Introduction

The Jinkushal Industries IPO presents a compelling opportunity for investors looking to participate in the global construction machinery sector. With a strong track record of supplying customised, new, and refurbished construction machines to over 30 countries—including major markets such as the UAE, USA, Mexico, Netherlands, Belgium, South Africa, Australia, and the UK—Jinkushal Industries Limited has carved a niche for itself as a trusted exporter with a reputation for quality, reliability, and innovation.

Founded in 2007, the company has grown steadily by focusing on tailored solutions for client-specific operational requirements, refurbishing pre-owned machinery to meet international standards, and promoting its proprietary brand, HexL, of construction machines. Over the years, the company has supplied more than 1,500 machines globally, demonstrating strong operational execution and rapid growth, with 1,171 machines supplied in just nine months ending December 2024.

The IPO comes at a time when global infrastructure development is on the rise, creating robust demand for construction machinery. By participating in the Jinkushal Industries IPO, investors gain a chance to be part of a company that blends global reach, technological expertise, and sustainable operational practices, making it a noteworthy addition to any investment portfolio.

IPO Overview – Jinkushal Industries IPO

The Jinkushal Industries IPO is a book building issue aggregating to ₹116.15 crores. It comprises a fresh issue of 0.86 crore shares worth ₹104.54 crores and an offer for sale (OFS) of 0.10 crore shares worth ₹11.61 crores. The IPO opens for subscription on 25th September 2025 and closes on 29th September 2025. The company plans to list on both BSE and NSE with a tentative listing date of 3rd October 2025.

The IPO’s price band is fixed between ₹115 – ₹121 per share, with a lot size of 120 shares, making the minimum retail investment approximately ₹14,520 at the upper price. Institutional investors such as S-NII and B-NII can apply in larger lots, with the maximum lot investment reaching over ₹10 lakhs for B-NII investors.

The IPO is managed by GYR Capital Advisors Pvt. Ltd. as the book running lead manager, and Bigshare Services Pvt. Ltd. serves as the registrar.

Jinkushal Industries IPO – IPO Details

| Detail | Information |

|---|---|

| IPO Type | Bookbuilding (Fresh Issue + OFS) |

| Total Issue Size | 95,99,548 shares (₹116.15 Cr) |

| Fresh Issue | 86,40,000 shares (₹104.54 Cr) |

| Offer for Sale | 9,59,548 shares (₹11.61 Cr) |

| Face Value | ₹10 per share |

| Price Band | ₹115 – ₹121 per share |

| Lot Size | 120 shares |

| Issue Open | 25 Sep 2025 |

| Issue Close | 29 Sep 2025 |

| Tentative Listing | 3 Oct 2025 |

| Listing Exchanges | BSE, NSE |

| Book Running Lead Manager | GYR Capital Advisors Pvt. Ltd. |

| Registrar | Bigshare Services Pvt. Ltd. |

| IPO Document | RHP File |

| Shareholding Pre-Issue | 2,97,46,000 shares |

| Shareholding Post-Issue | 3,83,86,000 shares |

This table summarises the key details of the Jinkushal Industries IPO, providing investors with a clear picture of the issue structure, lot sizes, and listing plans. Investors can gauge both the scale of the issue and potential participation levels.

Jinkushal Industries IPO – Important Dates

| Event | Date |

|---|---|

| IPO Open Date | Thu, 25 Sep 2025 |

| IPO Close Date | Mon, 29 Sep 2025 |

| Tentative Allotment Date | Tue, 30 Sep 2025 |

| Refunds Initiation | Wed, 1 Oct 2025 |

| Credit to Demat Account | Wed, 1 Oct 2025 |

| Tentative Listing Date | Fri, 3 Oct 2025 |

| Cut-off Time for UPI Mandate | 5 PM, Mon, 29 Sep 2025 |

These dates are critical for all investors, whether retail or institutional, to ensure timely application, allotment tracking, and receipt of shares on listing.

Objects of the Issue

The proceeds from the Jinkushal Industries IPO will be primarily used for:

- Funding the working capital requirements of the company – ₹726.75 million

- General corporate purposes

This allocation indicates the company’s strategic focus on enhancing liquidity, supporting day-to-day operations, and enabling sustainable growth across its global export operations.

Company Background – Jinkushal Industries Ltd.

Jinkushal Industries Limited, founded in November 2007, is a leading exporter of construction machinery, serving over 30 countries across the UAE, USA, Mexico, Netherlands, Belgium, South Africa, Australia, and the UK. The company has earned a strong reputation for delivering high-quality, customised, and reliable construction equipment tailored to client-specific operational and regional requirements.

The company operates across three main business verticals:

- Export of customised new construction machines: Jinkushal modifies and accessorises new machines to suit client needs, ensuring operational efficiency and compliance with regional standards.

- Export of used and refurbished machines: Offering cost-effective alternatives, the company refurbishes pre-owned machines through its in-house facility and independent partner centres, maintaining strict technical and quality standards.

- Export of HexL brand machines: Under its proprietary HexL brand, Jinkushal supplies backhoe loaders engineered for performance, durability, and global compliance, enhancing its market presence.

As of April 2025, Jinkushal Industries has supplied over 1,500 construction machines globally, including 900 new and 600 refurbished units. In the nine months ended December 31, 2024, the company delivered 1,171 machines (815 new and 356 refurbished), reflecting rapid growth and strong market demand.

Infrastructure and Workforce

- In-house refurbishment facility: 48 skilled employees handle customisation and reconditioning of pre-owned machinery.

- Partner refurbishment centres: Non-exclusive centres follow company SOPs and technical guidelines to ensure quality.

- Supplier network: 228 suppliers as of December 31, 2024, including 172 contractors, 51 traders, and 5 manufacturers.

- Employees: 90 permanent staff and 21 interns as of December 31, 2024.

Global Reach and Competitive Strengths

- International presence: Supplies construction machinery across 30+ countries, building a strong global brand.

- Leading exporter in UAE and USA: Strengthened by subsidiaries and strategic partnerships.

- Sustainability and circular economy: Refurbishment and reuse of machines contribute to environmental responsibility.

- Efficient supply chain: Supports smooth export operations and timely delivery worldwide.

- Diversified solutions: Provides new, refurbished, and proprietary brand machines to meet varied market demands.

With a combination of robust infrastructure, skilled workforce, international market reach, and sustainable operational practices, Jinkushal Industries Limited continues to strengthen its position as a trusted player in the global construction machinery export market.

Financials of Jinkushal Industries IPO

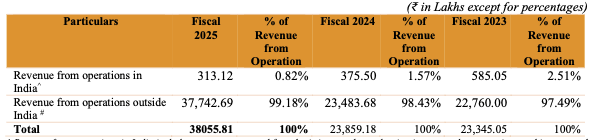

Jinkushal Industries has shown consistent financial growth over the past few years, with strong revenue expansion and profitability. The company has achieved a 5-year CAGR of 73.37% in revenue, reflecting effective operational efficiency and capital management.

Financial Performance (₹ in Crores)

| Particulars | FY2025 | FY2024 | FY2023 |

|---|---|---|---|

| Revenue from Operations | ₹380.56 | ₹238.59 | ₹233.45 |

| Growth in Revenue (%) | 59.50% | 2.20% | 31.92% |

| Other Income | ₹5.25 | ₹4.21 | ₹4.44 |

| EBITDA | ₹28.60 | ₹27.57 | ₹14.68 |

| EBITDA Margin (%) | 7.52% | 11.56% | 6.29% |

| Profit After Tax (PAT) | ₹19.14 | ₹18.64 | ₹10.12 |

| PAT Margin (%) | 5.03% | 7.81% | 4.33% |

| Net Worth | ₹86.19 | ₹43.07 | ₹24.50 |

| Net Asset Value (Post-Bonus) | ₹28.98 | ₹14.49 | ₹8.24 |

| Debt-Equity Ratio | 0.58 | 1.06 | 0.66 |

The financials show robust revenue growth, solid profit generation, and improved equity management. Despite a slight dip in EBITDA margin in FY2025, PAT growth remained strong, reflecting efficient cost control and operational scalability.

Key Performance Indicators of Jinkushal Industries IPO

| KPI | Value |

|---|---|

| ROE | 28.30% |

| ROCE | 18.39% |

| Debt/Equity | 0.58 |

| RoNW | 21.22% |

| PAT Margin | 5.03% |

| EBITDA Margin | 7.52% |

| Price to Book Value | 4.18 |

| EPS (Pre-IPO) | ₹6.43 |

| EPS (Post-IPO) | ₹4.99 |

| P/E (Pre-IPO) | 18.8 |

| P/E (Post-IPO) | 24.26 |

The KPIs indicate a financially stable company with moderate leverage, healthy returns, and a reasonable valuation based on price-to-book and P/E multiples.

Valuation & Peer Comparison – Jinkushal Industries IPO

Jinkushal Industries’ IPO valuation is moderate relative to industry peers, providing an opportunity for investors to benefit from growth in international construction machinery exports.

| Company Name | EPS (Basic) | EPS (Diluted) | NAV per Share (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

|---|---|---|---|---|---|---|

| Jinkushal Industries | 6.15 | 6.15 | 28.98 | 24.26 (Post-IPO) | 21.22 | 4.18 |

| Action Construction Equipment | 34.39 | 34.37 | 135.60 | 31.18 | 25.34 | 0.01 |

| Vision Infra Equipment Solutions | 15.97 | 15.97 | 66.82 | 10.94 | 20.68 | 2.64 |

Valuation Analysis:

- Post-IPO P/E of Jinkushal Industries (24.26x) is lower than Action Construction Equipment (31.18x) but higher than Vision Infra Equipment (10.94x), suggesting the IPO is fairly priced compared to larger peers while offering potential for growth.

- Price-to-book value (4.18) is higher than Vision Infra but reflects the company’s global presence, export reach, and consistent profitability.

- RoNW of 21.22% is in line with peers, showing healthy return generation on equity.

Strengths & Weaknesses

| Strengths | Weaknesses |

|---|---|

| Leading exporter across UAE, USA, and 30+ countries | Reliant on export demand, exposed to global economic fluctuations |

| Robust in-house refurbishment facility with 48 skilled employees | Smaller scale compared to some listed peers |

| Diversified offerings: new, refurbished, and proprietary HexL brand machines | Limited domestic market footprint |

| Strong supply chain with 228 suppliers | Exposure to foreign currency and trade risks |

| Contribution to circular economy via reuse/refurbishment | Profit margins sensitive to raw material and logistics costs |

The company’s strengths such as global presence, refurbishment capability, and diversified offerings outweigh the operational risks, making it a strong contender in its sector.

Jinkushal Industries IPO GMP / Grey Market Premium

| GMP Date | IPO Price | GMP | Sub2 Sauda Rate | Estimated Listing Price | Estimated Profit* |

|---|---|---|---|---|---|

| 24-09-2025 | 121.00 | ₹42 (34.71%) | 3800/53200 | ₹163 | ₹5040 |

| 23-09-2025 | 121.00 | ₹51 (42.15%) | 4700/65800 | ₹172 | ₹6120 |

The GMP indicates a strong listing gain potential of 34-42%, reflecting positive sentiment and demand in the grey market before listing.

Conclusion / Outlook

The Jinkushal Industries IPO is positioned to capture growth in the global construction machinery market. Its consistent financial performance, international reach, diversified product offerings, and robust refurbishment capability make it attractive for both retail and institutional investors.

- The IPO valuation is reasonable compared to peers, offering potential upside.

- Grey market premium suggests strong investor interest and possible listing gains.

- The company’s operational efficiency, export dominance, and focus on sustainable refurbishment practices provide a long-term growth outlook.

Overall, the Jinkushal Industries IPO is a promising opportunity for investors seeking exposure to the construction equipment export sector with growth potential and a solid financial foundation.

FAQs – Jinkushal Industries IPO

Q1: What is the Jinkushal Industries IPO price band?

A1: ₹115 to ₹121 per share.

Q2: When does the Jinkushal Industries IPO open and close?

A2: Opens on September 25, 2025, and closes on September 29, 2025.

Q3: What is the lot size for Jinkushal Industries IPO?

A3: 120 shares per lot.

Q4: How much is the minimum retail investment?

A4: ₹14,520 based on the upper price of ₹121 per share.

Q5: What is the total issue size of the Jinkushal Industries IPO?

A5: ₹116.15 crores, including a fresh issue of ₹104.54 crores and offer for sale of ₹11.61 crores.

Q6: Where will the Jinkushal Industries IPO be listed?

A6: BSE and NSE, with a tentative listing date of October 3, 2025.

Q7: Who are the promoters of Jinkushal Industries Ltd.?

A7: Anil Kumar Jain, Abhinav Jain, Sandhya Jain, Tithi Jain, and Yashasvi Jain.

Q8: What are the objects of the Jinkushal Industries IPO?

A8: Funding working capital requirements and general corporate purposes.

Q9: What is the expected allotment and refund date?

A9: Tentative allotment on September 30, 2025, and refunds initiated on October 1, 2025.

Q10: Is Jinkushal Industries IPO reasonably valued compared to peers?

A10: Post-IPO P/E is 24.26x, which is competitive compared to listed peers, suggesting potential for growth and reasonable valuation.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?