Market Under Pressure: Geopolitical Heat Grips Dalal Street

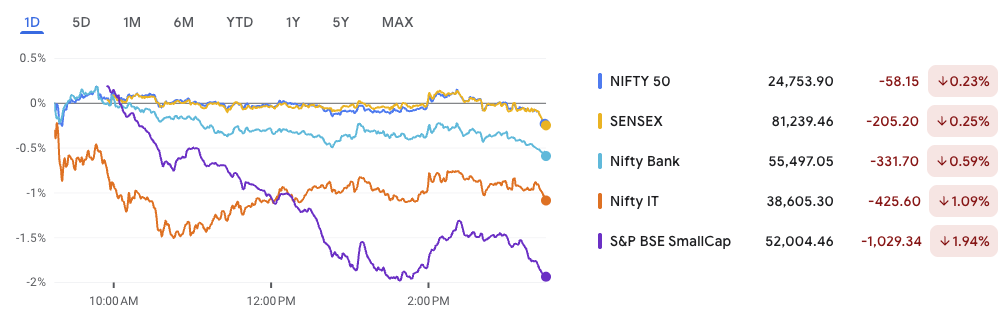

Tensions in the Middle East are once again casting a long shadow on global markets — and India isn’t immune. As the Nifty slips below 24,900, and Sensex closes over 130 points lower, investor nerves were clearly frayed. Escalating Iran-Israel tensions and a cautious global sentiment kept the markets under pressure, despite pockets of resilience in private banks and autos.

🔻 IT stocks & Small Cap took a hit, with TCS leading the decline, while defensives and midcaps saw selective buying. Amid the volatility, traders and investors are now asking: Is this just a pause, or the beginning of a deeper correction?

In this issue of the newsletter, we cut through the noise and spotlight what really matters:

🔍 Nifty Technical Analysis – Key levels, breakout/breakdown zones, and what charts are telling us now

🗞️ News & Stock Impact – From IPO to partnership

📊 Technical Radar – Pattern breakout, volume spike, momentum plays you can’t ignore

📈 IPO Tracker – Fresh GMP updates, SME & mainboard highlights, and which issues are hot right now

🚀 Smallcap Pick of the Day – A high-risk, high-reward breakout stock flying under the radar

Whether you’re looking for short-term trades or big-picture signals, this newsletter has something for everyone.

Let’s dive in.👇

Nifty Outlook: Market Under Pressure Amid Tight Range

Current Price: 24,793.25

9-day EMA: 24,755.90

Volume: 274.61 million

The Nifty 50 index is under pressure, consolidating in a narrow range between 24,452 and 25,108. Despite a strong rally in May, momentum has stalled. The price now sits just above the 9-day EMA, suggesting that short-term support is still intact. However, a lack of follow-through buying points to uncertainty in the near term.

Technical Picture

Nifty is trading sideways. This often signals a pause before the next major move. Price compression near support or resistance zones can result in sharp breakouts or breakdowns. Therefore, traders should stay alert.

Key Support and Resistance Levels

| Level Type | Price Range (INR) |

|---|---|

| Immediate Resistance | 25,095 – 25,108 |

| Immediate Support | 24,452 – 24,461 |

| Critical Support Zone | 23,801 – 23,805 |

| Breakout Target (upside) | 26,000 – 26,266 |

What Could Happen Next?

Bullish Setup

- If Nifty breaks above 25,108 with strong volume, it may resume the uptrend.

- A daily close above 25,100 could attract momentum buyers.

- In that case, the index may head toward 26,000–26,266.

Bearish Setup

- If the index falls below 24,452, it could trigger a deeper pullback.

- The next downside target would be 23,800.

- Rising volume during the fall would confirm a bearish breakdown.

Market Sentiment and Strategy

- Current Bias: Neutral-to-bullish above 24,450.

- Momentum: Flat and range-bound.

- EMA Trend: 9-day EMA is acting as dynamic support.

Suggested Approach

- For range traders: Consider buying near 24,450 with a stop below 24,400. Target 25,100+.

- For breakout traders: Enter only after a daily close above 25,100. Target 26,000+.

- Avoid shorts unless Nifty breaks below 24,450 with high volume.

Summary

The market remains under pressure, with Nifty consolidating after a strong rally. Until the index breaks out of the 24,452–25,108 range, expect sideways action with possible volatility. Watch price action near key levels before taking new positions.

News & Stock Impact: Market Under Pressure

As the market remains under pressure, here are the developments shaping stock-specific action:

1. Ambuja Cements & ACC get net-zero approval from SBTi

Global climate body SBTi has approved both companies’ net-zero emission targets, aligning them with global ESG benchmarks.

Impacted Stocks: Ambuja Cements, ACC — sentiment-positive for long-term ESG-focused investors.

2. HDB Financial likely to file IPO today

HDFC Bank-backed HDB Financial is expected to file its DRHP for an IPO, a long-awaited move that may unlock value.

Impacted Stock: HDFC Bank (holds 94% stake) — a successful IPO may aid capital efficiency.

3. Capillary Technologies files draft IPO papers to raise ₹430 crore

The marketing-tech firm aims to list on both NSE and BSE; the IPO includes fresh issue and OFS components.

Impacted Stocks: No listed peer impact, but may add buzz in tech IPO pipeline.

4. NSE changes SME IPO bidding rules from July 1

New norms mandate a minimum of 2 lots per application, eliminate the cut-off price option, and make bids non-cancellable.

Impacted Stocks: SME IPO candidates like AJC Jewel, Mayasheel Ventures, Icon Facilitators — may see retail participation shift after July.

5. Tata Technologies selected by Volvo Cars as strategic supplier

Will support global operations in embedded software, engineering, and PLM solutions.

Impacted Stock: Tata Technologies — boosts global credibility and client diversification.

6. Ashoka Buildcon wins ₹584 crore Guyana road project

Secured a major international EPC contract from Guyana’s Public Works Department.

Impacted Stock: Ashoka Buildcon — enhances overseas order book visibility.

7. RBI norms to impact gold loan NBFCs

Stricter cash flow and LTV norms expected to push up operating costs.

Impacted Stocks: Muthoot Finance, Manappuram Finance — may face pressure on spreads and profitability.

8. Jio Financial buys SBI’s 17.8% stake in Jio Payments Bank

Now holds 100% in Jio Payments Bank after acquiring SBI’s stake for ₹104.5 crore.

Impacted Stocks: Jio Financial Services (JFSL) — consolidates control; expands fintech play.

9. Biocon QIP and biosimilars update

HSBC retains ‘Buy’ on Biocon with reduced target, noting key catalysts lie in insulin approvals and scaling biosimilars.

Impacted Stock: Biocon — sentiment tied to execution on R&D and debt reduction.

10. Cosmic CRF sees stake hike by Ashish Kacholia

His stake rises to 18.4%, showing continued bullishness on company prospects.

Impacted Stock: Cosmic CRF — investor confidence may drive short-term re-rating.

11. MTAR Technologies signs 10-year contract with Weatherford

The deal includes Whipstock assemblies and other components, with ₹10 crore in FY26 and ~₹90 crore annually from FY27.

Impacted Stock: MTAR Technologies — long-term revenue visibility improves; stock may see rerating.

12. Indosolar relisted after Waaree Energies acquisition

Once under insolvency, the solar company reported a net profit of ₹55 crore in FY25 post-acquisition.

Impacted Stock: Indosolar — revival under Waaree could trigger interest in clean energy stocks.

13. SEAMEC signs equipment supply deal with Dubai firm

Agreement with Mubarak Bridge Maritime FZCO for air diving equipment on SEAMEC-III vessel.

Impacted Stock: Seamec Ltd — order adds visibility to asset utilization.

14. KPI Green Energy’s subsidiary receives 36.9 MW solar orders

Sun Drops Energia secured projects under the Captive Power Producer segment.

Impacted Stock: KPI Green Energy — growth visibility in CPP segment strengthens bullish outlook.

15. ESAF Small Finance Bank to offload ₹735 crore of NPAs

Board approved the sale of stressed assets to an ARC, aiming to clean up the balance sheet.

Impacted Stock: ESAF SFB — may improve asset quality metrics; positive for investor confidence.

16. R Systems gains on Coforge stake acquisition buzz

Coforge is reportedly planning to acquire a significant stake in the IT services firm.

Impacted Stock: R Systems International — potential strategic synergy could drive valuation.

17. Marksans Pharma subsidiary gets UK drug approval

Relonchem gets UK MHRA nod for bladder treatment drug.

Impacted Stock: Marksans Pharma — opens new revenue stream in international market.

18. Sky Gold falls as promoters offload ₹244 crore stake

Promoters sold 4.7% stake via block deals at an average price of ₹348.6.

Impacted Stock: Sky Gold — promoter selling may weigh on near-term sentiment.

19. Krishana Phoschem hits 52-week high on new plant plan

Board approved setting up DAP, NPK, and sulphuric acid units in Madhya Pradesh.

Impacted Stock: Krishana Phoschem — aggressive expansion supports future growth thesis.

20. IKS (Inventurus Knowledge Solutions) falls on block deal

30 lakh shares (~1.7% stake) worth ₹499 crore changed hands at ₹1,659 average.

Impacted Stock: IKS Health — supply overhang may lead to short-term correction.

21. MedPlus Health unit hit by drug license suspension

Optival Health Solutions faced suspension of licenses for 4 stores in Bengaluru.

Impacted Stock: MedPlus Health Services — negative operational impact; short-term stock pressure likely.

22. Puravankara surges on ₹272 crore residential order

Subsidiary Starworth Infra bags a large order from TRU Dwellings for a Bengaluru project.

Impacted Stock: Puravankara Ltd — improves order book; supports real estate upcycle narrative.

23. Zydus Lifesciences gets Form 483 with two FDA observations

Inspection at oncology injectable unit in Ahmedabad ends with Form 483.

Impacted Stock: Zydus Lifesciences — minor compliance concern; market to watch for resolution timelines.

Technical Radar

R Systems International Ltd (NSE: RSYSTEMS)

Date: June 19, 2025 | CMP: ₹431.45 | Volume: 685.24K | EMA (9-day): ₹417.53

Key phrase: Market under pressure

Despite the broader market being under pressure, R Systems International exhibits a contrastingly bullish technical setup, making it a notable outlier among small- and mid-cap stocks.

🔍 Chart Structure & Key Technical Observations

Rounded Bottom Breakout:

The daily chart reveals a well-defined rounded bottom pattern, typically indicative of a long-term trend reversal. The breakout above ₹426 was accompanied by strong volumes, confirming bullish intent.

Healthy Retest in Progress:

Following the breakout, the price is undergoing a controlled retest of the breakout zone (₹426–₹429). Notably, wick rejections near this level point to buying interest and supply absorption—a sign of base-building rather than a failed breakout.

EMA Alignment:

Moreover, the stock is comfortably trading above its 9-day EMA at ₹417. This short-term moving average is now acting as a dynamic support, reinforcing bullish momentum.

Volume Confirmation:

Another positive factor is the spike in volume during the breakout session, which often suggests institutional buying or renewed investor interest.

Key Price Levels to Track

| Zone/Level Type | Price Range (INR) |

|---|---|

| Immediate Support | ₹426 – ₹429 |

| Strong Swing Support | ₹417 (9 EMA) |

| Resistance 1 (Swing Zone) | ₹456 – ₹458 |

| Resistance 2 (Target Zone) | ₹519 – ₹521 |

Trade Setups

1. Swing Trade Opportunity

- Entry Zone: ₹426–₹431

- Stop Loss: Below ₹417

- Target 1: ₹457

- Target 2: ₹519

- Risk-Reward Ratio: ~1:3

Why it works: This is a textbook breakout–retest–continuation pattern. If the ₹426 zone holds, a rally towards ₹457 becomes highly probable, followed by an extended move to ₹519. Additionally, the narrow pullbacks and orderly consolidation support a low-risk, high-reward setup.

2. Short-Term Trade (3–5 Days Horizon)

- Entry: On a bounce confirmation above ₹432

- Stop Loss: ₹425

- Target: ₹456

- Entry Filter: Look for a bullish candle with volume above daily average, confirming fresh momentum.

Caution Points

- A breakdown below ₹417 would invalidate the bullish thesis.

- Historical supply zone near ₹457 could cause profit booking or consolidation.

- Broader market weakness, especially under the theme “Market under pressure,” may delay momentum beyond ₹460.

Summary

| Perspective | View | Trigger | Risk Zone |

|---|---|---|---|

| Short-Term & Swing | Bullish | Retest support near ₹426 | Close below ₹417 |

R Systems International stands out in a volatile market due to its strong technical posture. In an environment where “market under pressure” headlines dominate, this counter provides a well-defined and disciplined setup—ideal for swing traders with a 5–20 day horizon.

IPO Tracker: Market under pressure

Despite the broader market under pressure, IPO activity remains resilient with strong investor interest across several SME and mainboard issues. Below is a concise breakdown of recent and upcoming IPOs, segregated by category:

Mainboard IPOs

| Company | Open-Close Dates | GMP | Est. Listing Gain |

|---|---|---|---|

| Sambhv Steel Tubes | 19–21 June 2025 | ₹– | –% |

| HDB Financial | 25–27 June 2025 | ₹105 | 0% (Price N/A) |

| Arisinfra Solutions | 18–20 June 2025 | ₹22 | ~9.91% |

| Kalpataru Projects | 24–26 June 2025 | ₹– | –% |

| Ellenbarrie Gases | 24–26 June 2025 | ₹– | –% |

SME IPOs

| Company | Open-Close Dates | GMP | Est. Listing Gain |

|---|---|---|---|

| Globe Civil Projects | 24–26 June 2025 | ₹11 | 15.49% |

| Suntech Infra Solutions | 25–27 June 2025 | ₹12 | 13.95% |

| Mayasheel Ventures | 20–24 June 2025 | ₹6 | 12.77% |

| AJC Jewel | 23–26 June 2025 | ₹9 | 9.47% |

| Icon Facilitators | 24–26 June 2025 | ₹4 | 4.40% |

| Influx Healthtech | 18–20 June 2025 | ₹38 | 39.58% |

Note: Several new SME IPOs are opening next week. Keep an eye on listing gains, especially in counters showing high subscription interest and strong GMP.

Smallcap Pick of the Day: IIFL Capital Services Ltd

While the broader markets remain under pressure, certain smallcaps with strong operational momentum and robust balance sheets continue to stand out. IIFL Capital Services Ltd (formerly IIFL Securities) is one such emerging opportunity in the financial services space, offering both growth potential and structural resilience.

Business Model: Diversified Financial Powerhouse

Founded in 1996, IIFL Capital Services operates as a comprehensive financial services firm with five key business segments:

1. Retail Broking (29% of FY24 revenue):

This vertical caters to retail and HNI investors across asset classes—equity, derivatives, commodities, and currencies. Notably, revenue from this division has grown 57% between FY22 and FY24, driven by increased market participation and expanding investor base.

2. Financial Product Distribution (17%):

Here, the company earns fee-based income by distributing third-party financial products such as mutual funds, PMS, AIFs, and insurance. Importantly, this segment witnessed 83% revenue growth over the last two years, reflecting rising investor appetite for diversified instruments.

3. Institutional Broking (17%):

Serving over 930 institutional clients worldwide, this segment provides research, trading, and corporate access services. Backed by a 43-member analyst team and coverage of 281 stocks, institutional broking revenue surged 113% since FY22.

4. Investment Banking (10%):

From managing IPOs to M&As and QIPs, this division has executed 59 deals in FY24. Transactions such as the ₹6,560 Cr IPO of Bajaj Housing Finance underscore its market relevance. Although volatile, this vertical remains a strategic growth lever.

5. Other Services (27%):

This includes investments in subsidiaries that offer insurance broking and real estate advisory. While less glamorous, these businesses contribute to stability and fee income diversification.

Moreover, the company recently changed its name (Nov 2024) and appointed a new MD, signaling a strategic reset. Additionally, its subsidiary secured an IRDA license to operate in the insurance distribution space, further widening its revenue streams.

Key Financial Highlights

To assess whether this stock fits a high-risk, high-reward profile, consider these crucial ratios:

- ROCE: 34.6% → Indicates strong capital efficiency, especially important in a service-heavy business.

- ROE: 33.2% → Reflects high profitability relative to equity, often a sign of scalable business.

- Debt-to-Equity: 0.37 → Low leverage reduces risk during downturns.

- Operating Margin (OPM): 41.5% → Points to strong pricing power and cost control.

- P/E: 14.7 vs Industry P/E of 14.8 → Fairly valued relative to peers, leaving room for re-rating.

- Cash & Equivalents: ₹4,010 Cr → Strong liquidity buffer gives it flexibility in market corrections.

These ratios suggest a fundamentally sound business with high earnings quality and operational leverage—essential in identifying potential multibaggers.

Why It Matters Now

With the market under pressure, many quality stocks are consolidating. However, IIFL Capital’s business model offers a blend of cyclical upside (via broking and investment banking) and annuity-style revenue (through financial product distribution). This mix allows it to perform well across cycles.

Furthermore, the company’s continued expansion in SIPs, MTF book, and AUM indicates strong retail participation and recurring income visibility. Notably, its attempt to transfer its retail trading business to 5paisa (though later withdrawn) also reflects management’s intent to unlock value where necessary.

Bottomline

IIFL Capital Services Ltd is a high-beta, high-margin play in India’s growing capital markets ecosystem. With improving market share, lean operations, and high capital efficiency, it is well-positioned for outperformance once broader market sentiment stabilizes.

However, the stock remains volatile. Investors should wait for technical confirmation and enter on dips or breakouts depending on their risk appetite.

Conclusion: Navigating Opportunities as Market under pressure

As the market remains under pressure, investors are grappling with volatility and indecision. Yet, within this consolidation phase lie selective opportunities for those prepared.

On the technical front, Nifty 50 is stuck in a tight band between 24,452 and 25,108, awaiting a breakout or breakdown to determine direction. Until then, range-bound strategies are likely to outperform trend-following ones.

News flow also reflects a mixed macro environment. While global signals remain neutral, corporate India continues to churn out key developments—from HDB Financial’s IPO move to Ashoka Buildcon’s international contract win—signaling ongoing business momentum.

Technically, setups like R Systems International show how breakouts can still offer swing opportunities, even in a cautious market. Likewise, in the smallcap space, IIFL Capital Services stands out as a high-risk, high-reward pick with strong profitability metrics and diversified revenue streams.

In summary, while broader indices may pause or correct, sharp stock-specific moves are still possible. Staying selective, data-driven, and technically aligned will be key to navigating the volatility ahead.

Stay disciplined, stay informed.

Related Articles

Why the Iran Israel Conflict Hasn’t Hit Indian Markets

Ambani and Trump: A High-Stakes Real Estate Alliance Redrawing Global Business Ties