Market Outlook 16 October: Bulls Regain Control After Two-Day Slump

Good morning and welcome to your Market Outlook 16 October Edition — your pre-market dose of trends, analysis, and insights before the trading bell rings.

After two straight sessions of weakness, Dalal Street roared back to life on Wednesday, as both benchmarks — Nifty 50 and Sensex — surged nearly 0.75% each. The rebound came amid strong global cues, bargain buying in large caps, and renewed optimism in the banking and IT space.

- Nifty 50 climbed 185 points to close at 25,330.60, reclaiming the 25,300 mark.

- Sensex advanced 598 points, settling at 82,628.30, driven by HDFC Bank, Infosys, and Reliance.

- Bank Nifty added 328 points to finish at 56,824.50, supported by gains in ICICI Bank and Axis Bank.

- The Nifty IT index rose 0.53%, as tech counters saw selective buying after recent weakness.

- Broader markets outperformed slightly, with the BSE SmallCap index up 0.8%, showing resilience among mid and small-cap investors.

However, GIFT Nifty early trades hint at a slightly muted start today, tracking mixed Asian markets amid rising US yields and ongoing uncertainty around US-China trade tensions.

In this Market Outlook 16 October, we bring you — technical levels for key indices, major market-moving news, fresh IPO updates, and the top stock ideas to keep on your radar before the opening bell.

Index Outlook — Market Outlook 16 October

According to EquityPandit analysis, Indian indices maintained a positive technical outlook on Wednesday as bulls regained control after two days of weakness. Momentum indicators suggest that the market may continue its upward move, though key resistance zones could trigger short-term consolidation. Let’s break down the index-specific levels for today’s Market Outlook 16 October.

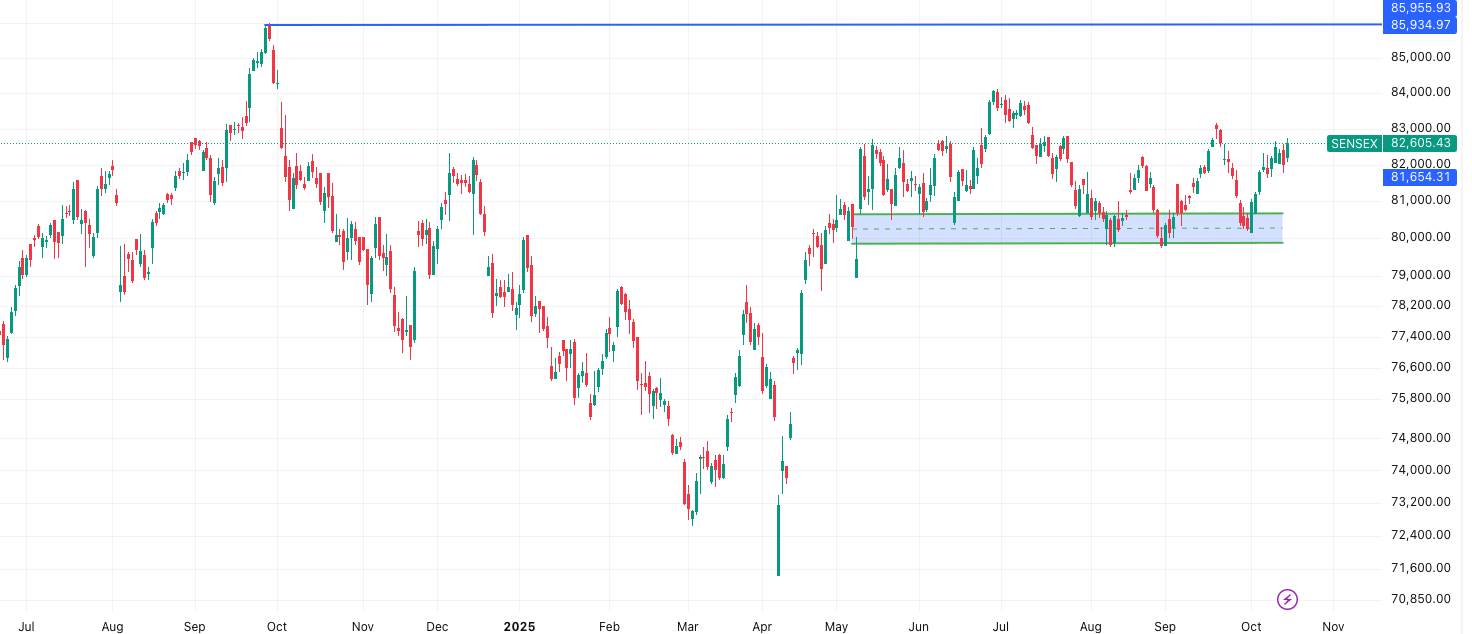

SENSEX Technical View

As per EquityPandit, the SENSEX (82,605) is currently trading in a positive trend. Traders holding long positions can continue to hold with a daily closing stop-loss at 81,784. The index is expected to face resistance near 83,000+ levels, where profit booking could emerge.

Key Levels :

- Support:

- 82,218

- 81,830

- 81,575

- Resistance:

- 82,860

- 83,115

- 83,503

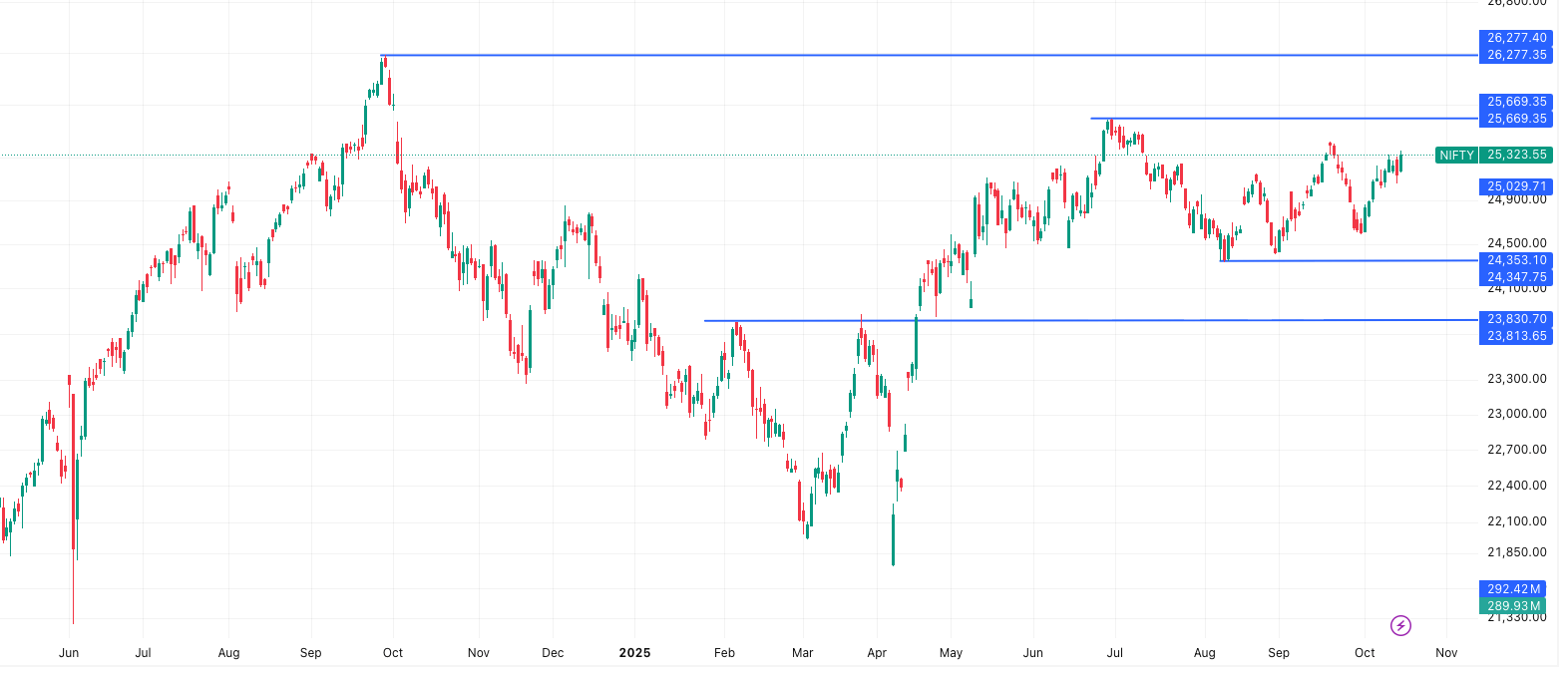

NIFTY 50 Technical View

The NIFTY 50 (25,324) continues to show strength and is in a positive phase, according to EquityPandit. Long positions can be held with a stop-loss below 25,076. A sustained breakout above 25,488 could lead to further upside toward 25,600 or higher levels.

Key Levels :

- Support:

- 25,200

- 25,077

- 24,994

- Resistance:

- 25,406

- 25,488

- 25,612

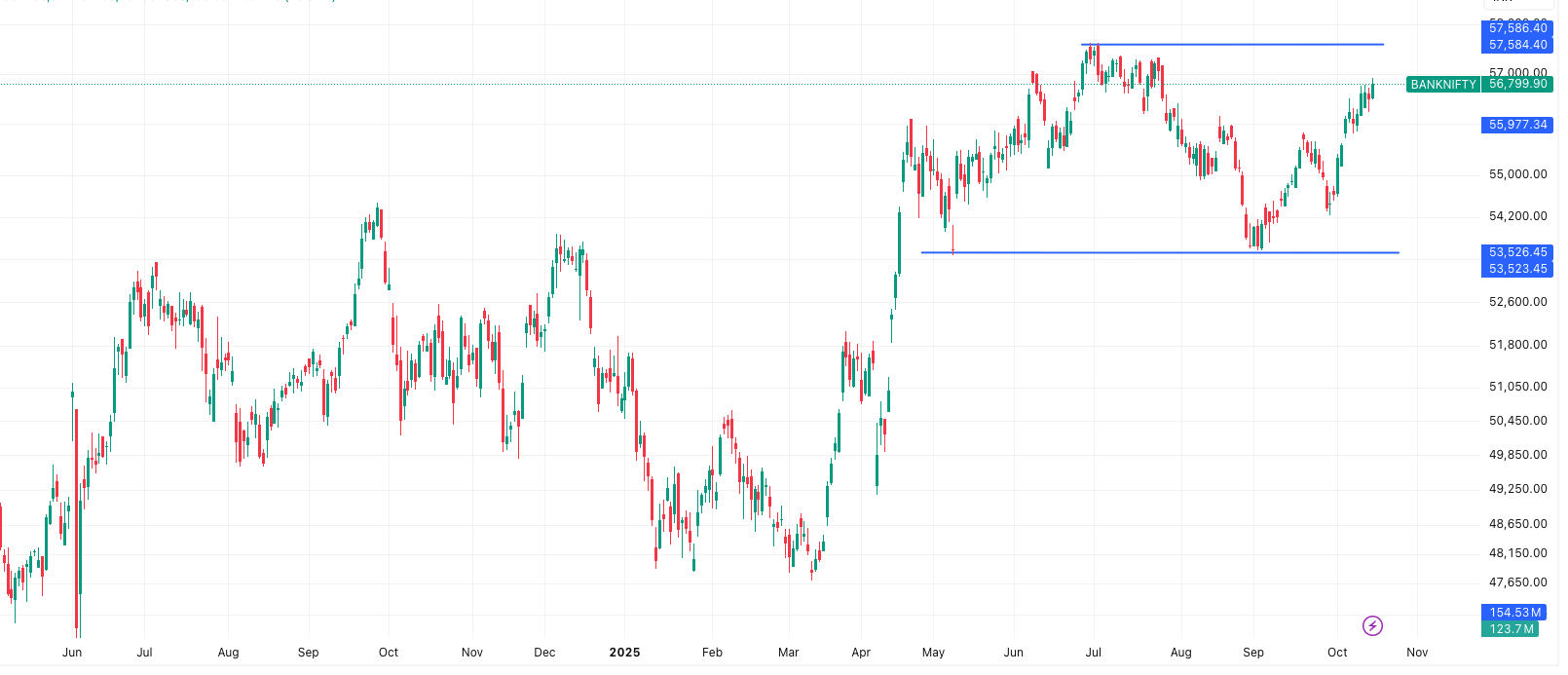

BANK NIFTY Technical View

The BANK NIFTY (56,800) is also maintaining a bullish bias as per EquityPandit analysis. Traders can hold longs with a stop-loss below 56,225. However, resistance around 57,100–57,400 could act as a near-term hurdle where some volatility may be seen.

Key Levels :

- Support:

- 56,554

- 56,307

- 56,123

- Resistance:

- 56,984

- 57,169

- 57,415

Overall, EquityPandit’s Market Outlook 16 October suggests that the broader market sentiment remains bullish, supported by strong technical structures across major indices. However, traders should stay alert near resistance levels and trail stop-losses to protect profits.

News & Stocks — Market Outlook 16 October

As part of today’s Market Outlook 16 October, here’s a quick round-up of the most impactful developments across corporate, macroeconomic, and market fronts — from Raymond’s big bets in Andhra Pradesh to RBI’s rupee defense and sectoral tailwinds in autos and renewables.

Raymond Group’s ₹940 Cr Investment Boost for Andhra Pradesh

The Andhra Pradesh government has cleared two major investments from Raymond Group, worth ₹940 crore, under its Industrial Development Policy 4.0 (2024–29).

- ₹510 crore will go into an aerospace manufacturing facility by JK Maini Global Aerospace Ltd., creating 1,400 jobs.

- ₹430 crore will fund JK Maini Precision Technology Ltd., an automotive component unit, adding 4,096 jobs.

Both plants are scheduled to begin operations by May 2027, marking Raymond’s entry into advanced manufacturing and boosting regional employment.

Fossil Group Eyes Indian IPO Worth $300–400 Million

Fossil Group Inc., the US-based luxury watchmaker, is reportedly planning to list its Indian arm — Fossil India Pvt. — in an IPO that could raise $300–400 million. The proposed listing would join a wave of multinational firms tapping India’s growing equity markets, following Hyundai, LG Electronics, and Tenneco.

📈 Fossil India reported FY24 revenue of ₹868 crore and a net profit of ₹70.4 crore.

RBI Fights Speculative Attacks on Rupee

The Reserve Bank of India has ramped up dollar sales in both onshore and offshore markets after spotting speculative attacks pushing the rupee near ₹89 per dollar.

- The RBI aims to defend the 88.80 level, calling recent depreciation speculation-driven, not fundamental.

- The rupee rebounded sharply by 0.8% to 88.07, its best gain in nearly four months, following the intervention.

With $700 billion in forex reserves, the RBI remains well-positioned to counter volatility and maintain currency stability.

Trade Deficit Widens to 13-Month High

India’s merchandise trade deficit jumped to $32.15 billion in September, from $26.5 billion in August, the highest in 13 months.

- Exports: Up 6.7% YoY to $36.38 billion

- Imports: Up 16.6% YoY to $68.53 billion

- Surge driven by gold, electronics, and fertiliser imports, with festive demand playing a key role.

Officials said cumulative gold imports remain below last year’s levels despite the recent spike.

India May Expand Oil Purchases from the US

During trade talks with Washington, Commerce Secretary Rajesh Agrawal said India is open to buying more US crude oil, if offered at the “right price.”

- India has previously imported $22–23 billion worth of US energy products.

- There’s still room to expand imports by $12–13 billion, aiding energy diversification amid trade negotiations.

Auto Industry Accelerates Ahead of Festive Season

According to SIAM, India’s auto industry saw strong wholesale growth in September:

- Two-wheeler sales: +6.7% YoY (21.6 lakh units)

- Passenger vehicles: +4.4% YoY (3.72 lakh units)

- Three-wheelers: +5.5% YoY (84,000 units)

SIAM President Shailesh Chandra attributed the surge to GST rate cuts, festive demand, and a boost in consumer sentiment. The festive momentum is expected to continue through October.

Adani Green Commissions 50 MW Solar Project at Khavda

Adani Green Energy’s step-down subsidiary, Adani Green Energy Twenty Six A Ltd., has operationalised a 50 MW solar project at Khavda, Gujarat, increasing its total operational capacity to 16,729.8 MW.

This milestone brings India closer to its 500 GW non-fossil energy target by 2030, reinforcing Adani’s leadership in renewable expansion.

Active Stockbroking Clients Fall 1.9% in September

India’s active investor count declined by 1.92% MoM to 45.31 million in September, according to NSE data.

- Groww led with 11.9 million clients (26.26% market share), followed by Zerodha (7.08M) and Angel One (6.89M).

- Traditional brokers like ICICIDirect, HDFC Securities, and Kotak saw marginal declines.

- Smaller platforms like Mirae Asset and Paytm Money bucked the trend, showing positive MoM growth.

Analysts attribute the dip to profit booking and seasonal participation slowdown, not structural weakness.

In summary, today’s Market Outlook 16 October highlights a blend of corporate expansion, macro resilience, and policy support — signaling a strong setup for the market ahead of the festive season.

IPO Update — Market Outlook 16 October

The IPO market remains active with strong subscription momentum and healthy grey market premiums across select mainboard issues. Let’s take a look at the latest updates from both Mainboard and SME IPOs 👇

Mainboard IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP (Est. Listing Gain) |

|---|---|---|---|---|

| Midwest IPO | 15 Oct | 17 Oct | 24 Oct | ₹175 (16.43%) |

| Canara HSBC Life IPO | 10 Oct | 14 Oct | 17 Oct | ₹– (0.00%) |

| Canara Robeco IPO | 9 Oct | 13 Oct | 16 Oct | ₹15 (5.64%) |

| Rubicon Research IPO | 9 Oct | 13 Oct | 16 Oct | ₹155 (31.96%) |

🟢 Listing Today: Canara Robeco & Rubicon Research — both expected to list with moderate-to-strong gains.

SME IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP (Est. Listing Gain) |

|---|---|---|---|---|

| No active SME IPOs | — | — | — | — |

💬 The grey market remains upbeat, especially for Rubicon Research IPO, showing one of the strongest premiums this month. Watch out for listing performance today as the sentiment could set the tone for ongoing issues like Midwest IPO.

Stocks in Radar — Market Outlook 16 October

Thyrocare Technologies Ltd. (CMP ₹1,265 | Target ₹1,560 | Upside 23%)

Research Source: ICICI Securities Ltd.

Thyrocare Technologies has delivered a strong Q2FY26 performance — beating revenue, EBITDA, and PAT estimates by ~1%, 14%, and 26% respectively. Both the pathology and partnership segments are driving growth, with volumes up significantly. Operating leverage and sourcing efficiency have helped expand EBITDA margins to 33%, the highest since the Covid boom.

Business Overview

- Core pathology segment grew 24.5% YoY to ₹2.0 bn, while the franchise model continues rapid expansion.

- ‘Jaanch’ wellness packages saw a 31% YoY rise; Aarogyam grew 19%.

- Radiology segment showed early signs of turnaround with margin expansion of 760 bps QoQ.

- Overseas growth also promising — Tanzania business up 30% YoY in Q2FY26.

Financials Snapshot

| Metrics | FY25A | FY26E | FY27E | FY28E |

|---|---|---|---|---|

| Revenue (₹ mn) | 6,874 | 8,361 | 9,706 | 11,270 |

| EBITDA Margin (%) | 27.7 | 31.1 | 32.2 | 33.3 |

| EPS (₹) | 17.3 | 32.4 | 39.6 | 48.2 |

| RoE (%) | 17.0 | 31.1 | 37.2 | 44.1 |

Growth Drivers

- Expansion of 100–150 new franchisees per month.

- Lower GST rates on diagnostic tests to boost demand.

- Integration of Vimta, Polo, and Think Health expanding presence across India.

- Rising insurance-linked diagnostics and GLP-1 test demand expected to sustain volume growth.

Outlook

Thyrocare is positioned for ~41% earnings CAGR (FY25–FY28) led by strong margin expansion, operational leverage, and a growing partnership ecosystem. Analysts maintain a BUY with a revised target price of ₹1,560, up from ₹1,460.

⚠️ Key Risk: Entire promoter stake is pledged; rising competition in imaging could impact pricing.

Thyrocare’s margin expansion, aggressive franchisee growth, and diversified presence make it one of the most promising healthcare plays in the diagnostic space — a stock to watch closely this week under the Market Outlook 16 October.

Conclusion — Market Outlook 16 October

After a strong rebound on Wednesday, Dalal Street is showing renewed optimism, with NIFTY and SENSEX both reclaiming key levels. The equity market trend remains positive, supported by healthy sectoral performances in banking, IT, and small caps, as well as upbeat corporate earnings.

Investor focus this week will be on ongoing IPO listings, including Canara Robeco and Rubicon Research, along with strong earnings from companies like Elecon Engineering and Thyrocare Technologies, which are driving momentum in their respective sectors.

Macro developments — including RBI interventions to stabilize the rupee, trade negotiations with the US, and robust auto and renewable energy sectors — are likely to influence sentiment. Meanwhile, the market technicals suggest key support and resistance levels to watch for NIFTY, SENSEX, and BANKNIFTY, helping traders manage risk.

Overall, the market outlook is positive but cautious, with opportunities emerging in quality stocks, ongoing IPOs, and sectors benefiting from policy tailwinds. Investors are advised to track earnings updates, follow technical levels, and stay alert for news-driven volatility.

Key Takeaway: Maintain focus on strong performers, IPOs with healthy GMPs, and stocks in radar like Elecon Engineering and Thyrocare Technologies, while monitoring broader market cues under the Market Outlook 16 October.

Related Articles

Pharma Tariff Effect – 100% Tariff Creates Big Risks & Hidden Opportunities

NITI Ayog AI Report: 7 Breakthrough AI Stocks Investors Can’t Ignore in 2025