Market Outlook 8 October: Pre-Market Edition

Good morning and welcome to your Market Outlook 8 October Edition! 🌅

Indian markets ended slightly higher on October 7, extending their positive momentum for the second consecutive session. The Nifty 50 closed at 25,117.80 (+0.16%), while the Sensex gained 161 points to finish at 81,951.98. Banking and FMCG stocks provided steady support, while IT saw mild profit booking ahead of the earnings season.

Broader indices underperformed, with the S&P BSE SmallCap slipping 0.15%, reflecting selective buying in large caps amid cautious investor sentiment. With global markets stabilising and domestic liquidity remaining strong, the near-term outlook for Indian equities continues to look constructive.

In this newsletter, we bring you technical views, key news, IPO updates, and stocks to watch for today.

Index Technical View — Market Outlook 8 October

According to EquityPandit Analysis, Indian markets are holding steady with a positive bias, supported by strong institutional flows and sectoral rotation. However, after a four-day winning streak, the indices have formed an inverse hammer candle on the daily chart — a pattern that often signals potential short-term weakness or mild profit booking. Hence, while the broader trend remains bullish, traders should stay cautious of possible intraday corrections today.

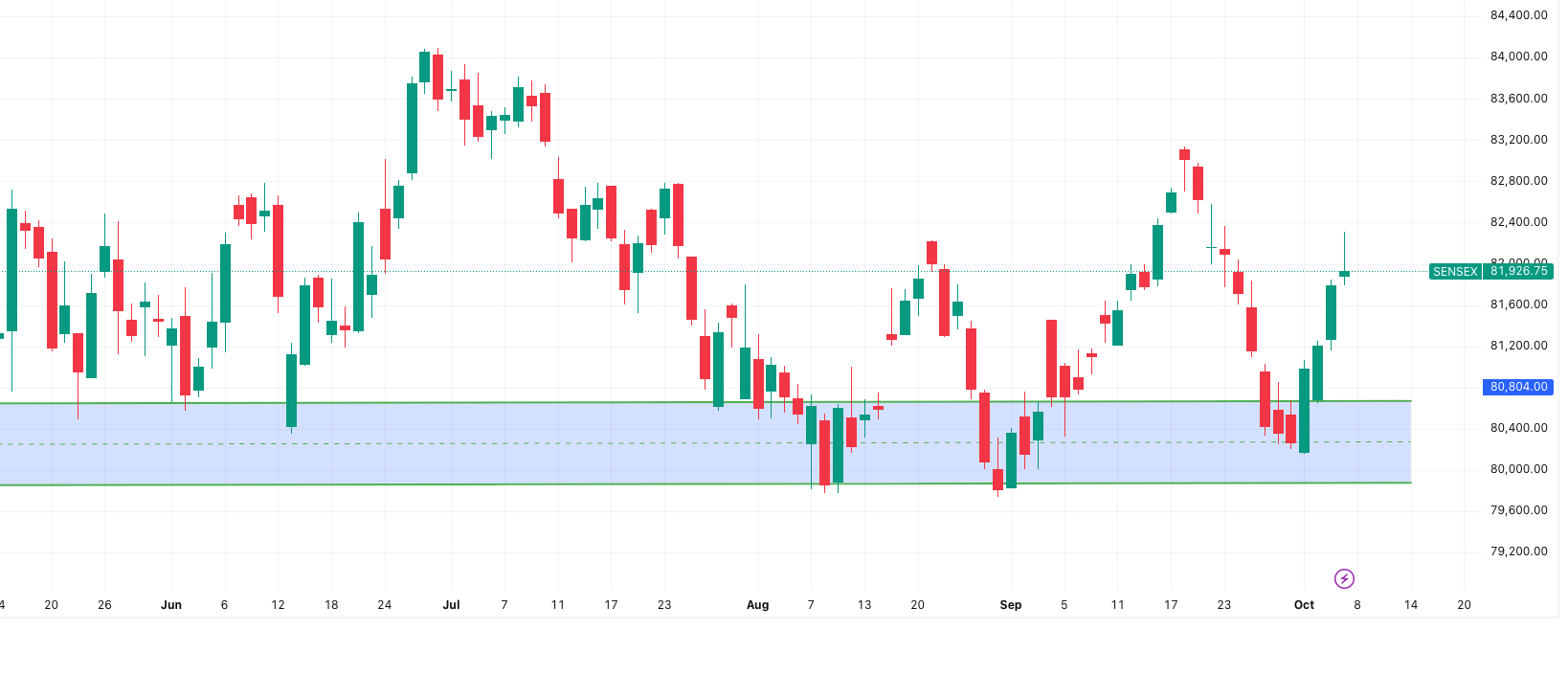

SENSEX Outlook 8 October

As per EquityPandit’s analysis, the SENSEX continues to trade in a positive trend, backed by strength in banking, auto, and FMCG stocks. Despite the bullish setup, the appearance of an inverse hammer candle hints at possible resistance near 82,200–82,500 levels and a short-term pause in momentum.

If you are holding long positions, continue to hold with a daily closing stoploss of 81,436. A close below this level may trigger mild corrections, while a breakout above 82,228 could resume the upward trend.

- Support Levels: 81,706 / 81,486 / 81,184

- Resistance Levels: 82,228 / 82,530 / 82,750

- Tentative Range: 81,316 – 82,537

- Outlook: The trend remains positive, but watch for a possible dip due to overbought conditions.

NIFTY 50 Outlook 8 October

The NIFTY, according to EquityPandit, maintains a positive setup, closing above 25,100 with continued support from financials, autos, and infra sectors. However, the inverse hammer pattern on the daily chart indicates that the index might face resistance near 25,250–25,300, and some consolidation or minor pullback could occur today.

Traders can hold long positions with a stoploss at 24,969. Fresh shorts may only be considered below this level. Sustained trade above 25,200 could, however, push Nifty toward 25,400–25,500 in the short term.

- Support Levels: 25,049 / 24,991 / 24,905

- Resistance Levels: 25,194 / 25,280 / 25,339

- Tentative Range: 24,927 – 25,288

- Outlook: Short-term caution warranted due to candle formation; buying interest likely near 25,000.

BANKNIFTY Outlook 8 October

According to EquityPandit Analysis, Bank Nifty continues to outperform, supported by strong credit growth and optimism in the banking sector. However, it too has shown signs of fatigue with the inverse hammer candle, suggesting the possibility of mild cooling-off before resuming its uptrend.

Traders can hold long positions with a stoploss at 55,779. A decisive close above 56,733 could take the index toward 57,200–57,400, while a dip below 55,900 may invite short-term weakness.

- Support Levels: 56,009 / 55,778 / 55,531

- Resistance Levels: 56,486 / 56,733 / 56,964

- Tentative Range: 55,761 – 56,717

- Outlook: Bullish undertone intact, but short-term volatility cannot be ruled out.

Overall Market Sentiment

As per EquityPandit’s view, the market remains structurally strong, but after four straight green sessions, an inverse hammer signals that the bulls might take a breather. Some profit booking or sideways movement is likely in today’s session, especially near upper resistance levels.

“The trend stays bullish, but expect a slight correction or consolidation today as the market cools off after a strong run. Hold longs with tight stop-losses — Nifty above 24,950 and Bank Nifty above 55,700 remain key support zones.”

Key News & Stocks — Market Outlook 8 October

The Market Outlook 8 October edition brings a mix of global upgrades, domestic reforms, and major corporate milestones — all shaping the near-term sentiment for Indian equities. Let’s break down the top stories and the stocks to watch today.

World Bank Upgrades India’s Growth Outlook

The World Bank has raised India’s GDP growth forecast for FY26 to 6.5% (from 6.3%), reaffirming India’s position as the world’s fastest-growing major economy. The report highlights strong consumption demand, rural recovery, and AI-driven productivity gains, though it cautions that the US’s 50% import tariff on Indian goods could pose medium-term challenges.

The bank’s South Asia Development Update also suggested that sequenced tariff cuts and free trade alignment could spur private investment and job creation. Growth in South Asia, however, is projected to moderate to 5.8% in 2026.

💡 Stock to Watch: Infosys, TCS, Tata Elxsi — may gain as AI-driven growth and global digital demand support tech exports.

The upgrade reinforces optimism for India’s macro stability, likely lending further confidence to foreign investors in the short term.

Rise of the Chief AI Officer (CAIO) — IBM Study Finds India Leading in AI Adoption

According to a new IBM Institute for Business Value report, India is witnessing the emergence of Chief AI Officers (CAIOs) across enterprises — a new C-suite role driving the country’s AI transformation. About 25% of Indian enterprises already have a CAIO, and 67% plan to appoint one within two years.

Indian CAIOs are also 10% more likely than global peers to focus on execution, with 60% controlling AI budgets and 70% coming from data backgrounds, signaling that India’s corporate AI push is moving from pilots to large-scale deployment.

💡 Stock to Watch: Tech Mahindra, Persistent Systems, LTIMindtree — key beneficiaries of enterprise AI spending.

With strong C-suite support, India could become a regional AI innovation hub, benefiting IT and cloud infrastructure players.

Cabinet Approves ₹24,634 Crore Railway Expansion Projects

The Union Cabinet, chaired by PM Modi, has approved four major railway multi-tracking projects spanning 1,619 km across Maharashtra, Gujarat, and Madhya Pradesh, with an investment of ₹24,634 crore. The projects aim to enhance connectivity to 3,600+ villages and improve freight movement by 78 MTPA.

These projects fall under the PM Gati Shakti Plan, focusing on logistics efficiency, connectivity to key industrial zones, and eco-friendly transport. They’re expected to reduce oil imports by 28 crore litres and cut CO₂ emissions equivalent to planting 6 crore trees.

💡 Stock to Watch: RVNL, IRCON International, Titagarh Rail Systems — likely to benefit from execution orders and rail infrastructure demand.

Strong policy momentum in capex-led sectors like railways could keep infrastructure and PSU stocks buzzing.

Festive Rush Drives Auto Retail Surge — Navratri Sales Up 35% YoY

According to FADA, India’s passenger vehicle sales jumped 35% YoY during Navratri, while overall September 2025 registrations grew 6% YoY, supported by GST 2.0 cuts and festive demand. Two-wheeler and tractor sales also showed strong rural momentum, reflecting robust consumer sentiment ahead of Diwali.

The surge underscores how policy and festival timing can trigger sharp spikes in retail activity. FADA expects this momentum to continue through Dhanteras and Deepawali, supported by strong OEM offers, rural demand, and stable financing costs.

💡 Stock to Watch: Maruti Suzuki, Hero MotoCorp, M&M, Tata Motors — poised to benefit from sustained festive momentum.

The combination of GST relief and festive sentiment may extend the auto sector’s outperformance into Q3 FY26.

Abbott India Launches Dual-Chamber Leadless Pacemaker System

Abbott India has introduced its breakthrough AVEIR DR dual-chamber leadless pacemaker system, marking a new era in cardiac care. The innovation enables wireless synchronisation between two miniature pacemakers, each directly implanted inside the heart, eliminating the need for surgical leads or pockets.

This next-gen technology offers real-time beat-by-beat coordination, reduced procedural risks, and improved recovery times — a milestone in minimally invasive heart rhythm management.

💡 Stock to Watch: Abbott India, Medtronic India, Narayana Hrudayalaya — could benefit from increased cardiac device adoption.

India’s fast-evolving medical device market signals growing premiumisation in healthcare technology.

Smartphone Exports Cross ₹1 Trillion in 5 Months — India’s PLI Success Story

India’s smartphone exports have surged past ₹1 trillion between April–August 2025 — a 55% YoY increase, led by Apple and Samsung, supported by the PLI Scheme. Tata Electronics and Foxconn alone shipped ₹75,000 crore worth of iPhones in just five months, contributing 75% of total smartphone exports.

The US and Europe remain top markets, while Motorola has emerged as a surprise third-largest exporter. This boom reflects how India’s manufacturing shift under the PLI framework is reshaping its global trade position.

💡 Stock to Watch: Dixon Technologies, Tata Electronics, Foxconn India, Avalon Tech — strong beneficiaries of the PLI-led export surge.

The milestone cements India’s role as a key electronics manufacturing hub, with more value chains expected to localise over time.

DreamFolks Services Enters B2C Space with ‘DreamFolks Club Memberships’

DreamFolks Services Ltd has officially launched its DreamFolks Club Memberships, marking its entry into the B2C segment after exiting the domestic lounge aggregation business. The three-tier membership (White, Orange, Black) offers lifestyle and travel privileges — from lounge access and golf sessions to OTT subscriptions and wellness packages — priced between ₹10,000–₹50,000 annually.

The company aims to democratise luxury access and expand globally into railway lounges, social clubs, and curated lifestyle experiences. Management expects this to become a new revenue growth engine.

💡 Stock to Watch: DreamFolks Services Ltd — potential re-rating candidate amid strategic business diversification.

Transitioning from B2B to B2C may boost DreamFolks’ margins and investor confidence in long-term scalability.

IPO Update — Market Outlook 8 October

The IPO street continues to buzz with fresh listings and strong grey market activity. As per the Market Outlook 8 October, both mainboard and SME segments are witnessing robust investor participation, led by high subscription levels and strong listing premiums.

Mainboard IPOs

| Company | Open Date | Close Date | Listing Date | GMP (Est. Listing Gain) |

|---|---|---|---|---|

| Canara Robeco IPO | 9 Oct | 13 Oct | 16 Oct | ₹24 (+9.02%) |

| Rubicon Research IPO | 9 Oct | 13 Oct | 16 Oct | ₹80 (+16.49%) |

| LG Electronics IPO | 7 Oct | 9 Oct | 14 Oct | ₹315 (+27.63%) |

| Tata Capital IPO | 6 Oct | 8 Oct | 13 Oct | ₹5.5 (+1.69%) |

| WeWork India IPO | 3 Oct | 7 Oct | 10 Oct | ₹— (Neutral) |

| Om Freight Forwarders IPO | 29 Sep | 3 Oct | 8 Oct | ₹2 (+1.48%) |

| Advance Agrolife IPO | 30 Sep | 3 Oct | 8 Oct | ₹15 (+15.00%) |

Listing Today: Advance Agrolife IPO and Om Freight Forwarders IPO

LG Electronics and Rubicon Research remain the star attractions of the week, boasting impressive GMPs. Tata Capital’s IPO, though large in size, is drawing moderate grey market enthusiasm, reflecting cautious optimism.

SME IPOs

| Company | Open Date | Close Date | Listing Date | GMP (Est. Listing Gain) |

|---|---|---|---|---|

| Mittal Sections | 7 Oct | 9 Oct | 14 Oct | ₹2 (+1.40%) |

| DSM Fresh Foods | 26 Sep | 6 Oct | 9 Oct | ₹— (Neutral) |

| Infinity Infoway | 30 Sep | 3 Oct | 8 Oct | ₹44 (+28.39%) |

| Sheel Biotech | 30 Sep | 3 Oct | 8 Oct | ₹10 (+15.87%) |

| Munish Forge | 30 Sep | 3 Oct | 8 Oct | ₹— (Neutral) |

| Valplast Technologies | 30 Sep | 3 Oct | 8 Oct | ₹— (Neutral) |

| Zelio E-Mobility | 30 Sep | 3 Oct | 8 Oct | ₹— (Neutral) |

| Chiraharit | 29 Sep | 3 Oct | 8 Oct | ₹— (Neutral) |

Listing Today: Infinity Infoway, Sheel Biotech, Munish Forge, Valplast Technologies, Zelio E-Mobility, and Chiraharit

The SME market continues to outperform, with Infinity Infoway leading the pack with a GMP of ₹44 (+28%), signaling strong retail appetite. Broad-based interest across multiple SME counters hints at sustained liquidity and confidence in small-cap growth stories.

Stocks in Radar — Market Outlook 8 October

Ashok Leyland Ltd

- CMP: ₹138

- Target: ₹170 (Upside 23.2%)

- Research By: SBI Securities — Diwali Pick

Business Overview:

Ashok Leyland is India’s 2nd largest commercial vehicle manufacturer, with a product portfolio spanning light, medium, and heavy trucks, buses, and specialized vehicles. It exports to over 50 countries, including South Asia, Africa, and the Middle East, making it a key player in the global CV market.

Investment Rationale — Why Investors Should Watch:

- Domestic Commercial Vehicle Recovery:

- Infrastructure and mining project execution is picking up, alongside a revival in logistics demand.

- GST rationalization on CVs (from 28% → 18%) and historically long truck replacement cycles (10–10.5 yrs vs 7–7.5 yrs) are expected to trigger an industry upcycle in 2HFY26.

- Strong Growth in Bus Segment:

- Ashok Leyland commands a 38% domestic bus market share.

- Greenfield facilities in Andhra Pradesh are being ramped up, and Lucknow plant expected online by 3QFY26.

- Expansion of Alwar and Trichy units may increase total bus production from 900 → 1,600 per month, capturing government tenders and private contracts.

- Electric Vehicle Division (Switch Mobility India):

- EV arm has turned PBT positive in 1QFY26 and aims for PAT breakeven by FY26.

- Order book of 1,500+ electric buses will be executed over the next 12–18 months.

- UK operations restructuring is progressing well, expected completion by early 3QFY26.

- Margin Expansion:

- Improved cost efficiencies, lower steel prices, favorable product mix, and disciplined pricing have steadily increased OPM.

- Higher share of Tippers and Multi-Axle Vehicles, which are more margin accretive, is expected to boost profitability further.

Financial Snapshot (Rs Cr)

| FY | Net Sales | EBITDA | OPM (%) | PAT | EPS (Rs) | P/E (x) | P/BV (x) | RoE (%) |

|---|---|---|---|---|---|---|---|---|

| FY24A | 38,367 | 4,607 | 12.0 | 2,632 | 4.5 | 30.8 | 9.2 | 29.9 |

| FY25A | 38,753 | 4,931 | 12.7 | 3,194 | 5.4 | 25.4 | 7.0 | 27.7 |

| FY26E | 41,635 | 5,351 | 12.9 | 3,505 | 6.0 | 23.0 | 6.3 | 28.3 |

| FY27E | 45,239 | 5,957 | 13.2 | 3,944 | 6.7 | 20.5 | 5.5 | 27.7 |

Valuation & Outlook:

- Trading at FY26E/FY27E P/E of 23.0x / 20.5x on standalone earnings.

- With expected CV recovery, EV growth, and steady margin improvement, ALL offers attractive medium-term upside.

Risks to Monitor:

- Increased competitive intensity impacting pricing

- Slower government capex spending

- Low acceptance or adoption of new product launches

Conclusion — Market Outlook 8 October

As we step into the trading day, markets are showing cautious optimism with SENSEX and NIFTY in positive trends, although the formation of an inverse hammer after four consecutive green candles suggests a potential minor correction. Key domestic developments, including strong festive demand in the automobile sector, government railway projects, and robust smartphone exports, continue to support economic growth.

Investors should monitor the latest corporate updates, IPO movements, and sectoral trends highlighted today, while keeping stop-loss levels and technical indicators in mind. With policy support, global opportunities, and strategic corporate actions, the Indian market presents both short-term trading opportunities and long-term growth potential.

In this newsletter, we bring you technical views, key news, IPO updates, and stocks to watch for today.

More Articles

How to Transfer Shares from Groww to Zerodha – Full Guide (2025)

Best Screener Queries for Stock Selection: Find Hidden Gems Before Others Do

How a Tea Seller Used the Power of Compound Interest to Build ₹45 Lakh