Market Outlook 17 October: Bulls Back in Control

Good Morning & Welcome to Your Market Outlook 17 October Edition

After a strong rebound midweek, Dalal Street extended its winning streak on Thursday as benchmark indices surged for a second straight session. The rally was led by banking, auto, and large-cap stocks, reflecting strong investor confidence ahead of the weekend.

The NIFTY 50 soared 251.50 points (0.99%) to close at 25,575.05, while the SENSEX climbed 778.49 points (0.94%) to finish at 83,383.92. Banking stocks continued their dominance, with the Nifty Bank jumping 573.35 points (1.01%) to 57,373.25. The Nifty IT index posted modest gains of 0.31%, and the S&P BSE SmallCap index rose 0.43%, showing a healthy but selective participation from broader markets.

Optimism was fueled by strong domestic cues, steady foreign inflows, and easing global yield pressures, setting a positive tone for Friday’s trade.

In this Market Outlook 17 October, we bring you — technical levels for key indices, major market-moving news, fresh IPO updates, and the top stock ideas to keep on your radar before the opening bell.

Index Technical View — Market Outlook 17 October

According to EquityPandit analysis, Indian indices continued to show strong bullish momentum on Wednesday. The overall market sentiment remains positive, backed by steady buying interest across large-cap and banking counters. Here’s a detailed look at how key indices are positioned for the Market Outlook 17 October 👇

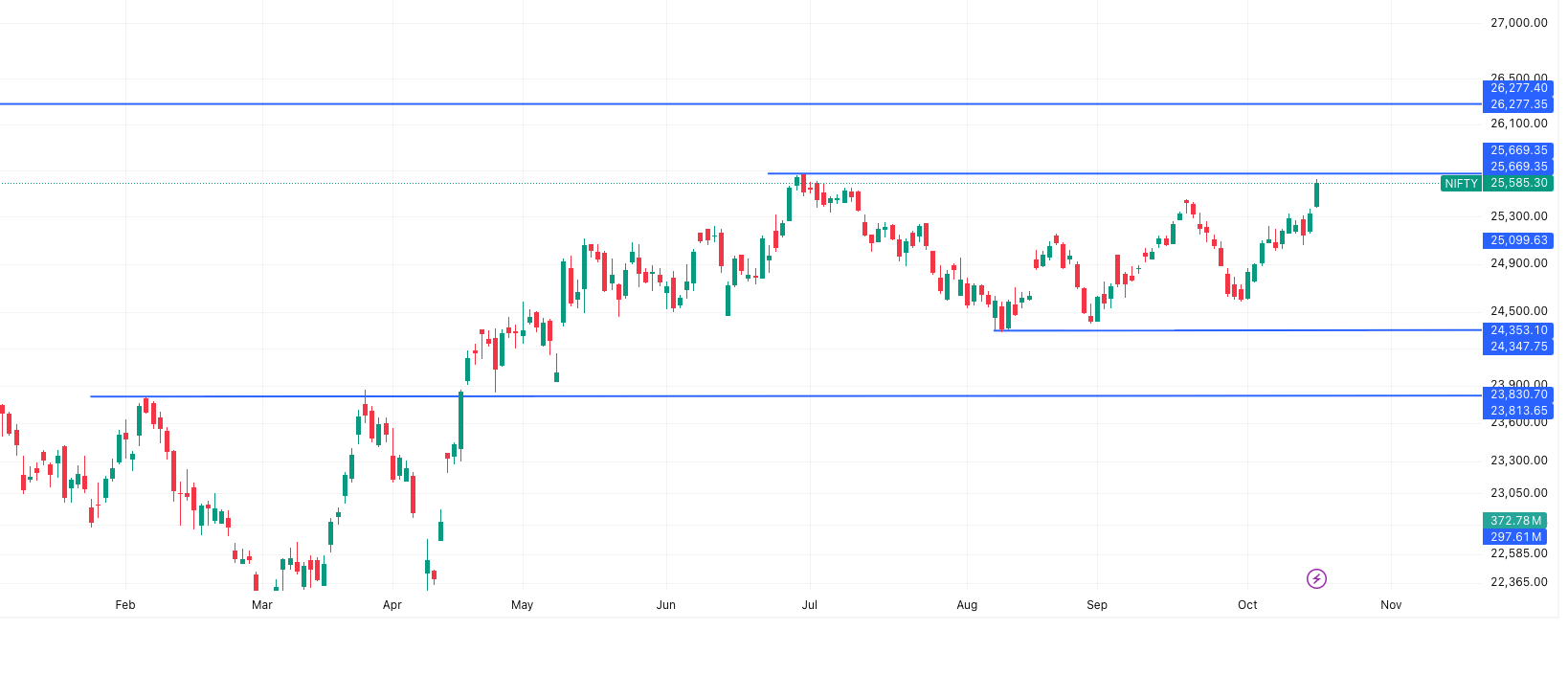

NIFTY 50 Outlook 17 October

Nifty extended its winning streak and closed comfortably above the 25,500 mark, indicating firm bullish control. The index is trading above major short-term moving averages, and momentum indicators suggest that dips may continue to attract buyers.

- Support Levels: 25,433 – 25,281 – 25,184

- Resistance Levels: 25,682 – 25,778 – 25,930

EquityPandit View: Nifty remains in a positive trend. Traders holding long positions should maintain a daily closing stoploss of 25,302. A close below this level could invite minor profit booking, while a move above 25,778 may open the door for a fresh breakout toward the 26,000 zone.

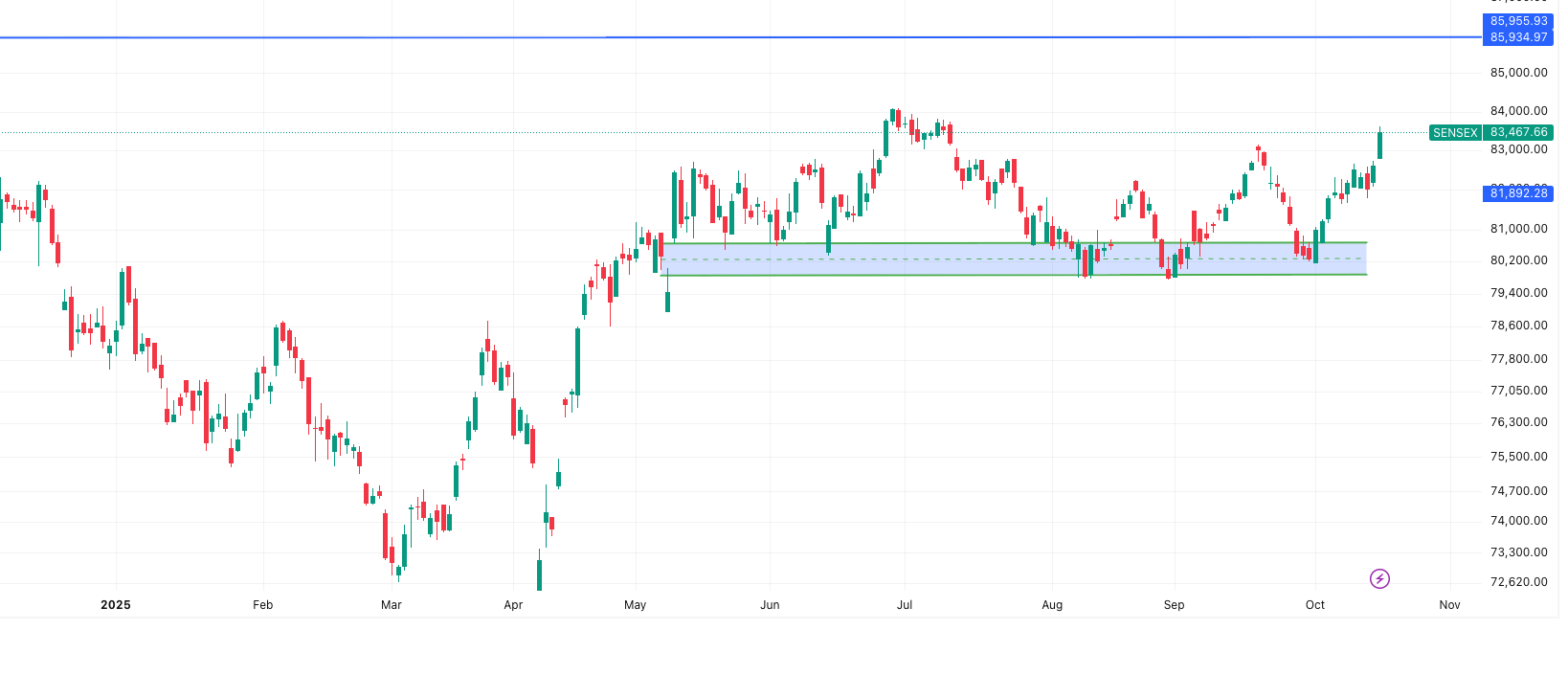

SENSEX Outlook 17 October

The Sensex continued its rally, driven by strength in financials and IT. The index reclaimed 83,000 decisively and closed near its day’s high — a sign of healthy market breadth.

- Support Levels: 82,968 – 82,467 – 82,143

- Resistance Levels: 83,792 – 84,116 – 84,616

EquityPandit View: The trend remains positive, and long positions can be held with a stoploss of 82,539. Sustained trade above 84,100 could push the index toward fresh record highs, while dips near 82,900 are likely to find strong buying support.

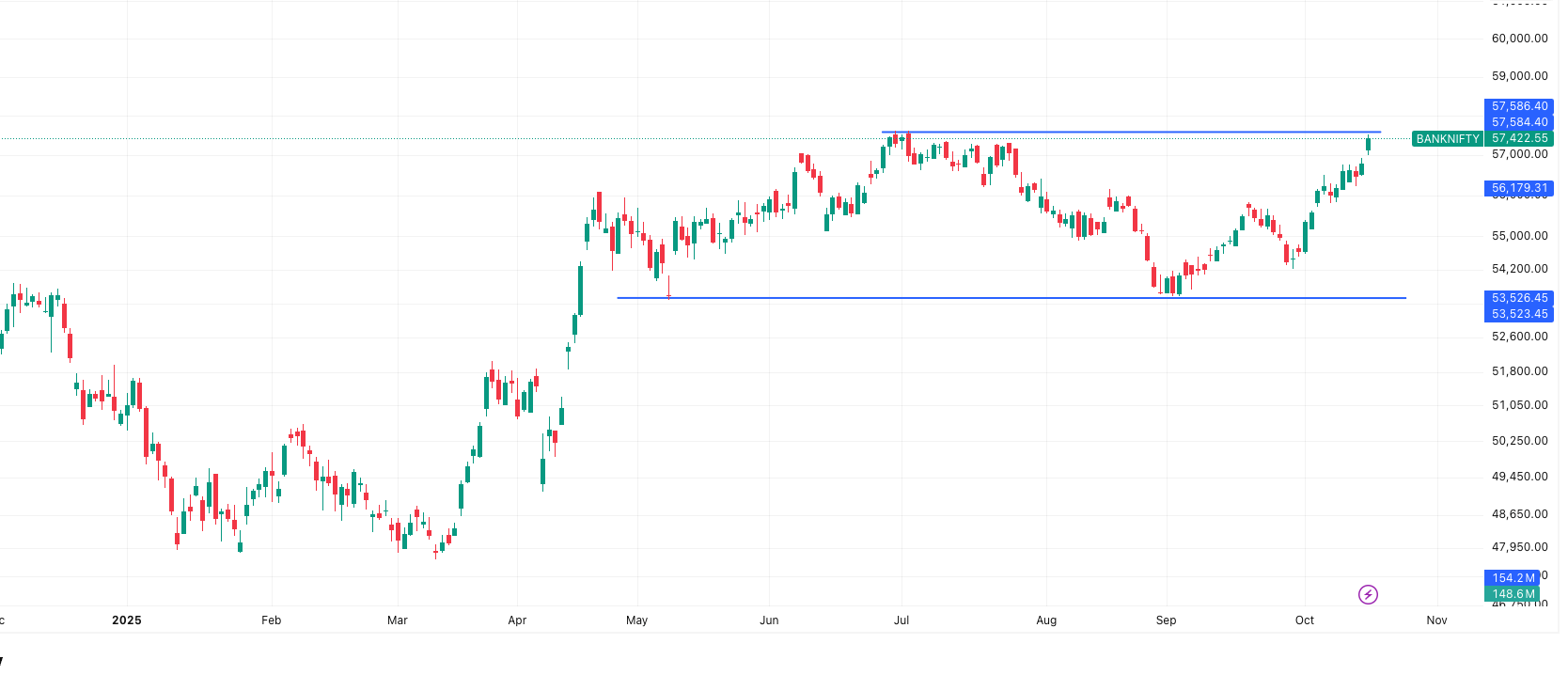

BANK NIFTY Outlook 17 October

Bank Nifty led Thursday’s rally as major private banks showed strong follow-up buying. The index crossed 57,000 with momentum and continues to form higher highs, confirming trend strength.

- Support Levels: 57,103 – 56,783 – 56,572

- Resistance Levels: 57,634 – 57,845 – 58,165

EquityPandit View: Bank Nifty is in a positive trend. Long positions should be protected with a stoploss of 56,751. A close above 57,845 could trigger a new leg of the rally toward 58,200 levels, while any dip near 56,800 should be seen as a buying opportunity.

💡 Summary:

In this Market Outlook 17 October, all major indices — Nifty, Sensex, and Bank Nifty — are showing continued bullish momentum with clear higher highs on the chart. While traders can stay optimistic, trailing stop losses are essential to protect profits as markets approach near-term resistance zones.

News & Stocks to Watch — Market Outlook 17 October

The Market Outlook 17 October edition brings you the most important developments that could influence market sentiment today — from corporate strategy shifts and regulatory crackdowns to macro moves impacting the rupee. Let’s break down the key news and the stocks to watch 👇

🍽️ Zomato stays single-app focused amid rivals’ multi-app push

Unlike competitors Swiggy and Rapido, Zomato’s parent Eternal Ltd. has announced it will not launch a separate app for budget-conscious customers. Instead, the company plans to integrate value-focused offerings within its main app. This approach aims to maintain operational efficiency while still catering to price-sensitive consumers.

Zomato recently reduced the minimum order value for free delivery for Gold members from ₹199 to ₹99 — a clear signal that it’s addressing the value-seeking segment internally.

📈 Stock to Watch: Zomato Ltd. — Focus will be on how this strategy impacts order volumes and user retention in the upcoming quarters.

💼 Graviton Research faces tax raids amid scrutiny on trading firms

India’s tax authorities have raided Graviton Research Capital LLP’s offices near New Delhi as part of a wider investigation into trading and tax compliance by high-frequency firms. Documents and data have been seized, though the company claims full compliance and denies any wrongdoing.

The raid follows recent regulatory pressure on trading entities like Jane Street Group and Nuvama Wealth, highlighting increased oversight on algorithmic and cross-border trading practices.

📈 Stocks to Watch:

- Nuvama Wealth Management — under continued observation given its past regulatory interactions.

- IIFL Securities, Angel One, and Motilal Oswal — may see sentiment swings as the brokerage and prop-trading space faces heightened scrutiny.

💸 Angel One hikes brokerage fees after years of flat pricing

Brokerage major Angel One will revise its brokerage charges effective November 17, marking the first fee hike in years. Delivery and intraday brokerage will now be the lower of ₹20 or 0.1% per trade, compared to the earlier 0.03% rate. The change aims to offset revenue pressure from lower retail activity and SEBI’s derivatives trading curbs.

The move underscores how retail brokers are adapting to regulatory and volume slowdowns after a record F&O participation phase during 2020–2023.

📈 Stocks to Watch:

- Angel One — focus on stock reaction to improved brokerage margins.

- Zerodha (unlisted), Groww (unlisted), and Upstox (unlisted) — may follow similar adjustments in pricing models.

💱 RBI intervention boosts rupee sentiment; traders flip bullish

The RBI’s aggressive intervention in the forex market has significantly lifted sentiment on the rupee. The 1-month USD/INR risk reversal has fallen to -0.8, the lowest in over a decade — indicating traders now pay a premium for rupee appreciation bets.

The rupee has gained over 1% in two days after touching near-record lows, reflecting confidence that the central bank will defend key levels near ₹90 per dollar.

📈 Stocks to Watch:

- IT majors (TCS, Infosys, Wipro) — could see mild pressure from a stronger rupee.

- Aviation and Import-heavy sectors (IndiGo, Voltas, Havells) — may benefit as a firmer rupee reduces import costs.

⚙️ Bharat Forge strengthens ties with Rolls-Royce

Pune-based Bharat Forge has expanded its partnership with Rolls-Royce to manufacture fan blades for Pearl 700 and Pearl 10X aircraft engines. This marks a key milestone in Bharat Forge’s aerospace ambitions and Rolls-Royce’s plan to double sourcing from India by 2030.

The collaboration began in 2020 and now positions Bharat Forge as the first Indian company offering advanced fan-blade technology for Rolls-Royce’s Pearl engine series.

📈 Stock to Watch: Bharat Forge Ltd. — expected to gain investor traction on export-led growth potential and deeper integration into Rolls-Royce’s global supply chain.

Nestlé’s Bold Restructuring Push Sends Stock Soaring

Swiss food giant Nestlé announced a massive restructuring plan that includes cutting 16,000 jobs worldwide over the next two years, aimed at accelerating transformation and efficiency. The move — representing around 6% of its global workforce — will save the company CHF 1 billion, doubling its previous cost-saving target.

The announcement came alongside a 1.9% dip in nine-month sales to CHF 65.9 billion, though organic growth stood at 3.3%, supported by strong momentum in coffee and confectionery segments. Shares jumped over 8% in Zurich trading, making Nestlé one of Europe’s top gainers of the day.

CEO Philipp Navratil emphasized the need to “move faster to accelerate growth momentum,” signaling a sharper focus on profitability and structural change.

📈 Stocks to Watch:

- Nestlé India Ltd (NESTLEIND) – The Indian arm could see sentiment spillover amid global restructuring and cost optimization efforts. Watch for volume reactions and any management commentary on local operations.

💡 In Summary:

In this Market Outlook 17 October, the spotlight will be on Zomato’s strategic stance, Angel One’s fee hike, and RBI’s intervention-driven rupee rally. Meanwhile, Bharat Forge could be the standout mover in the manufacturing space after its major global partnership announcement.

IPO Update — Market Outlook 17 October

In today’s Market Outlook 17 October, the IPO space remains active with one mainboard issue still open and multiple SME listings hitting the market. Here’s the latest update 👇

Mainboard IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP (Listing Gain) |

|---|---|---|---|---|

| Midwest IPO | 15-Oct | 17-Oct | 24-Oct | ₹175 (+16.43%) |

| Canara HSBC Life IPO | 10-Oct | 14-Oct | 17-Oct | ₹4 (+3.77%) ⚠️ Negative listing possible |

SME IPOs

| IPO Name | Listing Date | GMP (Listing Gain) |

|---|---|---|

| SK Minerals (BSE SME) | 17-Oct | No GMP |

| Sihora Industries (BSE SME) | 17-Oct | No GMP |

| Shlokka Dyes (BSE SME) | 17-Oct | No GMP |

The Midwest IPO continues to attract strong investor interest with robust subscription and a premium GMP, while Canara HSBC Life debuts today — watch for early market reaction. SME investors should keep an eye on SK Minerals, Sihora Industries, and Shlokka Dyes, all set to list today.

Stocks in Radar | Market Outlook 17 October

In this Market Outlook 17 October, our spotlight shines on Apeejay Surrendra Park Hotels (PARKHOTE IN) — a value play positioned for a strong growth revival in the hospitality sector. With its solid brand legacy, expanding footprint, and asset-light F&B model, the stock offers an attractive risk-reward setup ahead of FY25–28.

Apeejay Surrendra Park Hotels

Rating: BUY | CMP: ₹150 | Target Price: ₹238

Research Source: PL Capital

Investment Thesis

Apeejay Surrendra Park Hotels stands at the cusp of growth revival, driven by:

- Expansion of 258 owned & leased keys by FY28.

- Aggressive growth of Flurys, targeting 200 outlets by FY27.

- Expansion through management contracts with 2,198 keys under development.

- Robust balance sheet and healthy OCF generation — expected net debt/EBITDA at 0.5x in FY28E.

At just 14x/11.7x FY26E/FY27E EBITDA, valuations remain appealing. The company is poised for a 17%/22%/24% CAGR in revenue/EBITDA/PAT over FY25–28.

Business Overview

Founded in 1967, PARKHOTE IN operates 35 hotels with 2,394 keys across India. Its brands include:

- THE Park – flagship upscale hotels (8 properties, 1,221 keys)

- THE Park Collection – luxury boutique stays (5 properties, 114 keys)

- Zone by The Park – upper midscale (10 hotels, 539 keys)

- Zone Connect – modern affordable brand (12 hotels, 520 keys)

- Stop by Zone – economy motels (4 properties, 23 keys)

With 88+ F&B outlets, nightclubs, and bars, and a flourishing Flurys café chain, the group commands strong brand equity and diversified revenue streams.

Flurys – A Scalable, Asset-Light Model

- Blends café + confectionery concept for premium positioning.

- Operates 100 outlets (restaurants, cafés & kiosks) across India.

- Expected 41% revenue CAGR and 48% EBITDA CAGR over FY25–28.

- Focus on small-format expansion at airports and business hubs.

Expansion Plans

- Kolkata (EM Bypass): 250 rooms by Apr 2028 in JV with Ambuja Neotia Group.

- Pune: 200-key hotel by Apr 2027.

- Vizag: Brownfield expansion of 34 keys by Sep 2027.

- Navi Mumbai: Expansion from 80 to 250 keys by Mar 2029.

With a structured, asset-light development strategy, the company is set to enhance margins and return ratios while maintaining strong capital efficiency.

Outlook

Apeejay Surrendra Park Hotels offers a compelling blend of stability, expansion, and valuation comfort. Its balanced hospitality and F&B mix positions it as a multi-year compounding opportunity in the Indian hospitality space.

Verdict: BUY for medium-to-long term with TP ₹238

In this Market Outlook 17 October, Apeejay Surrendra Park Hotels emerges as a promising play on India’s rising travel, lifestyle, and premium F&B story — one to keep firmly on your radar before the opening bell.

Conclusion | Market Outlook 17 October

As we wrap up the Market Outlook 17 October, the setup for today’s session looks cautiously optimistic. With global cues showing mixed signals and domestic earnings providing stock-specific triggers, traders may witness a range-bound yet stock-driven market.

Key indices such as Nifty 50 and Sensex continue to hold above critical support levels, suggesting that volatility may persist but the broader uptrend remains intact. Sector rotation could dominate the action, particularly in banking, FMCG, and midcap themes.

Meanwhile, the IPO market stays active with Midwest IPO in focus and listings like Canara HSBC Life and SK Minerals likely to keep investor sentiment buzzing. On the stock front, Apeejay Surrendra Park Hotels shines as a value opportunity amid expanding hospitality and retail F&B prospects.

As always, it’s a day to stay selective — follow levels with discipline and keep an eye on fundamental triggers shaping the week ahead.

In this Market Outlook 17 October, we brought you — technical levels for key indices, major market-moving news, fresh IPO updates, and the top stock ideas to keep on your radar before the opening bell.

More Articles

When to Sell Mutual Funds: 5 Proven Exit Strategies

The Hidden Multibagger Stock: 5 Positive Triggers That Make Suven Life Sciences a Game-Changer

The Indian Retirement Savings Crisis: 5 Reasons EPF and PPF Won’t Be Enough