Market Outlook 31 July | Calm Before the Storm? Trump Tariff Shock After Market Hours

Good morning and welcome to your Market Outlook 31 July edition.

Tuesday’s session stayed relatively stable on the surface — Nifty 50 inched up by 26.55 points (+0.11%) to close at 24,847.65, while the Sensex added 140.79 points (+0.17%) to finish at 81,478.74. Sector-wise, Nifty IT gained 0.25% and SmallCap added 0.15%, but Nifty Bank saw some profit booking, closing down by 96.10 points.

But the real twist came after the market close.

Donald Trump dropped a geopolitical and economic bombshell by announcing a 25% tariff on Indian imports, alongside penalties targeting India’s oil and defense trade with Russia. This aggressive stance raises concerns over trade disruption, FDI flows, and sector-specific volatility in the coming sessions.

In today’s newsletter, we break down the technical setup for Nifty, analyze the potential impact of Trump’s tariff decision, highlight key stocks to watch, update you on IPO action, and bring you a promising small-cap pick.

Let’s dive into your full Market Outlook for 31 July.

Gift Nifty Update & Nifty Outlook | Gap-Down Opening Likely After Tariff Shock

Gift Nifty futures plunged 124.5 points (-0.50%) to 24,715.0 in overnight trade, following a surprise announcement by Donald Trump to impose 25% tariffs on Indian goods, alongside penalties on oil and defense imports from Russia.

This sharp move in Gift Nifty suggests a gap-down opening for Indian markets on Wednesday, as global investors react to the potential trade and geopolitical fallout.

Nifty Outlook – Key Levels & Trend Analysis

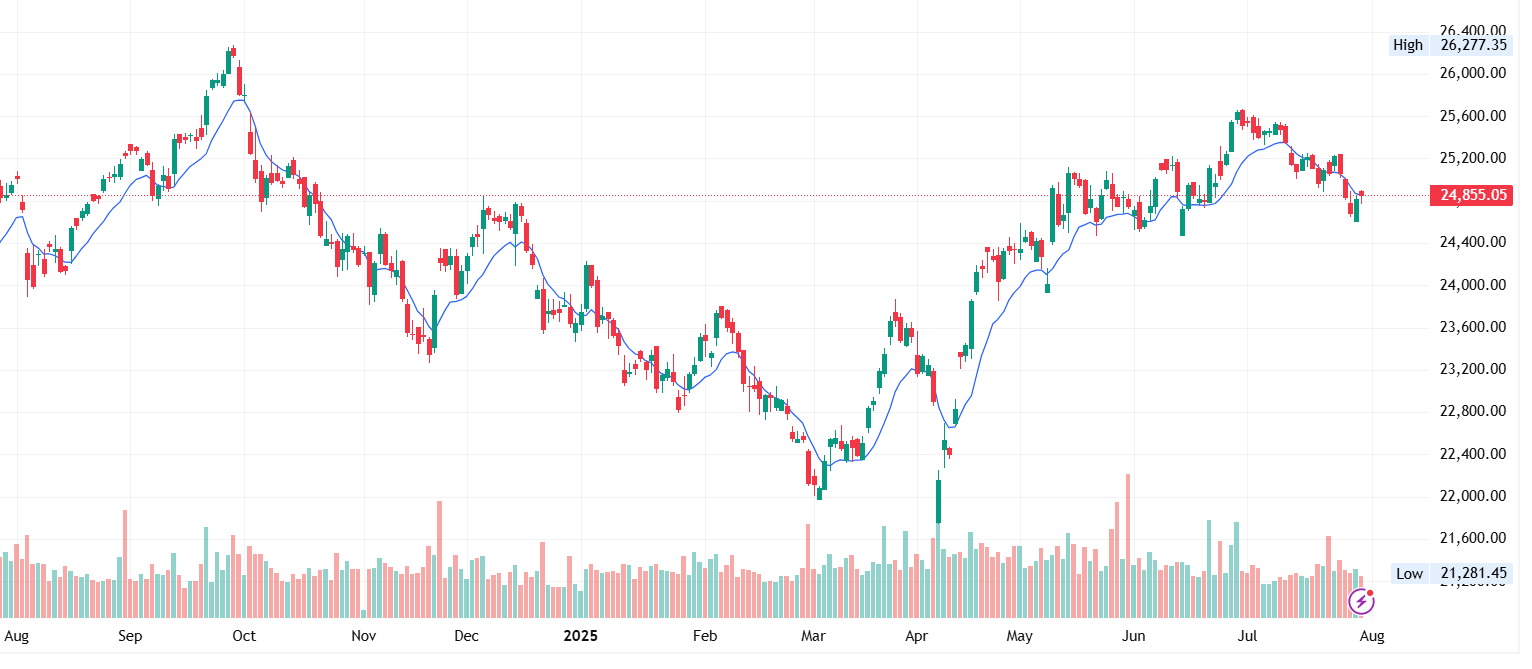

As per Equity Pandit, Nifty (closed at 24,855) remains in a short-term negative trend. The technical structure weakens further if the index fails to hold key support zones today.

Support Levels:

- 24,784

- 24,713

- 24,654

Resistance Levels:

- 24,914

- 24,973

- 25,045

Strategy Overview:

- Traders holding short positions should continue with a closing stop-loss at 24,927.

- Fresh long trades are not advised unless Nifty closes above 24,927, which would confirm a reversal.

With tariff tensions rising and Gift Nifty signaling a lower start, volatility may spike — especially in export, oil & defense-linked stocks. Today’s opening could be pivotal in deciding the next leg of market direction.

Top News – Key Developments and Sector Impact

1. US Imposes 25% Tariff on Indian Imports

In a significant geopolitical shift, the Trump administration announced a 25% tariff on all Indian imports late Tuesday. The decision is reportedly a response to India’s continued oil and defense trade with Russia, alongside the imbalance created by India’s tariffs on American goods. This move revives concerns over global protectionism and signals a deterioration in Indo-US trade relations.

What It Means:

This decision could severely impact India’s export-oriented industries. Key export sectors such as automobile components, steel, electronics, solar equipment, gems & jewelry, and seafood face direct revenue pressure. As these industries rely heavily on the US market, companies in these sectors are likely to see margin compression and demand-side disruptions.

Impacted Stocks:

- Auto & Ancillaries: Tata Motors, Bharat Forge, Motherson Sumi

- Metals: Hindalco, JSW Steel

- Electronics & OEMs: Dixon Technologies, Amber Enterprises

- Solar Equipment: Adani Green, Waaree Renewable

- Jewelry Exports: Titan, Rajesh Exports

- Marine Products: Avanti Feeds, Apex Frozen Foods

Pharma and semiconductors appear insulated, as they either enjoy stronger regulatory protections or are less exposed to the US market structurally.

2. SIDBI MSME Survey Indicates Stronger Credit Flow but Persistent Rate Worries

According to the latest survey by SIDBI, nearly 29% of Indian MSMEs anticipate improved capacity utilization over the next 12 months. This optimism is supported by the fact that 88% of respondents reported better access to financing, largely due to fintechs and small finance banks expanding credit lines.

However, concerns remain high regarding interest rate levels, which continue to suppress long-term expansion plans despite better liquidity access.

Impacted Stocks:

- Small Finance Banks: AU Small Finance Bank, Ujjivan SFB, Equitas SFB

- MSME Lenders/NBFCs: Satin Creditcare, CreditAccess Grameen, UGRO Capital

3. NSE Introduces Volatility Control on SME IPOs

To curb excessive listing-day volatility, the NSE will implement new rules for SME IPOs starting August 4. Specifically, stocks will be limited to a maximum 90% upside and a 20% downside in the pre-open session, bringing more structure to early trade.

What It Means:

The new mechanism addresses the price manipulation risk seen recently in smallcap and microcap IPOs. This could help improve investor confidence and weed out speculative volumes in the SME space.

Impacted Stocks:

- Recent SME IPOs on NSE Emerge

- Upcoming listings from Shanti Gold International, Aditya Infotech, Laxmi India Finance, and GNG Electronics

4. SEBI Cracks Down on Telegram-Based Pump & Dump Schemes

SEBI has fined ₹3.87 crore on 11 individuals who were found guilty of manipulating the share price of Darshan Orna Ltd through coordinated messaging on Telegram groups. The accused allegedly generated profits exceeding ₹2.5 crore by misleading retail investors using fake tips and mass buying activity.

Why It Matters:

This is a clear message from the regulator targeting unverified financial influencers and social media-based trading channels. The move underlines SEBI’s growing focus on retail protection and surveillance in the digital era.

Impacted Context:

- Higher regulatory scrutiny on microcap counters

- Stricter norms likely for small stocks circulated heavily on Telegram and WhatsApp

Watchlist: Darshan Orna, Kinetic Trust, and similar microcaps with unexplained price rallies

5. Jio Financial Services Announces ₹15,825 Cr Preferential Issue

Jio Financial has approved a preferential issue of 50 crore convertible warrants priced at ₹316.50 to promoter entities. This infusion will increase promoter stake from 6.1% to 10.17% post conversion and is likely to fund expansion into digital lending and wealth management.

Why It’s Important:

This is one of the largest fundraises in the financial space this year and shows the group’s commitment to aggressively scale operations. The deal also comes amid growing competition from fintech startups and traditional NBFCs.

Impacted Stocks:

- Jio Financial (direct beneficiary)

- Paytm, Bajaj Finance, HDFC AMC (indirect peers)

6. RBI Absorbs Liquidity via VRRR Auctions Instead of SDF

The Reserve Bank of India shifted its liquidity absorption method, moving ₹1.6 lakh crore from the Standing Deposit Facility (SDF) to a 3-day Variable Rate Reverse Repo (VRRR) auction. This transition allows the RBI to control short-term liquidity more actively.

Market Interpretation:

The central bank’s move indicates tighter liquidity management in the coming weeks, especially ahead of the bond auctions and potential global capital outflows due to geopolitical tensions.

Impacted Stocks:

- Interest-rate sensitive sectors: HDFC Bank, Axis Bank, Bajaj Finance

- G-Sec traders and bond proxies like LIC Housing Finance, PFC

7. Astrotalk Projects ₹2,000 Cr Revenue & Prepares for IPO

Astrotalk, India’s leading astrology and spiritual wellness platform, announced that it is preparing for a ₹2,000 crore IPO within the next 18 months. The company also launched ‘AstroStore’, its e-commerce vertical, which is already clocking ₹100 crore in run rate.

Why It Matters:

Astrotalk’s IPO could pave the way for a new segment of spiritual-tech or D2C spiritual e-commerce in the Indian public markets. The brand’s success also signals the potential of niche app-based businesses built on recurring revenue models.

Watchlist:

- App-based D2C models: Nykaa, CarTrade, Honasa (Mamaearth)

Stocks in Screener – Market Outlook 31 July

As part of our ongoing coverage in Market Outlook 31 July, we present a list of stock ideas identified by Axis Direct as high-conviction buy opportunities. These stocks are backed by strong technical setups or favourable long-term fundamentals and have been recently recommended or had their target prices upgraded. All figures are based on the latest available data and market price.

This screener is valuable for traders and investors looking for medium-term ideas in the current market environment:

| Stock | Author | LTP (₹) | Target (₹) | Price at Reco (₹) | Change Since Reco (%) | Upside (%) | Type |

|---|---|---|---|---|---|---|---|

| Varun Beverages | Axis Direct | 522.10 | 590.00 | 522.10 | 0.00% | 13.01% | Buy |

| NTPC | Axis Direct | 338.80 | 400.00 | 338.80 | 0.00% | 18.06% | Buy |

| Arvind SmartSpaces | Axis Direct | 616.50 | 840.00 | 616.50 | 0.00% | 36.25% | Buy |

| KEC International | Axis Direct | 872.95 | 1030.00 | 872.95 | 0.00% | 17.99% | Buy |

| Gravita | Axis Direct | 1898.00 | 2600.00 | 1898.00 | 0.00% | 36.99% | Buy |

These names represent opportunities across sectors—from FMCG and power to infrastructure and recycling. Investors should monitor these counters for price action and volume confirmation, especially during the volatile macro environment created by recent geopolitical developments.

Disclaimer: These stock names are compiled based on public research from Axis Direct and are not personal investment advice. Please consult your registered advisor before taking any financial decisions.

Conclusion – Market Outlook 31 July

The markets may have ended Tuesday on a mildly positive note, but the late-evening shocker from former U.S. President Donald Trump has changed the overnight sentiment. With Gift Nifty pointing to a gap-down opening, investors should brace for volatility on Wednesday.

From potential trade penalties on India to renewed geopolitical noise, global factors are now back in the driver’s seat. That makes it critical for traders and investors to stay nimble, focus on key support-resistance levels, and watch for sector-specific cues—especially in defence, oil & gas, and export-heavy stocks.

As we move into the midweek session, risk management remains the top priority. Stay tuned for intra-day updates, and revisit your portfolio in light of external headwinds. Opportunities will still emerge—but only for the prepared.

Let the data guide your decision-making.

Related Articles

Ongoing and Upcoming IPO Details, Review and Best Strategy

Sri Lotus Developers IPO: From Big B to SRK—Bollywood’s Biggest Names Are Investing Here

NSDL IPO 2025: India’s Largest Depository Goes Public – All You Need to Know