Market Outlook 4 November — Introduction

Good morning, traders and investors!

Welcome to your Pre-Market Newsletter for Market Outlook 4 November — your daily dose of market cues, stock trends, and trading insights before the bell rings.

On Monday, the Indian market started the week on a steady note — Nifty and Sensex held their ground, while Banking and Smallcap segments led the charge. The Nifty Bank index jumped over 0.6%, showing solid strength in financial counters, whereas IT stocks took a mild breather amid mixed global signals.

Here’s how the major indices closed (Source: Google Finance) —

- NIFTY 50: 25,768.25 ▲ +46.15 (0.18%)

- SENSEX: 84,010.52 ▲ +71.81 (0.09%)

- Nifty Bank: 58,120.95 ▲ +344.60 (0.60%)

- Nifty IT: 35,660.65 ▼ -51.70 (0.14%)

- S&P BSE SmallCap: 54,247.23 ▲ +371.09 (0.69%)

Despite global market caution, the domestic tone remains optimistic, supported by strong earnings, sectoral rotation, and robust retail participation.

So grab your morning coffee, because in today’s newsletter you’ll get —

- Key index levels for Nifty, Sensex, and Bank Nifty

- Top market-moving news and stocks to watch today

- Latest IPO updates from mainboard and SME markets

- Stock in focus — one company that deserves to stay on your radar today

Let’s dive in!

Index Outlook — Market Outlook 4 November

After a cautious start to the week, the Indian markets showed resilience on Monday, closing with modest gains despite mixed global cues. As we step into Tuesday’s session, investors are watching whether this stability can continue or if profit booking will weigh on sentiment. The Market Outlook 3 November suggests a technically sensitive phase where key indices are moving close to their respective resistance and support levels. According to EquityPandit’s analysis, the short-term trend across major indices like Sensex, Nifty, and Bank Nifty remains mildly negative, but select opportunities may arise if crucial breakout levels are crossed.

SENSEX — Market Outlook 4 November

The Sensex continues to remain under a mild negative bias, reflecting caution among institutional investors. Despite a few recovery attempts, the index is still struggling to maintain momentum above its upper range.

- Traders holding short positions can continue to hold with a daily closing stoploss of 84,542.

- A fresh long position can be considered only if the Sensex manages to close above 84,542, indicating renewed buying strength.

Support Levels:

- 83,683

- 83,388

- 83,166

Resistance Levels:

- 84,200

- 84,422

- 84,718

Tentative Range: 83,310 – 84,646

Overall, the Market Outlook 3 November indicates that the Sensex is likely to consolidate within this band unless a breakout triggers a directional move.

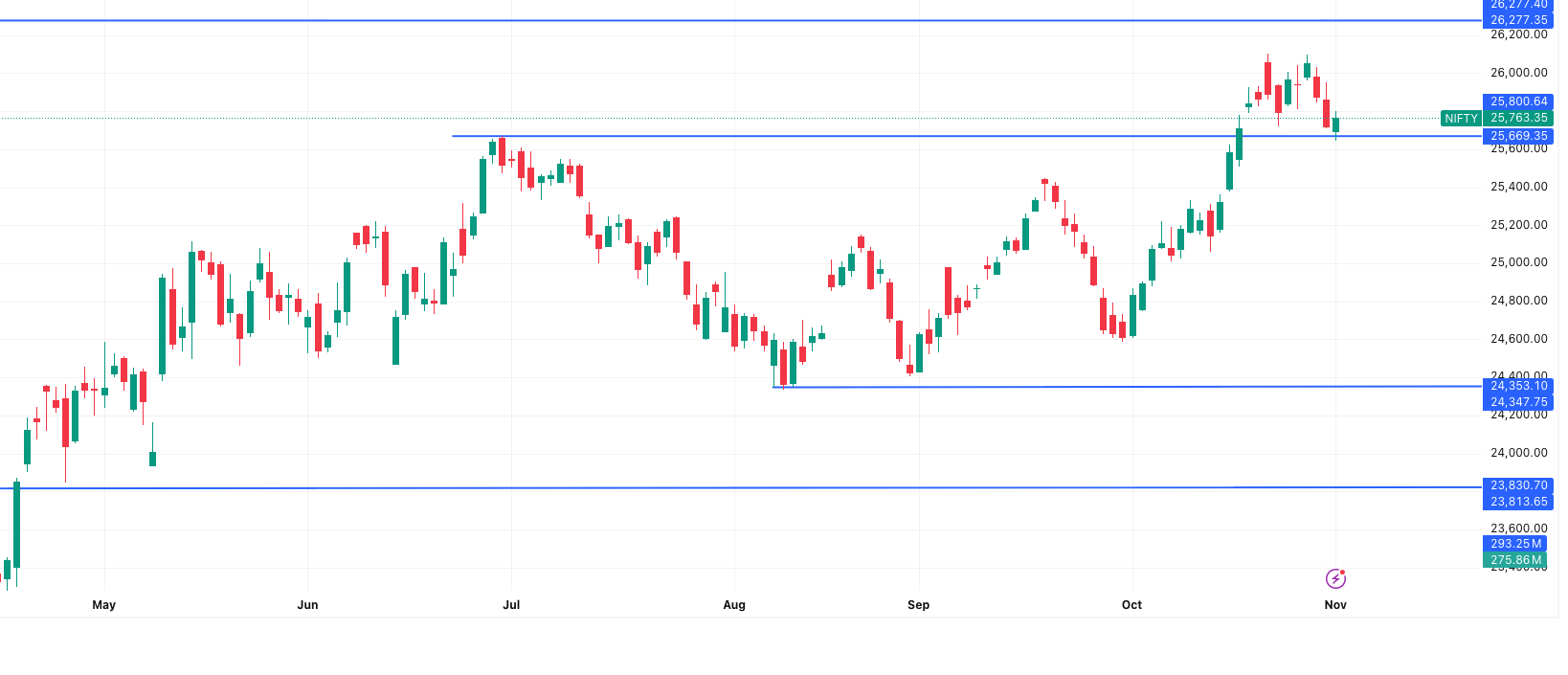

NIFTY 50 — Market Outlook 4 November

The Nifty 50 maintained a positive tone on Monday but still trades within a narrow range, suggesting indecision. The trend remains negative on a short-term basis, and traders are advised to stay alert to any shift in momentum near critical resistance zones.

- Short positions can be held with a stoploss at 25,927.

- Fresh long entries should only be initiated above 25,927 on a confirmed closing basis.

Support Levels:

- 25,672

- 25,580

- 25,514

Resistance Levels:

- 25,829

- 25,895

- 25,987

Tentative Range: 25,563 – 25,963

From a Market Outlook 3 November perspective, Nifty’s ability to sustain above 25,900 will decide whether a short-term uptrend can resume or if the index continues its sideways pattern.

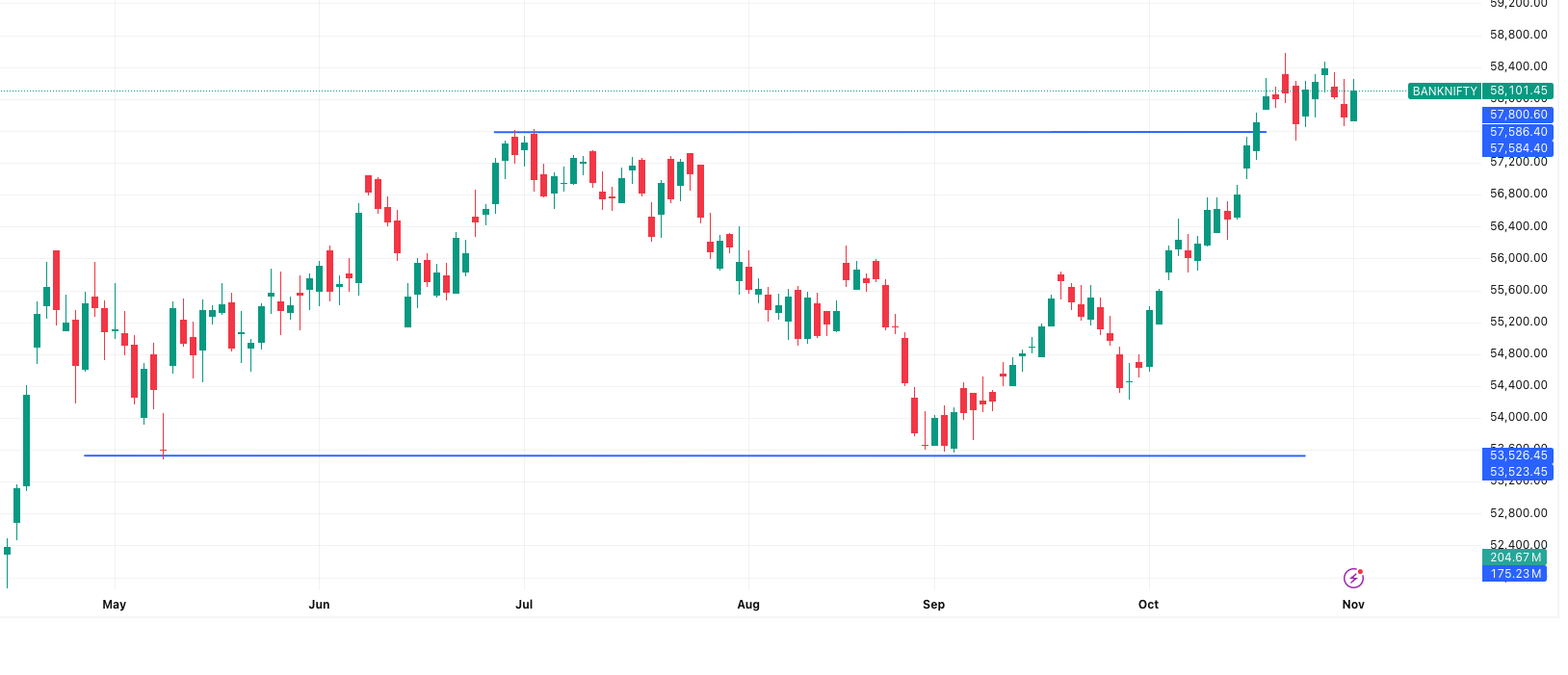

BANK NIFTY — Market Outlook 4 November

Bank Nifty recovered smartly on Monday, driven by select private banks, but still remains under short-term pressure. The sectoral index is in a consolidation phase, and traders should keep an eye on both range boundaries for trading opportunities.

- Short positions can be maintained with a stoploss at 58,393.

- Long positions may be considered above 58,393, only if supported by strong volume confirmation.

Support Levels:

- 57,797

- 57,493

- 57,268

Resistance Levels:

- 58,327

- 58,552

- 58,856

Tentative Range: 57,588 – 58,614

The Market Outlook 4 November for Bank Nifty suggests that the index is nearing a critical inflection point. Sustained movement above 58,400 could shift the bias positive, while failure to hold above 57,800 may trigger renewed weakness.

Overall View for Market Outlook 4 November:

Tuesday’s session may witness range-bound moves as the indices consolidate near key technical zones. The overall market tone remains cautious, with traders advised to follow strict stoplosses and avoid over-leveraging. Any decisive breakout above resistance levels could bring short-term momentum back into the markets, while weakness near supports may invite quick intraday selling.

Market News & Stocks to Watch — Market Outlook 4 November

The Market Outlook 29 October brings a mix of corporate developments, macroeconomic shifts, and foreign investment cues that are expected to shape today’s trading sentiment. Let’s dive into the top headlines that could move markets and identify key stocks to watch based on these updates.

1️⃣ Hero MotoCorp Sees 8% Drop in Domestic Sales Despite GST Overhaul

📄 Source: NDTV Profit

Hero MotoCorp Ltd., India’s largest two-wheeler manufacturer, reported an 8% YoY decline in domestic sales for October, even after significant price cuts following the GST rate reduction on sub-350 cc motorcycles from 28% to 18%.

- Total Domestic Sales: 6.5 lakh units (vs 6.57 lakh last year)

- Total Two-Wheeler Sales: 6.36 lakh units (down 6.4% YoY)

- Exports: 30,979 units (up 42.8% YoY)

- Models with Major Price Cuts: Karizma 210 (-₹15,743), Xpulse 210 (-₹14,516), Xtreme 250R (-₹14,055)

- Scooter Segment Discounts: Pleasure Plus, Destini 125, Xoom 160

Despite aggressive price revisions, the expected volume growth did not materialize, indicating sluggish rural demand and increased competition from peers like Bajaj Auto and TVS Motor.

📊 Stock to Watch: Hero MotoCorp (HEROMOTOCO) – Monitor for short-term weakness due to sales pressure. Competitors like TVS Motor and Bajaj Auto could see relative strength as they benefit from festive demand momentum.

2️⃣ U.S. Crude Imports to India Surge — Russia Still Top Supplier

📄 Source: NDTV Profit

India’s crude oil import mix is shifting once again. In October, U.S. oil shipments to India surged to a four-year high of 568,000 barrels per day (bpd) — roughly 12% of India’s total crude imports, as per Kpler data.

- Russia’s Share: 1.62 million bpd (34%) — remains top supplier

- Iraq: 826,000 bpd (2nd largest supplier)

- Saudi Arabia: 669,000 bpd (3rd largest)

- Total Imports: 4.81 million bpd (up 3% MoM)

Despite ongoing U.S. sanctions on Rosneft and Lukoil, India continues to maintain diversified sourcing while focusing on affordability and energy security for its 1.4 billion population.

📊 Stock to Watch: ONGC, Indian Oil Corp (IOC), BPCL, Reliance Industries (RIL) – Expect volatility in oil-linked counters as refiners balance costs amid changing import dynamics.

3️⃣ Maruti Suzuki Aims for 50% Market Share by 2030

📄 Source: NDTV Profit

Maruti Suzuki India Ltd. is setting an ambitious goal of capturing 50% of the domestic passenger vehicle market by 2030, as revealed by Chairman R.C. Bhargava. The automaker achieved record sales in October, fueled by festive demand and post-GST rate cut momentum.

- October Domestic Sales: 1,80,675 units (up 10.75% YoY)

- Passenger Vehicle Sales: 1,76,318 units (up 10.48% YoY)

- Retail Sales in Oct: 2,42,096 units – Highest ever for any October

- Festive Season Bookings: 5 lakh (4.1 lakh retail sales achieved)

- Exports Target: 7.5–8 lakh units by FY31

The company attributes the surge to renewed demand from first-time buyers and strong urban market sentiment post-GST reforms.

📊 Stock to Watch: Maruti Suzuki (MARUTI) – Momentum remains bullish; analysts expect continued outperformance amid strong festive and export guidance.

4️⃣ Raghuram Rajan Flags Risks from U.S. ‘HIRE Act’ Targeting Outsourcing

📄 Source: NDTV Profit

Former RBI Governor Raghuram Rajan has raised concerns about the proposed Halting Relocation of Employment (HIRE) Act in the U.S., which seeks to impose a 25% tax on payments made to outsourced workers abroad.

Rajan warned that such a move could hurt India’s IT and services exports, as it effectively acts like a tariff on digital services. He believes the act could have a greater impact on India than the recent H-1B visa fee hikes.

- The act will prohibit U.S. firms from claiming outsourced payments as tax-deductible expenses.

- Potentially affects IT giants with large U.S. exposure like Infosys, TCS, Wipro, HCLTech.

- Rajan noted that firms might respond by expanding offshore centres in India to retain cost advantages.

📊 Stock to Watch: TCS, Infosys, Wipro, HCLTech – Keep watch for sentiment dips in IT sector due to U.S. policy uncertainty.

5️⃣ Foreign Investors Boost Indian Bond Holdings on Rate-Cut Hopes

📄 Source: Economic Times

Foreign portfolio investors (FPIs) bought ₹13,400 crore ($1.5 billion) worth of Indian government bonds in October — the highest monthly inflow this fiscal year under the Fully Accessible Route (FAR).

- Ownership of FAR Bonds: 6.9%, up nearly 2x in two years

- Reason: Anticipation of rate cuts by RBI in December

- Top Bonds Purchased: 7.38% 2027, 7.06% 2028

- Motivation: Wider yield spread vs. U.S. Treasuries and index inclusion by JPMorgan, FTSE Russell, and Bloomberg

This marks the fourth straight month of net inflows into Indian debt, signalling renewed global interest in India’s fixed income market.

📊 Stock to Watch: State Bank of India (SBI), HDFC Bank, ICICI Bank – Likely beneficiaries of improving bond liquidity and potential rate cuts.

6️⃣ Smartworks Leases 8.15 Lakh Sq. Ft. from Hiranandani Group in Mumbai

📄 Source: Economic Times

Smartworks Coworking Spaces Ltd. has leased 8.15 lakh sq. ft. of prime office space in Vikhroli, Mumbai from Hiranandani Group, marking what will become the largest managed workspace campus globally.

- Developer: Regalia Office Parks Pvt. Ltd. (Hiranandani Group)

- Facility Operational By: Q4 CY2026

- Smartworks Total Portfolio: 12 million sq. ft. across 14 cities in India & Singapore

- Recent Lease: 5.57 lakh sq. ft. in Navi Mumbai’s Intellion Park

This move strengthens Smartworks’ leadership in the flexible workspace segment, targeting mid-to-large enterprises with global-standard infrastructure.

📊 Stock to Watch: Smartworks Coworking Spaces Ltd. – Positive long-term sentiment in commercial realty sector; Hiranandani-related REITs and real estate developers may benefit from increased demand for managed office spaces.

7️⃣ Aquilius Raises $1.1 Billion for Asia’s Largest Real Estate Secondaries Fund

📄 Source: Economic Times

Singapore-based Aquilius Investment Partners has raised $1.1 billion for its Asia Pacific Real Estate Secondaries Fund II, making it the largest of its kind in the region.

- Primary Focus: Japan, Korea, India, and Australia

- Deployment: 50% capital already invested across 8 deals

- Investors: Sovereign and pension funds from Asia & Middle East

- Target Sectors: Data centres, logistics, and modern living spaces

With global alternative assets expected to touch $29.2 trillion by 2029, this surge in secondary real estate investments indicates institutional confidence in Asian growth markets.

📊 Stock to Watch: DLF, Godrej Properties, Prestige Estates, Embassy REIT – Potential beneficiaries of renewed foreign capital inflows into real estate secondaries.

Summary — Market Outlook 4 November:

From auto sector churn to global capital inflows, today’s landscape reflects a dynamic mix of domestic adjustments and international trends. Auto majors remain in focus amid GST-led shifts, while IT and bond markets face evolving macroeconomic forces. Keep watch on oil refiners, realty, and auto counters — sectors likely to dominate discussions in Tuesday’s trade setup.

IPO Updates & Events – Market Outlook 4 November

The Market Outlook 4 November brings an action-packed IPO lineup as investors gear up for one of the busiest weeks on Dalal Street this season. With Groww IPO opening for subscription today and several other issues nearing listing, primary market sentiment remains upbeat despite cautious index movement.

Let’s take a closer look at the mainboard IPOs and their GMP performance, listing dates, and expected listing gains.

Mainboard IPOs – Market Outlook 4 November

| Company Name | Open Date | Close Date | Listing Date | GMP (₹) | Est. Listing Gain (%) |

|---|---|---|---|---|---|

| Groww IPO | 4-Nov-2025 | 7-Nov-2025 | 12-Nov-2025 | ₹17 | 17.00% |

| Lenskart Solutions Ltd. | 31-Oct-2025 | 4-Nov-2025 | 10-Nov-2025 | ₹62 | 15.42% |

| Pine Labs IPO | 7-Nov-2025 | 11-Nov-2025 | 14-Nov-2025 | ₹35 | 15.84% |

| Studds Accessories Ltd. | 30-Oct-2025 | 3-Nov-2025 | 7-Nov-2025 | ₹70 | 11.97% |

| Orkla India IPO | 29-Oct-2025 | 31-Oct-2025 | 6-Nov-2025 | ₹75 | 10.27% |

Highlight: The much-awaited Groww IPO opens for subscription today, expected to attract strong investor participation given its high retail visibility and fintech sector appeal. Meanwhile, Lenskart IPO closes today, with robust subscription numbers building optimism for a premium listing next week.

SME IPOs – Market Outlook 4 November

| Company Name | Open Date | Close Date | Listing Date | GMP (₹) | Est. Listing Gain (%) |

|---|---|---|---|---|---|

| No active SME IPOs with available GMP data | – | – | – | – | – |

At present, the SME segment remains relatively quiet, with no fresh issues commanding visible grey market premium (GMP) activity. However, post-Diwali, several SME filings are in the pipeline and could reignite investor interest in micro-cap listings.

Quick Take – Market Outlook 4 November

As we step into the first trading week of November, Groww IPO’s debut on the subscription floor adds fresh momentum to the primary market. Lenskart’s final day of bidding and Studds’ upcoming listing will keep retail and institutional investors equally active.

Stay tuned — we’ll bring you detailed subscription status updates and GMP movements throughout the week as India’s IPO calendar heats up!

Stocks in Focus – Market Outlook 4 November

In today’s Market Outlook 4 November, our spotlight stock is Transport Corporation of India (TCI) — a logistics giant that continues to demonstrate resilience even amid a softer demand cycle. Backed by strong fundamentals and a diversified business model, ICICI Securities has maintained its BUY rating on the stock with a target price of ₹1,500, implying a 24% upside from the current market price (CMP) of ₹1,205.

Transport Corporation of India (TCI)

Sector: Logistics

CMP: ₹1,205

Target Price: ₹1,500

Upside Potential: +24%

Recommendation: BUY (Maintained)

Research Source: ICICI Securities

Company Overview

Transport Corporation of India (TCI) is one of India’s most established logistics players, offering end-to-end solutions across freight, seaways, and supply chain services. Despite subdued demand in certain segments, the company has managed to deliver steady financial performance and maintain profitability through diversification and disciplined cost control.

- Q2FY26 EBITDA: ₹1,267 million — up 8.2% YoY, though slightly below estimates.

- Revenue Growth: 7.5% YoY, supported by its SCS (Supply Chain Solutions) segment, which posted ~32% revenue growth.

- EBITDA Margin: Stable at 10.5%, reflecting operational consistency.

- Capex Plans: ₹4 billion earmarked for FY26 to enhance capacity and logistics efficiency.

Key Investment Highlights

- Diversified Business Model: Exposure across freight, supply chain, and seaways divisions reduces dependence on any single segment.

- Strategic Growth Path: Management maintains 10–12% revenue growth guidance for FY26, with margins expected to stay robust.

- Supply Chain Boom: Demand surge in Q2FY26 was driven by GST reforms, benefiting warehousing and logistics.

- Infrastructure Push: Commissioning of a 285,000 sq. ft. warehouse in Eastern India supports the next leg of growth.

- Seaways Division Recovery Ahead: New ships scheduled to join the fleet in FY27 should improve voyage frequency and margins.

Financial Snapshot

| Metrics | FY25A | FY26E | FY27E |

|---|---|---|---|

| Net Revenue (₹ mn) | 44,918 | 49,821 | 55,373 |

| EBITDA (₹ mn) | 4,611 | 5,183 | 5,736 |

| EBITDA Margin (%) | 10.3 | 10.4 | 10.4 |

| Net Profit (₹ mn) | 4,161 | 4,486 | 5,321 |

| EPS (₹) | 53.4 | 57.6 | 68.3 |

| P/E (x) | 22.6 | 20.9 | 17.6 |

| RoCE (%) | 13.4 | 12.7 | 11.6 |

Outlook – Why It’s in Focus Today

In today’s Market Outlook 4 November, TCI stands out for its ability to maintain growth guidance even in a mixed demand environment. Its expansion in supply chain services, steady RoCE near 15%, and continued infrastructure investments make it a solid pick for medium-term investors.

ICICI Securities expects freight margins to recover in FY27, driven by a higher share of LTL (Less-than-Truckload) business and easing cost structures. While near-term softness may persist, long-term visibility remains strong — making TCI a high-conviction buy in the logistics sector.

Source: ICICI Securities Research Report

Conclusion – Market Outlook 4 November

As we wrap up today’s Market Outlook 4 November, Indian equities continue to show resilience amid mixed global cues. After Monday’s modest gains, the setup for Tuesday looks cautiously optimistic — with Nifty and Sensex attempting to reclaim higher support zones while Bank Nifty shows early signs of strength.

On the IPO front, Groww IPO remains in focus as retail participation continues to build strong momentum, while Studds Accessories gears up for listing this week. The broader sentiment in the mainboard IPO space stays upbeat with a healthy grey market trend.

Among stocks, Transport Corporation of India (TCI) takes center stage — backed by its diversified business mix and stable financial performance. With a target price of ₹1,500, the stock offers an attractive 24% upside, reaffirming investor confidence in India’s logistics growth story.

Going into the session, traders should monitor 25,580–25,890 levels on Nifty and 83,700–84,400 on Sensex as key intraday zones. Maintaining discipline with stop-losses and selective buying in sectors like logistics, auto, and banking could work best in this environment.

Stay tuned to our daily updates for more actionable insights and sector highlights.

Read full details and previous issues here 👉 Onedemat Newsletter Section

References

- NSE India — for benchmark index data & FPI flows.

- BSE India — for corporate results and announcements.

- Moneycontrol — for real-time market coverage.

- Economic Times Markets — for expert commentary and sectoral analysis.

Read Daily Market Update here: