Introduction

The JSW Cement IPO is coming to the Indian stock market, giving investors a chance to invest in one of the country’s fastest-growing green cement manufacturers. Backed by the JSW Group, the company aims to raise ₹3,600 crore through a mix of fresh shares and an offer for sale. The IPO opens for subscription on August 7, 2025, and it has already caught investors’ attention with its strong market presence and sustainable product portfolio.

The price band for the IPO is ₹139 to ₹147 per share, attracting both retail and institutional investors. In this blog, we cover JSW Cement IPO details, financials, valuation, and key strategies to help you decide if this IPO fits your investment plan.

JSW Cement IPO: Details & Key Dates

The JSW Cement IPO opens for subscription on August 7, 2025, and closes on August 11, 2025. Investors can bid for shares within a price band of ₹139 to ₹147 per share. The IPO includes a fresh issue of ₹1,600 crore and an offer for sale (OFS) of ₹2,000 crore, totaling ₹3,600 crore.

IPO Details

| Particulars | Details |

|---|---|

| IPO Opening Date | August 7, 2025 |

| IPO Closing Date | August 11, 2025 |

| Listing Date (Tentative) | August 14, 2025 |

| Face Value | ₹10 per share |

| Price Band | ₹139 to ₹147 per share |

| Lot Size | 102 shares |

| Total Issue Size | 24,48,97,958 shares (₹3,600 Cr) |

| Fresh Issue | 10,88,43,537 shares (₹1,600 Cr) |

| Offer for Sale | 13,60,54,421 shares (₹2,000 Cr) |

| Issue Type | Book Building IPO |

| Listing At | BSE & NSE |

IPO Timeline (Tentative)

| Event | Date |

|---|---|

| IPO Open Date | August 7, 2025 |

| IPO Close Date | August 11, 2025 |

| Allotment Date | August 12, 2025 |

| Refunds Initiation | August 13, 2025 |

| Shares Credit to Demat | August 13, 2025 |

| Listing Date | August 14, 2025 |

| UPI Mandate Confirmation Cut-off | 5 PM, August 11, 2025 |

JSW Cement IPO Objective

JSW Cement plans to utilize the net proceeds for the following purposes:

- Establish a new integrated cement unit in Nagaur, Rajasthan – ₹800 crore

- Prepayment or repayment of certain outstanding borrowings – ₹520 crore

- General corporate purposes

Company Overview: JSW Cement IPO

JSW Cement Limited, incorporated in 2006 and part of the JSW Group, is a leading manufacturer of green cement in India. The company focuses on sustainable cementitious products such as GGBS, PSC, PCC, OPC, and RMC, along with construction chemicals and screened slag.

JSW Cement began operations in 2009 with a single grinding unit in Vijayanagar, Karnataka. Since then, it has expanded across the southern, western, and eastern regions of India. Additionally, the company operates internationally through JSW Cement FZC in the UAE, which supplies clinker to its Dolvi unit and other customers.

As of March 31, 2025, JSW Cement operates seven plants in India, including one integrated unit, one clinker unit, and five grinding units, located in:

- Andhra Pradesh – Nandyal (Integrated Unit)

- Karnataka – Vijayanagar (Grinding Unit)

- Tamil Nadu – Salem (Grinding Unit)

- Maharashtra – Dolvi (Grinding Unit)

- West Bengal – Salboni (Grinding Unit)

- Odisha – Jajpur (Grinding Unit) and Shiva Cement (Clinker Unit)

Consequently, this strong network allows JSW Cement to maintain a robust supply chain and pan-India presence.

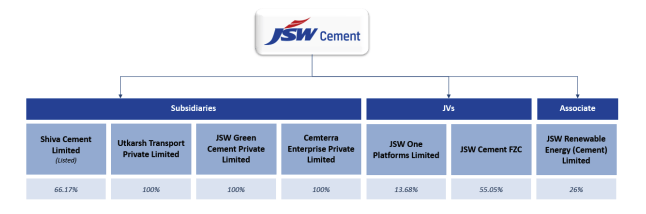

Subsidiaries, JVs, and Associates

JSW Cement’s growth is further supported by a network of subsidiaries, joint ventures, and associates:

- Subsidiaries:

- Shiva Cement Limited – 66.17%

- Utkarsh Transport Private Limited – 100%

- JSW Green Cement Private Limited – 100%

- Cemterra Enterprise Private Limited – 100%

- Joint Ventures (JVs):

- JSW One Platforms Limited – 13.4%

- JSW Cement FZC – 55.05%

- Associate:

- JSW Renewable Energy (Cement) Limited – 26%

Moreover, these entities enhance the company’s production capabilities, logistics network, and renewable energy integration.

Key Performance Snapshot

- JSW Cement ranks among the top 3 fastest-growing cement manufacturers in India from FY15–FY25 in terms of installed capacity and sales volume.

- Furthermore, it is among the top 10 cement companies in India by installed capacity and sales volume (CRISIL Report, March 31, 2025).

- Installed Grinding Capacity: 20.60 MMTPA (South: 11.00, West: 4.50, East: 5.10).

- Installed Clinker Capacity: 6.44 MMTPA, including the UAE unit.

- Additionally, JSW Cement plans to expand capacity to 41.85 MMTPA and clinker capacity to 13.04 MMTPA, creating a pan-India footprint.

- Industry Leadership in GGBS: 84% market share in FY25, with 77.41% of total sales from green cementitious products.

- Eco-Friendly Advantage: Clinker-to-cement ratio of 50.13% in FY25, lower than the peer average of 66.43%, resulting in lower CO₂ emissions.

- As a result of its aggressive expansion, the company achieved a 12.42% CAGR in capacity and 15.05% CAGR in sales volume (FY23–FY25), outperforming the industry average of 6.23% and 8.12%.

Financial Highlights & Key Ratios – JSW Cement IPO

JSW Cement has shown mixed financial performance over the last three fiscal years. While revenue remained stable, the company posted a loss in FY25 due to rising costs and interest expenses. Additionally, its debt levels increased as it pursued capacity expansions. Despite this, JSW Cement continues to maintain a strong operational presence supported by consistent EBITDA margins.

Restated Financial Performance (₹ in Crore)

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|

| Assets | 12,003.94 | 11,318.91 | 10,218.61 |

| Total Income | 5,914.67 | 6,114.60 | 5,982.21 |

| Profit After Tax | -163.77 | 62.01 | 104.04 |

| EBITDA | 815.32 | 1,035.66 | 826.97 |

| Net Worth | 2,352.55 | 2,464.68 | 2,292.10 |

| Reserves & Surplus | 1,287.31 | 1,399.06 | 1,296.66 |

| Total Borrowings | 6,166.55 | 5,835.76 | 5,421.54 |

Key observations:

- Revenue declined 3.27% from FY24 to FY25 due to market pressures.

- PAT turned negative in FY25, primarily due to higher finance costs and expansion-related expenses.

- EBITDA margin remains healthy, reflecting operational efficiency despite the profit dip.

Key Financial Ratios

| KPI (as of 31 Mar 2025) | Value |

|---|---|

| ROE | -6.90% |

| ROCE | 7.05% |

| Debt-to-Equity Ratio | 0.98 |

| RoNW | -4.85% |

| PAT Margin | -2.77% |

| EBITDA Margin | 13.78% |

| Price to Book Value | 6.16 |

Additionally:

- High debt levels indicate reliance on borrowings for expansion.

- Negative PAT and RoNW suggest short-term profitability pressure.

- However, strong EBITDA margins and strategic capacity growth could support long-term recovery once new units start contributing to revenue.

Valuation & Peer Comparison – JSW Cement IPO

The JSW Cement IPO valuation reflects a growth-focused company facing short-term profitability pressure. Before the IPO, the company’s EPS stood at -₹1.31, which slightly improves to -₹1.20 post-issue. However, the P/E ratio remains negative due to the loss in FY25. The Price-to-Book (P/B) ratio stands at 6.16, which is higher than some peers, indicating a premium valuation on its book value despite the recent loss.

JSW Cement Valuation Snapshot

| Metric | Pre-IPO | Post-IPO |

|---|---|---|

| EPS (₹) | -1.31 | -1.20 |

| P/E (x) | -112.61 | -122.38 |

| Price-to-Book | 6.16 | 6.16 |

Key Takeaway:

- The company is not profitable at the time of the IPO, which results in a negative P/E.

- Investors must rely on future growth and capacity expansion rather than current earnings for valuation comfort.

JSW Cement IPO Peer Comparison

The table below compares JSW Cement with major listed cement players as of March 31, 2025:

| Company Name | EPS (Basic) | NAV/Share (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

|---|---|---|---|---|---|

| JSW Cement Limited | -1.16 | 23.85 | NA | -4.85 | 6.16 |

| UltraTech Cement Limited | 205.30 | 2,403.71 | 59.56 | 8.54 | 5.08 |

| Ambuja Cements Limited | 17.00 | 218.00 | 35.97 | 7.80 | 2.80 |

| Shree Cement Limited | 311.18 | 5,969.32 | 97.77 | 5.21 | 5.10 |

| Dalmia Bharat Limited | 36.42 | 926.34 | 60.39 | 3.93 | 2.37 |

| JK Cement Limited | 111.44 | 788.03 | 58.39 | 14.14 | 8.26 |

| The Ramco Cements Limited | 11.53 | 314.82 | 103.50 | 3.66 | 3.80 |

| The India Cements Limited | 153.23 | 328.95 | 2.38 | -1.41 | 1.11 |

Observations:

- Compared to peers, JSW Cement has negative earnings, which results in no meaningful P/E ratio.

- Despite losses, the company trades at a P/BV of 6.16, which is higher than Ambuja, Dalmia, and India Cements.

- Premium valuation suggests investor confidence in growth prospects, especially due to planned capacity expansions and green cement leadership.

- In contrast, established players like UltraTech and Shree Cement offer stable profitability with moderate P/B multiples.

Grey Market Premium (GMP) – JSW Cement IPO

The Grey Market Premium (GMP) gives investors an early hint of potential listing gains. As of August 4, 2025, the JSW Cement IPO GMP stands at ₹21 per share, showing an upward movement in the unlisted market. Consequently, the stock is expected to list at a premium of around 14.29% over the upper price band of ₹147.

JSW Cement IPO Day-wise GMP Trend

| Date | IPO Price | GMP | Estimated Listing Price | Estimated Profit* |

|---|---|---|---|---|

| 04-08-2025 | ₹147.00 | ₹21 ↑ (Up) | ₹168 (14.29%) | ₹2,142 |

*Estimated profit is calculated per retail lot of 102 shares.

Key Takeaways:

- GMP movement indicates positive market sentiment ahead of the listing.

- If the trend sustains, the IPO may offer moderate listing gains for short-term investors.

- However, GMP is unofficial and speculative; investors should not rely solely on it for decision-making.

Conclusion: Should You Apply for the JSW Cement IPO?

The JSW Cement IPO provides an opportunity to invest in a fast-growing, sustainability-focused cement manufacturer backed by the JSW Group. The company has built a pan-India presence, expanded capacity aggressively, and established leadership in GGBS and other green cement products. However, short-term profitability pressure from FY25 losses and rising debt levels must be considered before investing.

Short-Term Strategy

In the short term, listing gains appear moderate, with the current GMP at ₹21 per share, indicating a 14–15% expected premium over the IPO price. Investors seeking quick gains may consider applying, but they should closely track the GMP trend and overall subscription levels until the final day of bidding.

Long-Term Strategy

Long-term investors may find the IPO appealing because JSW Cement is doubling its capacity from 20.6 MMTPA to 41.85 MMTPA, which can significantly enhance revenue and profitability once fully operational. Its focus on green cement, eco-friendly products, and low clinker-to-cement ratio aligns well with the future sustainability trends of the construction sector. Patience may be required, as profitability is likely to improve gradually post-expansion.

Allotment Strategy

Retail investors can apply for multiple lots up to their permissible limit to improve the odds of allotment. Applying early in the IPO window and monitoring subscription trends across retail, HNI, and QIB categories may help investors make informed decisions.

Final Verdict:

The JSW Cement IPO is best suited for medium- to long-term investors who can tolerate short-term earnings pressure in exchange for strong future growth potential. Short-term participants can also consider applying if the GMP remains stable or strengthens closer to the listing date.

JSW Cement IPO – FAQs

1. What is the JSW Cement IPO price band?

The JSW Cement IPO price band is ₹139 to ₹147 per share.

2. What are the JSW Cement IPO opening and closing dates?

The IPO opens on August 7, 2025, and closes on August 11, 2025.

3. What is the lot size for the JSW Cement IPO?

The minimum lot size is 102 shares, requiring an investment of ₹14,994.

4. What is the expected listing date of JSW Cement IPO?

The JSW Cement IPO is likely to list on August 14, 2025, on BSE and NSE.

5. What is the JSW Cement IPO GMP today?

As of August 4, 2025, the JSW Cement IPO GMP is ₹21 per share, indicating a 14–15% expected premium.

6. How is the financial performance of JSW Cement?

JSW Cement reported FY25 revenue of ₹5,914.67 crore and a loss of ₹163.77 crore, with strong EBITDA margins of 13.78%.

7. Should I apply for the JSW Cement IPO?

Investors may consider applying for long-term growth potential, while short-term gains are possible if the GMP remains positive.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?