Introduction: Kalpataru IPO

The Kalpataru IPO is all set to test investor confidence — with a ₹1,590 crore fresh issue from a company that’s both respected and risky.

Kalpataru Limited, one of India’s oldest and most recognized real estate players, is hitting the primary market at a time when the real estate sector is booming—but its own financials tell a different story. The company has completed 70 projects across metros like Mumbai, Pune, Bengaluru, and Hyderabad, and currently has 40 more in the pipeline.

But here’s the twist: Kalpataru has been loss-making for three straight years.

So why is this IPO generating buzz?

Because the company plans to repay a chunk of its huge debt and reboot growth. Backed by brand strength and a large urban footprint, the Kalpataru IPO is a bold bet that blends potential with caution.

Should you buy into this story of revival and real estate reach? Let’s dive in.

📋 Kalpataru IPO Details

| Particulars | Details |

|---|---|

| IPO Size | ₹1,590.00 crore (Fresh Issue only) |

| IPO Dates | June 24, 2025 to June 26, 2025 |

| Listing Date | Tue, Jul 1, 2025 |

| Price Band | ₹387 to ₹414 per share |

| Lot Size | 36 Shares |

| Face Value | ₹10 per share |

| IPO Type | Bookbuilding IPO |

| Listing At | BSE and NSE |

| Pre-Issue Shares | 16,74,89,537 shares |

| Post-Issue Shares | 20,58,95,334 shares |

| Employee Discount | ₹38 per share |

| Lead Managers | ICICI Securities, JM Financial, Nomura |

| Registrar | MUFG Intime India Pvt Ltd (Link Intime) |

| Promoters | Mofatraj P. Munot, Parag M. Munot |

🧾 Reservation Breakdown

| Investor Category | Reservation |

|---|---|

| QIB | Not less than 75% of the Net Offer |

| NII (HNI) | Not more than 15% of the Net Offer |

| Retail | Not more than 10% of the Net Offer |

Kalpataru IPO Objectives: Where Will the ₹1,590 Cr Go?

Kalpataru Limited plans to channel the IPO proceeds into two key priorities that aim to improve its financial structure and operational efficiency.

1. Repaying Borrowings – ₹1,192.5 Cr

The company will use a major share of the funds to repay or prepay specific loans taken by itself and its subsidiaries. By doing so, Kalpataru expects to reduce interest costs and improve its credit profile. This step also strengthens the balance sheet and paves the way for healthier future cash flows.

2. Fueling Business Growth

In addition to debt repayment, Kalpataru will use the remaining funds for general corporate purposes. These may include working capital needs, expanding operations, or launching new projects. This flexibility enables the company to remain agile in a competitive real estate market.

In summary, Kalpataru’s IPO is more than just a fundraising event — it’s a strategic move to reduce debt and create headroom for growth.

Kalpataru Limited: A Real Estate Giant with an Integrated Edge

Kalpataru Limited isn’t just another name in real estate — it’s one of the most established and integrated real estate developers in the Mumbai Metropolitan Region (MMR). With over three decades of experience and a legacy built under the Kalpataru Group banner, the company has carved out a strong reputation for trust, quality, and timely delivery.

Deep Roots in Key Markets

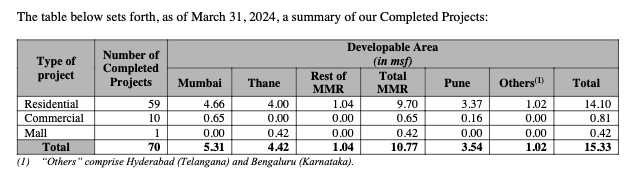

Kalpataru’s footprint spans high-demand urban centers like Mumbai, Thane, Panvel, Pune, Hyderabad, Indore, Bengaluru, and Jodhpur. As of March 31, 2024, it had completed 113 projects, covering more than 24.10 million square feet (msf) of developable area. A massive 67.71% of its residential portfolio is concentrated in the MMR — one of India’s most premium and supply-demand-driven regions.

A Fully Integrated Development Model

What sets Kalpataru apart is its end-to-end execution model. The company manages the entire lifecycle of real estate development — from land acquisition and planning to design, construction, marketing, and sales. This model not only improves project efficiency but also enhances quality control and customer experience.

Diverse Offerings Across Segments

Kalpataru focuses on luxury, premium, and mid-income housing, while also building commercial complexes, shopping malls, lifestyle gated communities, and integrated townships. It also explores asset-light development strategies, including joint ventures (JVs), joint development agreements (JDAs), and redevelopment models — giving it a flexible and capital-efficient growth edge.

As of March 31, 2024:

- Ongoing Projects: 22.02 msf developable area

- Forthcoming Projects: 19.93 msf developable area (FY25–FY27 launches)

- Land Reserves: 1,886.10 acres

Backed by the Kalpataru Group’s Global Legacy

Founded in 1969, the Kalpataru Group has a global presence with operations in 73 countries and a workforce of over 27,000 employees. With expertise in EPC contracting, infrastructure, logistics, and facility management, the group gives Kalpataru Limited unmatched technical and operational synergies. It also benefits from shared brand equity through a licensing agreement with Kalpataru Business Solutions Pvt. Ltd.

Strategic Focus and Research-Driven Planning

Kalpataru uses a research-backed approach to optimize layouts, FSI utilization, unit sizes, amenities, and sales strategy. With ongoing and upcoming projects across Maharashtra, Telangana, Uttar Pradesh, Gujarat, and Rajasthan, it is well-positioned to capitalize on regional growth trends.

Kalpataru Limited Financial Snapshot: Growth with Red Flags

While Kalpataru Limited commands a strong brand in real estate, its financials tell a more nuanced story. The company has witnessed volatile revenue trends and reported consistent losses over the last three fiscal years.

Key Financial Metrics (₹ in Crore)

| Fiscal Year End | Revenue | Profit After Tax | Net Worth | Total Assets | Total Borrowings |

|---|---|---|---|---|---|

| FY 2024 | 2,029.94 | -113.81 | 1,028.23 | 13,879.43 | 10,688.31 |

| FY 2023 | 3,716.61 | -226.79 | 1,221.89 | 12,540.77 | 9,679.64 |

| FY 2022 | 1,248.55 | -121.55 | 1,429.01 | 13,410.57 | 10,365.97 |

Financial Trends: What’s Working and What Isn’t

- Revenue Volatility: FY23 saw a revenue spike (₹3,716.61 Cr), but FY24 experienced a sharp drop of over 45%. This inconsistency could reflect the lumpy nature of project-based income in real estate.

- Persistent Losses: The company remains in the red, with a net loss of ₹113.81 Cr in FY24. Despite a narrowing of losses compared to FY23, it raises questions about profitability sustainability.

- High Debt Load: With total borrowings at ₹10,688.31 Cr, Kalpataru is highly leveraged. The IPO proceeds aim to ease this pressure — a strategic move to rebalance its capital structure.

- Deteriorating Net Worth: Net worth has steadily declined from ₹1,429.01 Cr in FY22 to ₹1,028.23 Cr in FY24, driven by accumulated losses.

Key Performance Indicator (KPI)

- Return on Net Worth (RoNW): -9.80% (FY24) — reflecting the company’s ongoing struggle to generate shareholder value.

🔎 While Kalpataru’s brand power and execution capability are clear, investors must weigh the company’s financial fragility before making allocation decisions.

Strengths and Risks of Kalpataru Limited IPO

Before investing in the Kalpataru Limited IPO, it’s essential to weigh the company’s strategic strengths against its financial and operational risks. Here’s a detailed breakdown:

✅ Strengths

- Strong Brand Legacy

- Kalpataru has over three decades of experience in real estate and benefits from the 55-year legacy of the Kalpataru Group, known for quality and reliability across sectors.

- Dominant Presence in MMR

- The company holds a significant footprint in the Mumbai Metropolitan Region (MMR), which has consistently ranked #1 in supply, absorption, and price growth among India’s top seven property markets (2019–2023).

- Integrated Business Model

- From land acquisition to project marketing, Kalpataru handles everything in-house. This control enables operational efficiency and better delivery timelines.

- Asset-Light Expansion Strategy

- By leveraging joint ventures (JVs), joint development agreements (JDAs), and redevelopment models, Kalpataru minimizes capital outlay while maintaining growth momentum.

- Robust Pipeline

- With 22.02 million sq ft in ongoing projects and 19.93 million sq ft in forthcoming launches, Kalpataru has strong revenue visibility over the next few years.

- Group Synergies

- Backed by the Kalpataru Group’s global expertise in EPC, infrastructure, and logistics, the company gains execution advantages and diversified knowledge.

⚠️ Risks

- Consistent Losses

- Kalpataru has posted net losses for the last three financial years. While the scale of loss has narrowed, profitability remains elusive.

- High Debt Levels

- As of FY24, total borrowings stood at ₹10,688.31 crore. Although the IPO aims to reduce debt, the current leverage level poses a financial strain.

- Heavy Regional Dependence

- Over 67% of residential developable area is concentrated in MMR. A downturn in this market could disproportionately affect revenues.

- Intense Competition

- The Indian real estate space, especially in metro cities, is crowded with established players like Godrej Properties, Oberoi Realty, and Lodha Group — all competing for the same customer base.

- Project Execution Risks

- Real estate development faces delays due to regulatory, legal, or environmental approvals. Any such hiccups can impact cash flow and investor confidence.

- Brand Licensing Arrangement

- The use of the “Kalpataru” name is subject to a licensing agreement with a group company. Any change or revocation in this agreement could affect brand continuity.

Bottom Line: Kalpataru Limited offers a compelling mix of brand strength, project scale, and group support. However, financial instability and high leverage make it a high-risk, high-potential bet — suitable mainly for long-term or aggressive investors.

Kalpataru IPO GMP Today

The Grey Market Premium (GMP) for Kalpataru Limited IPO has not started yet as the IPO dates and price band are still awaited. Investors are advised to stay tuned for GMP updates once the IPO timeline is officially announced.

Conclusion: Should You Apply for Kalpataru IPO?

Kalpataru Limited comes with a strong legacy, backed by the reputable Kalpataru Group with over five decades of experience. With a well-diversified portfolio across the Mumbai Metropolitan Region (MMR) and other high-potential urban markets, an integrated development model, and a significant land reserve pipeline, the company is well-positioned to capitalize on India’s growing real estate demand.

However, the persistent financial red flags—including losses in FY22, FY23, and FY24—raise valid concerns about profitability and debt sustainability. Investors should watch the IPO pricing, GMP trends, and upcoming financial disclosures before making a decision.

Short-Term View

At this stage, Kalpataru IPO doesn’t appear ideal for listing gain seekers, especially given its ongoing losses and negative RoNW. Unless there’s a notable surge in GMP or strong anchor interest, conservative investors may prefer to stay on the sidelines.

Long-Term View

Kalpataru’s extensive project pipeline, brand equity, and leadership in the MMR region suggest future potential. However, a clear financial turnaround is essential. Long-term investors should track revenue recovery, execution strength, and debt management before committing capital.

Allotment Strategy

A cautious approach is recommended. Consider applying only if:

- There’s a meaningful uptick in GMP close to the IPO date, or

- The company demonstrates improved financial health or promising forward guidance.

FAQs: Kalpataru Limited IPO

1. What is the issue size of the Kalpataru IPO?

The total issue size is ₹1,590 crore, and it is entirely a fresh issue of shares.

2. Who are the promoters of Kalpataru Limited?

The promoters are Mr. Mofatraj P. Munot and Mr. Parag M. Munot, part of the reputed Kalpataru Group with over 55 years of legacy.

3. Is Kalpataru IPO good for listing gains?

Given the company’s losses in FY22, FY23, and FY24, it may not be ideal for short-term listing gains unless GMP improves significantly near the IPO date.

4. What are the strengths of Kalpataru Limited?

Kalpataru has a strong brand, integrated real estate model, wide geographic presence in high-demand markets like MMR, and a solid pipeline of upcoming projects.

5. What are the financial red flags in Kalpataru IPO?

The company reported losses for three consecutive years and has high borrowings, which may concern risk-averse investors.

6. Will Kalpataru IPO be listed on NSE and BSE?

Yes, the IPO will be listed on both the NSE and BSE.

7. What is the face value of Kalpataru IPO shares?

The face value is ₹10 per share.

8. How should I decide whether to apply for Kalpataru IPO?

Investors should wait for pricing details, observe GMP trends, and assess financial improvement before making a decision.

9. What is the Kalpataru Group known for?

The Kalpataru Group is known for its real estate, EPC contracting, civil infrastructure, and logistics operations across 73 countries.

10. Is there a grey market premium (GMP) for Kalpataru IPO?

As of now, GMP has not started. Keep an eye closer to the IPO date for updates.

Related Articles

How Micro Factors Impact the Stock Market: A Deep Dive into India’s Sectoral Shifts