IT Stocks Stumble Late — What’s Next?

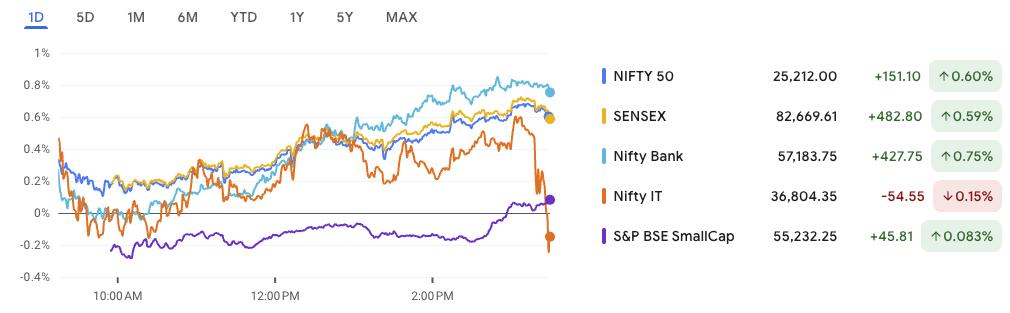

Bulls kept charging on July 23 as benchmark indices posted strong gains for the second straight session. The Nifty 50 surged 151 points to close at a fresh high of 25,212, while the Sensex jumped nearly 483 points, powered by robust buying in banks, autos, and FMCG. The Nifty Bank index climbed 0.75%, reflecting upbeat sentiment in the financial space.

But the rally wasn’t without a hiccup — Nifty IT, after holding steady all day, suddenly turned negative post 3 PM, hinting at sector-specific caution ahead of global tech earnings. Smallcaps continued to consolidate, suggesting stock-specific action could dominate.

As we step into July 24, the big question is: Can Nifty sustain this momentum, or is a near-term pullback on the cards?

In this newsletter: Get insights on Nifty’s next likely move, key news driving the market, stocks that could react, buzzing IPO GMPs, chart-based technical picks, and a must-watch small-cap idea.

Nifty Next Move – Market Outlook 24 July

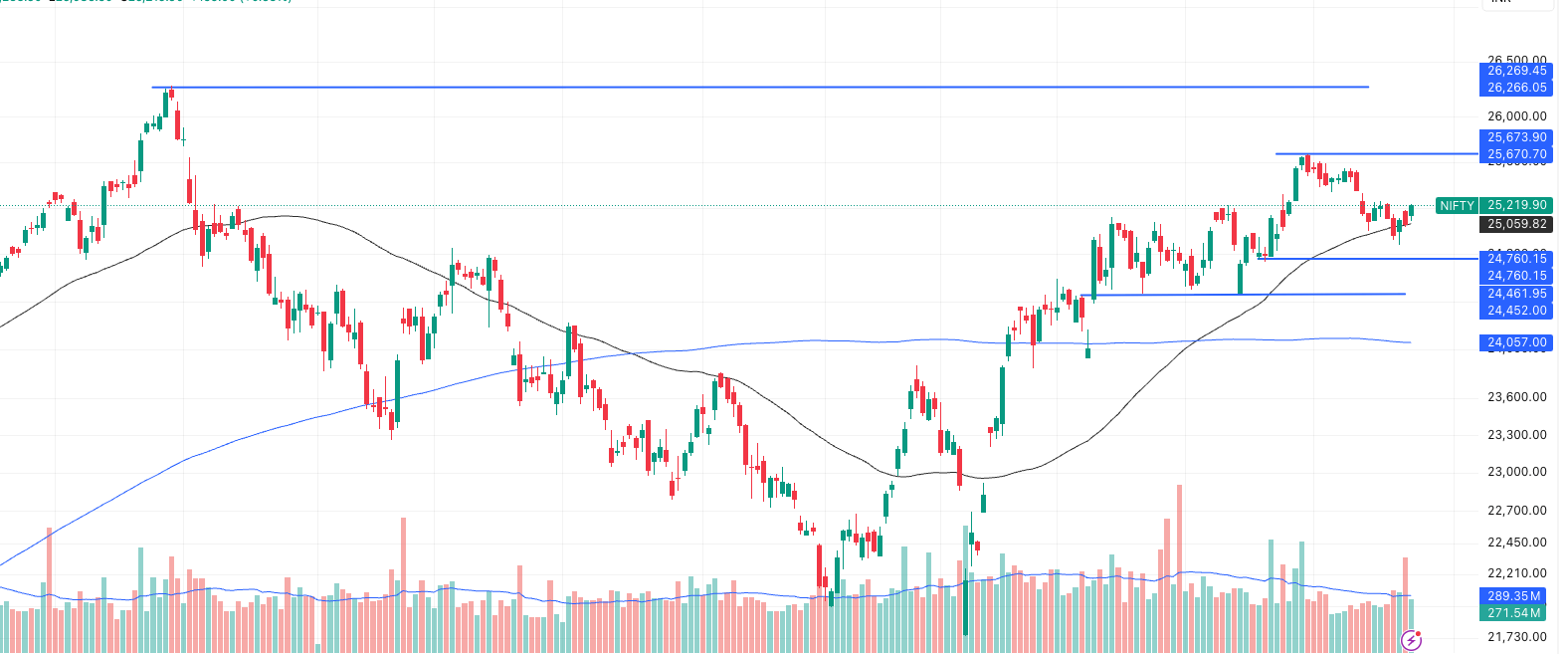

The Nifty 50 ended July 23 on a strong note, closing at 25,219.90, up 159 points or 0.63%, inching closer to a critical resistance level. The broader structure remains bullish, with the index consistently forming higher highs and higher lows — a classic uptrend pattern. However, there are signs of hesitation as Nifty approaches a key hurdle.

Technical Snapshot (Daily Chart Analysis)

- Immediate Support: 25,059 – 25,000 (aligned with the 50-day SMA)

- Stronger Support Zones: 24,760 → 24,460 (multi-tested base), and 24,057 (200-day SMA – uptrend invalidation)

- Resistance Levels: 25,670 – 25,675 (prior double top zone), and 26,266 – 26,269 (all-time highs)

While price action has reclaimed and respected the 50-SMA, volume hasn’t yet confirmed a breakout attempt. The index has been consolidating between 24,760 and 25,670 for nearly three weeks, signaling indecision but within a bullish setup.

What Could Happen Next?

Bullish Case (More Likely):

If Nifty breaks and closes above 25,675 on strong volume, we could see a sharp move toward 25,900 and eventually the all-time high zone near 26,250 – 26,269. Global market sentiment and Q1 earnings will play a supporting role.

Bearish Case (Cautious View):

A rejection from the 25,670 zone and a close below 25,000 could drag the index back toward the 24,760 – 24,460 region. A breakdown below 24,460 would turn the structure weak, with downside risk extending to the 200-SMA near 24,057.

Strategy Setup for Traders

- Breakout Longs: Above 25,675 with a stop loss at 25,420

- Buy on Dips: Between 24,760 – 24,900 for a swing toward 25,670

- Short (Riskier): Only if Nifty shows rejection candles near 25,660 with weakness confirmation

Conclusion:

For Market Outlook 24 July, Nifty’s broader bias remains moderately bullish, as long as it holds above the 50-SMA. A breakout above 25,675 could act as the next trigger for fresh momentum, but traders must watch for signs of exhaustion or low-volume rallies. Stay nimble and alert to global cues.

News and Stocks Likely to React | Market Outlook 24 July

In the Market Outlook 24 July, we bring you the key developments from corporate India that could influence investor sentiment in the coming sessions. These stories range from mining expansions and financial results to strategic fundraisings and international partnerships. Here’s what you need to know:

Vedanta Wins Iron Ore Mine in Karnataka – Boosts Long-Term Resources

Vedanta Ltd has been chosen as the preferred bidder for the Janthakal iron ore mine in Karnataka. This mine spans around 71 hectares and adds valuable reserves to Vedanta’s existing mining operations. Iron ore is a key input in steel manufacturing, and gaining new mines ensures supply security and cost efficiency in the long term.

Why this matters: For investors tracking Vedanta, this deal strengthens its raw material base. While the stock may not react instantly, progress on regulatory approvals and mine development could offer future catalysts.

Aditya Birla Real Estate Posts Loss Amid Pulp Business Exit Plans

Aditya Birla Real Estate Ltd, formerly known as Century Textiles, reported a consolidated loss of ₹27 crore in Q1FY26, despite standalone profits. The loss stems from the winding down of its pulp and paper business, which the company plans to sell to ITC Ltd. Meanwhile, the board approved raising ₹1,500 crore in long-term loans, possibly to support its real estate expansion and meet existing obligations.

Investor impact: This move shows the company is repositioning itself as a focused real estate player. While short-term financials appear weak, asset sales and fund infusion may strengthen the balance sheet.

PNB Housing Raises ₹400 Crore via Bonds – Q1 Profit Up 23%

PNB Housing Finance raised ₹400 crore through non-convertible debentures (NCDs) carrying a coupon of 7.43%. At the same time, the company posted a strong 23% year-on-year jump in profit for the June quarter, reaching ₹534 crore. Retail loan disbursements increased, and asset quality improved.

Market view: The fundraising shows lender confidence, and healthy earnings point to operational strength. As part of the Market Outlook 24 July, the stock could draw investor attention for its improving fundamentals.

Muthoot Capital Raises Funds Despite Weak Profit Growth

Muthoot Capital managed to raise ₹125 crore by issuing secured bonds, offering a relatively high interest rate of 9.5%. This suggests strong appetite among investors for its debt paper. However, its Q4FY25 results were mixed: while revenue rose 43%, profit dropped 45%, mainly due to rising interest costs.

Why this is important: The fundraising reflects liquidity strength, but declining profits may weigh on stock performance. Investors should watch margin trends and operational efficiency in coming quarters.

ADB Cuts India’s GDP Forecast to 6.5% for FY25

The Asian Development Bank (ADB) revised its growth projection for India, lowering the FY25 GDP estimate to 6.5% from 6.7%. ADB cited concerns about global trade disruptions, rising US tariffs, and uncertain export demand. However, the inflation forecast was revised lower to 3.8%, which is seen as supportive for rate-sensitive sectors.

What to watch: Export-dependent sectors like textiles, IT services, and industrials may come under pressure if external demand weakens. At the same time, lower inflation could benefit banks and consumer stocks.

Bajaj Finserv MF Launches New Balanced Fund – NFO Opens July 28

Bajaj Finserv Mutual Fund is launching its new Equity Savings Fund, which blends equity, arbitrage, and debt instruments to offer moderate returns with relatively low risk. The fund aims to appeal to conservative investors seeking stability alongside growth.

Why this matters: It adds a new investment avenue in a balanced category. This may also increase visibility for Bajaj Finserv’s AMC business. Investors in mutual funds could see increased competition and innovation in fund offerings.

Intellect Design Arena Wins Core Banking Deal in North America

Intellect Design Arena, a digital banking solutions company, announced a major deal with a Tier-1 Canadian bank. It will implement its AI-driven core banking platform eMACH.ai in the US, with plans to expand into Europe and Asia.

Investor takeaway: This win demonstrates Intellect’s growing global relevance. The stock could see positive momentum, particularly if revenue visibility improves in the coming quarters. In the context of the Market Outlook 24 July, this is one tech mid-cap to track.

Biocon Launches Biosimilar Nepexto in Australia

Biocon Biologics, through its partner Generic Health, launched Nepexto® in Australia. This is a biosimilar version of Etanercept, used to treat chronic autoimmune diseases like arthritis. The drug had already been launched in Europe and now adds a new geography to its reach.

Why this matters: This launch expands Biocon’s presence in the global biosimilars market, a key long-term growth area. The stock could benefit from improved monetization and higher export revenues.

Technical Chart Pick | Market Outlook 24 July

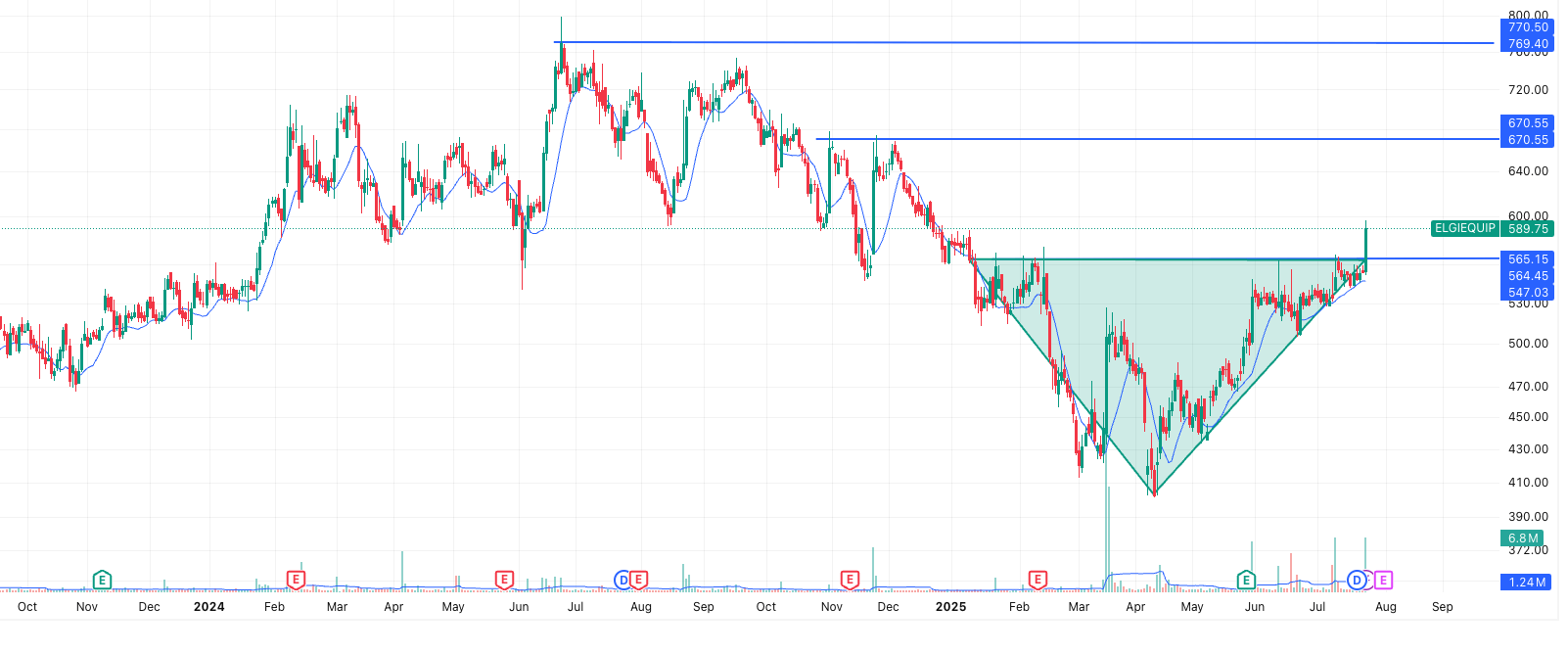

ELGI Equipments Ltd – Potential Breakout in Progress

- Chart Type: Daily

- Current Market Price: ₹589.75

- Pattern Observed: Inverted Broadening Triangle (also known as a Descending Broadening Wedge)

Pattern Recognition and Structure

On the daily chart, ELGI Equipments is forming an inverted broadening triangle, a pattern characterized by increasing volatility. Unlike symmetrical triangles that compress price, this pattern diverges with lower lows and higher highs, indicating indecision followed by accumulation.

This structure generally reflects a transition from a volatile consolidation phase to a strong directional move—typically a breakout in the direction of the prevailing trend. In this case, that direction is upward.

Breakout Confirmation

A strong breakout has already occurred from the upper boundary near ₹565. This was validated by above-average volume of 6.8 million shares, suggesting institutional participation and conviction behind the move.

Price is now trading comfortably above the breakout zone, indicating that the move is likely real and sustainable rather than a false breakout.

Key Technical Levels

| Level Type | Price (₹) | Commentary |

|---|---|---|

| Breakout Point | ₹565 | Key level cleared with strong volume |

| Current Price | ₹589.75 | Trading above resistance |

| Immediate Resistance | ₹670 | Previous swing high |

| Next Target Zone | ₹720 – ₹775 | Price projection and all-time high range |

| Suggested Stop Loss | ₹545 (closing) | Just below support and short-term EMA |

Price Target Estimation

The height of the pattern measures around ₹155, derived from the widest part of the triangle (₹565 – ₹410). By adding this to the breakout level, we get a conservative swing target of around ₹720. The longer-term upside could extend toward the all-time high near ₹770.

Trading Strategy

Two possible setups for traders in the current Market Outlook 24 July:

- Breakout Trade

- Entry: ₹589–595

- Stop Loss: ₹545

- Targets: ₹670 / ₹720

- Risk-Reward: Strong (1:2+)

- Pullback Entry (Retest Strategy)

- Entry Zone: ₹565–570

- Stop Loss: ₹540

- Target: ₹610+

- Risk-Reward: Still favorable for positional trades

Summary and Bias

- Pattern: Inverted Broadening Triangle

- Breakout: Confirmed with bullish price action and heavy volume

- Bias: Bullish as long as price remains above ₹565

- Upside Targets: ₹670 → ₹720 → ₹770

- Risk Factor: Inherent volatility of the pattern—tight stop loss is crucial

In the context of the Market Outlook 24 July, ELGI Equipments appears to be one of the better-positioned mid-cap stocks showing both technical strength and strong risk-reward for positional or swing trades.

IPO GMP Update

Market Outlook 24 July – Mainboard IPO Update

| IPO Name | Open | Close | Listing Date | GMP (as of Jul 23) |

|---|---|---|---|---|

| Brigade Hotel Ventures | 24-Jul | 28-Jul | 31-Jul | ₹8 (8.89%) |

| Indiqube Spaces | 23-Jul | 25-Jul | 30-Jul | ₹20 (8.44%) |

| GNG Electronics | 23-Jul | 25-Jul | 30-Jul | ₹96 (40.51%) |

| PropShare Titania | 21-Jul | 25-Jul | 4-Aug | ₹0 (No Change) |

| NSDL IPO | Yet to Open | — | — | ₹165 (Flat) |

Market Outlook 24 July – SME IPO Update

| IPO Name | Open | Close | Listing Date | GMP (as of Jul 23) |

|---|---|---|---|---|

| Shree Refrigerations SME | 25-Jul | 29-Jul | 1-Aug | ₹80 (64.00%) |

| Shanti Gold International SME | 25-Jul | 29-Jul | 1-Aug | ₹0 (Flat) |

| Sellowrap Industries SME | 25-Jul | 29-Jul | 1-Aug | ₹14 (16.87%) |

| Patel Chem Specialities SME | 25-Jul | 29-Jul | 1-Aug | ₹23 (27.38%) |

| Kaytex Fabrics SME | 29-Jul | 31-Jul | 5-Aug | ₹21 (11.67%) |

| Laxmi India Finance SME | 29-Jul | 31-Jul | 5-Aug | ₹19 (12.03%) |

| Repono SME | 28-Jul | 30-Jul | 4-Aug | ₹14 (14.58%) |

| Monarch Surveyors SME | 22-Jul | 24-Jul | 29-Jul | ₹170 (68.00%) |

| Swastika Castal SME | 21-Jul | 23-Jul | 28-Jul | ₹0 (Flat) |

| Savy Infra SME | 21-Jul | 23-Jul | 28-Jul | ₹25 (20.83%) |

| TSC India SME | 23-Jul | 25-Jul | 30-Jul | ₹0 (Flat) |

Quick Summary – Market Outlook 24 July:

- The IPO market continues to stay vibrant with strong interest in SME listings, especially Shree Refrigerations and Monarch Surveyors, both commanding over 60% GMP gains.

- On the mainboard, Brigade Hotel Ventures and GNG Electronics are drawing decent GMPs, indicating healthy subscription interest.

- Watch out for Monarch Surveyors’ listing on July 29, which could set the tone for SME IPO performance ahead.

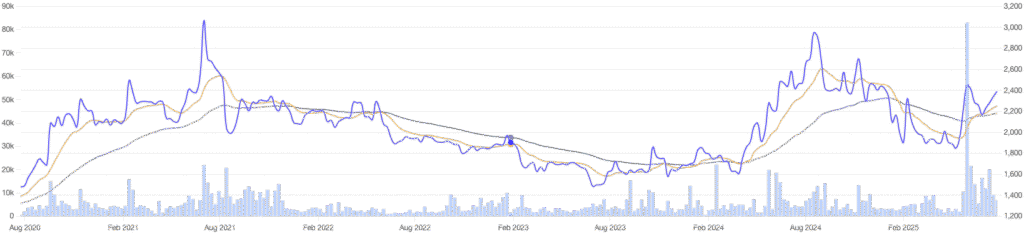

Small Cap of the Day: KSE Ltd

Price: ₹2,390 | Market Cap: ₹765 Cr | 1-Day Move: +1.21%

52-Week Range: ₹1,765 – ₹2,990

Industry: Animal Feed, Dairy, Solvent Extraction

Why KSE Ltd is Worth Watching:

KSE Ltd, a Kerala-based player founded in 1963, might not make headlines daily, but it’s quietly delivering value in a niche yet essential sector—cattle feed and dairy processing.

With a network of over 700 dealers and value-added services like on-call veterinary support, KSE combines old-school operations with customer-centric innovation. It’s certified by the National Productivity Council, adding credibility to its manufacturing standards.

What Makes It Stand Out Today?

- Strong Fundamentals:

- ROCE: 43.3%

- ROE: 34.3%

- P/E: Just 8.55 vs. industry average of 22.2

- Low Debt: Debt-to-equity of 0.08

- Healthy Cash: ₹51.4 Cr in hand

- Dividend Yield: 1.26%

- Undervalued?

KSE’s intrinsic value is estimated at ₹2,586, which is above its current price of ₹2,390—suggesting potential for upside. - Growth Story:

In the past 3 years, EPS has grown 120%, and it continues to generate robust operating margins (7.29%) in a sector known for thin spreads.

Takeaway:

KSE Ltd is a strong candidate for long-term investors looking for stable profitability, low debt, and strong return ratios in the small-cap space. With a solid foundation in both agriculture and dairy verticals, it offers defensive value in volatile markets.

This is one small cap that’s worth keeping on your radar—not flashy, but fundamentally rich.

Conclusion

As we step into Wednesday’s trade, the market tone remains cautiously optimistic. Nifty’s sharp recovery above 25,200 and Bank Nifty’s outperformance hint at resilience amid global uncertainty. However, the late-day dip in Nifty IT reminds us that sector-specific volatility isn’t over.

Stay tuned to key macro triggers and earnings updates. With IPOs like Shree Refrigerations and Patel Chem showing strong grey market buzz, the primary market continues to steal some spotlight. On the stock front, technically sound setups and fundamentally strong small caps like KSE Ltd could offer solid opportunities in the coming days.

In this newsletter, we covered:

- Nifty’s next technical move

- Key news likely to impact specific stocks

- IPO GMP trends worth tracking

- High-conviction chart picks

- A small-cap gem with long-term potential

The outlook is not just about reacting—it’s about positioning. Stay informed, stay nimble.

More Articles

Why Chennai’s Property Market Is Surging — and 5 Stocks to Ride the Boom

New SME IPO Rules 2025: Big Changes Investors Need to Know

Best Ad Tech Stock: India’s Emerging Digital Goldmine for Investors