Introduction- Market Outlook 7 October

Good Morning and Welcome to Your Market Outlook 7 October Edition 🌅

Indian markets kicked off the week with a strong recovery, as the benchmark indices extended their rebound, driven by a mix of technical short-covering and sector rotation. After a week of volatility, investors found comfort in value buying across IT, banking, and large-cap counters, even as smallcaps saw mild profit booking.

The Nifty 50 surged 182.60 points (+0.73%) to close at 25,076.85, while the Sensex advanced 577.31 points (+0.71%) to 81,784.48. The Bank Nifty gained 0.90%, supported by strong moves in major private lenders, and the IT index rallied over 2.2% after consecutive declines, helped by a rebound in U.S. tech stocks and a softer dollar. However, smallcaps remained under slight pressure, slipping 0.22%, as investors shifted focus to large, liquid names amid global uncertainty.

Globally, markets turned cautiously optimistic as U.S. Treasury yields cooled off and oil prices steadied. Domestically, upbeat auto and power sector performance ahead of the festive season also helped lift sentiment.

As of this morning, Gift Nifty is trading flat, indicating a steady start for Indian markets today.

💡 In this newsletter, we bring you technical views, key news, IPO updates, and stocks to watch for today.

Index Outlook — Market Outlook 7 October

According to EquityPandit Analysis, Indian indices continue to show positive momentum as bulls regained control after last week’s pullback. Broader sentiment remains optimistic, supported by strong institutional inflows, improving global cues, and a rebound in IT and banking heavyweights.

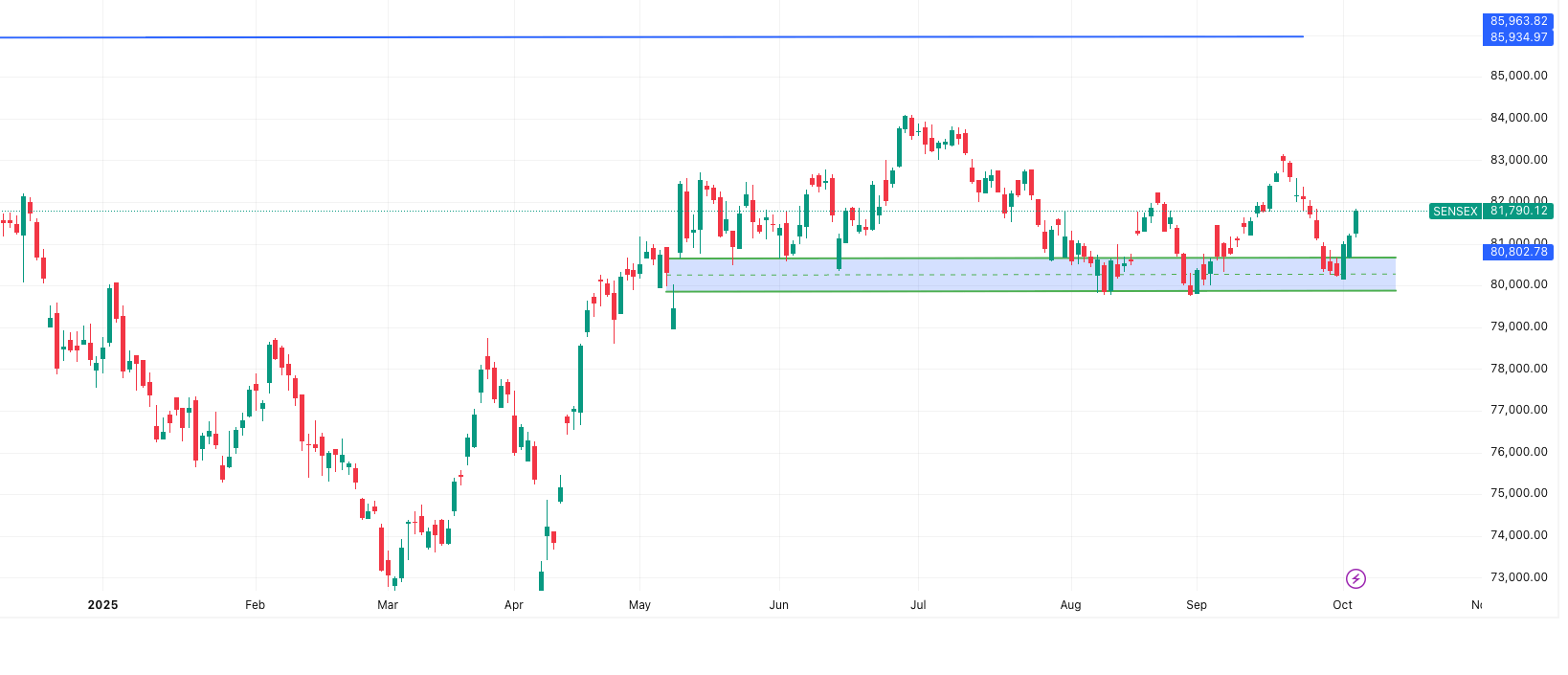

SENSEX Outlook

The Sensex remains in a positive trend after reclaiming key resistance levels.

If you are holding long positions, continue to hold with a daily closing stoploss of 80,877. A fresh short position can be initiated only if the index closes below 80,877.

- Support Levels: 81,349 – 80,907 – 80,658

- Resistance Levels: 82,039 – 82,288 – 82,730

- Tentative Range: 82,407 – 81,172

Viewpoint: The Sensex is likely to stay resilient above 80,800, with buying expected on dips. Any move above 82,000 could push it toward the next milestone of 82,500 in the near term.

NIFTY Outlook

The Nifty also maintains its positive structure, buoyed by renewed buying in IT, banking, and FMCG counters.

If you are holding long positions, continue to hold with a stoploss of 24,805 on a closing basis. Short positions may be considered only if Nifty closes below this level.

- Support Levels: 24,941 – 24,804 – 24,727

- Resistance Levels: 25,155 – 25,233 – 25,369

- Tentative Range: 25,260 – 24,894

Viewpoint: The Nifty’s momentum suggests that the next resistance at 25,233 will be crucial. Sustained strength above this level could extend gains toward 25,400, while dips near 24,900 may attract fresh buying.

BANK NIFTY Outlook

Bank Nifty continues to lead the charge, gaining nearly 500 points in the last session, driven by strength in private banks and improving credit growth outlook.

If you are holding long positions, continue to hold with a stoploss of 55,460 on a daily closing basis. Short trades can be considered only if the index falls below 55,460.

- Support Levels: 55,833 – 55,562 – 55,396

- Resistance Levels: 56,270 – 56,436 – 56,707

- Tentative Range: 56,582 – 55,626

Viewpoint: Bank Nifty looks poised to test 56,400–56,700 levels, with PSU banks showing renewed strength. As long as 55,500 holds, the trend remains firmly bullish.

Summary:

All three indices—Sensex, Nifty, and Bank Nifty—remain in positive territory, suggesting a stable and optimistic tone for the Market Outlook 7 October. Traders should maintain a buy-on-dips approach with strict stoploss discipline, as consolidation may continue before the next breakout.

News & Stocks – Market Outlook 7 October

The Market Outlook for 7 October reflects a cautiously positive tone, driven by strong corporate developments, global collaborations, and order-led earnings visibility across multiple sectors. Here are the key stories shaping today’s market action:

HCLTech partners with MIT Media Lab for next-gen AI innovation

IT major HCLTech announced a strategic collaboration with the prestigious MIT Media Lab at the Massachusetts Institute of Technology to co-develop AI, quantum computing, and human-centric innovation projects. The partnership will allow HCLTech to access advanced research ecosystems and co-create solutions that can shape the next wave of applied artificial intelligence.

This move highlights HCLTech’s long-term commitment to R&D-led digital transformation, coming right after its cautious margin guidance for FY26. With AI adoption now a global priority, the collaboration is expected to strengthen the company’s brand positioning in the innovation ecosystem and could trigger a rerating sentiment in the IT pack.

Stock to Watch: HCLTech Ltd — investors may track for follow-up announcements and global client traction post-collaboration.

JNK India bags ₹1,000 crore ultra-mega order from JNK Global

Heating equipment maker JNK India secured an ultra-mega order exceeding ₹1,000 crore from its Korean promoter JNK Global for support services and supplies to a refinery project in India. The order, scheduled for delivery by February 2028, strengthens the company’s visibility in the refinery and petrochemical furnace solutions segment.

The transaction—executed on an arm’s-length basis—underlines growing demand in India’s industrial and refinery infrastructure. With this win, JNK India has further cemented its leadership in the process heating equipment space, where it already commands nearly 27% market share.

Stock to Watch: JNK India Ltd — positive momentum likely as investors react to growing order book and refinery sector optimism.

AstraZeneca inks $555 million AI-driven gene-editing deal

Global pharma major AstraZeneca has signed a $555 million partnership with Algen Biotechnologies, a US-based AI and gene-editing startup. The collaboration aims to develop CRISPR-based therapies—a technology pioneered by Nobel laureate Jennifer Doudna—for treating immune system and rare diseases.

This deal underscores AstraZeneca’s growing interest in AI-assisted drug discovery and gene therapy innovation. While AI-led biotech remains in early stages globally, such collaborations are accelerating the pipeline of next-generation treatments, particularly in oncology and immunology.

Stock to Watch: AstraZeneca Pharma India Ltd — sentiment could improve as investors link the global deal to long-term innovation prospects in the domestic arm.

Groww acquires Fisdom ahead of ₹7,000 crore IPO

IPO-bound Groww completed its acquisition of wealth-tech startup Fisdom, marking its entry into the HNI and affluent wealth management space under a new vertical named “W.” This expansion diversifies Groww’s offerings beyond retail investing and mutual funds into advisory-led, high-margin services such as PMS and AIFs.

The move also comes right after regulatory clearance from SEBI and ahead of its ₹7,000 crore IPO filing, which includes a ₹1,060 crore fresh issue. With over ₹10,000 crore AUM and access to 400 million potential clients via partner banks, this acquisition enhances Groww’s long-term profitability and positions it strongly against incumbents like Zerodha and 360 One.

Stock to Watch: Groww (Pre-IPO) — investors should watch for IPO timing and valuation updates; could become one of India’s largest fintech listings.

Zydus Lifesciences gets USFDA approval for key DMD drug

Zydus Lifesciences received final approval from the USFDA for its generic version of deflazacort oral suspension (22.75 mg/mL), used in the treatment of Duchenne Muscular Dystrophy (DMD) — a rare genetic disorder affecting children.

The approval adds another molecule to Zydus’ expanding US pipeline, taking its total ANDA approvals to 424. This not only strengthens its US generics portfolio but also reinforces manufacturing credibility after a recent regulatory inspection. As the product will be manufactured at Doppel, Italy, it reflects Zydus’ global manufacturing network’s compliance and quality standards.

Stock to Watch: Zydus Lifesciences Ltd — sentiment may stay upbeat as new approvals continue to support export-led revenue growth.

Jindal Stainless opens fabrication unit near Mumbai

Jindal Stainless Ltd (JSL), through its subsidiary Jindal Stainless Steelway, launched a new ₹125 crore fabrication unit at Patalganga, Maharashtra. The 4-lakh sq. ft. facility will focus on bridge infrastructure components, enhancing JSL’s vertical integration from material supply to fabricated products.

By FY27, the facility aims to reach 18,000 tonnes annual capacity, up from 4,000 tonnes currently. This move is part of JSL’s strategy to capitalize on India’s infrastructure expansion, particularly in railways, bridges, and urban development. It will help the company capture higher value-add margins and establish a stronger domestic fabrication presence.

Stock to Watch: Jindal Stainless Ltd — likely to remain in focus amid strong infrastructure demand and margin improvement potential.

Overall Market Pulse

The Market Outlook for 7 October remains optimistic but selective, with stock-specific action expected in IT, metals, pharma, and capital goods. Investors may look for momentum opportunities in companies demonstrating structural growth visibility through innovation, expansion, or global tie-ups.

IPO Update – Market Outlook 7 October

As markets turn optimistic, the IPO lane stays busy with multiple new listings and strong subscription momentum across both mainboard and SME segments. Here’s a snapshot of the latest updates investors should track for Market Outlook 7 October:

Mainboard IPOs

| Company | Open Date | Close Date | Listing Date | GMP (₹) | Est. Listing Gain |

|---|---|---|---|---|---|

| Rubicon Research | 9 Oct | 13 Oct | 16 Oct | ₹80 | +16.5% |

| LG Electronics IPO | 7 Oct | 9 Oct | 14 Oct | ₹278 | +24.4% |

| Tata Capital IPO | 6 Oct | 8 Oct | 13 Oct | ₹12.5 | +3.8% |

| WeWork India IPO | 3 Oct | 7 Oct | 10 Oct | ₹– | Flat (0%) |

| Om Freight Forwarders IPO | 29 Sep | 3 Oct | 8 Oct | ₹2 | +1.5% |

| Advance Agrolife IPO | 30 Sep | 3 Oct | 8 Oct | ₹20 | +20.0% |

| Glottis IPO | 29 Sep | 1 Oct | 7 Oct | ₹– | Flat (0%) |

| Fabtech Technologies IPO | 29 Sep | 1 Oct | 7 Oct | ₹– | Flat (0%) |

Listing Today: Glottis IPO, Fabtech Technologies IPO

SME IPOs

| Company | Open Date | Close Date | Listing Date | GMP (₹) | Est. Listing Gain |

|---|---|---|---|---|---|

| Riddhi Display Equipments | — | — | — | ₹1 | +1.0% |

| DSM Fresh Foods | 26 Sep | 6 Oct | 9 Oct | ₹– | Flat (0%) |

| Chiraharit Ltd | 29 Sep | 3 Oct | 8 Oct | ₹– | Flat (0%) |

| Munish Forge | 30 Sep | 3 Oct | 8 Oct | ₹– | Flat (0%) |

| Zelio E-Mobility | 30 Sep | 3 Oct | 8 Oct | ₹– | Flat (0%) |

| Sheel Biotech | 30 Sep | 3 Oct | 8 Oct | ₹10 | +15.9% |

| Infinity Infoway | 30 Sep | 3 Oct | 8 Oct | ₹40 | +25.8% |

| Valplast Technologies | 30 Sep | 3 Oct | 8 Oct | ₹– | Flat (0%) |

IPO Pulse

The Market Outlook for 7 October highlights strong investor appetite in select mainboard IPOs, especially LG Electronics and Rubicon Research, where GMPs suggest double-digit listing gains. On the SME front, Infinity Infoway continues to attract massive interest with nearly 26% GMP ahead of its listing.

Overall, the primary market tone stays bullish — with tech, pharma, and manufacturing IPOs leading the sentiment.

Stocks in Radar – Market Outlook 7 October

Prince Pipes and Fittings Ltd (CMP: ₹324 | Target: ₹470 | Upside: 45%)

Research Source: ICICI Securities

Rating: BUY | Target Period: 12 months

Business Overview

Prince Pipes and Fittings Ltd (PPFL) is one of India’s leading manufacturers in the plastic piping industry, holding a 5% market share. Founded in 1987 and headquartered in Mumbai, the company operates 8 manufacturing units with a total capacity of 4.2 lakh MT, catering to diverse sectors — from plumbing and irrigation to industrial piping and sewage management. Its distribution network exceeds 1,500+ dealers nationwide, ensuring robust market presence under strong brands like Prince Pipes and Trubore.

Investment Rationale

1. Structural Demand Revival Ahead

The Indian government’s focus on affordable housing (PMAY Urban & Gramin) and clean water supply (Jal Jeevan Mission) is expected to double housing execution rates in the next 3–4 years.

With ₹10 lakh crore allocated under PMAY Urban 2.0 and ₹67,000 crore for Jal Jeevan Mission FY26, PPFL is well-placed to capture demand growth.

The plastic piping sector is projected to grow at 9–10% CAGR over FY25–FY27, driven by structural demand from housing and water projects.

2. Capacity Expansion to Drive Growth

PPFL’s capacity has grown at ~11% CAGR over FY21–FY25, with a new Bihar facility (52,188 tonnes) expected to enhance supply and market share.

Sales volume and revenue are expected to rise at 10% and 12% CAGR, respectively, over FY25–FY28.

3. Margin Expansion from Q2FY26

Stabilising PVC prices and an improved product mix (CPVC share rising to 25%) should lift EBITDA margins from 7% in Q1FY26 to 12% by Q4FY26.

ICICI Direct expects ~69% CAGR in PAT over FY25–FY28, led by stronger operational efficiency and lower inventory losses.

4. Financials at a Glance (₹ Crore)

| Metric | FY25 | FY26E | FY27E | FY28E | 3-Yr CAGR (FY25–28E) |

|---|---|---|---|---|---|

| Revenue | 2,524 | 2,765 | 3,139 | 3,583 | 12.4% |

| EBITDA | 162 | 258 | 340 | 429 | 38.4% |

| EBITDA Margin (%) | 6.4 | 9.3 | 10.8 | 12.0 | — |

| PAT | 43 | 82 | 139 | 207 | 68.7% |

| RoCE (%) | 3.3 | 7.3 | 10.6 | 13.7 | — |

5. Return Metrics to Rebound Strongly

Post FY25 trough (RoE 2.7%), returns are projected to improve to RoE 10.4% and RoCE 13.7% by FY28.

With OCF generation of ₹300 crore p.a. and reduced capex, debt reduction is likely to enhance the company’s financial strength.

Industry Context

The Indian plastic piping industry — valued at ₹500 billion — is witnessing consolidation, with top 5 players (Supreme, Astral, Finolex, Ashirvad, Prince) expanding market share from 38% to 46% in five years.

With upcoming anti-dumping duties on PVC imports and mandatory BIS certification, domestic organised players like Prince Pipes stand to gain from better pricing power and reduced import dependency.

Outlook

Prince Pipes is entering a multi-year growth upcycle supported by:

- Sustained demand from housing and irrigation projects

- Improved raw material pricing dynamics

- Rising CPVC contribution and operating leverage

At 25x FY28E P/E, ICICI Direct gives a BUY call with a target of ₹470, implying ~45% upside from current levels.

Conclusion – Market Outlook 7 October

As we step into the new trading week, the overall sentiment remains cautiously optimistic. The Nifty and Sensex continue to hold their positive trend, supported by strong domestic liquidity, easing global volatility, and renewed confidence from retail investors. With key indices maintaining healthy support levels, traders should continue to ride the uptrend with strict stop-loss discipline.

The IPO market stays vibrant, with several listings this week — including Glottis IPO and Fabtech Technologies IPO — signaling sustained investor appetite in the primary market. Meanwhile, strong grey market premiums for issues like LG Electronics and Rubicon Research hint at solid listing potential.

On the stock-specific front, Prince Pipes and Fittings Ltd stands out as a compelling medium-term opportunity backed by government-driven demand recovery, improved margins, and strong financial visibility. Broader market strength, along with continued institutional buying, could keep such sectoral leaders in focus.

In summary, the “Market Outlook 7 October” points toward a week of steady momentum — with eyes on inflation data, FII flows, and global cues. Staying selective in stock picking and disciplined in trades remains the key strategy for the days ahead.

Stay tuned, stay informed — and trade with clarity!

More Articles

When to Sell Mutual Funds: 5 Proven Exit Strategies

The Hidden Multibagger Stock: 5 Positive Triggers That Make Suven Life Sciences a Game-Changer

The Indian Retirement Savings Crisis: 5 Reasons EPF and PPF Won’t Be Enough