📰 Market Outlook 10 October

Good morning and welcome to your Market Outlook 10 October Edition.

Indian equities extended gains for a second consecutive session on Wednesday, driven by renewed buying interest in IT and large-cap stocks. The benchmark Nifty 50 climbed 126.55 points (+0.51%) to close at 25,172.70, while the Sensex gained 333.51 points (+0.41%) to settle at 82,107.17.

Bank Nifty inched up 106.10 points (+0.19%) to 56,124.35, showing mild strength ahead of key bank earnings. The Nifty IT index outperformed with a solid 1.09% rise, reflecting improved sentiment on global tech cues, while Smallcaps gained 0.22%, maintaining their positive bias.

Overall, markets remained buoyant amid a stable rupee and easing US bond yields, indicating improving risk appetite.

In this newsletter, we bring you technical views, key news, IPO updates, and stocks to watch for today.

Index Technical View — Market Outlook 10 October

According to EquityPandit Analysis, Indian indices continue to maintain a positive undertone as major benchmarks trade comfortably above key support levels.

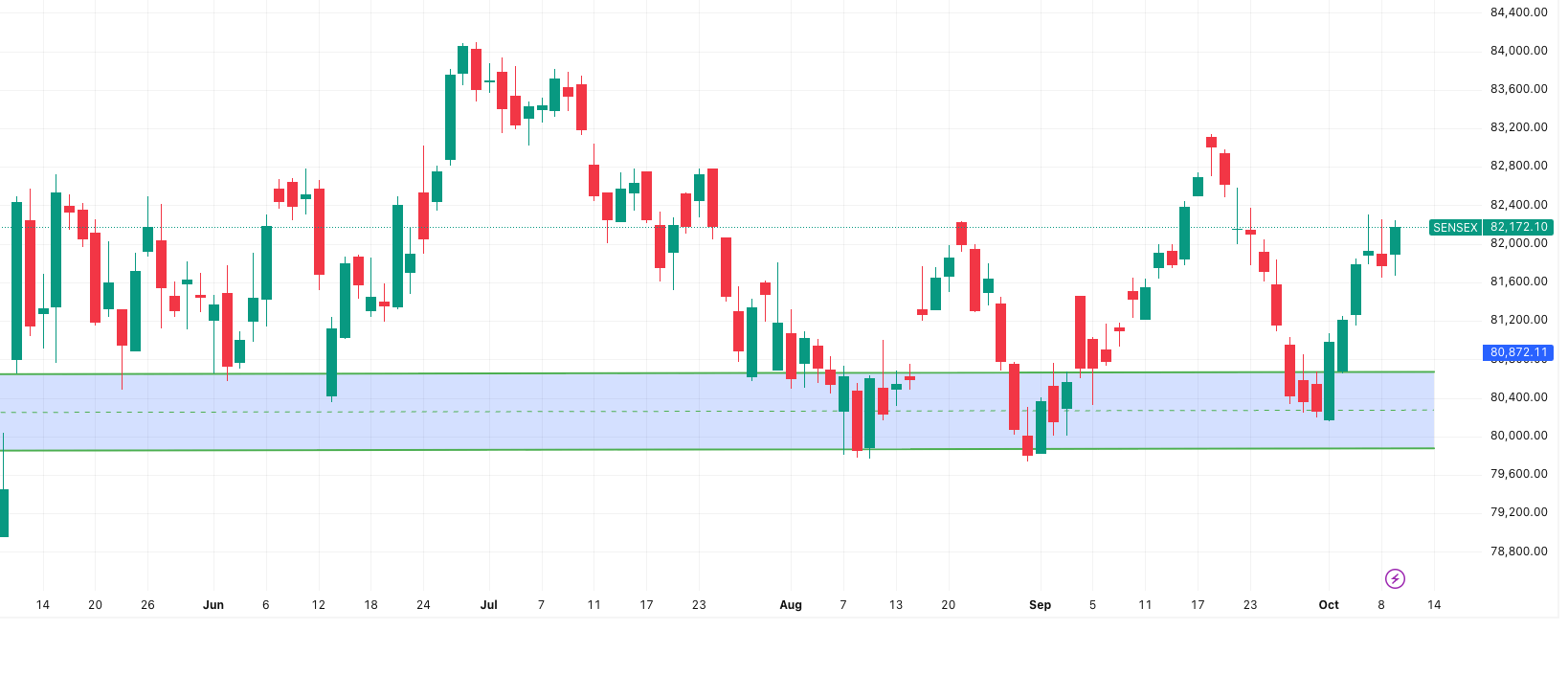

SENSEX Outlook 10 October

The SENSEX is currently in a positive trend. Traders holding long positions can continue to hold with a daily closing stoploss of 81,436. A fresh short position can be considered only if the index closes below this level.

- Support Levels: 81,811 – 81,449 – 81,231

- Resistance Levels: 82,391 – 82,609 – 82,971

- Tentative Range: 82,780 – 81,563

🔎 Candle Pattern Insight: The index formed a mild bullish candle, hinting at sustained buying momentum near the 81,800 zone.

NIFTY 50 Outlook 10 October

The Nifty remains firmly in a positive trend, continuing its upward trajectory above the 25,000 mark. Long positions can be held with a daily closing stoploss of 24,969. Any sustained close below this level may trigger short-term weakness.

- Support Levels: 25,071 – 24,960 – 24,896

- Resistance Levels: 25,246 – 25,310 – 25,421

- Tentative Range: 25,362 – 25,001

🔎 Candle Pattern Insight: A bullish continuation candle was observed on Wednesday, confirming short-term strength.

BANK NIFTY Outlook 10 October

The Bank Nifty continues in a positive trend, though momentum appears moderate compared to other indices. Long positions can be maintained with a stoploss of 55,779. Short positions may be considered below this mark.

- Support Levels: 55,929 – 55,665 – 55,486

- Resistance Levels: 56,371 – 56,550 – 56,813

- Tentative Range: 56,668 – 55,715

🔎 Candle Pattern Insight: The index formed a small-bodied candle, suggesting consolidation before a possible breakout.

News & Stocks — Market Outlook 10 October

Afcons Infrastructure Bags ₹576 Crore Project; Faces Fresh MCA Scrutiny

Infrastructure major Afcons Infrastructure Ltd, a part of the Shapoorji Pallonji Group, announced on Thursday that it has won a ₹576 crore (including GST) order for civil and allied works — a strong addition to its existing project portfolio. This contract highlights Afcons’ strong execution track record and its leadership in domestic infrastructure projects.

However, the company also revealed that it has received an inspection letter under Section 206(5) of the Companies Act, 2013, from the Ministry of Corporate Affairs (MCA). The inspection extends the earlier review period from FY2018–19 to FY2024–25, seeking clarification on certain non-compliance and accounting matters.

Afcons has stated that its legal position is robust and that it will “vigorously defend” its stance. Despite this regulatory noise, analysts believe the company’s diversified order book and recent international wins, like the €677 million Croatian rail project, provide strong business visibility.

Stocks to Watch: Afcons Infrastructure (Unlisted), Shapoorji Pallonji Group, L&T, and IRB Infra could stay in focus as investors track order inflows and project activity in the infrastructure space.

Lupin Expands Global Reach with Strategic Partnership for Long-Acting Injectables

Pharma giant Lupin Ltd has launched a global strategic partnership program aimed at expanding its PrecisionSphere platform — an innovative long-acting injectable (LAI) technology developed by its Dutch subsidiary, Nanomi B.V. The move comes after the platform received U.S. FDA approval for its first product, marking a crucial milestone in Lupin’s innovation-driven growth strategy.

PrecisionSphere is designed to solve one of the biggest challenges in chronic therapies — patient compliance. By allowing controlled drug release over weeks or months, it enhances treatment outcomes while extending the commercial life of existing molecules.

Lupin plans to collaborate with other global pharma firms to co-develop or license out LAI products, leveraging its manufacturing, regulatory, and R&D expertise.

The company’s management stated that this initiative “positions Lupin as a leader in advanced drug delivery systems” and aligns with its long-term goal of shifting toward specialty and complex generics.

Stocks to Watch: Lupin (NSE: LUPIN) — potential re-rating catalyst on specialty focus. Also keep an eye on Dr. Reddy’s Laboratories and Sun Pharma, as peers may explore similar innovation-led strategies.

India–UK Defence Pact Worth ₹4,150 Crore Spurs Sectoral Optimism

In a major diplomatic and strategic boost, India and the United Kingdom have signed a £350 million (₹4,150 crore) defence contract to supply lightweight multirole missiles (LMM) to the Indian Army. The pact, announced during UK Prime Minister Keir Starmer’s India visit, aims to deepen collaboration in the defence and aerospace sector.

In addition, both nations signed an Implementing Arrangement worth £250 million (₹2,972 crore) for developing electric-powered engines for naval ships, advancing India’s naval modernization roadmap. The deals are expected to support over 700 jobs in Northern Ireland while fostering greater technology transfer to Indian defence units.

Analysts note that the agreements underscore a broader strategic partnership, aligning with India’s Make in India initiative and expanding its domestic defence manufacturing base.

Stocks to Watch: Mazagon Dock Shipbuilders, Bharat Dynamics, HAL, and Mishra Dhatu Nigam may continue their positive momentum following renewed investor interest in defence manufacturing and export opportunities.

Supreme Court to Hear Sahara–Adani Deal on October 14

The Supreme Court of India is set to hear Sahara India Commercial Corporation Ltd’s (SICCL) plea seeking permission to sell landmark assets — including Aamby Valley (Maharashtra) and Sahara Shaher (Lucknow) — to Adani Properties Pvt Ltd.

The proposed transaction aims to liquidate these assets and channel funds into the SEBI–Sahara Refund Account, which has already received around ₹16,000 crore from prior asset sales.

The Sahara Group has been under long-standing scrutiny for investor repayment obligations. Its latest move to sell marquee assets to Adani Group could mark a decisive step toward resolving pending liabilities.

Legal experts see this as a potentially landmark case for large-scale corporate liquidations and investor refunds in India. If approved, it could accelerate the resolution process and restore partial confidence in the Sahara repayment framework.

Stocks to Watch: Adani Realty, Adani Enterprises, and DLF could see attention on property monetization themes and large-scale asset acquisitions.

ONGC Issues First Subsidiary Bond Guarantee in 15 Years

In a major financing milestone, Oil and Natural Gas Corporation (ONGC) has extended its first subsidiary bond guarantee since 2010 to ONGC Petro Additions Ltd (OPAL). The move will enable OPAL to raise ₹5,000 crore through rupee-denominated bonds this quarter.

The guarantee upgrades OPAL’s credit rating from AA+ to provisional AAA (CE), allowing it to borrow at more favorable terms. The bond issue aims to refinance existing debt and fund operational expansion at its Dahej petrochemical plant in Gujarat.

This strategic support indicates ONGC’s intent to consolidate its downstream portfolio and unlock value across the petrochemical chain. Analysts expect the move to strengthen OPAL’s balance sheet and improve return on capital employed (RoCE) over the next two years.

Stocks to Watch: ONGC (NSE: ONGC), Indian Oil Corp, and Reliance Industries may draw investor focus amid improving sentiment in the energy and petrochemical sector.

Sterlite Technologies Partners with QNu Labs to Drive Quantum Communications

Sterlite Technologies Ltd (STL) has entered a strategic MoU with QNu Labs Pvt. Ltd., a pioneer in quantum cybersecurity, to jointly develop quantum-secure optical communication systems.

The collaboration combines STL’s leadership in high-speed fibre networks with QNu Labs’ Quantum Key Distribution (QKD) technology to create next-generation secure data transmission systems.

This marks India’s entry into the global race for quantum-safe communications, a domain currently dominated by the US, China, and Europe. The partnership also aligns with India’s National Quantum Mission, which aims to make the country a global quantum hub by 2030.

Management commentary from both firms emphasized this as a “transformative step” toward building a quantum-safe digital infrastructure for telecom, defence, and enterprise networks.

Stocks to Watch: Sterlite Technologies (NSE: STLTECH), Tejas Networks, and Tata Elxsi could benefit as investors bet on India’s emerging quantum and secure communications ecosystem.

IPO Update – Market Outlook 10 October

Despite a busy week for the primary market, sentiment remains selective as investors weigh subscription trends and grey market signals. Several mainboard IPOs are seeing moderate-to-strong demand, while the SME segment remains quiet for now.

Mainboard IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP / Listing Gain |

|---|---|---|---|---|

| Canara HSBC Life IPO | 10-Oct | 14-Oct | 17-Oct | ₹10 (9.43%) |

| Canara Robeco IPO | 9-Oct | 13-Oct | 16-Oct | ₹21 (7.89%) |

| Rubicon Research IPO | 9-Oct | 13-Oct | 16-Oct | ₹100 (20.62%) |

| LG Electronics IPO | 7-Oct | 9-Oct | 14-Oct | ₹350 (30.70%) |

| Tata Capital IPO | 6-Oct | 8-Oct | 13-Oct | ₹6.5 (1.99%) |

| WeWork India IPO | 3-Oct | 7-Oct | 10-Oct | ₹– (0.00%) |

Listing Today: WeWork India IPO

All eyes are on the WeWork India IPO, which lists today (10 October). Early indicators suggest a flat to negative listing, as the company faces margin concerns and muted investor sentiment following global coworking sector headwinds. Traders may watch for intraday volatility, while long-term investors should assess post-listing performance before taking fresh positions.

SME IPOs

There are no SME IPOs currently open in the market. However, upcoming SME offerings are expected to return soon as market liquidity and sentiment improve ahead of the festive season.

Stocks in Radar – Market Outlook 10 October

Delhivery Ltd

CMP: ₹467 | Target Price: ₹540 (+16%) | Rating: BUY

Research Source: Motilal Oswal Financial Services Limited

Bloomberg Code: DELHIVER IN | Market Cap: ₹34,930 Cr

Business Overview

Delhivery is India’s largest third-party logistics (3PL) and express parcel delivery company, with a network spanning over 18,800 pin codes. Following its acquisition of Ecom Express, the company has cemented its position as the most dominant integrated logistics provider in the country. With a focus on express parcel, part truckload (PTL), and supply chain services, Delhivery is strategically aligned with India’s e-commerce and consumption growth story.

Financial Highlights

| (₹ in billion) | FY26E | FY27E | FY28E |

|---|---|---|---|

| Sales | 102.1 | 116.9 | 133.5 |

| EBITDA | 6.7 | 8.0 | 9.8 |

| Adj. PAT | 3.6 | 4.5 | 6.0 |

| EBITDA Margin (%) | 6.5 | 6.8 | 7.3 |

| RoE (%) | 3.8 | 4.5 | 5.7 |

Delhivery’s revenue is expected to grow at a 14% CAGR (FY25–28), while EBITDA and PAT are projected to rise 38% and 53% CAGR, respectively — a clear indication of operating leverage and margin improvement in play.

Key Growth Drivers

- Festive Tailwinds: According to RBI data, India’s total electronic payments surged to ₹11.3 trillion on 22nd September — a nearly 10x jump in a day — signaling a powerful revival in consumption. This directly boosts logistics volumes across retail and e-commerce channels.

- Auto & Consumer Demand Revival: Post the recent GST rate cuts, both automotive and consumer durable segments have witnessed robust demand, tightening logistics capacity nationwide — a positive sign for Delhivery’s express and PTL business.

- Ecom Express Acquisition: The ₹1,400 crore acquisition strengthens Delhivery’s rural reach and adds complementary volume capacity. It is expected to yield cost synergies and network efficiency gains, enhancing profitability and competitiveness.

- PTL & Supply Chain Expansion: These underpenetrated segments are expected to grow at 18–22% CAGR through FY25–28, driven by SME expansion, network formalization, and higher adoption of integrated logistics solutions.

Outlook & Valuation

Delhivery’s EBITDA margin is projected to improve from 4.2% in FY25 to 7.3% in FY28, driven by better asset utilization, automation, and consolidation benefits. The company’s balance sheet remains healthy with negative net debt and ample liquidity to support strategic investments.

At CMP ₹467, the stock trades at 58x FY28E P/E, reflecting optimism around long-term growth and operational efficiency. Motilal Oswal reiterates a BUY rating with a target price of ₹540, implying 16% upside potential from current levels.

Key Risks

- Prolonged weakness in e-commerce volumes post-festive season.

- Delay in integration or cost realization from the Ecom Express acquisition.

- Margin pressure from competitive pricing or fuel cost volatility.

Analyst Take

With strong festive momentum, strategic expansion, and an improving margin trajectory, Delhivery stands out as a top logistics play in the Indian equity market. The company’s scale, technology-led operations, and focus on profitability make it a compelling medium-term bet in the Market Outlook 10 October edition.

Conclusion – Market Outlook 10 October

As we wrap up the Market Outlook 10 October, it’s clear that the tone of the market is one of cautious optimism. On one hand, we’re witnessing strong triggers across defence, logistics, and pharma — from Afcons Infrastructure’s new contract win to Lupin’s global partnership in long-acting injectables and the UK-India defence pact strengthening aerospace and naval ties. These developments reflect the broadening strength of India’s industrial and innovation ecosystem.

Meanwhile, large-cap resilience continues amid steady institutional inflows and improving corporate earnings visibility ahead of Q2 results season. However, global macro factors such as U.S. inflation data, crude price volatility, and geopolitical risks may keep short-term volatility elevated.

The IPO space remains vibrant, with Canara HSBC Life and Rubicon Research IPOs drawing strong investor interest, while WeWork India IPO lists today with muted sentiment. This mixed performance underlines a selective but healthy primary market appetite.

Among stocks, Delhivery stands out as a strong logistics play, poised to ride festive demand and e-commerce tailwinds. The company’s improving profitability and strategic expansion position it well for sustained growth.

In summary, India’s markets continue to reflect domestic strength amid global uncertainty. Investors should maintain a stock-specific approach — focusing on businesses with robust earnings visibility, strong balance sheets, and participation in structural themes like defence, logistics, and innovation-driven manufacturing.

More Articles

How to Transfer Shares from Groww to Zerodha – Full Guide (2025)

Best Screener Queries for Stock Selection: Find Hidden Gems Before Others Do

How a Tea Seller Used the Power of Compound Interest to Build ₹45 Lakh