Introduction

Laxmi India Finance, a fast-growing NBFC, is set to launch its IPO on July 29, 2025. The ₹254.26 crore issue includes a fresh issue of ₹165.17 crore and an offer for sale of ₹89.09 crore. The Laxmi India IPO is priced in the range of ₹150–₹158 per share.

The company has a strong presence in MSME and vehicle financing across semi-urban and rural India. It reported a 42% rise in revenue and a 60% increase in profit in FY25. The IPO will help Laxmi India strengthen its capital base for future lending growth.

The stock is expected to list on BSE and NSE on August 5, 2025. Here’s a complete breakdown of the IPO and what investors should know.

Laxmi India IPO: Details & Key Dates

Here’s a quick snapshot of all the essential details investors need to know about the Laxmi India IPO:

IPO Details

| Particulars | Details |

|---|---|

| IPO Size | ₹254.26 crore |

| Fresh Issue | ₹165.17 crore (1.05 crore shares) |

| Offer for Sale (OFS) | ₹89.09 crore (0.56 crore shares) |

| Price Band | ₹150 to ₹158 per share |

| Face Value | ₹5 per share |

| Lot Size (Retail) | 94 shares |

| Minimum Investment | ₹14,852 |

| Listing Exchanges | BSE and NSE |

| Book Running Lead Manager | PL Capital Markets Pvt. Ltd. |

| Registrar | MUFG Intime India Pvt. Ltd. (Link Intime) |

| Market Cap (Post IPO) | ₹825.83 crore (approx.) |

IPO Timeline (Tentative)

| Event | Date |

|---|---|

| IPO Opens | July 29, 2025 (Tuesday) |

| IPO Closes | July 31, 2025 (Thursday) |

| Allotment Finalization | August 1, 2025 (Friday) |

| Refund Initiation | August 4, 2025 (Monday) |

| Demat Credit | August 4, 2025 (Monday) |

| Listing Date | August 5, 2025 (Tuesday) |

| UPI Mandate Cut-off Time | 5:00 PM, July 31, 2025 |

Laxmi India IPO Objective

The primary goal of the Laxmi India IPO is to support the company’s future growth by strengthening its financial foundation. Here’s how the net proceeds from the fresh issue will be utilized:

Objects of the Issue

| Purpose | Amount (₹ in crore) |

|---|---|

| Augmentation of capital base to meet future capital requirements for onward lending | ₹177.00 |

This capital infusion will enable Laxmi India Finance to expand its lending portfolio, especially across MSME and vehicle finance segments in rural and semi-urban markets. The company is focused on leveraging this strengthened base to drive long-term growth and improve financial inclusion in underserved regions.

Company Overview: Laxmi India Finance IPO

Laxmi India Finance is a non-deposit-taking NBFC that primarily serves underserved and financially excluded borrowers in India. Founded in the early 1990s as Deepak Finance & Leasing (DFL), the company experienced a major transformation in 2010 when the current Promoter acquired and integrated DFL’s operations. Since then, Laxmi India Finance has expanded rapidly, tapping into India’s growing demand for inclusive financial services.

Wide and Expanding Network

As of March 31, 2025, Laxmi India operated through 158 branches across Rajasthan, Gujarat, Madhya Pradesh, Chhattisgarh, and Uttar Pradesh. Notably, the company holds the distinction of having the largest branch network in Rajasthan among its peers (Source: CARE Report). Over the past two years, it has consistently scaled its presence, entering new geographies while deepening its reach in existing markets.

Strong and Consistent Growth

Thanks to a customer-focused approach and aggressive branch expansion, the company has shown robust growth:

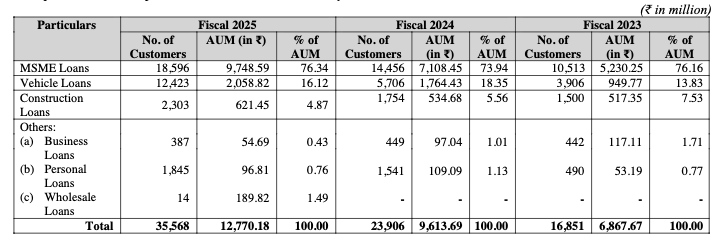

- Assets Under Management (AUM) rose from ₹6,867.67 million in FY23 to ₹12,770.18 million in FY25 — a CAGR of 36.36%.

- The customer base grew by 48.78% YoY, reaching 35,568 customers in FY25.

- Loan disbursements also increased sharply, climbing from ₹3,432.91 million in FY23 to ₹7,185.34 million in FY25.

Diverse Product Portfolio

Laxmi India offers a well-rounded set of secured lending products tailored to rural and semi-urban customers:

- MSME Loans: Account for 76.34% of total AUM and support small businesses. Over 80% qualify as Priority Sector Lending, aligning with RBI’s inclusion goals.

- Vehicle Loans: Make up 16.12% of AUM, serving individual and commercial needs.

- Construction Loans: Cater to infrastructure-related borrowers.

- Other Loans: Include personal, business, and wholesale loans.

Key Performance Snapshot

Between FY23 and FY25, the company witnessed remarkable improvements across all verticals:

Moreover, the MSME and vehicle loan verticals together contributed over 92% of the company’s total AUM, underscoring the company’s targeted approach.

Financial Highlights & Key Ratios – Laxmi India Finance IPO

Laxmi India Finance Ltd. has demonstrated robust financial growth, with a consistent rise in revenue, profitability, and asset base. The company continues to expand its lending portfolio while maintaining strong operational margins.

Restated Financial Performance (₹ in Crores)

| Particulars | FY25 (Mar 31) | FY24 (Mar 31) | FY23 (Mar 31) |

|---|---|---|---|

| Assets | ₹1,412.52 | ₹984.85 | ₹778.71 |

| Revenue | ₹248.04 | ₹175.02 | ₹130.67 |

| Profit After Tax | ₹36.01 | ₹22.47 | ₹15.97 |

| EBITDA | ₹163.88 | ₹114.59 | ₹85.96 |

| Net Worth | ₹257.47 | ₹201.22 | ₹152.33 |

| Reserves & Surplus | ₹236.99 | ₹181.87 | ₹134.23 |

| Total Borrowings | ₹1,137.06 | ₹766.68 | ₹615.49 |

Growth Highlights:

- Revenue growth of 42% YoY (FY24 to FY25)

- PAT growth of 60% YoY, indicating strong profitability traction

- Assets surged 43% over FY24, showcasing business expansion and growing loan book

Key Financial Ratios (as of March 31, 2025)

| Key Metric | Value | Interpretation |

|---|---|---|

| RoNW (Return on Net Worth) | 13.95% | Indicates strong return to shareholders |

| PAT Margin | 14.48% | Profitable business model with effective cost control |

| EBITDA Margin | 66.07% | Reflects operational efficiency and high-margin lending products |

| Debt to Equity Ratio | 4.42x | Highly leveraged NBFC model; typical for growth-focused lending outfits |

| Price to Book (P/B) | 2.57x | Reasonably valued considering growth and profitability |

| Market Cap | ₹825.83 Cr | Reflects investor interest and fair valuation |

Analyst Take

Laxmi India Finance’s financial trajectory reflects aggressive growth backed by efficient lending operations, particularly in underserved MSME and vehicle loan segments. While the debt-to-equity ratio is relatively high (as is common in NBFCs), the stable PAT margins and expanding AUM suggest prudent credit management.

Valuation & Peer Comparison – Laxmi India Finance IPO

Laxmi India Finance appears reasonably valued relative to listed NBFC peers, especially considering its growth momentum and return profile.

Valuation Snapshot

| Metric | Pre-IPO | Post-IPO |

|---|---|---|

| EPS (₹) | 8.61 | 6.89 |

| Price to Earnings (P/E) | 18.35x | 22.90x |

| Price to Book (P/B) | — | 2.57x |

Interpretation:

While the post-IPO P/E valuation of 22.9x places Laxmi India at a premium compared to some peers, it is still below others like SBFC Finance (P/E ~34x), suggesting room for listing upside if growth sustains.

Peer Comparison

| Company | EPS (₹) | NAV/Share (₹) | P/E (x) | RoNW (%) | P/B Ratio |

|---|---|---|---|---|---|

| Laxmi India Finance Ltd | 8.78 | 61.57 | 22.90 | 15.66% | 2.57x |

| Mas Financial Services Ltd | 17.48 | 142.50 | 16.97 | 14.71% | 2.08x |

| Five Star Business Finance | 36.61 | 214.13 | 20.62 | 18.60% | 3.52x |

| SBFC Finance Ltd | 3.21 | 29.40 | 34.38 | 11.39% | 3.68x |

| Ugro Capital Ltd | 15.68 | 222.57 | 11.65 | 8.68% | 0.77x |

| CSL Finance Ltd | 31.64 | 241.21 | 10.56 | 14.18% | 1.37x |

| Akme Fintrade (India) Ltd | 8.28 | 89.56 | 0.94 | 11.09% | 0.09x |

| Moneyboxx Finance Ltd | 0.39 | 79.85 | 476.67 | 0.53% | 2.33x |

Analyst View

- Strengths: Laxmi India boasts a solid RoNW of 15.66%, placing it ahead of many peers in terms of return on shareholder equity.

- Valuation Balance: While its P/E (22.9x) is on the higher side post-IPO, its P/B (2.57x) is still moderate, reflecting growth optimism but not overvaluation.

- Upside Potential: If the company maintains its current growth rate (PAT +60%) and keeps asset quality stable, there’s room for re-rating post-listing.

Grey Market Premium (GMP) – Laxmi India Finance IPO

As of the latest update, the Laxmi India Finance IPO is witnessing a neutral sentiment in the grey market, with no visible premium being reported.

Latest GMP Update

| Date | IPO Price | GMP | Estimated Listing Price | Estimated Profit | GMP Trend |

|---|---|---|---|---|---|

| 23 July 2025 | ₹158.00 | ₹0 | ₹158.00 | ₹0 (0.00%) | No change from previous day |

What Does This Mean?

Despite strong financials and sectoral tailwinds, the flat GMP signals that investors are currently taking a wait-and-watch approach, possibly due to:

- Broader market volatility

- Conservative valuations

- Investor caution post-recent IPO listings

However, it’s worth noting that GMP is unofficial and doesn’t always reflect actual listing performance.

Conclusion: Should You Apply for the Laxmi India Finance IPO?

Laxmi India Finance presents a compelling growth narrative. While its fundamentals appear robust, the listing prospects are currently subdued due to a flat grey market premium (GMP). Therefore, your investment strategy should depend on your risk appetite and time horizon.

Short-Term Strategy – Cautiously Neutral

For short-term investors, the IPO doesn’t promise immediate fireworks:

- Although the financials are solid, the GMP remains unchanged, indicating little or no listing gains at this point.

- Moreover, there are no major market tailwinds currently to support speculative buying.

Strategy: If you’re looking for quick profits, apply cautiously. A small allocation could still work in your favor if QIB and retail demand picks up sharply in the final hours.

Long-Term Strategy – Positive Bias

On the other hand, long-term investors may find Laxmi India Finance more attractive:

- The company has shown consistent growth, with a 60% jump in PAT and 42% rise in revenue YoY.

- Additionally, its deep presence in underserved regions like Rajasthan and consistent branch expansion offer a strong moat.

- Furthermore, with 80% of MSME loans qualifying as Priority Sector Lending, the company is well-aligned with government and RBI initiatives.

Strategy: If you believe in the long-term growth of India’s NBFC sector and rural credit ecosystem, this IPO could be a solid pick. Consider holding for 2–3 years to potentially benefit from AUM compounding and expanding profitability.

Allotment Strategy – Smart Bidding Advice

When it comes to allotment, a strategic approach can improve your chances:

- While the IPO is moderately sized, retail participation could spike in later stages.

- Therefore, applying through multiple retail applications (via family PANs) could improve your odds.

- Alternatively, if the HNI segment shows low demand until Day 2, a small HNI application (₹2–5 lakh) might offer better chances of allocation.

Should You Apply?

Skip if you’re chasing listing gains—GMP is flat. But if you’re in for the long run, Laxmi India Finance’s solid growth and rural lending focus make it a worthy bet.

Long-Term Play:

Strong AUM growth, wide reach, and MSME focus could deliver steady compounding.

Allotment Hack:

Apply across family PANs or watch the HNI demand—low bids may get lucky.

FAQs about Laxmi India Finance IPO

1. What is the Laxmi India Finance IPO opening and closing date?

The IPO opens on July 25, 2025, and closes on July 29, 2025.

2. What is the price band for Laxmi India Finance IPO?

The IPO price is fixed at ₹158 per share.

3. What is the lot size for the Laxmi India Finance IPO?

Investors can apply in lots of 1,000 shares, costing ₹158,000 per lot.

4. What is the objective of the IPO?

Primarily to boost capital base for lending and support future business growth.

5. Is Laxmi India Finance a deposit-taking NBFC?

No, it is a non-deposit taking NBFC focused on MSME and vehicle loans.

6. What is the company’s AUM as of March 2025?

Laxmi India Finance reported an AUM of ₹1,277 crore as of March 31, 2025.

7. What are the key risk factors?

High dependence on MSME lending, regional concentration, and rising NPAs in rural credit.

8. Is there any GMP (Grey Market Premium)?

Currently, the GMP is ₹0, suggesting no listing pop is expected.

9. Who are the peer companies?

Peers include MAS Financial, Five Star Business, SBFC Finance, and Ugro Capital.

10. Should I apply for this IPO?

If you’re looking for long-term potential in India’s underserved lending sector, yes. For listing gains, maybe wait and watch.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?