Introduction — Market Outlook 31 October

Good morning and welcome to your Pre-Market Newsletter — Market Outlook 31 October.

Welcome to today’s edition of our Daily Market Newsletter, where we bring you a crisp yet comprehensive look at how the markets are shaping up.

After a strong start to the week, Dalal Street witnessed some consolidation on the last trading day as global cues turned cautious. According to Google Finance, the benchmark indices ended in the red on Tuesday, led by selling in banking and IT counters.

The Nifty 50 slipped 165 points (-0.63%) to close at 25,888.80, while the Sensex dropped 530 points (-0.62%) to settle at 84,466.64. Banking stocks also saw pressure, with the Nifty Bank losing 317.80 points (-0.54%) and closing at 58,067.45. The Nifty IT index cooled off by 0.50%, ending at 35,910.95 amid mild profit booking in large-cap tech names.

Broader market sentiment was mixed, with the S&P BSE SmallCap index almost flat at 54,086.27 (-0.067%), suggesting select buying interest persisted among smaller stocks.

As we look ahead, today’s Market Outlook 31 October dives into the key index trends, stock-specific action, IPO developments, and institutional insights that could guide your trading and investing decisions for the day.

Let’s begin by exploring where the major indices are headed next in our Index Outlook section.

Index Outlook — Market Outlook 31 October

After a sharp pullback in the previous session, Indian indices enter Wednesday’s trade with mixed signals. According to EquityPandit’s analysis, both the Nifty and Sensex are still holding within a positive trend zone, though momentum has cooled slightly. On the other hand, Bank Nifty continues to trade with a negative bias, showing near-term resistance at higher levels.

Let’s break down today’s Market Outlook 31 October for each major index with their key levels and ranges:

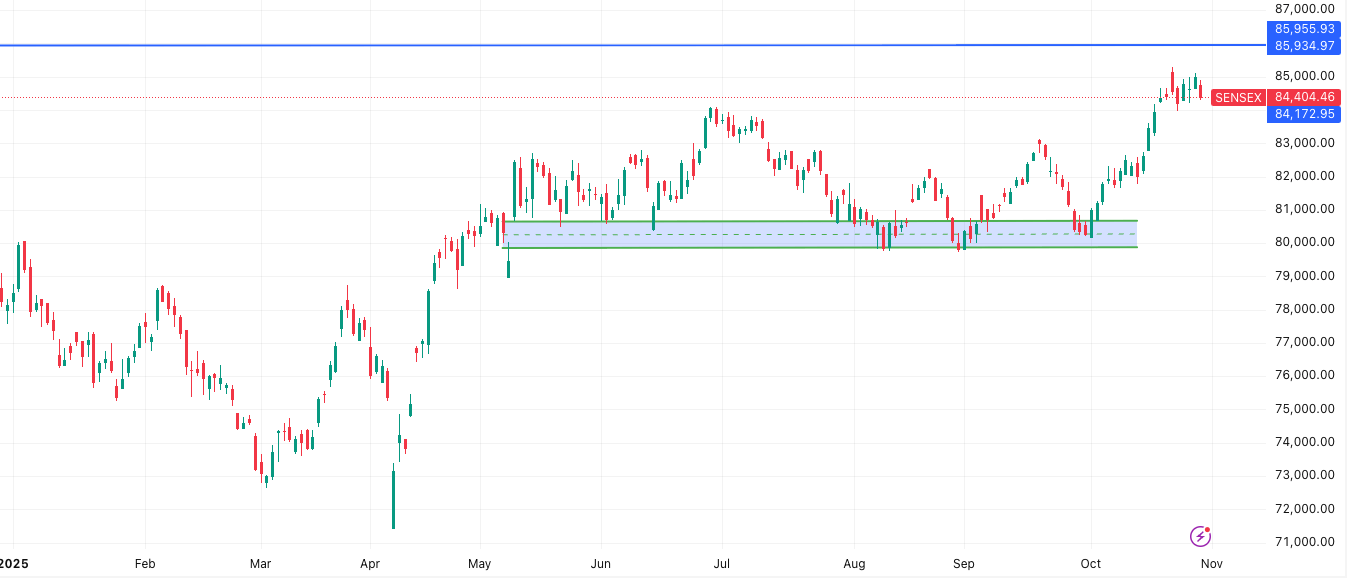

SENSEX Outlook — Market Outlook 31 October

The Sensex maintained a positive structure despite the previous day’s correction. As long as it stays above its critical support, the uptrend remains intact.

- Support Levels: 84,176 – 83,947 – 83,581

- Resistance Levels: 84,770 – 85,136 – 85,364

Trading View:

Traders holding long positions should continue to hold with a daily closing stop-loss at 84,194. A close below this level could signal short-term weakness. Fresh short positions can be considered only if the index closes below that mark.

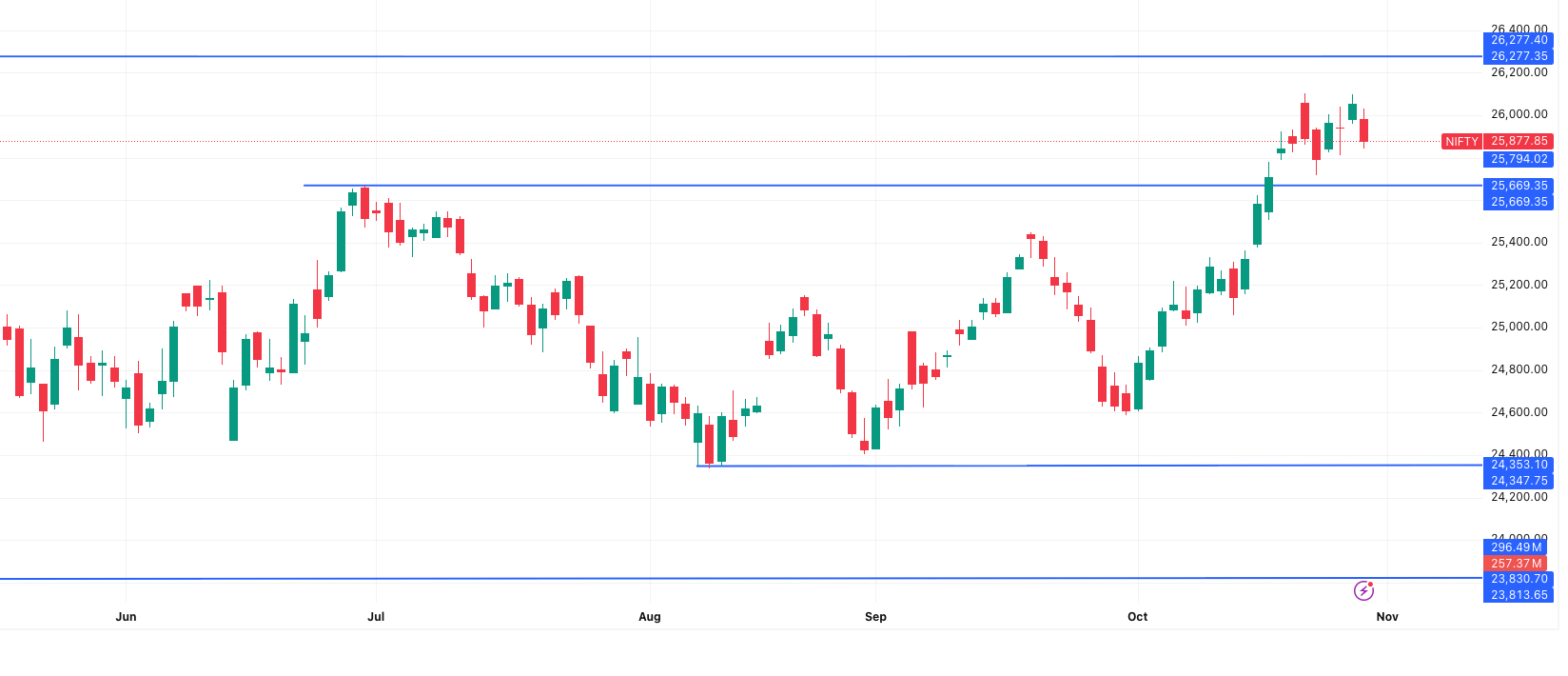

NIFTY 50 Outlook — Market Outlook 31 October

Nifty continues to hover within a broader consolidation range, yet maintains a mild bullish undertone.

- Support Levels: 25,805 – 25,732 – 25,618

- Resistance Levels: 25,992 – 26,105 – 26,178

Trading View:

The index is expected to move within a tentative range of 25,677 – 26,078. As long as Nifty sustains above 25,826, the bias stays positive. A close below that could invite further profit booking pressure.

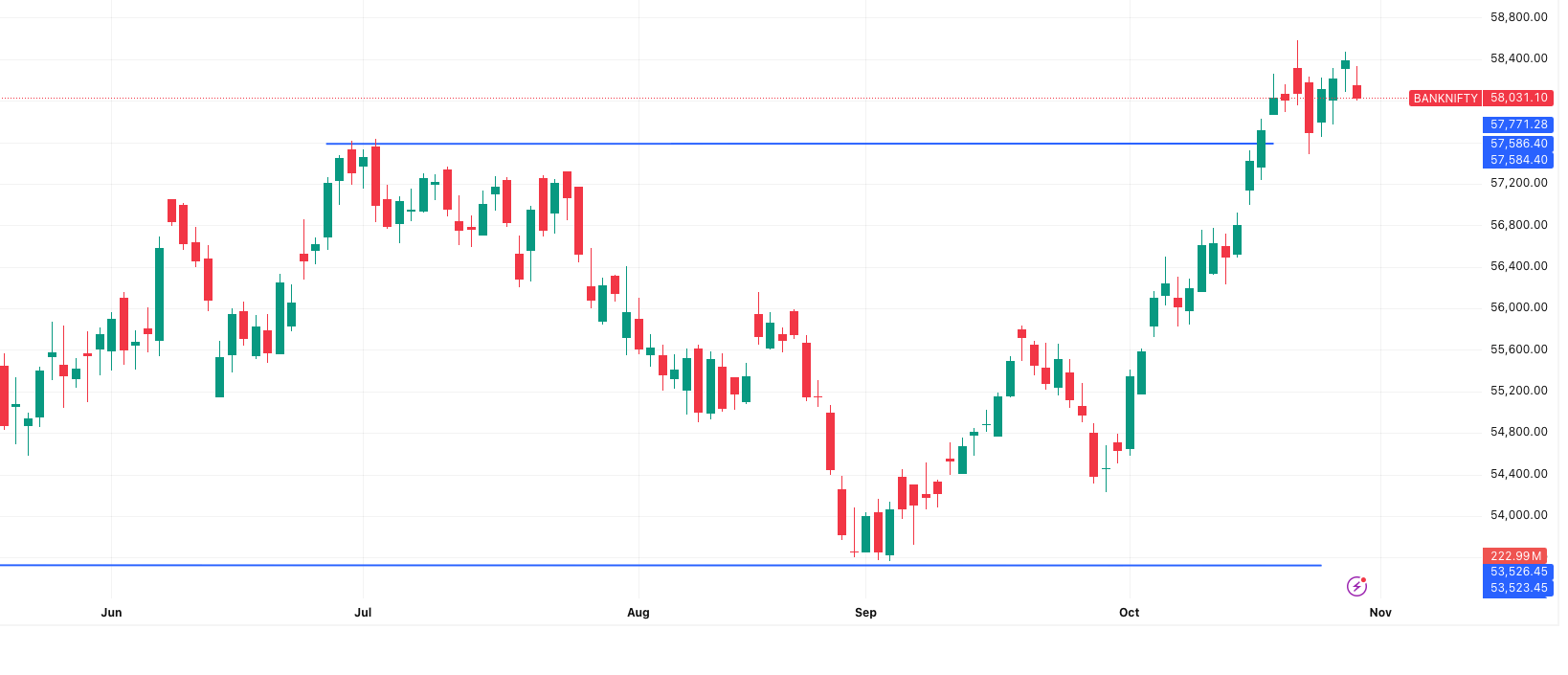

BANK NIFTY Outlook — Market Outlook 31 October

Bank Nifty continues to underperform, showing signs of consolidation after a steady slide.

- Support Levels: 57,910 – 57,789 – 57,578

- Resistance Levels: 58,242 – 58,453 – 58,574

Trading View:

The trend remains negative unless Bank Nifty closes above 58,393, which could open the door for a short-term reversal. Until then, traders can maintain short positions with strict stop-loss levels.

In summary:

The Market Outlook 31 October suggests that while Nifty and Sensex are still holding their bullish structures, volatility is creeping in. Bank Nifty’s weakness could continue to act as a drag on sentiment. Traders should stay cautious around resistance zones and protect profits with tight stop-losses as global cues remain mixed.

News & Stocks to Watch — Market Outlook 31 October

The markets are set for an eventful day as multiple domestic and global developments shape investor sentiment. From rare earth magnet breakthroughs and defence orders to billion-dollar fundraising plans, here’s everything driving the Market Outlook 31 October — along with key stocks to watch for each story.

India Grants First Chinese Rare Earth Magnet Import Licences — A Boost for EV & Auto Sector

Source: Firstpost

In a landmark move, the Indian government has issued the first set of import licences to four domestic firms — including the Indian arms of Hitachi and Continental India — allowing them to directly procure rare earth (RE) magnets from China.

This comes after months of supply strain triggered by Beijing’s export restrictions on critical components like neodymium-iron-boron (NdFeB) magnets, essential for EV motors, wind turbines, and high-tech devices.

The decision ends a major bottleneck for Indian automakers and component manufacturers, who had been struggling with sourcing these magnets through indirect routes.

Why it matters:

- These licences restore supply stability for India’s EV and auto manufacturing ecosystem.

- Automakers can now avoid costly redesigns since they can import magnets instead of entire motor assemblies.

- It’s a short-term fix until India develops a domestic RE supply chain.

Stock to Watch:

Tata Motors, Bosch, Motherson Sumi, and Samvardhana Motherson International — expected to benefit from eased input costs and smoother production cycles.

India Gets Six-Month US Sanctions Waiver on Iran’s Chabahar Port

Source: NDTV Profit

The Ministry of External Affairs (MEA) confirmed that the US has granted India a six-month exemption from sanctions on Iran’s Chabahar Port — a vital trade and connectivity link to Afghanistan and Central Asia.

The waiver, which follows extensive diplomatic discussions, ensures continued operations at the port under the 10-year agreement between Indian Ports Global Ltd. (IPGL) and Iran’s Port and Maritime Organisation.

Why it matters:

- The Chabahar Port helps India bypass Pakistan for trade with Central Asia.

- It also enhances India’s strategic and humanitarian reach in the region, particularly in Afghanistan.

- The port’s operations support India’s foreign policy objectives in regional connectivity and stability.

Stock to Watch:

Adani Ports & SEZ (APSEZ) — though not directly involved, sentiment for Indian port operators may rise on optimism over regional trade expansion.

Bharat Electronics (BEL) Secures ₹732 Crore in New Defence Orders

Source: NDTV Profit

Defence PSU Bharat Electronics Ltd (BEL) announced fresh orders worth ₹732 crore since October 22, including key deals for:

- Software Defined Radios (SDRs) — jointly developed with DRDO

- Tank subsystems, missile components, cybersecurity solutions, and financial management software

The company also received approval from the Andhra Pradesh government to set up an integrated defence manufacturing complex in Gorantla (Sri Sathya Sai district) with an investment of ₹2,500 crore.

Why it matters:

- These orders strengthen BEL’s defence communication systems portfolio.

- The new complex will boost high-tech manufacturing and employment in southern India.

- The project aligns with the government’s “Make in India – Defence” initiative.

Stock to Watch:

Bharat Electronics Ltd (BEL) — positive outlook with a rising order book and large-scale expansion plans.

Swiggy Plans ₹10,000 Crore Fundraise via QIP to Boost Quick Commerce War Chest

Source: Moneycontrol

Food and grocery delivery platform Swiggy has announced plans to raise up to ₹10,000 crore through qualified institutional placement (QIP) and other modes. The proposal will be reviewed by its Board on November 7, 2025.

The company aims to use the proceeds for technology upgrades, network expansion, and Instamart’s quick commerce operations as competition intensifies against Zepto, Blinkit, and Reliance JioMart.

Key Highlights:

- Recent Q2 FY26 results: Revenue up 54% YoY to ₹5,561 crore, but net loss widened to ₹1,092 crore.

- Swiggy sold its stake in Rapido for ₹2,400 crore to boost cash reserves.

- The company is preparing for a potential IPO in the next 12–18 months.

Stock to Watch:

Swiggy & Zomato Ltd. — as Swiggy’s closest listed peer, Zomato’s stock could see action as investors reassess competition and valuations in India’s quick commerce sector.

PhysicsWallah Eyes ₹3,820 Crore IPO Amid Strong Growth

Source: CNBC TV18

Edtech unicorn PhysicsWallah (PW) is reportedly gearing up for an IPO worth ₹3,820 crore, with a fresh issue of ₹3,100 crore and an OFS worth ₹720 crore by founders Alakh Pandey and Prateek Boob.

The company, backed by WestBridge Capital and Hornbill Capital, plans to use the proceeds for marketing, offline expansion, and subsidiary investments.

Key Financials:

- FY24 Revenue: ₹1,940 crore

- FY24 Loss: ₹1,130 crore

- Current Valuation: ~₹5 billion

- Paid users: 44.6 lakh in FY25

Stock to Watch:

Nazara Technologies, Happiest Minds, and Info Edge — could see sentiment spillover as investors eye growth-oriented tech and digital learning plays.

Razorpay & NPCI Partner to Enable UPI Payments in Malaysia

Source: Moneycontrol

Fintech leader Razorpay, via its Malaysian arm Curlec, has teamed up with NPCI International Payments Ltd (NIPL) to enable UPI payments for Indian travellers in Malaysia.

The move allows seamless rupee-linked payments at local merchants, settled in Malaysian Ringgit, enhancing cross-border UPI reach.

Why it matters:

- Over 1 million Indian tourists visited Malaysia in 2024, spending ₹11,000 crore.

- The collaboration boosts India’s position as a global fintech exporter.

- Extends UPI’s global presence — already active in Singapore, UAE, France, Nepal, and Mauritius.

Stock to Watch:

Paytm (One97 Communications) — may benefit from renewed investor optimism around UPI expansion and fintech interoperability.

Summary — Market Outlook 31 October

India’s market narrative today is powered by strong policy moves, defence sector orders, and strategic fundraising by startups. The macro picture suggests a balancing act between industrial recovery and tech-driven growth momentum, keeping investors selectively bullish.

Key Stocks to Track Today:

- BEL (Defence orders surge)

- Zomato (Swiggy fundraise impact)

- Tata Motors (Auto component relief)

- Adani Ports (Geopolitical trade optimism)

- Paytm (UPI global expansion theme)

IPO Update — Market Outlook 31 October

India’s IPO market continues to stay buzzing as investors eye strong grey market premiums (GMP) and active SME participation. With multiple listings and subscriptions underway, here’s your Market Outlook 31 October IPO tracker — from mainboard heavyweights like Groww and Lenskart to SME gems like Jayesh Logistics.

For full IPO analysis, live GMPs, and subscription data, visit our Mainboard IPO section.

Mainboard IPO Tracker

| IPO Name | GMP (Listing Gain) | Open Date | Close Date | Listing Date |

|---|---|---|---|---|

| Groww IPO | ₹11.5 (+11.50%) | 4-Nov | 7-Nov | 12-Nov |

| Lenskart Solutions IPO | ₹59 (+14.68%) | 31-Oct | 4-Nov | 10-Nov |

| Studds Accessories IPO | ₹65 (+11.11%) | 30-Oct | 3-Nov | 7-Nov |

| Orkla India IPO | ₹67 (+9.18%) | 29-Oct | 31-Oct | 6-Nov |

Listing Today: Orkla India IPO debuts with a strong ₹67 GMP, signaling an estimated +9.18% listing gain potential.

Explore detailed insights and live updates in our Mainboard IPO Coverage.

SME IPO Tracker

| IPO Name | GMP (Listing Gain) | Open Date | Close Date | Listing Date |

|---|---|---|---|---|

| Jayesh Logistics (NSE SME) | ₹9 (+7.38%) | 27-Oct | 29-Oct | 3-Nov |

SME counters continue to witness robust participation, reflecting strong investor appetite for niche growth stories. Keep an eye on Jayesh Logistics, which is set to list this week with a healthy grey market signal.

✨ Summary — Market Outlook 31 October

As the IPO season heats up, all eyes are on Lenskart, Groww, and Studds Accessories for potential listing pops. On the SME front, Jayesh Logistics is gaining traction among retail investors. The market sentiment remains upbeat, backed by strong subscription figures and consistent grey market demand.

Stock in Focus — Market Outlook 31 October

Today’s Market Outlook 31 October highlights Gujarat Pipavav Port Ltd (GPPL) — a strategically located port operator with strong infrastructure, improving connectivity, and solid volume growth momentum. Backed by SBI Securities’ “Pick of the Day”, this stock stands out as a short-to-medium-term opportunity in India’s logistics and infrastructure play.

📄 Source: SBI Securities Report

About the Company

Gujarat Pipavav Port Ltd (NSE: GPPL | BSE: 533248) is a private sector port on India’s west coast, located in Gujarat. Operated by APM Terminals, part of one of the world’s most extensive port networks, GPPL plays a key role in India’s global trade corridor — linking to the Middle East, Africa, Europe, and the Americas.

Stock Snapshot

| Parameter | Details |

|---|---|

| CMP (₹) | 169 |

| Target (₹) | 194 |

| Upside Potential (%) | 15.0% |

| Duration | 6–12 Months |

| Market Cap (₹ Cr) | 8,168 |

| Promoter Holding (%) | 44.0 |

| Pledge (%) | Nil |

| Avg. Volume (5D/30D, Lakh) | 9.7 / 17.8 |

| Avg. Delivery (5D/30D, Lakh) | 5.4 / 9.1 |

| Accumulation Range (₹) | 167 – 171 |

Investment Rationale

1. Strategic Infrastructure & Location Advantage

- Pipavav Port sits along a major international maritime trade route, connecting India with key export destinations.

- It boasts handling capacity of 1.35 million TEUs (containers), 4–5 million tons of bulk cargo, and ~2 million tons of liquid cargo.

- RORO (Roll-On Roll-Off) facilities enable efficient vehicle exports for major automakers like Maruti Suzuki and Honda Cars India.

2. Infrastructure & Connectivity Expansion

- Consistent investment in port and land-side infrastructure.

- A new LPG pipeline connecting Pipavav to the Kandla-Gorakhpur LPG corridor will enhance LPG throughput and operational efficiency.

- Capacity expansion to handle Very Large Gas Carriers (VLGCs) will attract new trade volumes.

3. Rising RORO Volumes & Auto Exports

- FY25 RORO volumes grew 70% YoY to 1.65 lakh units, with another 39% YoY jump in 1HFY26.

- Benefiting directly from India’s booming auto exports, especially from the Sanand hub in Gujarat.

4. Attractive Valuation & Dollar-Linked Revenue

- At CMP ₹169, GPPL trades at 19.8x FY26E P/E and 11.8x EV/EBITDA.

- Around 60–65% of revenue is USD-linked, offering a natural hedge against rupee depreciation.

- Improving realization expected as LPG share rises in cargo mix.

Key Risks

- Decline in EXIM trade due to global slowdowns.

- Non-renewal of concession from the Gujarat Maritime Board.

- Cyclones or natural disruptions affecting port operations.

Analyst Take — Why GPPL Now?

| Parameter | Sentiment |

|---|---|

| Financial Performance | ✅ Stable margins & growth outlook |

| Corporate Governance | ✅ Strong (No pledges, solid promoter base) |

| Valuation & Price Trend | ✅ Reasonably valued, post-correction |

| Industry Tailwinds | ✅ Beneficiary of trade & infrastructure push |

Analyst Verdict:

Gujarat Pipavav Port Ltd offers a 15% upside potential over the next 6–12 months, supported by strong trade flows, capacity expansion, and a favorable valuation base. A good short-to-medium-term bet for investors seeking steady returns in India’s port and logistics sector.

🔍 Recommended by: SBI Securities — Retail Research

Conclusion — Market Outlook 31 October

As we wrap up today’s Market Outlook 31 October, the sentiment across Indian equities remains cautiously optimistic despite recent volatility. Benchmark indices — NIFTY 50, SENSEX, and BANKNIFTY — continue to trade within a narrow range, reflecting a wait-and-watch approach ahead of key macro data and global cues.

Investors are advised to:

- Stay selective and focus on quality stocks with strong fundamentals and earnings visibility.

- Use dips for accumulation, especially in sectors like banking, ports, and infrastructure, which are well-positioned for medium-term growth.

- Track IPOs closely, as the ongoing lineup — from Groww to Lenskart and Studds Accessories — reflects rising market enthusiasm for new-age and manufacturing plays.

Today’s Stock in Focus, Gujarat Pipavav Port Ltd, stands out as a strong short-to-medium-term opportunity, supported by improving infrastructure, strategic location, and consistent growth in export-linked volumes.

For daily market recaps and IPO insights, explore our 📘 Newsletter Section on OneDemat, and stay updated with live data from Google Finance.

🔔 Stay tuned — tomorrow’s pre-market newsletter will bring you early cues and fresh stock ideas before the opening bell!

More Articles

We Read Groww’s IPO RHP So You Don’t Have To: 5 Big Surprises You Should Know

Studds Accessories IPO Review 2025: Strong Growth & Listing Buzz

Orkla India IPO 2025: Comprehensive Business and Financial Analysis