Market Setup for July 8: Nifty Steady, IT Slides—What to Watch Today

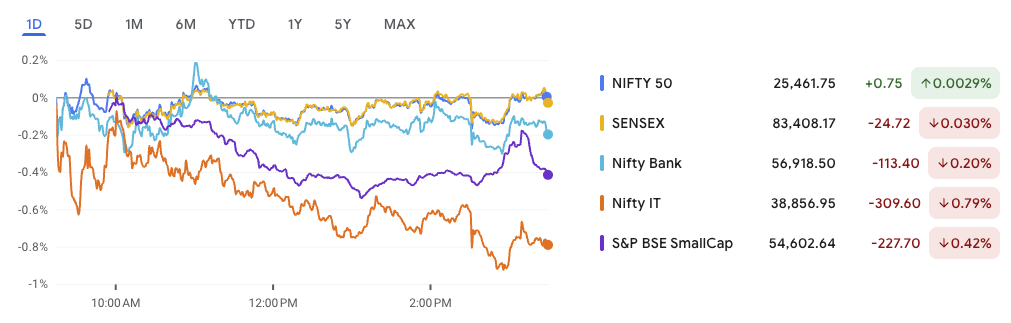

In the market setup for today, Indian stock indices showed a muted trend as Nifty closed flat and Sensex edged slightly lower. Traders are entering Tuesday with a focus on sectoral cues and breakout zones. The Nifty 50 closed almost flat at 25,461.75 (▲0.75 pts), while the Sensex slipped 24.72 points to settle at 83,408.17.

The mood remained mixed across sectors—Nifty Bank dipped 113 points to 56,918.50, and Nifty IT fell sharply by 309.60 points to close at 38,856.95, reflecting weakness in tech. Meanwhile, the broader market saw pressure, with the BSE SmallCap index down 0.42%, ending at 54,602.64.

As we begin trading on Tuesday, July 8, the market setup for today points to a narrow range with a possible directional move building up. Traders will be watching IT stocks, smallcaps, and banking cues closely, along with any early signs from global markets.

In today’s edition, we break down the key levels to track, sectors to watch, and top news driving sentiment.

Nifty Outlook: Bullish Setup Holds, Eyes on 25,674 Breakout

In the market setup for today, Nifty continues to display a structurally bullish formation, supported by strong technical signals. After breaking out above the ₹25,206–₹25,312 resistance zone last week, the index has retested this area successfully as support—an encouraging sign for continuation traders.

Currently, the index is consolidating just below the immediate resistance band at ₹25,670–₹25,674. This tight range could be forming a bullish base or flag pattern, suggesting that buyers are absorbing supply without sharp rejection. A breakout above this zone, especially with volume support, could open the path to higher levels.

Price Action & Trend Confirmation

- Nifty is trading well above the 9-day EMA, which sits around ₹25,312.

- The rising EMA slope reinforces ongoing bullish momentum.

- The structure remains healthy with higher highs and higher lows intact.

Volume Behavior

- Breakout candles were backed by rising volume—signaling genuine buying interest.

- The current consolidation phase is happening on lower volume, indicating a lack of strong selling pressure.

- This volume-price relationship typically supports the case for further upside once consolidation ends.

Key Technical Zones to Watch

| Level/Zone | Type | Interpretation |

|---|---|---|

| ₹25,206–₹25,312 | Support Zone | Previous resistance, now acting as support |

| ₹25,670–₹25,674 | Immediate Hurdle | Breakout zone; a move above can trigger rally |

| ₹26,266–₹26,269 | Target Zone | All-time high / projected breakout move |

| ₹25,200 (approx.) | Trend Checkpoint | A close below could weaken near-term trend |

What to Expect

As long as Nifty holds above ₹25,200, the technical structure remains in favor of the bulls. A decisive breakout above ₹25,674 may trigger a rally toward ₹25,900–₹26,270 in the coming sessions.

With the market setup for today tilted positively, short-term swing traders may find a favorable risk-to-reward opportunity if volume supports the next breakout leg.

News & Impacted Stocks: Key Triggers to Watch in Today’s Market Setup

In the market setup for today, several stock-specific and sectoral developments may drive investor sentiment and stock movements. Here’s a breakdown of the most important stories and the companies they impact:

1. Prestige Group Gets Nod for Private Flyover in Bengaluru

What Happened:

Prestige Estates Projects has received formal approval from the BBMP to construct a 1.5-km private flyover in Bellandur, connecting its upcoming 70-acre Beta Tech Park to Outer Ring Road. The flyover, fully funded by Prestige, is aimed at easing traffic congestion in the area and will also be accessible to the public.

Stock Impact:

The move is expected to improve infrastructure access for the company’s tech park tenants and enhance the real estate value in East Bengaluru. It also reinforces Prestige’s growth strategy, which includes launching 25 residential projects worth ₹42,120 crore this financial year.

Watch: Prestige Estates Projects (NSE: PRESTIGE)

2. Midcap IT Firms Shine Despite ₹16,500 Cr FPI Selloff

What Happened:

Despite heavy foreign investor outflows of over ₹16,000 crore in Q1FY26, the BSE IT index rose 5.5%, led by mid and smallcap players like Expleo, Intellect Design Arena, and Nucleus Software. Meanwhile, larger names like TCS underperformed.

Stock Impact:

This divergence suggests domestic funds are stepping in, and upcoming Q1 earnings will be critical in justifying valuations. If the trend sustains, select midcap IT names may continue to outperform.

Watch: Intellect Design, Expleo, Nucleus Software, Persistent Systems

3. Debt Funds Shift to Accrual Strategy Amid Yield Spike

What Happened:

Mutual funds and insurers are increasingly adopting an accrual strategy, focusing on high-yield short-term corporate bonds amid stable government yields. AAA-rated 2–3 year corporate bonds are now yielding 6.56%–6.70%, with spreads widening up to 85 bps.

Stock Impact:

This trend could benefit NBFCs, corporate bond issuers, and AMCs with exposure to dynamic or accrual-based debt funds. It may also support stability in bond-sensitive stocks.

Watch: HDFC AMC, Nippon India AMC, Edelweiss MF-linked stocks, large NBFCs like L&T Finance

4. ₹9 Lakh Cr Investment Planned for Power T&D by 2030

What Happened:

India plans to add at least 50 GW of renewable energy annually to meet its 2030 targets, driving massive demand in the power transmission and distribution (T&D) sector. Over ₹3 lakh crore worth of projects have already been tendered, with order books for EPC firms expanding 2–3x since March 2023.

Stock Impact:

The expansion benefits large players like Power Grid Corp, Adani Energy Solutions, Siemens Energy, Hitachi Energy, and EPC vendors like TARIL. Stocks in the T&D space may see renewed interest as order inflows accelerate.

Watch: Power Grid Corp, Adani Energy Solutions, Kalpataru Projects, KEC International

5. MapmyIndia Ties Up with India Post for Digital Addressing

What Happened:

MapmyIndia has partnered with India Post to roll out a universal digital address system (DIGIPIN), embedded within its Mappls app. The move enhances precision logistics, with long-term implications for e-commerce and public infrastructure.

Stock Impact:

This partnership could boost MapmyIndia’s recurring revenue and government-linked contracts. The company also recently won a ₹233 crore mapping deal from an international client.

Watch: MapmyIndia (C.E. Info Systems Ltd)

Stock on Technical Radar: RELAXO Breaks Out with Volume Surge

In the market setup for today, one stock making it to the technical screener is Relaxo Footwears, which has confirmed a strong bullish breakout after months of sideways action. The breakout has been accompanied by a sharp spike in volume, suggesting the start of a new trend phase.

Breakout Overview

Relaxo surged nearly 9% in a single session, breaking above its long-held resistance zone of ₹465–₹480. This move completes a rounded bottom reversal pattern, indicating a transition from a prolonged downtrend to a potential accumulation and uptrend phase.

Price Action & Moving Average Insight

- The stock now trades significantly above its 9-day EMA (₹436.62), which is trending sharply upward.

- While price is extended in the short term, it could either consolidate near current levels or see a mild pullback toward ₹480, creating a buy-on-dip opportunity.

Volume Signals Strength

- Trading volume jumped to 8.48 million shares, nearly 10x the 20-day average, marking strong institutional interest.

- This kind of volume is typically seen at the start of fresh bullish legs, especially post base breakouts.

Key Technical Levels

| Price Level | Role | Importance |

|---|---|---|

| ₹480–₹465 | Breakout Support | Watch for retest or entry on dip |

| ₹436 | EMA Support | Swing trend pivot |

| ₹392–₹403 | Base Support | Breakdown risk zone for swing trade |

| ₹692–₹698 | Resistance | Long-term target from pattern move |

Strategy Snapshot

Short-Term (1–7 Days):

- Ideal Entry: On a dip or sideways consolidation near ₹480–₹490

- Stop-Loss: ₹460

- Targets: ₹530 → ₹565

Swing Trade (2–5 Weeks):

- Entry: Either near ₹480–₹490 or breakout above ₹515 with strong volume

- Stop-Loss: ₹436

- Targets: ₹565 → ₹615 → ₹690

Bottom Line:

Relaxo’s breakout is backed by both price structure and volume—a strong combination for trend followers. While chasing after a big candle is risky, dips toward support zones or consolidations may offer attractive risk-reward setups for both short-term and swing traders.

IPO Watchlist: Active Listings & GMP Trends

In the market setup for today, here’s a quick update on the IPO space, split into Mainboard and SME IPOs. This snapshot includes the latest Grey Market Premiums (GMP) along with key dates to track.

Mainboard IPOs

| IPO Name | GMP (Est. Listing Gain) | Open | Close | Listing |

|---|---|---|---|---|

| NSDL IPO | ₹– (0.00%) | — | — | — |

| Anthem Biosciences | ₹– (0.00%) | — | — | — |

| Smartworks Coworking | ₹0 (0.00%) | 10 Jul | 14 Jul | 17 Jul |

| Travel Food Services | ₹16 (1.45%) | 7 Jul | 9 Jul | 14 Jul |

SME IPOs

| IPO Name | GMP (Est. Listing Gain) | Open | Close | Listing |

|---|---|---|---|---|

| Spunweb Nonwoven | ₹– (0.00%) | 14 Jul | 16 Jul | 21 Jul |

| Asston Pharma | ₹10 (8.13%) | 9 Jul | 11 Jul | 16 Jul |

| CFF Fluid Control | ₹– (0.00%) | 9 Jul | 11 Jul | 16 Jul |

| GLEN Industries | ₹25 (25.77%) | 8 Jul | 10 Jul | 15 Jul |

| Smarten Power Systems | ₹– (0.00%) | 7 Jul | 9 Jul | 14 Jul |

| Chemkart India | ₹– (0.00%) | 7 Jul | 9 Jul | 14 Jul |

| Meta Infotech | ₹48 (29.81%) | 4 Jul | 8 Jul | 11 Jul |

| White Force | ₹5 (6.58%) | 3 Jul | 7 Jul | 10 Jul |

| Cryogenic OGS | ₹32 (68.09%) | 3 Jul | 7 Jul | 10 Jul |

| Crizac Limited | ₹39 (15.92%) | 2 Jul | 4 Jul | 9 Jul |

Smallcap of the Day: Redtape Ltd (₹141)

High Risk – High Reward | Fashion Retailer with Premium Recall

In the market setup for today, smallcaps continue to show pockets of momentum—and today’s spotlight is on Redtape Ltd, a fashion and footwear brand that’s quietly emerging as a consumer lifestyle play with deep brand equity and rising fundamentals.

About the Company

Redtape, demerged from Mirza International in 2023, is India’s trusted fashion & lifestyle brand with 435+ exclusive stores across the country. Originally launched as a footwear brand in 1996, Redtape has since expanded into apparel and accessories for men, women, and kids. With strong recall in both Indian and global markets (including the UK), it’s positioning itself as a mass-premium lifestyle destination.

Why It Stands Out

| Metric | Value | Insight |

|---|---|---|

| CMP | ₹141 | Near support after sharp correction from ₹245 |

| Market Cap | ₹7,775 Cr | Smallcap with national retail footprint |

| ROE / ROCE | 23.7% / 21.5% | Efficient capital use for a retail brand |

| Operating Margin | 16.6% | Strong for a fashion business |

| PAT (FY) | ₹170 Cr | Reflects post-demerger focus |

| Inventory | ₹1,221 Cr | High, may pressure cash flows |

| Cash & Equivalents | ₹14.6 Cr | Thin liquidity buffer |

| Debt to Equity | 0.92 | Manageable but not low |

| Price to Book | 9.76x | Valuation rich—reflects brand value premium |

Risks to Watch

- High Valuation: P/E of 45+ and P/B nearing 10x make it richly priced vs intrinsic value (~₹78).

- Inventory Buildup: Working capital stress possible if sales don’t scale proportionately.

- Cash Reserves: Low cash cushion relative to size may restrict aggressive expansion.

Why It’s on the Radar

Despite being high-risk, Redtape could offer high-reward potential as a brand-first fashion smallcap with national reach, post-demerger focus, and improving operating metrics. If retail demand stays robust and expansion plays out, the stock could reward early trend-catchers over the medium term.

Conclusion: Cautious Optimism with Breakout Watch

As we step into today’s session, the market setup for today suggests a cautiously optimistic tone. While the broader indices closed nearly flat on Monday, technical indicators—especially on Nifty—still favor a bullish continuation, provided the index breaks above key resistance at 25,674. Banking remains range-bound, IT is under pressure, and smallcaps are seeing selective action.

We’re also tracking key developments across stocks—from Prestige’s infrastructure play to Redtape’s high-beta retail breakout potential, and strength in midcap IT names despite FII selloff. Meanwhile, IPO action is heating up in the SME space, with names like GLEN Industries and Meta Infotech drawing strong premium buzz.

Stay focused on breakout confirmations, sector-specific cues, and any surprise global data prints that may guide short-term sentiment.

We’ll be back tomorrow with your early edge—same time, sharper view.

Related Articles:

China’s Fertilizer Export Halt to India: Stocks Set to Gain from the Supply Shock

DRDO’s Emergency Weapon Orders: Defence Stocks Set to Gain

Insider Buying in Indian Stocks: Hidden Signals You Shouldn’t Ignore

More Articles

How to Transfer Shares from Groww to Zerodha – Full Guide (2025)

Why Fundamentals Are Failing—and Market Cycles Are Getting Shorter

How a Tea Seller Used the Power of Compound Interest to Build ₹45 Lakh