Market Outlook 21 July: What’s Ahead After a Broad-Based Sell-Off?

After a sharp rally earlier in the week, Indian markets took a breather on Friday, July 19. The Nifty 50 slipped 139 points (-0.56%) to close at 24,972, while the Sensex dropped 519 points (-0.63%), ending at 81,740.

The pressure was visible across the board – Bank Nifty fell over 1%, and SmallCap indices dropped 0.72%, indicating broader profit booking. Interestingly, IT stocks managed to stay flat, offering a slight cushion amid the weakness.

In today’s newsletter, you’ll find:

- A technical outlook on Nifty 50’s next move

- Key news headlines and the stocks impacted

- Our handpicked Breakout Stock of the Day

- The most important IPO listings and SME buzz

- A special focus on one Small Cap stock showing strong momentum

- And a crisp summary of what this all means for your portfolio

Let’s decode the action and prep for the coming week.

Nifty 50 – What’s Next for Market Outlook 21 July?

As we step into a fresh week, the Nifty 50 closed at ₹24,968.40, down by ₹143.05 (-0.57%) on Friday. The red candle on the daily chart, accompanied by high volumes, signals renewed selling pressure—marking a critical shift in short-term sentiment.

Key Technical Observations

1. Support & Resistance Levels

| Zone Type | Price Range | Significance |

|---|---|---|

| Immediate Support | ₹24,452 – ₹24,462 | Previous swing low from mid-June 2025 |

| Immediate Resistance | ₹25,670 – ₹25,674 | Rejection zone seen in recent price action |

| Major Resistance | ₹26,266 – ₹26,269 | All-time high region from October 2024 |

2. Moving Average Dynamics

- 9-Day EMA: ₹25,124.93

The index is currently trading below its short-term moving average. The downward bend in the 9-EMA suggests a weakening bullish momentum and potential bearish continuation.

3. Volume Analysis

- Friday’s Volume: 316.98M

Significantly higher than the average of 284.29M, this volume spike reinforces the strength of the bearish candle, potentially pointing to institutional selling or strong retail exit.

Technical Outlook: What the Chart Suggests

Short-Term Bias: Bearish

The combination of a price drop below the 9 EMA and a failed attempt to hold above resistance indicates short-term pressure. If Nifty breaches ₹24,452, a sharper correction cannot be ruled out.

Medium-Term Bias: Neutral

Unless Nifty decisively breaks above ₹25,670, the index is likely to remain rangebound.

Long-Term Bias: Bullish

As long as the index remains above its broader trend support and consolidates above 24,000, the structure remains intact for a longer-term uptrend toward all-time highs at ₹26,269.

Strategy for the Week

- Watch ₹24,452 – ₹24,462 for possible support bounce.

- A break below may invite further downside toward the 24,000 mark.

- Any rebound above the 9 EMA should be backed by strong volume to confirm strength.

In conclusion, the market outlook for 21 July remains cautious with a short-term bearish bias. Investors and traders should stay alert for either a support bounce or a deeper retracement in the coming sessions.

News & Impacted Stocks

In the lead-up to the week of 21 July, several key corporate developments and policy shifts emerged that could significantly shape short-term market sentiment. Here’s a curated breakdown of the major headlines and the stocks that could see action—bullish or bearish—based on fundamental triggers.

1. India-US Trade Talks Near Tariff Deadline

The fifth round of India–US trade negotiations concluded in Washington ahead of the crucial August 1 tariff deadline. While outcomes remain undisclosed, the talks hold major implications for Indian exporters—particularly in textiles, pharma, and IT.

Impacted Sectors: Export-driven sectors such as apparel, electronics, and chemicals may face volatility if the US imposes new tariffs.

Stocks to Watch:

- KPR Mill, Garware Technical Fibres (textiles)

- Laurus Labs, Divi’s Labs (pharma)

- Tata Elxsi, LTIMindtree (IT midcaps with US exposure)

2. Jio Financial–Allianz Reinsurance JV Announced

Jio Financial Services Ltd (JFSL) and Allianz Group have entered into a 50:50 domestic reinsurance JV, aimed at strengthening India’s insurance infrastructure. This move follows Allianz’s recent exit from its long-standing JV with Bajaj Finserv.

Implications:

- Expands JFSL’s footprint in insurance after its NBFC spin-off from Reliance.

- Positions JFSL for multi-line financial services dominance.

Stock Impact:

- JFSL: Positive long-term sentiment; watch for volumes.

- Bajaj Finserv: Neutral to slightly negative in short term.

3. Reliance Industries Reports Record ₹30,783 Cr Profit in Q1

Reliance Industries Ltd (RIL) posted a 76.5% YoY rise in net profit, supported by strong growth across Jio Platforms, Retail, and stable performance in its O2C (Oil-to-Chemicals) segment.

Segment Leaders:

- Jio Platforms: 200M+ 5G subscribers, ARPU up 14.9% YoY

- Retail: ₹84,171 Cr revenue, 388 new stores

- JioStar: 460M+ MAUs, 652M digital IPL viewers

Stock View:

- RELIANCE: Strong operational performance may drive positive momentum.

- Bullish bias above ₹2,900 level.

4. Coforge–Cigniti Merger Gains Regulatory Approval

Coforge Ltd has secured “no objection” letters from both BSE and NSE for its proposed merger with Cigniti Technologies. All that remains is NCLT approval.

Impacted Stocks:

- Coforge: Merger synergies in digital engineering and automation could support rerating.

- Watch for sustained moves above ₹1,900.

5. Mahindra Lifespaces Signs Strategic Pact with Osaka Govt

Mahindra Lifespace Developers signed a deal with Osaka Prefecture to attract Japanese industrial investments to India via its Origins Chennai cluster.

Market Reaction:

- Stock closed up 4.3% on Friday.

- Long-term positive for industrial real estate momentum.

Stock to Track:

- MAHLIFE: Breakout above ₹390 may attract institutional interest.

6. Reliance Retail Acquires Kelvinator Brand

Reliance Retail Ventures Ltd (RRVL) has acquired the legacy home appliance brand Kelvinator, marking a move into India’s ₹70,000 crore premium durables segment.

Rationale:

- Deepens RRVL’s product basket in appliances

- Boosts growth across 19,000+ retail touchpoints

- Taps nostalgia + affordability to compete with Samsung, LG, and Whirlpool

Stock Impact:

- RELIANCE (Parent of RRVL): Strengthens retail story

- Voltas, Blue Star, Whirlpool may see marginal competitive pressure

7. SEBI Proposes Major Mutual Fund Classification Overhaul

SEBI has released a Draft Circular on Fund Categorization, aimed at preventing overlap, increasing transparency, and introducing stricter norms for new schemes.

Key Proposals:

- 50% portfolio overlap limits for Value vs Contra Funds

- Sectoral funds capped at 60% overlap

- New funds only after 5 years + ₹50,000 Cr AUM in parent scheme

- Renaming and restructuring of duration-based debt schemes

Impacted Stocks:

- Asset management companies such as HDFC AMC, Nippon AMC, UTI AMC may need to adjust portfolios and marketing strategy.

- Positive for investor confidence; neutral to short-term negative for AMCs adjusting multiple schemes.

Summary for Market Outlook 21 July

| Event/Development | Stock(s)/Sector Impacted | Outlook |

|---|---|---|

| India–US Tariff Deadline Nears | Exporters (Textiles, Pharma, IT) | Cautious Watch |

| JFSL–Allianz Reinsurance JV | JFSL, Bajaj Finserv | Positive Bias |

| RIL Reports Record Profit | Reliance Industries | Bullish |

| Coforge–Cigniti Merger Progresses | Coforge | Positive Momentum |

| Mahindra–Osaka Strategic Pact | Mahindra Lifespaces | Long-Term Positive |

| Reliance Retail Buys Kelvinator | Reliance, Voltas, Whirlpool | Strategic Edge |

| SEBI Draft on Fund Classification | AMC Stocks | Mixed Reaction |

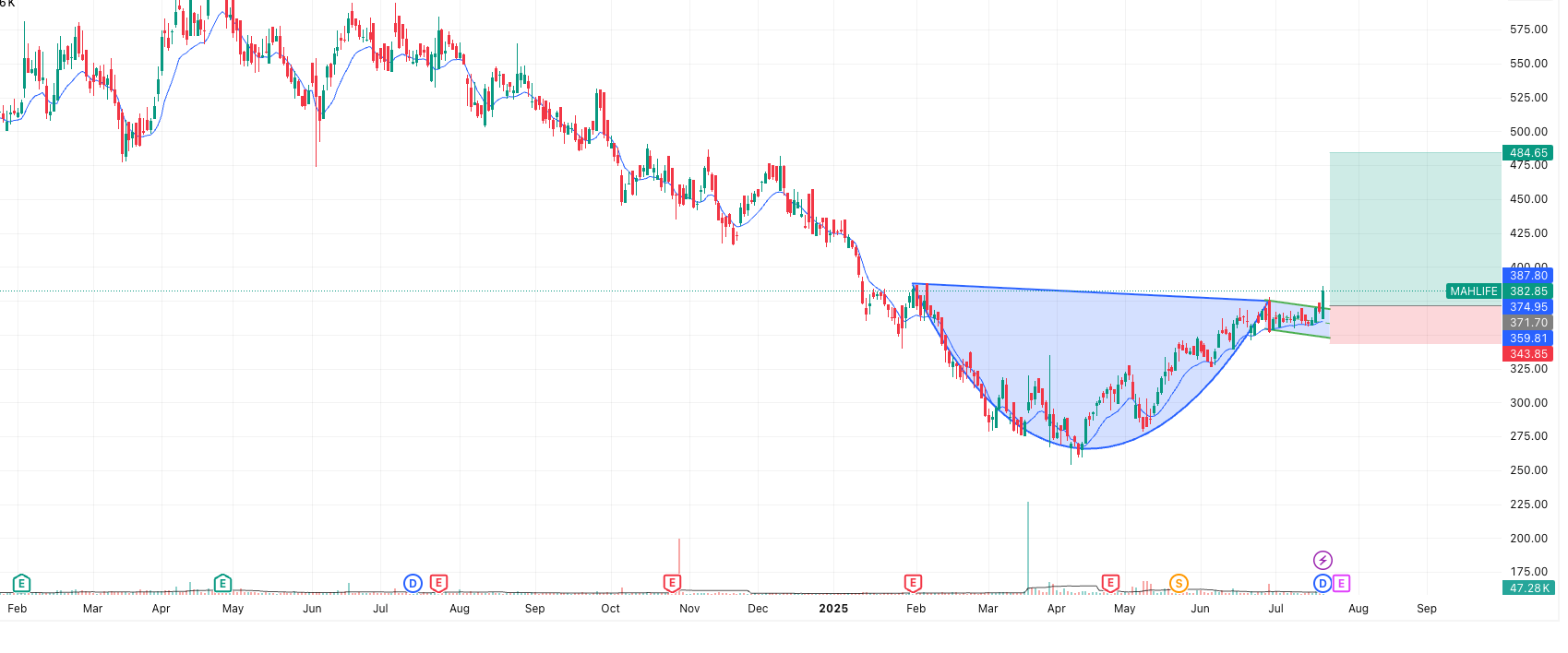

Breakout Stock of the Day: Mahindra Lifespace Developers (MAHLIFE)

On the daily timeframe, Mahindra Lifespace Developers is showing a classic Cup and Handle breakout, a high-probability bullish continuation pattern.

Pattern Identified: Cup and Handle

- Cup Formation: Rounded bottom from Feb 2025 to June 2025

- Handle Formation: Shallow pullback between late June and mid-July

- Breakout Zone: ₹375–₹380

- Current Price: ₹382.85 (as of July 19, 2025) — strong bullish candle (+4.08%)

Technical Indicators

1. Breakout Confirmation

- Price has broken above the handle resistance zone (~₹375)

- Volume has spiked on the breakout day, confirming the strength of the move

2. Moving Average

- EMA (9): ₹359.81 — current price is comfortably above the short-term moving average

- Upward sloping EMA indicates continued momentum

3. Risk-Reward Setup

| Entry Zone | Stop-Loss | Short-Term Target | Swing Target | Risk-Reward (Short) | Risk-Reward (Swing) |

|---|---|---|---|---|---|

| ₹375–₹382 | ₹343.85 | ₹410–₹425 | ₹475–₹485 | ~1:2 | ~1:3 |

Short-Term View (3–7 trading days)

| Parameter | Outlook |

|---|---|

| Trend | Bullish |

| Entry Range | ₹375–₹382 |

| Stop-loss | ₹343.85 |

| Target | ₹410–₹425 |

| Bias | Buy on dip or breakout retest |

If price pulls back to ₹375–₹378 with low volume, it may offer a second entry point.

Swing Trading View (2–6 weeks)

| Parameter | Outlook |

|---|---|

| Target | ₹475–₹485 |

| Stop-loss | ₹343.85 |

| Pattern Target | Height of cup (~₹100) added to breakout zone (₹380 + 100 = ₹480) |

| Bias | Hold for target or trail stop-loss as it rises |

Key Watchpoints

- Volume should remain strong on follow-up bullish candles

- If the price dips below the EMA (₹359), it may signal potential weakness

- A sharp reversal with high red volume is an early exit signal

Summary

| Type | Direction | Entry | Stop-Loss | Target | Risk-Reward | Confidence |

|---|---|---|---|---|---|---|

| Short-Term | Bullish | ₹375–₹382 | ₹343.85 | ₹410–₹425 | ~2:1 | High |

| Swing Trade | Bullish | ₹375–₹382 | ₹343.85 | ₹475–₹485 | ~3:1 | High |

IPO Updates – Key Listings to Watch

Mainboard IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP (Est. Listing Gain) |

|---|---|---|---|---|

| NSDL IPO | — | — | — | ₹143 (0.00%) |

| GNG Electronics IPO | 23-Jul | 25-Jul | 30-Jul | ₹71 (29.96%) |

| Indiqube Spaces IPO | 23-Jul | 25-Jul | 30-Jul | ₹40 (16.88%) |

| Anthem Biosciences IPO | 14-Jul | 16-Jul | 21-Jul | ₹127 (22.28%) |

| Shanti Gold International IPO | 25-Jul | 29-Jul | 1-Aug | ₹– (0.00%) |

| PropShare Titania IPO | 21-Jul | 25-Jul | 4-Aug | ₹– (0.00%) |

SME IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP (Est. Listing Gain) |

|---|---|---|---|---|

| Patel Chem Specialities IPO | 25-Jul | 29-Jul | 1-Aug | ₹– (0.00%) |

| TSC India IPO | 23-Jul | 25-Jul | 30-Jul | ₹– (0.00%) |

| Monarch Surveyors IPO | 22-Jul | 24-Jul | 29-Jul | ₹150 (60.00%) |

| Swastika Castal IPO | 21-Jul | 23-Jul | 28-Jul | ₹– (0.00%) |

| Savy Infra IPO | 21-Jul | 23-Jul | 28-Jul | ₹15 (12.50%) |

| Monika Alcobev IPO | 16-Jul | 18-Jul | 23-Jul | ₹– (0.00%) |

| Spunweb Nonwoven IPO | 14-Jul | 16-Jul | 21-Jul | ₹43 (44.79%) |

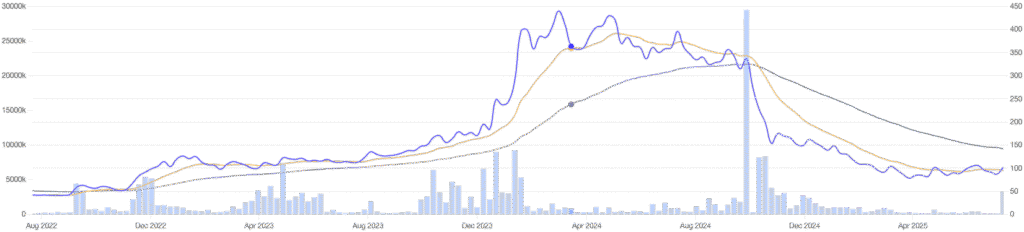

Smallcap of the Day – Vertoz Ltd

Given the dynamic market outlook 21 July, Vertoz Ltd’s data-driven AdTech model positions it as a resilient play. In the ever-evolving digital advertising and cloud technology space, Vertoz Ltd (₹102) has quietly emerged as a formidable player. With a market cap of ₹869 crore, this smallcap stock operates at the intersection of MadTech (Marketing + AdTech) and CloudTech, catering to clients across the globe.

What Does Vertoz Do?

Vertoz Ltd is an AI-powered digital advertising platform that helps brands, publishers, and agencies manage campaigns, monetize content, and analyze performance at scale. Its proprietary technology powers real-time programmatic advertising—buying and selling of digital ads using AI algorithms.

But Vertoz is not just another ad-tech firm. It has built a dual engine for growth:

- MadTech – Their digital marketing arm serves 25,000+ clients, helping advertisers and publishers deliver targeted, data-driven campaigns across multiple channels.

- CloudTech – Their domain management and cloud services have gained 18,000+ clients, with Vertoz becoming the second-largest domain processor globally via its Connect Reseller platform.

Key Financial Snapshot

| Metric | Value |

|---|---|

| Current Price | ₹102 |

| 52-Week High / Low | ₹385 / ₹73 |

| Market Cap | ₹869 Cr |

| Revenue (FY) | ₹255 Cr |

| Net Profit (FY) | ₹25.7 Cr |

| Operating Profit | ₹36.4 Cr |

| Operating Margin (OPM) | 14.3% |

| Net Profit Margin (NPM) | 10.4% |

| Stock P/E | 33.9 |

| Industry P/E | 37.6 |

| ROE / ROCE | 14.7% / 15.5% |

| Debt to Equity | 0.11 (very low) |

| Cash Equivalents | ₹12.8 Cr |

| Book Value | ₹22.4 |

| Price to Book Ratio | 4.56 |

| Intrinsic Value | ₹109 |

| EPS Growth (3Y) | 5.82% |

Why Vertoz Ltd Stands Out

- Scalability: Vertoz’s tech platform allows for high-volume, low-cost scaling, giving it a structural advantage in the digital ad space.

- Global Clientele: With a reach of 350 million+ audiences and over 3.48 lakh active domains, the company serves markets beyond India—especially the US and APAC.

- Strong Financials: Consistent profits, double-digit margins, and low debt levels add financial resilience.

- Zero Pledge, High Integrity: No promoter pledging, with efficient working capital and robust interest coverage (13.8x).

- Undervalued?: Intrinsic value is estimated at ₹109 vs the current market price of ₹102—suggesting modest upside potential.

Risks to Watch

- Volatility in Ad Spending: Economic slowdowns can impact digital ad budgets.

- Tech Disruption: The ad-tech space evolves rapidly; innovation is crucial to stay competitive.

- Global Competition: Faces stiff competition from global tech giants in both MadTech and CloudTech spaces.

Conclusion: Why Vertoz Ltd is Our Pick

With its unique blend of MadTech and CloudTech, Vertoz Ltd is not just another smallcap—it’s building a modern digital ecosystem. Its financial strength, low leverage, global client base, and scalable technology make it a compelling long-term story. While short-term volatility may persist, the fundamentals are aligned for sustainable growth.

For investors looking to ride the next wave of India’s digital advertising boom, Vertoz Ltd deserves a closer look.

Conclusion: What to Take Away from Today’s Newsletter

As we wrap up this edition, the market outlook 21 July appears cautiously optimistic with the Nifty 50 holding above key support levels and broader market sentiment driven by corporate earnings, policy signals, and sector-specific momentum.

Key takeaways from today’s newsletter:

- Nifty 50 is attempting a breakout, but needs stronger volumes and a decisive close above resistance to confirm.

- News-driven moves are driving volatility, especially in stocks like Vedanta, Paytm, and Bandhan Bank.

- Breakout stock Sealmatic India is riding high on order wins and operating leverage.

- On the IPO front, a busy lineup awaits next week with mainboard listings like Shanti Gold International and SME entries like Magenta Lifecare, giving investors fresh opportunities.

- Vertoz Ltd, our smallcap spotlight, blends ad-tech and cloud capabilities in a globally scalable business model with strong financials.

With earnings season heating up and F&O expiry around the corner, the coming week will test market conviction across sectors. Keep an eye on institutional flows, policy commentary, and breakout setups.

Stay tuned for our next edition as we decode the markets beyond the headlines.