Introduction – Market Outlook 30 October

Good Morning and welcome to your Pre-Market Newsletter for Market Outlook 30 October, where we decode the key trends shaping today’s trading session.

Indian equities ended the previous day on a strong note as benchmarks extended their winning streak. According to Google Finance, the Nifty 50 gained 131.50 points to close at 26,067.70, while the Sensex rose 408.92 points to finish at 85,037.08. The Bank Nifty added 185.55 points, ending at 58,399.65, signaling resilience in financial stocks. Sectorally, Nifty IT outperformed with a 0.73% rise, and SmallCap shares continued their rally, climbing 0.59% on the day.

This positive momentum came as investors cheered healthy corporate earnings and a steady global setup, with renewed interest across banking and IT names. The market’s tone remains constructive, and traders are likely to watch for follow-through buying as October draws to a close.

In today’s Market Outlook 30 October, you’ll find:

- Key levels and technical view for Nifty, Sensex, and Bank Nifty

- Major market-moving news and stocks to watch today

- The latest IPO updates and GMP trends

- And a featured stock in radar with expert recommendations

Catch all previous editions of our daily newsletter here 👉 onedemat.com/category/newsletter/

Index Outlook – Market Outlook 30 October

According to EquityPandit’s Analysis, the Indian indices continue to show resilience as market sentiment remains constructive ahead of the month-end expiry. Here’s a detailed look at today’s Index Outlook for Sensex, Nifty, and Bank Nifty under the Market Outlook 30 October theme.

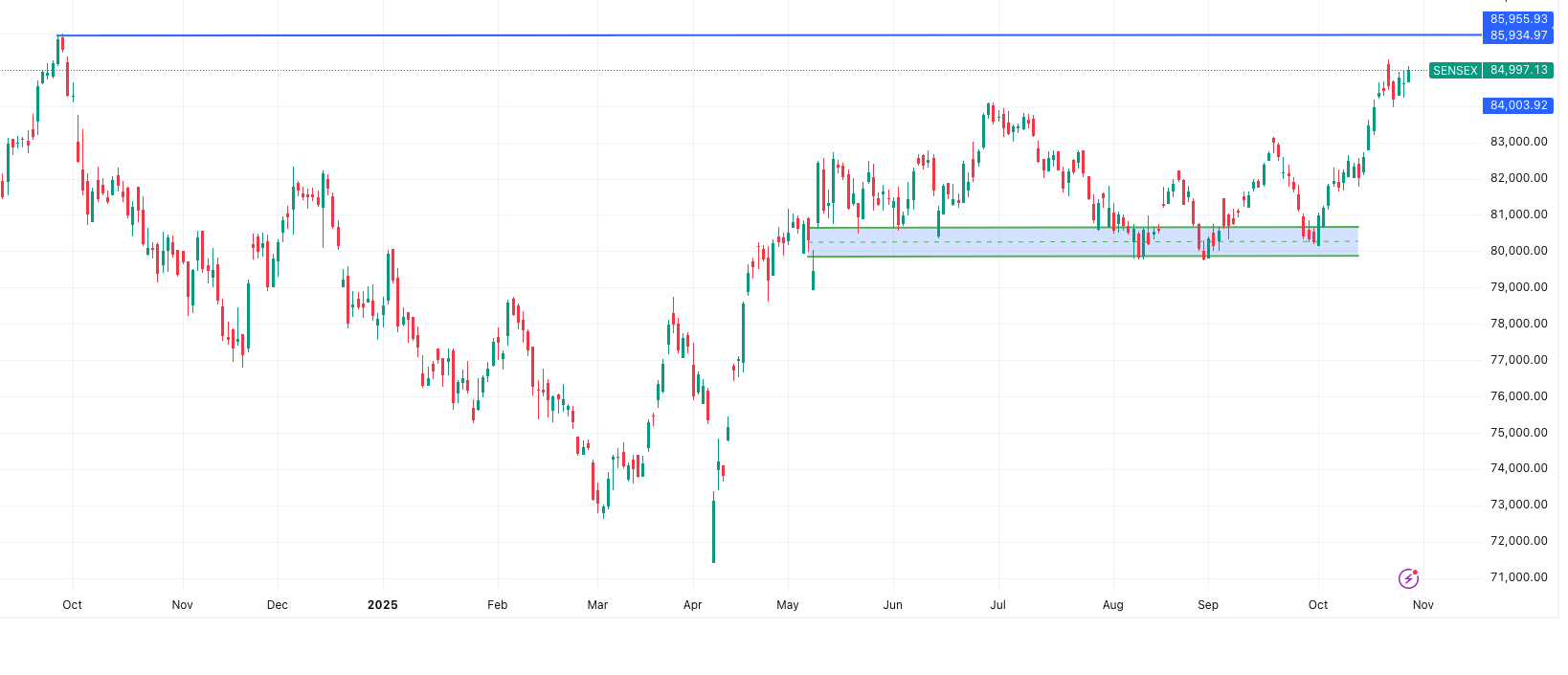

SENSEX Outlook 30 October

The Sensex remains in a positive trend, maintaining momentum from the previous session. Traders holding long positions should continue to hold with a daily closing stoploss of 84,194. A close below this level could invite mild profit-booking.

- Support Levels: 84,722 • 84,447 • 84,255

- Resistance Levels: 85,189 • 85,381 • 85,656

Range to Watch: Between 84,329 – 85,664

Momentum traders should look for a breakout above 85,381 for potential intraday upside.

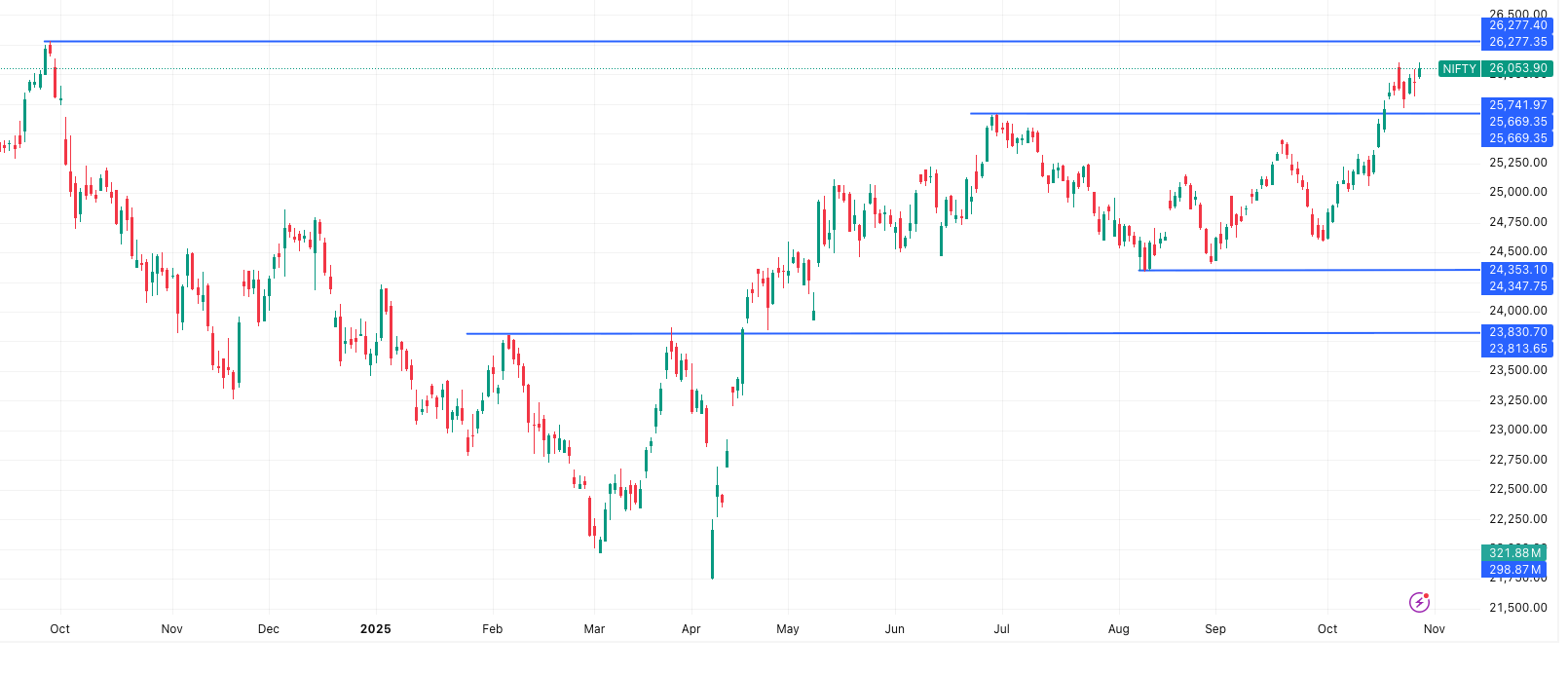

NIFTY Outlook 30 October

The Nifty 50 continues to sustain its positive bias, reflecting strong market breadth and participation from large-cap counters. Long positions can be held with a daily closing stoploss of 25,826.

- Support Levels: 25,977 • 25,900 • 25,839

- Resistance Levels: 26,114 • 26,175 • 26,252

Range to Watch: Between 25,854 – 26,253

A decisive close above 26,175 may trigger another round of momentum buying toward the upper resistance band.

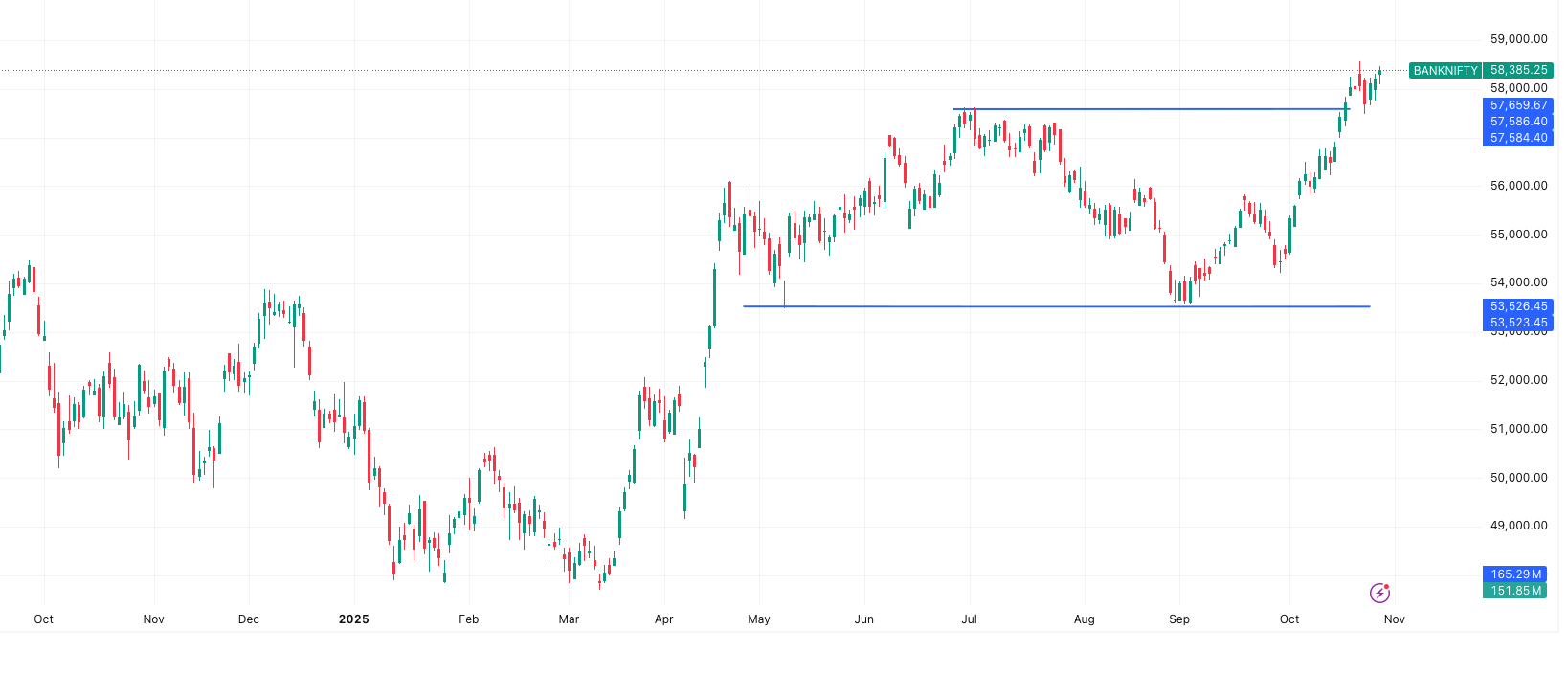

BANKNIFTY Outlook 30 October

The Bank Nifty continues to show relative weakness and remains in a negative trend. Those holding short positions can maintain them with a daily closing stoploss of 58,393. A sustained move above this level could shift sentiment in favor of the bulls.

- Support Levels: 58,158 • 57,931 • 57,775

- Resistance Levels: 58,541 • 58,697 • 58,924

Range to Watch: Between 57,871 – 58,899

Traders should watch for price action near 58,541 — a breakout here may lead to short-covering in the near term.

Overall, the broader setup in this Market Outlook 30 October remains cautiously optimistic, with Nifty and Sensex holding strong, while Bank Nifty may continue to consolidate before showing clear directional strength.

News & Stocks to Watch – Market Outlook 30 October

In today’s Market Outlook 30 October, a mix of geopolitical developments, major corporate updates, and commodity insights are likely to shape investor sentiment. From India’s fast-progressing trade negotiations with the European Union to Vedanta’s much-awaited demerger hearing, and from Reliance Brands’ luxury expansion to Wipro’s global deal win — the day ahead brings several potential triggers across sectors. Here’s your complete morning briefing.

1️⃣ India–EU Free Trade Agreement Enters Final Stage

Source: NDTV Profit

Commerce and Industry Minister Piyush Goyal announced that more than 50% of the chapters in the India–EU Free Trade Agreement (FTA) have been agreed upon. The EU has finalized nearly 10 out of 20 chapters, while another 4–5 chapters are agreed in principle.

The discussions also included key areas such as industrial tariffs, carbon border adjustment mechanism (CBAM), and market access frameworks.

Negotiations are in their final stages, and both sides are targeting a year-end conclusion when EU Trade Commissioner Maroš Šefčovič visits India in November-end or early December.

Impact: A successful FTA could enhance India’s exports to Europe, reduce tariffs, and benefit sectors such as pharma, textiles, and manufacturing.

Stock to Watch: Aditya Birla Fashion & Retail Ltd (ABFRL) – likely beneficiary from export-oriented opportunities and access to European retail markets.

2️⃣ Vedanta’s Demerger Final Hearing Set for November 12

Source: NDTV Profit

The National Company Law Tribunal (NCLT) has scheduled the final hearing for Vedanta Ltd.’s demerger on November 12.

The company aims to split into independent sector-specific entities, including Vedanta Aluminium, Vedanta Oil & Gas, Vedanta Power, Vedanta Steel and Ferrous Materials, and Vedanta Base Metals.

This restructuring seeks to unlock shareholder value, improve operational focus, and streamline management across verticals. The proposal has already received SEBI approval, with pending clarifications from the Ministry of Petroleum and Natural Gas.

Impact: The demerger could unlock hidden value in Vedanta’s verticals and simplify business structure for investors.

Stock to Watch: Vedanta Ltd. –Key Event: NCLT hearing on Nov 12 | Short-term momentum expected on positive verdict expectations.

3️⃣ Reliance Brands Brings MAX&Co. to India

Source: NDTV Profit

Reliance Brands Ltd. (RBL), a subsidiary of Reliance Retail Ventures, has signed a long-term master franchise agreement with Italian luxury fashion label MAX&Co.

Founded in 1986 and part of the Max Mara Fashion Group, MAX&Co. plans to launch its first store in Mumbai in early 2026, followed by expansions in other metropolitan cities.

The brand will bring its full product line — apparel, accessories, and &Co.llaboration capsules — to the Indian luxury retail market.

Impact: This move strengthens Reliance Brands’ international luxury portfolio and supports India’s growing premium fashion segment.

Stock to Watch: Reliance Industries Ltd. (RIL) – Luxury retail expansion adds incremental growth lever for its retail arm; potential long-term value addition.

4️⃣ HUDCO Signs ₹83,000 Crore MoUs for Port Infrastructure

Source: NDTV Profit

Housing and Urban Development Corporation (HUDCO) has signed two major MoUs during India Maritime Week 2025 worth over ₹83,000 crore.

- A non-binding MoU with Sagarmala Finance Corp. for maritime and coastal infrastructure development worth ₹80,000 crore.

- A separate MoU with Syama Prasad Mookerjee Port (SMP), Kolkata to modernize port and allied infrastructure, with HUDCO funding ₹3,000 crore.

These initiatives aim to enhance India’s maritime and coastal connectivity, supporting green energy, shipbuilding, and logistics infrastructure.

Impact: Strengthens HUDCO’s presence in large-scale infrastructure financing and could open new revenue streams in maritime logistics.

Stock to Watch: HUDCO Ltd. | Strong order pipeline and infra exposure may attract investor interest.

5️⃣ Wipro Bags Global IT Deal with HanesBrands

Source: CNBC TV18

Wipro Ltd. has signed a multi-year strategic agreement with US-based HanesBrands to overhaul its IT and cybersecurity operations using AI-first technology.

Through its AI suite Wipro IntelligenceTM WINGS, the company will streamline HanesBrands’ IT infrastructure, aiming to cut operational costs and enhance global compliance and security.

The partnership also provides HanesBrands access to Wipro’s Innovation Network of AI companies, technology partners, and academic collaborations.

Impact: Reinforces Wipro’s global positioning in AI-led managed services, potentially driving margin expansion in the medium term.

Stock to Watch: Wipro Ltd. – Recommended by Jefferies.

6️⃣ Copper May Rally Up to 50% in Next 18 Months

Source: CNBC TV18

Commodity experts Jonathan Barratt (ETO Markets) and Kishore Narne (Motilal Oswal Commodities) predict a 50% upside in copper prices over the next 18 months, driven by tightening supply, global green energy demand, and underinvestment in new capacity.

Base metals like aluminium (+4.5%), zinc (+3%), and copper (+4%) have rallied this week, hinting at a potential multi-year commodity supercycle.

Indian players like Hindalco, NALCO, Vedanta, and Tata Steel have already gained 6–12% in October on this optimism.

Impact: Higher copper and metal prices can lift revenue and margins for Indian metal producers, while strengthening the outlook for the entire commodity segment.

Stock to Watch: Hindalco Industries Ltd. | Supported by bullish copper price trajectory.

In summary, the Market Outlook 30 October signals a strong macro and corporate narrative. With progress in India–EU trade talks, large-cap action in Vedanta, and infrastructure expansion by HUDCO, the day ahead looks promising for diversified market participation across sectors.

IPO Updates – Market Outlook 30 October

The primary market activity remains strong as several high-profile IPOs line up for subscription this week. With investors showing steady enthusiasm in both mainboard and SME categories, Market Outlook 30 October highlights key ongoing and upcoming issues with their listing prospects.

Let’s take a look at the latest IPO movements and GMP trends.

Mainboard IPOs

| IPO Name | GMP (₹) | Est. Listing Gain | Open Date | Close Date | Listing Date |

|---|---|---|---|---|---|

| Studds Accessories IPO | ₹53 | 9.06% | 30-Oct | 3-Nov | 7-Nov |

| Orkla India IPO | ₹64 | 8.77% | 29-Oct | 31-Oct | 6-Nov |

| Lenskart Solutions IPO | ₹48 | 11.94% | 31-Oct | 4-Nov | 10-Nov |

| Groww IPO | ₹9.5 | 0.00% | Upcoming | TBA | TBA |

Open Today: Studds Accessories IPO Review – GMP, Listing & Full Details

Upcoming: Groww IPO

SME IPOs

| IPO Name | GMP (₹) | Est. Listing Gain | Open Date | Close Date | Listing Date |

|---|---|---|---|---|---|

| Jayesh Logistics NSE SME | ₹9 | 7.38% | 27-Oct | 29-Oct | 3-Nov |

Analyst View:

The IPO market continues its upbeat sentiment as investors seek fresh opportunities amid strong secondary market performance. With mid-cap indices gaining momentum, listings such as Studds Accessories and Orkla India could see robust subscription traction. Meanwhile, Groww IPO is one of the most awaited fintech listings, expected to attract massive retail and institutional participation once announced.

The Market Outlook 30 October indicates that the IPO space remains a bright spot for investors, offering both short-term listing gains and long-term thematic plays.

Stock in Focus — Market Outlook 30 October

As part of today’s Market Outlook 30 October, Axis Bank Limited takes the spotlight — a leading private sector bank demonstrating resilience, diversification, and forward-looking digital transformation.

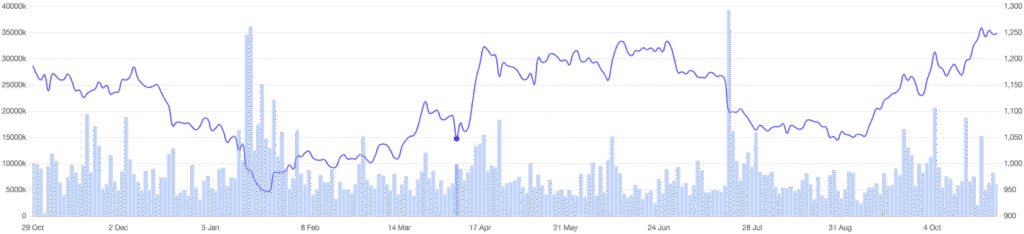

Axis Bank Limited

CMP: ₹1,246

Target Price: ₹1,400

Upside Potential: +12%

Recommendation: BUY

Research Source: Geojit Finance Report

Why Axis Bank is in Focus

Axis Bank continues to sustain steady operational performance, backed by strong deposit growth, diversified lending, and technological advancement. The bank’s management remains confident in its “GPS Strategy” — Growth, Profitability, and Sustainability — as it strengthens its footprint across India.

Key Financial Highlights (Q2FY26):

- Interest Income: ₹30,970 crore (+1.8% YoY) driven by growth in retail, SME, and corporate lending.

- Net Interest Income (NII): ₹13,745 crore (+1.9% YoY), with NIM at 3.73% (vs 3.80% in Q1FY26).

- Total Income: ₹37,595 crore (+1.2% YoY), supported by investment income and RBI balance interest.

- Pre-Provision Operating Profit: ₹10,413 crore (-2.8% YoY) due to elevated expenses.

- Deposit Growth: +10.7% YoY with CASA ratio at 40%, indicating healthy funding mix.

- Advances: +11.7% YoY, led by robust corporate (+20.3%) and SME (+19%) lending.

Analyst Insights

Geojit Finance maintains a BUY rating on Axis Bank with a target price of ₹1,400, implying a 12% upside from current levels.

The valuation is based on 1.8x FY27E BVPS, factoring in Axis’s strong balance sheet, consistent credit growth, and improving capital efficiency.

Key Highlights from Management Commentary:

- NIM expected to bottom out by Q3FY26 — aided by balance sheet optimization.

- Capital Adequacy Ratio (CAR): 16.6% — well above regulatory requirements.

- Credit Card Growth: Over 1 million new cards issued in Q2FY26.

- Continued dominance in UPI (37% market share) and merchant acquiring (20.6%).

Outlook

Axis Bank is well-positioned to deliver consistent growth in the coming quarters. Its focus on technology-driven expansion, disciplined credit practices, and expanding retail footprint makes it one of the top banking picks in the current Market Outlook 30 October.

Verdict: BUY | Target ₹1,400 | Upside +12% | Long-term Bullish

Conclusion — Market Outlook 30 October

As we wrap up today’s Market Outlook 30 October, the Indian equity market continues to show strength with the Nifty 50 and Sensex sustaining their upward momentum, supported by positive global cues and steady domestic earnings. The Nifty IT and SmallCap indices have added an encouraging layer of optimism, suggesting broad-based participation across sectors.

Investors are advised to maintain a cautious optimism — staying aligned with trend support levels and monitoring macro developments such as upcoming FOMC cues and India’s Q2 GDP data.

On the IPO front, the market remains vibrant with active listings like Studds Accessories IPO and upcoming offerings such as Groww expected to keep retail sentiment high.

From a stock-specific view, Axis Bank emerges as a strong contender for accumulation, backed by healthy growth guidance, strong deposit traction, and a digital-first strategy that promises long-term value creation.

With earnings momentum intact and liquidity support continuing, the broader outlook remains constructively bullish as we move toward the close of October.

For daily insights and analysis, visit our Newsletter section on OneDemat — your go-to source for curated market intelligence and actionable trading insights.