Introduction:

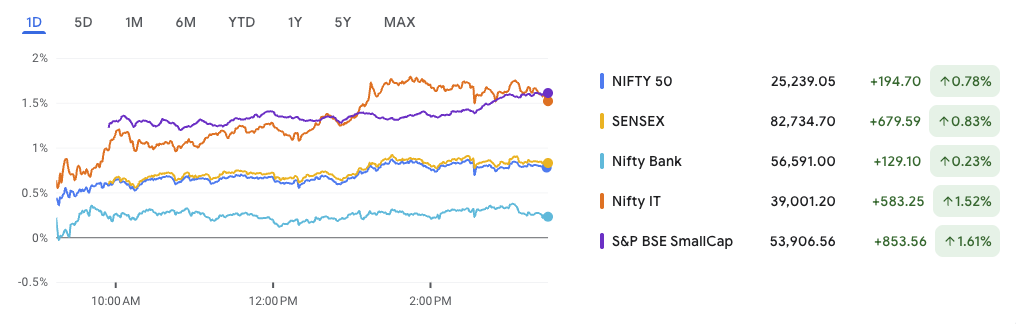

Markets kicked off the week with strong momentum. Nifty Breaks the resistance at 25,200 and closed at 25,239.05, up 194.70 points (0.78%). The Sensex also gained, ending at 82,734.70, up 679.59 points (0.83%).

The rally was broad-based. Nifty IT surged 1.52%, powered by upbeat global tech sentiment. Nifty Bank rose 0.23%, showing steady participation from financials. Small caps stole the spotlight. The BSE SmallCap index jumped 1.61%, signaling strong retail interest.

The breakout in Nifty signals a potential trend reversal. If momentum holds, the index may push toward fresh highs. In this edition, we break down the rally drivers, from policy updates to technical setups. We also highlight a Small Cap Stock of the Day and key sectors to watch.

Nifty Break the Resistance, What’s Next?

Nifty 50 is showing fresh strength as the index broke its short-term resistance near 25,100. It closed at 25,244.75, firmly above its recent range. This move marks a critical technical shift and could set the tone for a bullish continuation — if confirmed by volume.

Current Structure

- Trend: Bullish bias intact, with higher lows since April 2025.

- Support now flips: The former resistance zone of 25,100–25,106 becomes the new immediate support.

- 9 EMA at 24,880.41: Price is trading well above this level, showing positive momentum.

- Volume: At 260.58M, volume is modest but trending upward — a sign of growing participation.

Chart Signals

- Range Breakout: Nifty had been stuck between 24,450 and 25,106. Today, we saw Nifty break the resistance, pushing above that ceiling for the first time in weeks.

- No major supply until 26,266: With minimal resistance in this range, a move toward 25,800 or even 26,000 appears plausible if momentum holds.

- Support Levels: First support lies at 25,100–25,000, with deeper safety nets at 24,450 and 23,800.

Scenarios Ahead

- Bullish Continuation (Most Likely):

If Nifty holds above 25,100 and volume builds, it could test 25,800–26,000 quickly. - False Breakout Risk (Low to Medium):

A drop below 25,100 may signal a fake breakout, pulling the index back to the 24,450 zone. - Neutral Phase:

Price might consolidate between 24,900 and 25,300 before making a bigger move.

Trade Setup

| View | Entry Area | Stop Loss | Target | Position Type |

|---|---|---|---|---|

| Long (Positional) | 25,100–25,250 | 24,880 | 25,800 / 26,200 | Favorable |

| Aggressive Long | Above 25,300 (hourly) | 25,100 | 26,000+ | Conditional |

| Pullback Buy | Near 24,880 | 24,450 | 25,250 / 25,800 | Good Risk-Reward |

Final Word

We saw Nifty break the resistance with a moderately bullish candle. While the breakout is promising, it still requires validation from stronger follow-up volume. For now, trend traders can lean long with a cautious eye on key support levels.

Macro & Policy Moves: Fuel Alliances, Dairy Revival, Coalfield Relief, and PLI Boost

As Nifty breaks the resistance and charts a bullish path, macro and sectoral developments are laying the groundwork for long-term growth across key industries. Here’s what moved the needle this week:

1. Adani Total & Jio-bp Fuel Alliance: A Game-Changer in Retail Energy

ATGL and Jio-bp announced a strategic partnership that will allow each to tap into the other’s strengths. Adani outlets will now offer Jio-bp’s petrol and diesel, while select Jio-bp fuel stations will integrate Adani’s CNG dispensers. The collaboration covers current and future outlets — potentially reshaping India’s fuel retail landscape.

Stock Impact:

- Adani Total Gas Ltd (ATGL): Positive sentiment as the move could expand its fuel retail footprint and CNG volumes.

- Reliance Industries (Jio-bp JV): Marginally positive, with synergies enhancing scale without large fresh capex.

This synergy, coming at a time when Nifty breaks the resistance and shows signs of broader economic confidence, reinforces investor interest in fuel infrastructure plays.

2. UP’s Dairy Push Gets NDDB Backing

UP government signed an MoU with NDDB to revive three dairy plants and set up a feed unit. With strong political support and NDDB’s involvement, the initiative targets higher rural incomes and milk output.

Stock Watch:

- Heritage Foods, Parag Milk Foods, Hatsun Agro: Could benefit from regional demand growth and dairy infra expansion.

- LT Foods, Avanti Feeds: Secondary tailwinds from feed facility rollout.

3. Rs 5,940 Cr Jharia Rehab Plan Approved

The Cabinet approved a revised master plan to tackle the Jharia coalfield fire and relocate affected families. This plan is crucial for land safety, coal logistics, and public health.

Impact Picks:

- Coal India Ltd: Long-term gain from secured assets and possible production revival.

- Engineers India Ltd, NBCC: Likely beneficiaries of planning, EPC, and rehab infrastructure contracts.

4. PLI Disbursals Cross ₹21,500 Cr

The Centre has disbursed ₹21,534 crore under PLI schemes across 12 sectors. Electronics and pharma led the way, reaffirming India’s manufacturing push.

Top Gainers:

- Dixon Tech, Amber Enterprises, Syngene, Laurus Labs: Stocks aligned with PLI are likely to sustain upward momentum as Nifty breaks the resistance and manufacturing tailwinds gather pace.

5. Heatwave Play: Glucon-D’s Summer Activation

Zydus Wellness launched ‘Energy Ka Gola’ across 100+ stadiums and parks to promote Glucon-D. The campaign capitalizes on rising energy drink demand during extreme heat.

Stock to Watch:

- Zydus Wellness: Strong brand-led rural connect and consumer reach.

6. Macro Outlook: No Major Correction Yet, Says Macquarie

Macquarie’s Sandeep Bhatia believes a short-term correction won’t derail India’s bull market. He expects a positive second half, driven by RBI rate cuts, budget tailwinds, and rising rural demand. The resilience of the index, especially as Nifty breaks the resistance, points to more stock-specific action ahead.

Vodafone Idea – Breakout Play with High Risk, High Reward

As Nifty breaks the resistance and the broader market gains strength, risk appetite is also picking up — especially in beaten-down names showing breakout signals. One such name flashing on technical screens is Vodafone Idea (IDEA).

Technical Snapshot

- Current Price: ₹7.13

- Volume: 1.07 billion (heavy spike, signaling trader participation)

- 9 EMA: ₹6.59 (price holding well above)

Chart Structure:

Vodafone Idea has broken out from a multi-month descending wedge pattern, a setup known for strong directional moves. The price had been compressing under a falling trendline for over six months, while holding a horizontal base near ₹6.35.

The recent breakout above ₹7.00 with heavy volume signals the start of a possible new swing phase.

Key Levels to Watch

- Support Zones:

- Immediate: ₹6.60–₹6.90 (9 EMA + breakout zone)

- Major: ₹6.35 (multi-touch demand zone)

- Resistance Targets:

- ₹7.80–₹8.00: Near-term supply zone (March highs)

- ₹9.00–₹10.50: Swing target based on prior gap area and breakdown level

Possible Scenarios

- Bullish Swing Continuation (Likely):

Sustained price action above ₹7.10 with volume could push IDEA toward ₹7.80, and even ₹9.00+ in coming weeks. - False Breakout Risk (Manageable):

If price slips below ₹6.60–₹6.50 with volume, traders should reassess and exit, as a retest of ₹6.35 may follow.

Trade Setup

| Type | Entry Range | Stop Loss | Targets | Risk-Reward | Confidence |

|---|---|---|---|---|---|

| Swing Long | ₹6.95–₹7.15 | ₹6.35 | ₹7.80 / ₹8.90 / ₹10.50 | 1:2 to 1:6 | Moderate–High |

| Aggressive Add | Above ₹7.30 | ₹6.80 | ₹8.00 / ₹9.00 | 1:1.5+ | Medium |

Analyst Take

The breakout is technically clean and backed by strong volume. However, volatility remains high and fundamentals (tariff hikes, fundraise clarity) must improve for follow-through. This is a textbook high-risk, high-reward play — ideal for swing traders with tight risk management.

As broader sentiment improves and Nifty breaks the resistance, names like Vodafone Idea could see short-term capital rotation. But traders must respect levels and avoid emotional trades in such volatile setups.

IPO Watch: Momentum in Primary Market Builds as Nifty Break the Resistance

As Nifty breaks the resistance, optimism in the secondary market is rubbing off on primary issuances too. While large caps remain steady, retail and institutional appetite for IPOs—especially in the SME segment—is accelerating. Here’s a quick roundup of the top ongoing and recently closed IPOs to keep on your radar:

Mainboard IPOs

| Company | Close Date | Total Subscribed | GMP (Est. Gain) |

|---|---|---|---|

| Globe Civil Projects | Jun 26 | 14.28x | ₹12 (16.9%) |

| HDB Financial Services | Jun 27 | 0.71x | ₹50 (6.76%) |

| Kalpataru Ltd | Jun 26 | 0.40x | ₹9 (2.17%) |

| Ellenbarrie Ind. Gases | Jun 26 | 0.31x | ₹24 (6.00%) |

| Sambhv Steel Tubes | Jun 27 | 0.34x | ₹10 (12.2%) |

SME IPOs

| Company | Close Date | Total Subscribed | GMP (Est. Gain) |

|---|---|---|---|

| Suntech Infra Solutions | Jun 27 | 4.35x | ₹23 (26.74%) |

| Supertech EV | Jun 27 | 1.06x | ₹15 (16.3%) |

| Abram Food | Jun 26 | 3.29x | ₹8 (8.16%) |

| Icon Facilitators | Jun 26 | 1.41x | ₹10 (10.99%) |

| Adcounty Media India | Jun 27 | — | ₹33 (38.82%) |

Insights:

Despite low QIB interest in a few large-cap names, the SME space is buzzing. Globe Civil Projects stole the show with over 14x subscription, and Adcounty Media is drawing strong listing interest with a hefty 38% premium expected. The trend suggests selective interest in quality names — a theme consistent with the broader market sentiment as Nifty breaks the resistance and confidence rebounds.

Small Cap Stock of the Day

Prime Securities Ltd | Current Price: ₹270 | Market Cap: ₹906 Cr

What Does the Company Do?

Prime Securities Ltd is a financial services company that has been around since 1982. It offers investment banking, corporate advisory, and insurance distribution services. It holds a Category 1 Merchant Banking license, allowing it to handle IPOs, rights issues, and structured deals. Its subsidiary is also a licensed corporate insurance agent.

Simply put, Prime helps companies raise capital and manage large financial transactions — a business that scales with market activity.

Why It’s in the Spotlight

As Nifty breaks the resistance, investor interest is shifting toward clean, scalable small caps. Prime Securities stands out due to a combination of profitability, growth, and financial discipline:

| Metric | Value |

|---|---|

| Revenue (FY25) | ₹89 Cr |

| Net Profit (FY25) | ₹38 Cr |

| EPS (FY25) | ₹11.39 |

| 3-Year Profit CAGR | 34% |

| Operating Margin (FY25) | 47.2% |

| Return on Equity (FY25) | 19.4% |

| Debt-to-Equity | 0.00 (Debt-Free) |

| Cash Reserves | ₹20.6 Cr |

| Stock Price CAGR (5Y) | 41% |

These numbers signal efficient capital use, high profit margins, and sustainable earnings growth — a rare mix in the small-cap universe.

How to Approach This Stock

Prime Securities is a high-quality, niche small cap — but it comes with the usual small-cap risks like liquidity, limited analyst coverage, and market dependency.

Ideal for:

- Long-term investors looking for exposure to financial services

- Those who can handle moderate volatility

Not ideal for:

- Traders seeking short-term momentum

- Investors uncomfortable with low institutional coverage

Strategy:

- Buy Zone: ₹240–₹270 (accumulate on dips)

- Stop-Loss (Positional): ₹195 (52-week low)

- Upside Potential: ₹330–₹370 over the next 6–12 months if earnings remain strong

Bottom Line:

As Nifty breaks the resistance, Prime Securities offers a way to ride financial market tailwinds through a high-ROE, debt-free small cap with growing profitability. Just remember — size brings opportunity, but also risk. Position sizing is key.

Conclusion: Cautious Optimism as Breakout Holds

With Nifty breaking the resistance decisively above 25,100, the broader market is showing renewed strength — supported by bullish price action, policy support, and improving investor sentiment. This breakout isn’t just technical — it’s being backed by rotation into small caps, healthy IPO participation, and rising risk appetite.

But this optimism needs to be balanced with selectivity.

From Vodafone Idea’s high-risk breakout to Prime Securities’ clean small-cap story, the current phase offers opportunities — but only to investors who are disciplined, well-researched, and realistic about volatility.

The short-term setup favors trend continuation, yet follow-through volume and global cues will remain critical. Whether you’re trading momentum or investing for the long haul, the next few sessions could define direction — stay nimble, not nervous.

Start your stock market journey with Angel One – India’s trusted platform for trading, investing, and IPOs.

Related Articles

India’s Obesity Crisis Fuels a Billion-Dollar Boom: Top Pharma Stocks to Watch

Rare Earth Magnet Manufacturing Stocks: Catch These Before India’s ₹1,000 Cr Push Lifts Off

Ready-to-Drink (RTD) Cocktails: The Fastest-Growing Segment in the Liquor Market