Introduction

Investing is an essential part of financial planning, and two of the most popular investment avenues in India are Mutual Funds and the Stock Market. While both provide opportunities to grow wealth, they differ in terms of risk, returns, management, and investor involvement.

In this blog, we will explore the differences between mutual funds and direct stock investing, analyze key factors such as risk, returns, costs, and suitability, and present statistical data to help investors make informed decisions.

What is a Mutual Fund?

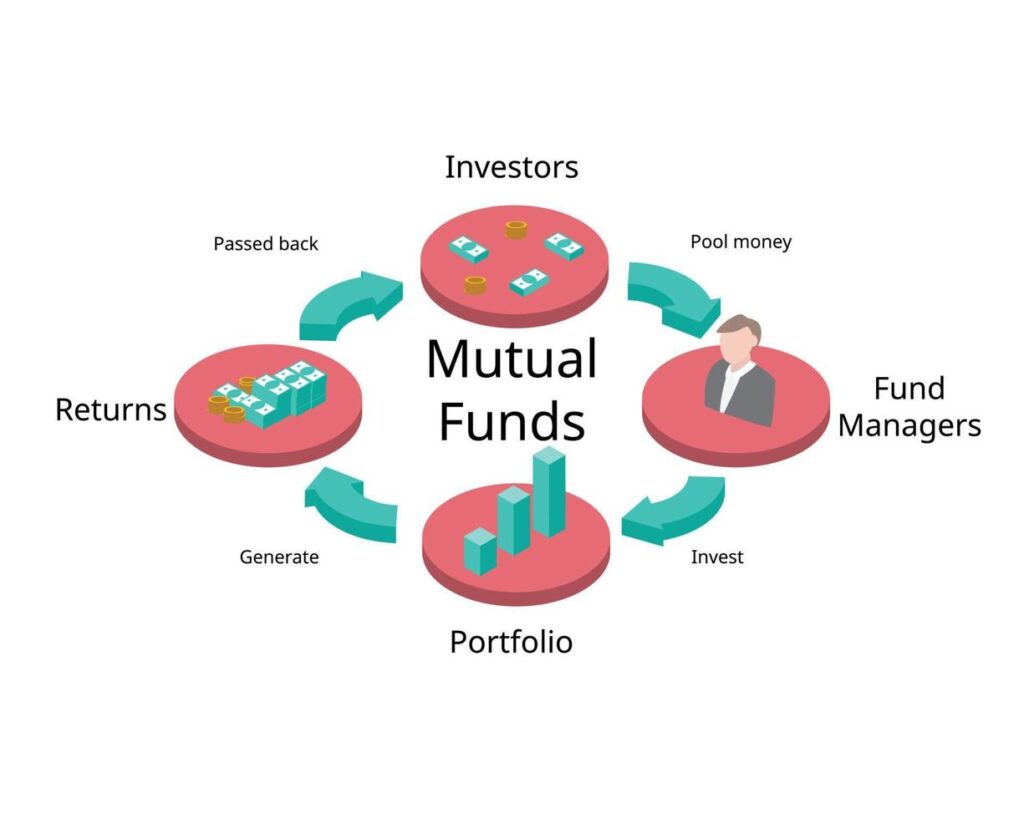

A mutual fund is a professionally managed investment vehicle that pools money from multiple investors and invests it in a diversified portfolio of stocks, bonds, or other assets. The fund is managed by a fund manager, who makes investment decisions on behalf of the investors.

Key Features of Mutual Funds:

- Diversification: Investment is spread across multiple stocks and sectors.

- Professional Management: Experienced fund managers make investment decisions.

- Systematic Investment Plan (SIP): Investors can start with small amounts.

- Liquidity: Investors can redeem units anytime (except ELSS funds which have a lock-in period).

- Regulated by SEBI: Ensures transparency and investor protection.

Types of Mutual Funds:

- Equity Mutual Funds – Invest primarily in stocks.

- Debt Mutual Funds – Invest in fixed-income securities.

- Hybrid Funds – Invest in a mix of equity and debt.

- Index Funds & ETFs – Track stock indices like Nifty 50 and Sensex.

- ELSS (Tax-Saving Funds) – Eligible for tax deductions under Section 80C.

What is the Stock Market?

The stock market is a platform where investors buy and sell shares of publicly traded companies. Unlike mutual funds, direct stock investing requires investors to research and manage their investments independently.

Key Features of Stock Market Investing:

- Ownership: Investors become partial owners of a company.

- Higher Returns Potential: Stocks can offer substantial gains if chosen wisely.

- Risk Exposure: Stocks are highly volatile and require active management.

- Liquidity: Stocks can be bought or sold anytime during market hours.

- Direct Control: Investors have complete control over their portfolio.

Popular Indian Stock Exchanges:

- National Stock Exchange (NSE)

- Bombay Stock Exchange (BSE)

Key Differences Between Mutual Funds and Stocks

Think of investing like food. The stock market is like cooking your own meal—you buy the ingredients, cook it, and hope it turns out right. But if you don’t know how to cook, things could go wrong, and you might waste your time and money.

On the other hand, mutual funds are like ordering food from a top restaurant. You don’t have to do anything—professional chefs (fund managers) handle everything. The risk of a bad meal (or loss) is lower, but you’ll pay a little extra for their expertise.

So, which one’s better? The stock market gives you full control, but you’ll need to know what you’re doing. With mutual funds, experts manage your money, but they charge a small fee for their service.

Mutual fund and Stock Market Comparison

Stock Market vs Mutual Funds: What’s the Difference?

In the stock market, you make all the decisions—what to invest in, how much, and for how long. With mutual funds, you let a skilled fund manager do the work for you.

| Feature | Mutual Funds | Stock Market |

|---|---|---|

| Management | Managed by professional fund managers | Self-managed by investors |

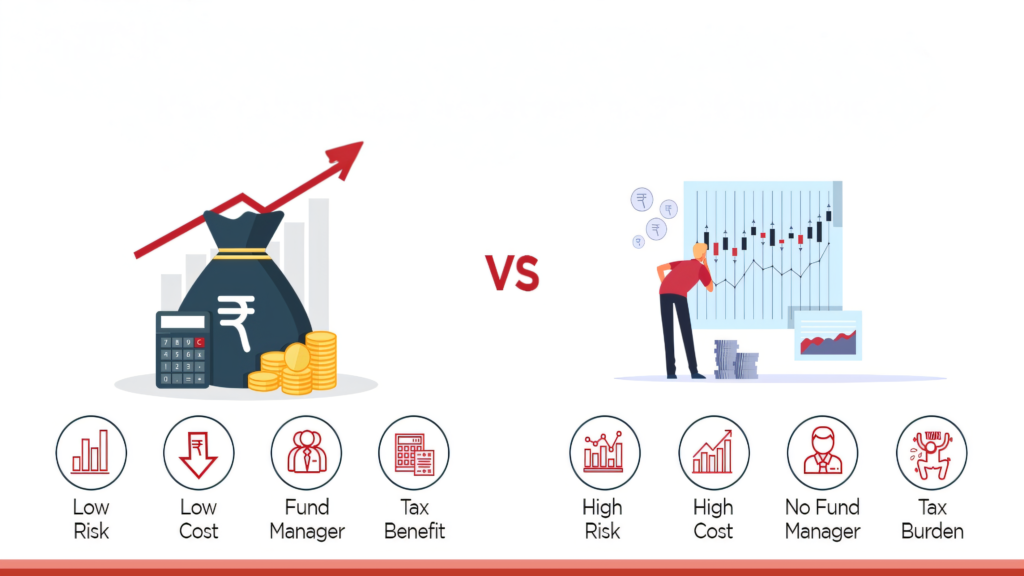

| Risk Level | Moderate to low (due to diversification) | High (depends on stock selection) |

| Returns | Comparatively stable returns | Can provide high returns but with volatility |

| Investment Cost | Expense ratio (1-2%) + Exit load in some cases | Brokerage fees, STT, and other transaction costs |

| Diversification | High (spreads risk across stocks/sectors) | Low (unless investor diversifies manually) |

| Investment Mode | Lumpsum or SIP | Direct purchase of shares |

| Tax Benefits | ELSS funds provide tax deductions | No direct tax benefits |

| Best Suited For | Passive investors, beginners | Active investors, experienced traders |

Statistical Insights: Mutual Funds vs Stock Market in India

- Retail Participation: According to SEBI, India had over 11 crore mutual fund investors in 2023, while 7 crore Demat accounts were registered for direct stock trading.

- Returns Comparison:

- Nifty 50 (10-year CAGR): ~13-17%

- Top Equity Mutual Funds (10-year CAGR): ~12-15%

- Risk Factor:

- Equity Mutual Funds had an average drawdown of 20-30% in market crashes, whereas individual stocks saw declines of 50-60% in extreme cases.

- SIP Growth: SIP investments in India crossed ₹15,000 crore/month in 2023, showing growing investor preference for mutual funds.

(Sources: AMFI, SEBI, NSE Reports)

Which One Should You Choose?

Choose Mutual Funds If:

✅ You are a beginner with limited market knowledge.

✅ You prefer professional management and passive investing.

✅ You want diversified exposure with lower risk.

✅ You want to invest in a disciplined manner through SIP.

Choose Direct Stock Investing If:

✅ You have experience and time to research stocks.

✅ You want full control over your investment decisions.

✅ You can tolerate high market volatility.

✅ You aim for higher potential returns through stock picking.

Investing in Stocks vs Mutual Funds: A Simple Example

Let’s say you want to invest ₹3000 every month in the stock market and buy shares of top companies like Reliance, TCS, Tata Motors, MRF, and Asian Paints. If you check their stock prices, you’ll see that buying even one share of each company will cost you around ₹1,40,000—something many can’t afford to invest all at once.

But with mutual funds, this becomes possible! Here’s how: With ₹3000, many investors like you contribute small amounts—₹500, ₹1000, ₹2000—into a mutual fund, and the fund manager uses this money to buy shares from multiple companies, including these top ones. As a result, you get a fraction of all these shares.

For example, let’s take the UTI Nifty 50 Index Fund. Its current price is ₹147, and it includes shares from 50 companies. So, with just ₹147, you can own a small part of all 50 companies, offering you huge diversification and lowering your risk of loss.

Conclusion

Both mutual funds and stocks have their pros and cons, and the choice depends on an individual’s risk appetite, knowledge, and investment goals. While mutual funds are ideal for those seeking diversified, professionally managed investments, direct stock investing suits those willing to actively manage and take higher risks for higher returns.

A hybrid approach—investing in both stocks and mutual funds—can help balance risk and maximize returns. Always assess your financial goals, risk tolerance, and investment horizon before making a decision.

FAQs

Which gives higher returns: mutual funds or stocks?

Stock investments can provide higher returns but come with greater risk. Mutual funds offer stable, diversified growth with moderate risk.

Are mutual funds safer than stocks?

Yes, mutual funds are generally less risky due to diversification and professional management, whereas individual stocks can be highly volatile.

Can I invest in both mutual funds and stocks?

Yes, a balanced approach of investing in both can help diversify your portfolio and reduce overall risk.

How much should I invest in mutual funds vs stocks?

It depends on your risk profile. A common strategy is to follow the 100 minus age rule (e.g., if you’re 30, allocate 70% in stocks and 30% in mutual funds).

Is SIP better than direct stock investing?

SIP in mutual funds helps with disciplined investing and rupee cost averaging, making it ideal for beginners. Stock investing requires active monitoring and research.

Disclaimer

Investing in financial markets involves risks. Investors should conduct their research and consult a financial advisor before making investment decisions. This article is for educational purposes only and does not constitute financial advice.