Introduction

The Midwest IPO has officially opened for subscription today, October 15, 2025, drawing strong interest from investors across categories. Midwest Limited, a leading name in the granite mining and natural stone export industry, is bringing its ₹451 crore public issue to the Indian markets.

The company is India’s largest producer and exporter of Black Galaxy Granite, a premium natural stone with global demand, particularly in China, Italy, and Thailand. With over four decades of operational expertise, a diversified mining portfolio, and a focus on sustainable extraction, Midwest Limited is well-positioned to attract long-term investors.

Given its scale, legacy, and global presence, the Midwest IPO is one of the most notable offerings in October 2025, marking a significant event for investors tracking India’s industrial and export-oriented sectors.

IPO Overview

Midwest IPO Details

| Particulars | Details |

|---|---|

| IPO Opening Date | October 15, 2025 |

| IPO Closing Date | October 17, 2025 |

| Listing Date (Tentative) | October 24, 2025 |

| Face Value | ₹5 per share |

| Price Band | ₹1,014 – ₹1,065 per share |

| Lot Size | 14 shares |

| Minimum Investment (Retail) | ₹14,910 |

| Issue Size | ₹451.00 crore |

| Fresh Issue | ₹250.00 crore |

| Offer for Sale (OFS) | ₹201.00 crore |

| Total Shares | 42,34,740 shares |

| Employee Discount | ₹101 per share |

| Issue Type | Book Building |

| Listing At | BSE, NSE |

| Book Running Lead Manager | DAM Capital Advisors Ltd. |

| Registrar | KFin Technologies Ltd. |

| Pre-Issue Shareholding | 3,38,12,415 shares |

| Post-Issue Shareholding | 3,61,59,832 shares |

| IPO Documents | DRHP/RHP |

Midwest IPO Timeline (Tentative Schedule)

| Event | Date |

|---|---|

| IPO Open Date | October 15, 2025 |

| IPO Close Date | October 17, 2025 |

| Basis of Allotment | October 20, 2025 |

| Refunds Initiation | October 23, 2025 |

| Shares Credit to Demat | October 23, 2025 |

| Listing Date | October 24, 2025 |

| UPI Mandate Confirmation Cut-off | October 17, 2025 (5 PM) |

Use of IPO proceeds — Midwest IPO

The Midwest IPO will raise up to ₹451.00 crore (combination of fresh issue and OFS). The Company proposes to utilise the Net Proceeds from the Issue towards the following objects (amounts as disclosed):

- Funding capital expenditure by Midwest Neostone (wholly owned subsidiary) towards the Phase II Quartz Processing Plant: ₹1,270.49 million.

- Capital expenditure for purchase of Electric Dump Trucks to be used by the Company and APGM (material subsidiary): ₹257.55 million.

- Capital expenditure for integration of solar energy at certain Mines of the Company: ₹32.56 million.

- Pre-payment/re-payment of, in part or full, certain outstanding borrowings of the Company and APGM: ₹538 million.

- General corporate purposes.

Note: the amounts above are taken exactly from the RHP/objectives you supplied; they form the core growth and de-leveraging narrative of the Midwest IPO — funding Phase II quartz capacity, electrifying mining heavy vehicles, and adding solar to reduce carbon intensity.

Why the Midwest IPO matters to investors

- Defensible niche leadership: Dominance in Black Galaxy export market (~64% share) and high production scale (16 mines) give Midwest structural advantages in a largely fragmented industry.

- Near-term growth levers funded by IPO: Phase II quartz processing (₹1,270.49m) and electric vehicle & solar investments (₹257.55m + ₹32.56m) move the company up the value chain and improve sustainability metrics — key for premium realisation and margin expansion post-listing.

- Improved balance sheet posture: The ₹538m earmarked for borrowings repayment supports deleveraging, lowering interest costs and improving financial flexibility — an important de-risk for IPO investors.

- Diversification & vertical integration: In addition to natural stone exports, diamond wire manufacturing and the new quartz processing plant provide diversification into higher-margin and domestic industrial markets.

Company Overview– Midwest Ltd.

Midwest Limited, incorporated in 1981, is one of India’s most prominent companies in the dimensional natural stone industry, specializing in the exploration, mining, processing, marketing, and export of granite.

The Midwest IPO offers investors exposure to a dominant player in the dimensional natural stone value chain — from exploration and mechanized mining to processing, fabrication, and global distribution — plus backward-integrated inputs (diamond wire manufacturing) and a new growth vertical in quartz processing.

Business model & operations

Core activities: Exploration, mining, processing, marketing, distribution and export of natural stones (dimensional granite) — principally Black Galaxy, Absolute Black, Tan Brown, and other natural stones.

Scale of operations: 16 operational granite mines across 6 locations in Telangana and Andhra Pradesh; two mechanized processing facilities (one each in Telangana and Andhra Pradesh). In addition, Midwest has identified a resource base of 25 locations across Andhra Pradesh, Telangana, Karnataka and Tamil Nadu for future mining — underpinning long-term raw material security.

Unique resource: Black Galaxy granite is rare (available in only one village in Andhra Pradesh globally), and Midwest reported 44,992 cubic meters of Black Galaxy Granite exports in Fiscal 2025, supporting its leadership position. According to CRISIL (RHP), Midwest held ~64% of the Indian export market for Black Galaxy Granite in Fiscal 2025.

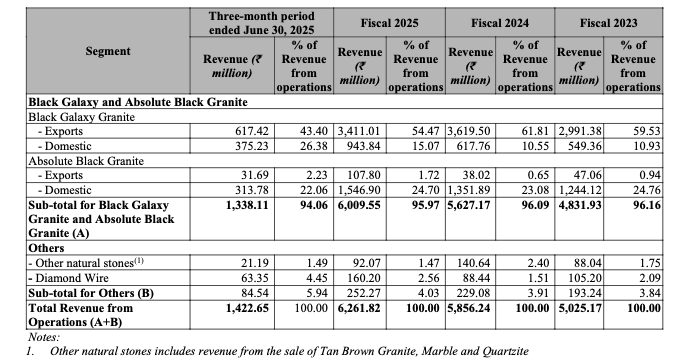

Revenue mix & scale: For the three months ended June 30, 2025, total revenue from operations was ₹1,422.65 million, and for Fiscal 2025 total revenue from operations was ₹6,261.82 million (with Black Galaxy & Absolute Black Granite accounting for ~95% of revenue in those periods). The Natural Stone segment (Black Galaxy + Absolute Black) contributed the vast majority of revenues; other segments (other natural stones and Diamond Wire) are small but strategic complements.

Diamond Wire segment (backward integration): Midwest manufactures diamond wire at a captive facility in Hyderabad to improve cutting efficiency and reduce input costs. Diamond Wire revenue contributed meaningfully in recent years and serves both captive consumption and external market demand.

Quartz processing (growth vertical): In Q3 FY2026 (quarter ended Sept 30, 2025) Midwest commenced operations of Phase I of its Quartz Processing Plant at the APIIC Growth Center (Annangi Village, Prakasam District, Andhra Pradesh) — a strategic move into value-added engineered stone and a growth lever for the Midwest IPO story.

Distribution, customers & global reach

Exports & markets: Midwest exports to 17 countries across five continents; principal markets include China, Italy, Thailand, Sweden and others. Key customers include MP STENEKO AB (Sweden), GI-MA STONE SRL (Italy), Quanzhou Xingguang Stone Co., Ltd. (China), The Xiamen Group (China), King Marble and Granite Co. Ltd (Thailand).

Marquee projects & long-term contracts: Midwest supplies to large construction and infrastructure projects abroad (examples: CSSC Power Tower, Shanghai; Shenyang MaoYe Center), and maintains long-standing contracts with top buyers — the top 5 and top 10 customers contributed 36.34% and 51.21% of FY2025 revenue respectively, underscoring concentrated but durable relationships (average relationship tenure ranges 1–10 years). Many contracts require interest-free deposits, assisting working-capital efficiency.

Workforce & organization

- Employees (as of June 30, 2025): 1,326 total personnel: 475 permanent employees, 822 contract workers, and 29 consultants — demonstrating a large operational workforce to run mines, processing units and exports.

Competitive edge & sustainability

- Market leadership: India’s largest producer/exporter of Black Galaxy and a leading producer of Absolute Black (Absolute Black accounted for 15.7% of India’s black granite production in FY2025). This leadership translates into pricing power in niche premium stone segments.

- Vertical integration: Own mines + close processing facilities + captive diamond wire manufacturing provide cost, quality and lead-time advantages versus unorganised peers.

- Capex & decarbonization focus: Midwest emphasizes mechanized mining, process optimization and decarbonization (solar integration plans mentioned in IPO uses), positioning the firm for sustainable scale-up as part of the Midwest IPO rationale.

Financial Performance — Midwest IPO

The Midwest IPO showcases a steadily growing financial trajectory, backed by rising revenues, improving profitability, and prudent capital management. Between FY2024 and FY2025, revenue rose by 7%, while profit after tax (PAT) jumped 33%, reflecting stronger margins and operational efficiency. Over FY2023–FY2025, the company’s profits have compounded at a 59% CAGR, highlighting consistent earnings growth from both core granite exports and the diamond wire segment.

Key Financial Summary (₹ crore)

| Particulars | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|---|

| Total Assets | 1,082.81 | 1,058.70 | 757.12 | 656.00 |

| Total Income | 146.47 | 643.14 | 603.33 | 522.23 |

| EBITDA | 38.97 | 171.78 | 151.44 | 89.59 |

| Profit After Tax (PAT) | 24.38 | 133.30 | 100.32 | 54.44 |

| Net Worth | 577.03 | 553.69 | 421.93 | 334.92 |

| Reserves & Surplus | 625.60 | 602.26 | 484.86 | 408.88 |

| Total Borrowings | 270.11 | 236.61 | 120.48 | 149.08 |

All figures are in ₹ crore unless stated otherwise.

Profitability Trends

| Indicator | Q1 FY2026 | FY2025 | FY2024 | FY2023 |

|---|---|---|---|---|

| EBITDA (₹ million) | 389.70 | 1,717.80 | 1,514.43 | 895.87 |

| EBITDA Margin (%) | 27.39 | 27.43 | 25.86 | 17.83 |

| PAT (₹ million) | 243.80 | 1,075.11# | 1,003.24 | 544.36 |

| Net Profit Margin (%) | 17.14 | 17.17 | 17.13 | 10.83 |

#PAT after excluding exceptional item of ₹257.88 million

The EBITDA margin improved sharply from 17.83% in FY2023 to 27.43% in FY2025, while the Net Profit Margin expanded from 10.83% to 17.17%, underscoring better realizations, higher value-added mix, and operational leverage.

Key Ratios — Midwest IPO Financial Indicators

| Indicator | Q1 FY2026 | FY2025 | FY2024 | FY2023 |

|---|---|---|---|---|

| Return on Capital Employed (RoCE) | 3.91%* | 18.84% | 25.00% | 14.39% |

| Return on Equity (RoE) | 4.23%* | 19.42% | 23.78% | 16.25% |

| Debt-to-Equity Ratio | 0.47 | 0.43 | 0.29 | 0.45 |

| Interest Coverage Ratio (times) | 8.74 | 13.37 | 14.11 | 7.51 |

| Current Ratio | 1.54 | 1.60 | 1.68 | 1.32 |

| Working Capital Cycle (days) | 142* | 120 | 89 | 106 |

(*Annualized for Q1 FY2026)

Midwest maintains a healthy capital structure, with debt-to-equity at 0.43 in FY2025 and an interest coverage ratio of 13.37x, reflecting robust debt-servicing ability. Improved current ratio and cash generation further indicate strong liquidity positioning ahead of the Midwest IPO.

Research & Development (R&D) Spend

| Period | Amount (₹ million) | % of Revenue |

|---|---|---|

| Q1 FY2026 | 11.55 | 0.81% |

| FY2025 | 40.03 | 0.64% |

| FY2024 | 114.61 | 1.96% |

| FY2023 | 57.84 | 1.15% |

R&D spending primarily supports quartz technology, automated cutting, and diamond wire efficiency improvements. Though modest (under 1% of revenue in FY2025), this investment underpins product quality, sustainability, and production efficiency.

Financial Health Snapshot — Midwest IPO

- Net worth increased from ₹334.92 crore in FY2023 to ₹553.69 crore in FY2025 — a 65% rise in just two years.

- Borrowings rose to ₹236.61 crore as of March 2025, mainly funding capacity expansions, yet leverage remains moderate.

- Operating cash flow turned strongly positive, moving from –₹519 million in FY2023 to ₹873 million in FY2025, showing a shift toward self-sustained operations.

- Market Capitalization (Midwest IPO): ₹3,851.02 crore — implying an EV/EBITDA multiple of around 22x FY2025 EBITDA, comparable to listed mining peers.

Financial Takeaway

The Midwest IPO represents a company with consistent top-line growth, expanding margins, and improving capital efficiency. Its export-driven model, vertical integration, and the upcoming quartz plant expansion all align toward stronger earnings visibility post-listing. The company’s high RoE and RoCE, robust liquidity, and controlled leverage together create a compelling financial foundation for investors seeking exposure to India’s premium natural stone and engineered quartz export sector.

Valuation & Peer Comparison — Midwest IPO

The Midwest IPO valuation reflects a premium pricing driven by the company’s steady growth, strong profitability, and leadership position in the premium granite export segment. Based on the upper price band and post-issue equity capital, the Midwest IPO is valued at a P/E ratio of 39.49x on a post-issue basis and 27.01x pre-issue, implying moderate-to-high valuations compared to industry peers, justified by its high margins and return ratios.

Midwest IPO Valuation

| Parameter | Value |

|---|---|

| Price to Book Value (P/BV) | 6.50 |

| Market Capitalization | ₹3,851.02 crore |

| Earnings Per Share (EPS) – Pre IPO | ₹39.42 |

| Earnings Per Share (EPS) – Post IPO | ₹26.97 |

| Price to Earnings (P/E) – Pre IPO | 27.01x |

| Price to Earnings (P/E) – Post IPO | 39.49x |

The Midwest IPO valuation multiples suggest a premium on book value and earnings, reflecting strong investor confidence and consistent earnings growth in recent years.

Midwest IPO Peer Comparison

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

|---|---|---|---|---|---|---|

| Midwest Limited | 39.42 | 39.42 | 163.75 | 39.49 | 22.11 | 6.50 |

| Pokarna Ltd. | 60.49 | 60.49 | 250.93 | 12.73 | 24.11 | 3.08 |

Source: Company RHP, Industry Filings.

Analysis — Midwest IPO vs. Peers

In comparison with Pokarna Ltd., a prominent listed peer in the granite and engineered stone industry, Midwest Limited commands a higher P/E multiple (39.49x vs. 12.73x) and a steeper P/BV ratio (6.50x vs. 3.08x).

While Pokarna leads slightly on Return on Net Worth (RoNW) at 24.11%, Midwest’s RoNW of 22.11% remains robust and well above sector averages.

This valuation gap underscores investor expectations for Midwest IPO to sustain its superior growth trajectory, supported by:

- Higher exports of Black Galaxy and Absolute Black granite,

- Consistent EBITDA margin expansion,

- Entry into the high-value engineered quartz market, and

- Strong cash flow visibility.

At a post-issue P/E of 39.49x, Midwest IPO appears fully priced but not overstretched, given the company’s rising profitability, strong RoCE (18.84% in FY2025), and a solid international order book pipeline.

Verdict on Valuation

From a valuation standpoint, the Midwest IPO positions itself as a premium play in the natural stone and engineered quartz industry, trading at higher multiples than peers but justified by its scale, integrated operations, and export market strength. Investors with a medium- to long-term horizon could find this IPO appealing if they believe in continued infrastructure growth and rising global demand for decorative and engineered stones from India.

Strengths & Risks — Midwest IPO

The Midwest IPO brings forward a company with a rich legacy in India’s natural stone industry, backed by integrated mining, processing, and export operations. However, like any resource-based business, it also faces operational and market-linked risks that investors should evaluate carefully before applying.

| Strengths | Risks |

|---|---|

| 1. Market Leadership in Premium Granite: Midwest Limited is India’s largest producer and exporter of Black Galaxy Granite, commanding ~64% of the Indian export market (FY2025, CRISIL Report). | 1. Sector Cyclicality: Demand for natural stones is tied to global real estate and infrastructure cycles. Economic slowdowns can impact export orders. |

| 2. Diversified Product Portfolio: The company produces Black Galaxy, Absolute Black, and Tan Brown Granites, and has expanded into the Quartz and Diamond Wire segments. | 2. High Geographical Concentration: A large portion of operations is concentrated in Andhra Pradesh and Telangana, exposing it to regional risks. |

| 3. Strong Global Presence: Exports to over 17 countries across five continents with key clients in China, Italy, Sweden, and Thailand, ensuring revenue diversification. | 3. Export Dependence: Around 60%+ of revenue is from exports, making it sensitive to currency fluctuations and global trade policies. |

| 4. Vertically Integrated Operations: End-to-end control from mining to processing and marketing improves efficiency, cost control, and quality assurance. | 4. Raw Material & Logistics Costs: Rising fuel, energy, and transport costs can squeeze margins in the mining and export business. |

| 5. Focus on Sustainability: Active investments in solar integration and use of electric dump trucks to reduce carbon footprint highlight ESG focus. | 5. Commodity Price Volatility: Granite and quartz prices depend on global demand-supply trends and competitor pricing. |

| 6. Healthy Financial Performance: Revenue grew by 7% and PAT surged 33% in FY2025, supported by improving EBITDA margins (27.4%). | 6. Debt and Working Capital Needs: While leverage is moderate (Debt/Equity 0.43x), ongoing expansion and equipment upgrades could raise short-term borrowings. |

| 7. Expansion into Engineered Quartz: Entry into quartz processing adds a new high-margin segment, diversifying away from traditional granite dependence. | 7. Regulatory and Environmental Approvals: Mining and processing operations require multiple licenses and clearances; any delay can disrupt operations. |

Summary — Midwest IPO Risk-Reward View

Overall, Midwest Limited stands out for its dominant position in the Black Galaxy Granite export market, strong integration, and forward-looking sustainability initiatives.

The Midwest IPO offers exposure to a niche yet globally relevant sector with consistent profitability and room for long-term growth. However, investors should remain aware of sector cyclicality and capital intensity before making investment decisions.

Grey Market Premium (GMP) & Listing Sentiment — Midwest IPO

The Midwest IPO GMP continues to reflect robust investor enthusiasm, hinting at a strong debut potential for this premium natural stone exporter. Despite volatile secondary market conditions, the grey market trend indicates steady confidence from both HNIs and retail participants.

Latest Midwest IPO GMP Data

| GMP Date | IPO Price | GMP | Sub2 Sauda Rate | Estimated Listing Price | Estimated Profit* | Last Updated |

|---|---|---|---|---|---|---|

| 15-10-2025 (Open) | ₹1065.00 | ₹145 (No Change) | ₹1500 / ₹21000 | ₹1210 (+13.62%) | ₹2030 | 15 Oct 2025 |

Note: GMP = Grey Market Premium; Sub2 Sauda indicates per-application premium for one lot. GMP values are unofficial and fluctuate daily.

GMP Analysis

The Midwest IPO GMP opened at around ₹140–₹145 and has held steady for the past three sessions, suggesting sustained demand from grey market traders.

A 13–14% premium over the issue price signals moderate listing optimism — neither euphoric nor weak — typical for strong industrial IPOs with proven fundamentals.

The Sub2 Sauda rate of ₹1500 per lot shows active trading interest, implying that retail investors are expecting a potential listing near ₹1200–₹1220 levels.

This stability in Midwest IPO GMP also mirrors the company’s solid balance sheet and impressive FY2025 earnings, reinforcing confidence in its post-listing prospects.

Listing Day Expectations

Considering the strong fundamentals, balanced pricing, and consistent grey market buzz, analysts estimate the Midwest IPO listing price could hover around ₹1200–₹1220, translating into ~13–14% listing gains.

However, broader market sentiment on the listing day — especially Nifty and midcap performance — could influence final outcomes.

⚠️ Disclaimer: GMP is an informal indicator and not a reliable measure of official listing price. Investors should base decisions on fundamentals and risk appetite.

Conclusion — Final Verdict on the Midwest IPO

The Midwest IPO stands out as a fundamentally solid offering backed by consistent growth, improving profitability, and leadership in the natural granite and stone exports segment. Its 7% revenue growth and 33% jump in PAT in FY2025 underline a business model that is scaling efficiently even amid cyclical industry challenges.

Valuation-wise, the post-issue P/E of 39.49x might appear on the higher side compared to peers like Pokarna Ltd., but it also reflects Midwest’s premium market positioning and superior RoNW of 22.11%. The company’s strong RoCE and improving cash flows further enhance its investment appeal for long-term investors seeking exposure to India’s building materials and export-driven industrial theme.

The Midwest IPO GMP trend—holding firm at around ₹145—signals stable listing expectations, with estimated gains of about 13–14%. This steady premium reflects both strong subscription traction and investor faith in the company’s fundamentals rather than speculative frenzy.

Overall, the Midwest IPO combines robust financials, credible management, and sustainable demand visibility. Investors with a medium-to-long-term horizon may find it an attractive bet, especially given the company’s proven track record, expanding product mix, and global export potential.

Verdict: Fundamentally sound and fairly priced; suitable for long-term investors. Short-term listing gains look promising as per Midwest IPO GMP trends.

Frequently Asked Questions (FAQs) — Midwest IPO

1. What is the Midwest IPO?

Midwest Ltd. is a leading granite and natural stone exporter from India, specializing in Black Galaxy and Absolute Black Granite, along with a growing presence in quartz manufacturing. The Midwest IPO is a mainboard issue aimed at funding capacity expansion, debt repayment, and working capital needs.

2. What are the Midwest IPO dates?

The Midwest IPO opens on October 15, 2025, and closes on October 17, 2025. The basis of allotment is likely to be finalized on October 20, 2025, and the listing date is expected to be October 22, 2025 on NSE and BSE.

3. What is the Midwest IPO price band and lot size?

The price band for the Midwest IPO is set between ₹1,014 and ₹1,065 per share.

The lot size is 14 shares, meaning retail investors can apply for a minimum of ₹14,910 at the upper price band.

4. How much is the Midwest IPO issue size?

The total issue size of the Midwest IPO is ₹451 crore, comprising:

- Fresh Issue: ₹250 crore

- Offer for Sale (OFS): ₹201 crore

5. What is the Midwest IPO GMP today?

As per the latest update (October 15, 2025), the Midwest IPO GMP stands at ₹145 with no change in movement. Based on this premium, the estimated listing price is ₹1,210, indicating a potential listing gain of 13.62%.

6. What is the Midwest IPO market capitalization?

The Midwest IPO values the company at a market capitalization of ₹3,851.02 crore at the upper price band.

7. What is the Midwest IPO valuation compared to peers?

At the post-IPO EPS of ₹26.97, the P/E ratio works out to 39.49x, which is higher than Pokarna Ltd. (P/E 12.73x) — reflecting strong growth expectations but also a premium valuation.

8. What are the objectives of the Midwest IPO?

The company intends to use the proceeds from the fresh issue for:

- Funding capacity expansion for quartz manufacturing 💎

- Partial repayment or prepayment of existing borrowings 🏦

- Supporting long-term working capital needs 💼

- General corporate purposes

9. When will the Midwest IPO allotment status be available?

The Midwest IPO allotment status can be checked on the registrar’s website around October 20, 2025, once the allotment is finalized.

10. Should you apply for the Midwest IPO?

The Midwest IPO review suggests a strong financial profile — with a 33% rise in PAT, steady margins, and solid RoCE. However, valuation looks slightly premium compared to peers. Investors seeking moderate listing gains or long-term export exposure may consider applying.

Related Articles

Canara Robeco AMC IPO: Hot Investment Opportunity in 2025

Rubicon Research IPO 2025: GMP, Risk, and Should You Apply?

More Articles

One Demat, Multiple Benefits: Power of a Single Demat Account

One Demat vs Multiple Demat – Which is Better for IPO Allotment?