Introduction: Market Outlook 8 September

Market Outlook 8 September begins on a cautious yet steady note as investors return after the weekend. On Friday, domestic benchmarks ended almost flat, reflecting a balanced tug-of-war between buyers and profit-bookers. The NIFTY 50 closed at 24,741 (+6.70 points, +0.027%), while the SENSEX settled at 80,749 (+31.62 points, +0.039%). Banking stocks held their ground with Nifty Bank finishing at 54,098 (+22.75 points, +0.042%), but IT shares dragged sentiment with Nifty IT dropping 1.36% to 34,664. Mid and small caps extended resilience as the S&P BSE SmallCap gained 0.19% to 52,807.

Turning to the global setup, Wall Street slipped on Friday with the Dow Jones (-0.48%), S&P 500 (-0.32%), and Nasdaq (-0.03%) ending lower, weighed by interest rate concerns. European indices also remained weak, with DAX (-0.73%) and CAC 40 (-0.31%) under pressure. However, Asian markets showed strength this morning — Nikkei 225 (+1.03%), Hang Seng (+1.43%), and Shanghai Composite (+1.24%) — signaling regional optimism.

For the Indian market, the GIFT Nifty is quoting at 24,825, down just 22 points, indicating a flat to slightly negative Pre-Market Update for Monday’s opening. Traders may expect a range-bound start, with stock-specific action driving momentum as the week kicks off.

Index Technical View | Market Outlook 8 September

As we step into a new week, the technical charts set the stage for a cautious yet opportunity-driven Pre-Market Update. According to Equitypandit Analysis, here’s how the major indices are shaping up for Monday’s trade:

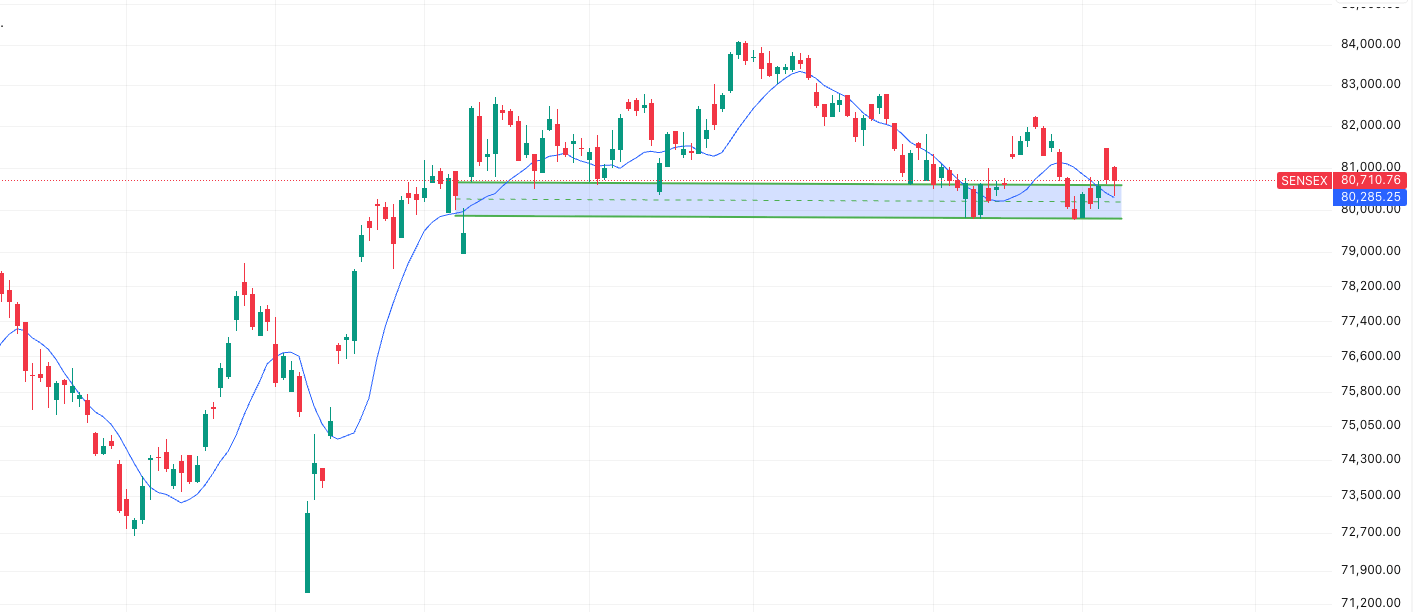

SENSEX Prediction – Market Outlook 8 September

The SENSEX (80,711) is holding firmly in a positive trend. For traders already carrying long positions, maintaining a daily closing stoploss at 80,345 is advisable. Any sustained close below this level could open the door for fresh short opportunities. On the flip side, if the index manages to clear its resistance zones, it may set the tone for another leg of rally.

SENSEX Support Levels:

- 80,342

- 79,974

- 79,627

SENSEX Resistance Levels:

- 81,058

- 81,405

- 81,773

Tentative Range: 81,395 – 80,025

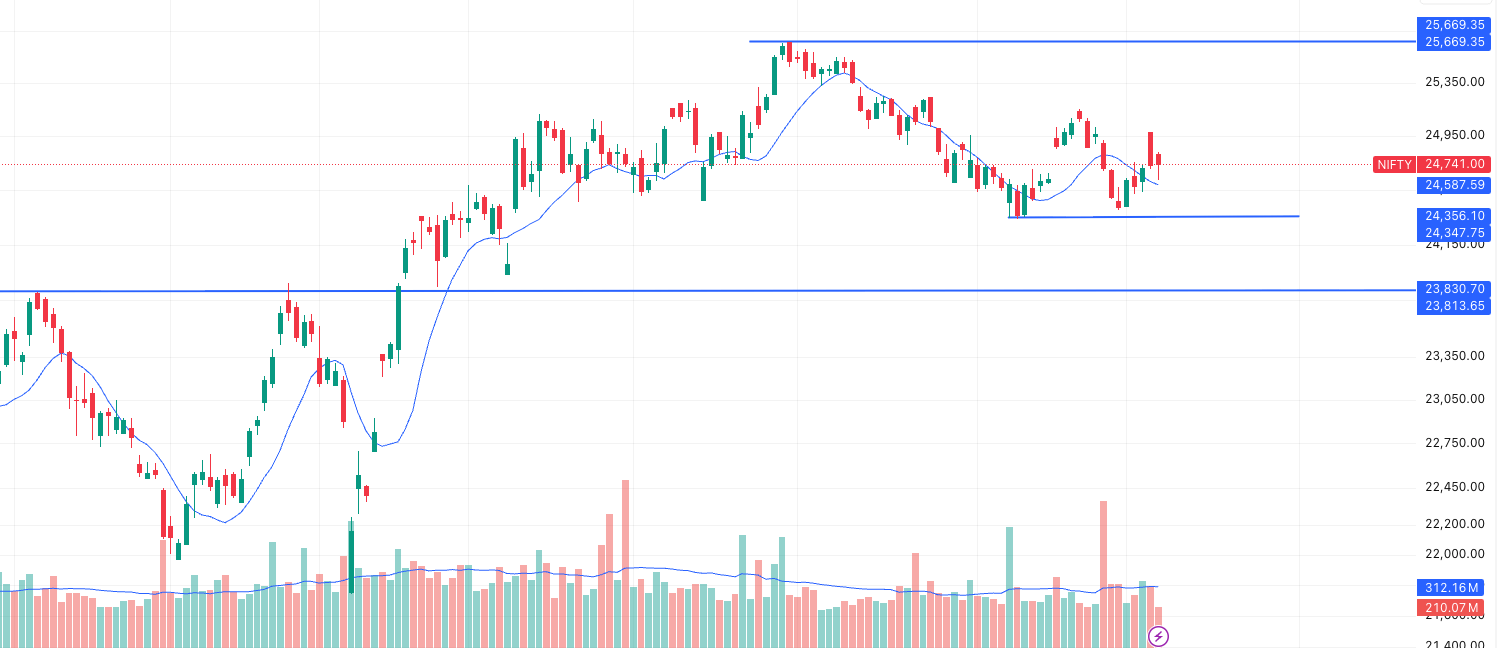

NIFTY Prediction – Market Outlook 8 September

The NIFTY 50 (24,741) also remains in a positive setup. Long positions can be held with a stoploss at 24,632 on a closing basis. If the index closes below this level, short-term corrections cannot be ruled out. Upside momentum will likely strengthen if Nifty sustains above its key resistance points.

NIFTY Support Levels:

- 24,631

- 24,521

- 24,420

NIFTY Resistance Levels:

- 24,842

- 24,942

- 25,052

Tentative Range: 24,951 – 24,530

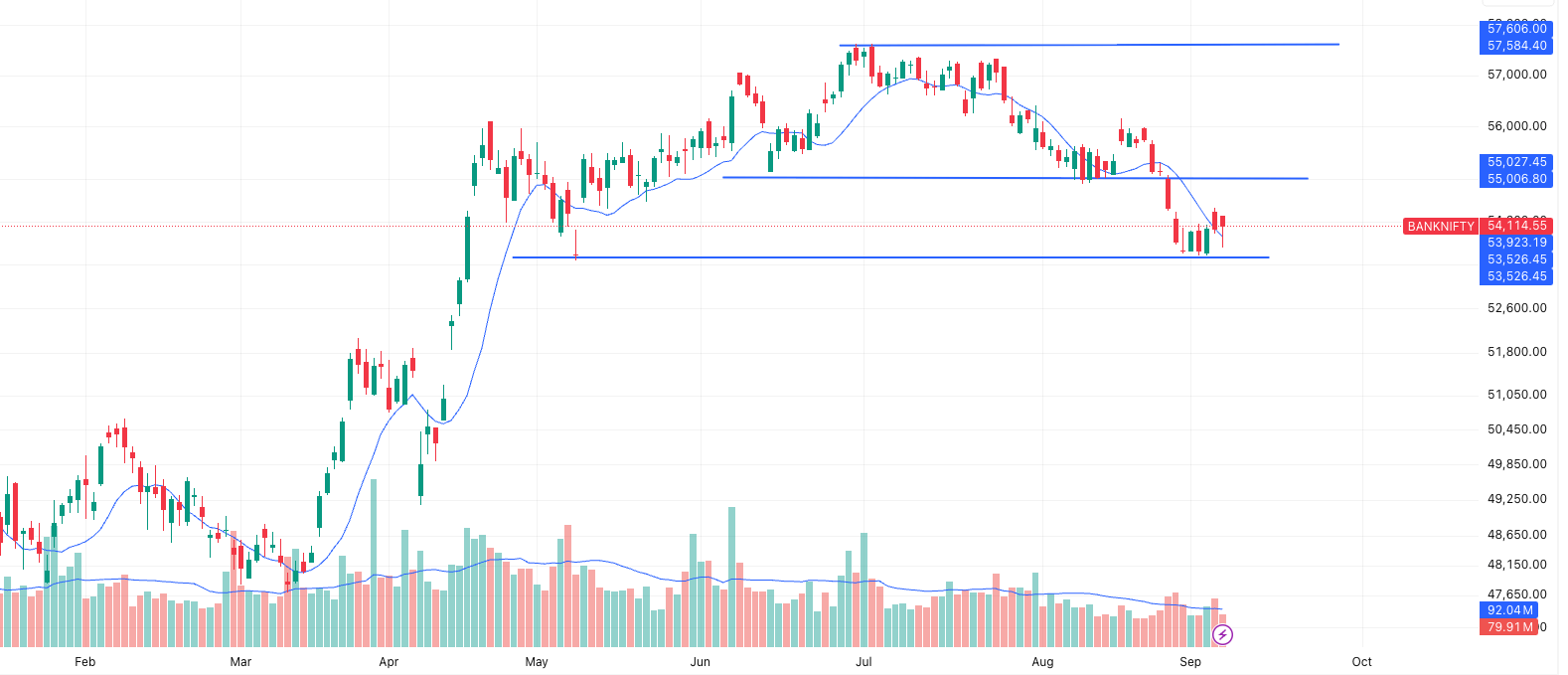

BANKNIFTY Prediction – Market Outlook 8 September

Unlike the broader market, the BANKNIFTY (54,115) is currently under a negative trend. Traders holding short positions can continue with a stoploss at 54,346, while fresh long positions should only be considered if the index manages to close above that level. Until then, banking stocks may remain under pressure, keeping traders on edge.

BANKNIFTY Support Levels:

- 53,787

- 53,459

- 53,198

BANKNIFTY Resistance Levels:

- 54,375

- 54,636

- 54,964

Tentative Range: 54,632 – 53,596

Index Analysis – Market Outlook 8 September

The broader setup for Monday signals a steady yet cautious start for Indian equities. Both SENSEX and NIFTY are holding their positive momentum, with support zones well-defined and resilience intact above their respective stoploss levels. This suggests that any dips may still attract buying interest, particularly from institutional investors who continue to bet on India’s growth story.

However, the picture is not entirely one-sided. BANKNIFTY continues to show relative weakness, weighed down by banking and financials. Unless it decisively crosses above its immediate resistance, traders should expect some choppiness in this segment.

From a short-term view, the indices are expected to trade within their tentative ranges, and breakouts beyond these levels will dictate fresh momentum. With global cues mixed and domestic triggers in play, the market could remain range-bound in early trade before picking a directional move later in the session.

In essence, Nifty and Sensex offer optimism for cautious bulls, while Bank Nifty demands vigilance from traders. Stock-specific action, sectoral rotations, and IPO buzz are likely to dominate intraday sentiment.

News & Stocks to Watch – Market Outlook 8 September | Pre-Market Update

U.S. Tariffs on Indian Exports – A $2 Trillion Dream Under Pressure

The road to India’s $2 trillion export target by 2030 just hit a major roadblock. The United States has doubled tariffs to 50% on a wide range of Indian exports, citing India’s oil trade with Russia. With the U.S. accounting for 20% of India’s exports and contributing nearly 2% to GDP, this policy shock could trim shipments by 40–45% in FY26.

- Sectors in focus: Textiles, gems & jewellery, furniture, seafood, and machinery.

- Stocks to watch: Titan, Kalyan Jewellers, Page Industries, V-Guard, Havells, and exporters in seafood and machinery.

- Government response: Launch of a ₹25,000 crore Export Promotion Mission with two schemes—Niryat Protsahan (soft infra, MSME support) and Niryat Disha (ports, logistics, customs digitisation).

This sets the stage for policy-driven momentum in logistics, ports, and MSME-linked companies, even as exporters brace for headwinds.

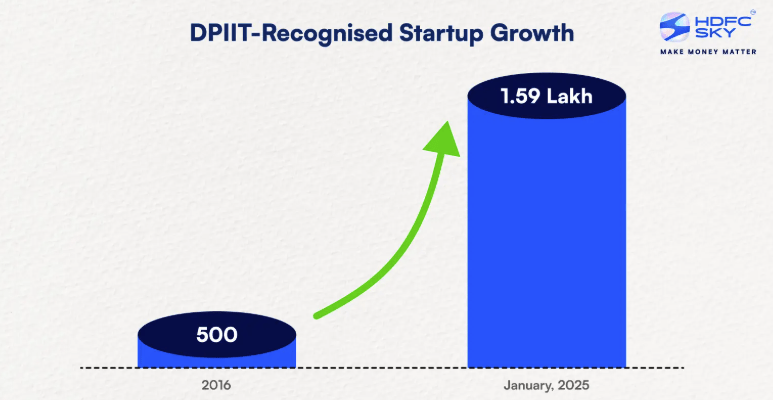

India’s Startup Ecosystem – Ranking 3rd Globally

India’s startup hub continues to shine, securing the 3rd spot globally in startup funding with $2.5 billion raised in Q1 2025. Over 1.57 lakh DPIIT-recognised startups and 100+ unicorns now form the backbone of this ecosystem.

- Key drivers: Govt schemes like FFS, SISFS, CGSS; focus on deep-tech, AI, and R&D.

- Stocks to watch: Info Edge (Naukri), Nazara Tech, Zomato, Paytm, and upcoming IPO candidates.

- Outlook: Shift from valuations to sustainable growth, with focus on AI, semiconductors, robotics, and quantum computing.

This maturing cycle signals healthier exits and increased M&A, benefitting listed tech investors.

Corporate Updates That Could Move Stocks

- Titagarh Rail Systems (NSE: TITAGARH, BSE: 532966)

Invests ₹5 crore in subsidiary Titagarh Naval Systems to strengthen defence diversification. Expect focus on defence and infra orders to drive sentiment. - Supreet Chemicals Limited (Unlisted)

Filed for a ₹499 crore IPO, entirely fresh issue. Funds will go into capex and debt repayment. Specialty chemicals remain a hot theme—watch peers like Aarti Industries, Deepak Nitrite, and Laxmi Organics. - Oravel Stays (Oyo)

Announces 1:1 bonus issue ahead of its IPO. This move doubles equity capital and improves liquidity. Hospitality peers like Indian Hotels and Lemon Tree may see sympathetic moves.

Energy Exports – India Rides the Diesel Wave

India’s diesel exports to Europe surged 137% YoY in August, reaching nearly 242,000 barrels/day as buyers stockpiled ahead of the EU’s January 2026 ban on Russian crude-refined products.

- Beneficiaries: Reliance Industries, Nayara Energy, ONGC.

- Global implication: Europe imports 44% of its diesel demand—making it highly vulnerable. India has emerged as a critical supplier, though sanctions could complicate trade from 2026.

Overall Takeaway:

- Tariff shock pressures exporters but opens doors for infra/logistics firms.

- Startup boom continues to strengthen India’s tech story.

- Corporate moves (Titagarh, Oyo, Supreet Chemicals) highlight sector-specific opportunities.

- Energy exports give India leverage in global trade, boosting refiners like Reliance.

IPO Watch – Market Outlook 8 September | Pre-Market Update

Mainboard IPOs

| IPO Name | GMP (₹) | Est. Gain % | Price (₹) | IPO Size | Open | Close | Listing |

|---|---|---|---|---|---|---|---|

| Dev Accelerator IPO | 9 | 14.75% | 61 | ₹143.35 Cr | 10-Sep | 12-Sep | 17-Sep |

| Shringar House of Mangalsutra IPO | 23 | 13.94% | 165 | ₹400.95 Cr | 10-Sep | 12-Sep | 17-Sep |

| Urban Co. IPO | 25 | 24.27% | 103 | ₹1900.00 Cr | 10-Sep | 12-Sep | 17-Sep |

Takeaway: Urban Co. IPO is showing the strongest premium (24% GMP), indicating high investor interest. Shringar House and Dev Accelerator also carry decent listing expectations in the 13–15% range, reflecting solid demand in mid-size offerings.

SME IPOs

| IPO Name | GMP (₹) | Est. Gain % | Price (₹) | IPO Size | Open | Close | Listing |

|---|---|---|---|---|---|---|---|

| Airfloa Rail Technology (BSE SME) | 150 | 107.14% | 140 | ₹86.53 Cr | 11-Sep | 15-Sep | 18-Sep |

| Jay Ambe Supermarkets (BSE SME) | 5 | 6.41% | 78 | ₹17.52 Cr | 10-Sep | 12-Sep | 17-Sep |

| Karbonsteel Engineering (BSE SME) | 17 | 10.69% | 159 | ₹56.31 Cr | 9-Sep | 11-Sep | 16-Sep |

| Sharvaya Metals (BSE SME) | 23 | 11.73% | 196 | ₹55.86 Cr | 4-Sep | 9-Sep | 12-Sep |

| Austere Systems (BSE SME) | 25 | 45.45% | 55 | ₹14.78 Cr | 3-Sep | 9-Sep | 12-Sep |

| Goel Construction (BSE SME) | 58 | 22.05% | 263 | ₹95.14 Cr | 2-Sep | 4-Sep | 10-Sep |

| Optivalue Tek Consulting (NSE SME) | 7 | 8.33% | 84 | ₹49.19 Cr | 2-Sep | 4-Sep | 10-Sep |

Takeaway: The SME space remains buzzing, led by Airfloa Rail Technology with a triple-digit premium (107%), pointing to blockbuster listing gains. Austere Systems and Goel Construction also shine with strong 45%+ and 22% GMPs. Meanwhile, smaller names like Jay Ambe and Optivalue carry modest premiums, suggesting selective investor appetite.

Stocks in Radar – Market Outlook 8 September

Triveni Turbine Ltd (TTL)

CMP: ₹531 | Target Price (as per Sharekhan Research): ₹700 | View: Positive

Business Overview:

Triveni Turbine Ltd is India’s leading manufacturer of industrial steam turbines in the 5–30 MW segment, with expanding capabilities up to 100 MW. It commands a 50–55% share in the domestic market and 20–25% globally, serving industries such as cement, steel, sugar, distillery, oil & gas, and waste-to-energy. Alongside manufacturing, TTL has a strong aftermarket business that is becoming a critical revenue driver worldwide.

Financials & Growth:

- Revenue/PAT CAGR projected at 21%/23% for FY2025–FY2027E.

- Domestic enquiry pipeline up 130% YoY in Q1FY26, with strong traction from steel, cement, and oil & gas.

- International business expanding into Middle East, Europe, and Southeast Asia.

- Debt-free balance sheet and efficient capital cycle support long-term expansion.

Growth Drivers:

- Rising adoption of renewable energy and waste heat recovery projects.

- Expanding aftermarket services with refurbishment outpacing parts and spares.

- Entry into API turbines market adds a new growth vertical.

- New US subsidiary aimed at tapping North American demand and aftermarket opportunities.

Outlook:

While Q1FY26 performance was impacted by geopolitical tensions, Sharekhan Research expects a stronger recovery from H2FY26 with order execution improving. TTL is strategically placed to benefit from India’s industrial expansion and the global energy transition.

Valuation Insight (Sharekhan Research):

Sharekhan Research has highlighted TTL’s strong order book, margin drivers, and international opportunities, valuing the stock at a target price of ₹700. This reflects confidence in sustained revenue growth and profitability in the coming years.

Conclusion

As the markets reopen after the weekend, the Market Outlook 8 September reflects a cautious but constructive environment. While global equity cues remain mixed, the underlying domestic fundamentals continue to provide support. The GIFT Nifty is signaling a flat to slightly positive opening, suggesting that investors may prefer to wait for fresh triggers before taking directional bets.

On the technical front, NIFTY is consolidating near crucial support levels and could see upward momentum if it manages to hold above them. The SENSEX too is showing resilience, while Bank Nifty remains the laggard, weighed down by selective profit booking. This makes sectoral rotation a key theme to watch, especially with IT, energy, and select capital goods stocks showing strength.

IPO activity is expected to stay in the spotlight with strong interest building up in both mainboard and SME issues, as highlighted in today’s Pre-Market Update. This not only reflects liquidity in the system but also retail and institutional appetite for new opportunities.

Stock-specific action will remain important, with stories like Triveni Turbine Ltd underscoring how niche leaders in growth sectors such as renewable energy and industrial power generation can deliver value even in volatile conditions. The company’s strong order pipeline and global expansion plans reinforce optimism for medium- to long-term investors.

Overall, the week ahead will likely be shaped by a mix of global macro signals, domestic institutional flows, and sector-specific earnings visibility. Traders may look for short-term opportunities within well-defined ranges, while long-term investors should remain focused on structural themes that continue to deliver growth despite short-term jitters.

The Market Outlook 8 September indicates that patience and selectivity will be key. Staying disciplined with allocations and riding on strong business fundamentals could help investors navigate the upcoming sessions with confidence.

More Articles

When to Sell Mutual Funds: 5 Proven Exit Strategies

The Hidden Multibagger Stock: 5 Positive Triggers That Make Suven Life Sciences a Game-Changer

The Indian Retirement Savings Crisis: 5 Reasons EPF and PPF Won’t Be Enough