Nifty slips as geopolitical tensions weigh on sentiment

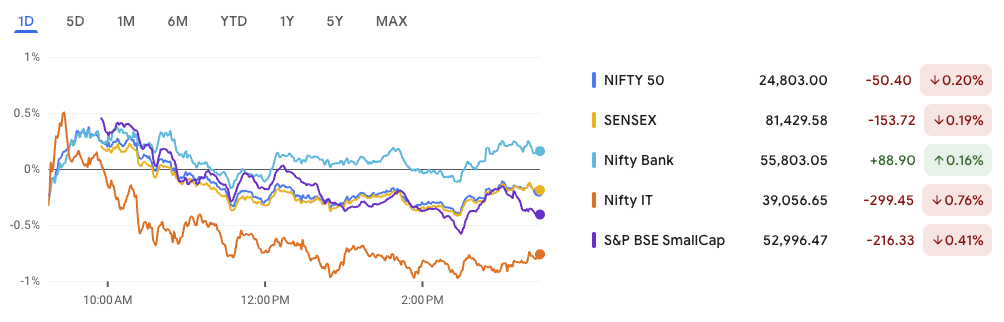

Nifty slips below 24,900 as global tensions rise: The Indian markets ended lower today as rising Iran-Israel tensions hit investor confidence. The Nifty slipped below the 24,900 mark, closing at 24,812, down 41 points. The Sensex also lost ground, ending at 81,444, down 138 points.

IT stocks were the worst hit, dragging down the broader indices. The Nifty IT index fell 0.83%, with TCS dropping nearly 2%. In contrast, IndusInd Bank surged over 5%, becoming the top gainer of the day.

The Nifty Auto index showed strength, rising 0.37%, making it the best performing sector. Defensive buying and selective accumulation helped limit deeper losses.

🧠 What’s inside this newsletter:

→ Nifty Technical Analysis

→ News & Stock Impact

→ Technical Radar

→ IPO Tracker

→ Smallcap Pick of the Day

Technical Analysis – Nifty slips, but structure still constructive

As Nifty slips below 24,900, price action indicates consolidation rather than a breakdown. Let’s break down the chart signals:

Chart Observations

- The daily candle was a small-bodied red candle with upper and lower wicks — a classic sign of indecision.

- Formed just below the resistance zone of 25,100–25,108, it reflects supply pressure without a full rejection.

- This follows a strong bullish candle from the previous session, suggesting a pause, not a trend reversal.

Key Technical Levels

| Type | Level | Commentary |

|---|---|---|

| Resistance | 25,108 | Tested multiple times, key breakout trigger |

| 26,266 | All-Time High and next big hurdle | |

| Support | 24,452–24,461 | Demand zone; strong buying interest noted here |

| 23,801–23,805 | Critical swing low — breach changes trend bias | |

| EMA Support | 9 EMA at 24,761 | Currently acting as dynamic support |

Volume & Momentum

- Volume: At 237.5M, lower than average → no strong bearish conviction.

- Buyers have been more aggressive on green days recently.

- MACD likely flattening; RSI hovering in the 50–60 zone → neutral to bullish momentum.

- No bearish divergence observed.

Pattern Formation

- Rectangle/Box Range: 24,452 to 25,108 → a continuation pattern unless broken.

- Price still holds above the April breakout zone (~24,000), keeping the medium-term uptrend intact.

Interpretation & Next Move

Base Case (Most Likely)

→ Sideways consolidation with bullish tilt.

→ A break above 25,108 with strong volume may fuel a rally toward 25,500–26,200.

→ If 24,450 breaks with volume, expect a correction to 23,800.

Confirmation Triggers

| Scenario | Condition | Target |

|---|---|---|

| Bullish | Close above 25,108 + Volume > 275M | 25,500 → 26,200 |

| Neutral | Consolidation between 24,450 – 25,108 | Wait & watch |

| Bearish | Close below 24,450 + Volume > 280M | 24,000 → 23,800 |

📌 Bias Summary

| Bias | Trigger | Target Range |

|---|---|---|

| Bullish | Close above 25,108 + high volume | 25,500 → 26,200 |

| Neutral | Range-bound 24,450–25,108 | Wait for breakout |

| Bearish | Close below 24,450 + spike | 24,000 → 23,800 |

News & Stock Impact

🧼 Urban Company Turns Profitable Pre-IPO

What Happened?

IPO-bound Urban Company reported a net profit of ₹240 crore in FY25, largely driven by a ₹211 crore deferred tax credit. Revenue surged 38% YoY to ₹1,144 crore, while EBITDA loss narrowed significantly. The company also revealed strong growth in both domestic (24%) and international (64%) markets.

IPO Details:

Filed draft papers in April 2025 for a ₹1,900 crore IPO. The issue includes ₹429 crore fresh issuance and a significant offer for sale by investors like Accel, Elevation, Bessemer, Tiger Global, and Vy Capital.

Stock Impact:

Though Urban Company is unlisted, IPO optimism may trigger sentiment in tech-backed IPO themes and consumer service enablers like:

- Zomato, Info Edge (Naukri), FSN E-Commerce (Nykaa)

- Investors in Urban Company like Info Edge may see action as listing nears.

✈️ Reliance Infra Soars on Dassault Aviation JV

What Happened?

Reliance Infrastructure jumped 5% after its arm, Reliance Aerostructure, partnered with Dassault Aviation to build Falcon 2000 business jets in India—the first such move outside France.

Impact:

- Strong strategic win boosting India’s defence aviation ecosystem.

- Expected to revive investor interest in Anil Ambani Group companies.

Stock Impact:

- Reliance Infra: May sustain upside as the deal progresses.

- HAL, Bharat Electronics, Bharat Forge: Positive spillover expected in defence sentiment.

🏦 RBI Flags Data Quality Drop in Private Banks

What Happened?

RBI’s Supervisory Data Quality Index showed a decline in the ‘completeness’ scores of private and small finance banks, hinting at operational lapses.

Stock Impact:

- Private Banks: Slight sentiment drag. Watch HDFC Bank, ICICI, IndusInd.

- Small Finance Banks (SFBs): Names like Ujjivan SFB, Equitas SFB may face mild regulatory overhang.

💊 Divi’s, Alembic, and Novartis Patent War Update

What Happened?

- USFDA inspection concluded at Alembic’s site with EIR awaited.

- Alembic also got USFDA approval for Bosutinib, a blood cancer drug.

- Divi’s Labs emerges as API supplier for Entresto, Novartis’ blockbuster drug.

- Novartis vs MSN patent battle continues, with the main patent expiring in July 2025.

Stock Impact:

- Alembic Pharma: Could gain from USFDA clearance + Bosutinib approval.

- Divi’s Laboratories: Long-term upside from Entresto API supply.

- MSN (unlisted) and Novartis litigation developments may influence generic pharma space.

💍 Gems & Jewellery Exports Slump in May

What Happened?

Gems & Jewellery exports dropped 15.8% YoY in May 2025. Sharpest fall was seen in cut & polished diamonds, down 35%. Imports also shrank.

Reasons:

- Global headwinds, weak demand, US tariff worries, excess inventory.

Stock Impact:

- Watch for potential pressure on Titan, Rajesh Exports, Kalyan Jewellers, Vaibhav Global.

- Diamond exporters like Asian Star, Goldiam, Renaissance Global may face headwinds.

🛡️ Bharat Forge-Turgis JV for Armed UAVs

What Happened?

Bharat Forge announced a strategic MoU with Turgis Gaillard for developing AAROK—an armed, high-endurance UAV capable of deep-strike and long surveillance.

Impact:

- Reinforces India’s UAV ambitions; domestic production strengthens defence tech edge.

Stock Impact:

- Bharat Forge: Strong positive as it adds defence capabilities.

- Peer interest in Tonbo Imaging, HAL, Paras Defence, Data Patterns may also rise.

📑 BSE Demat Auction Reminder

What Happened?

BSE’s DR-653 Rolling Settlement demat auction was conducted on June 18, 2025. Participants submitted buy offers for short-delivered securities.

Stock Impact:

- No direct market impact, but highlights the importance of delivery discipline for investors.

Nifty Slips Post Breakout, But Cup & Handle Structure Remains Intact

On June 18, 2025, price action on the chart reflected short-term weakness, as Nifty slipped following a breakout from a well-formed Cup and Handle pattern. However, the structural integrity of the breakout remains intact, suggesting the current move may represent a healthy pullback rather than a trend reversal.

Chart Structure & Technical Formation

A classic Cup and Handle pattern had developed, with the following parameters:

- Cup Depth: From ₹245 to ₹125, indicating a deep but symmetrical base.

- Handle Formation: Tight and shallow—considered ideal for continuation.

- Breakout Level: Around ₹190, breached on strong volume, confirming bullish momentum.

This is a high-conviction continuation pattern, typically resolving higher when backed by strong volume—exactly what occurred during the breakout session.

Price Action: Bearish Candle With Context

Despite the breakout, the latest session (June 18) printed a bearish engulfing candle, closing at ₹197.91 with a 4.87% decline. While this might appear negative in isolation, two key points support the bullish bias:

- Closing remains above the ₹190 breakout level, preserving the pattern’s validity.

- High volume on the red candle suggests profit booking, not breakdown—typical behavior following a breakout in momentum setups.

EMA & Support Dynamics

- 9 EMA (₹182.01): Price remains comfortably above the 9-day exponential moving average, a key support level.

- This EMA aligns with the prior breakout zone, increasing its credibility as a support on any pullback.

Fibonacci Perspective

Using the rise from the handle base (₹130) to the swing high (₹200), the 0.618 Fibonacci retracement lies in the ₹170–₹174 range. This is a crucial zone and represents a high-probability area for dip buying, should price correct further.

Short-Term Outlook (1–5 Sessions)

| Observation | Interpretation |

|---|---|

| Bearish engulfing post-breakout | Expect mild pullback or sideways consolidation |

| Key Support | ₹190 to ₹182 (Breakout + EMA) |

| Invalidation Level (Handle Base) | Below ₹178 |

| Short-Term Resistance | ₹208–₹210 (recent wick high) |

Tactical Approach:

Avoid immediate fresh long entries. Instead, monitor price behavior near the ₹182–190 zone. A pullback with declining volume and reversal signal would be a strong buy-on-dip opportunity. If the price reclaims ₹210 with volume, a quick move towards ₹225 could unfold.

Swing Outlook (2–4 Weeks)

- Pattern Target Calculation: Cup height = ₹120 (₹245–₹125)

- Projected Target: ₹190 (breakout) + ₹120 = ₹310

| Target Type | Price Zone |

|---|---|

| Initial Target | ₹225–₹230 |

| Intermediate | ₹260–₹270 |

| Full Pattern Target | ₹300–₹310 |

📌 Pattern remains valid above ₹182. Breakdown below ₹175–₹178 would negate the setup.

Professional Summary

| Time Horizon | Outlook | Key Support | Key Resistance |

|---|---|---|---|

| Short-Term | Healthy pullback after breakout | ₹182–₹190 | ₹208–₹210 |

| Swing | Bullish bias intact above ₹182 | ₹178 (guardrail) | ₹225 → ₹310 |

| Risk Trigger | Breakdown below ₹175 | — | — |

Conclusion:

While Nifty slips post-breakout, the underlying trend remains positive. A disciplined trader should treat this pullback as constructive, with ₹182 as a critical level to monitor. Patience and precision near the support zone will offer the best entry conditions for the next leg higher.

IPO Update: Nifty Slips, But IPO Market Buzzes with Activity

Despite recent market softness as Nifty slips, the IPO market remains active across Mainboard and SME segments. Here’s a quick snapshot of key IPOs – only essential info like Open/Close Dates, GMP, and Expected Listing Gains.

Mainboard IPOs

| IPO Name | Open–Close | GMP (₹) | Est. Listing Gain |

|---|---|---|---|

| Arisinfra Solutions | 18–20 June | ₹25 | 11.26% |

| HDB Financial | TBA | ₹100 | 0.00% |

| Kalpataru Projects | TBA | ₹– | — |

| Sambhv Steel Tubes | TBA | ₹– | — |

| Ellenbarrie Gases | TBA | ₹– | — |

SME IPOs

| IPO Name | Open–Close | GMP (₹) | Est. Listing Gain |

|---|---|---|---|

| Influx Healthtech (NSE SME) | 18–20 June | ₹45 | 46.88% |

| Eppeltone Engineers (NSE SME) | 17–19 June | ₹58 | 45.31% |

| Globe Civil Projects (NSE SME) | 24–26 June | ₹9 | 12.68% |

| Mayasheel Ventures (NSE SME) | 20–24 June | ₹6 | 12.77% |

| AJC Jewel (BSE SME) | 23–26 June | ₹9 | 9.47% |

| Ace Alpha Tech (BSE SME) | 26–30 June | ₹– | 0.00% |

| Shri Hare-Krishna Sponge (NSE SME) | 24–26 June | ₹– | 0.00% |

| Icon Facilitators (BSE SME) | 24–26 June | ₹– | 0.00% |

| Aakaar Medical Tech (NSE SME) | 20–24 June | ₹– | 0.00% |

| Safe Enterprises (NSE SME) | 20–24 June | ₹– | 0.00% |

Quick Takeaway

Even as Nifty slips, IPO investors are seeing sharp listing gains in select SME issues, particularly:

- ✅ Influx Healthtech and Eppeltone Engineers stand out with 40%+ GMPs.

- ✅ Mainboard IPO action is limited, but Arisinfra is drawing attention.

- ⚠️ Stay cautious with weaker or zero GMPs – many SME IPOs show flat sentiment.

📌 Track GMPs daily; they often change rapidly closer to listing.

Small Cap of the Day: Optiemus Infracom Ltd

Sector: Telecom Hardware & Distribution

Market Cap: ₹5,998 Cr | CMP: ₹687

Business Overview

Optiemus Infracom Ltd is a 25-year veteran in India’s mobile handset ecosystem, primarily engaged in:

- Trading & Distribution (42% revenue share):

Distributing phones for major brands like Nokia, Samsung, and HTC across India. - Pan-India Presence:

27 regional branches, 650+ distributors, 10,000+ retail partners, and 700+ service centers. - New Strategic Trigger (June 2025):

Subsidiary has entered a manufacturing partnership with OnePlus to produce IoT devices in India — a significant value-add and expansion into higher-margin tech products.

Key Financial Ratios & Metrics

| Metric | Value | Interpretation |

|---|---|---|

| Revenue | ₹1,890 Cr | Solid topline base |

| Net Profit Margin (NPM) | 3.72% | Thin margins; typical for distribution-heavy biz |

| EPS Growth (3Y) | 312% | Explosive earnings momentum |

| ROCE / ROE | 14.4% / 11.6% | Moderate returns on capital |

| Debt-to-Equity | 0.30 | Healthy leverage profile |

| Cash Equivalents | ₹146 Cr | Decent liquidity buffer |

| Inventory | ₹244 Cr | Working capital heavy, as expected |

| Price to Book (P/B) | 9.02x | Rich valuation |

| Stock P/E | 94.7x | Overvalued vs. industry P/E of 26.3x |

| Intrinsic Value | ₹158 | Trading at 4.3x intrinsic; priced for growth |

⚠️ Valuations are high. Market is factoring in future growth from IoT play.

Technical Structure & Chart View

1. Breakout Above 200-Day SMA

- Price closed above ₹608, a key long-term average.

- Indicates institutional accumulation and trend reversal.

2. Volume Confirmation

- Recent breakout saw 13M+ volume, highest in many months.

- Strong volume supports sustainability of breakout.

3. Price Structure

- After a deep correction from ₹960 to ₹400, stock consolidated.

- Now showing higher lows and bullish re-accumulation signs.

Key Levels

| Type | Level (₹) |

|---|---|

| Breakout Level | 610–620 |

| Current Price | 684.60 |

| Immediate Resistance | 710–730 |

| Major Targets | 780 / 880–900 |

| ATH Resistance | 960 |

| Support | 600 (SMA) / 545 (base) |

A close below ₹580–600 would invalidate this bullish breakout.

Long-Term View & Target Outlook

| Time Horizon | Expectation | Target Range (₹) |

|---|---|---|

| 3–6 Months | Bullish Continuation | 780–800 |

| 6–12 Months | Gradual move toward prior ATH | 900–960 |

| Risk Trigger | Close below ₹580 | Exit / Reassess |

Summary

Nifty slips, but Optiemus is breaking out on strong fundamentals and a new business catalyst. The OnePlus-IoT angle has the potential to rerate the stock if margin profile improves and execution is strong.

✅ Bullish View above ₹600

⏳ High-risk, high-reward play on India’s tech manufacturing boom

Conclusion: Nifty Slips, But Signals Are Mixed

This week’s newsletter highlighted a nuanced market environment. While the Nifty slips after a breakout attempt, the broader trend structure remains intact above key support zones like 18200. The bearish engulfing candle demands caution, but volume and EMA structure suggest no major breakdown yet — making the current dip a setup to watch, not fear.

Meanwhile, corporate news — like Optiemus Infracom’s strategic alliance with OnePlus — is quietly fueling momentum in smallcaps. Our featured pick today, Optiemus, reflects strong technical breakout signals aligned with fundamental triggers, underscoring the high-risk, high-reward potential in select names.

The IPO market, especially in the SME segment, continues to buzz. With strong listing gains in names like Influx Healthtech (+46.88%) and Eppeltone Engineers (+45.31%), investor appetite remains robust for fundamentally sound, smaller issues.

In summary:

- 📉 Index: Nifty slips, but structure intact above 18200.

- 🔍 Stock Radar: Action is shifting to select mid and small caps.

- 🚀 IPO Tracker: SME space continues delivering sharp listings.

- 💡 Strategy: Avoid index-level panic; focus on sectoral and stock-specific moves.

As always, when Nifty slips, don’t follow the fear — follow the data. Open your Angel One Demat account today and stay ahead when Nifty slips or surges.

Related Articles

Why the Iran Israel Conflict Hasn’t Hit Indian Markets

India’s Sparkling Shift to Lab-Grown Diamonds