Introduction: Why Jio BlackRock Mutual Fund Could Change the Game

The Indian mutual fund industry has a powerful new entrant — the Jio BlackRock Mutual Fund. This joint venture between Jio Financial Services and global investment firm BlackRock is one of the most anticipated launches in recent years. Backed by strong brand names and a “digital-first” approach, the fund aims to redefine how Indians invest.

After receiving SEBI’s final approval in May 2025, the Jio BlackRock Mutual Fund rolled out its first three investment schemes. These products are designed for short-term investors and come with low entry barriers. However, what makes this fund house stand out isn’t just its launch strategy — it’s the unique blend of cutting-edge technology and investment experience.

As more Indian investors embrace digital tools for wealth management, the timing of this launch aligns with shifting market behavior.

In the following sections, we’ll break down how the Jio BlackRock Mutual Fund operates, explore its offerings, and help you decide if it fits your investment goals.

Inside the Jio BlackRock Mutual Fund Partnership

The Jio BlackRock Mutual Fund brings together two giants from very different worlds—technology-led financial services and global investment management. On one side is Jio Financial Services, a part of the Reliance Group, known for its wide reach and digital-first approach. On the other is BlackRock, the world’s largest asset manager, handling over US$11 trillion across markets.

This partnership is more than just a brand collaboration. Jio offers deep market penetration in India, especially among digital-first users. Its presence through platforms like the MyJio app gives the mutual fund a ready base of retail investors. BlackRock, in contrast, brings decades of experience in managing global portfolios. It also offers advanced tools like the ALADDIN platform, which helps manage risk and improve decision-making.

For BlackRock, this marks a return to India’s mutual fund space after nearly seven years. It had previously exited its joint venture with DSP Investment Managers in 2018. The re-entry signals renewed confidence in India’s growing retail investment ecosystem.

Together, these strengths are expected to give the Jio BlackRock Mutual Fund a competitive edge—combining global expertise with local reach and digital convenience.

Jio BlackRock Mutual Fund & ALADDIN: A Tech Advantage

One of the biggest strengths behind the Jio BlackRock Mutual Fund is its access to ALADDIN—BlackRock’s proprietary technology platform. ALADDIN stands for Asset, Liability, and Debt and Derivative Investment Network. It’s often described as the software that powers many of the world’s largest portfolios.

ALADDIN connects portfolio management, trading, risk analysis, and compliance into one system. This allows fund managers to view real-time data, assess portfolio risks instantly, and make more informed decisions. It’s used by top institutional investors across the globe—including banks, pension funds, and sovereign wealth funds.

For Indian investors, the use of ALADDIN within the Jio BlackRock Mutual Fund could offer a significant advantage. It means access to global-grade risk management and strategy execution, even in basic mutual fund products.

By combining ALADDIN’s intelligence with Jio’s digital infrastructure, the mutual fund aims to deliver better transparency, efficiency, and performance tracking. This integration reflects the fund’s core philosophy: using smart technology to empower everyday investors.

Read More About Aladdin: Jio BlackRock and Aladdin: Is This the Jio Moment for Mutual Funds in India?Jio BlackRock Mutual Fund Schemes: What’s on Offer?

The Jio BlackRock Mutual Fund has launched with three short-term debt-oriented schemes, each designed to balance safety, liquidity, and modest returns. With a minimum investment of just ₹500 and no distributor commissions (direct-only plans), these funds are clearly targeting cost-conscious, digital-first investors. Let’s explore them in detail:

🔹 JioBlackRock Liquid Fund

The JioBlackRock Liquid Fund is an open-ended scheme that invests in money market and debt instruments with a residual maturity of up to 91 days. Its primary goal is to offer better returns than a regular savings account, while ensuring capital safety and liquidity.

Key Highlights:

- Minimum Investment: ₹500 (lump sum or SIP)

- Exit Load: 0.007% on Day 1, reducing daily to 0% after Day 7

- Benchmark: Nifty Liquid Index A-I

- Fund Managers: Arun Ramachandran, Vikrant Mehta, Siddharth Deb

- Provisional Credit Rating: ICRA A1+ (for portfolio instruments)

- Risk Level: Low to Moderate

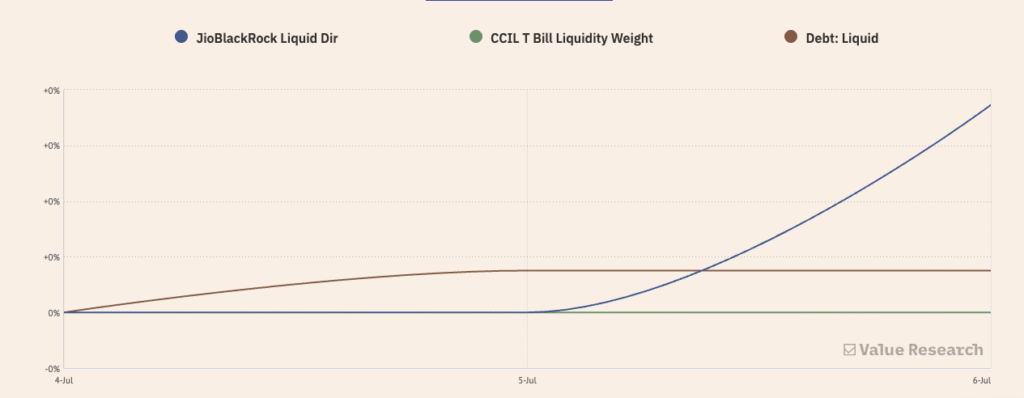

Comparative Insight:

Although the fund is new and performance data is not yet available, peer liquid funds like Bajaj Finserv Liquid Fund currently deliver ~7.27% annual returns with a 0.11% expense ratio. If Jio BlackRock Mutual Fund matches that efficiency, it could become a strong choice for short-term cash parking.

Ideal For:

Investors seeking a low-risk option to park idle funds for a few weeks to months with better-than-bank returns.

🔹 JioBlackRock Overnight Fund

The JioBlackRock Overnight Fund is the most conservative of the three. It invests exclusively in overnight securities, meaning assets that mature within 24 hours. This virtually eliminates both interest rate risk and credit risk.

Key Highlights:

- Minimum Investment: ₹500

- Exit Load: None – full liquidity available

- Benchmark: Nifty 1D Rate Index

- Fund Managers: Arun Ramachandran, Vikrant Mehta, Siddharth Deb

- Risk Level: Low

Comparative Insight:

Top overnight funds like Axis Overnight Fund offer ~6.45% 1-year returns with ultra-low expense ratios (around 0.06%). While expense data for this Jio BlackRock scheme isn’t public yet, the positioning suggests similar competitiveness.

Ideal For:

Ultra-conservative investors who prioritize capital safety and need to park funds for just a few days with instant liquidity.

🔹 JioBlackRock Money Market Fund

The Money Market Fund takes a slightly longer-term approach, investing in instruments like Commercial Papers (CPs), Certificates of Deposit (CDs), Treasury Bills (T-bills), and repos with up to 1-year maturity.

Key Highlights:

- Minimum Investment: ₹500

- Exit Load: None

- Benchmark: Nifty Money Market Index A-I

- Fund Managers: Same team as other schemes

- Risk Level: Moderate (per SEBI’s risk-o-meter)

Comparative Insight:

Money market funds from leading AMCs typically deliver 6–7% returns with expense ratios between 0.10–0.18%. While Jio BlackRock’s performance is yet to be established, its reliance on BlackRock’s ALADDIN tech could give it an operational edge over time.

Ideal For:

Investors looking for a short-term (6–12 months) investment option that balances safety and return potential without locking in funds.

Quick Comparison Table

| Fund Name | Exit Load | Risk Level | Benchmark | Ideal For |

|---|---|---|---|---|

| Liquid Fund | 0.007% → 0% (Day 7) | Low–Moderate | Nifty Liquid Index A-I | Parking idle funds for a few months |

| Overnight Fund | None | Low | Nifty 1D Rate Index | Short-term parking for days/weeks |

| Money Market Fund | None | Moderate | Nifty Money Market Index A-I | Short-term investing (6–12 months) |

Final Thoughts on the Schemes

By starting with simple, low-risk debt funds, the Jio BlackRock Mutual Fund appears to be focusing on building investor trust. The fund house is clearly playing to its strengths: low entry barriers, tech-enabled access, and institutional-grade risk management. Once these schemes gain traction, it’s likely the AMC will expand into equity and hybrid categories.

For now, if you’re looking for short-term investment options with the convenience of digital access and the backing of global expertise, these offerings deserve a closer look.

Leadership Behind the Fund

Strong leadership is often a key indicator of how a new fund house might perform. In the case of the Jio BlackRock Mutual Fund, the leadership is both seasoned and globally experienced.

Meet Sid Swaminathan – MD & CEO

At the helm is Sid Swaminathan, who has been appointed as the Managing Director and Chief Executive Officer of Jio BlackRock. He brings over two decades of deep experience in asset management across multiple geographies, asset classes, and investment styles.

Previously, Sid served as the Head of Index Equity for EMEA (Europe, Middle East, and Africa) and APAC (Asia Pacific) at BlackRock, operating out of London. In that role, he was responsible for managing a massive US$1.25 trillion in assets. His oversight spanned both passive and systematic strategies, giving him a robust understanding of institutional-grade fund management.

Before that, he led fixed income portfolio management for EMEA, where he managed portfolios driven by indexed and systematic investment strategies. His broad exposure to both equity and debt markets makes him uniquely qualified to lead a fund house launching with debt-oriented schemes.

Why This Matters

For the Jio BlackRock Mutual Fund, Swaminathan’s appointment signals a clear intent: to build a world-class AMC rooted in global standards but designed for Indian investors. His international background also strengthens BlackRock’s commitment to the Indian market, which it had exited in 2018 when it ended its JV with DSP Investment Managers.

Under his leadership, the fund house is expected to emphasize:

- Disciplined investment strategies

- Robust risk management

- Efficient, technology-led distribution

This leadership vision aligns well with the broader strategy of Jio Financial Services, which focuses on scaling financial products digitally across Bharat.

Should You Invest in Jio BlackRock Mutual Fund?

Investing in a new fund house always requires thoughtful evaluation. While the Jio BlackRock Mutual Fund certainly brings credibility through its parentage, it’s still in the early stages of building a track record. So, how should you decide if this AMC fits into your portfolio?

1. Your Risk Profile and Investment Horizon

First, consider your risk tolerance. All three schemes currently offered by the Jio BlackRock Mutual Fund are debt-oriented, targeting short-term investors. If you’re looking for capital preservation and modest returns over a few days to 12 months, these funds may suit you well.

However, if your goals involve long-term wealth creation or higher return expectations, you may need to wait for future equity or hybrid schemes, which the fund is likely to introduce down the line.

2. Cost Efficiency

Since all schemes are offered under the direct plan with a growth option, investors avoid distributor commissions. This lowers the expense ratio compared to regular plans—an important factor in improving net returns, especially for short-term investments.

Additionally, minimum investments start at ₹500, making these funds highly accessible even to first-time investors.

3. Digital Accessibility

Another major advantage lies in the fund’s digital-first model. By allowing investors to purchase and manage mutual fund schemes directly through the MyJio app, Jio BlackRock offers a seamless experience with reduced friction. If you already use MyJio, integrating your investments into one platform is both convenient and efficient.

4. Technology-Driven Strategy

The presence of BlackRock’s ALADDIN platform cannot be overstated. This technology helps manage risk, analyze data in real time, and improve decision-making—benefits typically reserved for institutional clients. With this capability, the Jio BlackRock Mutual Fund promises to bring world-class risk management to everyday investors.

5. No Historical Performance (Yet)

Of course, the biggest limitation right now is the absence of a performance track record. Unlike established AMCs that showcase historical NAVs and long-term returns, these schemes are starting from scratch. While the fund managers are experienced and the strategies sound conservative, only time will tell how the schemes perform under different market conditions.

Summary

If you are a short-term investor looking for safe, low-cost, and tech-enabled options, the Jio BlackRock Mutual Fund deserves a close look. On the other hand, if you prioritize long-term performance data or prefer equity exposure, it may be worth observing how the AMC evolves in the coming months.

Conclusion: Is Jio BlackRock Mutual Fund Right for You?

The launch of the Jio BlackRock Mutual Fund marks an important moment in India’s mutual fund landscape. It combines the scale and digital reach of Jio Financial Services with the global investment depth of BlackRock—two forces that could reshape how everyday Indians access financial products.

However, while the brand appeal is strong and the technology-driven model is compelling, investors must remember one thing: this is a new fund house. It does not yet have a proven track record of delivering consistent returns. That makes due diligence essential before committing your capital.

If your goals involve parking money safely, maintaining liquidity, or starting small, these initial debt schemes offer solid entry points. The low minimum investment, direct plans, and no-exit-load structures (in two of the three schemes) are definite advantages. Additionally, if you’re comfortable with digital platforms and prefer to manage your portfolio independently, the experience offered through the MyJio app can feel both modern and intuitive.

On the other hand, if you prefer funds with a long performance history or if you’re focused on aggressive growth, it might be best to wait and watch. Jio BlackRock is expected to roll out equity and hybrid schemes eventually, which could open up more diversified opportunities.

In the end, investing in the Jio BlackRock Mutual Fund should align with your financial goals, risk appetite, and investment horizon. The promise is strong. Now, the performance just needs to follow.

Frequently Asked Questions (FAQs)

1. What is Jio BlackRock Mutual Fund?

Jio BlackRock Mutual Fund is a joint venture between Jio Financial Services and BlackRock Financial Management Inc. It is a newly launched asset management company (AMC) that aims to offer a digital-first approach to investing in mutual funds in India.

2. Is Jio BlackRock Mutual Fund safe to invest in?

Like all mutual funds, the safety of investment depends on the scheme type. Jio BlackRock currently offers low-risk, debt-oriented schemes such as Liquid Fund, Overnight Fund, and Money Market Fund. These are generally considered safer for short-term goals, but returns are not guaranteed.

3. How can I invest in Jio BlackRock Mutual Fund?

You can invest directly through the MyJio app, which integrates mutual fund investment features. The fund offers only direct plans, so you won’t need a distributor or advisor to start investing.

4. What is the minimum investment amount?

All three current schemes under Jio BlackRock Mutual Fund have a minimum investment requirement of ₹500, whether you invest through a lump sum or a SIP (Systematic Investment Plan).

5. What makes Jio BlackRock Mutual Fund different from other AMCs?

This fund house stands out for its:

- Digital-first distribution via MyJio

- Use of ALADDIN, BlackRock’s powerful portfolio management platform

- Low-cost direct plans

- Backing from two well-established companies—Jio and BlackRock

6. Does Jio BlackRock Mutual Fund offer equity or hybrid funds?

As of now, no. The AMC has launched with three debt-based funds only. However, equity and hybrid offerings are expected in future phases.

7. What is the role of ALADDIN in managing these funds?

ALADDIN (Asset, Liability, and Derivative Investment Network) is a technology platform developed by BlackRock. It helps manage investment risks, provides real-time data analysis, and supports portfolio decision-making. It is used by some of the world’s largest institutions and now powers fund management at Jio BlackRock Mutual Fund.

8. Who is managing Jio BlackRock Mutual Fund?

Sid Swaminathan is the Managing Director and CEO of Jio BlackRock Mutual Fund. He brings over 20 years of global asset management experience and previously managed US$1.25 trillion in assets at BlackRock.

Related Articles

Jaiprakash Associates Insolvency: Adani vs Dalmia in a ₹14,000 Cr Bidding War

SEBI vs Jane Street: Inside India’s ₹36,500 Cr Derivatives Manipulation Scandal

Rare Earth Magnet Manufacturing Stocks: Catch These Before India’s ₹1,000 Cr Push Lifts Off