Introduction

Stock market investing is often described as unpredictable, but history tells a different story. One of the simplest and most powerful lessons from the Indian markets is this: the price you pay determines the returns you get. Among the many indicators, the NIFTY P/E ratio stands out as a time-tested guide for investors who want to know not just how markets look today, but what kind of returns they can expect tomorrow.

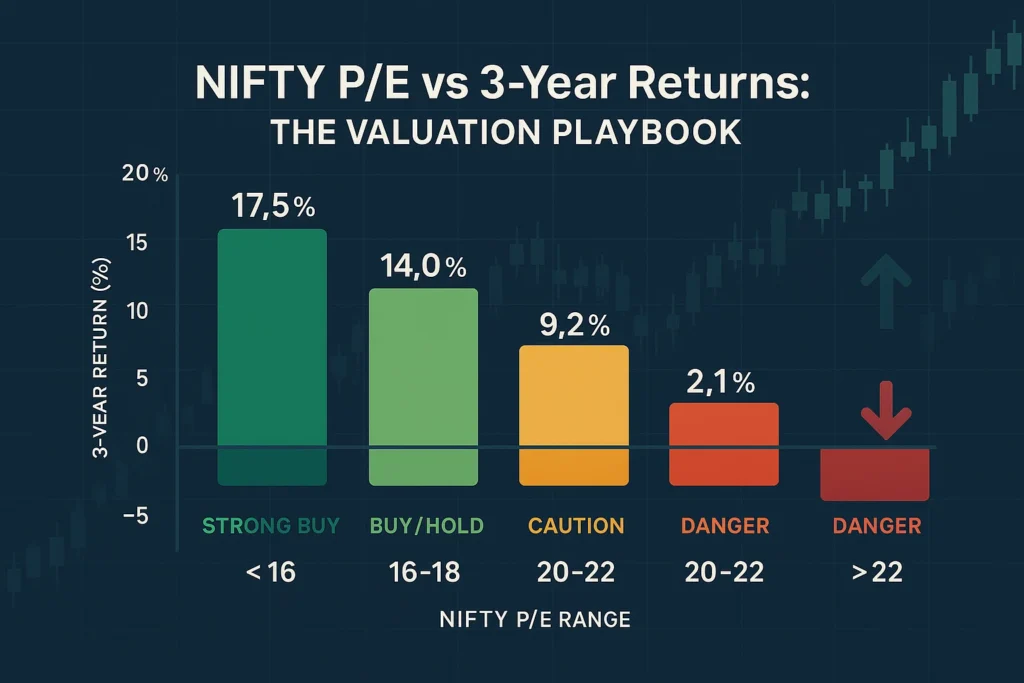

At the moment, NIFTY trades at a P/E of 21.67. Investors are asking: Is this the right time to enter? Or should I wait? The answer lies in what I call the NIFTY Valuation Playbook, a framework built on historical data that provides clues about when to invest in NIFTY and how to avoid the traps of market euphoria.

Understanding NIFTY P/E and Why It Matters

The NIFTY P/E ratio—short for Price-to-Earnings—tells us how much investors are paying for every rupee of earnings generated by NIFTY 50 companies. A high ratio reflects optimism and growth expectations, while a low ratio reflects fear or pessimism.

For long-term investors, this number is more than just an abstract valuation metric. It’s a compass that helps guide decisions on when to invest in NIFTY, offering a way to separate signal from noise.

What History Tells Us: NIFTY P/E vs 3-Year Returns

Markets may feel random in the short term, but over longer horizons, valuations have consistently predicted returns. Here’s what decades of data show about NIFTY P/E levels and the 3-year returns that followed:

| NIFTY P/E Range | 3-Year Returns (%) |

|---|---|

| Less than 14 | 152.10% |

| 14–16 | 112.36% |

| 16–18 | 79.14% |

| 18–20 | 51.18% |

| 20–22 | 21.18% |

| 22–24 | -14.98% |

| 24–26 | -32.92% |

| 26–28 | -36.60% |

| 28–30 | -40.17% |

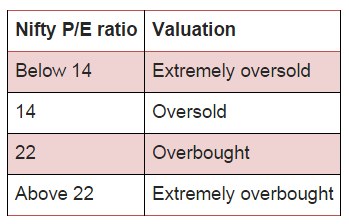

The pattern is hard to ignore: the lower the NIFTY P/E, the stronger the future returns. Once valuations cross 22, the probability of wealth erosion rises dramatically. The deepest drawdowns occur when investors rush into the market above 26 P/E—a zone of dangerous overvaluation.

With the current NIFTY P/E at 21.67, history places us on the edge of the caution zone.

The NIFTY Valuation Playbook: A Rulebook for Investors

From this data emerges the NIFTY Valuation Playbook—a framework for judging when to invest in NIFTY.

When P/E falls below 16, it’s the Strong Buy Zone. Fear dominates headlines, but future returns are most rewarding. Between 16 and 20, the Buy and Hold Zone, returns remain attractive and investors can expect healthy compounding.

Once valuations cross 20, caution is necessary. Between 20 and 22, returns shrink, and the risk-reward balance weakens. Beyond 22, history shows we enter the Danger Zone, where negative returns are more likely than gains.

This playbook doesn’t try to predict tomorrow’s prices; instead, it teaches patience and discipline. For investors wondering when to invest in NIFTY, the rulebook offers clear, historically backed guidance.

Why Investors Still Buy at High P/Es

If the evidence is so strong, why do investors keep buying when the NIFTY P/E is elevated? The answer lies in market psychology.

Bull markets breed euphoria. When indices hit record highs, investors fear missing out. Media headlines celebrate milestones, and the promise of quick profits overshadows the risks. This was the case in 2007, when NIFTY traded at extreme valuations above 25 P/E—only for the global financial crisis to wipe out years of gains.

The same dynamic repeated in 2020–21, when liquidity and stimulus drove valuations up, only for many investors who entered late to face poor outcomes. The lesson is timeless: herd behavior pushes people to buy at the worst possible times.

Applying the Playbook in 2025

So where does that leave us today, with NIFTY’s P/E at 21.67?

This level sits in the caution zone. It doesn’t mean a crash is inevitable, but it does mean that returns over the next three years may be muted compared to buying at cheaper valuations. For retail investors, the most prudent path is a disciplined Systematic Investment Plan (SIP)—averaging into the market gradually rather than committing large lump sums.

For investors with cash waiting on the sidelines, patience could be the ultimate advantage. Waiting for P/E levels closer to 18–20, or even lower if markets correct, could provide a far better entry point. The playbook suggests that knowing when to invest in NIFTY is less about catching tops or bottoms, and more about respecting valuation boundaries.

The Limits of NIFTY P/E

It’s important to note that NIFTY P/E is not a perfect crystal ball. It doesn’t capture the quality of earnings, sectoral shifts, or extraordinary macroeconomic events. High valuations can sometimes coexist with high earnings growth, cushioning returns. Likewise, markets can underperform even at fair valuations if external shocks occur.

This is why P/E should be seen as a guiding compass rather than a rigid rule. Combining it with Price-to-Book ratios, PEG ratios, and global liquidity trends makes for a more well-rounded strategy. But as a first filter to decide when to invest in NIFTY, few tools are as straightforward and evidence-backed as the P/E ratio.

Conclusion: The Rule Every Investor Should Remember

The verdict is clear: valuations matter. When the NIFTY P/E is low, long-term investors are rewarded handsomely. When it is high, risks rise and returns shrink.

At today’s level of 21.67, we are walking a fine line. The best course of action is balance—continue disciplined investing through SIPs, avoid reckless lump sums, and stay patient for better valuations.

The NIFTY Valuation Playbook boils down to a simple rule: buy aggressively when valuations are low, stay steady when they are fair, and be cautious when they are stretched. For investors wondering when to invest in NIFTY, the past decades have already written the answer. All that’s left is the discipline to follow it.

Check Nifty Historical PE ratio: Click Here

Frequently Asked Questions (FAQs)

1. What is the P/E ratio in stock markets?

The P/E ratio, or Price-to-Earnings ratio, shows how much investors are willing to pay for each unit of a company’s earnings. For indices like NIFTY, it reflects the overall market’s valuation.

2. Why does the NIFTY’s P/E ratio matter for investors?

It helps investors understand whether the market is undervalued, fairly priced, or overvalued. Historically, lower valuations have led to better long-term returns.

3. How is the NIFTY P/E ratio calculated?

It’s calculated by dividing the current market price of all NIFTY 50 stocks by their combined earnings per share (EPS).

4. What is considered a low P/E for NIFTY?

Historically, a P/E below 16 has been considered a “cheap” level where investors earned strong returns over the following years.

5. Is a high P/E ratio always bad for investors?

Not necessarily. A high P/E may be justified if earnings growth is very strong. However, over long periods, very high valuations usually lead to weaker returns.

6. Can P/E ratio alone predict future returns?

No. It’s a useful indicator, but investors should also consider earnings growth, interest rates, global trends, and company fundamentals.

7. What should I do if markets are at high P/E levels?

At higher valuations, it’s usually safer to invest gradually through SIPs rather than making big lump-sum entries.

8. How often should investors track NIFTY’s P/E ratio?

Monthly tracking is enough for long-term investors. Daily changes don’t offer much value for decision-making.

9. Do global markets also follow the same P/E-return relationship?

Yes, similar trends exist worldwide. For example, the U.S. S&P 500 also shows weaker future returns when valuations are stretched.

10. Is the P/E ratio useful for short-term trading?

Not really. P/E ratios are more helpful for long-term investment planning rather than short-term trading decisions.

More Articles

How to Transfer Shares from Groww to Zerodha – Full Guide (2025)

Best Screener Queries for Stock Selection: Find Hidden Gems Before Others Do

How a Tea Seller Used the Power of Compound Interest to Build ₹45 Lakh