Market Outlook 18 July: Indices Slip, Smallcaps Shine

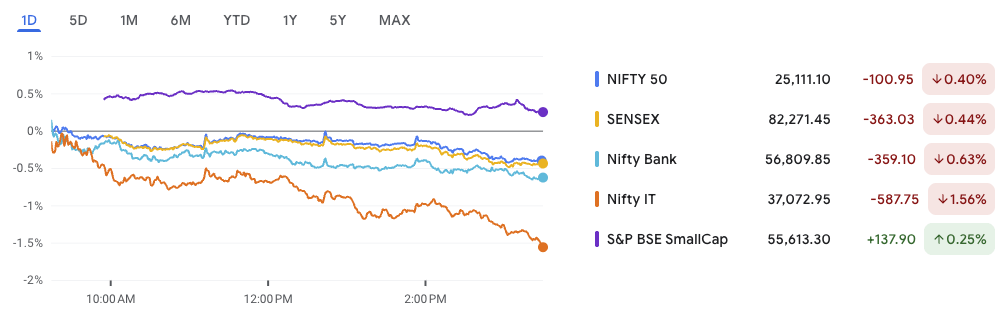

Welcome to the Market Outlook 18 July edition. After a strong rally earlier this week, Indian indices took a breather on Thursday. The Nifty 50 declined by 100.95 points to close at 25,111.10, while the Sensex slipped 363.03 points to end at 82,271.45.

Profit-booking and weak global cues weighed on large-cap stocks. Sectorally, Nifty IT tumbled 1.56%, and Nifty Bank lost 0.63%, dragging the benchmarks lower. Despite this, the broader market showed strength. The BSE SmallCap index gained 0.25%, highlighting investor interest in select smallcaps.

In this Market Outlook 18 July, we decode today’s movers and shakers, spotlight a breakout stock, and share what to track for Friday’s session. Let’s dive in.day.

Nifty Outlook – Market Outlook 18 July

In this Market Outlook 18 July, we take a closer look at the Nifty 50’s price structure and what lies ahead for traders and investors.

Chart Breakdown & Technical Analysis

1. Recent Structure (April–July 2025):

Nifty rallied sharply from around 22,800 to a peak near 25,670. However, after touching that swing high, it entered a short-term correction phase. Currently, it has retraced to around 25,100—right at the previous breakout zone and near the 9-day EMA at 25,176.

2. Key Support and Resistance Zones

| Zone | Type | Remarks |

|---|---|---|

| 25,066 – 25,111 | Strong Support | Tested twice; bulls still defending |

| 25,176 – 25,230 | 9 EMA & Resistance | Acting as resistance after the pullback |

| 25,670 – 25,673 | Swing High Resistance | Breakout zone; crossing this confirms bullish continuation |

| 24,450 – 24,460 | Major Support | Previous base from the last consolidation phase |

3. Candlestick and Volume Insights

The last few daily candles reflect indecision. Sellers have emerged near resistance levels, as shown by repeated upper wicks. Thursday’s red candle closed below the 9-day EMA, reinforcing a bearish bias in the short term. Moreover, the volume remains subdued, indicating a lack of aggressive buying near key levels.

Interpreting the Pattern

The Nifty appears to be undergoing a classic pullback following a strong breakout. The price action is hovering around a crucial support band (25,066–25,100), with both bulls and bears unwilling to commit to a clear trend.

What’s Next: Two Probable Scenarios

✅ Bullish Scenario – If Support Holds:

- A bounce from the 25,066–25,100 zone could trigger a recovery toward 25,230 and 25,400.

- If momentum builds, Nifty may retest 25,670 and potentially target the 26,266 mark.

- Key signals to confirm this setup include a bullish daily candle with strong volume and a close above the 9-day EMA.

⚠️ Bearish Scenario – If Support Breaks:

- A close below 25,066, particularly on higher volume, would confirm a breakdown.

- This move could shift the short-term trend to bearish, with downside targets at 24,460 and 24,200.

- The pattern would also complete a lower high structure, signaling caution.

Summary Table – Market Outlook 18 July

| Parameter | Value |

|---|---|

| Trend | Short-term correction inside long-term uptrend |

| Immediate Support | 25,066 – 25,111 |

| Resistance Levels | 25,176 – 25,230 and 25,670 |

| Breakdown Trigger | Below 25,066 |

| Breakout Trigger | Above 25,670 |

Trading Psychology & Strategy

Markets are in a “wait-and-watch” zone. Bulls are defending the 25,100 level, but bears remain active near resistance. Without a clear breakout or breakdown, it’s best to stay cautious. Traders may consider:

- Going long only if Nifty breaks above 25,230 with volume.

- Going short if it closes below 25,066 with conviction.

Until then, managing risk and waiting for confirmation is crucial.

News and Impacted Stocks – Market Outlook 18 July

1. Tata Electronics & Bosch Collaboration

Tata Electronics signed a strategic MoU with Germany’s Bosch GmbH to jointly advance semiconductor and chip packaging technologies. The partnership involves Tata’s new assembly and test facility in Assam and its semiconductor foundry in Gujarat.

Impacted Stocks:

- Tata Elxsi, Tata Motors (EV component synergy)

- Bosch India – Positive long-term sentiment due to localization push

- Dixon Technologies – May benefit from ecosystem development tailwinds

2. Hexaware Acquires SMC Squared for $120M

Hexaware Technologies has acquired U.S.-based SMC Squared to strengthen its Global Capability Center (GCC) presence in India. The acquisition boosts its delivery capabilities in Bengaluru and Hyderabad, aiming to tap into India’s booming $100B+ GCC market.

Impacted Stocks:

- Hexaware – Direct beneficiary; positive outlook

- Tata Consultancy Services (TCS), Infosys – Minor peer re-rating on increased competition

- Mid-cap IT stocks – Renewed M&A sentiment in sector

3. WeWork India IPO Plans

WeWork India is set to launch its ₹3,500 crore IPO in August, aiming to sell 43.75 million shares. Major backers, Embassy Buildcon and Ariel Way Tenant Ltd., will offload their stakes.

Impacted Stocks:

- Smartworks, Awfis – Potential valuation re-rating ahead of sector IPO buzz

- JM Financial, ICICI Securities – Involved as lead bookrunners

4. Adani Wilmar Stake Sale

Adani Enterprises will divest 20% in AWL Agri Business to Wilmar’s Lence Pte Ltd, valuing the deal at ₹7,150 crore. Wilmar will now hold a 64% majority in AWL, as Adani gradually exits the JV.

Impacted Stocks:

- Adani Enterprises – Capital release positive for balance sheet

- Adani Wilmar – Stock rallied 5.7% on stake clarity and record revenue growth

- FMCG sector – Positive sentiment from AWL’s strong Q1 (₹17,059 crore revenue, +21% YoY)

5. Sona BLW & BYD in Talks

Sona BLW may set up a local component manufacturing unit in China to support its growing EV business and collaboration with BYD. The move strengthens its global EV supply chain.

Impacted Stocks:

- Sona BLW Precision Forgings – Stock up 8% in 5 days; strong trading volumes

- Samvardhana Motherson – Indirect sentiment shift among auto component players

6. Tanla Platforms Announces ₹175 Crore Buyback

Tanla Platforms received 99.93% shareholder approval for a ₹175 crore equity buyback at ₹875/share. Despite the buyback news, the stock saw marginal correction, closing at ₹652.80.

Impacted Stocks:

- Tanla Platforms – Sentiment stable; cautious trade despite shareholder support

- Route Mobile – Peer watch for corporate action trends in CPaaS sector

7. India Prepares for Oil Supply Risks

Oil Minister Hardeep Singh Puri confirmed India is prepared to manage oil imports if Russian supplies are disrupted by potential U.S. sanctions. India is sourcing from 40 countries, including Guyana and Brazil.

Impacted Stocks:

- Reliance Industries, Nayara Energy – Stability in supply chain crucial

- ONGC, Oil India – Domestic production may gain focus

- Oil Marketing Companies (HPCL, BPCL) – Likely to benefit from diversified sourcing

Stock in Technical Radar – Market Outlook 18 July

Stock: Sona BLW Precision (SONACOMS)

Current Market Price: ₹486

Volume: 34.3 million shares (above average)

Chart Setup: Bullish Flag Breakout

Sona BLW Precision is flashing a strong technical breakout pattern just as the broader market hovers near key levels in the Market outlook 18 July. The stock has completed a bullish flag formation — a classic continuation pattern — and surged past its consolidation zone on July 17 with significant volume support.

Key Technical Highlights

| Parameter | Details |

|---|---|

| Pattern | Bullish Flag (ABCD Structure) |

| Breakout Confirmation | Yes – Clean breakout with volume spike |

| Volume Surge | 34.34M shares – institutional activity |

| Support Zones | ₹455 / ₹436 / ₹425 |

| Resistance Zones | ₹523 (short-term), ₹559 (swing target) |

| EMA Status | Price > 9 EMA; bullish slope |

Technical Breakdown

1. Pattern Analysis:

- After a steep upmove in April–May (AB leg), the stock entered a mild correction forming a downward sloping channel (BC leg).

- On July 17, a bullish candle pierced the upper flag resistance — validating the continuation of the prior uptrend.

2. Volume Confirmation:

- Breakouts without volume lack conviction — but here, the 34.3M surge signals strong demand, possibly from institutions.

- The volume validates the breakout, making this setup credible for both short-term and swing traders.

3. Key Support & Resistance:

- Immediate Support: ₹455 (also aligns with EMA-9 support)

- Major Resistance Levels: ₹523 (recent swing high) → ₹559 (flag projection target)

4. Moving Average Context:

- The 9-day EMA has started turning upward, with price action decisively above it — indicating trend reversal strength.

- The EMA may now serve as dynamic support during minor dips.

5. Fibonacci & Harmonic Insight:

- The breakout aligns with an ABCD harmonic extension. If the CD leg mirrors the AB leg (symmetry), the stock can target ₹559 — nearly a 15% potential upside from current levels.

Trading Strategy Based on the Chart

| Trade Type | Entry Range | Target | Stop Loss |

|---|---|---|---|

| Short-Term (1–5D) | ₹470 – ₹475 (on pullback) | ₹523 | ₹455 |

| Swing Trade (1–3W) | CMP or dips | ₹559 | ₹436 |

Takeaway for Market Outlook 18 July:

As Nifty shows signs of consolidation near key support, Sona BLW Precision has emerged as a technically strong counter with momentum potential. The breakout is clean, volume-backed, and supported by classic chart patterns.

If the market maintains stability, this setup offers a high-reward opportunity for traders looking for breakout plays in the current environment.

IPO Updates – Market Outlook 18 July

Even as broader markets witnessed mild correction ahead of Friday’s open, the primary market continues to show strong investor interest, especially in SME and biotech listings. Below is the latest IPO status update, including GMP trends, subscription buzz, and listing dates.

Hot IPOs to Watch

| IPO Name | GMP | Subscription | Issue Price | Est. Listing | IPO Size | Lot Size | Status |

|---|---|---|---|---|---|---|---|

| Anthem Biosciences (Mainboard) | ₹150 (26.32%) | 67.42x | ₹570 | ₹720 | ₹3395 Cr | 26 shares | Closed |

| Spunweb Nonwoven (NSE SME) | ₹34 (35.42%) | 251.32x | ₹96 | ₹130 | ₹57.89 Cr | 1,200 shares | Closed |

| Monarch Surveyors (BSE SME) | ₹60 (24.00%) | 250x (approx.) | ₹250 | ₹310 | ₹88.58 Cr | 600 shares | Opens 22 Jul |

| Savy Infra & Logistics (NSE SME) | ₹11 (9.17%) | 120x (Sub2) | ₹120 | ₹131 | ₹66.47 Cr | 1,200 shares | Opens 21 Jul |

| Monika Alcobev (BSE SME) | ₹10 (3.5%) | 1.56x (live) | ₹286 | ₹296 | ₹153.68 Cr | 400 shares | Closes 18 Jul |

Biotech Buzz: Anthem Biosciences

Anthem Biosciences emerged as the biggest blockbuster of the week with a massive 67x subscription. The GMP of ₹150 suggests a 26% listing gain, signaling strong HNI and institutional demand. This is a marquee play in the CDMO/biopharma space, and its listing on 21 July could impact sentiment positively for high-growth sectors in the next Market outlook after 18 July.

Infrastructure & Logistics: Savy Infra Gains Traction

Savy Infra & Logistics is showing early signs of traction with a GMP of ₹11 (9.17%) ahead of its opening on July 21. With a strong logistics + EPC revenue model and multiple ongoing infrastructure projects, this IPO is gaining popularity among SME investors tracking the Market outlook 18 July and beyond.

Textile, Manufacturing & Others:

- Spunweb Nonwoven, a micro-cap textile-based manufacturer, closed with 251x oversubscription and a GMP of ₹34, indicating over 35% listing premium.

- Monarch Surveyors, opening July 22, has started attracting grey market action with a 24% GMP jump.

- Monika Alcobev, currently open, has a modest GMP of ₹10, with oversubscription crossing 1.5x on Day 2.

Key Takeaways – Market Outlook 18 July:

- Investor Sentiment: Despite volatility in broader indices, SME IPOs continue to attract aggressive bids, suggesting retail risk appetite remains elevated.

- GMP Trends: Majority of active IPOs show positive grey market sentiment, with flagship names like Anthem and Spunweb indicating strong listing potential.

- Watchlist for Next Week: Focus remains on Monarch Surveyors and Savy Infra as fresh IPOs open post July 21

Small Cap of the Day – Thomas Cook (India) Ltd

CMP: ₹176

Market Cap: ₹8,317 Cr Industry: Travel Services & Forex

Business Snapshot: A 143-Year-Old Brand Reinventing Itself

Thomas Cook (India) Ltd, a name that resonates with travel planning for generations, has evolved far beyond being just a tour operator. Established in 1881, the company today runs a diversified travel empire spread across 25+ countries and 5 continents, backed by a workforce of over 8,388 employees.

Its bouquet of services includes:

- Foreign Exchange and Currency Cards

- Corporate Travel and MICE (Meetings, Incentives, Conferences, Exhibitions)

- Visa and Passport Facilitation

- Retail and Leisure Travel

- A robust E-Business vertical

Moreover, it owns 19 sub-brands including marquee names like SITA, Travel Corporation India (TCI), and Distant Frontiers, catering to niche and luxury tourism segments.

Stock Surge: What’s Fueling the Momentum?

On 17 July, Thomas Cook shares jumped 6.45%, making it one of the top gainers in the small-cap travel and services segment. This move is part of a broader travel-sector rally driven by:

- Strong rebound in domestic and outbound travel post-COVID

- Higher forex transaction volumes due to student and business travel

- Improving operating margins amid better capacity utilization

- Investor confidence in travel themes ahead of the festive season

The volume surge and technically significant breakout indicate strong institutional buying interest.

Financial Overview: A Lean, Profitable Travel Engine

| Key Metrics | FY25 / Latest |

|---|---|

| Revenue | ₹8,140 Cr |

| Net Profit (PAT) | ₹259 Cr |

| EPS Growth (3Y) | 45.4% |

| ROCE / ROE | 18.6% / 12.0% |

| Book Value | ₹48.0 |

| Stock P/E vs Industry P/E | 32.1 vs 37.4 |

| Debt-to-Equity | 0.21 (Low Leverage) |

| Cash & Equivalents | ₹1,004 Cr |

| Intrinsic Value (Est.) | ₹132 |

| Price to Book Ratio | 3.68x |

Healthy margins (OPM: 5.86%)

Debt-light balance sheet

Zero pledged promoter holding

The company has significantly de-risked itself and built operational strength with improving asset turnover and return ratios.

Strategic Strengths & Future Outlook

- Diversification across travel, forex, and digital channels ensures revenue stability even in seasonal downturns.

- The visa business has been gaining strong traction, especially with the rebound in student and corporate travel.

- Thomas Cook is also doubling down on technology platforms to provide frictionless experiences — from visa bookings to forex delivery and itinerary planning.

- The management has hinted at global M&A possibilities, signaling ambitions beyond Indian shores.

Valuation View: Is It Still Attractive?

At ₹176, the stock trades at ~32.1x P/E, a slight discount to the industry average of 37.4x — despite its clean balance sheet and growth visibility.

Although it is ~33% above its estimated intrinsic value of ₹132, the market is likely pricing in:

- Continued travel momentum

- Margin expansion

- High growth in forex and digital booking platforms

Thus, for medium- to long-term investors, it presents a “quality growth at reasonable price” story in the small-cap space.

Final Word: Why It Matters for Market Outlook 18 July

In a market searching for value beyond large caps, Thomas Cook (India) checks multiple boxes:

Travel & forex sector tailwinds

Re-rating potential based on brand moat and margin expansion

Low-debt, cash-rich balance sheet with aggressive digital pivot

As part of our Market Outlook for 18 July, this stock is a clear standout in the consumer services small-cap basket, and could see further re-rating if demand continues to hold strong through Q2FY26.

Conclusion: Why Thomas Cook (India) Stands Out Today

In the context of the Market outlook 18 July, Thomas Cook (India) Ltd has emerged as a small-cap gem backed by solid fundamentals, a legacy brand, and strong earnings momentum. With its diversified presence across travel, forex, and digital platforms — combined with a low debt profile and healthy profit margins — the stock offers a compelling blend of growth and stability.

As travel demand surges and the festive season approaches, Thomas Cook is well-positioned to benefit from rising discretionary spending and global travel revival. Investors looking to tap into the long-term travel and tourism story may find Thomas Cook to be an attractive candidate for further research and portfolio consideration.

Verdict: A fundamentally strong, low-leverage small-cap stock riding the post-pandemic travel boom — and worth watching closely in the weeks ahead.

More Articles

How to Transfer Shares from Groww to Zerodha – Full Guide (2025)

Why Fundamentals Are Failing—and Market Cycles Are Getting Shorter

How a Tea Seller Used the Power of Compound Interest to Build ₹45 Lakh