Introduction: Why MSME Loans Matter?

Do you own a small business or plan to start a new venture? If yes, then securing funds is one of the biggest challenges you might face. Every year, thousands of small businesses shut down due to a lack of funding. However, there is good news!

In the Budget 2025, Finance Minister Nirmala Sitharaman announced a major update— the credit guarantee cover for MSMEs has been increased from ₹5 crore to ₹10 crore. This means an additional ₹1.5 lakh crore in loans will be available for MSMEs over the next five years.

If you are a small business owner or an aspiring entrepreneur, this is the perfect time to explore MSME loan options. Let’s dive into the details of how you can secure funding for your business.

What is MSME?

MSME stands for Micro, Small, and Medium Enterprises. Businesses are categorized under MSMEs based on investment in machinery and annual turnover:

| Enterprise Type | Investment Limit | Annual Turnover |

|---|---|---|

| Micro Enterprise | Up to ₹2.5 crore | Up to ₹10 crore |

| Small Enterprise | Up to ₹25 crore | Up to ₹100 crore |

| Medium Enterprise | Up to ₹125 crore | Up to ₹500 crore |

To qualify for an MSME loan, you must first register your business as an MSME on the government portal udyamregistration.gov.in. The registration process is free and fully online, requiring only an Aadhaar Card & PAN Card.

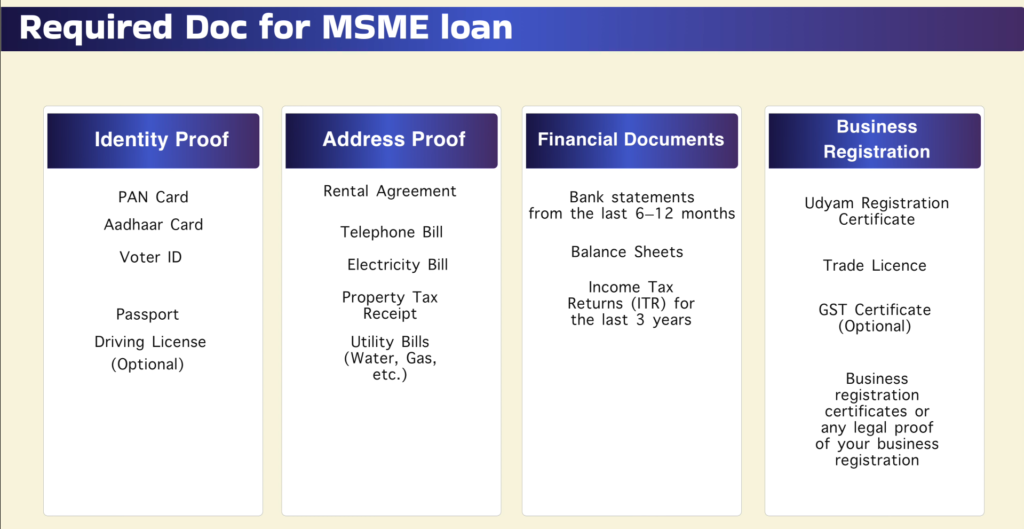

Documents Required for MSME Loan

To apply for an MSME loan, you need to submit the following documents:

1. Identity Proof

- PAN Card

- Aadhaar Card

- Voter ID

- Passport

- Driving License

2. Address Proof

- Electricity Bill

- Telephone Bill

- Property Tax Receipt

- Rental Agreement (if applicable)

3. Financial Documents

- Last 6-9 months’ bank statements

- Balance sheets & Profit and Loss statements

- Last 3 years’ Income Tax Returns (ITR)

4. Business Registration Documents

- Udyam Registration Certificate

- GST Registration Certificate (if applicable)

- Business Incorporation Certificate (for companies)

5. Additional Documents

- If you own a sole proprietorship, additional firm registration documents may be required.

- A business plan or project report may be needed for high-value loans.

Now that you know the basic requirements, let’s explore the top MSME loan schemes available in India.

Best MSME Loan Schemes in India

1. Pradhan Mantri Mudra Yojana (PMMY)

Launched in 2015, this scheme provides loans up to ₹10 lakh for micro and small businesses. The loans are available under three categories:

- Shishu Loan: Up to ₹50,000 for new businesses.

- Kishore Loan: Between ₹50,000 – ₹5 lakh for growing businesses.

- Tarun Loan: Between ₹5 lakh – ₹10 lakh for expanding enterprises.

- Interest Rate: 1% to 12% (varies by lender and loan type)

- Where to Apply?: Through udyamimitra.in or public/private sector banks.

2. Prime Minister’s Employment Generation Programme (PMEGP)

A government initiative for new businesses, providing loans up to ₹25 lakh (manufacturing) and ₹10 lakh (service sector) with subsidies between 15% to 35%.

- Where to Apply?: Online at kviconline.gov.in or through banks.

3. Credit Guarantee Trust Fund for Micro & Small Enterprises (CGTMSE)

A collateral-free loan scheme where the government guarantees 85%-90% of the loan amount for MSMEs.

- Loan Amount: ₹1 crore – ₹5 crore

- Where to Apply?: Through NBFCs and banks.

4. MSME Business Loan in 59 Minutes

A quick approval scheme where MSMEs can get loan approvals in under an hour with disbursement in 7-8 days.

- Loan Amount: Up to ₹5 crore

- Interest Rate: Starting from 8.5%

- Where to Apply?: psbloansin59minutes.com

How to Apply for an MSME Loan?

- Choose the Right Loan Scheme – Based on your business needs and eligibility.

- Prepare Documents – Gather identity, financial, and business registration documents.

- Apply Online or Offline – Use portals like udyamimitra.in, psbloansin59minutes.com, or visit a bank branch.

- Submit Application & Business Plan – Higher loan amounts may require a project report.

- Approval & Loan Disbursement – Once approved, the loan is transferred to your account.

Conclusion: Secure Funding for Your Business Growth

With new government policies and increased funding, MSME loans have become more accessible than ever. Whether you’re a startup or an established small business, these loan options can help you expand, manage working capital, or invest in new opportunities.

If you’re interested in any of these MSME loan schemes, start your application today and take advantage of low-interest rates and easy approvals!

FAQs

1. Can I apply for multiple MSME loans?

Yes, but eligibility depends on your credit profile and business needs.

2. What is the minimum credit score required for an MSME loan?

A credit score of 750 or above improves approval chances.

3. Can a new business apply for an MSME loan?

Yes, schemes like Mudra Loan and PMEGP support new businesses.

4. Is collateral required for MSME loans?

Some loans like CGTMSE and Mudra Loan offer collateral-free funding.

5. How long does it take to get an MSME loan?

Loan approval typically takes 7-15 days, while PSB Loans in 59 Minutes offer instant approvals.