Market Outlook 21 November – Pre-Market Newsletter

Good morning, and welcome to your pre-market newsletter for Market Outlook 21 November!

We’re stepping into the markets today with fresh momentum after a strong close yesterday. Indian indices carried forward their upward stride, signalling improving sentiment and a possible bullish setup for today’s session.

Yesterday, the Nifty 50 closed at 26,198.15 (+0.56%), while the Sensex climbed to 85,636.28 (+0.53%). Banking also ended positive with Nifty Bank finishing at 59,340.55 (+0.21%). IT stocks were mostly flat, as Nifty IT added a marginal 0.051% to settle at 37,063.45. However, the broader market struggled a bit — S&P BSE SmallCap slipped 0.18%, indicating some profit booking at lower levels.

(Source: Google Finance)

Yesterday’s move tells us one thing — large caps are taking the lead again, while smallcaps are cooling off after a heavy run. It sets the perfect stage for today’s trading day as we look for directional clues and fresh opportunities.

Before you dive in, grab your coffee — because today’s newsletter is packed with everything you need:

✔ Key levels for Nifty, Sensex & Bank Nifty

✔ Top news shaping the markets today

✔ Stocks to watch for potential moves

✔ Fresh IPO updates & GMP trends

✔ Stocks that should stay on your radar

For all our daily editions, you can always explore the full archive in our Daily Newsletter Section. Ready? Let’s dive into the full Market Outlook 21 November!

Index Outlook: Market Outlook 21 November – Key Levels and Trends

As we step into today’s session, let’s dive right into the heart of the action with the Index Outlook for Market Outlook 21 November. Powered by the latest analysis from EquityPandit, here’s what to expect for NIFTY, SENSEX, and Bank Nifty:

SENSEX Outlook: Market Outlook 21 November

SENSEX continues its positive streak, and momentum is in favor of the bulls.

If you’re already in long positions, continue to hold, but stay alert to the daily closing stoploss at 84,861. Only consider fresh shorts if the index closes below this mark.

- Support Levels:

- 85,289

- 84,945

- 84,688

- Resistance Levels:

- 85,889

- 86,146

- 86,490

Today’s SENSEX range is expected to stay between 84,983 and 86,281. For detailed company weightage and sector impact, check the SENSEX companies page (inbound link to be added).

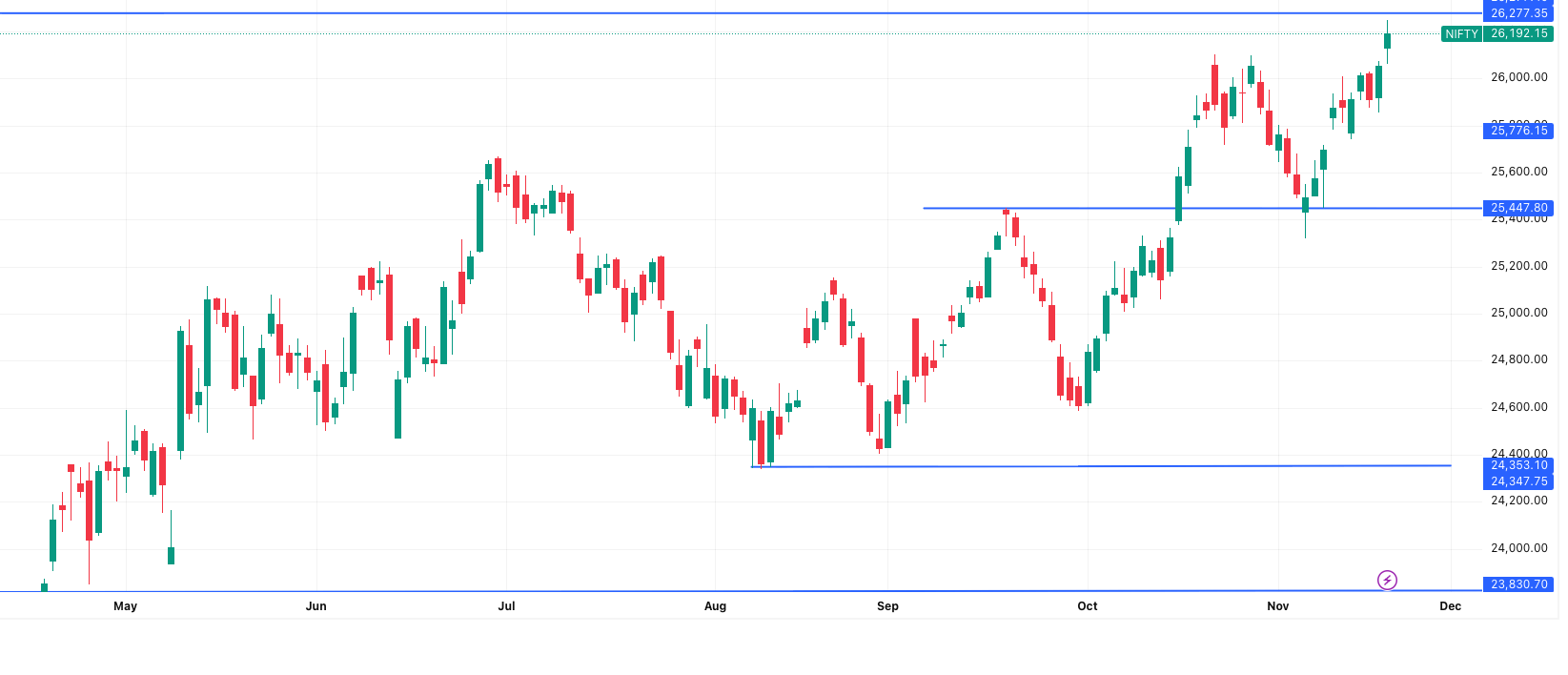

NIFTY Outlook: Market Outlook 21 November

NIFTY rides the bullish momentum.

For longs, maintain your position with a strict stoploss set at 25,959; shorts come into play only below this closing level.

- Support Levels:

- 26,088

- 25,984

- 25,905

- Resistance Levels:

- 26,271

- 26,351

- 26,455

Watch for a tentative trading zone between 25,994 and 26,390. Full NIFTY company distribution here (inbound link to be added).

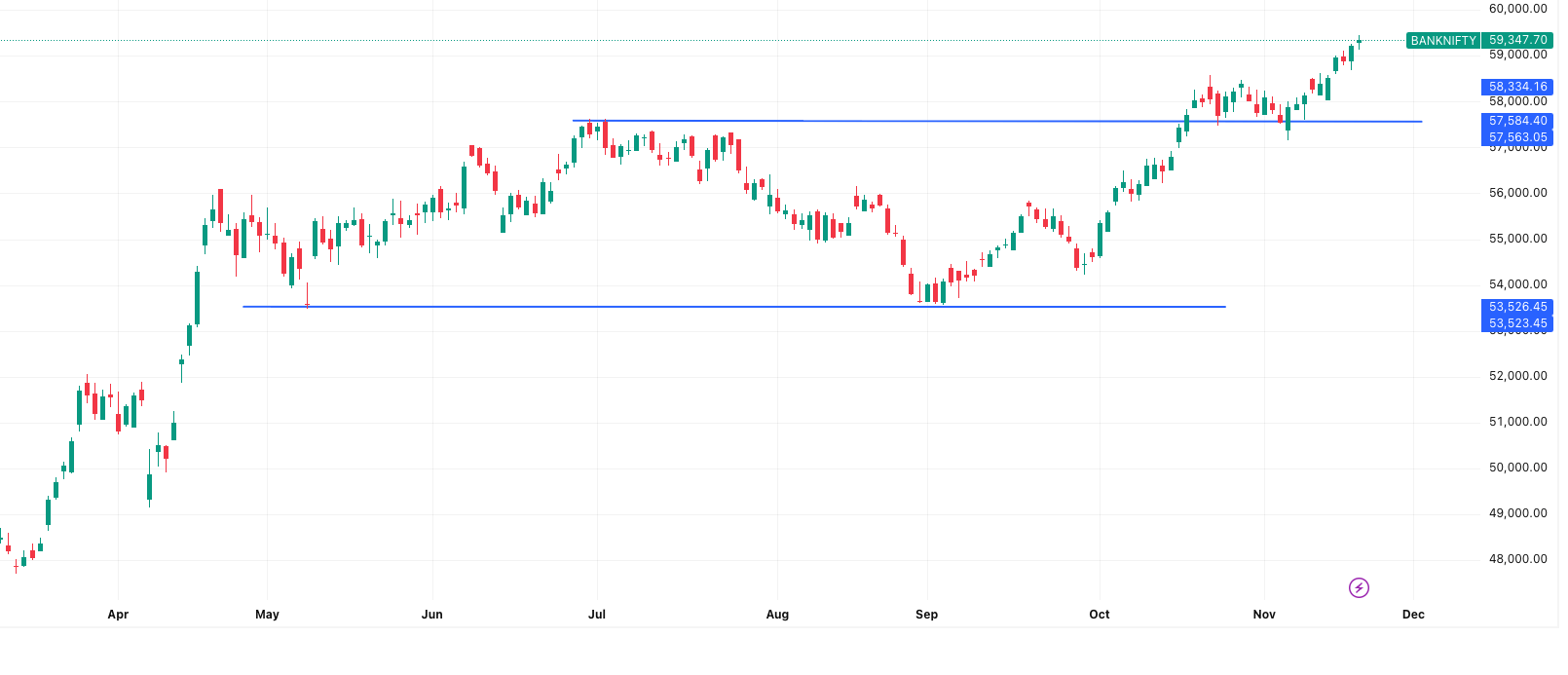

Bank Nifty Outlook: Market Outlook 21 November

Bank Nifty stands resilient, holding its positive stance.

Long players, keep your sights on the daily closing stoploss at 58,814. New short positions should be activated only if Bank Nifty cracks below this level.

- Support Levels:

- 59,169

- 58,990

- 58,854

- Resistance Levels:

- 59,483

- 59,619

- 59,798

The anticipated range lies between 58,866 and 59,828. Explore the full list of Bank Nifty heavyweights.

Your Trading Edge:

Stay focused as key indices continue their upward momentum, but remember, a tight stoploss and awareness of support/resistance can make all the difference today. Let the numbers steer your strategy for profitable moves in today’s market.

Market News & Stocks to Watch – Market Outlook 21 November

This roundup brings expanded context on major market-moving stories across IPOs, technology, energy, defence, metals and pharma — each item followed by Stocks to Watch and Stocks Impacted so you can act quickly.

ICICI Prudential AMC edging toward SEBI nod for a large IPO

A report says ICICI Prudential Asset Management Co. is close to receiving regulatory approval for a blockbuster IPO that could raise up to ₹100 billion (about $1.1 billion) and value the company near $11 billion. The draft RHP was filed in July, and market chatter points to a multi-bank syndicate (led by ICICI Securities and Citigroup) — a structure that underlines both the size and perceived investor appetite for the deal. If this goes through within the window being talked about, it may meaningfully lift the overall IPO pipeline and investor risk appetite, helping the wider capital-raising environment in India recover toward last year’s record levels. Read the original report on NDTV Profit: ICICI Prudential AMC near nod for $1.1bn IPO (NDTV Profit).

Why it matters: A large, well-subscribed AMC IPO typically re-energises mutual fund / financial services stocks, attracts fresh retail & HNI flows into the primary market, and increases interest in brokers and merchant bankers.

Stocks to Watch :

- ICICI Bank — strategic parent and likely long-term beneficiary.

- ICICI Securities — lead manager and distribution partner.

- HDFC AMC, UTI AMC — peer comparison trades.

Stocks Impacted:

- Brokerage / merchant banking names (Nuvama, ISEC) — deal fees & underwriting flows.

- Asset management peers — relative valuation re-ratings possible.

AI to drive up to 20% of Indian tech revenues by 2030 — Equirus report

Equirus’ sector study flags AI-led projects as the next major revenue engine for Indian IT and software exporters, estimating they could account for ~20% of revenues by 2030. The report highlights three consolidation themes — acquisition of AI-enabled delivery capabilities, buying AI-first platforms, and snapping up AI upskilling assets. It also forecasts rapid growth for Global Capability Centres (GCCs) and shows early margin uplift (200–400 bps) for companies that leverage AI to automate delivery. Full write-up: AI-led projects to make up 20% of Indian tech revenues by 2030 (NDTV Profit).

Why it matters: Structural re-rating potential for IT services and platform plays — winners will be those that convert AI investments into reproducible revenue streams and margin expansion.

Stocks to Watch:

- TCS, Infosys, Wipro, HCLTech — large-cap ITs with AI initiatives.

- LTIMindtree, Persistent — midcaps focused on AI-enabled transformation.

- Platform names (Zomato, Paytm, Rategain) — those showing measurable unit-economics gains from AI.

Stocks Impacted:

- IT services vendors supplying AI modules and automation tools.

- Training & upskilling firms, niche AI product vendors (M&As likely to lift valuations).

India books more tankers for Middle East crude after Russia sanctions

Market reports show a meaningful jump in tanker fixtures bringing Middle East crude to India — from roughly four fixtures to nearly a dozen — as importers scramble to replace volumes ahead of sanctions on some Russian producers. The increase in bookings (including VLCCs and Suezmax vessels) is lifting freight rates toward multi-year highs and signalling a near-term reshuffling of crude flows. This sourcing pivot is being watched closely because it affects refinery input costs, freight economics and the crude mix for domestic refiners. Source: India seeks tankers for Mideast oil after Russia sanctions (NDTV Profit).

Why it matters: Higher import volumes from the Middle East and rising freight rates affect refinery margins, working capital and the broader energy complex — a key macro input for industrial and transport sectors.

Stocks to Watch:

- Reliance Industries — largest refiner with diversified feedstock.

- Indian Oil Corporation, BPCL, HPCL — other refiners sensitive to crude mix & freight.

- Shipping Corp. of India — freight rate beneficiary.

Stocks Impacted:

- Upstream names (ONGC, Oil India) — relative competitiveness vs. imported crude.

- Petrochemical-linked players — margin flows may shift with crude costs.

Goodluck India’s defence arm bags $6m export order for artillery shells

Goodluck Defence & Aerospace, a subsidiary of Goodluck India Ltd, has secured a $6 million export order to supply 155mm M107 shells. The deal is a concrete sign of the company’s growing traction in defence manufacturing and supports management’s thesis that defence will become a larger revenue contributor in coming years. Read more: Goodluck India defence arm secures export order (CNBC-TV18).

Why it matters: Defence orders—especially export wins—validate product capability, improve revenue visibility and can be a catalyst for re-rating in smaller industrials with niche capabilities.

Stocks to Watch:

- Goodluck India — direct beneficiary.

- Bharat Forge, Solar Industries, Mishra Dhatu Nigam — peers in defence/manufacturing.

Stocks Impacted:

- Engineering & fabrication suppliers — potential order pipeline across defence programs.

- Midcap industrials with backward integration into defence supply chains.

Miners’ body calls for raising basic customs duty on aluminium to 15%

The Federation of Indian Mineral Industries (FIMI) has recommended raising the basic customs duty on primary aluminium and downstream aluminium products to 15% to curb surging imports and protect domestic manufacturers. The move, if adopted ahead of the Union Budget, would be aimed at checking import-led market share loss and addressing low-quality scrap inflows. Article: FIMI wants higher customs duty on aluminium (The Hindu).

Why it matters: A policy change of this scale would benefit domestic producers’ profitability and can shift procurement strategies for downstream sectors like autos and packaging.

Stocks to Watch:

- Hindalco, NALCO — primary aluminium producers.

- Vedanta — integrated metals exposure.

Stocks Impacted:

- Aluminium-consuming sectors (autos, white goods, packaging) — pricing & input cost dynamics could change.

- Scrap traders and secondary processors — regulatory tightening may affect margins.

NCLT clears SeQuent Scientific–Viyash Lifesciences merger

The National Company Law Tribunal has approved the merger between SeQuent Scientific and the Viyash Lifesciences group — a consolidation move intended to scale the combined entity in animal health and pharmaceutical manufacturing. The merger aims to deliver enhanced R&D, manufacturing capacity and a stronger global play in animal-health markets. Details: NCLT approves Sequent–Viyash merger (The Hindu).

Why it matters: Consolidation in animal health can create a stronger export-oriented platform and improve margins through synergies and scale.

Stocks to Watch:

- SeQuent Scientific — primary beneficiary.

- Hester Biosciences, Zydus Lifesciences — peers in animal health & veterinary products.

Stocks Impacted:

- API & contract manufacturing suppliers — potential incremental demand from scaled operations.

- Agri-animal health distributors & exporters — market share shifts.

IPO Updates – Market Outlook 21 November

The primary market continues to remain active, and in today’s Market Outlook 21 November, we bring you a crisp yet insightful look at the hottest Mainboard and SME IPOs, their subscription momentum, GMP trends, and what’s listing today.

For more detailed IPO coverage anytime, explore our IPO section through the OneDemat Newsletter Hub and deeper IPO analysis via the IPO Analysis Section.

Main Board IPOs

| Name | Open Date | Close Date | Listing Date | GMP (Approx. Listing Gain) |

|---|---|---|---|---|

| Sudeep Pharma | 21-Nov | 25-Nov | 28-Nov | ₹115 (19.39%) |

| Excelsoft Technologies | 19-Nov | 21-Nov | 24-Nov | ₹14.5 (12.08%) |

| Capillary Technologies (Listing Today) | 14-Nov | 18-Nov | 21-Nov | ₹58 (10.05%) |

SME IPOs

| Name | Exchange | Open Date | Close Date | Listing Date | GMP (Approx. Listing Gain) |

|---|---|---|---|---|---|

| Gallard Steel | BSE SME | 19-Nov | 21-Nov | 26-Nov | ₹40 (26.67%) |

Quick Take:

- Capillary Technologies debuts on the bourses today, while Sudeep Pharma and Excelsoft Technologies are both active with healthy grey market premiums, signaling high investor interest.

- In the SME segment, Gallard Steel continues to attract attention with a strong GMP, making it one to watch in the coming days.

Keep these dates and premiums on your radar for smarter listing plays and allocation strategies. Don’t miss the next opportunity in the fast-moving IPO lane—these details are front and center in your Market Outlook 21 November.

Stock in Radar – Market Outlook 21 November

Highlighting a top stock to keep on your radar for today’s Market Outlook 21 November: NCC Ltd., a construction and infrastructure powerhouse with solid fundamentals and robust future prospects.

Company Snapshot:

- Name: NCC Ltd.

- Market Cap: ₹11,565 crore

- Current Price (CMP): ₹181.0

- Accumulation Range: ₹179–183

- Target Price: ₹210.0

- Upside Potential: 16%

- Holding Duration: 6–12 Months

- Promoter Holding: 22.1%

- Order Book: ₹71,957 crore (as of Sep’25)

- Source: SBI Securities Research

Key Investment Rationale:

- Diverse Expertise: NCC Ltd is a veteran in civil construction, urban infrastructure, roads, water & environment, mining, power (T&D), and more. Its subsidiary, NCC Urban, handles important real estate and township projects across India.

- Strong Execution Track Record: Four decades of experience, with 520+ completed projects, 36,500 km water pipeline network, and electrification in 35,000+ villages.

- Order Book Strength: The latest order book stands at ₹71,957 crore, around 4.4x annualized FY26 revenue. New awards in 2QFY26 totaled ₹6,223 crore; H1 inflow reached ₹9,881 crore; roughly ₹17,000 crore received by October 2025. A ₹2.5 lakh crore pipeline signals high future visibility.

- Capital Expenditure for Growth: FY26 capex hiked to ₹1,050 crore (from ₹750 crore), reflecting confidence after snagging a major mining order.

- Current Headwinds but Improving Outlook: Weak results for 2QFY26 stemmed from delayed payments and extended monsoons, causing a cut in growth guidance. However, execution is set to rebound in 2H, with FY26 clarity expected after Q4.

- Valuation Comfort: Trading at a forward P/E of 12.6x for FY26 and 10.4x for FY27 (Bloomberg consensus), offering attractive entry for medium-term investors.

Key Risks:

- Regulatory changes

- Delayed collections (especially Jal Jeevan Mission)

- Execution hurdles in large projects

Why Watch NCC Ltd Today?

With a robust order book, increasing capex, proven expertise, and forecasted recovery in execution, NCC Ltd stands out as a smart pick for market participants in today’s Market Outlook 21 November. It’s well-positioned to benefit from India’s infrastructure push and sectoral tailwinds, making it a candidate to keep in your radar.

For in-depth research, check the full SBI Securities report: SBI Securities – NCC Ltd. Stock Analysis

Conclusion – Market Outlook 21 November

That wraps up this edition of your pre-market newsletter for Market Outlook 21 November. As we step into today’s trade, the stage is set with bullish momentum in the indices, a flurry of news affecting various sectors, and fresh IPO opportunities energizing the market. Keep an eye on the technical levels, top news, and the stocks highlighted in your radar to make informed and timely decisions.

Remember, a disciplined approach—staying updated on key developments and carefully monitoring your positions—can give you the essential edge in today’s fast-evolving market landscape.

Thank you for joining us for this comprehensive look ahead. For deeper dives, timely intraday updates, and more actionable ideas, be sure to follow the Onedemat Newsletter regularly.

Wishing you a profitable and insightful trading day ahead with Market Outlook 21 November—see you in the next issue!