Market Outlook 17 July: Markets Consolidate After Tuesday’s Rally

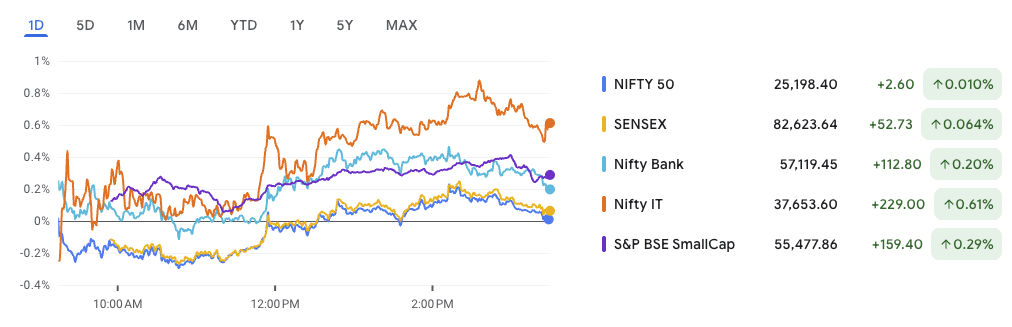

After Tuesday’s strong up move, the Indian stock market traded in a narrow range on Wednesday, showing signs of consolidation ahead of key earnings announcements and global cues. The Nifty 50 closed almost flat at 25,198.40 (up just 0.01%), while the Sensex inched up by 0.06% to finish at 82,623.64.

Meanwhile, broader market sentiment stayed relatively firm. The BSE SmallCap index advanced 0.29%, reflecting ongoing buying interest in select mid- and small-cap stocks. Sectorally, IT stocks led the gains, with the Nifty IT index rising 0.61%, followed by strength in banking and financial counters.

In today’s edition of the Market Outlook 17 July, we bring you:

- Nifty 50 technical trend and critical levels

- A high-potential small-cap stock of the day

- A breakout stock on the technical radar

- Market-moving news and impacted stocks

- Fresh IPO action with updated GMP and subscription data

Let’s break down what’s moving the market and where it could be headed next.

Nifty 50 Technical Setup – Market Outlook 17 July

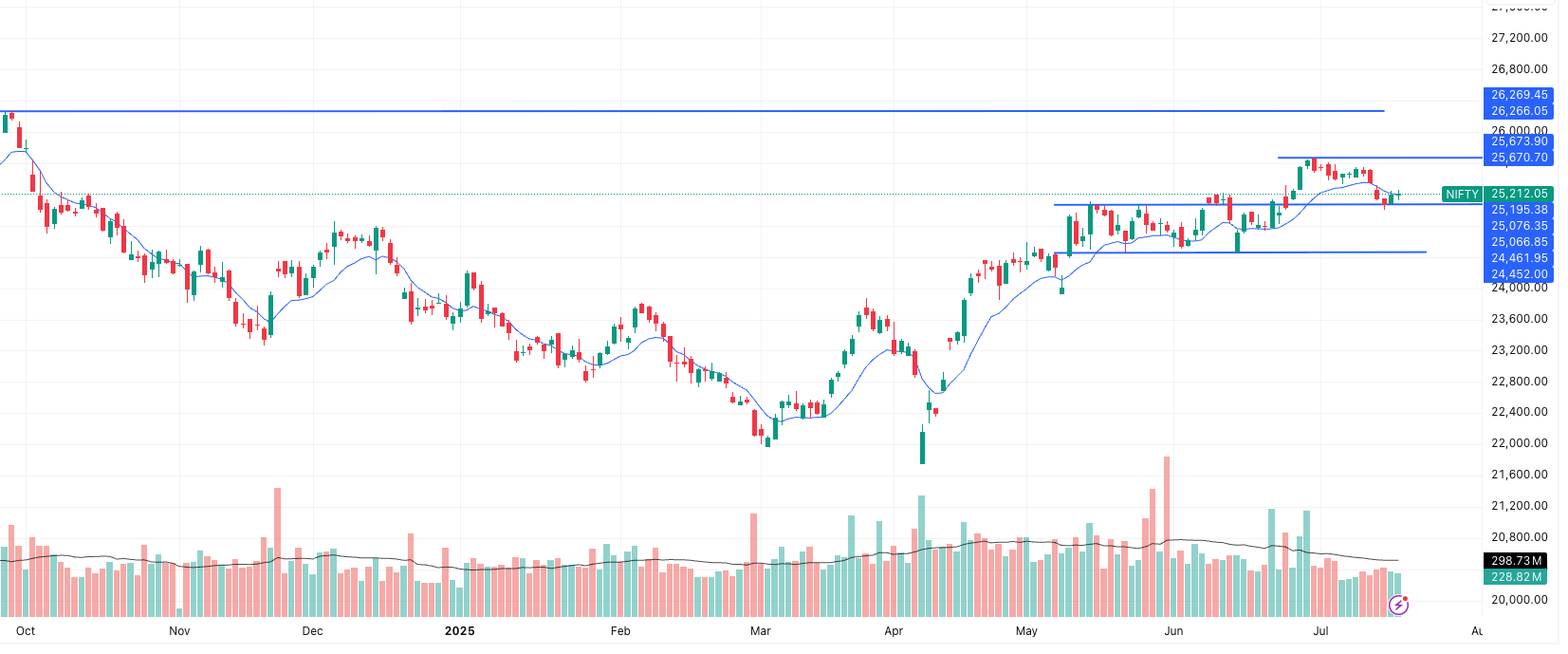

In the Market Outlook 17 July, the Nifty 50 continues to display a range-bound structure, reflecting indecision ahead of key earnings and global triggers. The index closed at ₹25,212.05, marginally up by 0.06%, and is currently hovering around its 9-day EMA (₹25,195.38). Volume remained below average at 228.82M, signaling a wait-and-watch stance by participants.

Chart Overview

- Index: Nifty 50 (Daily)

- Current Market Price: ₹25,212.05

- 9 EMA: ₹25,195.38

- Volume: Below average

Structure and Price Action – Consolidation in Play

The Nifty attempted a breakout above ₹25,670 in early July but failed to sustain, leading to a sideways phase. It now oscillates between:

- Resistance zone: ₹25,670–25,674

- Support zone: ₹25,066–25,076

This price structure suggests neutral momentum, with flattening EMAs and no clear trend.

| Observation | Implication |

|---|---|

| Failed breakout above ₹25,674 | Indicates weak bullish conviction |

| Holding above ₹25,066 | Buyers defending support |

| 9 EMA flattening | Momentum has neutralized |

| Low volume | Lack of aggressive participation |

Likely Scenarios Ahead

1. Bullish Breakout Case

- Trigger: Daily close above ₹25,674 with volume

- Targets: ₹26,266, then ₹26,500–₹26,700 (All-time high zone)

- Stop Loss: ₹25,070

- Confirmation: Green candle + Volume spike + RSI > 60

2. Bearish Breakdown Case

- Trigger: Daily close below ₹25,066

- Targets: ₹24,460, then ₹24,000

- Stop Loss: ₹25,220

- Confirmation: Red candle + High volume + EMA crossover

3. Neutral Consolidation (Base Case)

- Expected Range: ₹25,070 – ₹25,670

- Strategy: Ideal for range traders and option sellers

- Nifty likely to remain sideways unless a clear breakout/breakdown occurs

Summary of Key Levels

| Type | Level (₹) | Remarks |

|---|---|---|

| Immediate Resistance | 25,670–25,674 | Previous breakout rejection zone |

| Major Resistance | 26,266–26,270 | Previous swing high |

| Immediate Support | 25,066–25,076 | Bottom of the current range |

| Major Support | 24,450–24,460 | Key support from May-June rally |

Strategic Takeaways

For Swing Traders:

Avoid entering aggressive positions until there’s a confirmed move above ₹25,674 or below ₹25,066.

Positional Playbook:

| Setup | Entry Zone | Stop Loss | Targets |

|---|---|---|---|

| Bullish Breakout | Above ₹25,700 | ₹25,070 | ₹26,266 / ₹26,500 |

| Bearish Breakdown | Below ₹25,060 | ₹25,220 | ₹24,460 / ₹24,000 |

For Option Sellers (Neutral View):

A short strangle (Sell ₹25,000 PE + ₹25,700 CE) can be considered with defined risk management.

Final Take – Market Outlook 17 July

The Nifty 50 remains stuck within a narrow consolidation zone. A breakout above ₹25,674 or breakdown below ₹25,066 will be the key trigger for the next directional trend. Until then, traders are better off using range-based strategies or stock-specific setups like Swan Energy, which already confirmed a breakout.

News and Stock Impact – Market Outlook 17 July

1. WHO Policy Shift Faces CAPHRA Criticism — India’s Tobacco Sector at Risk

The Coalition of Asia Pacific Tobacco Harm Reduction Advocates (CAPHRA) has raised red flags over the World Health Organization’s (WHO) pivot away from tobacco harm reduction. The group claims the shift ignores decades of scientific consensus and poses economic and public health risks, especially for countries like India where over 200 million people use smokeless tobacco or bidis.

Stock & Sectoral Impact:

- Tobacco & FMCG Stocks: This could cloud policy clarity for listed companies like ITC and VST Industries, potentially delaying investments in safer nicotine alternatives.

- Rural MSME Supply Chains: Stocks linked to informal retail or rural microenterprise exposure may face medium-term concerns if the policy triggers regulatory uncertainty.

NPCI Boosts UPI-PayNow Linkage — 13 Banks Added

NPCI International announced the expansion of its UPI-PayNow real-time remittance corridor between India and Singapore, onboarding 13 new Indian banks. Starting July 17, users will benefit from a wider network for seamless cross-border transactions.

Stock & Sectoral Impact:

- Beneficiaries: HDFC Bank, ICICI Bank, Canara Bank, Karur Vysya Bank and SBI may see increased transaction volumes and NRI engagement.

- Fintech Ecosystem: Positive for UPI-enabled apps (PhonePe, Google Pay) and API aggregators.

- Sentiment Boost: Reinforces India’s leadership in real-time payments infrastructure.

3. NTPC Green Energy Push – Cabinet Approves ₹20,000 Cr Investment

The Union Cabinet has cleared NTPC’s investment of up to ₹20,000 crore in renewable energy. The company aims to ramp up its green capacity from 6 GW to 60 GW by 2032, cementing its role in India’s energy transition.

Stock & Sectoral Impact:

- NTPC Ltd: Strategically positive — stock may get re-rated as the green portfolio scales.

- Renewable Energy Sector: Sentiment uplift for players like SJVN, IREDA, and Borosil Renewables.

- PSU Reforms: Reinforces government commitment to green infrastructure and PLI-driven capex cycles.

4. Everest Kanto (EKC) Exits Hungary JV Amid Geopolitical Risk

Everest Kanto Cylinder Ltd has announced a complete exit from its Hungary-based JV, citing operational delays and geopolitical instability. The 80% stake sale fetches €96,000 and will allow the company to refocus on higher-return geographies like Egypt and India.

Stock Impact:

- Everest Kanto (EKC): Neutral-to-positive; the divestment removes loss-making exposure and aligns with its capital reallocation strategy.

- Strategic Pivot: Market may view this as a cleaner balance sheet move and focus more on EKC’s Indian and Egyptian operations.

5. Godavari Biorefineries Secures China Patent for Cancer Drug

Godavari Biorefineries has received a key cancer treatment patent from the China National Intellectual Property Administration (CNIPA). The compound targets breast and prostate cancer stem cells and marks a major step into oncology R&D.

Stock Impact:

- Godavari Biorefineries Ltd: Shares rose 5% intraday. The patent boosts its IP portfolio and could unlock future monetization via licensing or global pharma collaborations.

- Sector Outlook: Positive read-through for mid-cap specialty chemical and pharma R&D firms focused on high-margin innovation.

6. Riyaasat Lifestyle Files DRHP — SME IPO Ahead

Ahmedabad-based ethnic wear brand Riyaasat Lifestyle has filed its Draft Red Herring Prospectus for a 100% book-built IPO on the BSE SME platform. With ₹1247 lakh allocated for metro showroom expansion and ₹950 lakh for working capital, the brand is focused on pan-India scaling.

SME Sector Impact:

- Apparel Retail SMEs: Positive sentiment for peers like Goyal Fashion or Globe Textiles post-listing.

- IPO Watch: Retail investors may show strong interest due to rising apparel consumption and attractive growth metrics (FY24 net profit up 50x over FY22).

Summary – Market Outlook 17 July News Takeaways:

| News | Key Sector Impact |

|---|---|

| WHO vs CAPHRA | FMCG, Tobacco, Rural Retail |

| UPI-PayNow Expansion | Banking, Fintech, Payments |

| NTPC Green Capex | Energy, Renewables, PSUs |

| EKC Hungary Exit | Industrial Manufacturing |

| Godavari Biorefineries Patent | Pharma, Chemicals, R&D |

| Riyaasat IPO Filing | SME, Apparel Retail |

This collection of policy shifts, strategic exits, and sectoral tailwinds forms the foundation of market momentum in the days ahead. With the Market Outlook 17 July, investors should keep an eye on regulatory narratives, green energy catalysts, and SME listing buzz that could influence both benchmarks and broader participation.

Stock on Technical Screener – Market Outlook 17 July

Kellton Tech Solutions Ltd: Bullish Breakout from Long Base

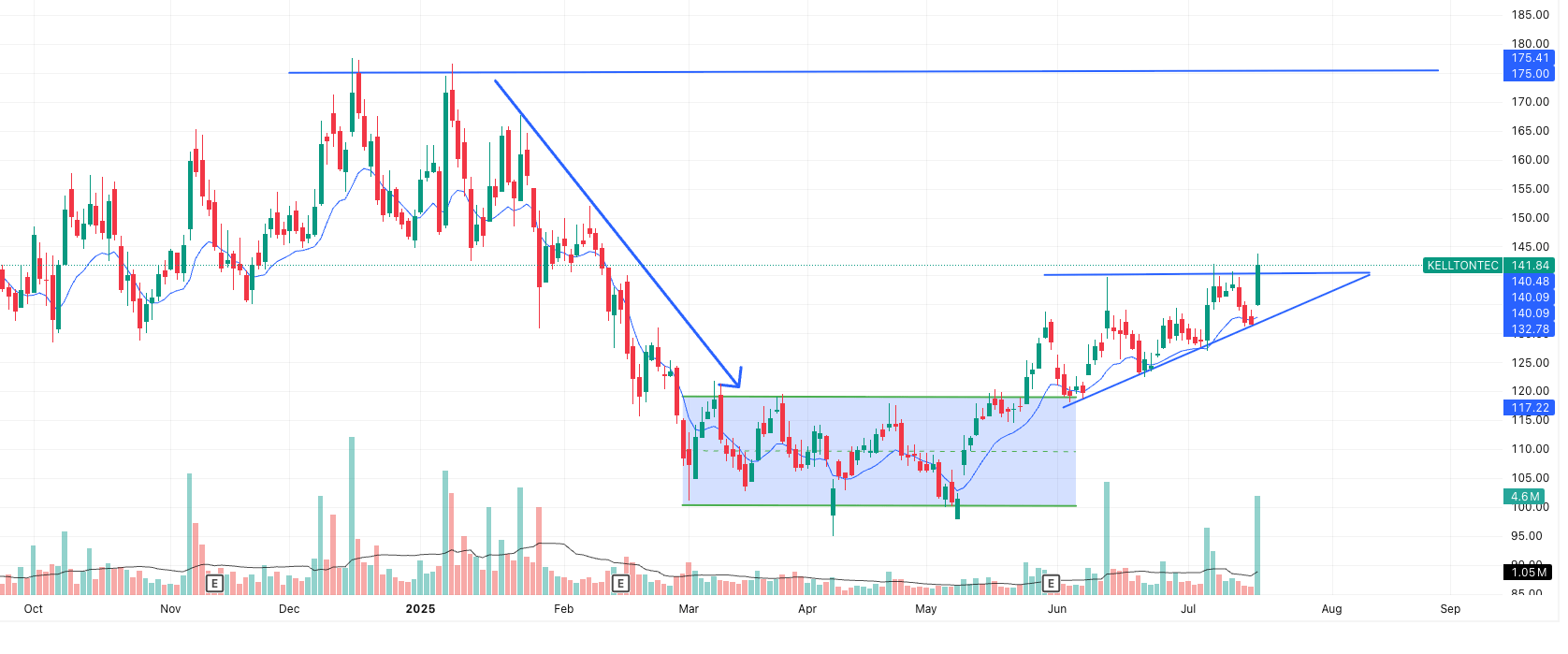

In the context of Market Outlook 17 July, Kellton Tech Solutions Ltd has emerged as a technical standout, triggering a textbook breakout from an ascending triangle pattern—often seen at the start of strong bullish phases.

Structure Analysis

1. Previous Trend: Steep Decline

The stock witnessed a significant correction from ~₹175 to ₹100 between December 2024 and March 2025. This downtrend reflected sustained bearish sentiment and profit-booking across midcaps.

2. Base Formation (March–June 2025):

From March to early June, Kellton Tech Solutions Ltd entered a prolonged rectangle consolidation phase between ₹100 and ₹117. This base-building process indicated possible accumulation by long-term investors, though volumes stayed muted during this time.

3. Breakout Confirmation: Ascending Triangle

- Formation: Rising support line (higher lows) from ₹117 to ₹140, with flat resistance at ₹141–₹143

- Today’s Action:

- The price closed decisively above ₹143

- Large bullish candle on high volume

- Clean breakout confirms the ascending triangle—one of the most reliable bullish patterns

Why It Matters

The breakout pattern in Kellton Tech Solutions Ltd shows:

- Buyers are getting aggressive at higher levels

- A strong base has been formed after months of consolidation

- This move suggests increased confidence, likely driven by fresh demand and possible accumulation by institutions

Trade Setup – Short-Term (5–10 Days)

| Parameter | Value |

|---|---|

| Entry Range | ₹141–143 |

| Target 1 | ₹152 |

| Target 2 | ₹160–165 |

| Stop Loss | ₹132.50 |

| Risk:Reward | Approx. 1:2 or better |

Swing Trade Setup (2–4 Weeks)

If broader sentiment remains stable and volume sustains:

| Parameter | Value |

|---|---|

| Swing Target 1 | ₹175 |

| Swing Target 2 | ₹185–₹190 |

| Trailing Stop | Below recent swing lows |

Volume Analysis

- Breakout volume today: 4.6 million shares

- 20-day average volume: 1.05 million

- Volume spike of over 4x clearly confirms buyer conviction and rules out a fake breakout scenario

Invalidation Signal

The bullish setup will invalidate below ₹132 (on closing basis).

A close below ₹117 would signal weakness and may reverse the trend—traders should exit if this level breaks.

Final Take – Market Outlook 17 July

Kellton Tech Solutions Ltd has triggered a high-conviction breakout after months of accumulation. With major indices like Nifty in consolidation mode, such stock-specific moves offer better opportunities. The ascending triangle breakout, backed by strong volume, suggests a shift in trend and offers a clear long trade with well-defined risk.

Traders can consider entering above ₹143 with targets of ₹152 and ₹165 in the short term, and ₹175+ in the coming weeks if momentum continues.

IPO Updates – Market Outlook 17 July

As the broader market consolidates, the primary market remains vibrant, with strong investor interest across both mainboard and SME IPOs. Here’s a snapshot of the latest GMP trends, subscription status, and key listings to track in the Market Outlook 17 July:

Active & Upcoming IPOs – Key Highlights

| IPO Name | GMP | Subscription (Sub) | Issue Price | Lot Size | IPO Size | Status |

|---|---|---|---|---|---|---|

| Spunweb Nonwoven (SME) | ₹34 (+35.4%) | 249.68x | ₹96 | 1200 | ₹57.89 Cr | Closed (Listing on Jul 21) |

| Anthem Biosciences (Mainboard) | ₹160 (+28.1%) | 67.27x | ₹570 | 26 shares | ₹3395 Cr | Closed (Listing on Jul 21) |

| Smartworks Coworking (Mainboard) | ₹25 (+6.1%) | 13.92x | ₹407 | 36 shares | ₹582.56 Cr | Closed (Listing on Jul 17) |

| Monika Alcobev (SME) | ₹0 (Flat) | 1.32x | ₹286 | 400 | ₹153.68 Cr | Ongoing (Closes Jul 18) |

| Swastika Castal (SME) | ₹– | 65 bids | ₹– | 2000 | ₹13.35 Cr | Opens Jul 21 |

| Savy Infra (SME) | ₹– | 120 bids | ₹120 | 1200 | ₹66.47 Cr | Opens Jul 21 |

| PropShare Titania (Mainboard) | ₹– | — | ₹TBD | 1 | ₹473 Cr | Opens Jul 21 |

| NSDL IPO | ₹– | — | TBD | — | 5.01 Cr Shares | Awaiting Details |

Key Momentum Picks

- Spunweb Nonwoven: A massive 249x oversubscription, backed by a GMP of ₹34, signals extremely high investor confidence. Listing pop expected.

- Anthem Biosciences: Backed by robust fundamentals and strong GMP, its 67x subscription sets the stage for a solid debut in the chemical and biotech segment.

- Smartworks Coworking: With moderate GMP and 13.92x subscription, the flex-space player eyes steady listing gains amid bullish real estate sentiment.

What to Watch This Week

- Monika Alcobev IPO closes on July 18 – Watch for final day subscription surge.

- Smartworks lists on July 17 – Could test investor appetite in new-age workspace businesses.

- Swastika Castal & Savy Infra open July 21 – Both SME plays from industrial and infra sectors with modest sizes but retail interest building.

Analyst View – Market Outlook 17 July

The IPO market is defying broader index consolidation, riding on strong SME interest and marquee names like Anthem. With listings lined up over the next few sessions, GMPs remain a key barometer of sentiment, especially in high-demand issues like Spunweb.

For investors, short-term momentum trades in recent IPOs may outperform Nifty’s current range-bound movement — but selective entry based on fundamentals and demand metrics is essential.

Smallcap of the Day – Market Outlook 17 July

Sportking India Ltd – Textile Underdog Regaining Strength

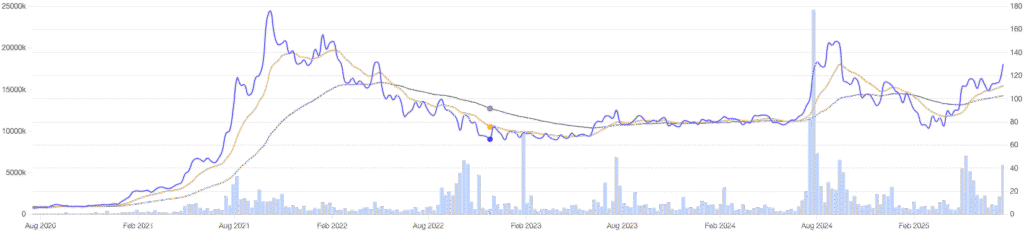

As part of today’s Market Outlook 17 July, Sportking India Ltd emerged as a strong gainer, rising 5.75% in a subdued market. While many large-cap names remained flat, this smallcap textile player attracted renewed interest—thanks to its healthy fundamentals and a recent price bounce from support.

Company Overview

Sportking India Ltd, a member of the Sportking Group, operates in the textile manufacturing sector. It specializes in the production of yarns, fabrics, and garments. Notably, it has a wide reach across both domestic and export markets.

Product Portfolio

The company offers an extensive range of yarns and fabrics. Specifically:

- Cotton Yarns: Compact, Eli-twist, slub variants

- Blended Yarns: Polyester/Cotton, melange

- Dyed Yarns: 100% cotton and PC blends

- Acrylic Blends: Bulk and non-bulk types

- Fancy Yarns: Including Jaspe, snow yarn, and injection slub

This variety allows Sportking to cater to a broad base of end-users, from knitwear manufacturers to large-scale exporters.

Key Financial Metrics

| Metric | Value |

|---|---|

| Market Cap | ₹1,654 Cr |

| CMP | ₹130 |

| 52-Week Range | ₹69.9 – ₹160 |

| Stock P/E | 15.2 (vs Industry PE: 27.1) |

| Book Value | ₹79.2 |

| ROCE / ROE | 11.9% / 11.9% |

| Profit After Tax | ₹109 Cr |

| Sales (FY24) | ₹2,524 Cr |

| Debt-to-Equity | 0.58 |

| Dividend Yield | 0.38% |

| Intrinsic Value | ₹135 |

While earnings growth has slowed over the past three years, Sportking maintains profitability and efficient capital usage. Moreover, the company has zero pledged shares, indicating strong promoter confidence.

Why It’s In Focus Today

Firstly, the stock rebounded nearly 30% from its 52-week low, signaling a possible trend reversal. Secondly, today’s 5.75% surge came with healthy volumes, suggesting broader market participation. In addition, its valuation remains attractive—trading below intrinsic value with a P/E of 15.2, far below the industry average of 27.1.

Furthermore, with textile demand gradually improving, value investors may see this as a re-rating opportunity. Lastly, its balance sheet remains healthy despite limited cash reserves, supported by a strong inventory turnover of 3.55×.

Final Take – Market Outlook 17 July

To sum up, Sportking India Ltd is showcasing renewed price action and investor interest at a time when broader indices are in consolidation. Although it remains a niche player in a cyclical industry, its combination of attractive valuation, low debt, and steady profitability makes it one to watch.

If buying momentum continues, the next price targets are ₹135–₹140, followed by resistance near ₹150. In contrast, any drop below ₹120 would need close monitoring.

Conclusion – Market Outlook 17 July

The Indian stock market paused its recent rally on July 17, trading within a narrow range as investors awaited fresh earnings cues and global developments. While Nifty 50 held above key support near 25,070, the absence of strong volumes and directional triggers reflected cautious sentiment.

On the sectoral front, IT and banking provided modest support, whereas broader indices like SmallCap and MidCap outperformed, hinting at selective bullish undertones beneath the surface.

Technically, the Nifty remains range-bound between 25,070 and 25,674, and only a breakout or breakdown from this zone will dictate the next leg of the move. Until then, traders may prefer stock-specific setups such as Kellton Tech and Sportking India, which continue to show breakout potential backed by volume.

As we step into the latter half of the earnings season and monitor global economic cues, expect markets to remain volatile yet opportunistic. Stick to disciplined risk management and watch for decisive moves beyond current consolidation levels

More Articles

Why Chennai’s Property Market Is Surging — and 5 Stocks to Ride the Boom

New SME IPO Rules 2025: Big Changes Investors Need to Know

Best Ad Tech Stock: India’s Emerging Digital Goldmine for Investors