Market Outlook 23 July

Market Outlook 23 July: After hitting record highs last week, the Indian stock market showed signs of consolidation on 22 July. The Nifty 50 slipped by 30.80 points to settle at 25,059.90, while the Sensex dipped by 20.29 points to close at 82,180.05. Pressure was also visible in the Bank Nifty, which declined by 0.40%, and the IT index, which lost 0.32%.

On the broader front, the S&P BSE SmallCap index eased by 0.16%, suggesting mild profit booking after last week’s gains. Despite the softness, overall market breadth remained largely stable.

As we step into Tuesday’s session, investors will keep an eye on corporate earnings, FII/DII flows, and global market cues. With the indices still trading near all-time highs, traders should brace for consolidation with stock-specific action dominating the landscape.

Nifty Outlook – Market Outlook 23 July

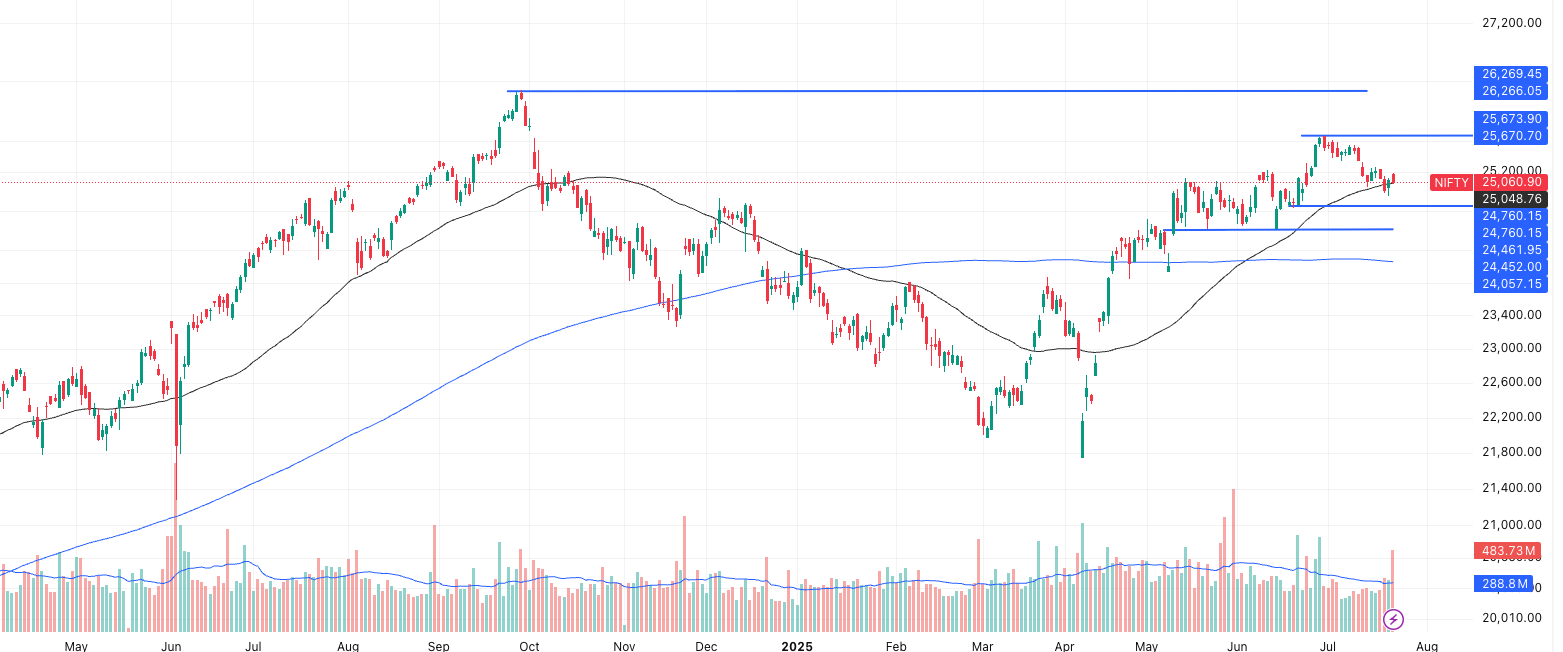

The Nifty 50 index closed at 25,060.90, down 0.12%, displaying a slight loss in momentum after the recent rally. On the daily chart, the index is now hovering near its 50-day simple moving average (SMA) at ₹25,048.76, a level that holds immediate technical significance. Despite the minor decline, the broader structure of higher highs and higher lows remains intact since April.

Key Technical Observations:

- Support and Resistance Levels:

| Zone Type | Level(s) | Commentary |

|---|---|---|

| Immediate Resistance | ₹25,670–₹25,674 | Recent swing high, yet to be broken |

| All-Time High | ₹26,266–₹26,269 | Long-term resistance zone |

| Immediate Support | ₹25,048–₹25,060 | Testing 50 SMA zone |

| Critical Support Zone | ₹24,760 – ₹24,452 | Prior consolidation and swing lows |

| Major Support | ₹24,057 | 200 SMA, long-term structural support |

- Price Action & Interpretation: The index has formed two consecutive red candles, signaling mild selling pressure. However, there is no major breakdown yet, as the index continues to trade above its 50-day SMA. Today’s volume came in significantly higher than the 20-day average, which indicates active participation—likely due to distribution or a range-bound market.

- Trend Status: While the short-term trend shows hesitation, the broader trend remains constructive. The 200-day SMA at ₹24,057 continues to slope upwards, affirming long-term bullishness.

Scenarios to Watch:

- Bullish Case:

If the index sustains above ₹25,048 and reclaims ₹25,150 with volume, we may see a bounce. Possible upside levels include:- ₹25,400 (intermediate resistance)

- ₹25,674 (recent swing high)

- ₹26,269 (all-time high breakout attempt)

- Bearish Case:

A daily close below ₹25,048 would mark a breakdown of the 50-SMA, weakening short-term sentiment. This could lead to a fall toward:- ₹24,760 (support zone)

- ₹24,460 (next cushion)

- ₹24,057 (major long-term support via 200-SMA)

Summary Table:

| Bias | Trigger | Target(s) | SL / Invalidation Level |

|---|---|---|---|

| Bullish | Bounce from ₹25,048 / break ₹25,150 | ₹25,400 → ₹25,670 → ₹26,269 | Close below ₹25,048 |

| Bearish | Close below ₹25,048 | ₹24,760 → ₹24,460 → ₹24,057 | Strong bounce above ₹25,150 |

Suggested Strategy:

Short-term traders should wait for a clear confirmation—either a bounce from support or a decisive breakdown. Trades should be executed with tight stop-losses due to the market’s current indecisiveness.

Swing traders should monitor the ₹25,048 and ₹24,760 zones closely to either add to positions or reduce exposure. The overall bias remains neutral to mildly bullish, unless key support levels are breached.

News and Stocks to Watch — Market Outlook 23 July

Luxury Real Estate Surge in Mumbai

Ultra-luxury housing in Mumbai (homes priced ₹10 crore and above) saw a 20% YoY surge in sales value, hitting ₹14,751 crore in H1 2025. According to a joint report by India Sotheby’s International Realty and CRE Matrix, 692 units were sold—an 11% rise from last year. Key demand drivers include improved infrastructure and a preference for new high-spec homes in areas like Worli, Malabar Hill, and Bandra West. The primary market led the growth with a 26% jump in value terms, while the resale market saw muted performance.

Stock to Watch: Realty sector majors with strong Mumbai exposure — Oberoi Realty, Godrej Properties.

Black Money Law Enforcement

The government has raised over ₹35,105 crore through tax and penalty demands under the Black Money (Undisclosed Foreign Income and Assets) Act, 2015. A total of 163 prosecution complaints have been filed, and 1,021 assessments completed as of March 31, 2025.

Implication: Strong tax enforcement may continue targeting undisclosed offshore assets.

Mutual Fund Industry Update – June 2025

The Indian mutual fund industry recorded ₹49,095 crore in net inflows in June, led by equity and hybrid funds.

- Equity MFs: ₹23,587 crore inflows (+24% MoM)

- Hybrid Funds: ₹23,223 crore inflows — highest monthly inflow on record

- Debt Funds: ₹1,711 crore net outflow (recovery from May’s ₹15,908 crore outflow)

- Passive Funds: ₹3,997 crore inflows, with Gold ETFs attracting ₹2,081 crore

Key Trends:

- Flexi-cap and small-cap funds led equity inflows

- ELSS funds saw net outflows for the third straight month

- Retail confidence continues to grow, driven by market gains

Stock to Watch: Asset management companies like HDFC AMC, Nippon Life India AMC.

Samvardhana Motherson Bonus Issue

Samvardhana Motherson International Ltd (NSE: MOTHERSON) completed its 1:2 bonus issue, increasing its share capital from ₹703.62 crore to ₹1,055.44 crore. The CCD conversion floor price was also adjusted downward from ₹190.00 to ₹126.67 post-bonus.

- Stock closed at ₹98.80 on July 22, down 1.99%

- VWAP: ₹99.50 | Market Cap: ₹1.04 lakh crore

Outlook: Capital restructuring may enhance liquidity and broaden investor participation.

Stock to Watch: Motherson remains in Nifty Next 50 and may gain from improved visibility.

India-US Trade Talks

India and the US are set to resume bilateral trade negotiations in August, aiming for an interim agreement before the August 1 tariff suspension deadline.

Key Issues:

- US seeks access to dairy, agriculture, EVs, industrial goods

- India seeks relief from US tariffs on steel, aluminium, auto components

Export Momentum: India’s exports to the US grew 22.8% YoY in Q1 FY26.

Watchlist: Export-driven sectors like textiles, chemicals, pharma, and auto components.

Oil & Gas Sector Outlook — HDFC Institutional Equities

- Crude oil expected to remain in the $60–70 range unless OPEC cuts or geopolitical risks rise.

- ONGC: REDUCE — Market pricing in unrealistically high crude realizations

- IOCL: REDUCE — Weak refining margins and petrochemical pressure

- Preferred Picks: City gas distribution (CGD) companies — MGL and IGL

Valuation Note: MGL and IGL trade below their 5-year average P/E, offering value.

Stock on Technical Radar — Market Outlook 23 July

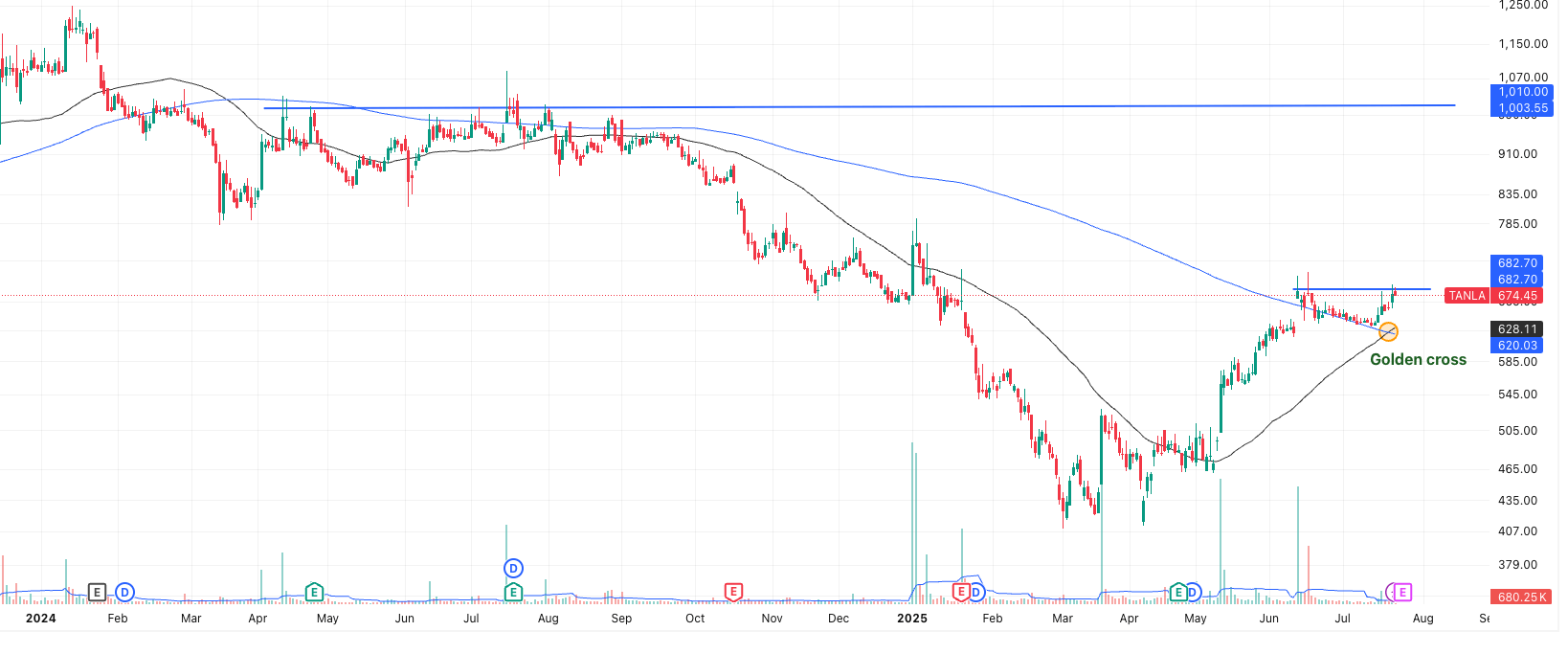

Tanla Platforms Ltd — Strong Bullish Setup Developing

Current Market Price (CMP): ₹674.45

Day’s Range: ₹671.95 – ₹684.60

Tanla Platforms Ltd has entered the spotlight in today’s Market Outlook 23 July, following a significant technical development — a golden cross. The 50-day simple moving average (SMA) at ₹628.11 has crossed above the 200-day SMA at ₹620.03, indicating a potential long-term trend reversal in favor of the bulls.

Volume Action:

Current volume stands at ₹680.25K, which is above the 20-day average of ₹591.54K — suggesting rising institutional interest and momentum.

Key Technical Levels

| Zone Type | Price Levels | Remarks |

|---|---|---|

| Immediate Resistance | ₹682.70 | Near-term breakout zone |

| Major Resistance | ₹1,003 – ₹1,010 | Historical supply zone from gap area |

| Immediate Support | ₹628 – ₹620 | 50 & 200 SMA confluence |

| Trend Support | ₹590 | Former breakout level, retest zone |

Price Action & Structure

Bullish Indicators:

- Golden Cross Confirmed: A key long-term bullish reversal signal.

- Breakout Test Underway: Price approaching a critical resistance near ₹682.

- Rounded Base Formation: Indicates accumulation and trend reversal potential.

- Volume Surge: Strengthens the validity of the breakout move.

Risk Factors:

- Price has repeatedly failed near ₹682 in June–July.

- A failure to close above this resistance could trigger a pullback to ₹630.

Short-Term Trading Strategy (2–5 Days)

Bullish Setup (confirmation needed):

- Buy Zone: Above ₹684

- Targets: ₹710 → ₹740

- Stop Loss: ₹663

- Comment: Wait for a strong close above ₹684 with volume before entry. Risk-reward profile is favorable (~2.5:1).

Bearish Rejection Scenario (riskier):

- Sell Zone: Near ₹682 only on bearish reversal pattern

- Targets: ₹645 → ₹630

- Stop Loss: ₹690

- Comment: Short only if rejection is sharp. Overall trend remains bullish.

Swing Trading Perspective (1–3 Weeks)

Bias: Bullish, supported by technical structure and the golden cross.

- Entry Zone on Pullback: ₹630–₹645

- Targets: ₹740 → ₹800 → ₹900

- Stop Loss: Close below ₹615 (invalidates golden cross breakout)

Summary Table

| View | Entry Zone | Targets | Stop Loss | Comments |

|---|---|---|---|---|

| Short-Term Bullish | ₹684+ | ₹710 → ₹740 | ₹663 | Valid after breakout confirmation |

| Short-Term Bearish | ₹682 (rejection) | ₹645 → ₹630 | ₹690 | Only on strong resistance rejection |

| Swing Long | ₹630–₹645 | ₹740 → ₹800 → ₹900 | ₹615 | Ideal for trend-followers on pullback entry |

IPO GMP Update — Market Outlook 23 July

In today’s Market Outlook 23 July, we observe a vibrant pipeline of IPOs, with several SME issues showing strong grey market premiums (GMP), signaling bullish sentiment among retail and HNI investors.

Below are the notable IPOs and their current GMP status as of July 22:

| IPO Name | GMP | Subscription | Issue Price | Estimated Listing | IPO Size | Lot Size |

|---|---|---|---|---|---|---|

| GNG Electronics IPO | ₹101 (42.62%) | 237x | ₹237 | July 30 | ₹460.43 Cr | 63 shares |

| Patel Chem Specialities IPO | ₹17 (20.24%) | 84x | ₹84 | August 1 | ₹55.83 Cr | 1600 shares |

| Brigade Hotel Ventures IPO | ₹14.5 (16.11%) | 90x | ₹90 | July 31 | ₹759.60 Cr | 166 shares |

| Indiqube Spaces IPO | ₹23 (9.70%) | 237x | ₹237 | July 30 | ₹700.00 Cr | 63 shares |

| Repono IPO (BSE SME) | ₹12 (12.50%) | 96x | ₹108 | August 4 | ₹25.34 Cr | 1200 shares |

| Sellowrap Industries IPO | ₹10 (12.05%) | 83x | ₹93 | August 1 | ₹28.76 Cr | 1600 shares |

| Savy Infra IPO | ₹23 (19.17%) | 7.98x | ₹120 | July 28 | ₹66.47 Cr | 1200 shares |

| Monarch Surveyors IPO | ₹165 (66.00%) | 17.47x | ₹250 | July 29 | ₹88.58 Cr | 600 shares |

Observations:

- Monarch Surveyors IPO leads the GMP chart with a massive 66% premium, hinting at strong post-listing enthusiasm.

- GNG Electronics is showing high interest with a 42.6% GMP and massive oversubscription.

- Brigade Hotel Ventures and Patel Chem Specialities are seeing moderate-to-strong grey market activity.

- Many SME IPOs are trading at healthy premiums, reflecting strong retail appetite.

Caution Note:

While GMP provides a sense of listing expectations, it is unofficial and purely speculative. Always base your IPO investment decisions on fundamentals, subscription data, and risk appetite.

Small Cap of the Day — Market Outlook 23 July

AVT Natural Products Ltd (₹75.10) | Market Cap: ₹1,143 Cr.

As part of the broader Market Outlook 23 July, we spotlight AVT Natural Products Ltd—a niche small-cap stock with deep roots in the plant-based extracts segment and a presence in global nutraceutical and food industries.

About the Company

AVT Natural Products is part of the A.V. Thomas Group, and specializes in natural ingredient solutions for food, beverage, animal nutrition, and nutraceutical sectors. It has built a diversified product line sourced from natural raw materials, targeting both domestic and international markets.

Product Mix (FY24)

- Marigold Oleoresin – 34%

Used in eye care, poultry pigmentation, and food coloring. The segment has seen revenue pressure due to climate disruptions (El Niño) and Chinese pricing competition. - Spice Extracts – 32%

Includes spice oleoresins and essential oils used widely for flavor and color in processed foods. - Value-Added Teas – 31%

Includes decaffeinated and instant teas. This segment has shown a notable rise from 22% in FY22 to 31% in FY24. - Others – 3%

Products include animal health solutions and agri-inputs.

Key Challenges

- Revenue fell 8% over FY22–FY24, led by weaker performance in marigold oleoresin.

- Chinese competition, subsidized by their government, led to pricing pressures.

- Climatic adversities (El Niño) affected raw material supply and yield.

Fundamental Snapshot

| Metric | Value |

|---|---|

| Stock P/E | 23.7 |

| Industry P/E | 22.7 |

| Book Value | ₹33.2 |

| Price to Book | 2.26 |

| ROCE / ROE | 12.8% / 9.88% |

| Debt-to-Equity | 0.22 |

| Dividend Yield | 0.93% |

| Operating Margin (OPM) | 12.6% |

| Profit After Tax | ₹48.2 Cr |

| Cash Reserves | ₹37 Cr |

| Intrinsic Value | ₹54.4 |

Outlook & Takeaway

While AVT Natural is navigating near-term headwinds, its diversified product line, clean balance sheet, and expansion in tea extracts offer a potential rebound opportunity. Investors should watch for margin stability and any turnaround in marigold exports.

📌 Disclaimer: This article is for informational purposes only and is part of our Market Outlook 23 July series. We are not SEBI-registered advisors. Please consult a certified financial advisor before making any investment decisions.

Conclusion – Market Outlook 23 July

As markets consolidate near all-time highs, investors should remain cautiously optimistic amid global uncertainty and sectoral rotation. While frontline indices like the Nifty and Sensex showed mild weakness, broader opportunities are emerging in select IPOs and small-cap spaces like AVT Natural Products.

Strong investor interest continues in the SME IPO segment, and small caps with healthy balance sheets and niche offerings remain compelling, especially when backed by improving fundamentals or export potential. That said, macroeconomic pressures—such as inflation trends, global commodity movements, and interest rate expectations—will continue to shape short-term sentiment.

Stay diversified, stay updated—and always invest with informed conviction.

Related Articles

How a Tea Seller Used the Power of Compound Interest to Build ₹45 Lakh

China’s Fertilizer Export Halt to India: Stocks Set to Gain from the Supply Shock

The 15-15-15 Rule: Why the ₹1 Crore SIP Dream Needs a Reality Check