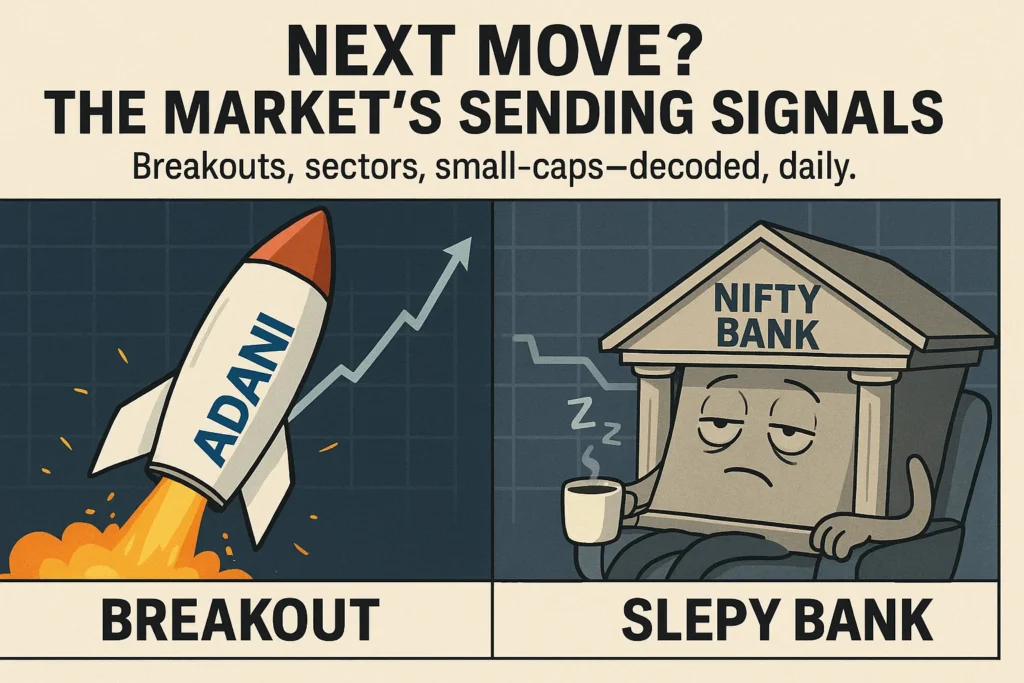

Next Move? The market teased us with a little sunshine—but kept the umbrella handy.

Nifty ended 114 points higher (+0.47%), powered largely by Adani Enterprises, which went full beast mode with a 7% rally. On the flip side, Kotak Mahindra decided to sabotage the banking pack, crashing over 4.5% and dragging Nifty Bank down by 0.36%.

While the frontbenchers like Sensex and Nifty looked upbeat, it wasn’t a broad-based celebration. Auto stocks zoomed ahead, becoming the star sector of the day (+1.85%), but banking stocks clearly missed the memo.

So where are we headed next? With sector-specific moves dominating and no clear leadership from heavyweight indices, it’s time to question whether this is a quiet consolidation… or the calm before a breakout.

The question everyone’s asking: What’s the Next Move—and should you make yours now?

Let’s decode it

NIFTY 50 – Ready for Takeoff?

Next Move? Nifty looks all set to fly business class.

On May 5, the index wrapped up at ₹24,461—firmly above its 9-day EMA of ₹24,072 and now eyeing its previous all-time high of ₹24,789 like it’s just another daily target.

The star setup? A bullish breakaway gap between ₹23,250–₹23,800. That gap is now acting like a launchpad, keeping the bulls confidently in charge.

We’re also seeing all the right signals:

- Rising volumes – smart money is definitely sniffing opportunity

- Higher highs + higher lows – classic uptrend mode

- Immediate resistance: ₹24,790. Break this, and we’re talking moon mission.

Strategy Corner – Your Next Move:

- Long already? Trail stop-loss to ₹24,072 (just under the EMA).

- Breakout hunters: If we close above ₹24,790 with volume, brace for ₹25,200–₹25,500.

- Cautious players: Sit tight for the breakout confirmation.

- Aggressive bulls: This is your dream setup—buy-on-dips mode activated.

The index isn’t asking if it’ll hit a new high—it’s asking when. So, what’s your Next Move?

Stocks in Focus: Big News, Bigger Moves

Let’s break down the headlines that could trigger your Next Move in the market:

🥤 Tata Consumer’s Sports-Only Strategy

What happened: Tata Consumer is gearing up to launch a sports drink, boldly skipping the fizzy cola war. While Coke and Pepsi battle it out, Tata is running laps around them with a healthier play.

Impacted Stock: Tata Consumer Products

Why it matters: Entering the sports drink segment aligns with the rising trend toward health-conscious choices. Investors could see this as a smart diversification beyond chai and salt.

Next Move: Watch for product launch updates and retail expansion—this could re-rate the FMCG story.

📈 Angel One AMC: Passive Funds, Active Buzz

What happened: Angel One AMC has launched two Nifty 50-based passive funds. You can invest during the NFO window open until May 16.

Impacted Stock: Angel One Ltd.

Why it matters: Launching passive funds shows Angel One is pushing into the long-term game of wealth management. With index investing gaining traction, this could bring in sticky AUM (Assets Under Management).

Next Move: Keep an eye on AMC traction. Higher inflows could translate to sustained revenue streams for the parent stock.

💳 NPST Hits the Big League

What happened: NPST, a payments-tech company, just moved from the NSE Emerge platform to the Mainboards of NSE and BSE. That’s like going from gully cricket to the IPL.

Impacted Stock: NPST (Network People Services Technologies)

Why it matters: Mainboard listing = better visibility, wider investor base, and more credibility. The move involved nearly 2 crore shares.

Next Move: With this upgrade, institutional interest could rise. If you’re bullish on digital payments, this is one to track.

👔 Warren Buffett’s $1.2 Trillion Succession Plan

What happened: The Oracle of Omaha, Warren Buffett, will step down as CEO of Berkshire Hathaway in Jan 2026. Greg Abel will take over, while Buffett stays on as Chairman.

Impacted Stock: Global Market Sentiment, indirectly Berkshire Hathaway investors

Why it matters: While this doesn’t directly move Indian stocks, Buffett’s moves are market signals. Investors may now reassess Berkshire’s future bets, including India-focused plays.

Next Move: Monitor Berkshire’s India exposure. Any increase under Abel could lift certain Indian sectors or stocks.

Bhushan Power: Govt Rewind Mode

What happened: The Indian government is reviewing a legal order involving Bhushan Power & Steel. They’re consulting senior legal minds to figure out the next step.

Impacted Stock: Bhushan Power-related resolution plays (keep an eye on lenders and bidders)

Why it matters: Legal clarity could revive interest in related insolvency resolution or asset monetisation themes.

Next Move: Wait for clarity, but if the outcome favors revival, infra or metals players tied to Bhushan could pop.

Serentica Powers INOX with Clean Energy

What happened: Serentica Renewables will supply 75 MW of hybrid clean energy to INOX Air Products.

Impacted Stocks: INOXAP (INOX Air Products), possibly future Serentica partners

Why it matters: Clean energy = cost savings + ESG brownie points. INOX is boosting its green portfolio significantly.

Next Move: For ESG-focused investors, this deal strengthens INOX’s long-term sustainability appeal.

Technical Radar: Where’s the Next Move?

Two stocks stood out on the charts—and they might just be warming up for a breakout. Let’s decode what the market’s trying to say.

Adani Power – Heating Up

Adani Power surged nearly 6% and printed a bullish candle that grabbed everyone’s attention.

It bounced cleanly from ₹524 and closed at ₹556.45, comfortably above its 9-day EMA of ₹535. Volumes were strong, suggesting that this move wasn’t just retail noise. And if it breaks ₹584? That could trigger the next rally leg toward ₹610.

Support: ₹535 and ₹524

Resistance: ₹584, then ₹610

Trading Setup:

| Type | Entry Zone | Target | Stop-Loss | Risk:Reward |

|---|---|---|---|---|

| Swing Buy | ₹556–558 | ₹583–586 | ₹535 | 1:2 |

| Breakout Trade | Above ₹585 | ₹610–615 | ₹572 | 1:2+ |

| Intraday Play | Around ₹555 | ₹570 | ₹547 | 1:1.5 |

👉 Next Move? A close above ₹584 could light the fuse. Trail your stop-loss if already in.

Finolex Cables – Silent No More

After weeks of sideways snoozing, FinCables finally woke up. It shot up 6.46% and closed at ₹913.25, well above its 9-day EMA of ₹862. Volume spiked, and the MACD flashed a bullish crossover—technical green lights everywhere.

The key resistance is ₹940–₹950. A clean move above that could open the door to ₹990–₹1000.

Support: ₹860 (EMA zone), ₹805–810 (swing low)

Resistance: ₹950, then ₹1000+

Trading Setup:

| Type | Entry Zone | Target | Stop-Loss | Risk:Reward |

|---|---|---|---|---|

| Positional Buy | ₹910–915 | ₹945 / ₹975 | ₹880 | ~1:2 |

| Intraday Play | Above ₹920 | ₹935 / ₹940 | ₹902 | ~1:1.5 |

| Breakout Trade | Above ₹950 | ₹990 / ₹1000+ | ₹935 | ~1:2.5+ |

👉 Next Move? If momentum continues, this one could sprint through ₹950 and beyond.

📢 Disclaimer:

This is not investment advice. Trade setups shared are for educational purposes only. Always do your own research and manage risk before taking any position.

Small-Cap Stock of the Day: Rushil Decor Ltd

You’ve heard of the fancy modular furniture. But do you know who’s making the boards that go behind those glossy kitchens and wardrobes? Meet Rushil Decor—a small-cap quietly dominating the MDF and laminate space.

The company blends German tech, global exports, and Indian cost efficiency to stay relevant in an industry that’s all about durability, design, and margins.

What Do They Do?

Rushil Decor manufactures a wide range of products like:

- MDF boards, laminates, HDFWR, and decorative pre-laminated sheets

- WPC and PVC boards/doors under its flagship brand VIR

- Supplies to both domestic and export markets—51 countries and counting

It has over 4,100 dealers and 460 distributors across India, with aggressive plans to tap into North America next.

Why It Stands Out

- Lean operations: Low debt (0.45 D/E), decent margins (OPM 12.4%), and smart use of local plantations for raw material

- Strong product demand: Their boards go into furniture, construction, and interiors—sectors seeing a steady revival

- Innovation focus: The company is agile, rolling out new designs and sustainable offerings with a long-term eye on agroforestry

Financial Snapshot

| Metric | Value |

|---|---|

| Market Cap | ₹653 Cr |

| Revenue | ₹896 Cr |

| Net Profit Margin | 9.26% |

| ROCE / ROE | 11.6% / 9.5% |

| Stock P/E vs Sector | 14.7 vs 42.4 |

| EPS Growth (3Y avg) | 49.3% |

| Market Cap to Sales | 0.73 |

In short? It’s undervalued on paper, profitable, and scaling gradually in an industry that’s consolidating.

Risk Radar

- Low liquidity: This isn’t a high-volume stock, so entries and exits can be choppy

- Slow capex curve: Scaling plants takes time, and the export game is competitive

- Small player vs big brands: They’re still a small fish in a global pond

What’s the Next Move?

For long-term small-cap investors, Rushil Decor is worth a closer look. It’s not a flashy breakout story—but it’s building a solid base. If you believe in India’s home decor, infra, and furniture growth story, this could be a sneaky compounder in the making.

Just don’t expect fireworks tomorrow—this one’s for those who know how to hold the line.

What To Do Now: Your Action Plan

The market didn’t exactly throw a party yesterday, but it dropped just enough hints for smart traders to plan their Next Move.

For Traders:

- Nifty Outlook: Stay bullish above ₹24,072. A breakout above ₹24,790 could trigger a fast move to ₹25,200+.

- Adani Power: Watch ₹584 closely. That’s your breakout level. Aggressive entries with tight SLs make sense here.

- Finolex Cables: Sustaining above ₹920 could push it toward ₹950 and beyond. Volume confirms the move.

- Overall: Sector-specific action is dominating. This isn’t the time to bet on the whole market—bet on the right pockets.

For Investors:

- Small Cap Watch: Rushil Decor may not be a household name yet, but it’s quietly growing in a stable, demand-driven sector. If you like long-term stories with improving fundamentals, this one deserves a place on your watchlist.

- Angel One AMC’s new funds offer a passive way to ride the Nifty 50. For those who don’t want to pick stocks, this is a low-effort, low-cost entry into large-cap investing.

Markets are moving, but not in one direction. This is the kind of week where stock selection beats index prediction.

Plan your trades, check your stops, and as always—don’t chase, prepare.

Whether you’re a quiet SIPper or a breakout-hunting ninja—Angel One helps you stay ready, not reactive.

👉 Open your account here and never miss your Next Move.

Related Articles

Virtual Galaxy Infotech IPO: All You Need to Know Before Investing