Market Outlook 28 July | A Weak Close Before the Weekend

Good morning and welcome to your Market Outlook 28 July edition.

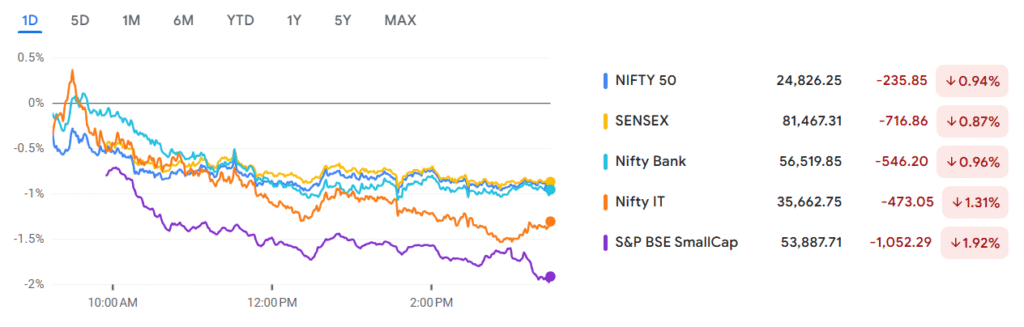

Markets wrapped up the week on a shaky note last Friday, setting the tone for a cautious start to the new week. The Nifty 50 closed at 24,826.25, slipping 235.85 points (-0.94%), while the Sensex dropped 716.86 points. Pressure was visible across sectors — Nifty Bank lost nearly 1%, Nifty IT declined by 1.31%, and SmallCap indices plunged by 1.92%, showing clear signs of profit booking and risk aversion.

In today’s newsletter, we decode the technical setup for Nifty, spotlight key news and stocks that could move the market, update you on ongoing IPOs, and bring our small-cap stock pick of the day.

Let’s get you ready for Monday’s market with a complete Market Outlook for 28 July.

Nifty Technical Analysis – Market Outlook 28 July

As we begin the week, the Nifty 50 is trading around ₹24,837, showing a decline of 225 points (-0.90%) from the previous close. The price currently sits below the 9-day EMA of ₹25,010, a short-term bearish signal suggesting that the market is losing momentum.

From a Fibonacci retracement perspective — drawn from the recent swing low of ₹21,996 to the swing high of ₹25,684 — the index has slipped below the 0.236 level at ₹24,814, signaling weakness. If the index fails to reclaim this level quickly, a move toward 0.382 (₹24,275) or 0.5 (₹23,840) levels cannot be ruled out.

Technically, the Nifty appears to be in a consolidation phase below critical resistance, with recent bearish candles accompanied by rising volume, pointing to possible distribution. Despite having broken out of its long-term downtrend channel earlier this year, the momentum is clearly cooling off.

Possible Scenarios for Nifty – Market Outlook 28 July:

- Bullish Case: If the index can reclaim and hold above ₹24,814, it may aim for a retest of the swing high at ₹25,684. A breakout beyond that could open the path toward ₹26,200+.

- Bearish Case (more likely): A close below ₹24,800 could accelerate downside pressure, with immediate supports at ₹24,275 and ₹23,840. A deeper correction could take the index toward ₹23,400 or even ₹22,780.

Our Bias and Strategy for the Day:

The short-term bias remains mildly bearish to neutral. Traders should keep an eye on two key zones:

- Below ₹24,800: Weakness may persist, with potential dips toward ₹24,275–₹23,840.

- Above ₹25,000–25,100: This range needs to be reclaimed to suggest strength returning to the bulls.

In summary, the Market Outlook for 28 July suggests cautious trading as the Nifty struggles below key short-term technical levels, with risk tilted slightly to the downside unless bulls stage a strong comeback early in the session.

News and Stocks That Might Be Impacted

As we head into the new trading week, several corporate developments and IPO announcements could influence stock-specific action. Here’s what traders should keep an eye on in the Market Outlook 28 July:

1. Sahajanand Medical Technologies (SMT) Files DRHP for IPO

SMT has filed its Draft Red Herring Prospectus for a 100% Offer for Sale, comprising 27.64 million equity shares. Prominent investors including Samara Capital, Kotak Pre-IPO, and NHPEA Sparkle are offloading their holdings. With a strong presence in cardiovascular medical devices and operations in over 75 countries, SMT’s financials show growing revenues but modest profitability. Heavy reliance on exports and regulatory overhangs are notable risks.

Likely Impact: Watch for movement in the broader healthcare and medical device segment. Once the price band is announced, peer stocks could see sentiment-based moves.

2. Nupur Recyclers (NSE: NRL) Acquires 51% Stake in Tycod Autotech

Nupur Recyclers has signed a share purchase agreement to acquire a 51% stake in Tycod Autotech Pvt Ltd, marking a shift toward operational asset-based expansion. The acquisition includes plant, machinery, and working capital components — a clear push toward vertical integration.

Likely Impact: Positive for Nupur Recyclers in the near term, as this acquisition aligns with its strategic intent to grow beyond recycling into automotive components. Keep an eye on volume spikes in the stock.

3. VA Tech Wabag Secures ₹380 Crore World Bank-Funded Project

VA Tech Wabag (NSE: WABAG) has been awarded a major ₹380 crore Design-Build-Operate contract by the BWSSB under a World Bank-supported program. The contract covers EPC and long-term O&M for advanced wastewater treatment plants in Bengaluru.

Likely Impact: Sentiment-positive for Wabag. The stock could attract interest from investors focused on sustainable infrastructure and ESG themes.

4. RITES Bags ₹177 Crore Strategic Order from BEL

RITES Limited has received a ₹177.225 crore order from Bharat Electronics Ltd (BEL) for designing and constructing a manufacturing facility in Andhra Pradesh. The order supports BEL’s expansion in defense infrastructure under the “Aatmanirbhar Bharat” initiative.

Likely Impact: Supports bullish sentiment in RITES, and may spill over into other PSU consultancy and infra stocks. Could also be a tailwind for BEL.

5. Nephrocare Health Services Files DRHP for ₹353 Crore IPO

Nephrocare has filed for a fresh issue worth ₹353.4 crore along with a sizeable OFS of 1.27 crore shares. With 490 clinics and strong international presence, the company reported a Net Profit of ₹670.96 million in FY25, a major turnaround from FY23. It’s now the largest dialysis provider in India, with plans to expand through proceeds from the issue.

Likely Impact: The IPO could generate interest in the broader healthcare services space. Existing players in dialysis, diagnostics, and multi-specialty care may see activity.

Technical Spotlight — Market Outlook 28 July

Stock in Focus: Gravita India Ltd

Gravita India Ltd is attracting technical interest after forming a bullish ABCD harmonic pattern with a potential breakout confirmation. The pattern completes near point D at ₹1,887.75, and the stock closed just below that at ₹1,886.60, marking a +4.07% gain in the latest session.

The price action is breaking out of a rising wedge/ascending triangle structure, backed by increasing volume — a bullish signal for short-term momentum traders.

Key Technical Highlights – Market Outlook 28 July

Bullish Indicators:

- The 9-day EMA at ₹1,743.43 is rising and has provided consistent support.

- A breakout above the short-term resistance zone at ₹1,880–₹1,887 signals strength.

- Recent price candle closed strong with volume exceeding prior sessions, validating the breakout attempt.

- The ABCD harmonic pattern suggests upward targets remain valid.

Key Price Levels to Watch:

| Type | Level (₹) | Description |

|---|---|---|

| Immediate Resistance | 1,887.75 | D-point of ABCD pattern; current breakout level |

| Next Resistance | 2,128–2,130 | Previous swing high, swing target zone |

| Support 1 | 1,745 | Trendline support + 9-day EMA |

| Support 2 | 1,641 | Recent swing low |

Trade Strategy:

Swing Buy Entry Zones:

- On dips: Accumulate near ₹1,840–₹1,860

- On breakout: Enter above ₹1,890–₹1,900 with follow-through volume

Target Levels:

- T1: ₹1,980

- T2: ₹2,050

- T3: ₹2,128–₹2,130 (swing high)

Stop-Loss:

- Conservative: Below ₹1,745

- Aggressive: Below ₹1,800

Strategy Note:

For traders looking at short-term setups, the breakout is backed by harmonics and volume. Sustaining above ₹1,890 could open a path to ₹2,050+, while any rejection near ₹1,887 may warrant caution and reevaluation near ₹1,745.

Gravita India fits well into the Market Outlook 28 July as a high-probability swing candidate, suitable for both momentum-based and dip-buying strategies.

IPO Updates – Market Outlook 28 July

A fresh wave of IPO activity continues into the new week, with several listings lined up and grey market premiums (GMP) offering early sentiment cues. Below is a snapshot of the most relevant listings in the Market Outlook 28 July, separated into Mainboard and SME IPOs.

Mainboard IPOs – Market Outlook 28 July

| IPO Name | Open | Close | Listing | GMP (Listing Gain %) |

|---|---|---|---|---|

| NSDL IPO | 30-Jul | 1-Aug | 6-Aug | ₹135 (16.88%) |

| Sri Lotus Developers IPO | 30-Jul | 1-Aug | 6-Aug | ₹32 (21.33%) |

| Aditya Infotech IPO | 29-Jul | 31-Jul | 5-Aug | ₹217 (32.15%) |

| Laxmi India Finance IPO | 29-Jul | 31-Jul | 5-Aug | ₹13 (8.23%) |

| Brigade Hotel Ventures IPO | 24-Jul | 28-Jul | 31-Jul | ₹2 (2.22%) |

| Highway Infrastructure IPO | 5-Aug | 7-Aug | 12-Aug | ₹25 (35.71%) |

SME IPOs – Market Outlook 28 July

| SME IPO Name | Open | Close | Listing | GMP (Listing Gain %) |

|---|---|---|---|---|

| Shree Refrigerations | 25-Jul | 29-Jul | 1-Aug | ₹90 (72.00%) |

| Sellowrap Industries | 25-Jul | 29-Jul | 1-Aug | ₹18 (21.69%) |

| Shanti Gold International | 25-Jul | 29-Jul | 1-Aug | ₹38 (19.10%) |

| Patel Chem Specialities | 25-Jul | 29-Jul | 1-Aug | ₹45 (53.57%) |

| Repono | 28-Jul | 30-Jul | 4-Aug | ₹21 (21.88%) |

| Umiya Mobile | 28-Jul | 30-Jul | 4-Aug | ₹– (0.00%) |

| Kaytex Fabrics | 29-Jul | 31-Jul | 5-Aug | ₹25 (13.89%) |

| M&B Engineering IPO | 30-Jul | 1-Aug | 6-Aug | ₹32 (8.31%) |

| Cash Ur Drive Marketing | 31-Jul | 4-Aug | 7-Aug | ₹25 (19.23%) |

| Renol Polychem | 31-Jul | 4-Aug | 7-Aug | ₹– (0.00%) |

| Flysbs Aviation | 1-Aug | 5-Aug | 8-Aug | ₹150 (0.00%) |

These listings and grey market premiums help shape sentiment ahead of debut days. We’ll continue tracking active subscriptions and allocation updates in future editions of the Market Outlook 28 July.

Small Cap of the Day

Company: Omax Autos Ltd

Current Market Price: ₹121

Market Cap: ₹259 Cr

Sector: Auto & Railway Component Manufacturing

Omax Autos Ltd, incorporated in 1983, is a specialized manufacturer of sheet metal, tubular, and machined components catering to both the automotive and railway industries. The company’s diversified product mix, strategic clientele, and capacity expansion make it a noteworthy small-cap candidate in today’s Market Outlook 28 July.

Business Highlights:

- Supplies critical components to Tata Motors’ CV segment and is an approved vendor for Indian Railways.

- Strong presence in railway products, with manufacturing capacity recently doubled in that segment.

- Also serves reputed clients such as Alstom and Volvo Eicher.

Product Portfolio:

- Commercial Vehicles: Chassis assemblies, cross members, bumpers, sub-structures, side rails.

- Passenger Vehicles: Steering shafts, axle shafts, hinges, oil pans.

- Railways: Loco shells, bogie frames, bio-toilets, dampers, stainless steel benches.

Financial Overview:

| Metric | Value |

|---|---|

| EPS | ₹12.2 |

| Stock P/E | 18.4 |

| ROE | 3.44% |

| ROCE | 9.28% |

| Debt-to-Equity | 0.25 |

| Dividend Yield | 2.06% |

| Book Value | ₹147 |

| Profit Growth (YoY) | 991% |

| Sales Growth (YoY) | 4.55% |

| PEG Ratio | 0.57 |

| Intrinsic Value (Est.) | ₹221 |

With a healthy balance sheet, strong operating leverage, and a well-diversified client base, Omax Autos is trading at a Price-to-Sales ratio of 0.67 — indicating reasonable valuation support. Recent profit growth, low debt, and a clean promoter pledge profile further add to its attractiveness.

Why It Stands Out in the Market Outlook 28 July:

- Exposure to both cyclical (automobile) and defensive (railway infrastructure) sectors.

- Strong turnaround with a PAT of ₹14.1 Cr in the recent fiscal.

- Valuation comfort with upside potential toward its intrinsic value of ₹221.

Omax Autos Ltd represents a small-cap idea with improving fundamentals and sectoral tailwinds, worth tracking closely in your watchlist for the Market Outlook 28 July.

Conclusion

As we head into the new trading week, markets appear to be digesting recent volatility, with Nifty and broader indices showing signs of consolidation after last week’s sharp declines. The Market Outlook 28 July points toward a cautiously optimistic tone — provided key support levels hold and earnings momentum continues across sectors.

This week’s newsletter gave you:

- A breakdown of Nifty’s technical outlook and key scenarios

- Impactful news and stocks to watch

- A high-conviction technical breakout setup in Gravita India

- A full round-up of Mainboard and SME IPO GMPs

- A promising small-cap pick: Omax Autos, with dual-sector tailwinds

Stay nimble, stick to your levels, and let the price action lead your next move. We’ll be back tomorrow before the bell with another detailed snapshot.