Introduction: Why Financial Planning Matters Now More Than Ever

“Someone’s sitting in the shade today because someone planted a tree a long time ago.”

— Warren Buffett.

Financial planning isn’t just about saving money—it’s about aligning your finances with your goals and securing your future. In 2025, with global uncertainties and inflation on the rise, having a clear financial plan has become essential for individuals at every income level. Whether you are just starting your financial journey or looking to refine your approach, this guide simplifies the process and helps you take control of your financial well-being.

Step 1: Assess Your Current Financial Situation

Understanding where you stand financially is the first step to building a robust financial plan. Begin by analyzing your income and expenses.

| Monthly Income | Fixed Expenses | Variable Expenses | Savings |

|---|---|---|---|

| ₹80,000 | ₹40,000 | ₹20,000 | ₹20,000 |

Tracking your expenses not only reveals where your money is going but also identifies areas where you can cut back and save more. Use budgeting apps like Walnut or a simple spreadsheet to categorize your spending. Once you have this clarity, calculate your net worth by subtracting liabilities like loans and credit card debt from assets like savings and property.

Step 2: Set SMART Financial Goals

A plan without a goal is just a wish. Define what you want to achieve financially in the short term and long term. Goals should be SMART—Specific, Measurable, Achievable, Relevant, and Time-bound.

- Example SMART Goal: Save ₹2 lakh for a down payment on a house within the next two years. To achieve this, you’d need to set aside ₹8,300 per month.

“Setting goals is the first step in turning the invisible into the visible.” — Tony Robbins

Breaking down larger goals into smaller milestones makes them feel more achievable and keeps you motivated.

Step 3: Build an Emergency Fund

Life is unpredictable, and financial surprises can derail even the best-laid plans. An emergency fund acts as your safety net, helping you manage unexpected expenses like medical emergencies or job loss without dipping into your investments.

How Much Should You Save?

- At least three to six months’ worth of living expenses.

- Store these funds in a liquid savings account or a liquid mutual fund for easy access.

Example: If your monthly expenses are ₹40,000, aim for an emergency fund of ₹1.2 lakh to ₹2.4 lakh.

Automating savings can make this process easier and ensure consistency.

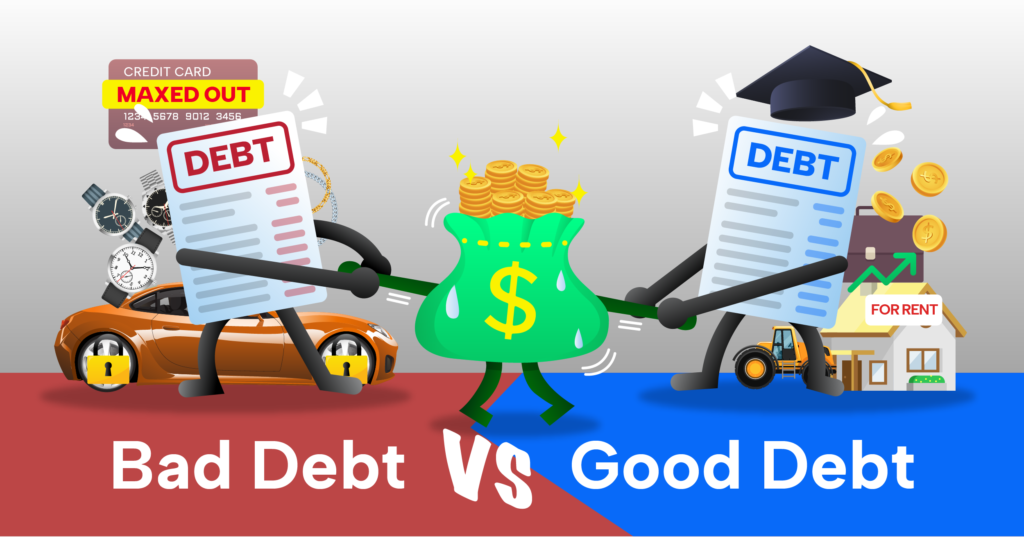

Step 4: Manage Debt Wisely

Debt can be a double-edged sword. While some types, like home loans, are considered good debt, others, like high-interest credit card debt, can drain your finances. Start by prioritizing the repayment of high-interest liabilities.

Effective Debt Management:

- Use the snowball method: Pay off smaller debts first to gain momentum while maintaining minimum payments on larger ones.

- Focus on high-interest loans like credit cards before tackling low-interest loans like education loans.

“Debt is like any other trap, easy enough to get into, but hard enough to get out of.” — Henry Wheeler Shaw

As you eliminate debts, redirect the freed-up money towards savings and investments.

Step 5: Invest for the Future

Investing is the cornerstone of financial planning. It’s not just about saving money; it’s about growing it. Start by understanding your risk appetite. Younger investors can afford higher-risk options like equities, while older individuals may prefer safer instruments like bonds.

Diversify Your Portfolio:

| Asset Class | Risk | Purpose |

| Equities | High | Growth |

| Debt | Low | Stability |

| Gold | Moderate | Inflation Hedge |

| Real Estate | Moderate-High | Long-term Appreciation |

Investing in index funds or ETFs is a great starting point for beginners seeking low-cost diversification.

Step 6: Plan for Retirement

The earlier you start saving for retirement, the more you benefit from compounding. Saving ₹10,000 monthly from age 25 can grow to over ₹2 crore by 60, assuming a 12% annual return.

Retirement Planning Tools:

- National Pension System (NPS)

- Public Provident Fund (PPF)

- Employee Provident Fund (EPF)

Regularly reviewing your retirement corpus ensures you’re on track to meet your post-retirement needs.

Step 7: Protect Yourself with Insurance

Insurance safeguards your financial future. Health insurance covers rising medical costs, while life insurance ensures your family’s financial stability in your absence. Choose a term plan for life insurance and calculate coverage as 10-15 times your annual income.

- Platform Recommendation: Compare policies on PolicyBazaar to find the best fit for your needs.

Step 8: Monitor and Adjust Your Plan

Financial planning is not a one-time activity. Set reminders to review your finances every six months. Use digital tools to track your progress and identify areas for improvement.

Adjust Based on Life Changes:

- Job promotions

- Marriage or childbirth

- Changing economic conditions

Proactive adjustments ensure that your financial plan remains aligned with your goals.

Conclusion: Your Financial Future Starts Today

Financial planning is a journey, not a destination. By taking control of your finances, setting realistic goals, and staying consistent, you can build a secure and prosperous future. Remember, small steps taken today can lead to significant achievements tomorrow. Start now, and make your financial dreams a reality.

FAQs

- Why is financial planning important? Financial planning helps you achieve life goals, manage risks, and secure your future against uncertainties.

- How much should I save monthly? Aim to save at least 20% of your income for emergencies, investments, and long-term goals.

- What tools can I use for financial planning? Budgeting apps like Walnut and investment platforms like PolicyBazaar are great starting points.

- When should I start saving for retirement? The earlier, the better. Starting in your 20s maximizes the power of compounding.