Market Outlook 25 September – Intro

Good morning and welcome to your Market Outlook 25 September Edition.

The Indian markets ended Tuesday on a weak note as selling pressure dragged key indices lower. The Nifty 50 slipped 104 points to close at 25,065.35 (-0.41%), while the Sensex lost 345 points, settling at 81,756.34 (-0.42%). The Bank Nifty was the top laggard, shedding 378 points to end at 55,131.50 (-0.68%), while Nifty IT fell 0.74% and SmallCap index declined 0.53%, indicating broad-based weakness.

Global cues remained cautious amid trade tensions and weak IT earnings, adding to the domestic pressure.

In this newsletter, we bring you technical views, key news updates, IPO buzz, and stocks to watch for today’s trade.

Market Outlook 25 September – Index Technical View

According to EquityPandit’s analysis, Indian equities are starting the week on a cautious note. Both Sensex, Bank Nifty and Nifty are trading under pressure. Traders should remain watchful of key support and resistance levels as markets may witness range-bound moves with sector-specific action.

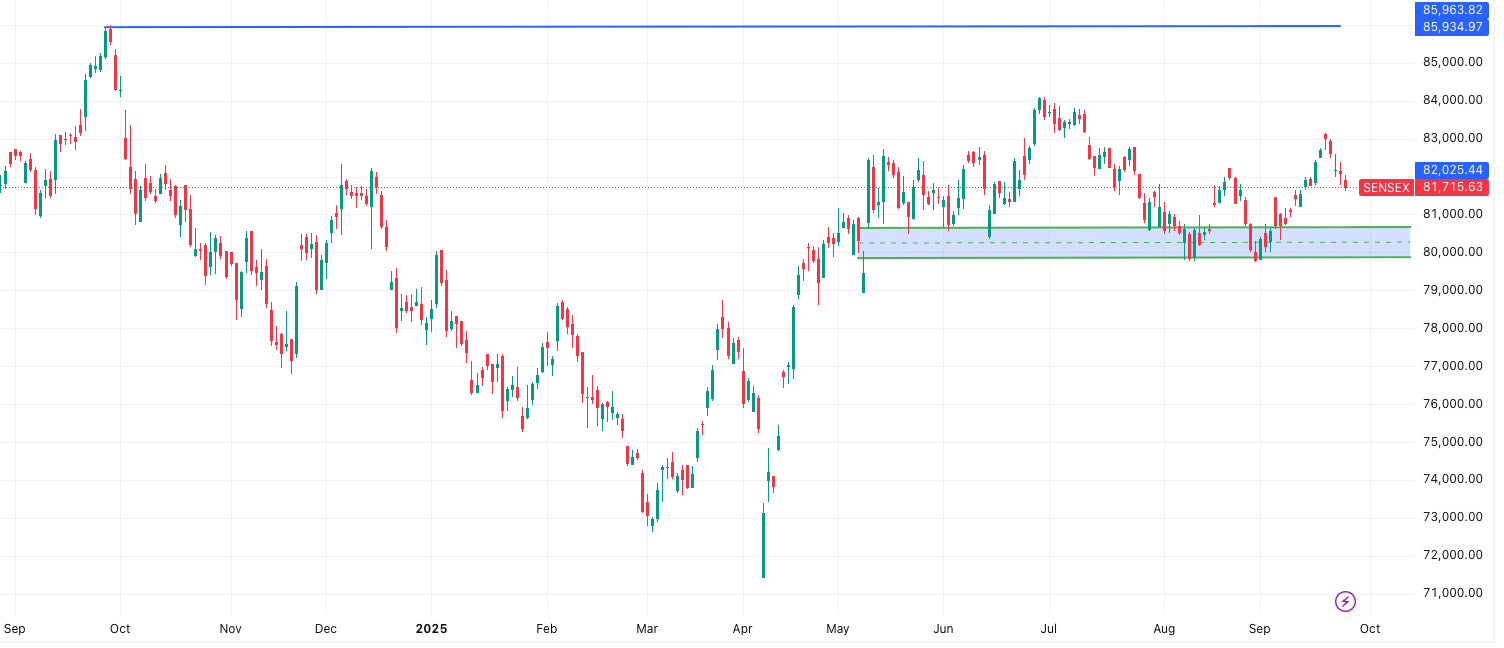

Sensex Outlook 25 September

The Sensex (81,716) extended its losing streak, slipping deeper into the red. The index is clearly locked in a negative trend, reflecting cautious sentiment from both global and domestic cues. As long as it trades below the crucial resistance at 82,367, the bears will have the upper hand. For now, traders holding short positions should continue to maintain their stance with this resistance as a protective stoploss. On the flip side, any decisive close above 82,367 could trigger short covering and fresh long positions.

- Key Supports: 81,534 – 81,352 – 81,096 (break below these may accelerate selling pressure)

- Key Resistances: 81,971 – 82,227 – 82,409 (hurdles that bulls must clear to regain control)

- Trading Range Watch: 82,281 – 81,149

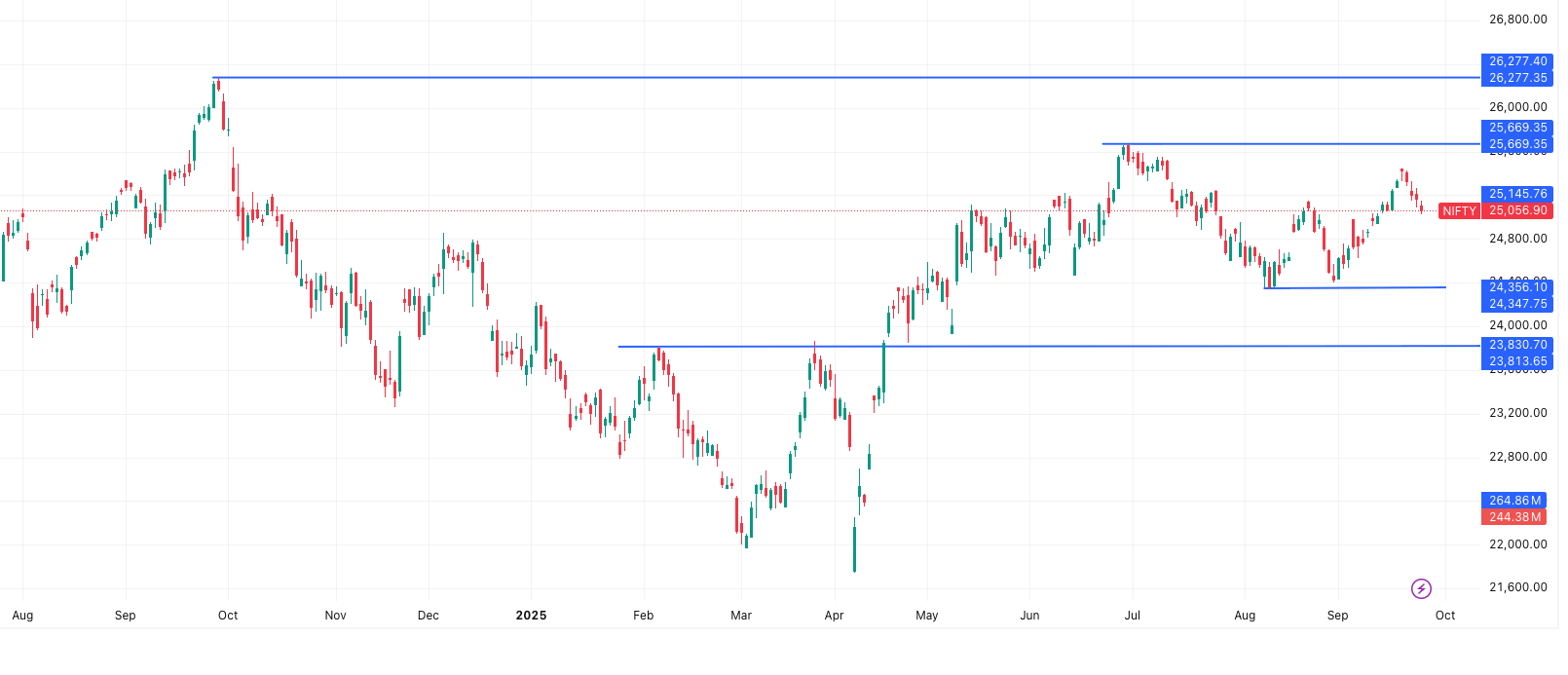

Nifty 50 Outlook 25 September

The Nifty (25,057) too remained weak, posting its second consecutive session in the red. The index is trading firmly in a bearish zone, signaling that traders should remain cautious. The near-term structure suggests that unless Nifty decisively crosses 25,248 on closing basis, the downward bias will persist. A failure to hold above 25,000 support could open the door for further declines toward the 24,950–24,880 zone.

- Key Supports: 25,006 – 24,956 – 24,884

- Key Resistances: 25,129 – 25,200 – 25,251

- Trading Range Watch: 25,225 – 24,888

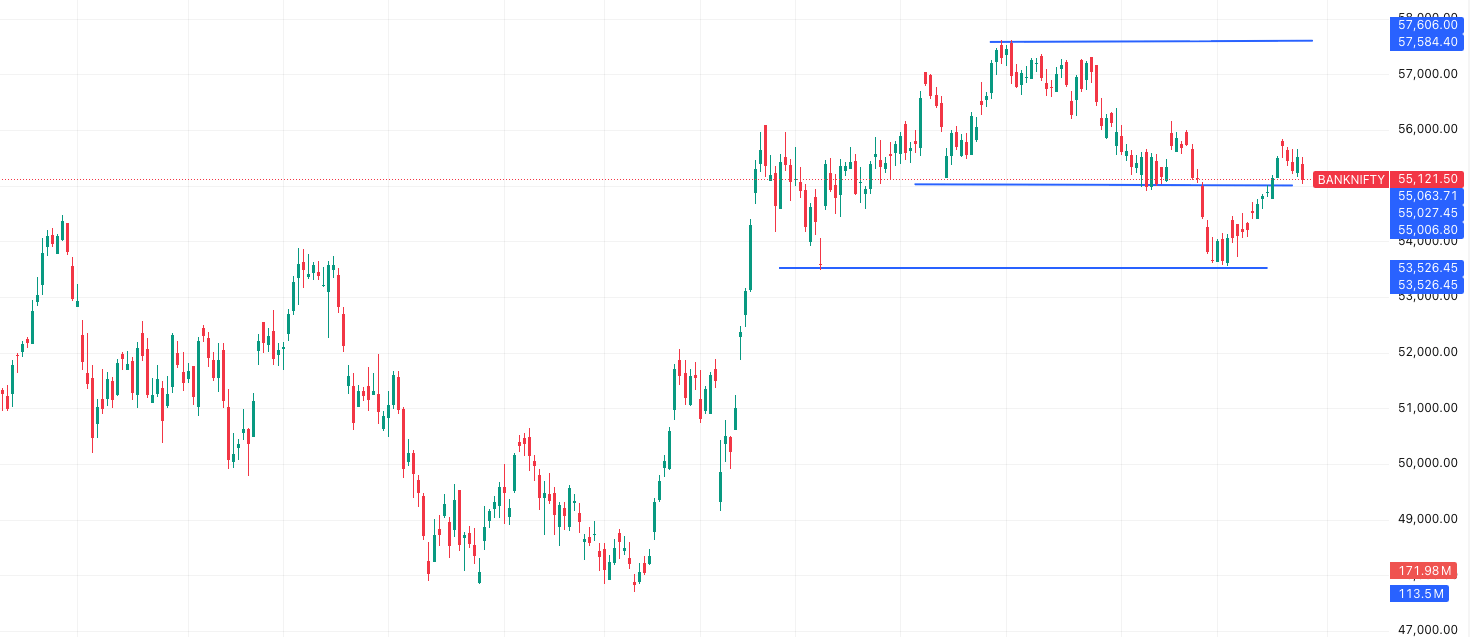

Bank Nifty Outlook 25 September

The Bank Nifty (55,122) was hit the hardest in yesterday’s session, dragging the broader markets lower. The index has now formally slipped into a negative trend, indicating that financial stocks may remain under pressure. Any intraday bounce is likely to face stiff resistance near 55,700, and unless this is reclaimed on a closing basis, the outlook stays bearish. Strong supports exist near the 54,950–54,470 band, and a breakdown below these levels could invite sharper corrections.

- Key Supports: 54,938 – 54,754 – 54,467

- Key Resistances: 55,408 – 55,695 – 55,879

- Trading Range Watch: 55,563 – 54,679

In summary, all three major indices are trading with a bearish bias as we step into September 25. Bulls will need to reclaim their respective resistance levels to reverse the trend, otherwise the market may remain under pressure with a sell-on-rise strategy dominating.

Market Outlook 25 September – Key Developments to Watch

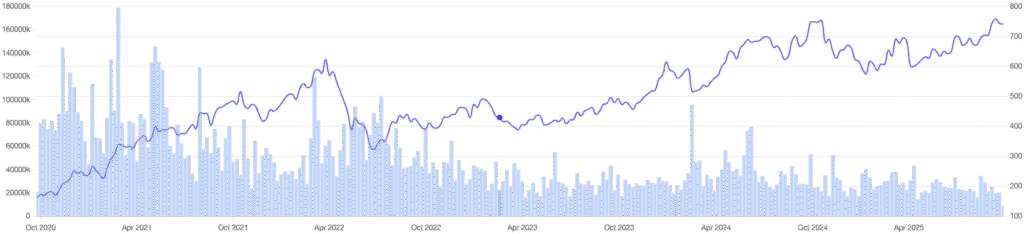

Rise of REITs & InvITs in India

The growth of Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) has been one of the biggest financial innovations in India. From just one REIT in 2019, the market has now grown to 5 REITs and 27 InvITs across sectors like real estate, energy, transport, and communications, with combined AUM crossing USD 103.5 billion. SEBI’s latest move to classify REITs as equity is a game-changer — aligning Indian regulations with global standards like the U.S., Singapore, and Hong Kong. This will:

- Boost liquidity and simplify allocation for mutual funds and AIFs.

- Attract deeper domestic and foreign institutional capital.

- Expand investor participation while providing stable yields of 6–7%.

However, while classification as equity strengthens the market, experts note that India still lacks a clear M&A framework for REITs/InvITs. A codified structure for mergers, acquisitions, and buybacks — similar to the Companies Act and SEBI’s takeover code — will be critical for the next phase of growth.

Corporate & Policy Updates

- Reliance Consumer Products to invest ₹1,156 crore in a 60-acre FMCG manufacturing hub in Tamil Nadu, creating 2,000 jobs.

- L&T and BEL form a strategic partnership for India’s 5th-generation fighter jet (AMCA) program, leveraging aerospace and defence electronics expertise.

- An external SEBI panel may soon mandate public asset disclosures for its chairman and top officials to strengthen transparency and prevent conflict of interest.

Global & Macro Highlights

- Ray Dalio warns retail investors against speculative trades, calling stock markets a zero-sum game. He recommends Treasury Inflation-Protected Securities (TIPS) as safer, inflation-beating alternatives.

- Copper demand surges as AI data centres emerge as massive consumers, using up to 30 tonnes per site. Hindustan Copper expects long-term structural demand, with analysts calling copper the “new gold.”

- Auto & Agri Outlook: Two-wheeler sales expected to grow 6–9% in FY26, aided by GST cuts and rural recovery. Tractor sales up 28% YoY in August, supported by above-normal monsoons and strong farmer sentiment.

IPO Update – Market Outlook 25 September

Mainboard IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP (Est. Listing Gain) |

|---|---|---|---|---|

| Om Freight Forwarders IPO | 29-Sep | 3-Oct | 8-Oct | ₹10 (7.41%) |

| Pace Digitek IPO | 26-Sep | 30-Sep | 6-Oct | ₹18 (8.22%) |

| TruAlt Bioenergy IPO | 25-Sep | 29-Sep | 3-Oct | ₹71 (14.31%) |

| Jinkushal Industries IPO | 25-Sep | 29-Sep | 3-Oct | ₹42 (34.71%) |

| Epack Prefab Technologies IPO | 24-Sep | 26-Sep | 1-Oct | ₹20 (9.80%) |

| Jain Resource Recycling IPO | 24-Sep | 26-Sep | 1-Oct | ₹22 (9.48%) |

| BMW Ventures IPO | 24-Sep | 26-Sep | 1-Oct | ₹2 (2.02%) |

| Jaro Institute IPO | 23-Sep | 25-Sep | 30-Sep | ₹115 (12.92%) |

| Anand Rathi Share IPO | 23-Sep | 25-Sep | 30-Sep | ₹35 (8.45%) |

| Seshaasai Technologies IPO | 23-Sep | 25-Sep | 30-Sep | ₹55 (13.00%) |

| Solarworld Energy IPO | 23-Sep | 25-Sep | 30-Sep | ₹56 (15.95%) |

| Atlanta Electricals IPO | 22-Sep | 24-Sep | 29-Sep | ₹116 (15.38%) |

| Ganesh Consumer Products IPO | 22-Sep | 24-Sep | 29-Sep | ₹4 (1.24%) |

| Saatvik Green Energy IPO | 19-Sep | 23-Sep | 26-Sep | ₹11 (2.37%) |

| GK Energy IPO | 19-Sep | 23-Sep | 26-Sep | ₹28 (18.30%) |

Mainboard IPOs

- Jinkushal Industries IPO – GMP ₹42 (34.71% gain) → Strong buzz with high expected premium.

- Atlanta Electricals IPO – GMP ₹116 (15.38% gain) → Healthy demand in power & infra play.

- GK Energy IPO – GMP ₹28 (18.30% gain) → Renewable energy sector traction.

SME IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP (Est. Listing Gain) |

|---|---|---|---|---|

| Riddhi Display Equipments SME | 24-Sep | – | – | ₹1 (1.00%) |

| Valplast Technologies SME | 30-Sep | 3-Oct | 8-Oct | ₹3 (5.56%) |

| Chatterbox Technologies SME | 25-Sep | 29-Sep | 3-Oct | ₹38 (33.04%) |

| Praruh Technologies SME | 24-Sep | 26-Sep | 1-Oct | ₹4 (6.35%) |

| Justo Realfintech SME | 24-Sep | 26-Sep | 1-Oct | ₹8 (6.30%) |

| Gurunanak Agriculture SME | 24-Sep | 26-Sep | 1-Oct | ₹16 (21.33%) |

| Systematic Industries SME | 24-Sep | 26-Sep | 1-Oct | ₹15 (7.69%) |

| BharatRohan Airborne Innovations | 23-Sep | 25-Sep | 30-Sep | ₹8 (9.41%) |

| Matrix Geo Solutions SME | 23-Sep | 25-Sep | 30-Sep | ₹4 (3.85%) |

| True Colors SME | 23-Sep | 25-Sep | 30-Sep | ₹45 (23.56%) |

| Ecoline Exim SME | 23-Sep | 25-Sep | 30-Sep | ₹15 (10.64%) |

| Aptus Pharma SME | 23-Sep | 25-Sep | 30-Sep | ₹8 (11.43%) |

| Prime Cable Industries SME | 22-Sep | 24-Sep | 29-Sep | ₹3 (3.61%) |

| JD Cables SME | 18-Sep | 22-Sep | 25-Sep | ₹27 (17.76%) |

SME IPOs

- Gurunanak Agriculture SME IPO – GMP ₹16 (21.33% gain) → Agro theme with decent grey market activity.

- Chatterbox Technologies SME IPO – GMP ₹38 (33.04% gain) → One of the hottest SME issues.

- True Colors SME IPO – GMP ₹45 (23.56% gain) → Solid interest in niche business.

Stocks in Radar – Market Outlook 25 September

Hindalco Industries (CMP ₹746 | TP ₹900 | Upside: 20.6%)

Researched by Emkay Research, Hindalco Industries has been upgraded to BUY with a revised target price of ₹900 (previously ₹650). After a flat 12-month performance, the stock is expected to gain from rising aluminium prices and strategic operational advantages.

Investment Drivers:

- Aluminium Strength – Firm global aluminium prices, alongside Hindalco’s industry-leading low cost of production (~USD1,700/t vs. China’s USD2,300/t), are expected to boost profitability in its India business.

- Cash Flow Generation – With strong cash flows (~₹300 bn annually), Hindalco is well-placed to fund capital allocation decisions while maintaining balance sheet strength.

- Novelis Recovery – The U.S. subsidiary’s profitability appears to have bottomed out, with margins expected to normalize around USD480/t by FY28E.

- Macro Tailwinds – A weak dollar (DXY) and supply constraints globally provide a supportive backdrop for industrial metals, giving Hindalco an edge among global peers.

Financials at a Glance (Consolidated)

- FY25E Revenue: ₹2.38 lakh crore | FY28E Revenue: ₹2.95 lakh crore

- FY25E EBITDA: ₹35,496 crore | FY28E EBITDA: ₹38,885 crore

- FY25E PAT: ₹16,881 crore | FY28E PAT: ₹20,151 crore

- Valuation: Currently trading at 9.9x FY26E PE, leaving room for re-rating.

Key Risks

- Industry-level supply expansion if higher prices trigger fresh capacity additions.

- Easing of Russian sanctions, which may alter global supply dynamics.

Outlook: Hindalco is poised to benefit from rising aluminium prices, strong India business margins, and Novelis recovery. With a 20%+ upside potential, the stock looks attractive for medium- to long-term investors.

Conclusion – Market Outlook 25 September

The Indian markets ended lower yesterday, with NIFTY, SENSEX, and sectoral indices showing mild corrections. Equitypandit’s technical view suggests NIFTY and SENSEX remain in a negative trend, with short positions advised until key resistance levels are breached. Meanwhile, Bank NIFTY also continues to face downside pressure.

Amid this cautious sentiment, investors can look at quality opportunities such as Hindalco, which offers a strong risk-reward proposition, supported by improving fundamentals and strategic positioning, as highlighted by Emkay Research.

IPO markets remain active, with both mainboard and SME listings opening new avenues for participation and listing gains. Real estate and infrastructure REITs are evolving as a promising alternative investment segment, with SEBI’s regulatory clarity expected to attract more domestic and institutional capital.

In a nutshell, while short-term volatility persists, selective equity plays, informed by technical trends and sectoral fundamentals, remain key for navigating the current market landscape.

More Articles

When to Sell Mutual Funds: 5 Proven Exit Strategies

The Hidden Multibagger Stock: 5 Positive Triggers That Make Suven Life Sciences a Game-Changer

The Indian Retirement Savings Crisis: 5 Reasons EPF and PPF Won’t Be Enough