Introduction – Market Outlook 18 November

Welcome to the Market Outlook 18 November, your early-morning brief designed to give traders, investors, and market watchers a clear and actionable view before the opening bell. After a strong close in the previous session, Indian equities continue to show momentum supported by resilient domestic flows, improving global sentiment, and strong sectoral participation.

On Monday, benchmark indices posted another day of gains. The Nifty 50 settled at 26,013.20 (+0.40%), while the Sensex closed at 84,913.96 (+0.42%), signaling sustained buying interest across key heavyweights. Banking, small-caps, and IT contributed meaningfully to the upside, with Nifty Bank gaining 0.77%, indicating strength in rate-sensitive counters. Small-caps also made a comeback, with the S&P BSE SmallCap Index rising 0.62%, showing healthy broad-market participation.

As we step into a fresh trading week, investors will be watching global cues, bond yields, FII flows, and earnings commentary closely. Today’s edition of the Market Outlook 18 November brings you a sharply structured preview of possible market direction, key levels to track, upcoming IPO events, and stocks that could be on traders’ radar.

Explore more daily market insights here → OneDemat Daily Newsletter

Index Outlook – Market Outlook 18 November

In today’s Market Outlook 18 November, benchmark indices continue to reflect strength with a firmly positive bias across the board. According to the latest analysis from EquityPandit, the market structure remains bullish for Sensex, Nifty, and Bank Nifty, with clear stop-loss levels and well-defined trading ranges for the day. Here’s a detailed breakdown:

SENSEX Outlook (84,951)

The Sensex stays in a positive trend, supported by strong global cues and steady domestic flows. Traders holding long positions are advised to continue with a strict daily closing stop-loss at 84,130. A reversal could trigger only if the index closes below this level.

Key Levels for the Day:

- Support:

• 84,692

• 84,433

• 84,285 - Resistance:

• 85,099

• 85,247

• 85,506

Expected Intraday Range:

- Tentative Range: 84,291 – 85,610

The index outlook within the Market Outlook 18 November framework suggests that dips are likely to be bought as long as the bullish structure remains intact.

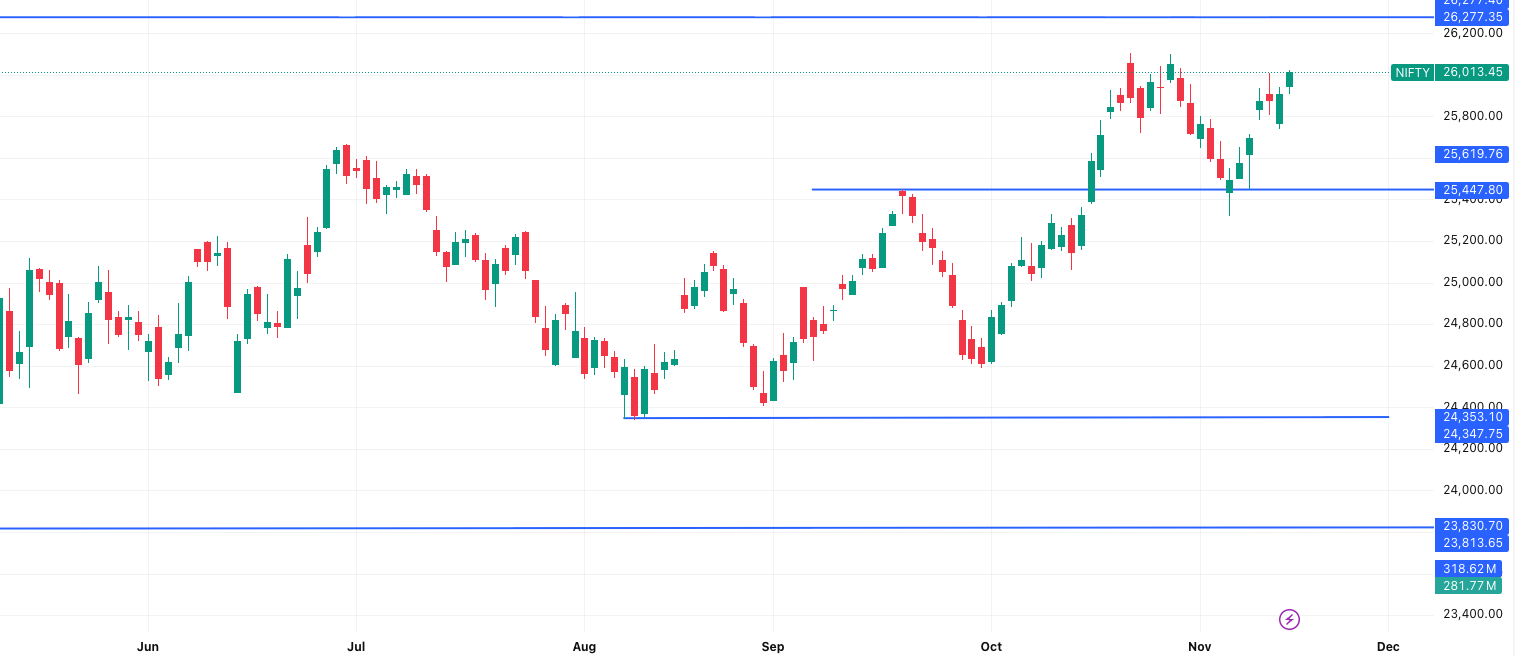

NIFTY 50 Outlook (26,013)

The Nifty maintains its upward sentiment, continuing its steady climb toward all-time highs. Long positions can be held with a daily closing stop-loss at 25,766. Any close below this level may invite short positions.

Key Levels for the Day:

- Support:

• 25,938

• 25,863

• 25,821 - Resistance:

• 26,056

• 26,099

• 26,174

Expected Intraday Range:

- Tentative Range: 25,813 – 26,213

Based on the Market Outlook 18 November, traders should watch out for a breakout above 26,099 which could push momentum-driven trades.

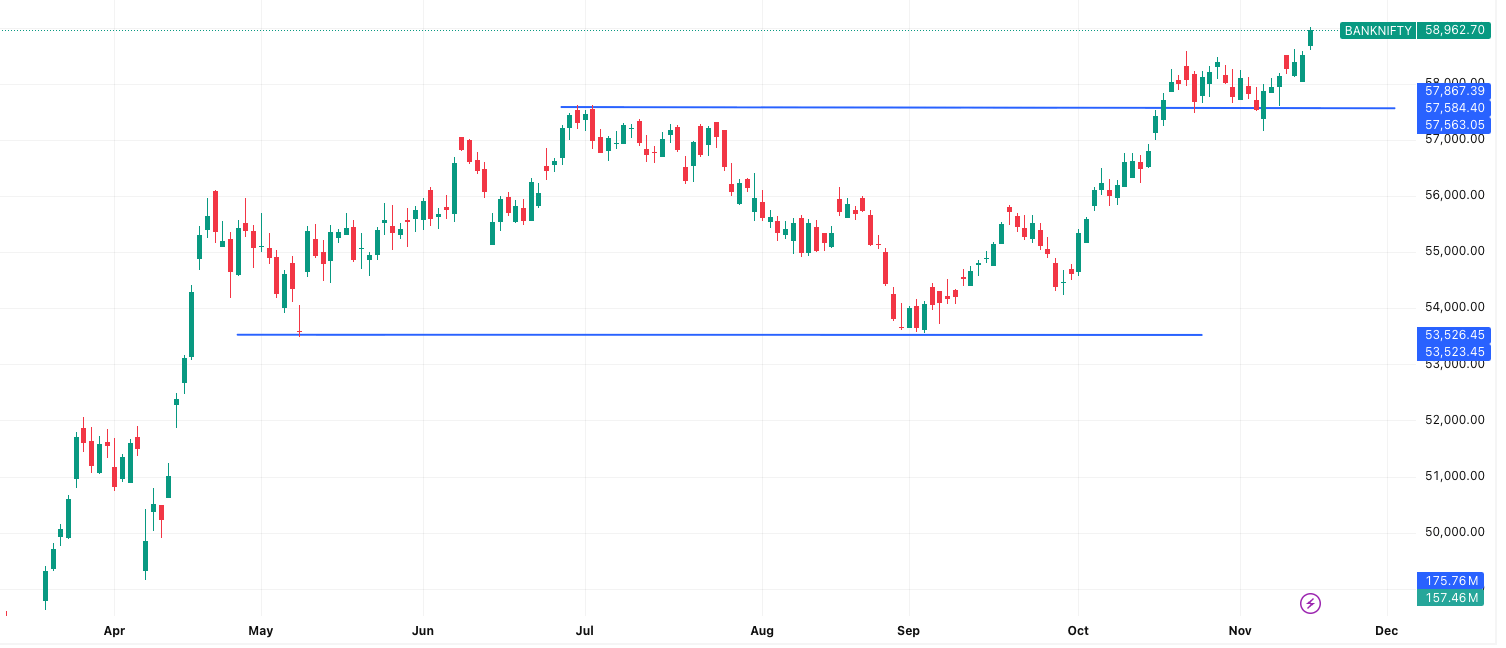

BANK NIFTY Outlook (58,963)

Bank Nifty continues to outperform, reflecting strength in private lenders and PSU banks. The trend is strongly positive, and traders should trail long positions with a closing stop-loss at 58,305.

Key Levels for the Day:

- Support:

• 58,711

• 58,460

• 58,315 - Resistance:

• 59,108

• 59,253

• 59,504

Expected Intraday Range:

- Tentative Range: 58,461 – 59,464

The Market Outlook 18 November signals a likely upside extension if 59,253 is taken out, with banking stocks poised to lead early-morning action.

Market News & Stocks to Watch – Market Outlook 18 November

India–New Zealand FTA Progress & Ministerial Engagements

India and New Zealand strengthened bilateral ties as Union Commerce and Industry Minister Piyush Goyal shared images and videos of a friendly cricket session with New Zealand’s Trade and Investment Minister Todd McClay, who arrived in Mumbai for advancing FTA discussions.

The warm gesture, shared via NDTV Profit, symbolised a “winning partnership,” highlighting progress both on and off the field.

Goyal also shared a video from the event on LinkedIn showcasing the cultural significance of the Khasdar Krida Mahotsav.

According to All India Radio reports, Todd McClay’s visit follows the fourth round of FTA talks in New Zealand, and his Mumbai meetings will push forward the India–NZ Free Trade Agreement agenda. McClay also attended cultural and business events emphasising cooperation in sectors like tourism, sports, investment, and trade.

Stock to Watch:

Tata Motors – Possible sentiment boost on global trade tie-ups and improved export prospects.

India–US Trade Deal First Tranche Nearing Closure

According to NDTV Profit, the first tranche of the India–US bilateral trade agreement is nearing completion. One part of the agreement focuses on reciprocal tariff relief, expected “sooner rather than later,” while the second part continues to undergo wider deliberations.

Washington had imposed 50% tariffs on Indian goods earlier, partly due to Russian oil imports. Recently, exemptions were granted on 254 products—primarily agricultural items—covering $1 billion of US imports from India.

Commerce Secretary Rajesh Agrawal highlighted that sectors like fruits, nuts, spices, tea, and coffee will benefit significantly.

Stock to Watch:

Tata Coffee – Likely to benefit from tariff exemptions and improved export competitiveness.

India Imposes Import Curbs on Certain Platinum Jewellery

The Indian government has imposed immediate restrictions on importing certain types of platinum jewellery till April 2026, according to The Hindu.

The Directorate General of Foreign Trade (DGFT) revised the import policy from Free to Restricted, requiring licences for importers.

The decision closes a loophole where bullion dealers were importing platinum-alloy jewellery duty-free, despite containing 90% gold.

Earlier, similar restrictions were placed on certain silver jewellery imports from Thailand to curb misuse of the Free Trade Agreement with ASEAN.

Stock to Watch:

Titan Company – Lower import competition may support domestic jewellery margins.

Government Approves ₹7,172 Cr Investment Under ECMS

As per The Hindu, the government has cleared 17 electronics component manufacturing projects worth ₹7,172 crore under the ECMS scheme.

The cumulative production from these projects is expected to reach ₹65,111 crore across camera modules, PCBs, oscillators, connectors, and more.

Notable approved players include:

- Jabil Circuit India

- Uno Minda

- TE Connectivity

- Aequs Consumer Products

- Zetfab India

- Meena Electrotech

The initiative aligns with India’s vision to become a global electronics manufacturing hub, supported by design teams, quality benchmarking, and supply chain resilience.

Stock to Watch:

Dixon Technologies – Positive sentiment from large-scale electronics manufacturing expansion.

India’s Unemployment Rate Stable at 5.2% in October

India’s unemployment rate remained unchanged at 5.2% in October 2025, according to NDTV Profit.

Key highlights:

- Rural unemployment improved to 4.4% (from 4.6%)

- Urban unemployment increased to 7% (from 6.8%)

- LFPR hit a six-month high at 55.4%

- Female labour participation continues to rise consistently, particularly in rural areas

Higher LFPR and stable unemployment suggest economic stability with growing workforce engagement.

Stock to Watch:

TeamLease Services – Increased labour participation may boost staffing and skilling demand.

India Releases AI Governance Guidelines 2025

The Ministry of Electronics & IT has published India’s landmark AI Governance Guidelines 2025, reported by NDTV Profit.

These guidelines place India at the forefront of safe, responsible, and innovation-friendly AI development.

The framework is built on Seven Sutras – Trust, People First, Innovation, Fairness, Accountability, Explainability, and Safety.

Six governance pillars include:

- National AI infrastructure (datasets, GPU clusters, AIKosh)

- Capacity building

- Policy and regulation

- Risk mitigation

- Accountability mechanisms

- Institutional oversight (AI Governance Group, AI Safety Institute, Expert Committee)

This strategy aligns with the national vision of AI for All and supports India’s ambition to become a global AI leader by 2047.

Stock to Watch:

Cyient – Expected to benefit from the push toward regulated, scalable AI integration across industries.

IPO Updates & Events – Market Outlook 18 November

The market sentiment for 18 November remains focused on ongoing IPO action, fresh listings, and grey market premium (GMP) trends. With multiple issues opening, closing, and listing this week, investors are tracking subscription momentum, listing expectations, and GMP stability.

Among all, Excelsoft Technologies IPO continues to attract attention due to its strong fundamentals and steady buzz ahead of opening day.

To help you make quick decisions, here is the updated 18 November IPO dashboard for both Mainboard IPOs and SME IPOs.

Mainboard IPOs – Status on 18 November

| IPO Name | Open Date | Close Date | Listing Date | GMP (Est. Listing Gain) |

|---|---|---|---|---|

| Excelsoft Technologies IPO | 19 Nov | 21 Nov | 26 Nov | ₹– (0.00%) |

| Capillary Technologies IPO | 14 Nov | 18 Nov | 21 Nov | ₹29 (5.03%) |

| Fujiyama Power Systems IPO | 13 Nov | 17 Nov | 20 Nov | ₹2 (0.88%) |

| Tenneco Clean Air IPO | 12 Nov | 14 Nov | 19 Nov | ₹122 (30.73%) |

| PhysicsWallah IPO | 11 Nov | 13 Nov | 18 Nov | ₹10 (9.17%) |

| Emmvee Photovoltaic IPO | 11 Nov | 13 Nov | 18 Nov | ₹– (0.00%) |

Listings Today (18 November)

✔ PhysicsWallah IPO

✔ Emmvee Photovoltaic IPO

SME IPOs – Status on 18 November

| IPO Name | Open Date | Close Date | Listing Date | GMP (Est. Listing Gain) |

|---|---|---|---|---|

| Gallard Steel BSE SME | 11 Nov | 14 Nov | 18 Nov | ₹11 (7.33%) |

| Workmates Core2Cloud BSE SME | 13 Nov | 14 Nov | 18 Nov | ₹88 (43.14%) |

Listing Today (18 November)

✔ Workmates Core2Cloud BSE SME

Stocks to Watch – Market Outlook 18 November

As the market steps into 18 November, analysts are closely tracking selective mid-to-large cap names showing strong operational momentum and improving order visibility. One of the top brokerage-backed ideas for the week is Kalpataru Projects International Ltd. (KPIL), which continues to demonstrate structural strength across transmission, buildings, and infrastructure segments.

Below is a detailed breakdown of KPIL’s fundamentals, investment rationale, financials, and valuation outlook.

Kalpataru Projects International Ltd. (KPIL)

Recommendation: BUY

Brokerage Research: SBI Securities

Time Horizon: 12 months

Current Market Price: ₹1,247

Target Price: ₹1,434

Potential Upside: 15%

About the Company

Kalpataru Projects International Ltd. (KPIL) is among India’s largest specialized EPC players operating across:

- Power Transmission & Distribution (T&D)

- Buildings & Factories (B&F)

- Water Supply & Irrigation

- Railways & Urban Mobility

- Oil & Gas Pipelines

- Highways & Airports

KPIL has execution presence across 30+ countries and a footprint in 75 global markets, backed by engineering strength, superior execution capabilities, and sustainability-aligned project practices.

Key Investment Rationale

1️⃣ Record Order Book Visibility

KPIL’s order book remains exceptionally strong:

- ₹64,682 crore as of Sep 2025

- 2.9× FY25 sales, ensuring multi-year growth visibility

- ₹14,951 crore order inflows till 31 Oct 2025 (FY26 YTD)

- Additional ₹5,000 crore orders under consideration

The company is well-positioned to benefit from long-term capex cycles across:

- Power transmission

- Real estate

- Urban mobility

- Hydrocarbon

- Industrial infrastructure

2️⃣ Strong Performance in 2QFY26

KPIL delivered robust YoY growth:

| Metric | Growth YoY | Value |

|---|---|---|

| Revenue | +32.4% | ₹6,528 crore |

| EBITDA | +28.1% | ₹562 crore |

| PAT | +91.3% | ₹240 crore |

The only drag came from the Water segment, which saw 5% decline due to payment delays.

Financial Summary

| Particulars (₹ crore) | FY24A | FY25A | FY26E | FY27E |

|---|---|---|---|---|

| Net Sales | 19,626 | 22,316 | 27,662 | 32,146 |

| EBITDA | 1,814 | 2,031 | 2,316 | 2,815 |

| Net Profit | 516 | 567 | 961 | 1,248 |

| EBITDA Margin (%) | 9.2 | 9.1 | 8.4 | 8.8 |

| EPS (₹) | 30.2 | 33.2 | 56.3 | 73.1 |

| ROE (%) | 7.4 | 8.1 | 13.9 | 16.5 |

| P/E (x) | 41.4 | 37.7 | 22.2 | 17.1 |

| P/BV (x) | 3.3 | 3.1 | 2.9 | 2.5 |

3️⃣ T&D and B&F Businesses Leading the Upside

- T&D revenue grew 51% YoY, with strong traction in India & international markets.

- Order book for T&D stands at ₹26,276 crore (+18% YoY).

- Tender pipeline worth ₹1,50,000+ crore over the next 12–18 months.

- B&F order book at a record ₹18,758 crore (+43% YoY).

These two segments are expected to drive majority of medium-term growth.

4️⃣ Upward Revision in FY26 Guidance

KPIL revised its FY26 outlook:

- Revenue Growth: Increased to 25%+ (from earlier 20–25%)

- Order Inflow Target: ₹25,000+ crore for FY26

5️⃣ Valuation Remains Attractive

At CMP ₹1,247:

- FY26E P/E: 22.2×

- FY27E P/E: 17.1×

- Strong earnings CAGR along with improving ROE signals further upside potential.

Key Risks

- Project execution delays

- Global macro or trade uncertainties

- Currency fluctuations due to large overseas operations

Conclusion – Market Outlook 18 November

The Market Outlook 18 November reflects a steady yet cautious setup as benchmark indices continue to hold their positive trend supported by firm global cues, healthy domestic macro data, and sustained sector-wise rotation. With Sensex, Nifty, and BankNifty all trading above key support zones, the market structure remains constructive, though selective volatility may persist due to ongoing IPO activity and global event risks.

On the investment side, strong fundamental stories such as Kalpataru Projects International Ltd. continue to stand out, backed by robust order books, improved earnings visibility, and sector-specific tailwinds. The pipeline of mainboard and SME IPOs—along with fresh listings—also adds momentum for short-term traders looking for listing gains.

As we advance through the week, staying focused on trend levels, sector leadership, and key earnings-driven stock triggers will be essential. Overall, the Market Outlook 18 November suggests a stable-to-positive bias, with opportunities emerging in infrastructure, capital goods, and selective mid-cap names. Maintain disciplined stop-loss levels and continue tracking data-heavy events that could drive near-term sentiment.

References

- NSE India — for benchmark index data & FPI flows.

- BSE India — for corporate results and announcements.

- Moneycontrol — for real-time market coverage.

- Economic Times Markets — for expert commentary and sectoral analysis.

Read Daily Market Update here: