Introduction: When Wall Street Met Its Match in SEBI

In July 2025, India’s capital markets witnessed a seismic moment. SEBI, India’s securities regulator, issued an interim ban against Jane Street, one of the world’s largest quant trading firms. The charge? Jane Street derivatives manipulation—a strategy so massive and complex that it allegedly distorted India’s benchmark indices and misled millions of retail investors.

At the heart of the case lies an eye-watering ₹36,500 crore in profits, a frozen ₹4,840 crore, and one critical question: Can India’s rapidly growing derivatives market protect itself against deep-pocketed algorithmic predators?

As SEBI’s 105-page order made headlines, Indian stockbrokers tumbled. Angel One fell 6%, BSE dropped 6.4%, and CDSL lost 3.5%. Nuvama Wealth—Jane Street’s local partner—plunged 9%. This wasn’t just a legal crackdown; it was a wake-up call to the systemic risk posed by unchecked high-frequency trading.

Who is Jane Street—and Why It Matters to India

Founded in 2000, Jane Street is a Wall Street titan known for its ultra-sophisticated algorithmic trading strategies. Operating in over 45 countries, the firm thrives in high-speed, high-volume markets—from U.S. ETFs to global options and derivatives.

Jane Street quietly entered India in December 2020. Within just a few years, it had become one of the largest players in India’s index options market, reportedly earning $1 billion in profits from Indian options in 2023 and $2.3 billion in 2024, as per Bloomberg.

Its India operations were handled via four entities—JSI Investments Pvt Ltd, JSI2 Investments Pvt Ltd, Jane Street Singapore Pte Ltd, and Jane Street Asia Trading Ltd—all now banned by SEBI’s interim order.

So why did SEBI take such a bold step?

The Charges: Jane Street Derivatives Manipulation Uncovered

According to SEBI’s investigation, Jane Street allegedly deployed manipulative strategies that distorted Nifty and Bank Nifty index levels, particularly on derivatives expiry days.

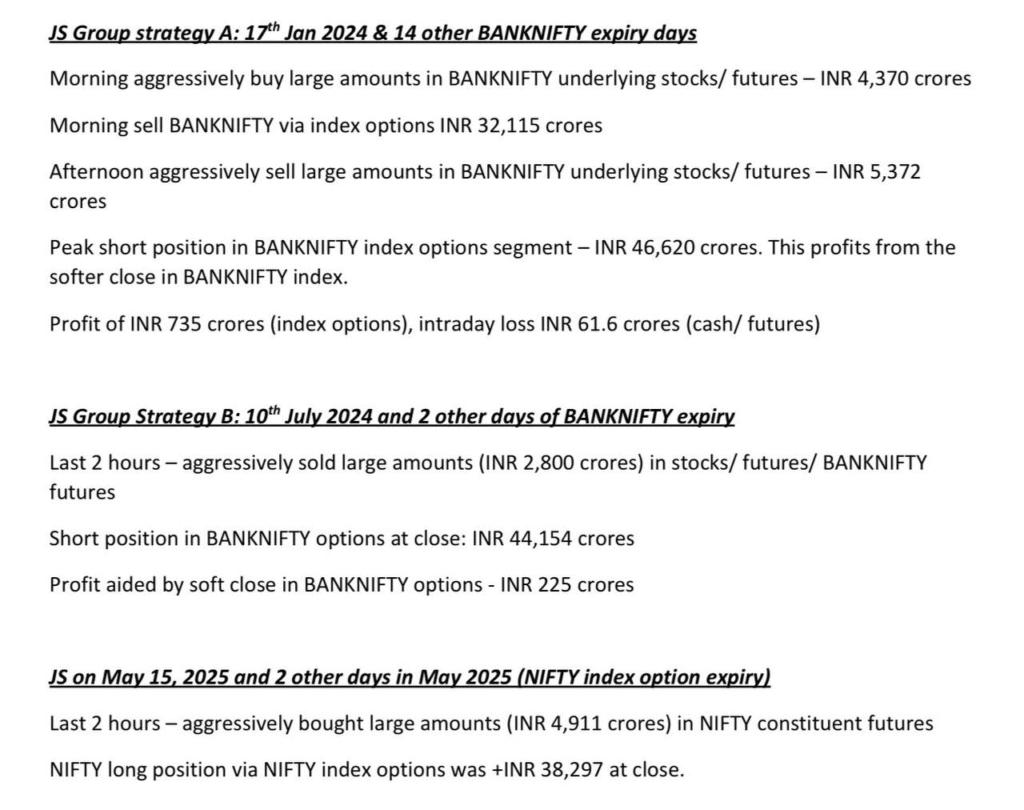

Here’s what SEBI alleges:

- Cross-segment distortion: Jane Street engaged in simultaneous buying and selling across cash equities, futures, and options to influence index levels.

- Artificial index pumping: On expiry mornings, the firm bought large volumes of index stocks to artificially push up Nifty Bank. By afternoon, it aggressively dumped them—profiting massively from short positions in index options.

- Massive profits from manipulation: On just one trading day—January 17, 2024—Jane Street allegedly earned ₹735 crore by executing this strategy.

- Ignored regulatory warnings: Even after NSE issued a cautionary letter in February 2025, Jane Street reportedly continued its behavior.

This strategy—dubbed the “Intra-Day Index Manipulation” and “Extended Marking the Close”—allowed the firm to game expiry-day volatility with surgical precision.

SEBI’s order now accuses the firm of misleading retail investors, violating fair market norms, and operating in utter disregard of transparency.

How Jane Street’s Strategy Shook Dalal Street

Step-by-Step: The Playbook of Jane Street Derivatives Manipulation

SEBI’s interim order reveals that Jane Street didn’t just rely on fast trades—it used a calculated, cross-segment playbook across equity, futures, and options to gain an edge.

Here’s how it allegedly worked:

- Morning Pumping: On expiry mornings, Jane Street aggressively bought large quantities of Bank Nifty stocks like SBI, ICICI Bank, and Axis Bank. This moved the index upwards artificially.

- Building Bearish Bets: While the index rose, Jane Street had already placed bearish index options trades—like buying Puts or selling Calls—anticipating a reversal.

- Midday Dump: Once retail traders jumped into the rally, Jane Street dumped the stocks by early afternoon. This led to a sharp fall in the Bank Nifty index.

- End-of-Day Crash: On many expiry days, they allegedly engaged in “Extended Marking the Close” trades—placing huge sell orders in the final minutes to push down the index further, locking in profits from their options.

- Repeat: SEBI found that Jane Street deployed this strategy on 15 out of 18 observed expiry days between 2023 and 2025.

The result? Over ₹36,500 crore in estimated profits—₹43,289 crore from index options alone—according to NSE data cited in SEBI’s report.

Fallout: How the Market Reacted

The interim order sent shockwaves across Indian financial markets. Here’s what happened:

- Angel One, a top retail brokerage, dropped 6% intraday.

- BSE and CDSL, key market infrastructure companies, fell 6.4% and 3.5% respectively.

- Nuvama Wealth, Jane Street’s India partner, saw its stock plunge by over 9%.

Analysts noted that the action could lead to temporary volume drops in derivatives. With Jane Street out and regulatory heat rising, market makers and high-frequency traders may pull back.

💬 “We’re seeing a more realistic volume now. It will take time to return,” said Amit Chandra of HDFC Securities.

Retail participation could also decline as confidence takes a hit—especially after SEBI’s earlier report showed retail traders lost $21.7 billion in F&O between FY21 and FY24, while institutions like Jane Street gained massively.

SEBI’s Heavy-Handed Actions

To limit further damage, SEBI acted swiftly and firmly:

- ₹4,840 crore frozen from Jane Street-linked accounts.

- Complete market access ban on Jane Street and its four India-related entities.

- Direction to banks: No debit transactions allowed without SEBI’s nod.

- 21 days given to file objections before the Securities Appellate Tribunal (SAT).

This move is also part of a broader shift. While NSE closed its internal probe after Nuvama’s clarification, SEBI doubled down, signaling it won’t let high-frequency foreign traders exploit India’s retail-heavy market unchecked.

SEBI’s Crackdown & The Future of India’s Derivatives Market

Why SEBI’s Action Matters

India’s derivatives market has grown rapidly—especially among retail investors. In FY24 alone:

- Nearly 40 crore options contracts were traded on NSE.

- Yet, retail traders lost over ₹1.8 lakh crore, as per SEBI’s study.

- Meanwhile, institutions and proprietary traders gained ₹61,000 crore, often using algorithmic strategies.

SEBI’s action against Jane Street is not just about one firm. It reflects a broader concern:

Is India’s options market skewed in favour of global high-frequency traders?

By barring Jane Street, SEBI is drawing a red line on manipulative practices, especially on:

- Expiry-day distortion using high capital volume.

- Strategies that mislead retail investors on intraday trends.

- Complex trades designed to profit from engineered volatility.

This case may now set a regulatory precedent for how India governs its rapidly growing F&O ecosystem.

How Jane Street Ignored Warnings

Jane Street’s India arm began operations in December 2020. Over time, it scaled up to massive trades, making ₹2.3 billion in 2024 alone from equity derivatives.

SEBI had already sent a caution letter in February 2025, routed via NSE.

Yet, Jane Street allegedly continued manipulating expiry-day trades, as per the order. It operated with:

- Largest “cash-equivalent” risk in F&O, especially in index options.

- Intraday reversals that misled retail traders, who lacked access to real-time macro order flows.

This led to the most severe penalty SEBI has imposed on a global quant player in recent memory.

What’s Next for Investors & the Market?

Here’s what this means for various stakeholders:

Retail Investors

- Short-term volatility may reduce as large manipulative players exit.

- However, options premiums may rise due to lower liquidity.

- Awareness is key: Retail must now be extra cautious with expiry-day trading.

Market Intermediaries (like Nuvama, Angel One, etc.)

- Could face stricter due diligence obligations.

- May lose volume temporarily but benefit long-term from restored confidence.

SEBI & Policymakers

- May introduce tighter rules for:

- Algo trading disclosure

- Intraday position limits

- Surveillance on expiry-day behaviour

- Expect greater coordination with exchanges like NSE, and more real-time reporting.

Final Thoughts: India’s Market Integrity on Trial

The Jane Street derivatives manipulation case isn’t just about ₹36,500 crore in alleged profits or algorithmic strategies—it’s a moment of reckoning for Dalal Street.

As India’s F&O market becomes the world’s busiest, ensuring fair play matters more than ever.

SEBI’s bold move may cause a short-term dip in volumes. But it also signals that India will not allow its markets to become a playground for unchecked quant trading, especially at the cost of millions of unaware retail participants.

The message is clear:

Innovation is welcome. Manipulation is not.

FAQs

1. What is the Jane Street derivatives manipulation case about?

SEBI alleges that Jane Street used complex, high-volume trading strategies to distort index levels (especially on expiry days) and earn massive profits from index options, misleading retail investors.

2. How much profit did Jane Street allegedly make in India?

SEBI estimates Jane Street made approximately ₹36,500 crore in profits from Jan 2023 to Mar 2025, with over ₹43,000 crore from index options alone.

3. What actions has SEBI taken against Jane Street?

SEBI has barred Jane Street and its affiliates from trading in Indian markets, frozen ₹4,840 crore of its alleged unlawful gains, and restricted debit activity from their Indian accounts.

4. Why is this case important for retail investors?

It highlights how retail traders can be misled by large institutional strategies that manipulate intraday index movements, especially during expiry days. SEBI’s action aims to protect retail interests.

5. What does this mean for India’s derivatives market?

There could be short-term drops in trading volumes, but long-term, it may lead to fairer markets, tighter regulations on algo trading, and improved surveillance of expiry-day volatility.

6. Can Jane Street challenge SEBI’s order?

Yes, the firm has 21 days to file objections or appeal before the Securities Appellate Tribunal (SAT).

Related Articles

How a Tea Seller Used the Power of Compound Interest to Build ₹45 Lakh

China’s Fertilizer Export Halt to India: Stocks Set to Gain from the Supply Shock

The 15-15-15 Rule: Why the ₹1 Crore SIP Dream Needs a Reality Check