Introduction- Market Outlook 10 September

Good morning and welcome to your Market Outlook 10 September edition.

The markets started the week on a stronger note with broad-based buying. The NIFTY 50 climbed 102 points (0.41%) to close at 24,875.45, while the SENSEX surged 330 points (0.41%) to settle at 81,117.40.

Among the key movers, Nifty IT stole the spotlight, jumping 2.70% to 35,235.30, fueled by buzz around Infosys’ upcoming buyback, which lifted sentiment across the sector. The Nifty Bank inched up 0.068% to 54,223.55, while the S&P BSE SmallCap index added 0.28%, reflecting sustained investor interest in broader markets.

In today’s newsletter, you’ll get the complete pulse of the Pre-Market Update — from major news and stock-specific updates to IPO highlights and key stocks on our radar.

Index Technical View – Market Outlook 10 September

As we step into a new week, the technical charts set the stage for a cautious yet opportunity-driven Pre-Market Update. According to Equitypandit Analysis, here’s how the major indices are shaping up for Tuesday’s trade:

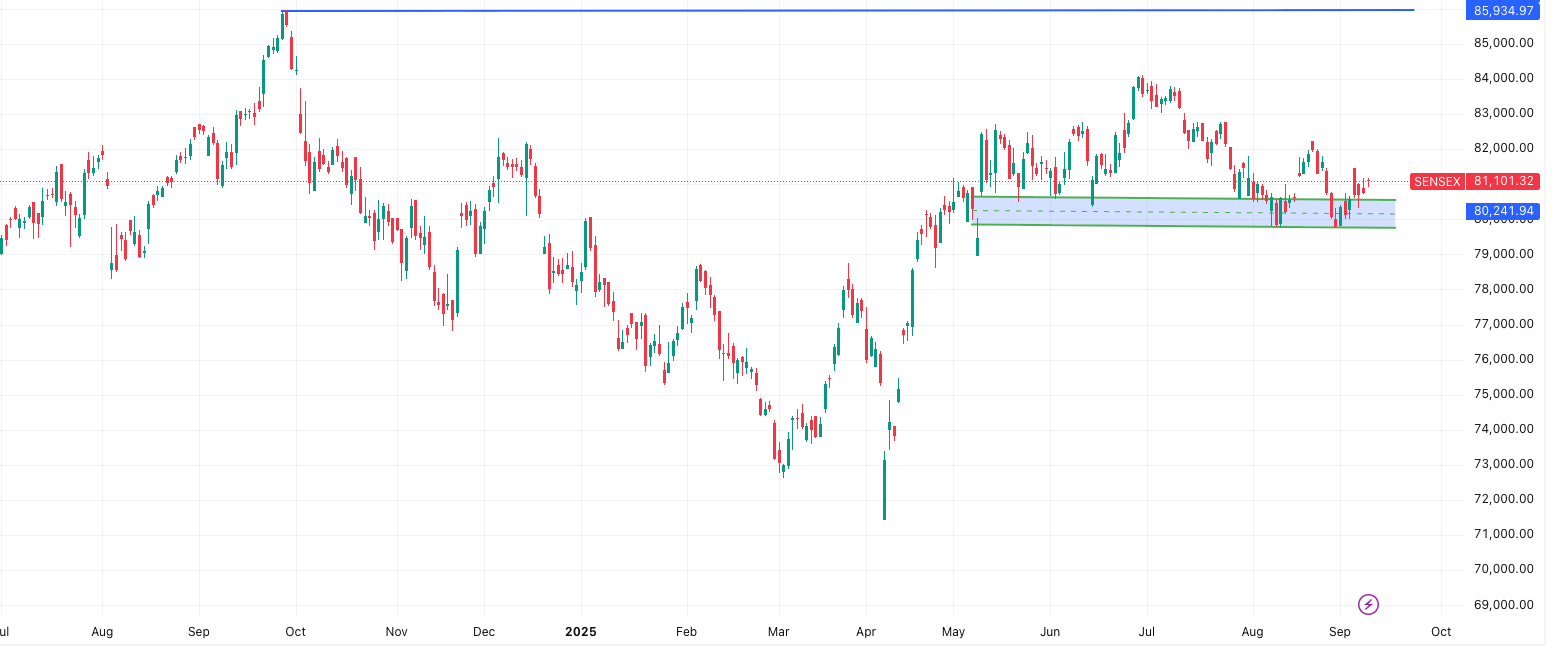

SENSEX Outlook 10 September:

The SENSEX (81,101) closed strong in the previous session, reflecting sustained buying momentum. The index is currently in a positive trend, which means bulls are holding the upper hand. Traders with long positions should continue to stay invested but must trail their positions with a daily closing stoploss of 80,419 to protect against sudden reversals. A decisive close below this level could open the gates for fresh short positions.

- Support Levels: The immediate supports are at 80,959 – 80,817 – 80,706, which may act as cushions if the market faces selling pressure.

- Resistance Levels: On the upside, resistance is seen at 81,212 – 81,324 – 81,466. A breakout above these zones may drive the index towards new highs.

- Tentative Range: Analysts expect the trading range for the day between 80,451 – 81,750, suggesting a fairly broad band that offers both upside opportunities and caution at lower levels.

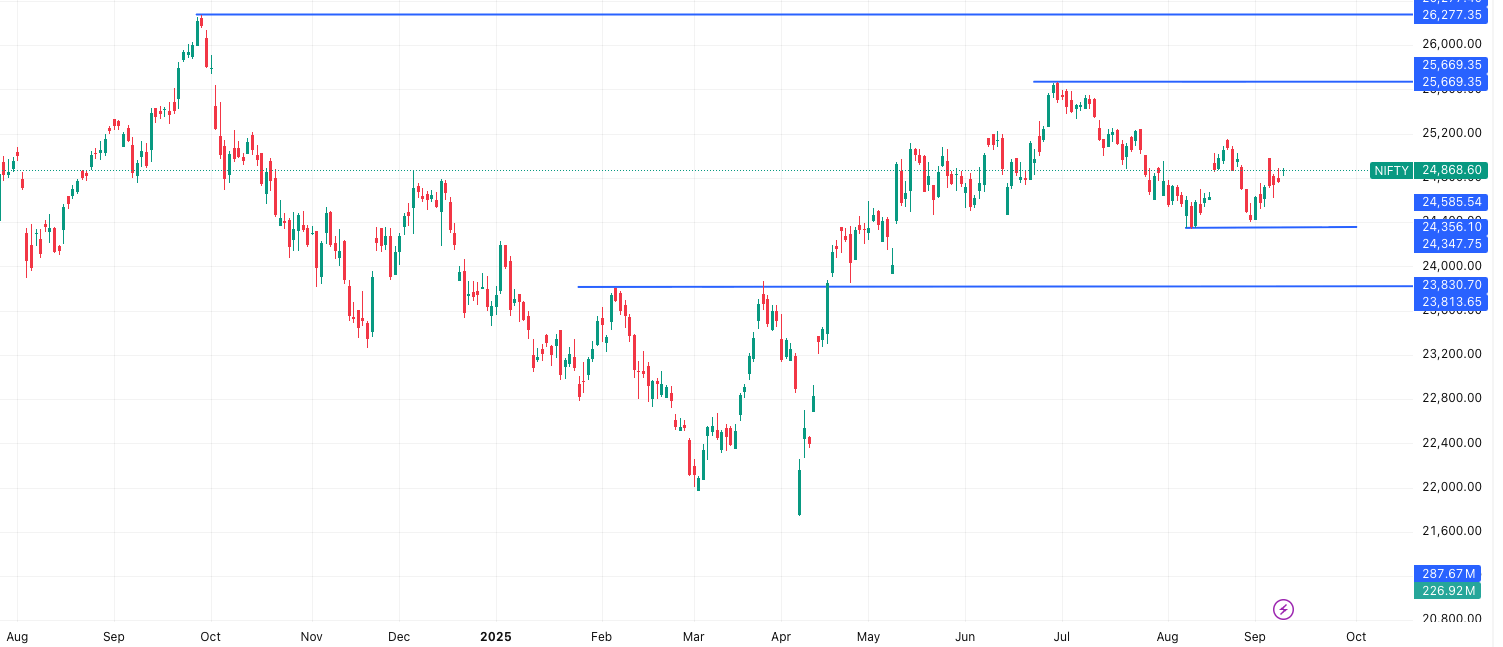

NIFTY Outlook 10 September:

The NIFTY (24,869) also ended in the green, extending its bullish momentum. The index continues to maintain a positive trend, signaling that the market breadth remains healthy. Investors holding long positions should maintain a stoploss at 24,658, while new short positions should only be considered if Nifty decisively slips below this mark.

- Support Levels: Key supports are placed at 24,824 – 24,780 – 24,747, which will be crucial zones to watch in case of intraday profit booking.

- Resistance Levels: On the higher side, Nifty faces resistance at 24,902 – 24,936 – 24,980. A strong close above 24,980 could open the path towards the psychological 25,000 level.

- Tentative Range: Market watchers see the index oscillating between 24,668 – 25,068, giving scope for both consolidation and breakout plays.

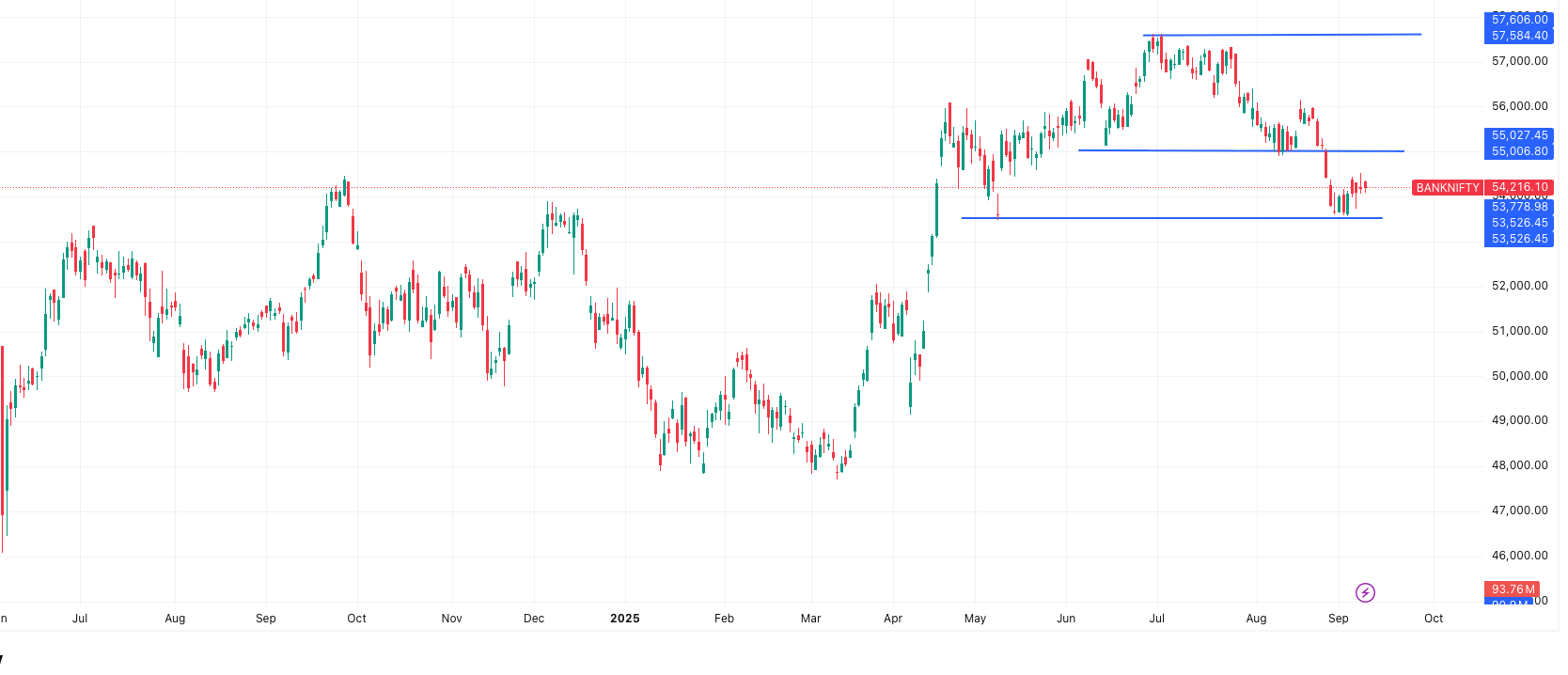

BANK NIFTY Outlook 10 September:

Unlike the headline indices, the Bank Nifty (54,216) is displaying a negative trend, indicating relative weakness in the banking pack. This divergence could act as a cap on broader market momentum. Traders holding short positions are advised to maintain them with a stoploss at 54,346. Only a close above this level would trigger fresh long opportunities.

- Support Levels: The support lies at 54,080 – 53,944 – 53,809, zones where buyers might attempt a pullback.

- Resistance Levels: Upside hurdles are seen at 54,351 – 54,487 – 54,623. Unless these are breached, recovery in Bank Nifty may remain limited.

- Tentative Range: Analysts project a trading band of 53,719 – 54,712, pointing towards possible volatility around support and resistance levels.

👉 In summary, Market Outlook 10 September shows Nifty and Sensex sustaining positive momentum, while Bank Nifty remains a drag. Traders should watch key support-resistance levels for intraday cues, especially as Nifty inches closer to the 25,000 milestone.

News & Stocks That Might Be Impacted | Market Outlook 10 September

The trading session on Market Outlook 10 September is likely to be influenced by a mix of corporate announcements, regulatory updates, and sectoral developments. Let’s look at the highlights and their possible Indian Stock market impact:

1. NBCC’s Mega MoU with NMRDA

NBCC (India) Ltd has signed an MoU with the Nagpur Metropolitan Region Development Authority to develop a 1,710-acre business district at Naveen Nagpur. This mega project positions the city as a potential International Business and Finance Centre (IBFC). With integrated infrastructure like underground tunnels, automated waste systems, and cooling facilities, the move could open up significant long-term opportunities for NBCC in project management and consulting.

Impact: NBCC shares may attract investor attention on growth prospects, particularly after reporting a 26% YoY rise in Q1 profit.

2. Sumitomo Mitsui’s Exit from Kotak Mahindra Bank

Japanese lender SMBC is set to sell its 1.65% stake in Kotak Mahindra Bank, valued at over ₹6,000 crore, via block deals. The proceeds are expected to fund its investment in Yes Bank, where RBI has cleared SMBC to acquire up to 24.99%. This marks one of the largest cross-border investments in Indian banking.

Impact: Kotak Mahindra Bank may face short-term pressure due to supply overhang, while Yes Bank could see buying interest on expectations of stronger capital infusion.

3. Relief for FMCG, Pharma & Apparel Companies on GST Transition

The government has allowed manufacturers to use existing packaging with new price stickers until December 31, easing the transition after recent GST rate changes. This move prevents wastage of inventory worth thousands of crores and protects margins across FMCG, pharma, and apparel players.

Impact: FMCG majors (HUL, Nestle, Dabur), pharma companies, and apparel retailers (Aditya Birla Fashion, Trent, Page Industries) stand to benefit.

4. SEBI’s New Framework for PSU Delisting

SEBI has simplified the voluntary delisting process for PSUs where the government owns over 90%. The new norms allow delisting at a fixed price with a 15% premium, relaxing earlier requirements.

Impact: This may accelerate government’s disinvestment plans and impact listed PSUs such as MMTC, STC, and Hindustan Copper.

5. Tata Power & Tata Passenger EV’s MegaCharger Hub

On World EV Day, Tata Power and Tata Passenger Electric Mobility launched India’s largest EV charging hub in Mumbai near the airport. The facility, powered by 100% renewable energy, has 8 DC fast chargers supporting 16 bays, a milestone in India’s EV ecosystem expansion.

Impact: Positive for Tata Power and Tata Motors, boosting their positioning in the clean energy and EV infrastructure space.

6. Reliance Industries Denies Ambani-Trump Meeting Rumors

Reliance clarified that Chairman Mukesh Ambani will not meet former US President Trump, contrary to earlier reports. Still, the focus remains on Reliance’s sharp increase in Russian oil imports, which surged to nearly 50% of Jamnagar refinery’s crude intake in 2025. With geopolitical heat around Russian energy, Reliance’s strategic sourcing keeps it under investor spotlight.

Impact: Reliance shares may remain range-bound but global oil price volatility could add pressure.

7. India-US Trade Pact by November

Commerce Minister Piyush Goyal announced India aims to finalize a trade agreement with the US by November 2025. Talks with the EU are also progressing, while China ties are “normalizing.”

Impact: Export-oriented sectors such as IT, textiles, and specialty chemicals could benefit if market access widens under the pact.

In short, Market Outlook 10 September suggests NBCC, Kotak Mahindra Bank, Yes Bank, FMCG, PSUs, Tata Power, Tata Motors, Reliance, and export-oriented companies will likely stay on investors’ radar today.

IPO Update | Market Outlook 10 September

The IPO market remains buzzing with both Mainboard and SME issues, attracting heavy investor participation. Grey Market Premiums (GMPs) suggest strong listing expectations for certain names, while others are showing modest to weak traction. Here’s a snapshot:

Mainboard IPOs Open Today

| IPO Name | GMP (Listing Gain) | Open | Close | Listing | IPO Size |

|---|---|---|---|---|---|

| Urban Co. IPO | ₹35.5 (34.47%) | 10-Sep | 12-Sep | 17-Sep | ₹1,900 Cr |

| Dev Accelerator IPO | ₹7.5 (12.30%) | 10-Sep | 12-Sep | 17-Sep | ₹143.35 Cr |

| Shringar House of Mangalsutra IPO | ₹25 (15.15%) | 10-Sep | 12-Sep | 17-Sep | ₹400.95 Cr |

IPO Today: Among mainboards, Urban Co. IPO looks the most attractive with strong GMP (34%+), indicating possible healthy listing gains. Both Dev Accelerator and Shringar Mangalsutra IPO are also in focus with decent premiums.

SME IPOs in Action

| IPO Name | GMP (Listing Gain) | Open | Close | Listing | IPO Size |

|---|---|---|---|---|---|

| TechD Cybersecurity | ₹100 (51.81%) | 15-Sep | 17-Sep | 22-Sep | ₹37.03 Cr |

| Airfloa Rail Technology | ₹170 (121.43%) | 11-Sep | 15-Sep | 18-Sep | ₹86.53 Cr |

| Jay Ambe Supermarkets | ₹11 (14.10%) | 10-Sep | 12-Sep | 17-Sep | ₹17.52 Cr |

| Galaxy Medicare | – | 10-Sep | 12-Sep | 17-Sep | ₹21.19 Cr |

| Nilachal Carbo Metalicks | ₹6 (7.06%) | 8-Sep | 11-Sep | 16-Sep | ₹53.28 Cr |

| Krupalu Metals | – | 8-Sep | 11-Sep | 16-Sep | ₹12.80 Cr |

| Taurian MPS | ₹14 (8.19%) | 9-Sep | 11-Sep | 16-Sep | ₹37.41 Cr |

| Karbonsteel Engineering | ₹19.5 (12.26%) | 9-Sep | 11-Sep | 16-Sep | ₹56.31 Cr |

| Vashishtha Luxury Fashion | – | 5-Sep | 10-Sep | 15-Sep | ₹8.42 Cr |

| Vigor Plast | – | 4-Sep | 9-Sep | 12-Sep | ₹23.85 Cr |

| Sharvaya Metals | ₹2.5 (1.28%) | 4-Sep | 9-Sep | 12-Sep | ₹55.86 Cr |

| Austere Systems | ₹32 (58.18%) | 3-Sep | 9-Sep | 12-Sep | ₹14.78 Cr |

| Goel Construction | ₹50 (19.01%) | 2-Sep | 4-Sep | 10-Sep | ₹95.14 Cr |

| Optivalue Tek Consulting | ₹14 (16.67%) | 2-Sep | 4-Sep | 10-Sep | ₹49.19 Cr |

- Airfloa Rail Technology is leading the SME pack with a staggering 121% GMP, making it one of the hottest IPOs this week.

- TechD Cybersecurity and Austere Systems are also commanding strong premiums, indicating high subscription demand.

- Other SMEs like Jay Ambe Supermarkets, Karbonsteel Engineering, and Goel Construction are showing moderate traction.

Market Outlook 10 September shows that IPO frenzy continues with a mix of high GMP leaders (Airfloa Rail Tech, TechD Cybersecurity) and steady mainboard performers (Urban Co., Shringar Mangalsutra). Investors should track subscription levels closely before making allocation decisions.

Stocks in Radar | Market Outlook 10 September

CESC Ltd

- CMP: ₹153

- Target Price: ₹204 (+33% upside)

- Call: BUY (Maintain)

- Research Source: ICICI Securities (09 September 2025)

Business Overview

CESC, part of the RP-Sanjiv Goenka Group, is India’s oldest fully-integrated electrical utility, engaged in power generation, transmission, distribution, and coal mining. Its core operations span Kolkata, Noida, Rajasthan, and Maharashtra.

Growth Drivers

- Growth Vision 2030: Aims to double profits by FY30, driven by capex in renewable energy (RE), distribution assets, and solar manufacturing.

- RE Expansion: Targeting 3.2GW RE capacity by FY29 with plans to scale to 10GW by FY32. Already concluded PPAs for 1.2GW.

- DISCOM Privatisation: Positioned to benefit from UP DISCOM privatisation (~17.5mn customers, 65BU consumption), which could unlock massive growth.

- Solar Manufacturing: Investing ₹30bn to build 3GW each of solar cell and module capacity by FY28.

- Distribution Growth: ₹60bn capex planned, with profit contribution from Kolkata, Noida, Chandigarh (newly acquired), and turnaround of Malegaon operations.

Financials Snapshot (ICICI Sec Estimates)

| Metric | FY24A | FY25A | FY26E | FY27E |

|---|---|---|---|---|

| Net Revenue (₹ mn) | 1,70,500 | 1,82,490 | 1,96,455 | 2,12,827 |

| EBITDA (₹ mn) | 38,830 | 39,370 | 43,891 | 50,067 |

| Net Profit (₹ mn) | 13,759 | 13,690 | 15,295 | 16,996 |

| EPS (₹) | 10.3 | 10.3 | 11.5 | 12.8 |

| P/E (x) | 14.9 | 14.9 | 13.4 | 11.7 |

Outlook

With a strong RE pipeline, strategic investments in distribution, and an aggressive push into solar manufacturing, CESC is well-positioned to ride India’s energy transition wave. ICICI Securities reiterates BUY, setting a target price of ₹204, implying a 33% upside from current levels.

Top Stocks To Watch: CESC stands out as a multi-year growth story in utilities, combining legacy distribution strength with aggressive green energy ambitions.

Conclusion | Market Outlook 10 September

Market Outlook 10 September highlights a cautiously optimistic start for Indian markets, with NIFTY and SENSEX showing positive momentum, led by strong sectoral performance in IT and selective auto stocks. Key developments from NBCC’s mega urban project, SMBC’s potential Kotak stake sale, GST packaging relief, and Sebi’s PSU delisting rules provide significant market catalysts. Investors should also keep an eye on major IPOs opening today, including Urban Co., Dev Accelerator, and Shringar House of Mangalsutra, alongside SME offerings like TechD Cybersecurity and Airfloa Rail Technology.

On the stock radar, CESC emerges as a strong multi-year growth opportunity, backed by renewable energy expansion, DISCOM privatisation prospects, and solar manufacturing initiatives. Overall, markets are positioned for selective stock-specific opportunities amid stable index trends, making this a day for strategic plays rather than broad bets.

Stay informed, track key IPOs, and focus on high-potential stocks as per Market Outlook 10 September.

Related Articles

Read Our All Newsletter On Pre-Market Analysis

Systematic Withdrawal Plan 2025 – 7 Powerful Benefits

Best IPOs in 2025: Top 10 Stocks That Doubled Investors’ Money