Market Outlook 25 July: Nifty Cracks Below 25,100 as IT Rout Sparks Broad Sell-Off

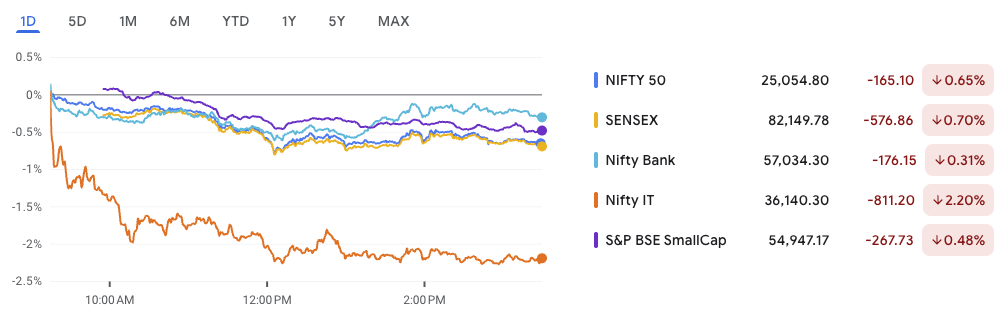

The Indian stock market witnessed a sharp pullback on July 24, with the NIFTY 50 dropping 165 points to settle at 25,054.80, and the SENSEX sliding 576.86 points to close at 82,149.78. The real story of the day was the massive 2.2% plunge in Nifty IT, triggered by weak global cues and sector-specific concerns.

The pressure wasn’t limited to tech—broader indices like Nifty Bank and SmallCap also ended in the red, pointing to a broad-based risk-off sentiment among investors. Profit booking after recent highs and lack of fresh triggers ahead of major earnings added to the weakness.

So, what does this mean for Nifty’s next move?

In today’s newsletter, we break down the implications of this sudden slide and answer key questions:

- Is this just a healthy correction or the start of something deeper?

- What are the critical support and resistance levels for Nifty going into July 25?

- Which sector is showing resilience amid the tech-led sell-off?

- One stock on the technical radar that could outperform if the market stabilizes.

- A small-cap pick to watch, backed by steady fundamentals.

Whether you’re a trader, investor, or just keeping an eye on the pulse of the markets—this outlook helps you stay a step ahead.

Nifty Technical Analysis – Market Outlook 25 July

Current Market Overview

As we step into 25 July, Nifty 50 finds itself under pressure. The index closed at 25,062.10, down 157.80 points (-0.63%). Notably, market volume spiked to 338.7 million, well above the 20-day average of 284.84 million, indicating strong institutional participation behind the move.

Key Technical Levels

Support Zones:

- 24,892 – Recent swing low acting as immediate support

- 24,452 – Stronger demand zone from earlier consolidation

Resistance Levels:

- 25,669 – Mid-July swing high, the immediate resistance to watch

- 26,277 – March’s all-time high remains a long-term hurdle

Moving Averages Insight

- 9-Day SMA stands near 25,028, with the current price hovering close.

- A decisive breakdown below this moving average could signal a short-term bearish shift.

- Conversely, a rebound from this level may hint at continuation of the broader uptrend.

Price Action: Range with a Bearish Bias

Nifty appears to be trapped in a rectangle range between 24,892 and 25,669, reflecting indecision.

However, the formation of lower highs alongside a flat support base around 24,892 resembles a descending triangle pattern, which is typically a bearish signal.

Measured Move Calculation:

- Height of the pattern: 25,062 – 24,452 = 610 points

- Breakdown target: 24,450 – 610 = ~23,840

Possible Scenarios

Bearish Case:

- A breakdown below 24,892 with strong volume could trigger a fall toward 24,450, and possibly extend to 23,840 based on the triangle’s projection.

Bullish Case:

- A breakout above 25,669 would invalidate the bearish structure.

- Such a move, especially with rising volume and bullish candles (like Bullish Engulfing), could restart the uptrend targeting 26,277.

Market Outlook 25 July: Expert Take

The technical outlook remains neutral to mildly bearish for the short term. The presence of a descending triangle combined with a rejection from higher levels points toward caution.

Trigger Zones to Watch:

- Bearish confirmation: Closing below 24,892

- Bullish confirmation: Breakout above 25,669 with volume

Strategy Ahead

For Traders:

- Short setup: Enter short trades below 24,892 with a stop-loss above 25,100, targeting 24,450

- Long setup: Buy only on a confirmed breakout above 25,669 with a stop-loss below 25,400

For Investors:

- Hold off on fresh buying unless price sustains above 25,669

- Consider accumulating around 24,450–24,000 zone for long-term positions if a breakdown unfolds

Stay cautious and let the market confirm its next direction before taking aggressive positions.

News and Stocks That Might Be Impacted — Market Outlook 25 July

As we look toward the Market Outlook for 25 July, several developments across trade, energy, healthcare, and infrastructure are likely to influence stock movements and investor sentiment:

🔹 India–UK Free Trade Agreement Signed

What happened:

India and the UK have finally signed a Free Trade Agreement (FTA) after several rounds of negotiations. This deal will remove or lower import-export duties on almost 99% of traded goods, making it cheaper and easier for Indian companies to export to the UK and vice versa.

Why it matters:

Indian sectors like textiles, auto parts, pharma, tea, and FMCG will benefit from easier access to the UK market. Lower duties make Indian products more competitive abroad.

Impacted Stocks:

- Tata Motors – Big UK exposure through Jaguar Land Rover

- Britannia, HUL – FMCG exports

- Dr. Reddy’s, Cipla – Pharma exports

- KPR Mill, Welspun India – Textile exporters

🔹 Executive Centre India Files for ₹2,600 Cr IPO

What happened:

The flexible office space provider, Executive Centre India, has filed papers to raise ₹2,600 crore through an IPO. It plans to use the funds to expand in India, UAE, and Singapore.

Why it matters:

Demand for coworking and flexible office spaces is growing, especially post-COVID. This IPO reflects investor interest in the commercial real estate and workspace solutions space.

Impacted Stocks:

- DLF, Phoenix Mills – Commercial space developers

- Embassy Office Parks REIT, Mindspace REIT – Listed workspace REITs that may gain investor attention

- Awfis Space Solutions – Direct peer

🔹 JSW Energy Signs Solar + Battery Storage PPA

What happened:

JSW Energy signed a long-term (25-year) power purchase agreement with BESCOM for a 100 MW solar + 100 MWh battery storage project in Karnataka at ₹4.31/unit.

Why it matters:

It highlights how renewable energy is expanding with storage integration, which solves power supply fluctuation issues. This adds to JSW Energy’s green energy portfolio.

Impacted Stocks:

- JSW Energy – Direct beneficiary

- Tata Power, Adani Green – Competitors in renewable energy

- Reliance Industries (green energy expansion plans)

🔹 VA Tech Wabag Wins $272 Mn Desalination Project

What happened:

Wabag bagged a massive order worth $272 million to build a seawater desalination plant in Saudi Arabia, one of its largest international contracts.

Why it matters:

This boosts its global order book and signals growing demand for clean water infrastructure in arid regions. It also opens up more Middle East opportunities for Wabag.

Impacted Stocks:

- VA Tech Wabag – Direct gainer

- Larsen & Toubro, Ion Exchange – Infrastructure/engineering peers

🔹 RITES & CMPDI Sign MoU for Mining & Renewable Projects

What happened:

RITES Ltd and CMPDI (a Coal India arm) signed an MoU to collaborate on mining and renewable energy consulting projects in India and abroad.

Why it matters:

RITES is traditionally a railway consultancy firm. This marks a diversification into new, potentially high-margin areas like mining advisory and solar/wind energy consulting.

Impacted Stocks:

- RITES – Positive outlook on expansion

- Engineers India Ltd (EIL), NBCC – Similar engineering consultancies

🔹 Lupin Gets USFDA Approval for Two Injectables

What happened:

Lupin received final USFDA approvals for two important injectable drugs:

- Liraglutide (for type 2 diabetes)

- Glucagon (for low blood sugar emergencies)

Why it matters:

These are complex injectable generics, hard to make and therefore more profitable. Lupin strengthens its US portfolio, targeting a market worth over $580 million.

Impacted Stocks:

- Lupin – Direct winner

- Sun Pharma, Dr. Reddy’s, Zydus – Peer Indian pharma companies

🔹 Mindspace REIT Buys Hyderabad Office Asset

What happened:

Mindspace Business Parks REIT acquired an office property called Q-City (8.1 lakh sq. ft.) in Hyderabad for ₹512 crore.

Why it matters:

It shows confidence in commercial office demand, especially in tech hubs like Hyderabad. The asset is 95% occupied, meaning instant cash flows for Mindspace.

Impacted Stocks:

- Mindspace REIT – Direct impact

- Embassy REIT – Peer REIT, may see positive sentiment

- Brigade Enterprises, Prestige Estates – Hyderabad developers

🔹 Torrent Power in Talks to Acquire L&T’s Thermal Biz

What happened:

Torrent Power is reportedly in early talks to acquire L&T’s thermal power plants for approx $1 billion.

Why it matters:

If the deal goes through, Torrent could significantly scale its generation capacity, while L&T may use funds to strengthen its balance sheet or invest in core infra/green businesses.

Impacted Stocks:

- Torrent Power – Could gain or be re-rated

- Larsen & Toubro (L&T) – Capital inflow boost

- JSW Energy, NTPC – Peer companies to watch

🔹 Zydus Lifesciences Gets Tentative USFDA Nod for Ibrutinib

What happened:

Zydus Lifesciences received tentative US approval for a generic version of Ibrutinib, a blockbuster cancer treatment drug (used in blood cancers).

Why it matters:

The brand version (Imbruvica) has US sales of over $2.1 billion. Zydus entering this market could offer strong revenue potential when exclusivity lifts.

Impacted Stocks:

- Zydus Lifesciences – Direct beneficiary

- Natco Pharma, Glenmark – Oncology-focused peers

- Lupin, Sun Pharma – Large pharma exporters

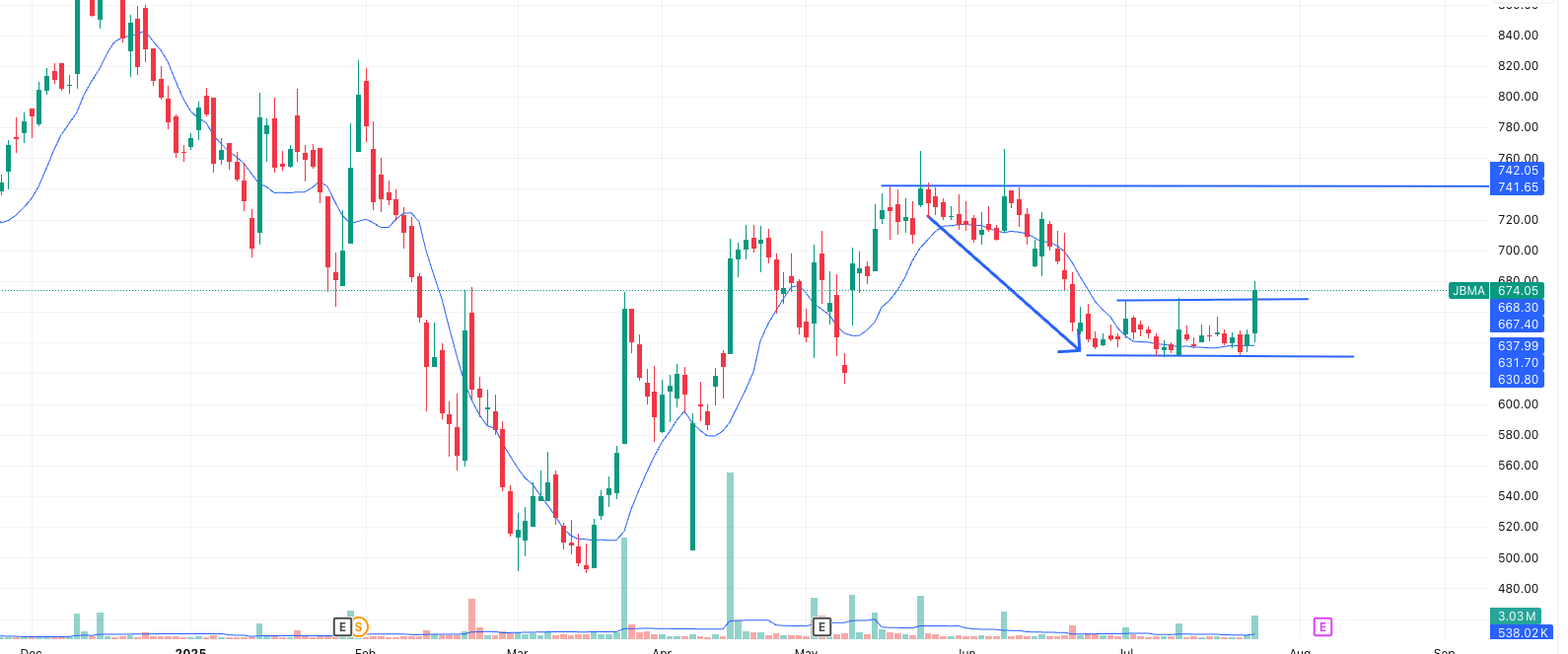

Technical Spotlight — JBMA (JBM Auto Ltd)

JBM Auto Ltd (JBMA) showed significant bullish activity on July 24, closing at ₹674.05. Notably, this is well above its 9-day simple moving average (SMA) of ₹637.99, which strengthens its short-term technical setup.

Bullish Pattern Breakout

The stock had been forming a falling wedge, which is typically a bullish reversal pattern. After a gradual downtrend, JBMA consolidated between ₹630–667 for several sessions. However, during the most recent session, the stock broke out with a sharp move on above-average volume, indicating a shift in momentum.

Key Price Levels

Resistance Zones:

- ₹680 – immediate hurdle, touched intraday

- ₹742 – major swing high from June

- ₹760+ – if the stock sustains above ₹742, it may test these multi-month highs

Support Zones:

- ₹667 – previous resistance, now acting as support

- ₹637 – 9-day SMA, offering short-term trend confirmation

- ₹630 – bottom of recent consolidation; a crucial base level

Volume & Momentum Indicators

While price action alone signals strength, volume confirms the breakout. JBMA recorded a 3.03 million volume, significantly higher than its 20-day average of 538K. This volume surge often reflects institutional interest, which further validates the move.

Moreover, although the RSI is not mentioned explicitly, the breakout candle’s strength suggests it may be entering bullish momentum territory (above 60–70). Therefore, short-term momentum is likely to continue if market conditions remain supportive.

Trade Setup

Short-Term Positional Idea:

- Buy Zone: ₹667–674

- Stop-Loss: ₹637 (below SMA and key support)

- Target 1: ₹690

- Target 2: ₹742

- Risk–Reward: Around 1:2.5, which is attractive for swing setups

Swing Trade Outlook (1–3 Weeks):

- When a breakout is supported by volume and a clear pattern, continuation is more likely.

- If the broader market holds steady, JBMA could target ₹760–775 over the next few weeks.

- A trailing stop-loss strategy below swing lows (e.g., ₹667 and ₹680) can protect gains while riding momentum.

Analyst View

- Short-Term Bias: Strongly bullish

- However, traders should monitor broader Nifty levels, as JBMA’s continued momentum may correlate with market stability.

- Market Context: If Nifty remains above the psychological 25,000 level, JBMA could lead gains within the midcap auto segment.

- Long-Term Outlook: Not yet favorable unless the stock closes and sustains above ₹760 with continued volume strength.

IPO Updates – Market Outlook 25 July

As part of the Market Outlook 25 July, here’s a snapshot of key IPOs currently in focus. We’ve separated Mainboard and SME IPOs for clarity. This includes their open/close dates, GMP, and expected listing date to help you track sentiment and spot potential listing pops.

Mainboard IPOs

| IPO Name | Open | Close | GMP | Listing Date |

|---|---|---|---|---|

| Shanti Gold International IPO | 25-Jul | 29-Jul | ₹35 (17.59%) | 1-Aug |

| NSDL IPO | 30-Jul | 1-Aug | ₹167 (0.00%) | 6-Aug |

| Aditya Infotech IPO | 29-Jul | 31-Jul | ₹240 (35.56%) | 5-Aug |

| Brigade Hotel Ventures IPO | 24-Jul | 28-Jul | ₹6.5 (7.22%) | 31-Jul |

| Indiqube Spaces IPO | 23-Jul | 25-Jul | ₹12 (5.06%) | 30-Jul |

| GNG Electronics IPO | 23-Jul | 25-Jul | ₹100 (42.19%) | 30-Jul |

| PropShare Titania IPO | 21-Jul | 25-Jul | ₹– (0.00%) | 4-Aug |

SME IPOs

| IPO Name (SME) | Open | Close | GMP | Listing Date |

|---|---|---|---|---|

| Monarch Surveyors SME | 22-Jul | 24-Jul | ₹210 (84%) | 29-Jul |

| Savy Infra SME | 21-Jul | 23-Jul | ₹25 (20.83%) | 28-Jul |

| Kaytex Fabrics SME | 29-Jul | 31-Jul | ₹21 (11.67%) | 5-Aug |

| Laxmi India Finance SME | 29-Jul | 31-Jul | ₹18 (11.39%) | 5-Aug |

| Sellowrap Industries SME | 25-Jul | 29-Jul | ₹14 (16.87%) | 1-Aug |

| Patel Chem Specialities SME | 25-Jul | 29-Jul | ₹23 (27.38%) | 1-Aug |

| Shree Refrigerations SME | 25-Jul | 29-Jul | ₹80 (64.00%) | 1-Aug |

| Repono SME | 28-Jul | 30-Jul | ₹17 (17.71%) | 4-Aug |

| Umiya Mobile SME | 28-Jul | 30-Jul | ₹– (0.00%) | 4-Aug |

| Takyon Networks SME | 30-Jul | 1-Aug | ₹– (0.00%) | 6-Aug |

| Mehul Colours SME | 30-Jul | 1-Aug | ₹– (0.00%) | 6-Aug |

| B.D. Industries SME | 30-Jul | 1-Aug | ₹– (0.00%) | 6-Aug |

| Cash Ur Drive Marketing SME | 31-Jul | 4-Aug | ₹– (0.00%) | 7-Aug |

| Jyoti Global Plast SME | 4-Aug | 6-Aug | ₹– (0.00%) | 11-Aug |

This concludes the IPO update for the market outlook 25 July. With robust SME listings and some high-GMP mainboard IPOs in play, traders may find lucrative short-term opportunities.

Smallcap of the Day – PTC India | Market Outlook 25 July

PTC India: Power Play Amid Exchange Shock

In today’s Market Outlook 25 July, while the broader indices saw a dip, one stock quietly stayed resilient — PTC India Ltd. A pioneer in power trading, PTC India might be stepping into the spotlight as structural changes shake up the power exchange landscape.

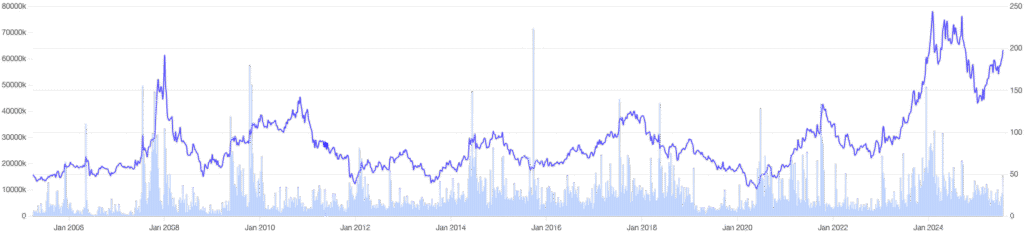

About the Company

Established in 1999 by the Government of India, PTC India is a leader in long-, medium-, and short-term power trading. It’s backed by NTPC, PGCIL, PFC, and NHPC — the heavyweights of India’s power sector. PTC also co-promoted IEX, India’s first electricity exchange, and is a major player in cross-border energy trade with Nepal, Bhutan, and Bangladesh.

Why This Stock Matters Today

IEX Crashes 30%! Market Monopoly No More?

The power sector was shaken today when IEX — India’s dominant power exchange — plunged over 30% in two sessions, hitting back-to-back lower circuits. This followed CERC’s decision to approve market coupling from Jan 2026.

So what does it mean?

- Uniform pricing will be introduced across all exchanges.

- IEX’s price discovery advantage is wiped out.

- Its 85% market share could get challenged by competitors.

➡️ PTC India, with its independent trading platform and cross-border power deals, may benefit from a more level playing field as exchanges compete on efficiency rather than monopoly power.

Business Strength Snapshot

- Trading Volume (FY23): 70.6 BUs — market leader in volume.

- Revenue Split:

- Generators & Utilities – 78%

- Cross-Border Trade – 21%

- Advisory Services – 1%

- New Initiatives:

- Data analytics lab for real-time energy trends

- Foray into Green Hydrogen and Battery Storage Systems

- Subsidiaries:

- PTC Energy: 288.8 MW of renewable assets

- PTC Financial Services: Infrastructure financing

Key Financials

| Metric | Value |

|---|---|

| Market Cap | ₹5,874 Cr |

| CMP | ₹198 |

| P/E | 8.74 |

| Dividend Yield | 5.90% |

| ROE / ROCE | 12.3% / 11.5% |

| Debt to Equity | 0.51 |

| Book Value | ₹196 |

| Intrinsic Value (Est.) | ₹240 |

Why It’s in Focus

In the Market Outlook 25 July, PTC stands out as a power sector smallcap that’s:

- Not overly dependent on IEX

- Expanding globally and innovating

- Poised to benefit if regulatory shifts dismantle monopolies in power trading

With a solid balance sheet, deep sectoral linkages, and defensive traits, PTC India may offer investors a low-risk power sector exposure in uncertain times.

Conclusion | Market Outlook 25 July

As we wrap up the Market Outlook 25 July, it’s clear the Indian markets are entering a cautious phase. After Monday’s sharp sell-off, Nifty and Sensex both closed in the red, led by heavy damage in IT and energy stocks. While profit booking was expected after a strong rally, the intensity—especially in the tech space—signals broader concerns, possibly around US earnings or global risk sentiment.

But amidst this volatility, themes are emerging. The power sector is in focus, with regulatory shakeups hitting IEX and possibly creating tailwinds for alternatives like PTC India. At the same time, IPO activity remains upbeat, and stock-specific action continues to drive the mid and smallcap segments.

Going forward, all eyes will be on how Nifty handles the crucial 25,000–24,900 zone. Will the bulls step in again? Or are we setting up for a deeper consolidation?

Stay tuned, trade smart — and don’t forget, tomorrow’s market moves will be shaped by today’s headlines.

More Articles

Sri Lotus Developers IPO: From Big B to SRK—Bollywood’s Biggest Names Are Investing Here

Luxury Housing Boom: Real Estate Stocks to Watch in 2025

Golden Crossover vs Death Crossover: How to Use These Powerful Chart Signals