 14,288.61 | 17,274.00 | 20,053.41 | – |

This strong financial footing—especially the healthy profit margins, double-digit growth in revenue and PAT, and increasing EPS—makes the NSDL IPO an appealing opportunity for both retail and institutional investors.

Valuation & Peer Comparison: NSDL IPO

As NSDL steps into the public markets, all eyes are on how it stacks up against its key rival — CDSL — which has already enjoyed years of market exposure and investor trust. The NSDL IPO is purely an Offer for Sale (OFS), meaning no new funds will be infused into the company, and investors need to evaluate it based on fundamentals and valuation alone.

NSDL IPO Valuation Highlights

| Metric | Pre-IPO Value |

|---|---|

| Earnings Per Share (EPS) | ₹17.16 |

| Price-to-Earnings Ratio (P/E) | 46.63x |

| Price-to-Book Value (P/BV) | 7.98x |

With a post-IPO P/E of 46.63x, NSDL is being valued at a premium compared to traditional industry standards, though still lower than its listed peer CDSL in terms of headline multiples.

Peer Comparison: NSDL vs CDSL

Below is a snapshot of how NSDL compares to its closest peer, Central Depository Services (India) Limited (CDSL), as of FY25:

Key Financial Metrics (FY25)

| Company | EPS (Basic/Diluted) | NAV/Share (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

|---|---|---|---|---|---|

| NSDL | ₹17.16 | ₹100.27 | 46.63 | 17.11% | 7.98 |

| CDSL | ₹25.20 | ₹84.23 | 68.04 | 29.90% | 20.40 |

Observation: CDSL outperforms NSDL on return metrics like RoNW and EBITDA margin, but NSDL has stronger institutional clientele and larger assets under custody.

NSDL vs. CDSL: Operational Snapshot

| Feature | NSDL | CDSL |

|---|---|---|

| Established | 1996 (India’s first electronic depository) | 1999 |

| Listing Status | IPO in 2025 (pure OFS) | Listed since 2017 |

| Active Demat Accounts | ~4.01 crore (May 2025) | ~15.29 crore (Mar 2025) |

| Assets Under Custody | ₹49.5 trillion (June 2025) | ₹71 trillion (Mar 2025) |

| FY25 Total Income | ₹1,535 crore | ₹1,199 crore |

| FY25 Net Profit | ₹343 crore | ₹526 crore |

| EBITDA Margin (FY25) | ~25% | ~52% |

| Focus | Institutional & Custodial | Retail + Fintech Integration |

| Ownership | NS, IDBI, SBI, HDFC, SUUTI | Promoted by BSE |

| Valuation | ~₹25,500–₹30,000 crore (Unlisted est.) | ~₹36,354 crore (Market cap) |

| Growth Outlook | SEBI-driven Institutional Services | Retail Surge + Subsidiary Growth |

Final Take on Valuation

While NSDL IPO offers a slice of India’s original depository, its valuation seems stretched when considering margins and demat account base compared to CDSL. However, its institutional dominance, SEBI-compliance services, and strategic positioning could reward long-term investors.

NSDL IPO GMP Trend: What the Grey Market Signals

The NSDL IPO is buzzing in the grey market, though recent trends suggest some cooling off in enthusiasm. As of 25 July 2025, the grey market premium (GMP) stands at ₹164, marking a slight dip compared to earlier days.

Here’s a snapshot of the day-wise GMP movement and what it could mean for potential investors:

NSDL IPO Day-wise GMP Trend

| Date | IPO Price | GMP (₹) | Estimated Listing Price | Estimated Profit* | Last Updated |

|---|---|---|---|---|---|

| 25-07-2025 | ₹800.00 | ₹164 ↓ | ₹964 | ₹2,952 (20.5%) | 25 July 2025 |

Trend Insight: The downward movement in GMP suggests a slight pullback in speculative demand, but the estimated listing gain still stands at a healthy 20%+. This makes it a potentially rewarding short-term bet if listing sentiment stays positive.

However, investors should stay cautious — grey market trends are unofficial and volatile. A GMP drop could indicate profit-booking by early entrants or shifts in broader market sentiment.

Conclusion: Should You Apply for the NSDL IPO?

The NSDL IPO brings to market a highly respected player in India’s capital markets infrastructure. As a pure OFS issue, it offers no fresh capital infusion — but does open a rare window to invest in India’s first and oldest depository.

Short-Term Strategy

With a GMP of ₹164 and estimated listing gains of around 20%, short-term investors may consider applying for listing gains, especially if overall market sentiment stays stable to positive. However, do note that the GMP has dipped slightly, suggesting some moderation in speculative enthusiasm.

Long-Term Strategy

NSDL offers a strong institutional pedigree, sound financials (with FY25 PAT of ₹343 crore), and plays a critical role in India’s market infrastructure. However, compared to CDSL, NSDL has lower margins, fewer retail accounts, and is priced at a higher P/E multiple (~46x pre-IPO EPS).

Long-term investors should evaluate whether NSDL’s growth outlook — driven by regulatory expansion and tech upgrades — justifies its premium valuation. It may reward patience, but CDSL currently appears more retail-focused and profitable.

Allotment Strategy

- Retail quota is typically 35%, and being a mainboard IPO, chances of oversubscription are high.

- Apply on day 2 or 3 once QIB and HNI data becomes clearer.

- Use multiple applications via eligible family accounts to improve chances of allotment.

NSDL IPO opens a door to India’s financial backbone — solid, seasoned, but priced for perfection.

FAQs: NSDL IPO

Q1. What is the NSDL IPO price band?

The price band for the NSDL IPO is ₹800 per share.

Q2. When will the NSDL IPO open for subscription?

The IPO is expected to open in early August 2025. Official dates will be announced soon.

Q3. Is NSDL IPO a fresh issue or offer for sale (OFS)?

It is a 100% Offer for Sale (OFS); the company will not receive any IPO proceeds.

Q4. What is the lot size for NSDL IPO?

The lot size details are yet to be confirmed, but typically range between 18–25 shares per lot.

Q5. How does NSDL compare to CDSL?

NSDL leads in institutional focus and asset custody, while CDSL has a larger retail customer base and better margins.

Q6. What is the GMP of NSDL IPO?

As of July 25, 2025, the Grey Market Premium (GMP) is ₹164, indicating a potential listing gain of ~20.5%.

Q7. Who are the promoters of NSDL?

Prominent institutions like IDBI Bank, SBI, HDFC Bank, and NSE are among NSDL’s promoters.

Q8. Is NSDL IPO good for long-term investment?

NSDL offers strong fundamentals and industry dominance, but its premium valuation requires careful consideration.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?