Market Recap: Nifty Market Recovery After Geopolitical Jitters

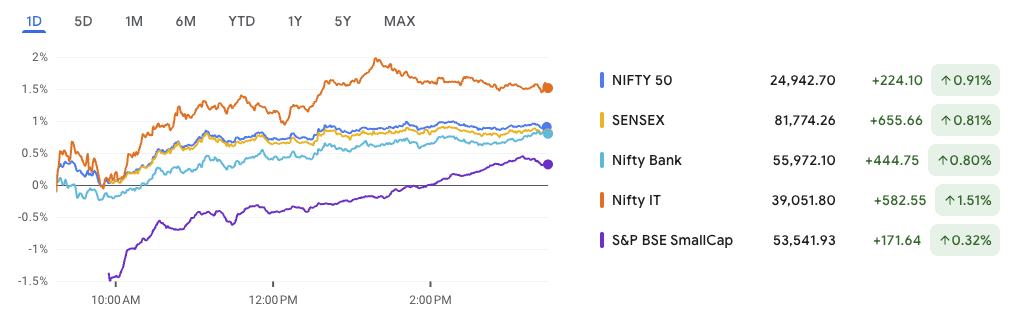

After a jittery start triggered by escalating Israel-Iran tensions, Indian markets staged a remarkable comeback on Monday. The Nifty 50 surged 228 points to close at 24,946, while the Sensex rallied 678 points, shrugging off global uncertainty. This strong move marks a sharp Nifty market recovery, driven by broad-based buying across sectors.

All sectoral indices ended in the green, with IT, metal, realty, and oil & gas gaining around 1% each. Even midcap and smallcap indices joined the rally, rising 0.9% and 0.4% respectively. The sentiment shift highlights investor confidence returning after initial panic selling.

Top Movers:

- Biggest Gainer: Bharat Electronics surged +2.45%, continuing its bullish momentum.

- Biggest Loser: Tata Motors dropped -3.57%, reacting to stock-specific pressure.

- Best Sector: Nifty IT led the way with a +1.57% gain.

- Worst Sector: Nifty Auto, still positive, added +0.18%—making it the least performing among gainers.

Now that the dust is settling, is the market gearing up for a fresh breakout—or just catching its breath? Let’s dive into the charts, news movers, and technical setups shaping the week ahead.

NIFTY 50: Riding the Nifty Market Recovery

Current Price: 24,946.50

Volume: 305.73M (Healthy)

9 EMA: 24,751.95 (Price above EMA indicates bullish short-term bias)

Key Technical Observations

1. Support Remains Intact

Nifty bounced firmly from the 24,452 – 24,462 demand zone, a region that has repeatedly held up during pullbacks. This base is now well-established, reinforcing market participants’ confidence in the current rally.

2. Rebound from Short-Term Moving Average

The index also took support at the 9 EMA, suggesting momentum is still in favor of bulls. This moving average has guided recent dips and reinforces the structure of the current Nifty market recovery.

3. Resistance Zone at 25,095 – 25,108

This supply zone has rejected price action three times in the recent past. A daily close above this band is crucial for a continuation toward higher levels. Until then, price may remain range-bound between the highs and the support zone.

4. Next Key Resistance Around All-Time Highs

On a confirmed breakout, the next major technical resistance lies near 26,266—the previous all-time high. This level is nearly 5% above current prices and could be a medium-term target if momentum sustains.

Price Outlook Scenarios

Bullish Scenario (More Likely):

If Nifty sustains above 24,950 and decisively breaks above 25,108:

- Target 1: 25,500

- Target 2: 26,260

The structure of this Nifty market recovery supports a bullish bias as long as price holds above the 9 EMA (24,750).

Bearish Scenario:

If price fails to overcome resistance and drops below 24,750:

- Expect a retest of the 24,450–24,460 zone

- A breakdown below 24,450 could target:

- Target 1: 23,800

- Target 2: 23,500

Strategy Outlook

| Bias | Description |

|---|---|

| Bullish | Strong rebound from support, close above 9 EMA, increasing volume |

| Neutral | Market needs a breakout above 25,108 to confirm continuation of the rally |

| Bearish | Only valid if price breaks and closes below 24,450 with volume |

Swing Trader Action Plan

- Buy only on breakout above 25,108 with a stop-loss at 24,750

- Avoid fresh positions if price stays within the current range

- Buy-on-dips strategy near 24,450 is viable if price forms a bullish reversal pattern

The technical chart continues to reflect a consolidative structure within a broader uptrend, supporting the narrative of an ongoing Nifty market recovery. Confirmation above resistance levels will pave the way for a directional rally toward new highs.

News & Stock Impact: Catalysts Behind the Nifty Market Recovery

As Indian equity benchmarks post a sharp rebound, multiple stock-specific and macroeconomic developments are contributing to the broader Nifty market recovery narrative. Here’s a curated round-up of key headlines and how they impact stocks and sectors:

UltraTech Cement Faces SEBI Compliance Hurdle

News: UltraTech Cement must offload approximately 7% of its stake in India Cements—valued at over ₹667 crore—to comply with SEBI’s 25% minimum public shareholding norm.

Impact:

- India Cements (ICEM) may witness increased supply pressure in the near term as UltraTech divests.

- However, this also opens up institutional interest opportunities if priced attractively.

- UltraTech Cement (ULTRACEMCO) remains fundamentally strong; the regulatory divestment isn’t expected to materially affect its operations.

Market Takeaway: While short-term volatility is expected in both counters, UltraTech’s strategic compliance move won’t derail cement sector sentiment, which remains stable amid infrastructure-led growth themes supporting the Nifty market recovery.

Capri Global Raises Rs 2,000 Cr; Stars Back It

News: Prominent investors Prashant Jain and Madhu Kela participated in Capri Global Capital’s ₹2,000 crore Qualified Institutional Placement (QIP).

Impact:

- Strong endorsement from marquee investors is a confidence booster.

- Capri Global will use the funds to scale lending operations across retail, SME, and affordable housing sectors.

Stock Outlook: Expect heightened market interest and short-term bullishness in Capri Global as capital adequacy improves. A potential rerating could be on the cards.

InCred Expands into Retail Broking via Stocko Buyout

News: InCred Money is acquiring Stocko, a discount broker with massive daily volumes (~₹1 lakh crore), marking its formal entry into the retail broking business.

Impact:

- Signals growing competition in the discount broking space.

- Zerodha, Angel One, and Groww may face price and market share pressure in the medium term.

Investor Insight: Expect higher M&A activity in fintech/broking as new players chase digital transformation. This is another example of how private capital expansion supports the structural strength of the Nifty market recovery.

Earthood Services Re-Files IPO With ESG Focus

News: Earthood Services re-files IPO with SEBI; issue revised to a pure Offer for Sale of 62.9 lakh shares. The company offers ESG auditing, certification, and carbon advisory services.

Impact:

- ESG-focused businesses are attracting institutional attention. Strong past growth (80% profit YoY) will likely attract retail investors too.

- IPO space continues to stay vibrant despite global macro tensions, signaling liquidity and sentiment health.

IPO Tracker: Watch this IPO for long-term sustainability themes. May benefit from current bullish IPO sentiment amid the Nifty market recovery.

May Auto Sales: Mixed Bag for Automakers

News:

- Passenger vehicles down 0.8% YoY to 3.44 lakh units.

- Two-wheelers up 2.2% to 16.56 lakh units.

- Three-wheelers down 3.3%.

- Total vehicle sales up 1.8%.

Impact:

- Mixed numbers may weigh slightly on auto stocks short term.

- Tata Motors, the Nifty’s biggest loser today (-3.57%), likely faced selling due to these muted figures.

Outlook: With rising fuel efficiency, EV push, and rural recovery in sight, expect a rebound later in FY26. For now, auto underperformance doesn’t derail the overall Nifty market recovery.

India’s Trade Deficit Narrows to $21.88 Billion

News: India’s May trade deficit came in below estimates at $21.88B vs $26.43B in April. Merchandise exports fell 2.2%, but imports also declined.

Impact:

- A smaller deficit is positive for the Indian rupee and macro stability.

- Export-heavy sectors (like IT, pharma, and capital goods) may see continued inflows and earnings strength.

Macro Take: A narrowing deficit alongside stable WPI inflation helps reinforce the sustainability of the current Nifty market recovery.

India’s Shift to Premium Whisky

News: ICICI Securities reports a shift in alcohol consumption trends: premium whisky now accounts for 39% of top brand volumes, while regular segment shrinks 5% CAGR over five years.

Impact:

- Positive for liquor companies like United Spirits, Radico Khaitan, and Pernod Ricard.

- Companies focusing on premiumization are better positioned for margin expansion.

Consumption Trend: Reflects India’s evolving consumption pattern—rising disposable incomes support premium brands and discretionary stocks, adding another layer to the Nifty market recovery thesis.

Technical Radar: Cup & Handle Signals Fresh Momentum in Nifty Market Recovery

Stock in Focus

CMP: ₹1,233.60 | Change: +₹66.30 (+5.68%)

The stock has formed a strong bullish candle, indicating decisive upward movement, aligned with the ongoing Nifty market recovery.

Chart Structure Breakdown

- 9-day EMA: ₹1,181.78 — Price is well above this average, highlighting short-term strength.

- Volume: 4.32 million — A notable spike confirms the legitimacy of today’s breakout.

Pattern Analysis: Cup and Handle Breakout Confirmed

Cup Phase:

Formed between February and May 2025, the base signals accumulation and a full recovery from a previous downtrend.

Handle Formation:

Developed as a controlled falling wedge pattern between late May and mid-June — a textbook continuation signal.

Breakout:

Today’s price action has cleared the handle resistance zone with strong volume, confirming bullish momentum within the broader Nifty market recovery trend.

Key Technical Zones

| Zone Type | Price Level (Approx.) | Significance |

|---|---|---|

| Resistance 1 | ₹1,267–₹1,290 | Handle high and recent supply zone |

| Breakout Zone | ₹1,190–₹1,200 | Wedge breakout level + neckline of Cup & Handle |

| Support Zone | ₹1,150–₹1,180 | EMA support + previous consolidation |

| Target Zone | ₹1,380–₹1,450 | Cup breakout projected move |

Price Projection: Swing Trading View

Bullish Case (Preferred):

- Entry: At current levels (₹1,230–₹1,240) or on dips to ₹1,200

- Stop-loss: ₹1,160 (below EMA and wedge base)

- Target 1: ₹1,300

- Target 2: ₹1,380

- Target 3: ₹1,450–₹1,500 (if momentum sustains)

Projection Logic: Cup depth of ₹500 added to breakout point ₹1,200 implies a medium-term target of ₹1,700.

Bearish Case (Invalidation Zone):

- Breakdown below ₹1,160 with volume may negate the bullish setup.

- Potential downside support lies at ₹1,100–₹1,050.

Trading Strategy Summary

Swing Traders (1–3 weeks):

- Buy Zone: ₹1,200–₹1,240

- SL: ₹1,160

- Target Range: ₹1,300 → ₹1,380 → ₹1,450+

Short-Term Traders (2–5 days):

- Buy above: ₹1,250

- SL: ₹1,200

- Target: ₹1,295–₹1,310

This technical setup adds momentum to the ongoing Nifty market recovery, supported by institutional buying and sectoral strength. With volume and structure aligning, this breakout presents a high-conviction opportunity.

Mainboard IPO Update

Get ready for fresh primary market action! Here’s a look at ongoing and upcoming mainboard IPOs with current GMP trends and potential IPO listing gains:

| IPO Name | Open-Close | GMP | Expected Listing Gain | Listing Date |

|---|---|---|---|---|

| Oswal Pumps IPO | 13–17 June | ₹60 | 9.77% | 20 June |

| Sambhv Steel Tubes | Yet to open | ₹0 | 0% | TBD |

| Ellenbarrie Industrial Gases | Yet to open | ₹0 | 0% | TBD |

| Kalpataru Projects | Yet to open | ₹0 | 0% | TBD |

| HDB Financial Services | Yet to open | ₹0 | 0% | TBD |

| Arisinfra Solutions | 18–20 June | ₹25 | 11.26% | 25 June |

SME IPO Update

The SME IPO space remains a hotbed for aggressive short-term bets. Here’s the list of live and upcoming IPOs with notable IPO listing gains potential:

| IPO Name | Open-Close | GMP | Expected Listing Gain | Listing Date |

|---|---|---|---|---|

| AJC Jewel (BSE SME) | 23–26 June | ₹0 | 0% | 1 July |

| Globe Civil Projects | 24–26 June | ₹0 | 0% | 1 July |

| Safe Enterprises | 20–24 June | ₹0 | 0% | 27 June |

| Mayasheel Ventures | 20–24 June | ₹5 | 10.64% | 27 June |

| Influx Healthtech | 18–20 June | ₹37 | 38.54% | 25 June |

| Eppeltone Engineers | 17–19 June | ₹63 | 49.22% | 24 June |

| Patil Automation | 16–18 June | ₹22 | 18.33% | 23 June |

| Samay Project Services | 16–18 June | ₹0 | 0% | 23 June |

| Aten Papers & Foam | 13–17 June | ₹10 | 10.42% | 20 June |

| Monolithisch India | 12–16 June | ₹46 | 32.17% | 19 June |

Small Cap Stock Pick: Shipping Corporation of India (SCI)

CMP: ₹234 | Market Cap: ₹10,907 Cr | Sector: Logistics / Maritime Transport

Why SCI Stands Out During the Nifty Market Recovery

As the Nifty market recovery gathers momentum, cyclical sectors like shipping and logistics often witness renewed investor interest. One strong small-cap candidate riding this wave is Shipping Corporation of India (SCI) — India’s largest state-owned shipping enterprise.

Key Highlights

- India’s Largest Shipping Company: SCI holds the top spot in India’s maritime fleet by capacity, operating across tankers, bulk carriers, container vessels, offshore supply, and passenger-cargo services.

- Strong Government Backing: A Navratna PSU since 2008, SCI manages vessels for several government departments — a sign of strategic importance and trust.

- Financial Stability & Low Debt:

- Debt-to-equity is just 0.27, showing minimal leverage.

- Cash and equivalents stand at ₹581 Cr, offering financial cushion.

- Book Value: ₹178 | P/B Ratio: 1.34 – reasonable for a PSU shipping major.

- Valuation Comfort:

- Stock P/E: 13 (vs Industry P/E: 13.3)

- EV/EBITDA: 6.31 – indicating undervaluation on enterprise level metrics

- Intrinsic Value: ₹244 – near CMP, suggests limited downside

- Operating Margins & Profitability:

- OPM: 31.5%, NPM: 12.5% – healthy for the shipping sector

- ROE/ROCE over 9% shows decent return profile for a government enterprise

Technical & Sectoral Boost

With global shipping demand stabilizing and India boosting coastal shipping infrastructure, SCI is well-positioned. The Nifty market recovery is also lifting investor sentiment toward PSU and logistics plays, creating a favorable setup for SCI’s re-rating.

Bottom Line

Shipping Corporation of India is a strategically significant, financially stable PSU with attractive valuations. Amid the Nifty market recovery, SCI can benefit from both cyclical tailwinds and increasing market interest in asset-heavy, undervalued PSU stocks.

Conclusion

India’s equity market showcased resilience today with a strong Nifty market recovery, bouncing back from a weak opening to close near record highs.

- The Nifty 50 ended the day at 24,946, up nearly 228 points (+0.92%), supported by gains in IT, realty, oil & gas, and financials. The technical analysis shows continued bullish momentum, with the index now eyeing 25,000+ levels in the short term. Key indicators like price > 9EMA and broad sector participation confirm strength. However, immediate resistance lies near 25,100–25,150, and profit booking around that zone cannot be ruled out.

- On the technical radar, a standout stock forming a classic Cup and Handle breakout pattern was analyzed — showing strong volume-led bullish confirmation. With breakout above the handle and support from the 9-day EMA, the stock projects potential swing targets up to ₹1,450–1,500. This aligns well with traders seeking momentum opportunities during the Nifty market recovery phase.

- In the IPO space, both mainboard and SME issues are gaining traction. Noteworthy SME IPOs like Influx Healthtech, Eppeltone Engineers, and Mayasheel Ventures are reflecting solid GMPs and oversubscription, hinting at possible robust listings.

- Our small-cap pick, Shipping Corporation of India, looks well-positioned in this recovery theme, with a solid balance sheet, undervalued valuation, and status as the country’s largest shipping PSU — a potential long-term gainer in a rising market.

As the Nifty market recovery theme strengthens, staying aligned with technical patterns, IPO buzz, and macro signals will help investors and traders make well-informed decisions. 📈

Stay tuned and stay smart in the market!

Related Articles

India Becomes the Cheapest Manufacturing Hub: Stocks Set to Win Big

RBI Cancels Green Bond Auction: Why Yields Spiked & What It Means for Investors