Market Crash Done. What Now?

Good morning, fearless traders and chai-powered investors.

Yesterday was brutal. Market Crash nearly 3%. Nifty Metal nosedived 8%, IT slipped over 7%, and Auto, Realty, and Oil & Gas all fell more than 5%. Small-caps? Down 10%. Mid-caps? Down 7.3%.

💸 Total damage: ₹27 lakh crore in market cap gone. FPIs? Already packing, pulling out over ₹10,000 crore last week.

But that was yesterday’s drama.

Today, we look ahead—What’s next for Nifty? Global signals, technical levels, and a peek at history might just show us the way.

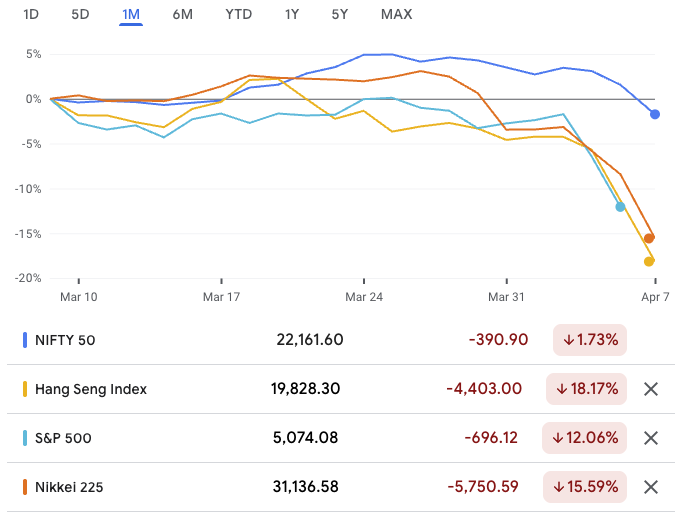

🌍 Nifty vs Global Markets: Who Crashed Harder?

If you thought Dalal Street had a rough Monday, global markets said, “Hold my beer.”

Here’s the 1-month bloodbath leaderboard:

- 🇮🇳 Nifty 50: -1.73% (seems mild, but the last few days were brutal)

- 🇺🇸 S&P 500: -12.06%

- 🇯🇵 Nikkei 225: -15.59%

- 🇭🇰 Hang Seng: -18.17%

While India saw a sudden drop, these other indices have been tumbling for weeks. In short? Nifty held strong—until it couldn’t.

🧐 So, what’s next? Time to check the charts and the past to make sense of the present.

📊 Nifty Chart Analysis: Panic Drop Meets Key Support

That wasn’t just a fall—it was a full-blown technical breakdown. Nifty tanked over 1,000 points in one session, and volume hit 647M, a level we haven’t seen in months. But now, the chart speaks louder than the panic.

Here’s the quick technical scoop:

- 🔻 Support Zone: Nifty fell straight into the 21,400–22,000 support band marked on the chart—same zone that acted as a strong base in June and October 2024. Coincidence? Nope. Smart money buys here.

- 🧱 If this support breaks? Eyes shift to the next major zone near 19,300–19,500. That’s a 10% drop from here. Let’s not go there.

- 📈 Recovery Targets: For bulls to come back roaring:

- Step 1: Reclaim 22,500

- Step 2: Cross 23,800

- Final boss: Breakout above 24,800

- ❗But till then? Trend stays weak. Lower highs and lower lows are forming—a classic sign of a short-term downtrend.

What this means: We’re at a do-or-die zone. If this support holds, you might thank your lucky RSI. If it breaks, well… maybe don’t check your portfolio till May.

Been There, Crashed That: Nifty’s Crash Legacy

This isn’t Nifty’s first heartbreak. Our markets have been ghosted by scams, elections, pandemics—you name it. Let’s take a trip down Crash Lane:

📉 1992 – Harshad Mehta Scam | Drop: 12.7% on April 28

India’s first big market shock. Harshad Mehta manipulated bank receipts to inflate stock prices. When the scam was exposed, investor panic caused the Sensex to plummet by 570 points — a 12.7% single-day fall.

📉 2001 – Ketan Parekh Scam | Drop: 4.13% on March 2

Another scam, another collapse. Ketan Parekh rigged low-liquidity stocks, pumping them with FII money. Once regulators stepped in, those inflated stocks burst like Diwali crackers — taking the market down.

📉 2004 – Election Shock | Drop: 11.1% on May 17

No one saw this coming. The UPA’s surprise win spooked markets over policy uncertainty. Result? Panic selling, and the Sensex tanked 11.1% intraday — circuit breakers had to be used.

📉 2008 – Global Financial Crisis | Drop: 7.4% on Jan 21

Lehman hadn’t collapsed yet, but fear had already arrived. On Jan 21, 2008, fears of a US-led recession caused FIIs to rush for the exits, dragging Sensex down 1,408 points — a 7.4% fall.

📉 2020 – COVID-19 Crash | Drop: 13.2% on March 23

India entered lockdown. So did investors’ portfolios. Fear of the unknown, shutdowns, and a global freeze led to the worst single-day fall in history — 3,935 points wiped out, or 13.2%.

💪 History Says: Bounce-Back is Built-In

But here’s the twist: Nifty has a PhD in bouncing back from disasters.

| Crash | Fall (%) | Return in 6 Months |

|---|---|---|

| May 2004 (Election) | -20% | +33% |

| May 2006 | -25% | +52% |

| Oct 2008 (GFC) | -22% | +50% |

| Mar 2020 (COVID) | -35% | Full recovery |

So yeah, maybe your portfolio looks like it got hit by a truck. But zoom out—and you’ll see we always rise from the ashes like a well-dressed Phoenix holding a Demat account.

What To Do Now: Your Action Plan

Don’t sell in panic. Seriously. Red portfolio ≠ red alert.

If you’ve got cash and courage, this could be your “buy the dip” moment — but only for quality stocks.

📚 Want the full survival guide?

Read : What To Do When Your Portfolio Is in Red

🗞️ News That Will Move Markets Today

1. Federal Reserve’s Emergency Meeting Sparks Speculation

The U.S. Federal Reserve has scheduled a closed-door meeting today at 11:30 AM ET to review and determine the advance and discount rates charged by Federal Reserve Banks. This unexpected meeting has led to speculation about a possible emergency rate cut.

Stock Impact:

- Indian IT Companies: A U.S. rate cut could lead to a weaker dollar, potentially impacting revenue for export-driven IT firms like Infosys (INFY) and Tata Consultancy Services (TCS).

- Banking Sector: Lower U.S. rates might influence global interest rate trends, affecting Indian banks with international exposure, such as HDFC Bank (HDFCBANK).

2. Tata Group’s $1.3 Billion Investment in BigBasket and 1mg

The Tata Group plans to invest $1.3 billion into its digital ventures, allocating $1 billion to BigBasket and $300 million to 1mg. This move aims to enhance their competitiveness in the quick commerce and online healthcare sectors.

Stock Impact:

- Tata Group Companies: This significant investment underscores Tata’s commitment to digital expansion, potentially boosting investor confidence in Tata Consumer Products (TATACONSUMER) and Tata Chemicals (TATACHEM), which have synergies with these ventures.

3. Increase in LPG Prices by ₹50 per Cylinder

Effective April 8, the price of Liquefied Petroleum Gas (LPG) cylinders will rise by ₹50. For general consumers, the cost will increase from ₹803 to ₹853 per 14.2-kg cylinder, while beneficiaries of the Pradhan Mantri Ujjwala Yojana (PMUY) will see prices go from ₹500 to ₹550.

Stock Impact:

- Oil Marketing Companies (OMCs): Firms like Indian Oil Corporation (IOC), Bharat Petroleum (BPCL), and Hindustan Petroleum (HPCL) may experience shifts in margins due to the price adjustment.

- Consumer Goods Companies: Increased cooking fuel costs could impact disposable income, potentially affecting spending on non-essential items.

4. Excise Duty on Petrol and Diesel Increased by ₹2 per Litre

The Indian government has raised the excise duty on petrol and diesel by ₹2 per litre, bringing the duties to ₹13 and ₹10 per litre, respectively. This measure aims to bolster government revenues without altering retail fuel prices.

Stock Impact:

- Oil Marketing Companies (OMCs): Companies like IOC, BPCL, and HPCL may need to absorb the increased duty, potentially impacting their profitability.

- Automobile Sector: Stable retail fuel prices mean consumer demand for vehicles is unlikely to be affected in the short term, maintaining the status quo for companies like Maruti Suzuki (MARUTI) and Hero MotoCorp (HEROMOTOCO).

5. India Considers Reducing Auto Import Tariffs to 10%

In ongoing trade negotiations with the European Union, India is contemplating lowering import tariffs on automobiles from over 100% to 10%. This potential policy shift aims to facilitate a trade deal but faces resistance from domestic automakers.

Stock Impact:

- Domestic Automakers: Companies like Tata Motors (TATAMOTORS) and Mahindra & Mahindra (M&M) may face increased competition from imported vehicles, potentially impacting market share and pricing strategies.

- Luxury Car Segment: A reduction in tariffs could make high-end European cars more affordable, potentially boosting sales in this segment.

6. Adani Ports Commences Operations at Colombo Terminal

Adani Ports and Special Economic Zone Ltd. (APSEZ) has begun operations at the Colombo West International Terminal in Sri Lanka. This development marks a significant expansion of Adani’s international footprint in port operations.

Stock Impact:

- Adani Ports (ADANIPORTS): The commencement of operations at the Colombo terminal could enhance revenue streams and strengthen Adani Ports’ position in the regional maritime logistics sector.

Investor Takeaway: These developments present a mix of opportunities and challenges across various sectors. Staying informed and analyzing the specific impacts on relevant stocks will be crucial for making strategic investment decisions.

If you’re wondering how to trade Nifty during this volatility — whether to buy the dip, wait it out, or just rage-quit the market — this is where expert advice can make all the difference.

Want real-time technicals, expert recommendations, and strategies for entry-exit levels on Nifty and top stocks? You’ll find all of it (minus the drama) on platforms like Angel One — where smart investors get smarter.

Conclusion: Be Greedy When Others Are Panicking

Markets aren’t crashing. They’re going on sale.

Every big fall in the past looked scary in the moment — Harshad Mehta scam, 2008, COVID. But each crash had one thing in common: it created generational buying opportunities for those who had guts while others were panicking.

So, if your portfolio is bleeding — good. It means you’re in the game.

Now’s the time to act smart, not scared.

📉 Don’t dump your stocks like expired Maggi.

🛒 Start shopping for quality stocks like it’s Diwali Dhamaka.

🧘♂️ And please, stop checking your portfolio every 3 minutes.

If you want actual buy/sell strategies, expert-backed ideas, and to know what pros are doing with Nifty right now —

go check out the free tools on Angel One. (Yes, they’re free. Yes, really.)

Let the rest of India panic. You? You’re playing chess in a game of snakes and ladders. ♟️🔥

Related Articles

Trump’s 26% Tariffs: Which Sectors Will Win & Who’s in Trouble?