Introduction – Market Outlook 19 November

The Market Outlook 19 November begins on a cautious tone as benchmark indices witnessed mild profit-booking in the previous session. According to the latest numbers sourced from Google Finance, the Indian market closed lower across major indices, reflecting a mix of global uncertainty and domestic sector rotation.

The Nifty 50 slipped 121.40 points (0.47%) to settle at 25,892.05, while the Sensex also declined 324.96 points (0.38%) to end at 84,625.99. Banking and IT saw notable pressure, with Nifty Bank easing 0.22% and Nifty IT falling sharply by 1.19%. Broader markets followed the same trend—S&P BSE SmallCap contracted by 0.88%, indicating weakness beyond frontline stocks.

As part of our daily coverage under the Daily Newsletter section, today’s Market Outlook 19 November breaks down what these moves mean for investors, the sentiment cues driving the market, and what to watch out for in the next trading session.

Index Outlook – Market Outlook 19 November

The Market Outlook 19 November signals a continuation of positive momentum across major indices, even though short-term volatility remains visible. Based on the latest analysis from EquityPandit, key indices are still holding their upward trend, but traders must keep a close eye on critical support and resistance levels.

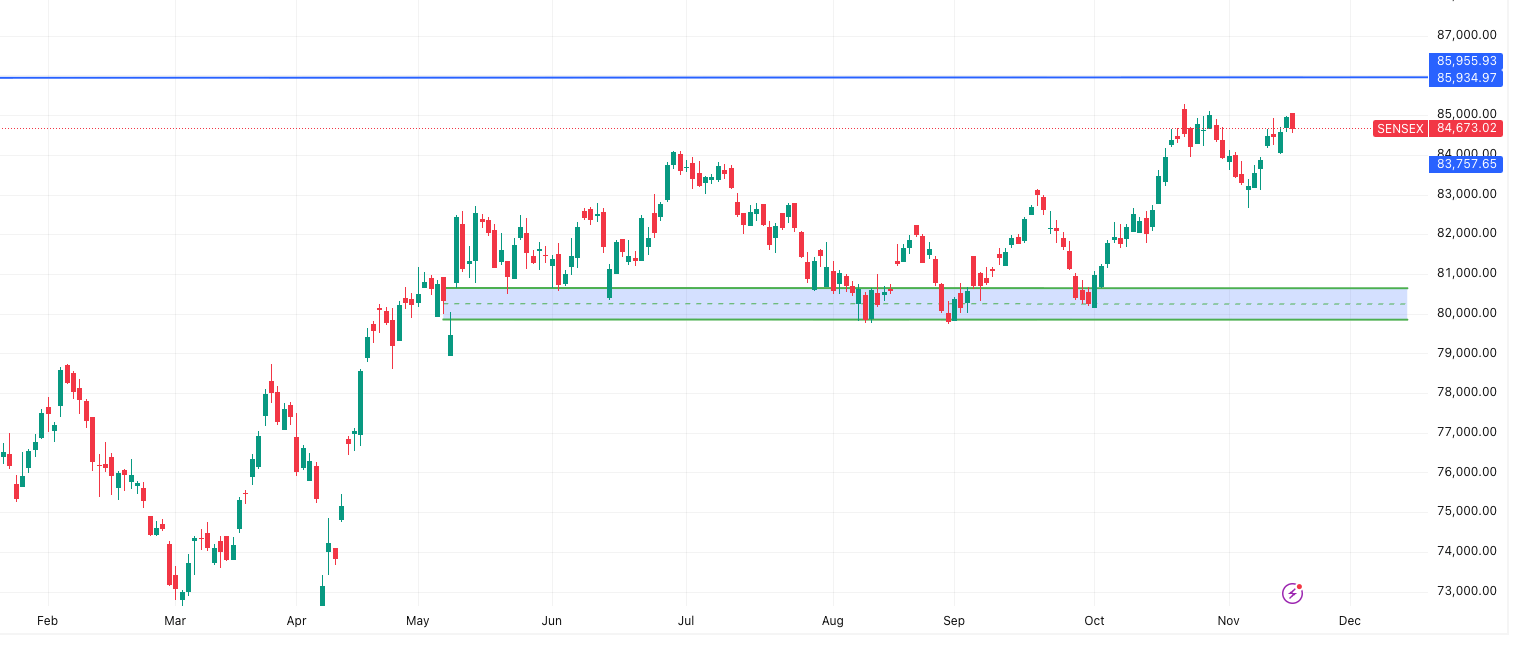

SENSEX Outlook – Market Outlook 19 November

The SENSEX continues to trade in a positive trend, maintaining strength despite recent pullbacks.

- Long holders can continue their positions with a daily closing stoploss at 84,165.

- A fresh short position is only advisable if SENSEX closes below 84,165.

SENSEX Support Levels

- 84,473

- 84,274

- 83,989

SENSEX Resistance Levels

- 84,958

- 85,242

- 85,442

The Market Outlook 19 November suggests that as long as SENSEX sustains above its stoploss zone, bullish sentiment remains intact with an eye on the higher resistance band.

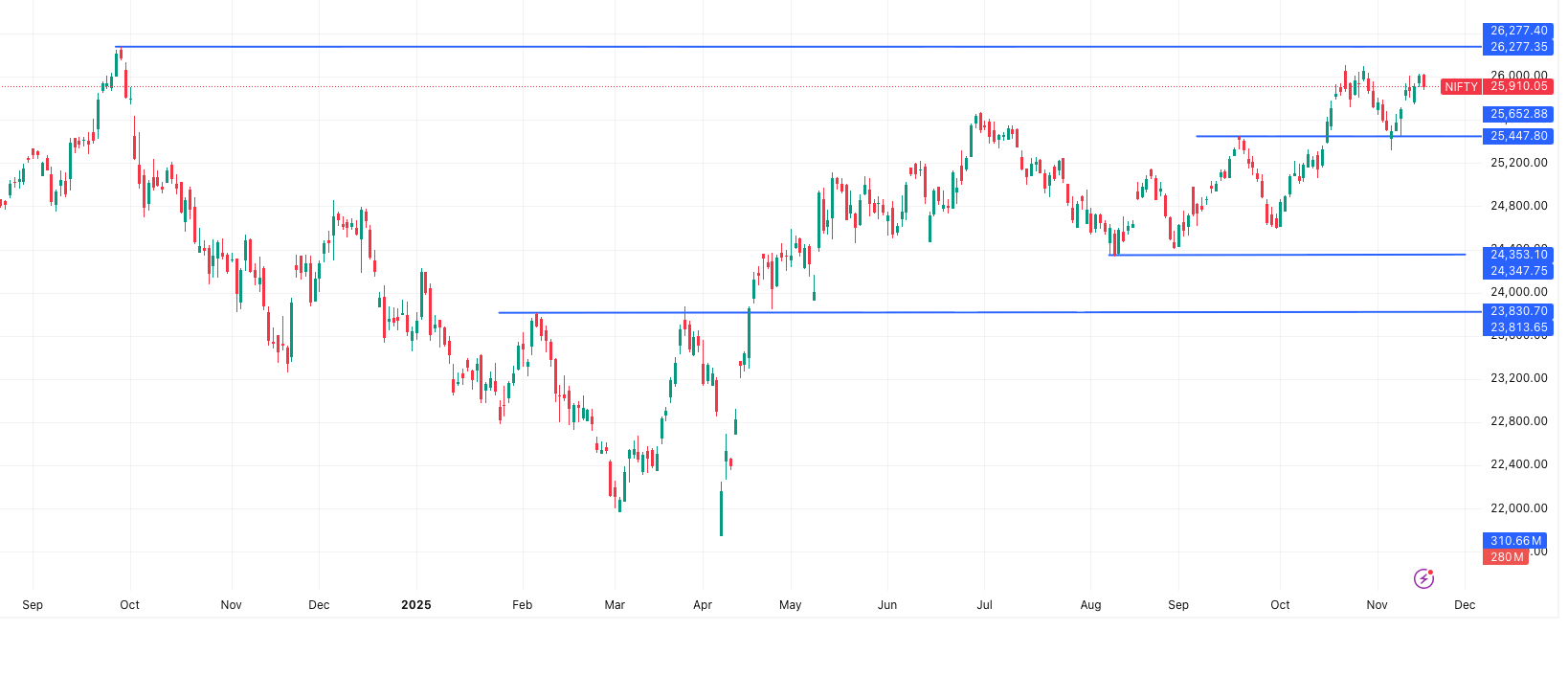

NIFTY Outlook – Market Outlook 19 November

NIFTY is also moving within a positive trend, supported by healthy buying interest on dips.

- Long positions can be held with a daily closing stoploss at 25,766.

- A fresh short opportunity arises only if NIFTY closes below 25,766.

NIFTY Support Levels

- 25,848

- 25,785

- 25,694

NIFTY Resistance Levels

- 26,001

- 26,092

- 26,154

Within the Market Outlook 19 November, NIFTY’s resistance zone becomes crucial—breaking above 26,154 may trigger a fresh rally towards new highs.

Bank Nifty Outlook – Market Outlook 19 November

Bank Nifty continues to hold a positive trend, though it’s consolidating within a narrow range.

- Long positions are safe above the daily closing stoploss of 58,474.

- Short trades should only be considered if Bank Nifty closes below 58,474.

Bank Nifty Support Levels

- 58,764

- 58,629

- 58,459

Bank Nifty Resistance Levels

- 59,069

- 59,239

- 59,374

The Market Outlook 19 November highlights that a breakout above 59,374 could strengthen the momentum for the banking index, while support levels will determine the next directional move.

Market News & Stocks to Watch – Market Outlook 19 November

The Market Outlook 19 November brings several major corporate developments across IT, IPO markets, entertainment, consulting, and global outsourcing services. Each news update includes its impact analysis along with Stocks to Watch for the day. All sources are linked inside the respective words as requested.

TCS Wins Major 5-Year NHS Contract – Market Outlook 19 November

Source: NDTV Profit

Tata Consultancy Services (TCS) has secured a major five-year contract from the UK’s NHS Supply Chain, focusing on modernising core business systems and cloud infrastructure. Under this partnership:

- TCS will deploy cloud and AI-enabled solutions to upgrade NHS Supply Chain’s IT setup.

- The company will replace legacy systems with a modern Supply Chain ERP system and implement a product and platform-based IT model, aligning with NHS’ long-term digital transformation vision.

- This follows NHS’ broader initiatives, including the massive €1.2 billion (₹14,137 crore) contract awarded to Infosys in October for workforce management systems.

The update also comes against the backdrop of a cyberattack on Tata Motors-owned Jaguar Land Rover, which disrupted retail and production systems, though no customer data loss was reported.

Stocks to Watch

- TCS – Direct beneficiary of the large IT modernization contract.

- Infosys – Continues strong traction in UK healthcare contracts.

- Tata Motors – Under pressure due to the JLR cyberattack headlines.

Milestone Gears Files for ₹1,100 Crore IPO – Market Outlook 19 November

Source: NDTV Profit

Milestone Gears Ltd. has officially filed for an IPO worth ₹1,100 crore, consisting of:

- ₹800 crore fresh issue

- ₹300 crore offer for sale

Key highlights from the DRHP:

- Manufacturers of high-precision transmission components for multiple industries including tractors, EVs, locomotives, windmills, and heavy machinery.

- Operates nine manufacturing facilities across Punjab, Haryana, and Himachal Pradesh.

- The company exported to 10+ countries, including the US, UK, Turkey, Germany, and China.

- Proceeds usage:

- ₹357 crore for debt repayment (current debt: ₹381 crore).

- ₹297 crore for a greenfield EV components project.

- Financials: FY25 revenue at ₹530 crore, net profit ₹22 crore, margins at 18.16%.

Stocks to Watch

- Mahindra & Mahindra – Key customer of Milestone Gears.

- Tafe Motors & Tractors – Significant buyer of transmission components.

- Motilal Oswal / Axis Capital / JM Financial – Lead managers to the IPO.

Wonderla Announces Chennai Park Launch on December 2 – Market Outlook 19 November

Source: CNBC TV18

Wonderla Holidays is set to launch its fifth amusement park, Wonderla Chennai, on December 2, with CM M.K. Stalin inaugurating it on December 1. This marks Wonderla’s expansion into Tamil Nadu with a massive ₹611+ crore investment.

Key highlights of the new park:

- Spread across 64.30 acres (37 acres developed).

- Features 43 rides, including:

- Tanjora – India’s first and largest B&M inverted roller coaster.

- Spin Mill – India’s tallest spinning thrill ride at 50 meters.

- Sky Rail – A 540-metre monorail with Viking-themed gondolas.

- Ticket pricing starts at ₹1,489, with 10% online booking discount and 20% discount for college students.

- The park can host 6,500 visitors per day.

- Includes 8 themed dining venues, offering Tamil Nadu specialties and international cuisine.

- Strong sustainability features: rainwater harvesting of 3.75 crore litres, 1,000 kW solar capacity (Phase 2), and 1,000+ indigenous trees.

- Expected to generate 1,000+ direct and indirect jobs.

Stocks to Watch

- Wonderla Holidays – Key beneficiary; major long-term expansion milestone.

- Local tourism & hospitality players – Potential demand boost in Chennai/Yelagiri corridors.

Choice International Acquires Ayoleeza Consultants – Market Outlook 19 November

Source: CNBC TV18

Choice International has expanded its infrastructure advisory footprint through the acquisition of Ayoleeza Consultants Pvt. Ltd. The subsidiary, Choice Consultancy Services Pvt Ltd (CCSPL), has fully acquired the firm.

Key deal insights:

- Ayoleeza Advisors specialises in railways, metros, bridges, highways, tunnels, and urban infrastructure consulting.

- Currently handling ₹200+ crore worth of live infrastructure projects.

- 69% of its projects operate on time-based contracts, ensuring steady monthly revenue.

- New bids under evaluation:

- ₹350+ crore in railway projects

- ₹150+ crore in road & highway projects

- The acquisition strengthens Choice’s public-sector consulting capabilities and its long-term growth strategy.

Stocks to Watch

- Choice International – Strong business diversification and order book expansion.

BLS International Secures Global Visa Processing Contract – Market Outlook 19 November

Source: CNBC TV18

BLS International has bagged a five-year global mandate from the Slovak Republic to establish and run Visa Application Centres (VACs) in 80+ countries.

Contract highlights:

- VACs will be equipped with advanced tech systems, upgraded infrastructure, and multilingual staff.

- Expands the company’s presence across Asia, Europe, Africa, Middle East, Americas.

- BLS already operates in 70+ countries, processing millions of applications annually.

- The company recently reported its strongest quarter ever:

- Revenue up 48.8% YoY to ₹736.6 crore

- Net profit up 27.4% YoY to ₹185.7 crore

- This new contract solidifies its position in the global visa outsourcing market.

Stocks to Watch

- BLS International – Direct beneficiary; strong global footprint expansion.

IPO Updates & Events – Market Outlook 19 November

The Market Outlook 19 November brings an active IPO calendar featuring multiple ongoing issues across the Mainboard and SME segments. Below is the simplified and actionable update, showing only the required data:

Open Date, Close Date, Listing Date, and GMP (Listing Gain) — all neatly structured in tables.

Mainboard IPOs – Market Outlook 19 November

| IPO Name | GMP (Listing Gain) | Open Date | Close Date | Listing Date |

|---|---|---|---|---|

| Sudeep Pharma IPO | ₹53 (8.94%) | 21 Nov | 25 Nov | 28 Nov |

| Excelsoft Technologies IPO | ₹16 (13.33%) | 19 Nov | 21 Nov | 26 Nov |

| Capillary Technologies IPO | ₹46 (7.97%) | 14 Nov | 18 Nov | 21 Nov |

| Fujiyama Power Systems IPO | ₹4.5 (1.97%) | 13 Nov | 17 Nov | 20 Nov |

| Tenneco Clean Air IPO | ₹121 (30.48%) | 12 Nov | 14 Nov | 19 Nov |

Listing Today: Tenneco Clean Air IPO is listing today.

SME IPOs – Market Outlook 19 November

| IPO Name | GMP (Listing Gain) | Open Date | Close Date | Listing Date |

|---|---|---|---|---|

| Gallard Steel (BSE SME) | ₹11 (7.33%) | 19 Nov | 21 Nov | 26 Nov |

Stocks to Watch – Market Outlook 19 November

Hindustan Copper (HCP)

Rating: BUY

Target Price (12M): ₹450

Current Market Price: ₹339

Research Source: Anand Rathi Report

Hindustan Copper enters the Market Outlook 19 November list as a high-conviction structural growth play, backed by a strong multi-year expansion cycle in India’s copper ecosystem.

Why Hindustan Copper Is in Focus

1. Massive Production Ramp-Up (3.5x Growth by FY31)

- HCP’s ore production is expected to jump from 3.47 million tonnes (FY25) to 12.2 million tonnes by FY31.

- Growth is driven by the extension of key mining leases, resumption of older mines, and MDO operations coming online.

- Its flagship MCP mine alone is expected to scale up to a 5 million tonne capacity.

2. Ideal Positioning Amid Global Supply Constraints

- Global copper supply growth is weakening due to:

- Operational disruptions in Chile, DRC, Indonesia

- Long gestation periods for new mines — usually 15–17 years

- In this environment, HCP has one of the clearest, most executable expansion roadmaps globally, boosting its long-term relevance in the global copper chain.

3. Domestic Copper Demand to Double

India’s copper demand is expected to surge due to expansion in:

- Renewable Energy (RE)

- Digital Infrastructure

- EV ecosystem

- AI data centers

- Advanced manufacturing

Demand is estimated to cross 2.5 million tonnes over the next decade.

Globally, copper demand is headed toward 37 million tonnes by 2035, reinforcing the structural upcycle.

4. Strong Financial Outlook

HCP’s multi-year ramp-up is expected to drive:

- Revenue CAGR: 25.3%

- EBITDA CAGR: 26.8%

- APAT CAGR: 33%

By FY31, revenue and EBITDA may rise 4x to:

- Revenue: ₹80,100 crore

- EBITDA: ₹30,700 crore

Valuations remain attractive considering the growth runway, industry-leading margins, and higher RoE potential.

Key Risks

- Copper price volatility

- Delays in mine execution

- Ore grade depletion over time

Why it’s a key stock today:

- Positioned perfectly for India’s copper demand boom

- One of the few global companies with a scalable and executable expansion plan

- Strong long-term visibility backed by industry tailwinds and structural demand factors

Conclusion – Market Outlook 19 November

As we step into the trading session for Market Outlook 19 November, the overall sentiment remains cautious yet selectively constructive. Global cues continue to drive short-term volatility, while domestic fundamentals stay resilient. With key indices coming off mildly in the previous session, the market may look for fresh triggers—whether from global data flows, institutional activity, or sector-specific developments.

Investors should stay focused on themes showing structural strength, such as metals, capital goods, auto, and selective financials. Stocks like Hindustan Copper demonstrate how long-term demand cycles can outweigh short-term fluctuations, making them important names to track.

As always, maintaining a disciplined approach with a blend of defensives and growth opportunities remains crucial. Keep an eye on sector rotation and price action, and use dips strategically in fundamentally strong counters.

Stay tuned to our daily updates in the Newsletter Section for timely market insights, stock ideas and data-backed perspectives.

References

- NSE India — for benchmark index data & FPI flows.

- BSE India — for corporate results and announcements.

Read Daily Market Update here: